Supermoney personal loans offer a potential solution for various financial needs. This comprehensive guide delves into the features, application process, repayment options, and customer experiences associated with Supermoney personal loans, providing a detailed overview to help you determine if they’re the right choice for you. We’ll explore eligibility criteria, compare them to other lenders, and address common concerns to empower you with the knowledge needed to make an informed decision.

From understanding the eligibility requirements and navigating the online application to comprehending repayment schedules and fees, we aim to provide a transparent and informative resource. We’ll also examine customer reviews to give you a realistic perspective on the overall experience, allowing you to weigh the pros and cons effectively. Ultimately, this guide aims to equip you with the tools to confidently assess whether Supermoney personal loans align with your financial goals.

Understanding Supermoney Personal Loans

Supermoney personal loans offer individuals access to flexible financing for various needs. Understanding the features, eligibility requirements, and comparative advantages is crucial before applying. This section details the key aspects of Supermoney personal loans to help potential borrowers make informed decisions.

Supermoney Personal Loan Features

Supermoney personal loans typically offer a range of features designed to cater to diverse borrower profiles. These features often include competitive interest rates, flexible repayment terms, and convenient online application processes. Some lenders may also offer options for early repayment without penalty, though this should be verified directly with Supermoney. The specific features available may vary depending on the loan product and the borrower’s creditworthiness. For example, some loans might offer fixed interest rates while others provide variable rates. The availability of additional features such as loan protection insurance should also be confirmed.

Supermoney Personal Loan Eligibility Criteria

Eligibility for a Supermoney personal loan usually involves meeting specific criteria set by the lender. These criteria often include a minimum age requirement (typically 18 years or older), proof of income and employment stability, and a satisfactory credit history. The lender will assess the applicant’s credit score and debt-to-income ratio to determine their creditworthiness and ability to repay the loan. Providing accurate and complete information during the application process is crucial for a smooth and successful approval. Specific requirements may vary depending on the loan amount and type.

Comparison with Other Lenders

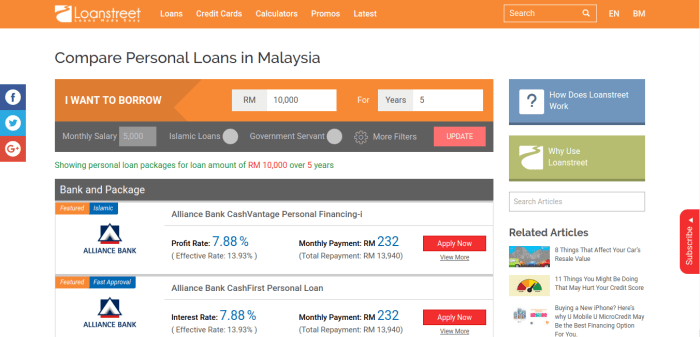

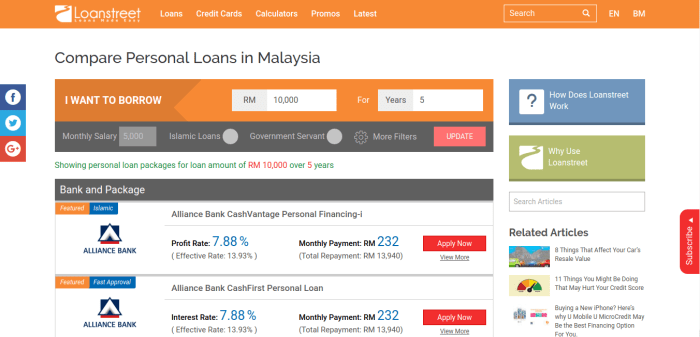

Comparing Supermoney personal loans with offerings from other lenders is essential for securing the best possible terms. Factors to consider include interest rates, fees, repayment terms, and the overall application process. Some lenders may offer lower interest rates but have stricter eligibility criteria, while others might have more flexible terms but higher fees. Researching and comparing offers from multiple lenders allows borrowers to identify the loan that best suits their individual financial situation and needs. Consider using online comparison tools to streamline this process. For instance, comparing Supermoney’s offerings with those of a major bank might reveal differences in interest rates and loan terms.

Situations Where a Supermoney Personal Loan is Beneficial

Supermoney personal loans can be beneficial in various situations. For example, they can be used to consolidate high-interest debt, finance home improvements, cover unexpected medical expenses, or fund a vacation. They can also provide short-term financial relief for unexpected costs or emergencies. A personal loan can be a more structured and predictable way to manage debt compared to using high-interest credit cards. Consider a scenario where unexpected car repairs are needed – a Supermoney personal loan could provide the necessary funds without incurring high credit card interest.

