Salary advance loan state employees’ credit union options offer a lifeline for state workers facing unexpected financial hurdles. Understanding the nuances of these loans—from eligibility requirements and interest rates to repayment plans and potential drawbacks—is crucial for making informed financial decisions. This guide delves into the specifics of salary advance loans offered by state employees’ credit unions, comparing various programs and helping you navigate the application process. We’ll explore the benefits and risks, examining alternatives and legal considerations to ensure you’re equipped to choose the best financial solution for your needs.

This comprehensive resource provides a detailed look at the landscape of salary advance loans available to state employees. We’ll cover everything from the application process and required documentation to repayment options and potential consequences of default. By comparing different credit unions, their loan terms, and interest rates, you can confidently select the most suitable option for your individual circumstances. We’ll also discuss alternative financial solutions and address frequently asked questions to ensure you have a complete understanding of this crucial financial tool.

State Employee Credit Union Loan Programs

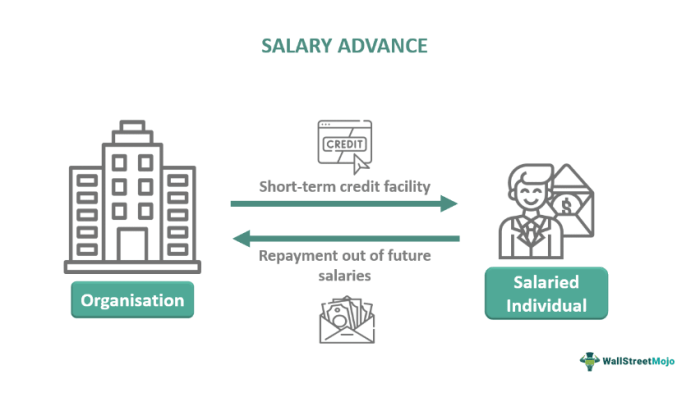

State employee credit unions (SECUs) offer a range of financial products designed to meet the specific needs of their members. One crucial service frequently sought is the salary advance loan, providing short-term financial assistance until the next paycheck. Understanding the nuances of these loans across different SECUs is key to making an informed financial decision. This section details the various loan programs, focusing on salary advance loans, comparing interest rates, terms, and eligibility requirements.

Salary Advance Loan Products Offered by State Employee Credit Unions

SECUs typically offer various loan products, including auto loans, mortgages, personal loans, and credit cards. However, the focus here is on salary advance loans, which are short-term, small-dollar loans designed to bridge the gap between paychecks. These loans are usually repaid through payroll deduction, making them convenient for state employees. The specific features and availability of salary advance loans can vary significantly between different SECUs. Some may offer these loans as a standard product, while others might have alternative short-term borrowing options.

Interest Rates and Terms of Salary Advance Loans

Interest rates and loan terms for salary advance loans vary considerably depending on the specific SECU and the borrower’s creditworthiness. Generally, these loans have higher interest rates than other loan products due to their short-term nature and the inherent risk associated with smaller loan amounts. It’s crucial to compare offers from multiple SECUs to find the most competitive rates and terms. For instance, one SECU might offer a salary advance loan with a 10% APR and a repayment period of one month, while another might offer 15% APR with a repayment period of two months. The actual rates will depend on the individual credit union’s policies and the borrower’s credit history.

Eligibility Requirements for State Employee Credit Union Salary Advance Loans

Eligibility requirements for salary advance loans vary between SECUs. However, common requirements typically include: membership in the specific credit union, active employment with the state, a consistent employment history, and a satisfactory credit history (although the specific credit score requirements can differ). Some SECUs might also have minimum income requirements or restrictions on the number of outstanding loans. It’s essential to check the specific eligibility criteria with each SECU before applying.

