BTD6 student loans: the seemingly disparate worlds of Bloons TD 6 and student debt surprisingly intersect. Many BTD6 players fall within the crucial 18-25 age demographic, a group heavily burdened by student loans. This overlap raises intriguing questions about how in-game spending habits might reflect real-world financial decisions, and vice-versa. Consider the young adult juggling late-night study sessions with intense BTD6 gameplay – how does the pressure of looming loan repayments impact their gaming experience, and how might their in-game resource management translate to their financial situation?

This exploration delves into the financial realities faced by BTD6 players, examining the potential conflict between the desire for in-game upgrades and the necessity of responsible debt management. We’ll analyze how stress, time constraints, and even in-game strategies might mirror the challenges of navigating student loan repayment.

Understanding the Connection

The seemingly disparate worlds of Bloons TD 6 (BTD6) and student loan debt share an unexpected intersection: a significant portion of BTD6’s player base likely falls within the student loan demographic. Understanding this overlap requires examining the typical player profile and their financial realities.

The average BTD6 player likely ranges in age from teenagers to young adults in their twenties and thirties, aligning with the age group most burdened by student loans. Many players may be students themselves, or recent graduates navigating early career stages with limited income and significant debt. While precise income data for BTD6 players is unavailable, anecdotal evidence and the game’s free-to-play model suggest a broad spectrum, from those with disposable income to those with tighter budgets. Spending habits, however, are likely influenced by the game’s in-app purchase system, which offers various cosmetic and gameplay enhancements.

Financial Implications of In-Game Purchases

In-game purchases in BTD6, such as hero upgrades, skins, and monkey knowledge, mirror real-world financial decisions. The choice to spend money on these items represents an allocation of resources, much like the decision to prioritize student loan repayments over other expenses. Players must weigh the immediate gratification of in-game upgrades against the long-term benefits of debt reduction. The impulsive nature of some in-game purchases can parallel the temptation to make non-essential spending choices when managing finances, potentially delaying or hindering student loan repayment.

A Hypothetical Scenario: Resource Allocation

Imagine Sarah, a 22-year-old college graduate with a $30,000 student loan debt and a monthly income of $2,500. She enjoys playing BTD6 and finds herself tempted by a new hero skin costing $20. Her monthly budget allows for approximately $500 in discretionary spending. This decision forces Sarah to weigh her options: paying an extra $20 towards her student loan, reducing the overall debt and interest accrued, or indulging in the in-game purchase. This simple scenario highlights the parallel between managing in-game resources and managing personal finances, especially in the context of student loans. Choosing the in-game purchase represents a short-term gratification that potentially delays the long-term financial goal of debt repayment. This decision highlights the potential for seemingly small in-game expenditures to represent a larger pattern of financial choices. For Sarah, and many others like her, the seemingly insignificant cost of a BTD6 skin might represent a broader issue of prioritizing immediate pleasure over long-term financial well-being.

The Impact of Student Loans on BTD6 Gameplay

The pressure of student loan debt can significantly impact various aspects of life, including leisure activities like video gaming. For players of Bloons TD 6 (BTD6), this financial burden can subtly yet profoundly affect their engagement with the game, altering playtime, strategic choices, and overall enjoyment. Understanding this connection is crucial for recognizing potential challenges and identifying coping strategies.

The demanding nature of studying and working to repay student loans often directly competes with the time commitment required for BTD6 gameplay. High-level play demands significant time investment for strategic planning, completing challenges, and optimizing tower placements. This time constraint forces players to make difficult choices between academic pursuits, paid work, and dedicated BTD6 sessions.

Time Management and BTD6 Playtime

Balancing academic responsibilities, part-time employment, and the desire to progress in BTD6 necessitates careful time management. Players might find themselves sacrificing sleep or social activities to accommodate all their commitments. The resulting fatigue can diminish the enjoyment of BTD6, leading to shorter play sessions or a decreased focus on optimizing gameplay. A student working 20 hours a week, attending classes, and aiming for high grades might only have a few hours a week left for BTD6, limiting their ability to participate in challenging events or collaborative gameplay. This can lead to frustration and potentially a decline in engagement.

