Loan Calculator UFCU: Understanding your financing options just got easier. This comprehensive guide delves into the UFCU loan calculator, exploring its functionality, comparing it to competitors, and providing tips for maximizing its use. We’ll cover everything from input parameters and result interpretation to advanced features and accessibility considerations, empowering you to make informed borrowing decisions.

We’ll examine the various loan types supported by the calculator, detail the step-by-step process of using it, and compare its features and user experience against other leading financial institutions. Understanding how loan terms, interest rates, and total costs interrelate is crucial, and we’ll provide clear explanations and visual representations to help you grasp these concepts.

Understanding the UFCU Loan Calculator

The UFCU loan calculator is a valuable online tool designed to help potential borrowers estimate their monthly payments and understand the overall cost of various loan options before applying. It simplifies the loan application process by providing quick and accurate calculations, allowing users to compare different loan scenarios and make informed financial decisions. This eliminates the guesswork and empowers borrowers to choose the loan that best fits their budget and financial goals.

UFCU Loan Calculator Functionality

The UFCU loan calculator is a user-friendly tool that processes input data to generate an estimated monthly payment and total loan cost. It accounts for factors like the loan amount, interest rate, and loan term to provide a comprehensive overview of the loan’s financial implications. The calculator’s speed and accuracy make it an efficient way to explore various loan options and determine affordability before committing to a formal application.

Loan Types Supported by the UFCU Calculator, Loan calculator ufcu

The UFCU loan calculator likely supports a range of loan types commonly offered by the credit union. These typically include, but are not limited to, auto loans, personal loans, home equity loans, and possibly mortgages. The specific loan types available for calculation may vary depending on the current offerings of UFCU and the features implemented in their online calculator. It is advisable to check the UFCU website for the most up-to-date list of supported loan types.

Input Parameters for the UFCU Loan Calculator

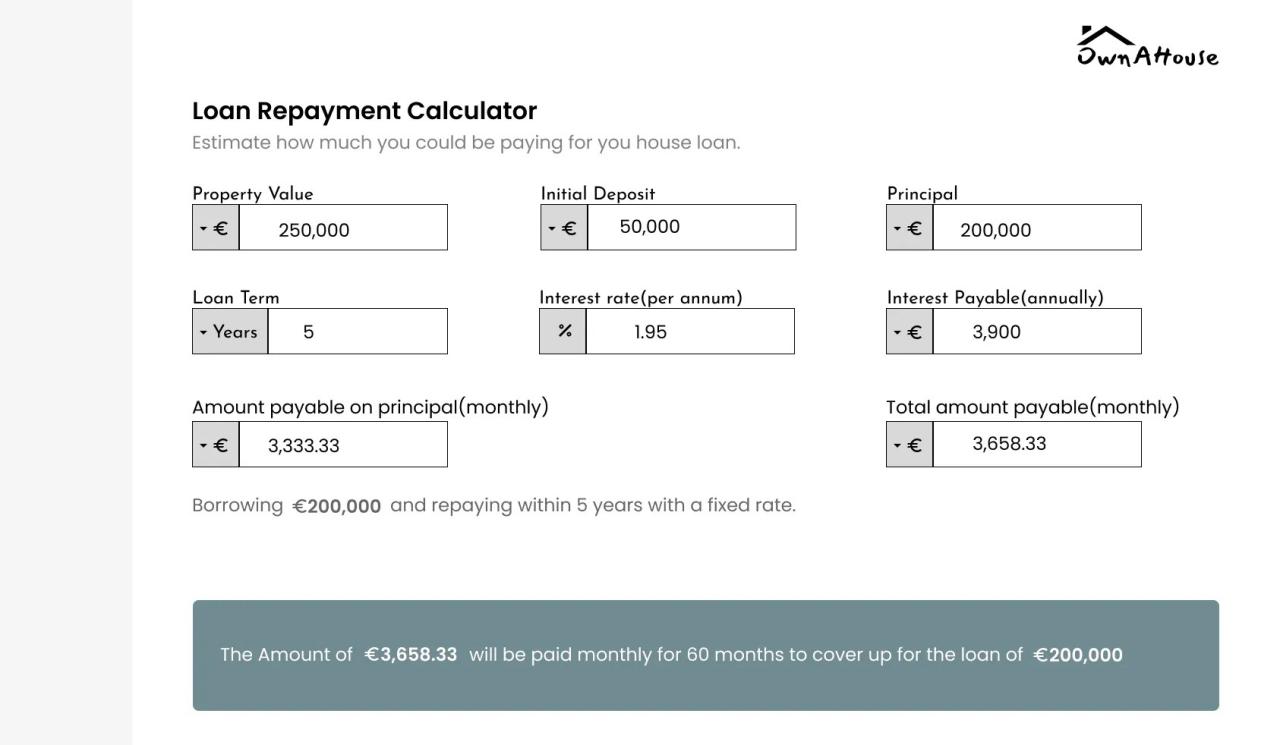

The UFCU loan calculator requires several key pieces of information to perform its calculations. These essential input parameters typically include:

- Loan Amount: The total amount of money you wish to borrow.

