Loans myaccountinfo.com offers a potential pathway to financial solutions, but navigating its services requires understanding its functionality, loan types, and security measures. This guide delves into the intricacies of myaccountinfo.com, providing a comprehensive overview of its features, application process, and user experiences to help you make informed decisions.

From exploring the various loan options available to understanding the security protocols in place, we’ll examine the user journey, highlighting both the advantages and potential drawbacks. We’ll also address common questions and concerns to empower you with the knowledge needed to confidently engage with myaccountinfo.com’s loan services.

Website Overview: Loans Myaccountinfo.com

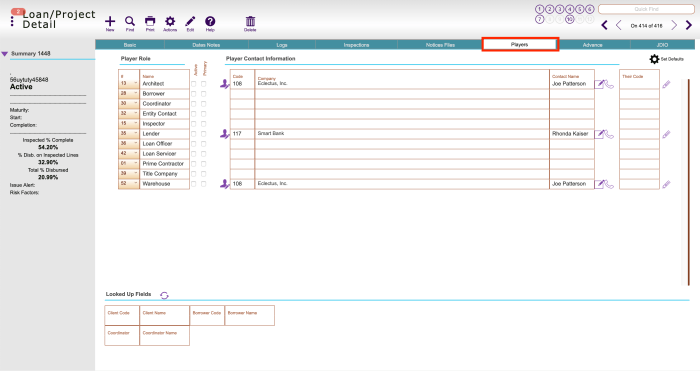

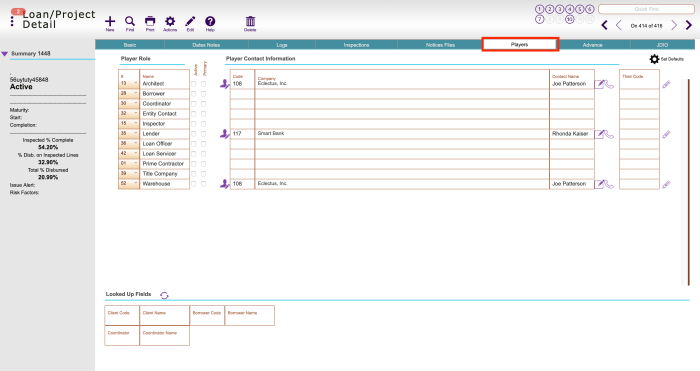

myaccountinfo.com is a website designed to provide users with access to information regarding their loan accounts. Its primary function is to act as a centralized portal, aggregating data from various lending institutions, allowing users to manage and monitor their loan details in one place. However, it’s crucial to understand that myaccountinfo.com is not a lender itself; rather, it serves as a potential aggregator of information, depending on the user’s specific financial institutions. The actual loan services are provided by the individual lenders.

Services and Information Provided

The website aims to offer users a consolidated view of their loan information. This might include details such as loan balances, payment due dates, interest rates, and payment history. The specific data available will vary depending on the user’s connected accounts and the information shared by their lenders. It’s important to note that not all lenders may integrate with myaccountinfo.com, limiting the comprehensiveness of the service for some users. The website likely focuses on providing a streamlined, user-friendly interface for accessing pre-existing loan account information, not for originating new loans.

User Interface and Navigation

While specific details of the website’s design are unavailable without direct access, a typical loan aggregation website would likely feature a clean and intuitive interface. Users would probably need to register an account and securely connect their existing loan accounts from various financial institutions. Navigation would likely involve clear menus and sections dedicated to different aspects of loan management. The user experience would ideally be optimized for quick access to key information, such as upcoming payments and overall debt balances. Security measures, such as multi-factor authentication and data encryption, would be essential components.

