ACBS loans offer a unique financing solution, but understanding their intricacies is key. This guide delves into the world of ACBS loans, exploring eligibility criteria, interest rates, application processes, and potential benefits and drawbacks. We’ll examine real-world scenarios to illustrate how these loans can impact individuals and businesses, equipping you with the knowledge to make informed decisions.

From defining what constitutes an ACBS loan and who qualifies, to navigating the application process and understanding repayment options, we’ll cover all the essential aspects. We’ll also compare ACBS loans to other financing options, helping you weigh the pros and cons to determine if it’s the right choice for your specific needs.

ACBS Loan Definition and Eligibility

An ACBS loan, or Agricultural Credit Bank Scheme loan, is a type of agricultural loan offered by various financial institutions in certain regions. These loans are designed to provide financial assistance to farmers and agricultural businesses for various purposes related to agricultural production and development. The specific terms and conditions, eligibility criteria, and available loan amounts can vary depending on the lending institution and the prevailing government policies in the region. Understanding the intricacies of an ACBS loan is crucial for potential borrowers to assess its suitability for their needs.

The primary purpose of an ACBS loan is to facilitate agricultural activities. This encompasses a broad range of needs, from purchasing seeds and fertilizers to investing in new equipment or expanding farming operations. Access to credit through such schemes is intended to boost agricultural productivity and contribute to the overall economic growth of the agricultural sector. The specific details of what constitutes an eligible expense under an ACBS loan will be defined by the lending institution.

ACBS Loan Eligibility Criteria

Eligibility for an ACBS loan hinges on several factors, primarily focused on assessing the borrower’s creditworthiness and the viability of their agricultural project. Meeting these criteria is essential for loan approval. Failure to meet any of these criteria may result in loan application rejection.

Generally, eligibility criteria include:

- Proof of land ownership or lease agreement: Applicants must demonstrate legal rights to the land they intend to utilize for agricultural purposes. This typically involves providing land ownership documents or a legally binding lease agreement.

- Credit history: A good credit history, indicating responsible financial management, is usually a prerequisite. Lenders will review the applicant’s past borrowing and repayment behavior to assess their risk profile.

- Agricultural experience: Experience in agricultural practices is often considered, demonstrating the applicant’s knowledge and capability to manage the proposed agricultural project successfully.

- Detailed business plan: A comprehensive business plan outlining the proposed agricultural activity, projected income, and repayment strategy is crucial. This plan should demonstrate the feasibility and profitability of the venture.

- Minimum income requirements: Some lending institutions may have minimum income requirements to ensure the applicant has the capacity to repay the loan.

- Age restrictions: Certain age limits might be imposed, depending on the lending institution’s policies.

Examples of Eligible Borrowers

ACBS loans are typically accessible to a wide range of individuals and businesses involved in agricultural activities.

Examples include:

- Smallholder farmers: Individuals cultivating small plots of land for subsistence or commercial purposes.

- Large-scale agricultural businesses: Companies involved in extensive farming operations, such as large-scale crop production or livestock rearing.

- Agricultural cooperatives: Groups of farmers collaborating to improve efficiency and access to resources.

- Agricultural entrepreneurs: Individuals starting new agricultural ventures or expanding existing ones.

Required Documentation for ACBS Loan Application

The specific documentation required for an ACBS loan application may vary depending on the lending institution. However, common documents generally include:

Typical documentation includes:

- Application form: A completed loan application form provided by the lending institution.

- Proof of identity: Documents such as a national ID card, passport, or driver’s license.

- Proof of address: Utility bills, bank statements, or rental agreements.

- Land ownership documents or lease agreement: Evidence of legal rights to the land used for agricultural purposes.

- Business plan: A detailed plan outlining the proposed agricultural activity, projected income, and repayment strategy.

- Financial statements: Bank statements, income tax returns, or other financial records demonstrating the applicant’s financial stability.

- Collateral: Depending on the loan amount and the lender’s requirements, collateral may be needed to secure the loan. This could include land, equipment, or other assets.

