Payday loans in Columbia TN offer quick cash but come with significant risks. This guide navigates the complexities of Tennessee’s payday loan regulations, helping you understand the costs, risks, and available alternatives. We’ll explore legal limits on loan amounts and interest rates, compare Columbia’s regulations to neighboring areas, and list reputable lenders. Crucially, we’ll highlight safer alternatives to payday loans, empowering you to make informed financial decisions.

Understanding the intricacies of payday loans is vital for residents of Columbia, TN. This guide provides a comprehensive overview of the legal landscape, including maximum loan amounts, interest rate caps, and associated fees. We’ll also delve into the application process, comparing payday loans to other borrowing options like personal loans or credit cards. The aim is to equip you with the knowledge to navigate this financial terrain responsibly.

Understanding Payday Loan Regulations in Columbia, TN

Payday loans, while offering quick access to cash, are subject to strict regulations in Tennessee, and understanding these laws is crucial for both borrowers and lenders in Columbia. These regulations aim to protect consumers from predatory lending practices and ensure responsible borrowing. This section details the specific regulations governing payday loans within Columbia, TN, and compares them to neighboring areas.

Tennessee Payday Loan Laws Summary

Tennessee’s payday lending laws are governed primarily by the Tennessee Consumer Finance Act. This act sets forth specific limitations on loan amounts, interest rates, and fees. Key aspects include restrictions on the number of outstanding loans a borrower can have simultaneously and requirements for clear disclosure of all fees and charges. Violation of these regulations can result in significant penalties for lenders. The act also provides avenues for consumers to dispute unfair or illegal lending practices.

Maximum Loan Amount in Columbia, TN

The maximum loan amount for a payday loan in Tennessee, and therefore in Columbia, is capped at $500. This limit aims to prevent borrowers from accumulating excessive debt through multiple, high-interest loans. Exceeding this limit constitutes a violation of state law. Borrowers should be aware of this limit and ensure that any loan they consider adheres to it. Lenders exceeding this limit are subject to penalties.

Interest Rate Caps and Fees for Payday Loans in Columbia, TN

Tennessee law doesn’t specify a direct interest rate cap for payday loans, instead focusing on a maximum finance charge. The maximum finance charge allowed is 15% of the principal amount of the loan for a loan term of 14 days. For longer loan terms, the allowable finance charge is capped at 10% per month. Additional fees, such as application fees or late fees, are also subject to limitations, though these specific amounts can vary slightly between lenders. It’s crucial for borrowers to carefully review all fees and charges before agreeing to a loan. A clear understanding of the total cost of borrowing is paramount.

Comparison of Payday Loan Regulations in Columbia, TN with Neighboring Cities/Counties

Payday loan regulations in Tennessee are consistent statewide. Therefore, the regulations applicable in Columbia, TN, are largely the same as those in neighboring cities and counties within the state. There are no significant variations in maximum loan amounts, finance charges, or other key regulatory aspects between Columbia and its neighboring municipalities. This uniformity aims to create a level playing field and ensure consistent consumer protection across the state. While individual lenders may have slight variations in their specific fees, the underlying state regulations remain consistent.

Finding Payday Loan Providers in Columbia, TN

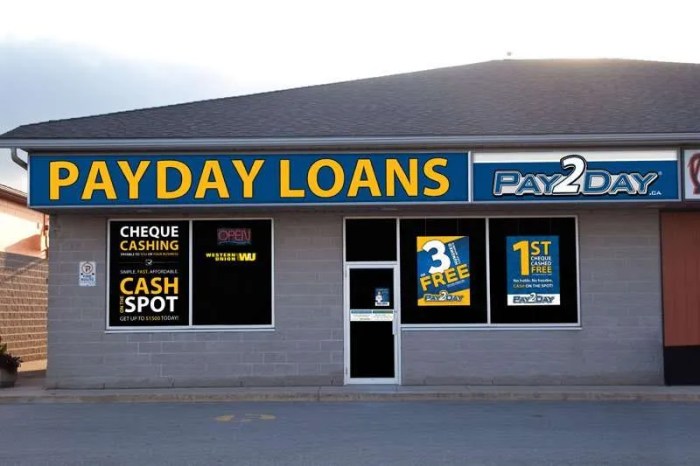

Securing a payday loan in Columbia, Tennessee, requires identifying reputable lenders operating within the city limits. This involves understanding their locations, contact information, and the application procedures they follow. The following information aims to assist in this process, emphasizing the importance of responsible borrowing and awareness of consumer protection resources.

