Payday loans Junction City KS represent a complex financial landscape for residents needing short-term funds. This guide explores the availability, regulations, and alternatives to payday loans in Junction City, Kansas, providing crucial information for informed decision-making. We’ll delve into the various lenders, interest rates, and loan terms, highlighting the potential risks and benefits. Understanding the legal framework surrounding payday lending in Kansas is essential, allowing borrowers to navigate the system effectively and avoid predatory practices.

We’ll compare payday loans to alternative financial solutions, such as credit unions and community assistance programs, analyzing their respective advantages and disadvantages. The economic impact of payday lending on Junction City’s community will also be examined, considering both the benefits and drawbacks for individuals and the local economy. Finally, we’ll offer practical advice on consumer protection and financial literacy, empowering residents to make responsible borrowing choices.

Understanding Payday Loan Availability in Junction City, KS

Payday loans in Junction City, Kansas, operate within the framework of state and federal regulations governing short-term lending. Understanding the landscape of available lenders and loan terms is crucial for borrowers to make informed decisions and avoid potential financial hardship. This section details the types of lenders, typical loan terms, and potential risks associated with payday loans in Junction City.

Payday Lending Landscape in Junction City, KS

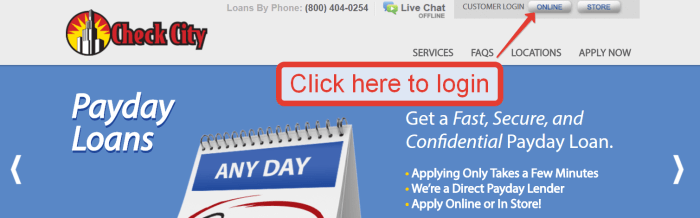

Junction City, like many other communities, offers a mix of storefront and online payday loan providers. Storefront lenders maintain physical locations within the city, allowing for face-to-face interactions with borrowers. Online lenders, conversely, operate entirely online, providing convenience but potentially lacking the personal touch of a storefront lender. The availability of specific lenders can fluctuate, so it’s advisable to conduct thorough research before applying for a loan. Competition among lenders might influence interest rates and loan terms offered, but this can vary significantly.

Types of Payday Loan Providers in Junction City, KS, Payday loans junction city ks

Payday loan providers in Junction City typically fall into two categories: storefront and online. Storefront lenders offer the advantage of in-person consultations and potentially more personalized service. However, online lenders often provide a broader range of loan options and may have a less stringent application process. The choice between these two types depends on individual preferences and circumstances. Some borrowers may prefer the convenience of online applications, while others may value the personal interaction offered by storefront lenders.

Typical Payday Loan Terms and Conditions in Junction City, KS

Payday loans in Junction City are typically characterized by short repayment periods, usually two to four weeks, and high interest rates. Loan amounts vary depending on the lender and the borrower’s income and credit history, but they generally range from a few hundred to a thousand dollars. It’s crucial to carefully review all terms and conditions before agreeing to a loan, paying close attention to the Annual Percentage Rate (APR) and any additional fees. Failure to repay the loan on time can lead to significant additional charges and potential damage to credit scores.

Comparison of Payday Loan Offers in Junction City, KS

The following table provides a hypothetical comparison of potential loan offers from different lenders in Junction City. Note that these are examples only, and actual offers may vary considerably depending on the lender, the borrower’s creditworthiness, and prevailing market conditions. Always confirm details directly with the lender.

| Lender | Annual Percentage Rate (APR) | Loan Amount | Repayment Period |

|---|---|---|---|

| Example Lender A (Storefront) | 400% | $300 | 2 weeks |

| Example Lender B (Online) | 350% | $500 | 4 weeks |

| Example Lender C (Storefront) | 450% | $200 | 2 weeks |

| Example Lender D (Online) | 380% | $400 | 3 weeks |

Regulations and Legal Aspects of Payday Loans in Junction City, KS: Payday Loans Junction City Ks

Payday lending in Junction City, Kansas, is governed by a complex interplay of state and federal regulations designed to protect consumers while allowing lenders to operate. Understanding these regulations is crucial for both borrowers and lenders to navigate the legal landscape and avoid potential pitfalls. This section details the key aspects of payday loan regulations in Kansas and highlights potential risks for borrowers.