- Interest Rate: The annual percentage rate (APR) charged on the loan. This rate reflects the cost of borrowing the money.

- Loan Term: The length of time (in months or years) you have to repay the loan. Longer loan terms generally result in lower monthly payments but higher overall interest costs.

Depending on the loan type, additional parameters might be required. For example, an auto loan calculator may request the vehicle’s price and down payment amount. A home equity loan calculator may ask for the home’s value and current mortgage balance.

Step-by-Step Guide to Using the UFCU Loan Calculator

Using the UFCU loan calculator is generally straightforward. While the specific steps may vary slightly based on the calculator’s design, the process typically follows these steps:

- Navigate to the Calculator: Access the UFCU loan calculator through the credit union’s official website. Look for a section dedicated to loans or financial tools.

- Select Loan Type: Choose the type of loan you are interested in (e.g., auto loan, personal loan). This will often lead to a specialized calculator for that loan type.

- Enter Loan Details: Input the required information, such as the loan amount, interest rate, and loan term. Ensure the accuracy of all entered data.

- Review Results: The calculator will then display your estimated monthly payment, total interest paid, and the total amount repaid over the loan term.

- Compare Scenarios: Experiment with different loan amounts, interest rates, and loan terms to compare various scenarios and find the most suitable option for your financial situation. This allows you to optimize your loan choice based on affordability and long-term cost.

Remember that the results provided by the calculator are estimates. The actual loan terms and payments may vary slightly depending on UFCU’s final approval process and any additional fees or charges.

Comparing UFCU Loan Calculator with Competitors

UFCU’s loan calculator provides a valuable tool for prospective borrowers, but its effectiveness is best understood by comparing its features and user experience against those offered by other major financial institutions. This comparison will highlight UFCU’s strengths and weaknesses, ultimately informing users about the best tool for their needs. We will analyze two competitors to provide a balanced perspective.

Feature Comparison of Loan Calculators

To effectively assess the UFCU loan calculator, a comparison with other prominent financial institutions is crucial. This allows for a nuanced understanding of its capabilities and limitations within the broader financial technology landscape. The following table directly compares key features across three different loan calculators. Note that features and offerings can change over time, so it’s essential to verify information directly on each institution’s website.

| Feature | UFCU | Competitor A (e.g., Navy Federal Credit Union) | Competitor B (e.g., USAA) |

|---|---|---|---|

| Loan Types Offered | Auto, Personal, Home Equity | Auto, Personal, Home Equity, Mortgage | Auto, Personal, Home Equity, Mortgage, Business |

| Repayment Options Displayed | Loan Term, Monthly Payment | Loan Term, Monthly Payment, Amortization Schedule (partial) | Loan Term, Monthly Payment, Amortization Schedule (full), Extra Payment Options |

| Additional Fees Displayed | APR, Origination Fee (if applicable) | APR, Origination Fee, Processing Fee, Late Payment Fee | APR, Origination Fee, Processing Fee, Late Payment Fee, Prepayment Penalty (if applicable) |

| Customization Options | Loan Amount, Loan Term | Loan Amount, Loan Term, Down Payment (for applicable loans) | Loan Amount, Loan Term, Down Payment, Interest Rate (for illustrative purposes) |

| Amortization Schedule Availability | No | Partial | Full |

User Interface and User Experience Comparison

The user interface (UI) and user experience (UX) significantly impact a loan calculator’s usability. UFCU’s calculator generally presents a clean and straightforward design. However, compared to competitors, it may lack some advanced features that enhance the user experience. For example, Competitor B often includes interactive graphs illustrating loan amortization, making it easier for users to visualize their repayment schedule. Competitor A might offer more detailed explanations of terms and conditions directly within the calculator interface. While UFCU’s calculator is functional, competitors sometimes offer a more intuitive and visually appealing experience, incorporating features like progress bars and clear visual cues to guide users through the process. The overall ease of navigation and understanding of the results can vary significantly.

Strengths and Weaknesses of the UFCU Loan Calculator

UFCU’s loan calculator boasts a simple and functional design, making it easy to obtain quick estimates. Its strength lies in its straightforward approach, which is beneficial for users who prioritize simplicity and clarity. However, a weakness is the lack of advanced features found in some competitors, such as detailed amortization schedules or the ability to adjust interest rates for more comprehensive projections. The limited loan type selection compared to larger institutions also presents a limitation. While the basic functionality is effective, a more comprehensive feature set would enhance its competitiveness.