Comparison of State Employee Credit Union Salary Advance Loan Programs

The following table compares hypothetical examples of salary advance loan programs from different state employee credit unions. Remember that these are illustrative examples, and actual rates and requirements may vary significantly. Always check directly with the individual credit union for the most up-to-date information.

| Credit Union Name | Loan Type | Interest Rate (APR) | Eligibility Requirements |

|---|---|---|---|

| Example SECU A | Salary Advance | 12% | State employee membership, 1 year employment, good credit history |

| Example SECU B | Payroll Deduction Loan | 15% | State employee membership, 6 months employment, minimum credit score of 650 |

| Example SECU C | Short-Term Loan | 10% | State employee membership, active employment, no outstanding loans |

Application Process and Requirements

Securing a salary advance loan from your state employee credit union is a straightforward process designed to provide quick financial assistance. The application procedure is typically streamlined, requiring minimal paperwork and a relatively short processing time. Understanding the steps involved and the necessary documentation will ensure a smooth and efficient application.

The application process generally involves several key steps, from initial inquiry to loan disbursement. Applicants should be prepared to provide specific financial information and supporting documents to verify their eligibility. The credit union’s staff will guide applicants through each stage, answering any questions and providing assistance as needed.

Application Form Completion

The loan application form itself is usually a concise document requesting essential personal and financial details. It will typically ask for information such as your name, address, employment details (including your state employee ID number and length of service), desired loan amount, and intended use of funds. Accurate and complete information is crucial for a timely processing of your application. Sections may also include questions about your existing debts and credit history. Carefully review each section before submitting the completed form.

Required Documentation

To support your application, the credit union will likely require several documents to verify your identity, employment, and financial stability. These typically include a copy of your government-issued photo identification (such as a driver’s license or passport), your most recent pay stubs showing your current salary and deductions, and potentially bank statements demonstrating your income and expenditure patterns. In some cases, additional documentation may be requested depending on the loan amount or individual circumstances. For example, if you have recently changed jobs, additional proof of employment may be necessary.

Step-by-Step Application Process

The following steps Artikel a typical application procedure. While specific steps may vary slightly depending on the credit union, this provides a general overview:

- Initial Inquiry: Contact the credit union to inquire about salary advance loan options and eligibility criteria.

- Application Submission: Complete the loan application form accurately and thoroughly.

- Documentation Gathering: Gather all necessary supporting documents as Artikeld above.

- Submission of Documents: Submit the completed application form and all required supporting documentation to the credit union.

- Credit Check and Verification: The credit union will conduct a credit check and verify the information provided in your application.

- Loan Approval or Denial: You will receive notification regarding the approval or denial of your loan application.

- Loan Disbursement: If approved, the loan proceeds will be disbursed according to the credit union’s procedures, often directly deposited into your designated account.

Loan Repayment Options and Terms

Salary advance loans from State Employee Credit Unions offer convenient financing, but understanding repayment options and potential consequences is crucial for responsible borrowing. This section details the various repayment plans, potential repercussions of default, and a comparison of terms offered across different credit unions. We’ll also provide a sample repayment schedule to illustrate different repayment scenarios.

Repayment Options for Salary Advance Loans

State Employee Credit Unions typically offer flexible repayment options tailored to individual financial situations. Common options include fixed monthly payments spread over a predetermined loan term, or accelerated repayment plans that allow for faster loan payoff with higher monthly installments. Some credit unions may also allow for partial payments beyond the scheduled payments, reducing the overall interest paid and loan term. The specific options available will vary depending on the credit union and the individual’s financial profile.

Consequences of Defaulting on a Salary Advance Loan

Defaulting on a salary advance loan can have serious financial repercussions. These consequences can include damage to credit scores, impacting future loan applications and potentially increasing interest rates on other loans. Late payment fees can accumulate, significantly increasing the overall cost of the loan. In some cases, the credit union may pursue legal action to recover the outstanding debt, which could result in wage garnishment or legal judgments. Furthermore, default may negatively affect your standing within the credit union, potentially limiting access to future financial services.

Comparison of Repayment Terms Across Credit Unions

Repayment terms, including loan duration and payment frequency, vary among State Employee Credit Unions. Loan durations typically range from a few months to a year or more, depending on the loan amount and the borrower’s repayment capacity. Payment frequency is usually monthly, but some credit unions may offer bi-weekly or even weekly payment options. It is essential to compare offers from different credit unions to find the most suitable repayment terms aligned with your budget and financial goals. For instance, Credit Union A might offer a 6-month loan with monthly payments, while Credit Union B might offer a 12-month loan with bi-weekly payments. The total interest paid will vary depending on the loan term and the interest rate.

