USSFCU auto loan rates are a key factor for anyone considering financing a vehicle through this credit union. Understanding these rates, along with the various loan options, eligibility requirements, and repayment plans, is crucial for making an informed decision. This comprehensive guide delves into every aspect of USSFCU auto loans, equipping you with the knowledge to secure the best financing for your needs.

We’ll explore the factors influencing interest rates, compare USSFCU’s offerings to competitors, and guide you through the application process. We’ll also cover crucial details like fees, repayment options, and customer experiences, providing a holistic overview to help you navigate the world of USSFCU auto financing with confidence.

Understanding USSFCU Auto Loan Rates

Securing an auto loan can be a significant financial decision, and understanding the interest rates offered by your lender is crucial. This section delves into the factors influencing USSFCU’s auto loan interest rates, the types of loans they offer, and how their rates compare to those of other credit unions. We will also provide illustrative examples of potential loan terms. Remember that actual rates are subject to change and depend on individual creditworthiness and other factors.

Factors Influencing USSFCU Auto Loan Interest Rates

Several key factors determine the interest rate you’ll receive from USSFCU on an auto loan. These include your credit score, the loan amount, the loan term (length), the type of vehicle (new or used), the vehicle’s value, and the loan-to-value ratio (LTV). A higher credit score generally results in a lower interest rate, as does a shorter loan term. Borrowing a smaller amount also typically leads to a lower rate. The condition and type of vehicle also play a significant role; new vehicles often command lower rates than used vehicles. Finally, a lower LTV (the loan amount as a percentage of the vehicle’s value) can positively impact your interest rate.

Types of Auto Loans Offered by USSFCU

USSFCU likely offers various auto loan options to cater to different needs. These may include loans for new and used vehicles, potentially with different terms and interest rates depending on the vehicle’s age and condition. They might also offer refinancing options for existing auto loans, allowing borrowers to potentially secure a lower interest rate or better terms. Specific loan products and their features should be confirmed directly with USSFCU.

Comparison of USSFCU Auto Loan Rates with Other Credit Unions

Directly comparing USSFCU’s auto loan rates with other credit unions requires accessing current rate information from multiple sources. Rate comparisons are dynamic and depend on the specific loan terms, applicant’s credit profile, and prevailing market conditions. It’s advisable to obtain personalized quotes from several credit unions, including USSFCU, to make an informed comparison. Consider factors beyond just the interest rate, such as loan fees, customer service, and the overall loan application process.

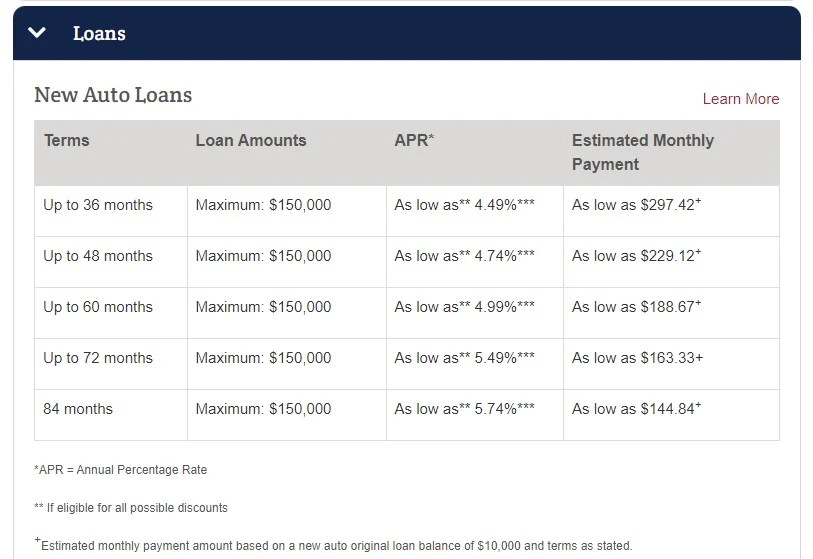

Sample Auto Loan Terms Comparison

The following table provides a hypothetical comparison of loan terms for different vehicle types. These figures are for illustrative purposes only and should not be considered guaranteed rates. Actual rates will vary based on individual circumstances.

| Vehicle Type | Loan Amount | Interest Rate (%) | APR (%) | Loan Duration (Months) |

|---|---|---|---|---|

| New Car | $30,000 | 4.5 | 4.75 | 60 |

| Used Car | $20,000 | 6.0 | 6.25 | 48 |

| New SUV | $45,000 | 5.0 | 5.25 | 72 |

| Used Truck | $25,000 | 7.0 | 7.25 | 60 |

Eligibility and Application Process

Securing a USSFCU auto loan involves meeting specific eligibility criteria and navigating a straightforward application process. Understanding these aspects ensures a smoother experience when financing your next vehicle. This section details the requirements, steps, and necessary documentation.