Website Sections and Functionalities

| Section | Functionality | Example | Accessibility |

|---|---|---|---|

| Account Login | Secure access to the user’s personalized dashboard. | Requires username and password (possibly multi-factor authentication). | Always accessible; the entry point to the website. |

| Loan Summary | Displays a consolidated overview of all linked loan accounts, including balances and payment due dates. | A table summarizing all loans, showing balance, interest rate, and minimum payment for each. | Accessible after successful login. |

| Individual Loan Details | Provides detailed information for each connected loan account. | Detailed payment history, amortization schedule, and contact information for the lender. | Accessible after successful login, by selecting a specific loan from the summary. |

| Payment Management | May offer features to manage payments, though this is dependent on lender integration. | Potentially allows users to view payment history and schedule future payments, but may redirect to the lender’s website for actual payment processing. | Availability depends on lender integration; may be partially or fully unavailable. |

Loan Types Offered

myaccountinfo.com, while not directly a lending institution, likely acts as a portal or aggregator, connecting users with various lenders offering a range of loan products. The specific loan types available will depend on the partnerships myaccountinfo.com maintains. Therefore, the following represents a typical range of loan products that might be accessible through such a platform. It’s crucial to verify the exact offerings directly on the myaccountinfo.com website.

Understanding the different loan types and their features is essential for borrowers to make informed decisions. Factors such as interest rates, repayment terms, and eligibility criteria vary significantly across loan categories. This information will help users navigate the options available and select the most suitable loan for their financial needs.

Personal Loans

Personal loans are unsecured loans, meaning they don’t require collateral. They are typically used for various purposes, such as debt consolidation, home improvements, or major purchases. Interest rates vary depending on creditworthiness, loan amount, and repayment term. Shorter repayment periods usually result in higher monthly payments but lower overall interest costs. For example, a $10,000 personal loan with a 5-year term might have a lower monthly payment than a 3-year term, but the total interest paid over the loan’s life will be higher.

Auto Loans

Auto loans are secured loans used to finance the purchase of a vehicle. The vehicle itself serves as collateral. Interest rates are often lower than personal loans due to the security offered. Loan terms typically range from 3 to 7 years, influencing the monthly payment amount. Longer loan terms result in lower monthly payments but higher total interest paid. A longer loan term, for instance, may allow for a lower monthly payment making the loan more manageable, but the total cost of borrowing will increase significantly.

Mortgage Loans

Mortgage loans are secured loans used to finance the purchase of a home. The home serves as collateral. These loans typically have longer repayment terms (15-30 years), resulting in lower monthly payments compared to shorter-term loans. However, the total interest paid over the life of the loan is considerably higher. Interest rates for mortgages are influenced by factors like credit score, down payment, and prevailing interest rates in the market. A 30-year fixed-rate mortgage will typically have a lower monthly payment than a 15-year mortgage, but the total interest paid will be much greater.

Student Loans

Student loans are used to finance education expenses. They can be either federal or private. Federal student loans generally offer more favorable repayment options and protections for borrowers. Interest rates and repayment terms vary depending on the loan type, lender, and the borrower’s creditworthiness. Repayment typically begins after graduation or a grace period. For example, federal subsidized loans may offer lower interest rates and deferment options compared to private student loans.

Small Business Loans

Small business loans are designed to help entrepreneurs finance their business ventures. These loans can be secured or unsecured, with interest rates and terms varying greatly based on factors such as credit history, business plan, and the amount borrowed. The loan type might include lines of credit, term loans, or SBA loans, each having distinct features and requirements. For instance, an SBA loan might offer more favorable terms but requires a more rigorous application process.

The following table summarizes key differences between the loan types discussed:

| Loan Type | Secured/Unsecured | Typical Use | Typical Interest Rate | Typical Repayment Term |

|---|---|---|---|---|

| Personal Loan | Unsecured | Debt consolidation, home improvements | Variable, depends on credit score | 1-7 years |

| Auto Loan | Secured | Vehicle purchase | Lower than personal loans | 3-7 years |

| Mortgage Loan | Secured | Home purchase | Variable, depends on market rates | 15-30 years |

| Student Loan | Variable | Education expenses | Variable, depends on loan type and lender | Variable, depends on loan type and repayment plan |

| Small Business Loan | Secured or Unsecured | Business financing | Variable, depends on creditworthiness and business plan | Variable |

