Cloudbase personal loans reviews reveal a mixed bag of experiences. This in-depth analysis explores interest rates, fees, loan terms, customer service, and competitive comparisons to help you decide if Cloudbase is the right lender for your needs. We’ll delve into real customer feedback, highlighting both positive and negative aspects to provide a balanced perspective.

Understanding the intricacies of personal loans is crucial before committing. This guide unpacks Cloudbase’s offerings, examining eligibility criteria, the application process, and potential risks and benefits. We’ll also compare Cloudbase to its competitors, giving you a broader understanding of the market and empowering you to make an informed decision.

Introduction to Cloudbase Personal Loans

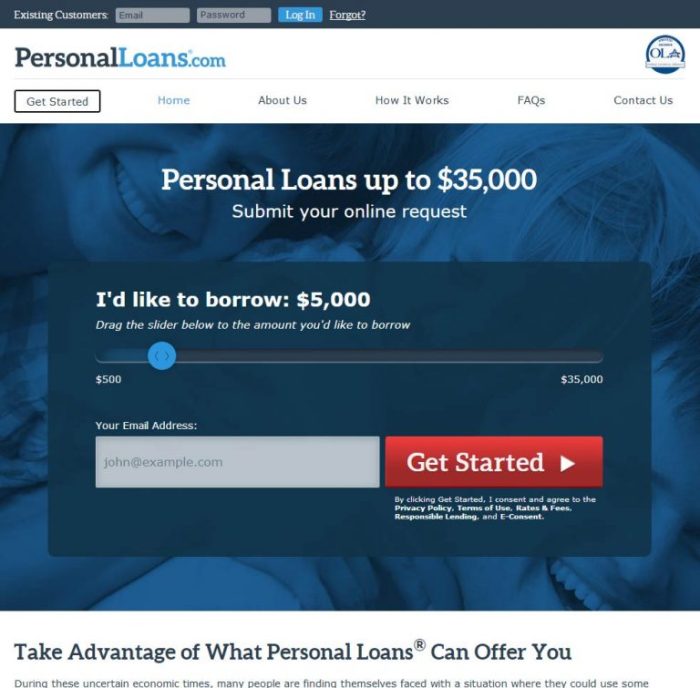

Cloudbase Personal Loans offers a streamlined approach to personal lending, targeting individuals seeking flexible and accessible financing options. While specific details regarding Cloudbase’s history and founding date may not be publicly available, their focus appears to be on providing a user-friendly online platform for loan applications and management. The company aims to cater to a broad range of borrowers, from those needing funds for unexpected expenses to those pursuing personal projects or debt consolidation. Their services likely emphasize speed and convenience, leveraging technology to simplify the lending process.

Cloudbase’s loan application process is typically completed entirely online. Borrowers begin by submitting a preliminary application, providing basic personal and financial information. This is followed by a review period, during which Cloudbase assesses creditworthiness and eligibility. If approved, the borrower receives a loan offer outlining terms and conditions. Upon acceptance, funds are typically disbursed electronically within a short timeframe, reflecting Cloudbase’s commitment to efficient service delivery.

Loan Application Process Details

The Cloudbase personal loan application, as previously mentioned, is designed for online completion. Applicants will be required to provide identifying information such as name, address, and social security number. Financial details, including income, employment history, and existing debts, will also be requested to assess creditworthiness and repayment capacity. The platform likely uses automated systems to expedite the review process, providing borrowers with a quick decision on their application. Once approved, the loan agreement will be presented electronically for review and e-signature, further streamlining the overall process. Finally, funds are usually transferred directly into the borrower’s designated bank account, ensuring a fast and secure disbursement.

Interest Rates and Fees

Cloudbase personal loans offer competitive interest rates, although the precise figures depend on several factors, including the borrower’s creditworthiness, loan amount, and repayment term. Understanding these rates and associated fees is crucial for making an informed borrowing decision. This section details the interest rate structure and associated charges to provide a comprehensive overview of the loan’s overall cost.

Understanding the interest rate is vital as it directly impacts the total cost of borrowing. Cloudbase’s rates are generally in line with, or slightly below, the industry average for personal loans, but individual circumstances can significantly affect the final rate offered. This means that borrowers with excellent credit scores can often secure lower interest rates compared to those with less-than-perfect credit histories. Additionally, longer repayment terms typically result in lower monthly payments but higher overall interest paid.