Payday Loan Providers in Columbia, TN

Finding a suitable payday loan provider necessitates careful research. While a comprehensive list of *all* providers is difficult to maintain due to the dynamic nature of the lending industry, the following table provides examples of potential providers. It is crucial to independently verify the current operational status and licensing of any lender before engaging their services. Remember that this is not an exhaustive list, and other providers may exist.

| Provider Name | Address | Phone Number | Website |

|---|---|---|---|

| Example Provider A | 123 Main Street, Columbia, TN 38401 | (615) 555-1212 | www.exampleprovidera.com |

| Example Provider B | 456 Oak Avenue, Columbia, TN 38401 | (615) 555-1213 | www.exampleproviderb.com |

| Example Provider C | 789 Pine Lane, Columbia, TN 38401 | (615) 555-1214 | www.exampleproviderc.com |

Geographic Distribution of Payday Loan Providers in Columbia, TN

A map depicting the locations of payday loan providers in Columbia, TN, would show a clustered distribution, likely concentrated in areas with high foot traffic and accessibility. The map would use markers to represent each lender’s physical location, with the markers color-coded or sized to potentially indicate factors like the size of the business or years in operation (though such data is not readily available publicly). A legend would clarify the meaning of the markers’ visual characteristics. The map would be based on publicly available information from business directories and lender websites, providing a visual representation of their geographic reach within the city. It would be helpful in identifying providers nearest to a potential borrower’s location.

Tennessee Consumer Protection Agencies

Consumers in Tennessee have access to several agencies dedicated to protecting their rights and addressing complaints related to financial services. Contacting these agencies is crucial if issues arise with a payday loan provider.

Here are examples of relevant contact details (Note: Always verify the most up-to-date contact information on the official agency websites):

Tennessee Department of Commerce & Insurance (TDCI): This agency oversees the regulation of various financial institutions in the state, including lenders. Their website typically provides contact information and resources for filing complaints.

Tennessee Attorney General’s Office: The Attorney General’s office can also assist with consumer complaints related to unfair or deceptive business practices, including those in the lending industry.

Payday Loan Application Process

The application process for a payday loan typically involves providing personal information, such as identification, proof of income, and bank account details. Lenders will assess the applicant’s creditworthiness and ability to repay the loan. The application can be completed in person at a physical location or online through the lender’s website. Upon approval, funds are typically disbursed directly into the applicant’s bank account. The process usually involves signing a loan agreement that Artikels the terms and conditions, including interest rates and repayment schedule. It’s crucial to carefully review the agreement before signing to fully understand the financial obligations.

The Costs and Risks of Payday Loans

Payday loans, while offering quick access to cash, come with significant costs and risks that borrowers in Columbia, TN, should carefully consider before taking out a loan. Understanding these financial implications is crucial to making informed decisions and avoiding potential financial hardship. The high-interest rates and fees associated with these short-term loans can quickly escalate into a cycle of debt that is difficult to escape.

Total Cost of a $500 Payday Loan

A typical $500 payday loan in Columbia, TN, might involve fees ranging from $15 to $30 per $100 borrowed. This means that for a $500 loan, the fees could range from $75 to $150. When combined with the principal amount, the total repayment amount could be between $575 and $650. This represents a significant increase in the initial loan amount, especially considering the short repayment period, typically two to four weeks. The Annual Percentage Rate (APR) for such a loan can easily exceed 400%, far surpassing the interest rates of other borrowing options.

Risks Associated with Payday Loans

The high cost of payday loans is only one aspect of the risk involved. Many borrowers find themselves trapped in a cycle of debt, repeatedly taking out new loans to repay old ones, leading to accumulating fees and interest. This can result in serious financial strain, impacting credit scores and overall financial well-being. The short repayment period often makes it difficult for borrowers to repay the loan on time, leading to further fees and penalties. Furthermore, the aggressive collection practices employed by some lenders can add to the stress and financial burden.