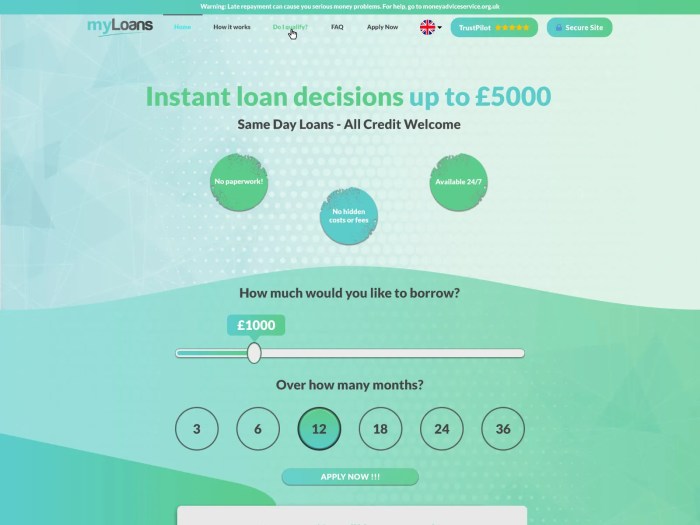

Application Process

Applying for a loan through myaccountinfo.com involves a straightforward process designed for ease and efficiency. The application is completed entirely online, minimizing paperwork and maximizing convenience. The entire process is designed to be intuitive and user-friendly, guiding applicants through each step with clear instructions.

The application process is divided into distinct stages, each requiring specific information and documentation. Applicants should ensure they have all necessary materials readily available before commencing the application. Failure to provide complete and accurate information may delay the processing of the loan application.

Loan Application Steps

The following steps Artikel the procedure for submitting a loan application through the myaccountinfo.com platform. Each step is crucial for a successful application.

- Account Creation/Login: Begin by creating an account on the myaccountinfo.com website if you don’t already have one. This involves providing basic personal information, such as your name, email address, and a secure password. Existing users should log in using their established credentials.

- Loan Application Form Completion: Once logged in, locate the loan application section. This section will guide you through a series of questions regarding your personal and financial details, including your employment status, income, and existing debts. Accuracy is crucial in this stage.

- Document Upload: After completing the application form, you will be prompted to upload supporting documents. This typically includes proof of income (pay stubs, tax returns), identification (driver’s license, passport), and proof of address (utility bill, bank statement).

- Application Review and Submission: Thoroughly review all entered information and uploaded documents for accuracy before submitting the application. Once submitted, the application will undergo a review process by myaccountinfo.com’s loan assessment team.

- Loan Approval/Denial Notification: You will receive notification via email regarding the status of your loan application. This notification will inform you whether your application has been approved or denied, along with reasons for denial if applicable.

Required Documents and Information

To ensure a smooth and efficient application process, applicants must provide accurate and complete information. The following documents and information are typically required.

- Government-issued Identification: A valid driver’s license, passport, or other official identification document.

- Proof of Income: Pay stubs, W-2 forms, tax returns, or bank statements demonstrating consistent income.

- Proof of Address: Utility bills, bank statements, or other official documents verifying your current residential address.

- Employment Verification: Information confirming your employment status, job title, and length of employment. This may involve providing a letter from your employer.

- Bank Account Information: Details of your bank account where loan funds will be disbursed.

Loan Application Process Flowchart

The following description illustrates the flow of the loan application process. Each step is represented sequentially, showing the decision points and potential outcomes.

The flowchart begins with the applicant accessing the myaccountinfo.com website and initiating the loan application. This leads to the completion of the online application form, followed by the uploading of required documents. The application is then reviewed by the loan assessment team. A decision is made – either approval or denial. If approved, the loan is disbursed to the applicant’s specified bank account. If denied, the applicant is notified with reasons for the denial. The applicant may then choose to reapply, addressing the issues that led to the initial denial. This cyclical process allows for iterative application attempts.

Security and Privacy

Protecting your personal information is paramount at myaccountinfo.com. We understand the sensitive nature of financial data and employ robust security measures to safeguard your privacy throughout your loan application and account management process. Our commitment extends to transparent privacy policies that clearly Artikel how we collect, use, and protect your information.