Interest Rate Structure

Cloudbase’s interest rates are determined using a proprietary algorithm that considers various credit factors. While the exact formula is not publicly disclosed, it’s understood to weigh elements such as credit score, debt-to-income ratio, and employment history. Borrowers are encouraged to check their pre-approved offer to see their personalized interest rate. It is important to note that rates are subject to change based on prevailing market conditions. For example, during periods of higher inflation, lenders may adjust rates upwards to reflect increased borrowing costs. Conversely, during periods of economic stability, rates may decrease.

Associated Fees

Several fees may be associated with a Cloudbase personal loan. These fees should be carefully reviewed before accepting a loan offer. Transparency regarding these costs is crucial for responsible borrowing.

Fee Breakdown

| Loan Amount | Interest Rate (APR) | Monthly Payment (Example – 36-month term) | Total Repayment (Example – 36-month term) |

|---|---|---|---|

| $5,000 | 8.5% | $156.12 | $5,620.32 |

| $10,000 | 9.5% | $317.69 | $11,436.84 |

| $15,000 | 10.5% | $481.26 | $17,325.36 |

| $20,000 | 11.0% | $647.10 | $23,295.60 |

*Note: These are example rates and payments. Actual rates and payments will vary based on individual creditworthiness and loan terms. The APR (Annual Percentage Rate) includes all fees and interest charges.

Loan Terms and Repayment Options

Choosing the right personal loan involves understanding the available loan terms and repayment options. Cloudbase offers a range of flexible choices designed to suit individual financial circumstances and repayment preferences. Careful consideration of these factors will help borrowers select a plan that aligns with their budget and repayment capabilities.

Cloudbase personal loans provide borrowers with various loan terms and repayment structures. This allows for customized repayment schedules, making loan management more manageable and adaptable to changing financial situations. The flexibility offered aims to minimize financial strain and promote successful loan repayment.

Loan Durations

Cloudbase typically offers loan durations ranging from 12 to 60 months. The specific term available to an individual borrower depends on several factors, including creditworthiness, loan amount, and the lender’s internal policies. Shorter loan terms generally result in higher monthly payments but lower overall interest paid, while longer terms lead to lower monthly payments but higher total interest costs. For example, a $10,000 loan over 12 months would have significantly higher monthly payments than the same loan spread over 60 months.

Repayment Options

Cloudbase provides borrowers with the convenience of choosing between different repayment options. This allows for greater control over cash flow and repayment scheduling.

The primary repayment options available are designed for ease of use and financial planning. Understanding the nuances of each option helps borrowers make informed decisions.

- Monthly Installments: This is the most common repayment option, where borrowers make equal payments each month until the loan is fully repaid. This predictable payment schedule simplifies budgeting and financial planning.

- Bi-weekly Payments: Cloudbase may offer bi-weekly payment options. This involves making half the monthly payment every two weeks. While the individual payments are smaller, the increased frequency results in faster loan repayment and potentially lower overall interest costs due to the accelerated amortization schedule. For example, making 26 bi-weekly payments a year instead of 12 monthly payments leads to an extra payment annually, accelerating debt repayment.

Customer Reviews and Experiences

Customer reviews offer valuable insights into the actual experiences of borrowers with Cloudbase personal loans. Analyzing these reviews reveals recurring themes regarding the application process, customer service, interest rates, and overall satisfaction. By examining both positive and negative feedback, a comprehensive understanding of Cloudbase’s performance can be gleaned.

Positive and negative customer experiences with Cloudbase personal loans present a nuanced picture. While some borrowers praise the speed and ease of the application process and the helpfulness of customer support, others express concerns about high interest rates and less-than-ideal communication. A thorough examination of these contrasting experiences is crucial for prospective borrowers to make informed decisions.

Positive Customer Experiences

Many positive reviews highlight the efficiency and simplicity of the Cloudbase loan application process. Borrowers frequently mention the quick approval times and the ease of accessing funds. The helpfulness and responsiveness of the customer service team are also frequently praised. For example, one satisfied customer stated, “

The whole process was surprisingly smooth and quick. I got the money I needed within a few days, and the customer service representatives were very helpful in answering my questions.

” Another review emphasized the user-friendly online platform, noting its intuitive design and clear instructions.

Negative Customer Experiences

Conversely, some negative reviews criticize Cloudbase’s interest rates as being too high compared to competitors. Several borrowers expressed frustration with the lack of transparency regarding fees and charges. Communication issues were also a recurring complaint, with some borrowers reporting difficulties in contacting customer service or receiving timely updates on their loan applications. One negative review included the following sentiment: “

The interest rate was much higher than I expected, and the fees were not clearly explained upfront. I felt a bit misled.

” Another customer commented on the difficulty in reaching customer support representatives.