Kansas, like many states, has specific laws regarding payday loans, aiming to curb predatory lending practices. These laws dictate aspects such as maximum loan amounts, interest rates, and loan terms. Federal regulations, primarily through the Consumer Financial Protection Bureau (CFPB), also play a significant role in overseeing the industry and ensuring compliance with fair lending practices.

Kansas State Regulations on Payday Loans

Kansas regulates payday loans under the Kansas Consumer Loan Act. This act sets limits on the amount a lender can charge in fees and interest. Specifically, it caps the total finance charge on a payday loan at 15% of the amount borrowed. The law also establishes specific requirements for loan disclosures, ensuring borrowers understand the terms and conditions before entering into a loan agreement. Failure to comply with these regulations can result in significant penalties for lenders. The Kansas Attorney General’s office actively monitors compliance with these laws.

Potential Risks and Consequences of Payday Loans

Borrowing from payday lenders can carry significant financial risks. The high-interest rates and fees can quickly lead to a debt cycle, making it difficult for borrowers to repay the loan. Repeated borrowing to cover previous loans can result in substantial debt accumulation. Furthermore, missed payments can damage credit scores, impacting future borrowing opportunities. In severe cases, borrowers may face legal action from lenders, potentially leading to wage garnishment or other financial repercussions. It’s crucial for Junction City residents to carefully consider the potential consequences before taking out a payday loan.

Comparison of Payday Loan Regulations: Junction City, KS vs. Topeka, KS

While specific municipal regulations regarding payday lending are less common than state-level regulations, comparing Junction City to a neighboring city like Topeka reveals the consistent application of Kansas state law. Both cities operate under the same state-level regulations Artikeld in the Kansas Consumer Loan Act. There aren’t significant differences in the legal framework governing payday loans between these two cities. The consistency of state-level regulation across Kansas ensures a uniform standard of protection for consumers regardless of their location within the state. However, the availability of payday lenders and their specific practices might vary based on market conditions and individual lender policies, even within the confines of the same state law.

Alternatives to Payday Loans in Junction City, KS

Securing short-term funds can be challenging, and while payday loans might seem like a quick solution, they often come with high fees and interest rates that can trap borrowers in a cycle of debt. Fortunately, residents of Junction City, KS, have access to several viable alternatives that offer more manageable and responsible ways to address immediate financial needs. These alternatives prioritize financial well-being over quick profits, offering sustainable solutions for borrowers.

Exploring these alternatives is crucial for making informed financial decisions. Understanding the application processes, eligibility requirements, and the advantages and disadvantages compared to payday loans allows individuals to choose the best option for their specific circumstances.

Credit Unions as an Alternative

Credit unions are member-owned financial cooperatives that often offer more favorable loan terms than traditional banks or payday lenders. They frequently provide small-dollar loans with lower interest rates and more flexible repayment options. Many credit unions prioritize community development and offer financial literacy programs to help members manage their finances effectively. For example, some credit unions offer “payday alternative loans” specifically designed to help members avoid the high costs of payday loans.

Bank Loans and Lines of Credit

Banks, while sometimes perceived as less accessible for small loans, can offer personal loans or lines of credit as viable alternatives to payday loans. While the application process might be more rigorous, the interest rates and repayment terms are typically far more favorable than those associated with payday loans. Individuals with established banking relationships and good credit scores are more likely to be approved for these types of loans. Banks may also offer overdraft protection, though fees can still apply.

Community Assistance Programs

Junction City, KS, and surrounding areas likely have several non-profit organizations and community assistance programs that provide financial assistance to residents facing temporary hardship. These programs often offer grants, emergency loans, or referrals to other resources. Eligibility requirements vary depending on the specific program, but they often consider factors such as income, household size, and the nature of the financial emergency. Contacting local charities, churches, or social service agencies can help identify these resources.