Interest Rates and Loan Terms

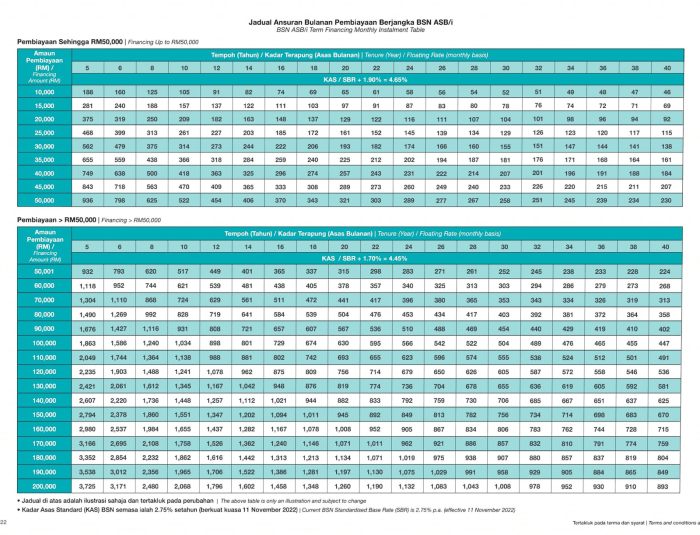

Understanding the interest rates and loan terms associated with ACBS (Agricultural and Business Credit Scheme) loans is crucial for potential borrowers. These factors significantly impact the overall cost and affordability of the loan. This section will detail the key aspects influencing these financial parameters.

Factors Influencing ACBS Loan Interest Rates

Several factors contribute to the determination of ACBS loan interest rates. These include the prevailing market interest rates, the borrower’s creditworthiness (credit score and history), the loan amount, the loan tenure, and the type of collateral offered. Government regulations and policies also play a significant role, as they often influence the minimum and maximum interest rates that lending institutions can charge. Furthermore, the risk assessment of the specific business or agricultural project for which the loan is sought also influences the final interest rate. A higher-risk project will generally attract a higher interest rate compared to a lower-risk venture. Finally, the economic climate and inflation rates also contribute to the fluctuations in ACBS loan interest rates.

Comparison of ACBS Loan Interest Rates with Other Loan Types

ACBS loan interest rates are generally competitive compared to other loan types, particularly for agricultural and small business ventures. While the exact rates vary depending on the factors mentioned above, they are often lower than personal loans or unsecured business loans due to the presence of collateral and government support. However, they may be higher than loans offered through specific government-backed schemes with heavily subsidized interest rates. The comparison hinges on the specific loan type and the individual circumstances of the borrower. For example, a secured business loan from a commercial bank might have a higher interest rate than an ACBS loan with similar terms, while a microfinance loan might have a lower interest rate than an ACBS loan, but with stricter conditions and potentially higher fees.

Typical Loan Terms for ACBS Loans

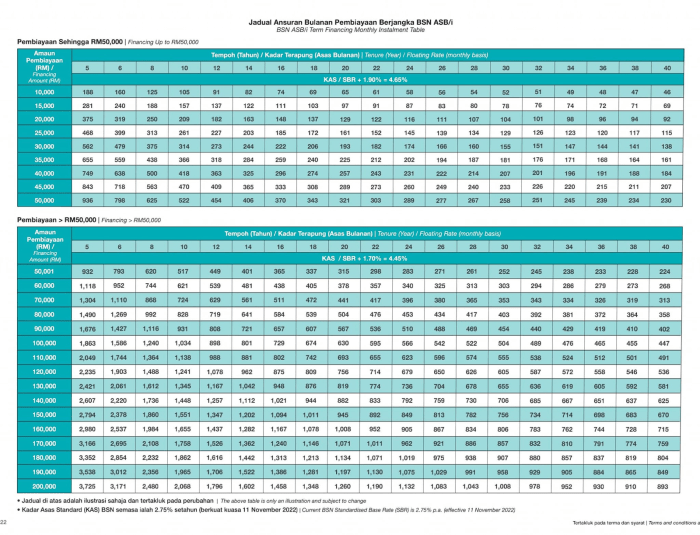

ACBS loans typically offer flexible repayment periods, ranging from a few months to several years, depending on the loan amount and the nature of the project. Shorter-term loans usually come with lower interest rates, while longer-term loans offer more manageable monthly payments but accumulate higher overall interest costs. The repayment schedule is usually structured in installments, often monthly or quarterly, to ensure manageable repayments for the borrower. Early repayment options may or may not be available, depending on the specific terms of the loan agreement. Late payment penalties are typically included in the loan contract to incentivize timely repayments.