USSFCU’s auto loan eligibility hinges on several factors, primarily focusing on your financial stability and creditworthiness. While specific requirements may vary depending on the loan amount and type of vehicle, generally, you’ll need to be a member of the credit union, demonstrate a consistent income stream, and maintain a satisfactory credit history. The credit union aims to assess your ability to repay the loan responsibly.

Eligibility Requirements

Meeting the eligibility criteria is the first step in securing a USSFCU auto loan. These requirements help the credit union assess your financial responsibility and capacity to repay the loan.

- Membership in USSFCU: You must be a member of the United States Servicemen’s Credit Union to apply for a loan.

- Acceptable Credit History: While the exact credit score requirement isn’t publicly stated, a good credit history significantly improves your chances of approval and securing favorable interest rates. A history of responsible credit management demonstrates your ability to handle debt.

- Sufficient Income: USSFCU will assess your income to ensure you can comfortably afford the monthly loan payments. Proof of income, such as pay stubs or tax returns, will be required.

- Acceptable Debt-to-Income Ratio: Your debt-to-income ratio (DTI) – the percentage of your gross monthly income that goes towards debt payments – plays a crucial role. A lower DTI generally increases your approval chances.

Application Steps

Applying for a USSFCU auto loan is a streamlined process. The following steps provide a clear Artikel of what to expect.

- Pre-qualification: Before formally applying, consider pre-qualifying online or by contacting USSFCU directly. This helps you understand potential interest rates and loan amounts without impacting your credit score.

- Complete the Application: Once pre-qualified (or if you choose to skip this step), complete the formal auto loan application online or in person at a branch. This will involve providing personal and financial information.

- Provide Necessary Documentation: Gather and submit all required documents, as Artikeld in the following section. Having these readily available expedites the application process.

- Loan Approval and Processing: USSFCU will review your application and supporting documentation. This may involve a credit check. Upon approval, you’ll be notified and the loan processing will begin.

- Loan Closing: Once the loan is processed, you’ll sign the loan agreement and receive the funds, typically after the vehicle purchase is finalized.

Required Documentation

Preparing the necessary documentation beforehand simplifies the application process and ensures a quicker turnaround time. This section lists the commonly required documents.

- Proof of Identity: A valid driver’s license or government-issued ID.

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns.

- Proof of Residence: Utility bill, bank statement, or lease agreement.

- Vehicle Information: Details about the vehicle you intend to purchase, including the year, make, model, and VIN (Vehicle Identification Number).

- Credit Report Authorization (if required): USSFCU may request authorization to obtain your credit report.

Loan Repayment and Fees

Understanding USSFCU auto loan repayment options and associated fees is crucial for responsible borrowing. This section details the repayment methods, potential costs, and strategies for effective loan management. Careful planning can significantly impact your overall loan experience.

Repayment Options

USSFCU likely offers various repayment methods to suit different financial situations. Borrowers can typically choose between monthly, bi-weekly, or even weekly payment schedules. The frequency of payments will influence the overall repayment timeline and the amount due per payment period. Contacting USSFCU directly will provide the most accurate and up-to-date information on available repayment options. Choosing a repayment schedule that aligns with your income stream and budget is key to avoiding late payments and potential penalties.

Fees Associated with USSFCU Auto Loans

Several fees might be associated with a USSFCU auto loan. These can include origination fees, which are charged upfront to cover the administrative costs of processing the loan application. Late payment fees are typically incurred if a payment is not received by the due date. Other potential fees could include returned check fees or early payoff penalties, though these are less common. It’s essential to review the loan agreement thoroughly to understand all applicable fees and their amounts. Proactive budgeting and careful financial planning can help avoid these additional costs.

Strategies for Managing Loan Repayments Effectively

Effective loan repayment management involves proactive planning and consistent effort. Creating a realistic budget that incorporates the monthly loan payment is a fundamental step. Automating payments through online banking or direct debit can prevent missed payments. Tracking your loan balance and payment history online provides transparency and allows for proactive monitoring. In case of unforeseen financial difficulties, contacting USSFCU promptly to discuss potential options, such as temporary payment deferral or modification, is crucial. Open communication with the credit union can help prevent serious consequences like default.

