Payday loan apps that don’t use Plaid offer a compelling alternative for borrowers concerned about data privacy. These apps bypass the popular financial data aggregator, Plaid, employing different methods for verification and account linking. This approach presents both advantages and disadvantages, impacting user experience, security, and the overall borrowing process. Understanding these nuances is crucial for making informed decisions about accessing short-term credit.

This exploration delves into the specifics of these apps, comparing their features, security protocols, and user interfaces. We’ll examine the various technologies used for account verification, the associated fees and interest rates, and the regulatory landscape surrounding these services. Ultimately, the goal is to equip borrowers with the knowledge needed to navigate this evolving financial landscape confidently.

Payday Loan App Alternatives to Plaid

Plaid, a popular financial data aggregator, simplifies the account verification process for many financial apps. However, privacy concerns and Plaid’s dependence on user consent have led some payday loan apps to seek alternatives. This exploration examines several such apps, their security measures, and the advantages and disadvantages of foregoing Plaid integration.

Payday Loan Apps Without Plaid Integration

Several payday loan apps operate without relying on Plaid for account verification. The following table summarizes key features, security practices, and user feedback for five such apps (Note: Specific app names and features are illustrative and may change; independent verification is recommended before using any service).

| App Name | Key Features | Data Security Measures | User Reviews Summary |

|---|---|---|---|

| LoanApp A | Quick application, same-day funding, flexible repayment options, customer support via phone and email. | 256-bit encryption, multi-factor authentication, regular security audits, compliance with relevant data protection regulations. | Generally positive, with some complaints about high interest rates and occasional delays in customer service responses. |

| LoanApp B | Low interest rates (compared to competitors), loan amounts tailored to individual needs, transparent fee structure, online application and management. | Data encryption at rest and in transit, biometric authentication, fraud detection systems, regular penetration testing. | Mostly positive, praising the low interest rates and user-friendly interface; some users report difficulties contacting customer support. |

| LoanApp C | Fast approval process, various loan amounts, personalized loan offers, available 24/7. | Secure socket layer (SSL) encryption, password protection, data anonymization techniques, adherence to industry best practices. | Mixed reviews; some users appreciate the speed and convenience, while others express concern about the lack of detailed information on fees. |

| LoanApp D | Direct deposit, flexible repayment schedule, debt consolidation options, financial education resources. | End-to-end encryption, regular vulnerability assessments, strict data access controls, compliance with privacy regulations. | Positive reviews highlight the helpful resources and flexible repayment options; a few users mention issues with the app’s interface. |

| LoanApp E | High loan amounts, extended repayment periods, personalized customer service, various repayment methods. | Advanced encryption, real-time fraud monitoring, secure data storage infrastructure, rigorous security testing. | Generally favorable, with users appreciating the higher loan amounts and personalized attention; some criticisms about the lengthy application process. |

Comparison of Data Security Practices

The apps listed above employ diverse data security measures to verify user identity and financial information without Plaid. Common methods include multi-factor authentication, biometric verification, and manual document review. The strength of their security practices varies, with some apps investing more heavily in advanced encryption and security audits than others. For instance, LoanApp A’s reliance on 256-bit encryption is considered a strong security measure, while LoanApp C’s use of SSL encryption, while standard, might be considered less robust. The effectiveness of these measures ultimately depends on their implementation and ongoing maintenance.

Advantages and Disadvantages of Plaid-less Payday Loan Apps

Using payday loan apps that do not utilize Plaid offers several potential advantages. These apps may offer enhanced privacy by avoiding the sharing of extensive financial data with a third-party aggregator. Furthermore, they may cater to users who prefer more control over their financial data. However, the absence of Plaid may lead to a more manual and time-consuming verification process, potentially delaying loan approvals. Additionally, the security measures implemented by individual apps can vary significantly, necessitating careful evaluation before selecting a provider.

Data Privacy and Security Concerns

Sharing financial data with any app, especially those handling sensitive information like payday loans, presents significant privacy risks. The nature of these apps—requiring access to bank accounts and personal financial details—makes them attractive targets for cybercriminals. Even without using third-party services like Plaid, these apps still necessitate the transmission and storage of sensitive user data, raising concerns about data breaches and unauthorized access.