Loan Calculator Results Interpretation

Understanding the output of the UFCU loan calculator is crucial for making informed borrowing decisions. The calculator provides key figures that directly impact your financial commitment, allowing you to compare loan options effectively and choose the most suitable one for your budget. This section will detail how to interpret these results and their implications.

The UFCU loan calculator typically displays several key pieces of information. The most prominent are the monthly payment amount, the total interest paid over the loan’s lifetime, and the total amount repaid (principal plus interest). These figures are directly influenced by three primary factors: the loan amount, the interest rate, and the loan term (length).

Monthly Payment Breakdown

The monthly payment represents your regular obligation to the lender. This figure is calculated based on the loan amount, interest rate, and loan term. A higher loan amount, a higher interest rate, or a longer loan term will all result in a larger monthly payment. For example, a $10,000 loan at 5% interest over 36 months will have a significantly lower monthly payment than the same loan at 10% interest over 60 months. Understanding this relationship allows you to budget effectively and ensure the monthly payment fits comfortably within your financial plan.

Factors Influencing Loan Affordability

Loan affordability hinges on the interplay between the monthly payment and your overall financial situation. The calculator’s results allow you to assess affordability by comparing the calculated monthly payment to your disposable income. Factors beyond the calculator’s direct output, such as other debt obligations, living expenses, and unexpected costs, must also be considered. A seemingly manageable monthly payment could strain your budget if you fail to account for these additional financial pressures. Therefore, responsible borrowing requires a holistic assessment of your financial health.

Impact of Loan Terms and Interest Rates on Total Cost

The total cost of a loan, as shown by the calculator, is the sum of the principal amount borrowed and the total interest paid. Choosing a longer loan term (e.g., 60 months instead of 36 months) reduces the monthly payment, but significantly increases the total interest paid over the life of the loan. Conversely, a shorter loan term leads to higher monthly payments but substantially lower overall interest costs. Similarly, a lower interest rate directly reduces both the monthly payment and the total interest paid, making it a more financially advantageous option. The calculator allows for a direct comparison of these trade-offs.

Visual Representation of Loan Term, Interest Rate, and Total Cost

Imagine a three-dimensional graph. The X-axis represents the loan term (in months), the Y-axis represents the interest rate (as a percentage), and the Z-axis represents the total cost of the loan (in dollars). As you move along the X-axis to longer loan terms, the Z-axis (total cost) increases, even if you hold the interest rate constant. Similarly, moving along the Y-axis to higher interest rates increases the Z-axis (total cost), holding the loan term constant. The graph would show a surface that slopes upward in both the X and Y directions, illustrating the combined effect of loan term and interest rate on the total cost. The steepness of the slope would reflect the sensitivity of the total cost to changes in the loan term and interest rate. A steeper slope indicates a greater increase in total cost for a given change in loan term or interest rate.

Advanced Features and Considerations: Loan Calculator Ufcu

The UFCU loan calculator, while straightforward, offers several features beyond basic loan calculations that can significantly enhance your understanding of potential loan terms and repayment strategies. However, it’s crucial to be aware of its limitations and employ best practices to ensure you’re making informed financial decisions. Understanding these nuances is key to leveraging the calculator effectively.

Beyond providing a simple loan payment estimate, a sophisticated understanding of the UFCU loan calculator allows for more strategic financial planning. This involves recognizing the calculator’s strengths and limitations and employing sound borrowing practices.

Amortization Schedule and Extra Payment Options

The UFCU loan calculator may or may not provide a detailed amortization schedule, a table showing the breakdown of each payment over the life of the loan. This schedule typically displays the principal and interest components of each payment, allowing borrowers to visualize how their loan balance decreases over time. The availability of an amortization schedule is a significant advantage, providing a clear picture of the loan repayment process. Some calculators also allow users to input extra payments to see how this affects the loan term and total interest paid, offering a valuable tool for accelerating debt reduction. For example, adding an extra $100 per month to a $20,000 loan could significantly reduce the overall interest paid and shorten the repayment period.

Limitations for Complex Loan Scenarios

While useful for standard loan scenarios, the UFCU loan calculator may have limitations when dealing with more complex situations. For instance, it may not accurately reflect loans with variable interest rates, balloon payments, or graduated payment schedules. These scenarios require more sophisticated calculations that a basic online calculator might not handle. Furthermore, the calculator likely doesn’t account for factors such as closing costs, loan origination fees, or potential prepayment penalties, which can significantly impact the true cost of borrowing. For loans with unusual features or significant additional fees, it’s advisable to consult directly with a UFCU loan officer for a precise financial analysis.

Best Practices for Effective Loan Calculator Usage

Using a loan calculator effectively requires a strategic approach. Accuracy depends on the correct input of all relevant information. This includes the loan amount, interest rate, loan term, and any additional fees. Double-checking the inputted data before generating results is essential. It’s also important to compare results from multiple loan calculators or sources to ensure consistency. Finally, remember that the calculator provides an estimate; always confirm the final loan terms with the lender before proceeding.