Sample Repayment Schedule

The following table illustrates example repayment schedules for different loan amounts and terms. Remember that these are examples only, and actual loan terms and payments will vary based on individual creditworthiness, interest rates, and loan type. Contact USSFCU for personalized rate quotes and repayment schedules.

| Loan Amount | Loan Term (Months) | Monthly Payment (Estimate) | Total Interest Paid (Estimate) |

|---|---|---|---|

| $15,000 | 36 | $450 | $1,800 |

| $20,000 | 48 | $480 | $3,840 |

| $25,000 | 60 | $500 | $6,000 |

| $30,000 | 72 | $520 | $8,640 |

Special Offers and Promotions

USSFCU frequently offers special promotions on its auto loans to attract new members and reward existing ones. These promotions can significantly impact the overall cost of borrowing, making it crucial for prospective borrowers to understand the terms and conditions before committing to a loan. The availability and specifics of these offers change periodically, so checking the credit union’s website or contacting them directly is essential.

Understanding the nuances of different promotional offers requires careful consideration of their benefits and potential drawbacks. While lower interest rates are often the primary draw, hidden fees or restrictive terms could negate the initial savings.

Current Promotional Offers

Promotional offers from USSFCU are dynamic and vary based on factors like membership status, loan amount, and credit score. It’s vital to check the credit union’s official website for the most up-to-date information. However, past promotional examples can offer insight into the types of offers typically available. For instance, past promotions might have included reduced interest rates for new car purchases, rebates on loan origination fees, or special financing options for used vehicles with certain mileage limits.

Comparison of Promotional Offers

Let’s consider two hypothetical promotional offers to illustrate a comparison. Imagine one offer advertising a 1% reduction in the interest rate for a 60-month loan, and another offering a $500 rebate on the loan origination fee for a 72-month loan. To determine which offer is better, a borrower needs to calculate the total interest paid under each scenario, factoring in the loan amount and the different terms. The offer that results in the lowest total cost, considering both interest and fees, would be the more favorable option. This requires careful analysis, and potentially using a loan calculator to compare the total cost of each option.

Finding and Utilizing Available Discounts

USSFCU members can discover current promotions through several channels. The credit union’s website usually has a dedicated section for current offers. Additionally, members may receive email notifications or see promotions advertised in branch locations or through their online banking portal. To utilize any discounts, borrowers should mention the specific promotion during the loan application process. Providing proof of eligibility, if required by the promotion’s terms and conditions, is crucial for securing the discounted rate or rebate.

Summary of Current Promotions (Hypothetical Example)

It is important to note that the following are hypothetical examples and may not reflect currently available promotions. Always check the USSFCU website for the most up-to-date information.

- Promotion 1: Reduced Interest Rate for New Vehicles: 0.5% reduction on the standard auto loan interest rate for new vehicle purchases, valid for loans with a term of 60 months or less. Minimum loan amount of $10,000 required. Offer valid until [Date].

- Promotion 2: Loan Origination Fee Rebate for Used Vehicles: $250 rebate on the loan origination fee for used vehicle purchases, valid for loans with a term of 72 months or less. Maximum loan amount of $25,000. Offer valid until [Date].

- Promotion 3: Loyalty Discount: 0.25% reduction on the standard auto loan interest rate for existing USSFCU members with a history of responsible borrowing. Applicable to all loan terms and amounts. Offer valid until [Date].

Customer Experiences and Reviews

Understanding the experiences of other USSFCU auto loan customers is crucial before making a decision. Real-world feedback provides valuable insights that supplement official information, offering a more comprehensive picture of the loan process and the overall customer service. By analyzing both positive and negative reviews, potential borrowers can make a more informed choice aligned with their individual needs and expectations.

Finding and interpreting customer reviews requires a strategic approach. Multiple platforms host reviews, each offering a different perspective. Consider checking websites dedicated to financial reviews, such as those focusing on credit unions, as well as app stores (if applicable) and the USSFCU’s own website (though be aware that self-hosted reviews might be more curated). Remember that diverse perspectives are essential; focusing solely on positive or negative reviews provides an incomplete picture.

Identifying Credible Review Sources

Identifying trustworthy sources is paramount. Look for reviews that are detailed, specific, and offer concrete examples rather than vague generalizations. Pay attention to the reviewer’s profile; established users with a history of reviews are often more reliable. Beware of reviews that seem overly positive or negative, as these might be biased or even fake. Cross-referencing reviews across multiple platforms can help identify consistent themes and patterns, indicating a more accurate reflection of the customer experience. Checking for responses from USSFCU to negative reviews demonstrates their commitment to customer service and problem resolution. For example, a review stating, “The loan application process was surprisingly smooth and the representative was very helpful in explaining all the terms,” would be considered more credible than a simple one-star rating with no explanation. Conversely, a review solely focusing on a minor inconvenience might not be as representative of the overall experience.

Summary of Common Positive and Negative Aspects

Positive reviews frequently highlight the competitive interest rates offered by USSFCU, along with the ease and efficiency of the online application process. Many reviewers praise the helpfulness and responsiveness of USSFCU’s loan officers. For instance, one review might state:

“I was impressed by how quickly my application was processed and approved. The online portal made everything very convenient.”