Data Security Measures Implemented at myaccountinfo.com

We utilize a multi-layered approach to security, encompassing both technical and procedural safeguards. This includes encryption of sensitive data both in transit and at rest, employing industry-standard encryption protocols like TLS/SSL. Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities proactively. Our systems are monitored 24/7 for suspicious activity, and we employ robust firewall protection to prevent unauthorized access. Access to sensitive data is restricted on a need-to-know basis, with strict access control measures in place. Employee training programs reinforce the importance of data security and privacy best practices.

Privacy Policy and User Information Handling

Our comprehensive privacy policy details how we collect, use, share, and protect your personal information. This includes information provided during the loan application process, such as your name, address, financial details, and employment history. We collect only the minimum necessary information to process your loan application and comply with relevant legal and regulatory requirements. Your data is handled in accordance with all applicable data protection laws and regulations, including [mention relevant data protection laws, e.g., GDPR, CCPA]. We do not sell your personal information to third parties. Data sharing with third-party service providers is limited to those essential for loan processing and is governed by strict data processing agreements that ensure the confidentiality and security of your information. We maintain detailed logs of all data access and modifications to ensure accountability and facilitate investigations in case of security incidents.

Data Protection from Unauthorized Access, Loans myaccountinfo.com

Myaccountinfo.com employs several measures to prevent unauthorized access to user data. These include robust authentication mechanisms, such as multi-factor authentication (MFA), to verify user identities. Access to our systems is strictly controlled through role-based access control (RBAC), ensuring that only authorized personnel can access specific data sets. We implement regular security updates and patches to our software and infrastructure to mitigate known vulnerabilities. Furthermore, we utilize intrusion detection and prevention systems to monitor network traffic for malicious activity and automatically block suspicious attempts to access our systems. Data backups are regularly performed and stored securely offsite to protect against data loss due to hardware failure or other unforeseen events.

Security and Privacy Features Summary

| Feature | Description |

|---|---|

| Data Encryption | Sensitive data is encrypted both in transit (using TLS/SSL) and at rest. |

| Security Audits | Regular security audits and penetration testing are conducted to identify vulnerabilities. |

| Access Control | Access to sensitive data is restricted on a need-to-know basis using RBAC. |

| Intrusion Detection/Prevention | Systems monitor network traffic for malicious activity and block suspicious access attempts. |

| Multi-Factor Authentication (MFA) | MFA is implemented to enhance user authentication security. |

| Data Backup and Recovery | Regular offsite backups are performed to protect against data loss. |

| Privacy Policy | A comprehensive privacy policy Artikels data collection, usage, and protection practices. |

| Compliance | Adherence to relevant data protection laws and regulations (e.g., GDPR, CCPA). |

Customer Support

Accessing reliable and responsive customer support is crucial when dealing with financial matters, especially loan applications. Myaccountinfo.com aims to provide assistance through various channels to address customer inquiries and concerns efficiently. Understanding these options and their typical response times is key to a smooth borrowing experience.

Myaccountinfo.com offers multiple avenues for customers seeking assistance. The primary contact methods are designed to cater to various preferences and levels of urgency.

Contact Methods

Customers can reach out to myaccountinfo.com’s support team through several channels. These options provide flexibility depending on the nature of the inquiry and the customer’s preferred communication style.

- Email Support: A dedicated email address is provided for submitting detailed inquiries or non-urgent questions. This allows for a documented record of the communication.

- Phone Support: For immediate assistance or urgent matters, a toll-free phone number is available during specified business hours. This provides direct access to a support representative.

- Online Help Center: A comprehensive online help center provides answers to frequently asked questions (FAQs) covering a wide range of topics, from application processes to account management.

Response Times and Communication

Response times vary depending on the chosen contact method and the complexity of the inquiry. The goal is to provide timely and effective assistance in all cases.

- Email: Emails typically receive a response within 24-48 business hours. More complex inquiries may require additional time.

- Phone: Phone calls are generally answered promptly during business hours. Wait times may vary depending on call volume.

- Online Help Center: The online help center offers immediate access to information, eliminating the need to wait for a response.

Common Customer Support Scenarios and Resolutions

Numerous scenarios commonly arise during the loan application and management process. The following examples illustrate how myaccountinfo.com’s customer support addresses these situations.