Comparison of Supermoney Loan Products

The following table compares different Supermoney loan products (assuming hypothetical data for illustrative purposes. Actual rates and terms should be obtained directly from Supermoney).

| Loan Product | Interest Rate (APR) | Loan Term (Months) | Maximum Loan Amount |

|---|---|---|---|

| Personal Loan A | 7.5% | 12 | $5,000 |

| Personal Loan B | 9.0% | 24 | $10,000 |

| Personal Loan C | 10.5% | 36 | $15,000 |

| Personal Loan D | 6.0% | 60 | $20,000 |

Application Process and Requirements

Applying for a Supermoney personal loan is a straightforward process designed for convenience and efficiency. The entire application can be completed online, requiring minimal paperwork and offering a quick turnaround time for approval. Understanding the steps involved and the necessary documentation will significantly increase your chances of a successful application.

The application process is designed to be user-friendly, guiding you through each step with clear instructions. However, providing accurate and complete information is crucial to ensure a smooth and timely approval. Failure to do so may result in delays or rejection of your application.

Steps in the Online Application Process

The online application process for a Supermoney personal loan involves several key steps. Completing each step accurately and thoroughly is essential for a successful application.

- Visit the Supermoney Website: Navigate to the Supermoney website and locate the personal loan application section. This typically involves clicking a prominent button or link usually found on the homepage or within a dedicated loans section.

- Create an Account (if necessary): If you are a new user, you will need to create an account by providing your email address, creating a password, and potentially verifying your identity through a verification email or SMS. A screenshot of this stage would show a registration form with fields for email, password, and potentially a CAPTCHA.

- Fill out the Application Form: The application form will request personal information, including your name, address, date of birth, employment details (employer, income, employment length), and financial information (bank account details, existing debts). A screenshot here would display a multi-page form with various input fields clearly labeled.

- Upload Supporting Documents: You will be required to upload supporting documents to verify your identity and income. This usually includes a government-issued ID (such as a driver’s license or passport), proof of address (utility bill or bank statement), and proof of income (payslips or tax returns). A screenshot of this section would show a file upload interface with instructions on accepted file types and sizes.

- Review and Submit: Before submitting your application, carefully review all the information you have provided to ensure accuracy. Once you are satisfied, submit your application. A screenshot here would display a summary page showing all the entered information before the final submission button.

- Receive Confirmation and Updates: Upon submission, you will receive a confirmation message, and Supermoney will notify you of the application’s progress via email or SMS. A screenshot might show a confirmation message displayed on the screen or an email notification in an inbox.

Required Documentation

Providing the necessary documentation is crucial for a swift and successful loan application. Incomplete or inaccurate documentation is a common cause of application delays or rejections.

- Government-Issued Photo ID: A valid driver’s license, passport, or national ID card.

- Proof of Address: A recent utility bill (gas, electricity, water), bank statement, or rental agreement.

- Proof of Income: Payslips, tax returns, or bank statements showing regular income.

- Bank Account Details: Account number and bank name for direct deposit of the loan amount.

Reasons for Loan Application Rejection

Several factors can lead to a personal loan application being rejected. Understanding these reasons can help you improve your chances of approval in future applications.

- Insufficient Income: Applicants with insufficient income to comfortably repay the loan may be rejected. This is assessed based on your debt-to-income ratio and repayment capacity.

- Poor Credit History: A history of missed payments or defaults on previous loans can negatively impact your credit score and lead to rejection.

- Incomplete Application: Missing information or incomplete documentation can delay or prevent approval.

- Inaccurate Information: Providing false or misleading information will automatically lead to rejection.

- High Debt-to-Income Ratio: A high ratio suggests you already have significant debt obligations, making it difficult to manage additional debt.

Loan Repayment and Fees

Understanding how Supermoney personal loans are repaid, including associated fees, is crucial for responsible borrowing. This section details repayment options, interest calculations, potential late payment penalties, and a breakdown of various fees. Careful consideration of these factors will help you make informed financial decisions.

Repayment Options

Supermoney offers flexible repayment options tailored to individual financial situations. Borrowers can typically choose between monthly installments, spread over the agreed loan term. The specific repayment schedule is determined at the time of loan approval and is clearly Artikeld in the loan agreement. Contacting Supermoney directly will provide the most accurate and up-to-date information regarding available repayment options.