Sample Repayment Schedule

The following table illustrates a sample repayment schedule for a $1,000 salary advance loan, demonstrating different repayment options:

| Repayment Option | Loan Term (Months) | Monthly Payment | Total Interest Paid (Estimated) |

|---|---|---|---|

| Option 1: Standard Repayment | 6 | $175 | $50 |

| Option 2: Accelerated Repayment | 3 | $350 | $25 |

*Note: These are sample figures and actual interest rates and payment amounts will vary depending on the credit union and the individual’s creditworthiness. The total interest paid is an estimate and may differ slightly based on the calculation method used by the credit union.*

Benefits and Drawbacks of Salary Advance Loans

Salary advance loans, offered by credit unions like the State Employee Credit Union, provide a convenient way for state employees to access funds before their next paycheck. However, like any financial product, they come with both advantages and disadvantages that require careful consideration before application. Understanding these aspects will empower you to make an informed decision about whether a salary advance loan is the right choice for your specific financial situation.

These loans offer a relatively straightforward and often less stringent application process compared to traditional personal loans. The speed and accessibility make them appealing for urgent, short-term financial needs. However, it’s crucial to be aware of the potential drawbacks, including interest charges, and the impact on future budgeting, to ensure you’re making a financially responsible choice.

Advantages of Salary Advance Loans from State Employee Credit Unions

Salary advance loans from a state employee credit union offer several key benefits stemming from the credit union’s member-centric approach. These benefits often include lower interest rates than other short-term loan options, a streamlined application process designed for convenience, and flexible repayment terms tailored to the borrower’s pay schedule. The credit union’s understanding of the state employee’s financial situation often translates to more compassionate and understanding customer service. For example, a credit union might offer extended repayment options during unforeseen financial hardship, something less common with other lenders.

Disadvantages and Risks of Salary Advance Loans

While convenient, salary advance loans are not without their drawbacks. The interest rates, while often lower than payday loans, are still typically higher than those of longer-term loans. Borrowing frequently can create a cycle of debt, particularly if the underlying financial issue isn’t addressed. Furthermore, failing to repay the loan on time can negatively impact your credit score, making it harder to secure loans or credit in the future. A significant risk is the potential for over-reliance on these loans to manage recurring expenses, masking deeper financial problems that require more comprehensive solutions.

Comparison with Other Short-Term Borrowing Options, Salary advance loan state employees’ credit union

State employees have several short-term borrowing options besides salary advance loans. Payday loans, while offering quick access to cash, often come with extremely high interest rates and fees. Personal lines of credit provide more flexibility but typically require a credit check and may have higher interest rates than salary advances from a credit union. Overdraft protection on checking accounts can provide short-term relief but often involves significant fees. Compared to these alternatives, salary advance loans from a credit union often present a more favorable balance between accessibility, speed, and affordability, assuming responsible use.

Benefits and Drawbacks: A Comparison

The following points highlight the key differences between the advantages and disadvantages of salary advance loans:

- Benefit: Lower interest rates than payday loans or some personal lines of credit.

- Benefit: Faster and simpler application process compared to traditional loans.

- Benefit: Repayment aligned with your paycheck schedule.

- Drawback: Interest charges still apply, impacting your overall cost.

- Drawback: Frequent borrowing can lead to a debt cycle.

- Drawback: Late payments can harm your credit score.

Alternatives to Salary Advance Loans: Salary Advance Loan State Employees’ Credit Union

State employees facing short-term financial difficulties have options beyond salary advance loans. Exploring these alternatives can lead to more favorable terms and avoid potential long-term financial burdens. Understanding the pros and cons of each solution is crucial for making an informed decision.

Financial Counseling Services for State Employees

Many state governments and employee assistance programs offer free or low-cost financial counseling services. These services provide personalized guidance on budgeting, debt management, and creating a financial plan to address immediate needs and prevent future crises. Counselors can help state employees assess their financial situation, identify areas for improvement, and develop strategies for achieving their financial goals. They can also connect employees with resources such as credit counseling agencies and debt consolidation programs. For example, some states partner with non-profit organizations to provide these services directly to their employees. These services often include workshops, online resources, and one-on-one consultations.