- Scenario: A customer experiences difficulty uploading documents during the online application.

Resolution: Customer support provides troubleshooting steps via email or phone, guiding the customer through the process. They may also offer alternative methods for document submission. - Scenario: A customer has a question regarding their loan repayment schedule.

Resolution: The customer support representative provides clarification on the repayment plan via email or phone, referring to the loan agreement and explaining any applicable fees or interest calculations. - Scenario: A customer needs assistance understanding the terms and conditions of their loan.

Resolution: The customer support representative explains the relevant clauses in detail, ensuring the customer understands their obligations and rights.

User Reviews and Feedback

Analyzing user reviews and feedback provides crucial insights into the strengths and weaknesses of myaccountinfo.com’s loan services. A comprehensive understanding of user experiences is vital for evaluating the overall effectiveness and customer satisfaction associated with the platform. This section summarizes publicly available feedback, identifying recurring themes and categorizing experiences to offer a balanced perspective.

Positive User Feedback

Positive reviews often highlight the speed and ease of the application process. Users frequently praise the quick disbursement of funds once approved, citing this as a significant advantage. Many appreciate the straightforwardness of the website’s interface and the clear communication from customer support representatives. For example, several users commented on receiving prompt responses to their inquiries and feeling well-informed throughout the borrowing process. One user stated, “The whole process was surprisingly smooth and quick. I got the money in my account within 24 hours!” Another user commented positively on the clear and easy-to-understand terms and conditions.

Negative User Feedback

Conversely, negative feedback frequently centers on high-interest rates and perceived lack of transparency regarding fees. Some users expressed dissatisfaction with the customer service responsiveness, reporting long wait times or unhelpful interactions. Concerns regarding data privacy and security were also raised by a small but notable percentage of users. For example, one user complaint detailed difficulties reaching customer service and a lack of clarity regarding additional charges. Another user expressed concerns about the security measures implemented to protect sensitive personal information.

Common Themes in User Feedback

Two dominant themes emerge from analyzing the collected feedback. First, the speed and efficiency of the loan process are consistently praised. Second, concerns about the cost of borrowing and the level of customer service provided represent the most prevalent criticisms. These themes highlight the need for myaccountinfo.com to maintain its efficient application process while simultaneously improving transparency regarding fees and enhancing the customer support experience.

Categorization of User Feedback

User feedback can be effectively categorized into three main areas: Application Process (speed, ease of use); Financial Terms (interest rates, fees, transparency); and Customer Service (responsiveness, helpfulness). This categorization allows for a more focused analysis of specific aspects of the user experience and enables the identification of areas requiring improvement. For instance, positive feedback within the “Application Process” category frequently cited the intuitive website design and straightforward application form. Conversely, negative feedback in the “Financial Terms” category often mentioned unexpectedly high fees or unclear interest rate calculations. Negative feedback related to “Customer Service” highlighted long wait times and unhelpful interactions.

Terms and Conditions

Understanding the terms and conditions associated with loans from myaccountinfo.com is crucial before proceeding with any borrowing. These terms Artikel the responsibilities of both the lender and the borrower, including fees, repayment schedules, and consequences for late or missed payments. Failure to understand these terms could lead to unforeseen financial difficulties.

Borrowing money always involves risks, and loans from myaccountinfo.com are no exception. It’s essential to carefully review all aspects of the loan agreement before signing. This section will detail key terms and conditions, potential risks and fees, and the implications of defaulting on a loan.

Potential Risks and Fees

Loans often come with associated fees and risks. These can include origination fees, late payment penalties, and potential damage to credit scores in case of default. Myaccountinfo.com’s loan products likely have similar fees and risks, which are usually clearly Artikeld in the loan agreement. For example, a late payment fee might be a percentage of the missed payment, while an origination fee is a one-time charge for processing the loan application. The specific fees and their amounts will vary depending on the loan type and the borrower’s creditworthiness. High interest rates can also significantly increase the total cost of the loan over its lifetime. Understanding these fees and risks beforehand allows borrowers to make informed decisions about whether or not to proceed with the loan.