Tips for Accurate and Useful Results

To maximize the value of the UFCU loan calculator, consider these key points:

- Verify Interest Rate: Use the precise annual percentage rate (APR) provided by UFCU, not just the nominal interest rate.

- Include All Fees: Factor in any applicable closing costs, origination fees, or other charges into your loan amount calculation for a more realistic total cost.

- Explore Different Scenarios: Experiment with varying loan terms and interest rates to understand the impact on your monthly payments and total interest paid.

- Compare with Competitors: Use other loan calculators to compare rates and terms from different lenders to secure the best possible loan offer.

- Consult a Financial Advisor: For complex loan situations or if you need personalized financial advice, seek guidance from a qualified financial professional.

User Experience and Accessibility

The UFCU loan calculator’s user experience and accessibility are crucial factors determining its effectiveness and inclusivity. A well-designed calculator should be intuitive, easy to navigate, and accessible to users with diverse needs and abilities. This section evaluates the UFCU loan calculator’s performance in these areas and suggests potential improvements.

The overall user experience hinges on the clarity of the interface, the ease of inputting data, and the comprehensibility of the results. Accessibility, on the other hand, focuses on ensuring usability for individuals with visual, auditory, motor, or cognitive impairments. A successful loan calculator must excel in both aspects to serve a broad range of users effectively.

Overall User Experience Evaluation

The UFCU loan calculator’s user experience is generally positive, characterized by a clean and uncluttered interface. The input fields are clearly labeled, and the calculation process is relatively quick. However, some areas could benefit from improvements. For example, the visual representation of the results could be enhanced for better understanding. A more interactive approach, perhaps with graphical representations of amortization schedules, could greatly enhance the user experience. Additionally, clear explanations of terminology used within the calculator would be beneficial to users unfamiliar with financial jargon.

Accessibility Features for Users with Disabilities

Currently, the level of accessibility features offered by the UFCU loan calculator is unclear without direct examination of the site’s code and functionality. To ensure compliance with accessibility standards like WCAG (Web Content Accessibility Guidelines), the calculator should incorporate features such as keyboard navigation, screen reader compatibility, and sufficient color contrast. Alternative text for images and descriptive labels for interactive elements are also essential. The absence of these features could significantly limit access for users with disabilities.

Suggestions for UI and Functionality Improvements

Several improvements could enhance both the user experience and accessibility of the UFCU loan calculator. These improvements should focus on making the calculator more intuitive, efficient, and inclusive. For instance, implementing a progress bar during the calculation process would provide visual feedback to the user. Adding a “save and resume later” feature would allow users to pause and return to their calculations without losing their progress. Moreover, providing the option to download the results in various formats (e.g., PDF, CSV) would increase the utility of the calculator.

Potential Improvements to the UFCU Loan Calculator

The following list categorizes potential improvements based on usability and accessibility considerations.

- Usability Improvements:

- Implement a more visually appealing and informative presentation of results, perhaps including charts and graphs.

- Provide clear definitions of all terms used within the calculator, accessible via tooltips or a glossary.

- Add a “What-if” scenario feature allowing users to easily adjust input parameters and see the immediate impact on the results.

- Offer a comparison tool to contrast different loan options side-by-side.

- Incorporate a progress indicator to show the calculation status.

- Accessibility Improvements:

- Ensure full keyboard navigation throughout the calculator.

- Implement sufficient color contrast to meet WCAG guidelines.

- Provide alternative text for all images and icons.

- Make the calculator compatible with screen readers.

- Support various input methods (e.g., voice input).

Final Summary

Mastering the UFCU loan calculator is key to navigating the complexities of personal finance. By understanding its features, comparing it to alternatives, and interpreting its results effectively, you can make confident borrowing decisions. Remember to leverage the advanced features, consider potential limitations, and always prioritize responsible borrowing practices. Armed with this knowledge, you can confidently plan your financial future.

FAQ Summary

What loan types does the UFCU loan calculator support?

The calculator typically supports various loan types, including personal loans, auto loans, and possibly mortgages. Check the UFCU website for the most up-to-date list.

Can I use the UFCU loan calculator for refinancing?

This depends on the specific features of the calculator. Some calculators allow you to input existing loan details to explore refinancing options. Consult the UFCU website or contact them directly to confirm.

What happens if I enter inaccurate information into the calculator?

Inaccurate input will lead to inaccurate results. Double-check all entries (loan amount, interest rate, loan term) before generating a calculation.

Is the UFCU loan calculator secure?

UFCU employs security measures to protect user data. However, it’s always advisable to use secure internet connections when accessing financial tools online.