Comparison of Salary Advance Loans, Payday Loans, and Other High-Interest Loans

Understanding the differences between salary advance loans and other short-term borrowing options is vital. Payday loans, for instance, are notorious for their extremely high interest rates and short repayment periods, often leading to a cycle of debt. Other high-interest loans, such as title loans or personal loans from non-bank lenders, also carry significant risks. Salary advance loans, while convenient, may still have fees and interest charges, albeit typically lower than those associated with payday loans.

| Solution | Description | Pros | Cons |

|---|---|---|---|

| Salary Advance Loan | Loan from a credit union or employer, repaid through payroll deductions. | Convenient, relatively low interest (compared to other options), often available to employees with good standing. | May still incur fees, limits the amount borrowed, can impact credit score if not repaid on time. |

| Payday Loan | Short-term, high-interest loan repaid on the borrower’s next payday. | Quick access to cash. | Extremely high interest rates, short repayment period leading to debt cycles, potential for hidden fees, negative impact on credit score. |

| Personal Loan (from Bank or Credit Union) | Loan with a fixed repayment schedule and interest rate, typically repaid over several months or years. | Lower interest rates than payday loans, longer repayment period, can be used for various purposes. | Requires a credit check, may not be approved if credit score is low, may have higher initial fees. |

| Credit Card Cash Advance | Borrowing money against your credit card’s available credit. | Quick access to cash, readily available if you have a credit card. | High interest rates, fees, potential negative impact on credit utilization ratio and credit score. |

| Financial Counseling | Guidance from a financial counselor on budgeting, debt management, and financial planning. | Free or low-cost, personalized advice, helps create a long-term financial plan, can connect you with other resources. | Requires time commitment, may not provide immediate financial relief. |

| Borrowing from Family or Friends | Requesting a loan from trusted individuals. | Potentially lower interest or no interest, avoids formal loan application process. | Can strain personal relationships if not repaid on time, may not be a feasible option for everyone. |

Legal and Regulatory Considerations

Salary advance loans, even within the seemingly secure environment of a state employee credit union, are subject to a complex web of state and federal regulations designed to protect borrowers from predatory lending practices. Understanding these regulations is crucial for both the credit union and its members to ensure compliance and avoid potential legal pitfalls.

State and federal laws dictate various aspects of these loans, including interest rates, fees, disclosure requirements, and collection practices. Failure to adhere to these regulations can result in significant financial penalties for the credit union and potential legal recourse for borrowers. The specific regulations vary by state, highlighting the need for thorough research and adherence to the governing laws of the relevant jurisdiction.

State and Federal Regulations Governing Salary Advance Loans

State laws often dictate the maximum permissible interest rates for various types of loans, including salary advances. Federal regulations, such as the Truth in Lending Act (TILA), mandate clear and conspicuous disclosure of loan terms, including the annual percentage rate (APR), fees, and repayment schedule. These regulations aim to prevent borrowers from entering into agreements they don’t fully understand. The Consumer Financial Protection Bureau (CFPB) plays a significant role in enforcing these federal regulations and protecting consumers from unfair or deceptive lending practices. Specific state laws may also govern aspects such as the maximum loan amount allowed based on an employee’s salary, or the permissible frequency of salary advance loans. For instance, a state might prohibit more than one such loan within a specified time frame.

Importance of Understanding Loan Agreements

A loan agreement serves as a legally binding contract between the borrower and the lender. It Artikels all the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, fees, and any other relevant details. Borrowers must carefully review and understand all aspects of the agreement before signing. Failure to do so could result in unforeseen financial burdens or legal disputes. Understanding the terms allows borrowers to make informed decisions and avoid potential problems down the line. Disputes often arise from misunderstandings regarding repayment terms, late payment fees, or other aspects of the loan agreement.

Applicable Consumer Protection Laws

Several consumer protection laws apply to salary advance loans. These laws aim to prevent unfair or deceptive practices by lenders. For example, the Fair Debt Collection Practices Act (FDCPA) protects borrowers from abusive or harassing collection tactics. The Electronic Fund Transfer Act (EFTA) regulates electronic transfers of funds, including automated deductions for loan repayments. Violation of these laws can lead to significant penalties for the lender and potential legal remedies for the borrower. The CFPB provides resources and guidance to consumers on their rights and how to report violations of consumer protection laws. State-specific consumer protection laws might offer additional safeguards for borrowers.