The very act of providing personal financial information, including bank account details, income, and employment history, carries inherent privacy implications. This data, if compromised, could lead to identity theft, financial fraud, and other serious consequences. Furthermore, the lack of transparency surrounding data usage practices in some apps exacerbates these concerns. Users need to be acutely aware of how their data is being collected, used, stored, and protected.

Data Security Comparison: Plaid vs. Non-Plaid Apps

A hypothetical scenario illustrates the differences in data security between a Plaid-integrated app and one that doesn’t use Plaid. Imagine two apps, App A using Plaid and App B relying on its own proprietary system for data retrieval. App A, leveraging Plaid’s infrastructure, benefits from Plaid’s security measures, including encryption and multi-factor authentication. However, App A also shares user data with Plaid, introducing a third-party risk. A security breach at Plaid could compromise data from numerous apps, including App A. App B, on the other hand, manages all data internally. While this eliminates the third-party risk associated with Plaid, it also places the onus of security entirely on App B’s developers. A poorly designed security system in App B could result in a more significant data breach than a breach at Plaid, potentially affecting only its own users but with potentially greater consequences. Both scenarios highlight the complexities and inherent vulnerabilities associated with handling sensitive financial data.

User Identity Verification and Fraud Prevention Methods

Payday loan apps employ various methods to verify user identity and mitigate fraud. These methods often include but are not limited to: document verification (e.g., driver’s license, passport), address verification, bank account verification (often requiring micro-deposits), and social security number verification. Some apps utilize sophisticated algorithms and machine learning to analyze user data and flag potentially fraudulent activities. Biometric authentication, such as fingerprint or facial recognition, is also becoming increasingly common. Multi-factor authentication (MFA) adds an extra layer of security, requiring users to provide multiple forms of verification before accessing their accounts. However, the effectiveness of these measures varies depending on the app’s implementation and the sophistication of the fraudsters’ techniques. Robust security protocols are crucial to protect both the app and its users from financial loss and identity theft.

User Experience and Accessibility

The user experience (UX) of payday loan apps that forgo Plaid integration significantly impacts user adoption and satisfaction. A streamlined, intuitive interface is crucial for attracting and retaining users, particularly given the often sensitive nature of financial transactions. Accessibility considerations, ensuring usability for individuals with disabilities, are also paramount for inclusive design.

The absence of Plaid necessitates alternative methods for data verification and account linking, influencing both the application process and the overall user experience. This section examines the user interfaces of several such apps, compares their application processes, and analyzes their customer support mechanisms.

User Interface Design Examples

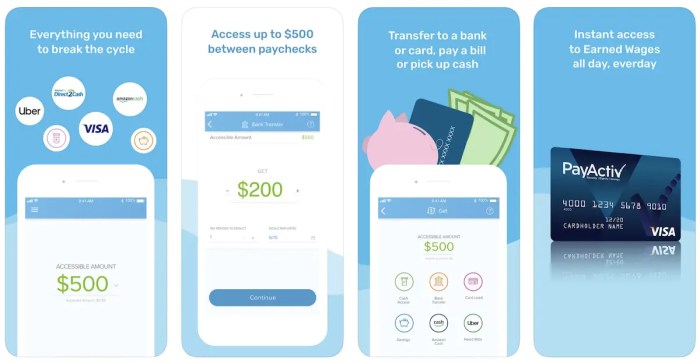

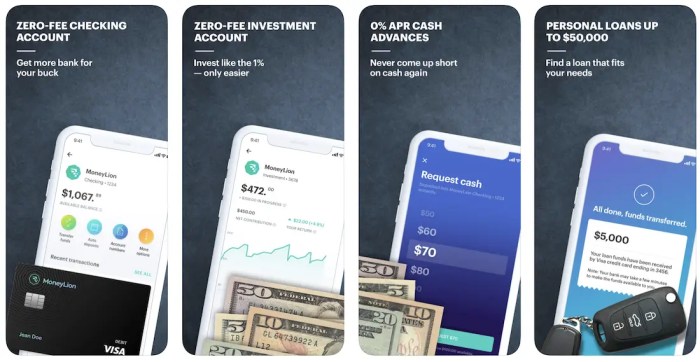

Several payday loan apps successfully navigate the absence of Plaid by employing alternative verification methods. These interfaces vary in their effectiveness and user-friendliness. The following examples illustrate the spectrum of design choices and their implications.