Comparison of Different ACBS Loan Options

| Loan Type | Interest Rate (Annual %) | Repayment Period (Years) | Collateral Requirements |

|---|---|---|---|

| Short-Term Crop Loan | 8-12% | 1 | Land/Crop |

| Medium-Term Livestock Loan | 10-14% | 3 | Livestock |

| Long-Term Infrastructure Loan | 12-18% | 5 | Land and Building |

| Small Business Loan | 9-15% | 2-5 | Business Assets |

Application Process and Required Documents

Securing an ACBS loan involves a straightforward yet crucial application process. Careful preparation and accurate documentation are key to a smooth and timely approval. Understanding the steps involved and gathering the necessary documents beforehand will significantly improve your chances of a successful application.

Step-by-Step Application Process

The ACBS loan application process typically involves several key steps. Applicants should expect to complete each stage diligently to ensure a complete and accurate application. Failure to do so may result in delays or rejection.

- Initial Inquiry: Begin by contacting ACBS directly to inquire about loan eligibility and discuss your specific financial needs. This allows you to gather preliminary information and determine if an ACBS loan is the right choice for you.

- Application Submission: Once you’ve determined your eligibility, complete the official ACBS loan application form. This form will require detailed personal and financial information.

- Document Submission: Gather and submit all required supporting documents (detailed below). Ensure all documents are clear, legible, and accurately reflect your financial situation.

- Credit and Background Check: ACBS will conduct a thorough credit and background check to assess your creditworthiness and repayment ability. This is a standard procedure for all loan applications.

- Loan Approval/Rejection: Based on the application review and verification of documents, ACBS will notify you of their decision. If approved, you will receive a loan offer outlining the terms and conditions.

- Loan Disbursement: Upon acceptance of the loan offer, ACBS will disburse the loan funds according to the agreed-upon terms. This typically involves a direct deposit into your designated bank account.

Required Documents Checklist

A complete application requires the submission of several key documents. Failure to provide all necessary documentation may delay the processing of your loan application.

- Completed Loan Application Form: The official ACBS loan application form, accurately and completely filled out.

- Government-Issued Identification: A valid driver’s license, passport, or other government-issued identification.

- Proof of Income: Pay stubs, tax returns, or bank statements demonstrating consistent income.

- Proof of Address: Utility bills, bank statements, or rental agreements showing your current address.

- Bank Statements: Recent bank statements showing your account activity and available funds.

- Credit Report: A copy of your credit report, which can be obtained from a credit reporting agency.

Application Process Flowchart

Imagine a flowchart beginning with “Initial Inquiry,” followed by a diamond-shaped decision box asking “Eligible?” with “Yes” leading to “Application Submission” and “No” leading to “Application Denied.” “Application Submission” leads to “Document Submission,” which then flows to “Credit and Background Check.” A second diamond-shaped decision box asks “Approved?” with “Yes” leading to “Loan Disbursement” and “No” leading to “Application Denied.” Both “Application Denied” paths end the flowchart.

Common Application Mistakes

Applicants often make mistakes that can hinder the loan application process. Understanding these common errors can help applicants avoid delays and rejection.

- Incomplete Application Forms: Failing to fully and accurately complete the application form is a major cause of delays. Missing information or inaccurate details can lead to rejection.

- Inaccurate or Missing Documents: Submitting incorrect or incomplete documents is another common mistake. Ensure all documents are legible, accurate, and up-to-date.

- Misrepresenting Financial Information: Providing false or misleading financial information is a serious offense and will likely result in application rejection. Honesty and accuracy are crucial.

- Late Submission of Documents: Delaying the submission of required documents can significantly slow down the application process. Submit all necessary documents promptly.

Advantages and Disadvantages of ACBS Loans

Securing an ACBS loan, like any financial product, presents a blend of potential benefits and drawbacks. Understanding these aspects is crucial for making an informed decision about whether this type of loan aligns with your specific financial circumstances and goals. A thorough assessment of both advantages and disadvantages will empower you to navigate the loan process effectively and avoid potential pitfalls.