Interest Calculation and Total Repayment

The total repayment amount for a Supermoney personal loan includes the principal loan amount plus accumulated interest. Interest is typically calculated using a fixed or variable interest rate, clearly stated in your loan agreement. The calculation method will be specified in your contract. For example, a loan of $5,000 with a 10% annual interest rate spread over 12 months would result in a different total repayment amount than the same loan spread over 24 months. The exact total repayment amount will be detailed in your personalized loan offer. It’s essential to review this information carefully before accepting the loan. A simple formula for calculating simple interest is:

Interest = Principal x Rate x Time

More complex calculations, such as those involving compound interest, may be used depending on the loan terms.

Late Payment Fees

Late payments on Supermoney personal loans can incur significant fees. These fees are designed to compensate for the increased administrative burden and potential financial risk associated with late payments. The specific amount of the late payment fee is detailed in the loan agreement and can vary depending on the loan amount and the length of the delay. Repeated late payments can negatively impact your credit score and may lead to further penalties or even loan default. It’s crucial to make timely payments to avoid these consequences. Supermoney may also charge additional fees for returned payments.

Repayment Schedule Examples

Below are illustrative examples of repayment schedules. Remember, these are examples only and your actual repayment schedule will depend on your individual loan terms.

| Loan Amount | Loan Term (Months) | Monthly Payment (Estimate) | Total Repayment (Estimate) |

|---|---|---|---|

| $1,000 | 12 | $87.92 | $1055.04 |

| $5,000 | 24 | $230.00 | $5520.00 |

| $10,000 | 36 | $350.00 | $12600.00 |

*Note: These are illustrative examples only and do not represent actual loan offers. Contact Supermoney for accurate quotes.*

Fees Associated with Supermoney Personal Loans

The following table Artikels various fees that may be associated with Supermoney personal loans. The specific fees and their amounts may vary depending on the individual loan and circumstances. It is crucial to review the loan agreement for complete and accurate fee information.

| Fee Type | Description | Potential Amount (Estimate) | Notes |

|---|---|---|---|

| Origination Fee | A fee charged for processing the loan application. | $0 – $50 | May vary depending on loan amount. |

| Late Payment Fee | Charged for payments made after the due date. | $25 – $50 | Specific amount Artikeld in loan agreement. |

| Returned Payment Fee | Charged if a payment is returned due to insufficient funds. | $30 – $50 | May vary depending on lender policy. |

| Early Repayment Fee (Potential) | May be charged if you repay the loan early. | Varies | Check loan agreement for details. |

Customer Reviews and Experiences

Understanding customer feedback is crucial for assessing the overall quality and reliability of Supermoney personal loans. This section summarizes reviews from various online platforms, highlighting both positive and negative experiences to provide a balanced perspective. We analyze common themes in customer feedback, categorized for clarity, to help potential borrowers make informed decisions.

Summary of Customer Reviews and Ratings

Supermoney personal loans receive a mixed bag of reviews across different online platforms. While some customers express high satisfaction with the speed of the loan approval process and the helpfulness of customer service representatives, others report negative experiences related to high interest rates and difficulties in contacting support. Aggregate ratings vary depending on the platform, ranging from 3.5 to 4.5 out of 5 stars, indicating a degree of variability in customer satisfaction. The average rating, however, suggests a generally positive, though not universally glowing, perception of the service.

Positive Customer Experiences

Positive reviews frequently cite the speed and ease of the online application process as major advantages. Many customers praise the quick approval times, often receiving funds within a few days of applying. Another recurring positive theme is the helpfulness and responsiveness of Supermoney’s customer service team, with many reviewers mentioning positive interactions with representatives who resolved their issues efficiently. For example, one reviewer stated,

“I was surprised how quickly I got approved and the money transferred. The customer service was also excellent when I had a small question about the repayment schedule.”

This positive feedback emphasizes the efficiency and support offered by Supermoney.

Negative Customer Experiences

Conversely, negative reviews often focus on the relatively high interest rates charged compared to other lenders. Some customers also complain about the difficulty in contacting customer service, with long wait times on the phone or unanswered emails. Another recurring complaint involves hidden fees or unexpected charges, leading to dissatisfaction with the overall cost of the loan. One negative review exemplifies this:

“While the application was easy, the interest rate was much higher than advertised, and I felt like there were hidden fees. I wouldn’t recommend them unless you have no other options.”