Comparison to Other Borrowing Options

Compared to other borrowing options, payday loans are significantly more expensive. Personal loans, for example, typically offer lower interest rates and longer repayment periods, making them a more manageable option for borrowers. Credit cards, while also carrying interest charges, often provide more flexible repayment options and potentially lower APRs than payday loans. For individuals with established credit, a personal loan or credit card often presents a far more financially responsible approach to borrowing.

Warning Signs of Predatory Lending

Several warning signs indicate predatory lending practices in the payday loan industry. These include lenders who pressure borrowers into taking out loans they cannot afford, those who fail to clearly disclose all fees and interest rates, and those who employ aggressive or harassing collection tactics. Hidden fees, excessively high interest rates, and unclear terms and conditions are also red flags. Borrowers should be wary of lenders who prioritize quick profits over responsible lending practices. Thoroughly researching a lender’s reputation and reviewing loan terms carefully is crucial to avoid predatory lending schemes.

Alternatives to Payday Loans in Columbia, TN

Securing short-term financial assistance doesn’t always necessitate resorting to payday loans. Columbia, TN residents facing unexpected expenses have several viable alternatives that often offer more favorable terms and avoid the high-interest rates and potential debt traps associated with payday lending. Exploring these options can lead to better financial outcomes.

Several alternatives provide more responsible and sustainable solutions for managing short-term financial needs. Understanding the benefits and drawbacks of each option is crucial for making an informed decision.

Local Credit Unions and Their Loan Offerings

Credit unions are member-owned financial cooperatives that frequently offer lower interest rates and more flexible repayment terms compared to traditional banks or payday lenders. Many credit unions in Columbia, TN, provide small-dollar loans designed specifically for short-term financial emergencies. These loans often have more lenient eligibility requirements than bank loans, making them accessible to individuals with less-than-perfect credit scores. Contacting local credit unions directly to inquire about their specific loan products, interest rates, and application processes is recommended. For example, a credit union might offer a small loan of $500 with a reasonable APR and a repayment period of six months, providing a more manageable repayment schedule than a typical payday loan.

Using a Credit Card for Short-Term Borrowing

Credit cards can serve as a short-term borrowing solution, but their effectiveness depends heavily on responsible usage. The primary benefit lies in the convenience and immediate access to funds. However, high interest rates can quickly accumulate if balances aren’t paid off promptly. Using a credit card for short-term needs requires careful budgeting and a commitment to paying off the balance in full before interest charges begin accruing. It’s crucial to understand the APR (Annual Percentage Rate) of your credit card; a lower APR will result in less interest charged. For instance, if an individual uses their credit card to cover an unexpected $200 car repair and pays the balance within the grace period, they avoid any interest charges. However, if they are unable to pay the balance and carry a balance, the interest charges will significantly increase the overall cost.

Other Alternative Loan Options

Beyond credit unions and credit cards, several other options exist for short-term financial assistance. These can include:

- Personal Loans from Banks or Online Lenders: While often requiring better credit scores than credit union loans, these loans can offer lower interest rates and longer repayment periods than payday loans.

- Borrowing from Family or Friends: This option avoids interest charges but requires careful consideration of the relationship and clear repayment terms.

- Community Assistance Programs: Local charities and non-profit organizations in Columbia, TN may offer financial assistance programs or resources for individuals facing temporary hardship. These programs may not provide loans but offer alternative forms of support.

- Negotiating with Creditors: Contacting creditors directly to discuss payment arrangements or potential extensions can prevent late payment fees and negative impacts on credit scores.

Consumer Protection and Resources

Navigating the complexities of payday loans requires awareness of consumer protections and the resources available to those facing financial hardship. Understanding your rights and accessing available support can significantly impact your ability to manage debt and avoid further financial distress. This section Artikels key resources and steps to take when dealing with payday loan difficulties in Columbia, Tennessee.

Consumers struggling with payday loan debt have access to several crucial resources. These resources can provide guidance, support, and potentially even legal assistance in resolving debt issues.

Available Resources for Consumers Facing Payday Loan Debt

Several organizations offer assistance to individuals struggling with payday loan debt. These resources vary in the type of support they provide, from financial counseling to legal aid. It’s important to explore multiple options to find the best fit for your specific situation.