Financial Pressure and In-Game Spending

The financial pressure associated with student loans can also affect in-game spending habits. While BTD6 offers a freemium model, the temptation to purchase in-game currency for faster progression or access to premium content might conflict with the need to prioritize loan repayments. Players might experience internal conflict between the desire to enhance their BTD6 experience and the responsibility to manage their finances effectively. This could manifest as restrained spending or even a complete avoidance of in-game purchases, potentially impacting their overall gameplay experience.

Coping Mechanisms and Stress Reduction

Many BTD6 players might employ various coping mechanisms to deal with the financial pressures of student loans. Some might use the game as a form of stress relief, finding solace in the strategic challenges and rewarding gameplay. Others might choose to focus on free-to-play aspects of the game, minimizing financial investment and maximizing enjoyment within their budgetary constraints. Social interaction within the BTD6 community can also provide support and a sense of camaraderie, helping to alleviate some of the stress associated with financial burdens. However, it’s important to acknowledge that BTD6, while enjoyable, cannot replace proper financial planning and stress management techniques.

Comparison of In-Game and Real-World Resources

The following table illustrates the parallels between the resources within BTD6 and the real-world resources used in student loan repayment.

| BTD6 Resource | Real-World Resource | BTD6 Function | Real-World Function |

|---|---|---|---|

| In-game Money | Time & Money | Purchasing towers, upgrades | Paying loan installments, covering living expenses |

| Heroes | Energy & Skills | Providing strategic advantages | Managing workload, maintaining mental health |

| Towers | Financial Resources & Knowledge | Defending against bloons | Protecting financial future, achieving academic goals |

| Upgrades | Experience & Learning | Improving tower effectiveness | Enhancing career prospects, improving repayment capacity |

BTD6 Community and Student Loan Discussions

The intersection of video game communities and real-world financial concerns, such as student loan debt, is a surprisingly common theme. While seemingly disparate, the pressures and anxieties associated with both can intertwine, leading to discussions and shared experiences within online gaming communities like those dedicated to Bloons TD 6 (BTD6). This section explores how BTD6 players might discuss financial matters, including student loans, within their online communities.

Online forums and social media platforms dedicated to BTD6 provide fertile ground for such conversations. While not explicitly focused on finance, the sense of community fosters an environment where players may share personal anecdotes and challenges, including those relating to their financial situations. The anonymity afforded by online platforms can also encourage individuals to be more open about sensitive topics like debt.

Examples of User-Generated Content Relating BTD6 to Financial Challenges

Identifying specific user-generated content directly linking BTD6 gameplay to student loan struggles requires careful searching through various online forums and social media platforms. However, we can extrapolate likely scenarios. For instance, a forum post might describe the frustration of not being able to afford a premium skin or upgrade due to loan repayments. A YouTube video could feature a player documenting their gaming sessions as a form of stress relief from the pressures of student loan debt, potentially showcasing a correlation between intense gaming sessions and periods of high financial stress. Another example could be a Reddit thread where users share strategies for managing their gaming time while dealing with the burden of student loan payments, demonstrating how financial constraints influence their gameplay choices. These examples, while hypothetical, reflect the realistic pressures faced by many players.

Hypothetical Discussion Thread on a BTD6 Forum

Imagine a forum thread titled “Student Loans and My BTD6 Addiction: How Do You Balance It?”. The thread could begin with a user describing their struggle to balance the demands of loan repayments with their desire to play and progress in BTD6. Replies could range from empathetic responses from fellow students sharing similar experiences to advice from graduates and working professionals on budgeting and time management techniques. Some users might discuss how they prioritize in-game purchases based on their financial situation, while others might suggest alternative strategies for managing their gaming habits to reduce financial strain. The discussion would likely reveal a diverse range of coping mechanisms and strategies employed by players to navigate this intersection of personal finance and gaming.

Perspectives on Balancing BTD6 and Loan Repayments

Different player demographics would approach the balancing act between BTD6 and loan repayments with varying perspectives. Students might prioritize free-to-play aspects of the game or engage in more casual gameplay, limiting their in-game spending. Graduates entering the workforce might have more disposable income but still face the pressure of loan repayments, leading them to prioritize budgeting and responsible spending on in-game purchases. Working professionals with established careers may have more financial flexibility but could still find themselves needing to balance their gaming habits with other responsibilities. Each group would likely develop unique strategies for managing their time and resources to accommodate both their gaming enjoyment and their financial obligations.