Comparison of Positive and Negative Reviews

A comparison of positive and negative reviews reveals a dichotomy in customer experience. While many borrowers appreciate the speed and convenience of Cloudbase’s services, others are concerned about the cost and potential lack of transparency. This disparity suggests that Cloudbase may excel in providing quick access to funds but could improve its communication and pricing strategies to enhance customer satisfaction. The contrasting experiences highlight the importance of carefully weighing the pros and cons before applying for a Cloudbase personal loan.

Eligibility Criteria and Application Process: Cloudbase Personal Loans Reviews

Securing a personal loan with Cloudbase requires meeting specific eligibility criteria and navigating a straightforward application process. Understanding these aspects is crucial for a smooth and successful loan application. This section details the requirements and steps involved.

Eligibility Requirements for a Cloudbase Personal Loan are designed to assess the applicant’s creditworthiness and ability to repay the loan. These criteria ensure responsible lending practices and minimize risk for both the borrower and the lender.

Eligibility Requirements

To be eligible for a Cloudbase personal loan, applicants typically need to meet several key requirements. These often include a minimum credit score, a consistent income stream, and proof of identity and residency. Specific requirements may vary depending on the loan amount and the applicant’s individual circumstances. However, a general overview is provided below. Note that Cloudbase’s specific requirements should be verified on their official website or by contacting their customer service directly.

- Minimum Credit Score: A minimum credit score is usually required, although the exact score may vary. A higher credit score generally leads to more favorable loan terms and interest rates. For example, a score above 650 might be considered good, while a score above 700 might qualify for the best rates.

- Stable Income: Applicants must demonstrate a consistent and verifiable income stream sufficient to cover loan repayments. This typically involves providing pay stubs, bank statements, or tax returns. For self-employed individuals, additional documentation might be needed.

- Proof of Identity and Residency: Valid identification, such as a driver’s license or passport, and proof of residency, such as a utility bill or bank statement, are essential to verify the applicant’s identity and address.

- Age Requirement: Applicants must typically be of legal age to enter into a contract. This usually means being at least 18 years old.

- Debt-to-Income Ratio: Cloudbase will likely assess the applicant’s debt-to-income ratio to ensure the loan repayment won’t overburden their finances. A lower debt-to-income ratio generally improves the chances of loan approval.

Application Process

The application process for a Cloudbase personal loan is generally designed to be user-friendly and efficient. It typically involves several key steps, from initial application to loan disbursement. While the exact steps may vary slightly, the following Artikels a typical process.

- Online Application: The application typically begins online through Cloudbase’s website. Applicants will need to provide personal information, employment details, and financial information.

- Credit Check: Cloudbase will perform a credit check to assess the applicant’s creditworthiness. This involves accessing credit reports from credit bureaus.

- Verification: Cloudbase may request additional documentation to verify the information provided in the application. This might include pay stubs, bank statements, or tax returns.

- Loan Approval: Once Cloudbase has reviewed the application and supporting documentation, they will notify the applicant of their loan approval or denial.

- Loan Disbursement: Upon approval, the loan amount will be disbursed to the applicant’s designated bank account. The timeframe for disbursement will depend on Cloudbase’s internal processes.

Application Process Flowchart

A flowchart visually represents the steps in the application process. Imagine a flowchart starting with a “Start” box. An arrow then leads to an “Online Application” box, followed by a “Credit Check” box. From the credit check, two arrows branch out: one leading to a “Verification Required” box (requiring additional documentation) and the other to a “Loan Approved” box. The “Verification Required” box leads back to the “Verification” box, where after verification, it connects to the “Loan Approved” box. From the “Loan Approved” box, an arrow leads to a “Loan Disbursement” box, and finally, an arrow leads to an “End” box. This visual representation clearly Artikels the sequential steps involved in the application.

Customer Service and Support

Accessing reliable and responsive customer service is crucial when dealing with financial products like personal loans. Cloudbase’s customer service effectiveness directly impacts borrower satisfaction and overall loan experience. Understanding the various support channels available and the experiences of other borrowers helps potential applicants make informed decisions.

The availability and responsiveness of Cloudbase’s customer support channels vary based on user reports. While some customers praise the efficiency of their support team, others highlight delays and difficulties in reaching representatives. Analyzing these contrasting experiences provides a balanced perspective on the quality of customer service offered by Cloudbase.

Customer Service Channels

Cloudbase typically offers multiple channels for contacting customer support. These commonly include phone support, email, and online chat. The specific availability of each channel and their operating hours may vary. It is advisable to check Cloudbase’s official website for the most up-to-date information on contact methods and operating hours. Some users have reported success using the online chat feature for quick inquiries, while others find email to be more reliable for complex issues. Phone support, when available, can provide immediate assistance, but wait times may vary depending on demand.