Advantages of ACBS Loans

ACBS loans offer several key advantages, particularly for individuals or businesses needing flexible financing options. These benefits stem from the loan’s structure and the often-favorable terms offered by lenders. Careful consideration of these advantages against the alternatives is vital in the decision-making process.

Compared to other financing options, such as traditional bank loans or credit cards, ACBS loans often stand out due to their potentially faster processing times and less stringent eligibility criteria. This speed and accessibility can be invaluable in situations requiring urgent funding. Moreover, the flexibility in loan terms, including repayment schedules, can be tailored to better suit individual cash flow patterns, offering a more manageable repayment experience than some other loan types. The potential for lower interest rates compared to high-interest credit cards is another significant advantage. For example, a business requiring immediate capital for a time-sensitive opportunity might find an ACBS loan a more attractive option than a longer, more complex bank loan application process.

Disadvantages and Risks of ACBS Loans

While ACBS loans offer certain benefits, potential borrowers should also be aware of the associated risks and disadvantages. Understanding these aspects is essential for responsible financial planning and mitigating potential negative outcomes.

One significant disadvantage is the potential for higher interest rates compared to some other loan types, especially if the borrower’s credit score is not strong. Furthermore, the shorter repayment periods often associated with ACBS loans can lead to higher monthly payments, potentially straining the borrower’s budget. The penalties for late or missed payments can also be substantial, adding to the overall cost of borrowing. For instance, a borrower with a lower credit rating might face a significantly higher interest rate on an ACBS loan compared to a borrower with excellent credit. The lack of transparency in some ACBS loan agreements can also present a risk, making it crucial to thoroughly review all terms and conditions before signing.

Pros and Cons of ACBS Loans

The following list summarizes the key advantages and disadvantages of securing an ACBS loan to aid in a balanced assessment.

Weighing the pros and cons carefully is essential before committing to an ACBS loan. Consider your financial situation, risk tolerance, and the specific terms offered by the lender. Seeking professional financial advice can further enhance your understanding and ensure you make the best decision for your circumstances.

- Pros: Faster processing times, potentially lower interest rates than credit cards, flexible repayment options, accessibility to borrowers with varying credit profiles.

- Cons: Potentially higher interest rates than some bank loans, shorter repayment periods leading to higher monthly payments, substantial penalties for late payments, potential lack of transparency in loan agreements.

ACBS Loan Repayment and Default

Understanding the repayment options and potential consequences of default is crucial for borrowers considering an ACBS loan. This section details various repayment methods, the ramifications of non-payment, and strategies for successful repayment. It also provides illustrative examples of repayment schedules and their associated costs.

ACBS Loan Repayment Options

Borrowers typically have several repayment options available to them, depending on the lender and the specific loan terms. These options may include fixed monthly installments, where the borrower pays a consistent amount each month until the loan is repaid. Alternatively, some lenders may offer graduated payment plans, where the initial payments are lower and gradually increase over time. Interest-only payments, where only the interest is paid during a specific period, might also be an option, although the principal balance remains outstanding. Finally, some lenders may permit accelerated repayment, allowing borrowers to pay more than the minimum monthly payment to reduce the loan term and overall interest paid. The choice of repayment plan significantly impacts the total cost of borrowing.

Consequences of Defaulting on an ACBS Loan

Defaulting on an ACBS loan carries severe financial repercussions. These consequences can include damage to the borrower’s credit score, making it difficult to obtain future loans or credit cards. Late payment fees and penalties can significantly increase the overall cost of the loan. Furthermore, lenders may pursue legal action to recover the outstanding debt, which could involve wage garnishment or the seizure of assets. In extreme cases, default may lead to bankruptcy. The specific consequences vary depending on the lender and local laws.

Strategies for Managing and Successfully Repaying an ACBS Loan

Successful loan repayment requires careful planning and budgeting. Creating a realistic budget that accounts for all monthly expenses, including the loan payment, is paramount. Borrowers should prioritize loan repayments to avoid accumulating late payment fees and damaging their credit score. Establishing an automatic payment system can help ensure timely payments. If financial difficulties arise, borrowers should proactively contact their lender to explore options such as loan modification or forbearance to avoid default. Seeking financial counseling from a reputable organization can also provide valuable guidance and support.