Another might add:

“The loan officer I worked with was extremely knowledgeable and patient, answering all my questions thoroughly.”

Negative reviews, while less frequent, often cite difficulties in reaching customer service representatives or delays in processing applications, particularly during peak periods. Some reviewers mention issues with communication or a lack of transparency regarding certain fees. For example, a negative review might include a statement like:

“I had trouble getting in touch with someone to answer my questions about the loan terms.”

Or:

“The fees associated with the loan weren’t clearly explained upfront.”

It’s important to remember that even negative reviews can be valuable; they highlight areas where USSFCU might need improvement, and they offer a realistic perspective on potential challenges. By considering both positive and negative feedback, you gain a more complete and nuanced understanding of the USSFCU auto loan experience.

Comparing USSFCU to Competitors

Choosing the right auto loan requires careful consideration of various factors beyond just the interest rate. This section compares USSFCU’s auto loan offerings with those from major banks and other credit unions, highlighting key differences in terms, conditions, and potential cost savings. We’ll analyze interest rates, APRs, and loan features to help you make an informed decision.

Direct comparison of auto loan rates requires specific data points that change frequently. Therefore, providing exact numerical comparisons is impractical without access to real-time data feeds from various lenders. However, we can illustrate the general differences and factors influencing the final cost of an auto loan across different financial institutions.

Interest Rate and APR Comparison

Interest rates and APRs (Annual Percentage Rates) are crucial factors in determining the total cost of your auto loan. APRs typically include interest, fees, and other charges, offering a more comprehensive representation of the loan’s true cost than the interest rate alone. While USSFCU often competes favorably with credit unions, major banks may offer varying rates depending on credit score, loan term, and the type of vehicle being financed.

| Lender Type | Interest Rate Range (Example) | APR Range (Example) | Typical Loan Terms |

|---|---|---|---|

| USSFCU | 3.5% – 10% | 4.0% – 11% | 24-72 months |

| Major Bank (e.g., Bank of America) | 4.0% – 12% | 4.5% – 13% | 24-84 months |

| Other Credit Union (Example) | 3.0% – 9% | 3.5% – 10% | 36-60 months |

Note: The interest rate and APR ranges provided are illustrative examples only and should not be considered current or guaranteed rates. Actual rates will vary based on individual creditworthiness, loan amount, and other factors. Always check with the lender for the most up-to-date information.

Loan Term and Conditions, Ussfcu auto loan rates

Loan terms significantly impact the monthly payment and the total interest paid over the life of the loan. Shorter loan terms result in higher monthly payments but lower overall interest costs. Longer terms reduce monthly payments but increase the total interest paid. USSFCU, like other lenders, offers a range of loan terms, allowing borrowers to tailor their payments to their budget. However, specific terms and conditions may vary, such as prepayment penalties or requirements for loan insurance.

Potential Savings or Increased Costs

The potential savings or increased costs associated with choosing one lender over another depend on several factors, including the borrower’s credit score, the loan amount, and the prevailing market interest rates. A borrower with an excellent credit score might qualify for a significantly lower interest rate from any lender, including USSFCU, resulting in substantial savings over the loan term. Conversely, a borrower with a lower credit score may find that the rate differences between lenders are less pronounced, minimizing the impact of choosing one lender over another. For example, a $25,000 loan at 5% APR over 60 months will cost significantly less than the same loan at 10% APR. The difference in total interest paid could easily reach several thousand dollars over the life of the loan. Detailed amortization schedules from each lender will allow for a precise comparison.

Last Recap

Securing an auto loan can feel overwhelming, but with a clear understanding of USSFCU’s auto loan rates and the process involved, you can confidently navigate the journey. By comparing rates, understanding eligibility, and planning your repayment strategy, you can make an informed decision that aligns with your financial goals. Remember to carefully review all terms and conditions before committing to a loan.

Essential FAQs: Ussfcu Auto Loan Rates

What credit score is needed for a USSFCU auto loan?

While USSFCU doesn’t publicly state a minimum credit score, a higher score generally leads to better interest rates. It’s best to check your credit report and contact USSFCU directly to discuss your eligibility.

Does USSFCU offer pre-approval for auto loans?

Yes, USSFCU likely offers pre-approval, allowing you to understand your potential loan terms before you shop for a vehicle. Contact them to inquire about their pre-approval process.

What types of vehicles are eligible for financing through USSFCU?

USSFCU likely finances new and used cars, trucks, SUVs, and possibly motorcycles. Check their website or contact them for a complete list of eligible vehicles.

Can I refinance my existing auto loan with USSFCU?

Possibly. USSFCU may offer auto loan refinancing options. Contact them directly to see if you qualify for refinancing your current auto loan.