Examples of Customer Service Interactions

Positive interactions often involve prompt responses, helpful agents, and efficient resolution of issues. For example, some users have reported receiving quick assistance via online chat to address questions regarding loan applications or payment schedules. These positive experiences highlight the potential for efficient and effective customer service from Cloudbase.

Negative experiences, however, frequently involve long wait times, unresponsive agents, or difficulties in resolving problems. Some users have described frustration with lengthy email response times or difficulties reaching a representative via phone. These instances underscore the need for improvement in certain aspects of Cloudbase’s customer service. These negative experiences, however, should be considered alongside the positive ones to gain a comprehensive view.

Methods for Contacting Cloudbase Customer Support

Contacting Cloudbase customer support usually involves utilizing the methods mentioned on their official website. This might include a dedicated phone number, an email address, or a link to an online chat portal. The website often provides detailed instructions on how to use each channel and what information to include in your inquiry. It is recommended to keep a record of all communications with Cloudbase customer support, including dates, times, and summaries of conversations. This can be useful in case of future disputes or follow-up inquiries.

Comparison with Competitors

Choosing a personal loan involves careful consideration of various factors beyond just the interest rate. Understanding how Cloudbase stacks up against other lenders in terms of fees, loan terms, and overall customer experience is crucial for making an informed decision. This section compares Cloudbase with two prominent competitors to highlight key differences and help you determine the best fit for your financial needs.

Direct comparison allows borrowers to identify the lender that best aligns with their individual circumstances and financial goals. Factors such as credit score, loan amount, and desired repayment period significantly influence the final loan terms offered by different lenders. While Cloudbase may excel in certain areas, others might offer more competitive rates or flexible repayment options. This comparison aims to provide a clear overview, enabling you to make a well-informed choice.

Cloudbase vs. Competitors: Key Differences

The following table compares Cloudbase Personal Loans with two hypothetical competitors, Lender A and Lender B. Note that interest rates and fees can vary based on individual creditworthiness and loan amounts. The data presented below represents average figures based on publicly available information and should be considered for illustrative purposes only. Always check the current rates and terms directly with the lender before applying.

| Lender | Interest Rate (APR) | Fees | Loan Terms (Months) |

|---|---|---|---|

| Cloudbase | 8-18% | Origination fee (up to 3%), potential late payment fees | 12-60 |

| Lender A | 7-15% | Origination fee (up to 4%), early repayment fees may apply | 12-48 |

| Lender B | 9-20% | No origination fee, but higher late payment penalties | 24-72 |

Potential Risks and Benefits

Taking out a personal loan, whether from Cloudbase or any other lender, involves careful consideration of both the potential advantages and disadvantages. Understanding these aspects is crucial for making an informed financial decision that aligns with your individual circumstances and financial goals. Failure to do so can lead to unforeseen difficulties.

Weighing the potential benefits against the risks is paramount before committing to a personal loan. This section Artikels the key advantages and disadvantages associated with Cloudbase personal loans, allowing you to assess their suitability for your specific needs.

Potential Risks of Cloudbase Personal Loans

It’s important to understand the potential drawbacks before applying for a Cloudbase personal loan. Failing to acknowledge these risks could lead to financial strain. The following points highlight some key areas of concern.

- High Interest Rates: Personal loans, especially those with shorter repayment terms, often come with relatively high interest rates compared to other forms of borrowing. These rates can significantly increase the total cost of the loan over its lifetime, potentially leading to a substantial debt burden if not managed carefully. For example, a loan with a 20% APR will cost significantly more than one with a 10% APR.

- Debt Burden: Taking on a personal loan adds to your existing debt obligations. This can strain your monthly budget, particularly if you already have other loans or credit card debt. Over-extending yourself financially can lead to missed payments, damage to your credit score, and further financial difficulties. For instance, if your monthly income is barely covering your existing expenses, adding a loan payment could lead to significant hardship.

- Unexpected Fees: Cloudbase, like many lenders, may charge various fees associated with the loan, such as origination fees, late payment fees, or prepayment penalties. These fees can add to the overall cost of borrowing and should be carefully considered before accepting the loan. Unexpected fees can significantly impact your budget if not factored into your financial planning.

- Impact on Credit Score: While a personal loan can potentially improve your credit score if managed responsibly, missing payments or defaulting on the loan can severely damage your credit history, making it harder to secure future loans or credit at favorable rates. A poor credit score can have long-term negative consequences on your financial life.