Examples of Repayment Schedules and Their Impact on Overall Loan Costs

Consider two scenarios for a hypothetical ACBS loan of $10,000 with a 5% annual interest rate.

Scenario 1: A 36-month repayment plan with fixed monthly payments of approximately $300 results in a total repayment of approximately $10,800, including interest.

Scenario 2: A 60-month repayment plan with fixed monthly payments of approximately $185 results in a total repayment of approximately $11,100, including interest.

This example illustrates how a longer repayment period (Scenario 2) reduces monthly payments but increases the total interest paid over the life of the loan compared to a shorter repayment period (Scenario 1). The optimal repayment schedule depends on the borrower’s individual financial circumstances and risk tolerance. Note that these are simplified examples, and actual loan costs may vary based on lender fees and other factors.

Illustrative Example of an ACBS Loan Scenario

This section presents a realistic scenario demonstrating how an ACBS loan can be utilized by a small business to overcome financial challenges and achieve growth. We will follow the journey of “Artisan Breads,” a bakery experiencing rapid growth but facing limitations due to insufficient working capital.

Artisan Breads, a thriving local bakery, has seen a significant increase in customer demand over the past year. Their delicious artisan breads and pastries have become highly sought after, leading to consistent sales growth. However, this rapid expansion has strained their resources. They require additional funds to purchase a larger oven to meet the increasing demand, upgrade their delivery van, and increase their inventory of high-quality ingredients. Securing a traditional bank loan proved difficult due to their relatively short operational history and limited collateral. An ACBS loan, however, offered a viable solution.

Artisan Breads’ ACBS Loan Application and Approval

Artisan Breads applied for an ACBS loan with a local credit union participating in the ACBS program. They submitted their financial statements, including sales records, profit and loss statements, and cash flow projections. The credit union assessed their creditworthiness and the viability of their business plan, ultimately approving a loan of $25,000. The interest rate was set at 8%, a competitive rate considering their circumstances and the relatively short repayment term. The loan repayment was structured as 24 monthly installments of approximately $1,130.

Financial Impact and Business Outcomes

The $25,000 ACBS loan allowed Artisan Breads to purchase the larger oven, significantly increasing their production capacity. The upgraded delivery van improved their efficiency and allowed them to reach a wider customer base. Increased inventory levels ensured they could consistently meet demand, avoiding lost sales opportunities. These improvements resulted in a substantial increase in revenue, exceeding their projections. The monthly loan repayments, while significant, were manageable given the increased profitability. The bakery was able to consistently meet its repayment obligations, demonstrating the positive impact of the ACBS loan on their financial stability.

Challenges and Benefits Experienced

While the ACBS loan provided significant benefits, Artisan Breads also faced challenges. The initial application process required careful preparation and documentation. They needed to accurately forecast their future revenue and expenses to demonstrate the loan’s viability. However, the benefits significantly outweighed the challenges. The increased production capacity and improved efficiency led to a substantial increase in revenue and profit. The bakery was able to expand its operations, hire additional staff, and enhance its brand presence within the community. The ACBS loan served as a crucial catalyst for their growth, enabling them to overcome financial hurdles and achieve long-term sustainability.

Concluding Remarks

Securing an ACBS loan requires careful consideration of various factors, from eligibility and interest rates to repayment strategies and potential risks. By understanding the intricacies of the application process, the advantages and disadvantages, and the importance of responsible repayment, you can navigate the world of ACBS loans with confidence. Remember to thoroughly research your options and compare them against other financing alternatives before making a decision.

Detailed FAQs

What does ACBS stand for in the context of a loan?

The specific meaning of “ACBS” in relation to loans depends on the lending institution. It’s crucial to clarify this abbreviation with the lender directly to understand the loan type fully.

What happens if I miss an ACBS loan payment?

Missing payments can result in late fees, damage to your credit score, and potentially, loan default. Contact your lender immediately if you anticipate difficulty making a payment to explore options like repayment plans.

Are there prepayment penalties for ACBS loans?

Whether or not prepayment penalties apply depends on the specific terms of your ACBS loan agreement. Review your loan documents carefully to understand any associated fees.

Can I refinance my ACBS loan?

Refinancing an ACBS loan may be possible, but the feasibility depends on your financial situation and the lender’s policies. It’s advisable to contact your lender or explore options with other financial institutions to determine your eligibility.