Examples of Potential Legal Issues

Potential legal issues related to salary advance loans can include disputes over interest rates exceeding legal limits, failure to provide accurate disclosures as required by TILA, and violations of the FDCPA during debt collection. A borrower might challenge a loan agreement if they believe they were misled or pressured into accepting terms they didn’t fully understand. Lenders could face legal action for engaging in deceptive or unfair lending practices, including charging excessive fees or resorting to aggressive collection methods. For example, a lender might face legal action for failing to disclose all fees associated with a loan, or for repeatedly contacting a borrower at unreasonable times or places. Another example might be a credit union using an employee’s salary advance as leverage for future employment decisions, which would be a violation of labor laws in many jurisdictions.

Illustrative Example

Sarah Miller, a 35-year-old state employee working as a social worker, finds herself facing an unexpected financial challenge. While she diligently manages her finances, a series of unforeseen events has created a temporary shortfall in her budget. This case study illustrates how a salary advance loan from her state employee credit union could provide a crucial lifeline and its potential impact on her financial well-being.

Sarah’s monthly income is $4,500, a comfortable salary for her cost of living. However, her expenses are substantial. She pays $1,500 in rent, $500 for her car payment, $300 for groceries, $200 for utilities, and $100 for transportation. This totals $2,600 in essential monthly expenses. She also has student loan payments of $300 and a credit card debt of $200, leaving her with a total monthly expenditure of $3,100. This leaves her with $1,400 for savings, discretionary spending, and unexpected costs.

Sarah’s Financial Predicament

Recently, Sarah’s car required unexpected repairs costing $800. Simultaneously, her elderly mother experienced a medical emergency requiring a $500 contribution towards her medical bills. These unforeseen expenses depleted her savings, leaving her with a significant shortfall in her budget before her next paycheck. This situation created significant stress, as she worried about paying her upcoming rent and other essential bills.

Impact of a Salary Advance Loan

A salary advance loan of $1,300 from the State Employee Credit Union would bridge this temporary gap. The loan would allow Sarah to cover the immediate expenses, preventing late payments and potential damage to her credit score. The repayment terms, likely spread over a few months, would be manageable within her existing budget.

Potential Impact on Financial Health

By utilizing the salary advance loan, Sarah avoids incurring additional debt through high-interest credit cards or payday loans. This prevents a potential downward spiral of accumulating debt. The manageable repayment plan allows her to regain control of her finances without disrupting her overall financial health. It’s a responsible solution to a temporary setback, unlike high-interest debt which can have long-term negative consequences. Her credit score remains unaffected, maintaining her financial stability. The loan provides a safety net, allowing her to navigate a financial crisis without resorting to damaging financial practices.

Final Wrap-Up

Securing a salary advance loan from your state employees’ credit union can provide much-needed financial relief, but careful consideration is key. Understanding the terms, comparing options, and exploring alternatives are crucial steps in responsible borrowing. By weighing the benefits and drawbacks, and fully comprehending the application process and repayment options, state employees can leverage these loans effectively while mitigating potential risks. Remember to always review the fine print and seek financial guidance if needed to ensure a positive outcome.

Questions Often Asked

What credit score is typically required for a salary advance loan?

Credit score requirements vary between credit unions. Some may not require a credit check, while others may have minimum score thresholds. It’s best to check directly with your specific credit union.

Can I apply for a salary advance loan online?

Many state employee credit unions offer online application portals for added convenience. However, some may still require in-person applications. Check your credit union’s website or contact them directly.

What happens if I miss a payment on my salary advance loan?

Missing payments can result in late fees, damage to your credit score, and potential collection actions. Contact your credit union immediately if you anticipate difficulty making a payment to explore options like repayment plans.

Are there any fees associated with salary advance loans?

Some credit unions may charge origination fees or other processing fees. It’s essential to review the loan agreement carefully to understand all associated costs.