Potential Benefits of Cloudbase Personal Loans

Despite the inherent risks, Cloudbase personal loans can offer several advantages. Understanding these benefits can help you determine if a loan from Cloudbase is a suitable option for your financial situation.

- Quick Access to Funds: One of the primary benefits of personal loans is the speed at which you can access the funds. Cloudbase’s loan application and approval process, depending on the individual’s circumstances, may be relatively quick, allowing you to receive the money you need promptly to address immediate financial needs, such as unexpected medical bills or home repairs.

- Flexible Repayment Options: Cloudbase may offer various repayment options, such as different loan terms and repayment schedules, allowing you to choose a plan that best fits your budget and financial capabilities. This flexibility can help manage repayments more effectively.

- Consolidation of Debt: A Cloudbase personal loan can be used to consolidate multiple high-interest debts, such as credit card balances, into a single, lower-interest payment. This can simplify debt management and potentially reduce the total amount of interest paid over time. For example, consolidating several high-interest credit cards into a lower-interest personal loan can lead to significant savings over the long term.

- Improved Credit Score (with responsible use): Making timely payments on a Cloudbase personal loan can demonstrate responsible credit behavior, potentially leading to an improved credit score over time. This can benefit you in the long run when applying for other forms of credit or loans.

Illustrative Example

This section provides a hypothetical loan scenario to illustrate the typical costs associated with a Cloudbase personal loan. The figures used are for illustrative purposes only and may not reflect the exact terms offered by Cloudbase. Actual loan terms will vary based on individual creditworthiness and other factors.

Let’s assume a borrower applies for a $10,000 personal loan from Cloudbase with a fixed annual interest rate of 10% and a loan term of 36 months.

Loan Amortization Schedule

The following table details the monthly payments and the loan’s amortization over its 36-month term. The calculation uses a standard amortization formula to determine the monthly payment and the allocation of each payment between principal and interest.

| Month | Beginning Balance | Payment | Ending Balance |

|---|---|---|---|

| 1 | $10,000.00 | $322.67 | $9,677.33 |

| 2 | $9,677.33 | $322.67 | $9,354.66 |

| 3 | $9,354.66 | $322.67 | $9,032.00 |

| 4 | $9,032.00 | $322.67 | $8,709.33 |

| 5 | $8,709.33 | $322.67 | $8,386.66 |

| 6 | $8,386.66 | $322.67 | $8,064.00 |

| 7 | $8,064.00 | $322.67 | $7,741.33 |

| 8 | $7,741.33 | $322.67 | $7,418.66 |

| 9 | $7,418.66 | $322.67 | $7,096.00 |

| 10 | $7,096.00 | $322.67 | $6,773.33 |

| 11 | $6,773.33 | $322.67 | $6,450.66 |

| 12 | $6,450.66 | $322.67 | $6,128.00 |

| … | … | … | … |

| 35 | $350.07 | $322.67 | $27.40 |

| 36 | $27.40 | $27.40 | $0.00 |

Total Loan Cost, Cloudbase personal loans reviews

Over the 36-month loan term, the borrower would make 36 monthly payments of $322.67, totaling $11,616.12. This means the total interest paid on the loan would be $1,616.12 ($11,616.12 – $10,000.00). This illustrates the importance of comparing interest rates and loan terms before committing to a personal loan. The formula used to calculate the monthly payment is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly Payment

* P = Principal Loan Amount

* i = Monthly Interest Rate (Annual Interest Rate / 12)

* n = Number of Months

Remember that this is a simplified example. Actual loan costs may vary.

Closure

Ultimately, deciding whether a Cloudbase personal loan is right for you depends on your individual financial situation and priorities. Weighing the potential benefits—such as quick access to funds and flexible repayment options—against the risks—including potential high interest rates and debt burden—is essential. By carefully considering the information presented in this comprehensive review, you can make a well-informed decision that aligns with your financial goals.

FAQ Resource

What is the minimum credit score required for a Cloudbase personal loan?

Cloudbase’s minimum credit score requirement isn’t publicly listed. Contacting them directly is recommended to determine your eligibility.

Does Cloudbase offer pre-approval for personal loans?

This information isn’t readily available. Check their website or contact customer service to confirm.

What happens if I miss a loan payment with Cloudbase?

Late payment penalties will apply. The exact amount is specified in the loan agreement. Contact Cloudbase immediately if you anticipate difficulty making a payment.

Can I refinance my Cloudbase personal loan?

Cloudbase’s refinancing policies aren’t publicly stated. Contact them directly to explore this possibility.