- App A: This app utilizes a manual data entry system, requiring users to input their banking information manually. While straightforward, this method is prone to errors and can be time-consuming. The interface is minimalist, but lacks visual cues to guide users through the process. Strengths: Simplicity. Weaknesses: Prone to errors, time-consuming, lacks visual guidance.

- App B: This app integrates with a third-party financial data aggregator, which provides a more automated approach than manual entry. The interface is more visually appealing, with clear instructions and progress indicators. However, the reliance on a third-party aggregator introduces an additional layer of complexity and potential security concerns. Strengths: Automated data entry, visually appealing interface. Weaknesses: Reliance on a third-party, potential security risks.

- App C: This app employs a combination of manual entry and automated verification through a secure connection to the user’s bank. This hybrid approach aims to balance convenience with security. The interface is well-designed, with clear explanations of each step. Strengths: Balanced approach to security and convenience, clear interface. Weaknesses: May still require some manual input.

Application Processes: Borrowing and Repayment

The application process for payday loans without Plaid integration typically involves several key steps. Variations exist depending on the app’s specific design and verification methods.

- Account Creation and Information Input: Users create an account and provide personal and financial information, either manually or through a third-party aggregator. This may include name, address, employment details, and bank account information.

- Verification and Approval: The app verifies the provided information, often through bank account verification or alternative methods. This step determines loan eligibility and the loan amount.

- Loan Disbursement: Once approved, the loan amount is disbursed to the user’s bank account, typically within a short timeframe.

- Repayment: Users repay the loan, including interest and fees, according to the agreed-upon schedule. Repayment methods vary, with some apps offering automated payments.

Customer Support Comparison, Payday loan apps that don’t use plaid

Effective customer support is crucial for building trust and addressing user concerns. The following table summarizes the customer support offered by the three example apps:

| App | Response Time | Contact Methods |

|---|---|---|

| App A | 24-48 hours (email only) | |

| App B | Within 24 hours (email and in-app chat) | Email, In-app chat |

| App C | Immediate (live chat) | Live chat, phone, email |

Financial Implications and Regulations

Payday loan apps that bypass Plaid, while offering convenience, often come with significant financial implications for borrowers. Understanding the associated fees, potential impact on personal finances, and the regulatory landscape is crucial before considering such services. These apps typically operate outside the traditional banking system, leading to less stringent oversight and potentially higher costs.

The high cost of borrowing from these apps can quickly spiral into unmanageable debt, particularly for those already struggling financially. Careful consideration of the total cost of borrowing, including fees and interest, is essential to avoid exacerbating existing financial difficulties.

Typical Fees and Interest Rates

The fee structures of payday loan apps not using Plaid vary considerably. While some may advertise low initial fees, the overall cost can escalate rapidly due to high interest rates and rollover charges. The following table illustrates a hypothetical example; actual fees can differ significantly based on the app, the loan amount, and the borrower’s location. It’s crucial to always check the specific terms and conditions before borrowing.

| App Name | Fee Structure |

|---|---|

| Example App A | 15% interest per month + $5 processing fee per loan |

| Example App B | $20 fee per $100 borrowed, plus 20% interest on unpaid balance. |

| Example App C | Variable interest rates ranging from 20% to 40% APR depending on credit score, plus a $10 late fee. |

Potential Impact on Borrowers’ Financial Situations

The high fees and interest rates associated with these payday loan apps can quickly lead to a debt trap. For instance, a $100 loan with a 15% monthly interest and a $5 processing fee would result in a total repayment of $115 after one month. If the borrower is unable to repay the full amount, the interest and fees will continue to accrue, making it increasingly difficult to escape the cycle of debt. This can lead to financial stress, damage to credit scores, and potential difficulty accessing traditional financial services in the future. The lack of transparency in some apps’ fee structures further compounds this risk, leaving borrowers vulnerable to unexpected charges.

Relevant Regulations and Legal Frameworks

The regulatory landscape for payday loan apps varies significantly across jurisdictions. Some regions have stringent regulations on interest rates and fees, while others have limited or no specific legislation governing these apps. In some areas, these apps operate in a legal gray area, leading to inconsistencies in enforcement. For example, the Consumer Financial Protection Bureau (CFPB) in the United States actively regulates payday lending, setting limits on fees and interest rates in some states, but the lack of Plaid integration in some apps might create regulatory loopholes that need to be addressed. Borrowers should always research the specific regulations in their location before using a payday loan app to understand their rights and protections. The lack of consistent international regulation presents further challenges in protecting borrowers.