Comparison of Payday Loans vs. Alternatives

The following table compares the advantages and disadvantages of payday loans versus alternative financial solutions:

| Feature | Payday Loan | Credit Union Loan | Bank Loan | Community Assistance Program |

|---|---|---|---|---|

| Accessibility | Easy application, quick approval | Requires membership, may require credit check | Requires credit check, more rigorous application | Varies widely, based on program requirements |

| Interest Rates | Very high | Significantly lower | Lower than payday loans, varies based on credit score | Often interest-free or with very low interest |

| Repayment Terms | Short-term, often due on next payday | More flexible repayment options | Longer repayment terms available | Varies widely, based on program requirements |

| Fees | High fees and charges | Lower fees | Lower fees than payday loans | Often no fees or minimal fees |

| Impact on Credit Score | Can negatively impact credit score | May positively impact credit score with on-time payments | May positively impact credit score with on-time payments | Generally no impact on credit score |

The Economic Impact of Payday Lending in Junction City, KS

Payday lending in Junction City, Kansas, exerts a multifaceted influence on the local economy, impacting both individual borrowers and the broader financial landscape. While providing short-term liquidity for some residents, its consequences can be detrimental to long-term financial stability and overall economic health. Understanding these impacts requires examining both the direct effects on borrowers and the indirect effects on the community.

The presence of payday lenders in Junction City likely contributes to a cycle of debt for a significant portion of the population. This cycle can hinder economic growth by diverting funds away from more productive uses like investments, savings, or consumption of goods and services within the local community. Conversely, the payday lending industry itself contributes to the local economy through employment and tax revenue, albeit often at the expense of vulnerable residents.

Demographic Characteristics of Payday Loan Users in Junction City, KS

Individuals utilizing payday loans in Junction City likely share common demographic characteristics with borrowers nationwide. These characteristics often include low-to-moderate income levels, limited access to traditional banking services, and a higher likelihood of experiencing unexpected financial emergencies. Data from the Consumer Financial Protection Bureau (CFPB) and similar sources could reveal more specific demographic information regarding age, income brackets, employment status, and geographic location within Junction City, allowing for a more nuanced understanding of the population most affected by payday lending practices. A detailed analysis might reveal disparities in access to credit and financial literacy among different demographic groups within the city.

Hypothetical Scenario Illustrating the Long-Term Financial Consequences of Repeated Payday Loan Usage

Consider Sarah, a single mother working a minimum-wage job in Junction City. Facing an unexpected car repair bill, she takes out a $300 payday loan with a 400% annual interest rate. Unable to repay the loan in full on her next payday, she rolls it over, incurring additional fees. This cycle repeats over several months, accumulating substantial interest and fees. The escalating debt burdens her monthly budget, leaving her with less money for necessities like rent, groceries, and childcare. Eventually, she may fall behind on bills, leading to further financial instability and potentially impacting her credit score, making it even more difficult to access affordable credit in the future. This scenario, while hypothetical, represents a common pattern observed in studies of payday loan borrowers across the United States, highlighting the potential for a seemingly small loan to snowball into a significant financial crisis. The long-term consequences could include eviction, bankruptcy, and prolonged financial hardship.

Consumer Protection and Awareness in Junction City, KS

Protecting consumers from predatory lending practices is crucial in Junction City, KS, as it is everywhere. Access to financial literacy resources and understanding of consumer rights are vital tools in navigating the complexities of the payday loan market. This section Artikels available resources and provides guidance for residents to make informed financial decisions.

Financial Literacy Resources and Consumer Protection Services in Junction City, KS

Several organizations offer valuable resources and support to residents of Junction City, KS, seeking financial guidance and protection. These include local credit unions, non-profit organizations focused on financial literacy, and state-level consumer protection agencies. Credit unions often provide free financial counseling and workshops, offering personalized guidance on budgeting, debt management, and alternative financial products. Non-profit organizations may offer similar services, sometimes specializing in assisting low-income individuals. The Kansas Attorney General’s office and the Consumer Financial Protection Bureau (CFPB) are key resources for reporting predatory lending practices and learning about consumer rights related to payday loans. Contacting these organizations directly is recommended for the most up-to-date information on available services.