Visualizing the Relationship

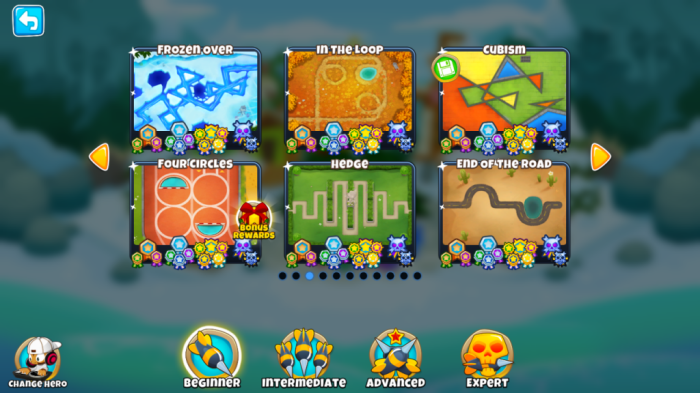

The complex interplay between the dedication required for in-game progression in Bloons TD 6 (BTD6) and the persistent commitment to paying off student loans can be effectively illustrated through various visual representations. These visualizations aim to highlight the often-overlooked parallel between the long-term investment of time and resources in both spheres.

A compelling visual representation could leverage the inherent progression systems within both BTD6 and the student loan repayment process.

A Dual-Axis Chart Comparing Time Investment, Btd6 student loans

A dual-axis chart would effectively demonstrate the time commitment involved in both BTD6 gameplay and student loan repayment. The x-axis could represent time (in months or years), while the y-axis would have two scales: one representing the player’s in-game progression (e.g., number of maps completed, towers upgraded, achievements unlocked) and the other representing the percentage of student loans repaid. This would allow for a direct visual comparison, showing how the time spent grinding for in-game rewards might correlate with (or potentially detract from) the time dedicated to reducing student loan debt. For example, a steep incline on the BTD6 progression axis might coincide with a relatively flat line on the loan repayment axis, illustrating a potential trade-off. Conversely, periods of focused loan repayment could be visually represented by a steeper incline on the repayment axis, potentially accompanied by a slower progression in BTD6.

An Infographic Comparing Costs

An infographic comparing the costs of in-game purchases in BTD6 to the overall cost of student loans would effectively highlight the financial disparities. The infographic could utilize a segmented bar chart to compare the total cost of a specific in-game purchase (e.g., a premium hero or a large bundle of in-game currency) against the total cost of a year’s worth of student loan payments for a representative student loan amount. This visual comparison would underscore the significant financial difference between in-game spending and the real-world burden of student loan debt. For instance, the cost of a single in-game hero might be shown alongside the monthly payment for a $10,000 student loan, emphasizing the scale of the difference. Another section could illustrate the cumulative cost of various in-game purchases over a specific period, juxtaposed against the cumulative amount repaid on the student loan over the same period. This would provide a clear visual representation of the relative financial weight of each commitment.

Closing Summary: Btd6 Student Loans

The connection between BTD6 and student loans reveals a fascinating microcosm of modern financial struggles. While the seemingly frivolous world of in-game purchases might seem distant from the serious burden of student debt, the parallels are striking. Time management, resource allocation, and the psychological impact of financial pressure all play significant roles in both spheres. Understanding this connection can offer valuable insights into personal finance and the importance of mindful spending, even within the engaging context of a popular mobile game like Bloons TD 6. Ultimately, finding a balance between enjoyment and responsibility is key to navigating both the virtual battles of BTD6 and the real-world challenges of student loan repayment.

Top FAQs

What are the average in-game spending habits of BTD6 players?

This varies greatly depending on the player’s dedication and income. Some spend minimally, while others invest significantly in in-game purchases.

Are there any BTD6 communities specifically focused on financial discussions?

While not explicitly focused on finance, general BTD6 forums or Discord servers may have threads where players casually discuss financial topics, including student loans.

How can I balance my BTD6 playtime with my student loan repayment responsibilities?

Set a budget for in-game purchases, prioritize loan repayment, and allocate specific time slots for gaming to avoid excessive playtime and ensure you meet your financial obligations.

Can playing BTD6 actually help manage stress related to student loans?

For some, playing BTD6 can serve as a healthy distraction and stress reliever. However, excessive gaming can exacerbate financial problems if it leads to neglecting loan repayments or overspending.