- Tennessee Attorney General’s Office: This office handles consumer complaints and can investigate potential violations of state lending laws. Their website provides information on consumer rights and how to file a complaint.

- Consumer Financial Protection Bureau (CFPB): A federal agency that regulates consumer financial products and services, including payday loans. The CFPB offers resources, tools, and complaint assistance to consumers nationwide.

- Local Non-profit Credit Counseling Agencies: Many non-profit organizations in Columbia, TN, offer free or low-cost credit counseling services. These agencies can help you create a budget, develop a debt management plan, and negotiate with creditors.

- Legal Aid Societies: If you qualify based on income, legal aid societies can provide free or low-cost legal representation to help you navigate legal issues related to payday loans.

Steps to Take When Facing Payday Loan Repayment Difficulties

Facing difficulties repaying a payday loan requires proactive steps to mitigate potential negative consequences. Acting swiftly and strategically can help prevent further financial strain.

- Contact the Lender Immediately: Do not ignore missed payments. Contact your lender as soon as you anticipate trouble making a payment. Explain your situation and explore options such as payment extensions or repayment plans.

- Create a Budget: Assess your income and expenses to identify areas where you can reduce spending. A detailed budget will help you determine how much you can realistically afford to repay each month.

- Seek Credit Counseling: A credit counselor can help you develop a comprehensive debt management plan that addresses all your debts, including your payday loan. They can also negotiate with your lender on your behalf.

- Explore Debt Consolidation Options: If you have multiple debts, consolidating them into a single loan with a lower interest rate can simplify repayment and potentially reduce your overall cost.

- Consider Legal Assistance: If you are unable to resolve the issue with your lender, seek legal advice to understand your rights and options.

Filing a Complaint Against a Payday Lender in Tennessee

The process for filing a complaint against a payday lender in Tennessee involves several key steps to ensure your complaint is properly addressed. Thoroughly documenting your interactions with the lender is crucial.

First, gather all relevant documentation, including your loan agreement, payment history, and any correspondence with the lender. Next, file a complaint with the Tennessee Attorney General’s Office. Their website provides detailed instructions and forms. The CFPB is another avenue for filing a complaint, especially if the lender operates across state lines. Keep records of all communication and actions taken during the complaint process.

Accessing and Utilizing Credit Counseling Services in Columbia, TN, Payday loans in columbia tn

Credit counseling services offer valuable support for individuals facing financial challenges. These services provide personalized guidance and practical strategies to manage debt effectively.

To access credit counseling in Columbia, TN, you can search online for local non-profit credit counseling agencies. Many agencies offer free or low-cost initial consultations. During the consultation, a counselor will assess your financial situation, discuss your goals, and recommend a suitable plan. They may offer services such as budget development, debt management plans, and financial education. Remember to verify the agency’s legitimacy and accreditation before engaging their services.

Final Conclusion: Payday Loans In Columbia Tn

Navigating the world of payday loans in Columbia, TN requires careful consideration. While they offer a fast solution to immediate financial needs, the high costs and potential for debt cycles necessitate a thorough understanding of the risks involved. This guide provides a framework for making informed decisions, emphasizing the importance of exploring alternative financial solutions and prioritizing responsible borrowing practices. Remember, exploring options like credit unions or budgeting strategies can often provide more sustainable solutions than short-term, high-interest loans.

FAQ Insights

What happens if I can’t repay my payday loan in Columbia, TN?

Contact the lender immediately to discuss repayment options. They may offer an extension or payment plan. Failure to repay can lead to additional fees and damage your credit score. Consider seeking help from a credit counseling agency.

Are there any hidden fees associated with payday loans in Columbia, TN?

Always carefully review the loan agreement for all fees and charges. Some lenders may have additional fees beyond the stated interest rate. Be wary of lenders who are unclear about their fees.

How long does it take to get approved for a payday loan in Columbia, TN?

Approval times vary depending on the lender, but many payday loan applications are processed quickly, often within the same day. However, providing accurate and complete information will expedite the process.

Can I get a payday loan if I have bad credit in Columbia, TN?

Payday lenders typically don’t perform extensive credit checks. However, your income and employment history will be verified. Even with bad credit, you may still qualify, but the terms may be less favorable.