This highlights the importance of thoroughly reviewing all terms and conditions before accepting a loan.

Customer Feedback Categorization

To further clarify the range of experiences, customer feedback can be categorized as follows:

- Customer Service: Reviews are split, with some praising helpful and responsive representatives, while others report difficulty contacting support or receiving unsatisfactory responses.

- Loan Approval Process: Many customers praise the speed and ease of the online application and approval process, while others experienced delays or complications.

- Repayment Experience: While most reviews don’t specifically detail repayment issues, some mention difficulties contacting customer service regarding payments or concerns about high interest rates affecting their repayment capacity.

Alternative Lending Options

Supermoney personal loans represent one option within a broader landscape of personal lending products. Understanding the alternatives is crucial for borrowers to secure the most suitable financing solution based on their individual financial circumstances and needs. This section compares Supermoney to other loan types and providers, highlighting key factors to consider during the selection process.

Comparison of Supermoney Personal Loans with Other Loan Types

Supermoney offers unsecured personal loans, meaning they don’t require collateral. This contrasts with secured loans, such as those secured by a car or home. Secured loans typically offer lower interest rates due to the reduced risk for the lender, but carry the risk of asset repossession in case of default. Supermoney’s unsecured nature provides flexibility but may result in higher interest rates compared to secured options. Another alternative is a credit union loan, which often provides competitive rates and personalized service, but may have stricter membership requirements. Finally, peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders, potentially offering unique terms but requiring careful due diligence to assess lender reliability.

Advantages and Disadvantages of Choosing Supermoney

Supermoney’s advantages might include a streamlined application process, quick approval times, and potentially flexible repayment options. However, disadvantages could include higher interest rates compared to some competitors, or potentially stricter eligibility criteria. A thorough comparison with other lenders is vital to determine whether Supermoney’s benefits outweigh its drawbacks for a particular borrower.

Factors to Consider When Choosing a Personal Loan Provider

Several factors influence the choice of a personal loan provider. These include the interest rate, loan term, fees (origination fees, late payment fees, etc.), repayment flexibility, eligibility requirements (credit score, income verification), customer service reputation, and the overall transparency of the lending process. Borrowers should carefully review the terms and conditions of each loan offer before committing to a specific provider.

Examples of Alternative Lenders and Their Offerings

Several lenders offer competitive personal loan products. For instance, LendingClub is a well-known P2P lending platform that connects borrowers with individual investors. They offer a wide range of loan amounts and terms. Similarly, banks and credit unions often provide personal loans with varying interest rates and repayment schedules. These institutions typically have established reputations and robust customer service networks. Finally, online lenders like Upstart utilize alternative data sources to assess creditworthiness, potentially offering loans to individuals with limited credit history.

Comparison Table of Personal Loan Providers, Supermoney personal loans

| Feature | Supermoney | LendingClub | Local Bank/Credit Union | Upstart |

|---|---|---|---|---|

| Interest Rate | Variable, depends on creditworthiness | Variable, depends on creditworthiness and market conditions | Variable, typically lower than online lenders | Variable, potentially higher for lower credit scores |

| Loan Amounts | Varies, typically up to a certain limit | Varies widely | Varies widely | Varies widely |

| Loan Terms | Varies, typically 12-60 months | Varies widely | Varies widely | Varies widely |

| Fees | May include origination fees and late payment penalties | May include origination fees and late payment penalties | May include origination fees and late payment penalties | May include origination fees and late payment penalties |

Closure

Securing a personal loan is a significant financial decision, and understanding all aspects is crucial. This guide has explored Supermoney personal loans in detail, from application and repayment to customer experiences and alternative options. By carefully considering the information presented—including the comparison with other lenders and the analysis of customer feedback—you can make a well-informed choice that best suits your individual circumstances and financial needs. Remember to always compare offers and read the fine print before committing to any loan agreement.

Expert Answers

What credit score is needed for Supermoney personal loans?

Supermoney’s minimum credit score requirement varies depending on the loan amount and term. Check their website or contact them directly for specific details.

Can I prepay my Supermoney personal loan?

Prepayment options and any associated fees should be Artikeld in your loan agreement. Contact Supermoney for clarification on their prepayment policy.

What happens if I miss a payment?

Missing a payment will likely result in late fees and could negatively impact your credit score. Contact Supermoney immediately if you anticipate difficulties making a payment.

What types of documentation are required?

Typically, you’ll need proof of income, identification, and potentially bank statements. The specific requirements are detailed on Supermoney’s application page.