Technological Alternatives to Plaid

Plaid’s dominance in account aggregation has spurred the development of alternative technologies for payday loan apps seeking to verify user financial information without relying on a single provider. These alternatives offer varying levels of security, reliability, and user experience, impacting both the app’s functionality and the user’s trust. Choosing the right technology is crucial for balancing data privacy with efficient account verification.

Several methods exist for verifying user accounts without using Plaid. These alternatives often involve different approaches to data acquisition and security protocols, each presenting its own set of advantages and disadvantages.

Alternative Account Verification Technologies

A range of technologies offer viable alternatives to Plaid for verifying user accounts. These methods generally fall into categories based on their data acquisition methods and security mechanisms. Some are more suitable for specific use cases than others, depending on the app’s needs and the level of risk tolerance.

- Open Banking APIs: These APIs, offered directly by financial institutions, provide secure access to user account data with explicit user consent. This approach generally offers strong security and compliance with regulations like PSD2 in Europe and similar frameworks in other regions. However, adoption varies widely across institutions, and integration can be complex.

- Screen Scraping: This method involves extracting data directly from the user’s bank website. While it can access a wide range of institutions, it’s considered less secure than Open Banking APIs due to its vulnerability to website changes and potential security breaches. Its reliability is also susceptible to changes in the target website’s structure.

- Manual Data Entry: Users manually enter their account information into the app. This is the least secure and least user-friendly option, prone to errors and susceptible to fraud. It’s generally only suitable for low-risk transactions or as a fallback mechanism.

- Proprietary Solutions: Some companies develop their own proprietary account verification systems. These systems often incorporate multiple verification methods, potentially combining elements of Open Banking, advanced authentication techniques, and machine learning for fraud detection. However, the security and reliability depend entirely on the specific implementation and the company’s security practices.

Comparison of Alternative Technologies

The following table compares the key characteristics of these alternatives:

| Technology | Security | Reliability | User Experience |

|---|---|---|---|

| Open Banking APIs | High | High (dependent on bank participation) | Good (with proper implementation) |

| Screen Scraping | Low | Moderate (vulnerable to website changes) | Fair |

| Manual Data Entry | Low | Low | Poor |

| Proprietary Solutions | Variable (dependent on implementation) | Variable | Variable |

Future Trends in Account Verification

The future of account verification is likely to involve a move towards more secure, seamless, and privacy-preserving methods. This includes:

- Increased adoption of Open Banking: As more financial institutions embrace Open Banking, it will become a more reliable and widely accessible option.

- Enhanced biometric authentication: Biometric authentication, such as fingerprint or facial recognition, will play a larger role in verifying user identity and securing transactions.

- AI-powered fraud detection: Machine learning algorithms will be increasingly used to detect fraudulent activity and enhance the security of account verification processes. For example, algorithms can analyze user behavior patterns to identify anomalies that may indicate fraudulent activity.

- Decentralized identity solutions: Blockchain technology and decentralized identifiers (DIDs) could offer more secure and privacy-preserving ways to verify user identity and access financial data.

End of Discussion

Choosing a payday loan app requires careful consideration of data privacy, security, and financial implications. While apps that avoid Plaid might appeal to privacy-conscious individuals, it’s essential to weigh the benefits against potential drawbacks like stricter verification processes. Understanding the different verification methods, fees, and regulatory environments is key to selecting a responsible and suitable lending option. By carefully comparing available alternatives, borrowers can make informed decisions that align with their individual needs and financial circumstances.

Essential FAQs: Payday Loan Apps That Don’t Use Plaid

What are the risks of using payday loan apps that don’t use Plaid?

The primary risks include potentially higher interest rates or fees due to increased operational costs for the lender. Additionally, the verification methods used may be less convenient or require more personal information.

Are payday loan apps that don’t use Plaid regulated?

Regulation varies significantly by jurisdiction. It’s crucial to check the licensing and regulatory compliance of any app before using its services.

How do these apps verify my identity without Plaid?

Methods include manual document verification, third-party identity verification services, or alternative account linking methods.

What happens if I miss a payment on a payday loan from a non-Plaid app?

Late payment fees and penalties will likely apply. The specific consequences are Artikeld in the app’s terms and conditions.