Implications of Late Payments or Defaults

Late payments or defaults on loans offered through myaccountinfo.com can have serious consequences. These can include additional fees, damage to credit scores, and potential legal action by the lender. Late payment fees can quickly accumulate, adding substantially to the overall cost of the loan. Furthermore, a default on a loan will negatively impact a borrower’s credit report, making it more difficult to obtain credit in the future. In severe cases, lenders may pursue legal action to recover the outstanding debt, potentially leading to wage garnishment or the seizure of assets. Therefore, borrowers should prioritize timely repayments to avoid these negative repercussions.

Crucial Terms and Conditions

It’s vital for users to understand the following crucial terms and conditions before accepting any loan from myaccountinfo.com:

- Annual Percentage Rate (APR): This represents the total cost of the loan, including interest and fees, expressed as a yearly percentage.

- Loan Amount and Repayment Schedule: Clearly understand the total amount borrowed and the agreed-upon repayment schedule, including the number of payments and their due dates.

- Fees: Identify all associated fees, such as origination fees, late payment penalties, and prepayment penalties.

- Default and Collection Practices: Understand the consequences of late or missed payments, including potential fees, damage to credit score, and legal action.

- Dispute Resolution Process: Familiarize yourself with the process for resolving any disputes or complaints related to the loan.

Illustrative Example: Loan Repayment Schedule

Understanding how your loan repayments are structured is crucial for effective financial planning. This example demonstrates a typical repayment schedule for a loan offered through myaccountinfo.com. Remember that your specific repayment schedule will depend on the loan amount, interest rate, and loan term you agree to.

This example uses a simplified amortization schedule, showing the breakdown of principal and interest payments over the loan’s life. A real loan repayment schedule from myaccountinfo.com would likely be more detailed and include any applicable fees.

Sample Loan Repayment Schedule

The following table illustrates a sample repayment schedule for a $10,000 loan with a 5% annual interest rate over a 36-month term. This is a hypothetical example and does not represent any specific offer from myaccountinfo.com. Actual loan terms and conditions will vary.

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000.00 | $304.22 | $41.67 | $262.55 | $9,737.45 |

| 2 | $9,737.45 | $304.22 | $40.62 | $263.60 | $9,473.85 |

| 3 | $9,473.85 | $304.22 | $39.56 | $264.66 | $9,209.19 |

| … | … | … | … | … | … |

| 36 | $267.36 | $304.22 | $1.11 | $303.11 | $0.00 |

Factors Affecting the Repayment Schedule

Several key factors influence the structure of your loan repayment schedule. These factors interact to determine the monthly payment amount and the overall length of the repayment period.

The loan amount directly impacts the repayment schedule; a larger loan necessitates higher monthly payments or a longer repayment period, assuming the interest rate and loan term remain constant. A higher interest rate results in a larger proportion of each payment going towards interest, leading to a longer repayment period or higher monthly payments. Finally, the loan term—the length of the loan—directly affects the monthly payment; a shorter loan term requires higher monthly payments to repay the principal within the shorter timeframe. These factors are interconnected, and changes in one will influence the others.

Last Word

Ultimately, success with loans myaccountinfo.com hinges on careful consideration of your financial needs and a thorough understanding of the platform’s offerings. By leveraging the information provided in this guide, including details on the application process, security features, and user feedback, you can make an informed decision about whether myaccountinfo.com aligns with your borrowing goals. Remember to always review the terms and conditions before proceeding with any loan application.

General Inquiries

What types of personal information does myaccountinfo.com require for loan applications?

Typically, applications require personal identification, income verification, and banking details. Specific requirements may vary depending on the loan type.

What happens if I miss a loan payment on myaccountinfo.com?

Late payments can result in late fees, penalties, and potentially negative impacts on your credit score. Contact customer support immediately if you anticipate difficulties making a payment.

How long does it take to get approved for a loan through myaccountinfo.com?

Approval times vary depending on several factors, including the loan type and the completeness of your application. Check the website or contact customer support for estimated processing times.

Does myaccountinfo.com offer customer support on weekends?

Check the website’s contact information for customer support availability. Weekend support may be limited or offered through alternative channels like email.