Guidance on Avoiding Predatory Lending Practices

Navigating the payday loan market requires careful consideration. The following steps can help residents of Junction City, KS, avoid predatory lending practices:

- Shop around and compare offers: Before taking out a payday loan, compare interest rates, fees, and repayment terms from multiple lenders. Don’t settle for the first offer you receive.

- Read the loan agreement carefully: Thoroughly review the terms and conditions before signing any loan agreement. Understand all fees, interest rates, and repayment schedules.

- Understand the total cost of the loan: Calculate the total amount you will repay, including all fees and interest. This will help you assess whether the loan is affordable.

- Avoid lenders who pressure you: Legitimate lenders will not pressure you into taking out a loan. If a lender uses high-pressure tactics, walk away.

- Explore alternative financing options: Consider alternatives such as borrowing from family or friends, using a credit union loan, or seeking assistance from a non-profit organization before resorting to a payday loan.

- Budget carefully: Create a realistic budget to ensure you can afford loan repayments without falling into a cycle of debt.

- Report predatory lending practices: If you believe you have been a victim of predatory lending, report it to the Kansas Attorney General’s office and the CFPB.

Calculating the Total Cost of a Payday Loan

Let’s illustrate how to calculate the total cost of a payday loan using a sample scenario. Assume a $300 payday loan with a $45 fee and a two-week repayment period. The annual percentage rate (APR) is a crucial metric, but it can be complex to calculate directly from the short-term nature of a payday loan. Instead, we can calculate the total cost.

The total cost of the loan is the principal amount plus all fees. In this example, the total cost would be $300 (principal) + $45 (fee) = $345. This means you would repay $345 over two weeks.

This simple calculation demonstrates the significant cost associated with payday loans, highlighting the importance of careful consideration before borrowing. The actual APR will vary depending on the lender and state regulations, but the above example illustrates the substantial additional cost compared to the principal borrowed.

Visual Representation of Payday Loan Data for Junction City, KS

Visual representations of payday loan data can offer valuable insights into borrowing patterns and repayment trends in Junction City, Kansas. Analyzing this data allows for a better understanding of the impact of payday lending on the community. The following sections detail hypothetical examples of such visualizations, acknowledging the difficulty in obtaining precise, publicly available data on payday loan specifics at a local level. The data used below is illustrative and should not be considered factual data for Junction City, KS.

Payday Loan Amount Distribution in Junction City, KS

A bar chart could effectively illustrate the distribution of payday loan amounts borrowed by Junction City residents. The horizontal axis would represent loan amounts, categorized into ranges (e.g., $100-$200, $201-$300, $301-$400, $401-$500, and over $500). The vertical axis would represent the frequency or number of loans issued within each amount range. The height of each bar would correspond to the number of loans in that particular amount range. Data for this chart could hypothetically be collected through surveys of payday loan borrowers, analysis of anonymized loan data from lending institutions (with appropriate ethical considerations and data privacy safeguards), or through public records requests (if such data is made available). The methodology would involve data aggregation, categorization, and visualization using statistical software or spreadsheet programs. For example, a hypothetical chart might show a high frequency of loans in the $201-$300 range, indicating this is a common borrowing amount.

Payday Loan Repayment Success Rates in Junction City, KS

A pie chart would be suitable for visualizing the percentage of payday loan borrowers in Junction City who successfully repay their loans versus those who default. The pie would be divided into two segments: one representing the percentage of borrowers who successfully repaid their loans, and the other representing the percentage of borrowers who defaulted. The size of each segment would be proportional to its percentage. Data sources for this chart could potentially include internal data from payday lending companies (again, subject to ethical considerations and data privacy), though access to this type of data is often limited. Alternatively, researchers might attempt to estimate default rates through surveys or by analyzing court records related to debt collection. The methodology would involve calculating the percentage of successful repayments and defaults from the available data and then representing these percentages visually in the pie chart. For instance, a hypothetical chart might show 70% successful repayment and 30% default, highlighting a significant portion of borrowers facing difficulties.

Final Wrap-Up

Navigating the world of payday loans requires careful consideration. While these loans can offer quick access to cash, understanding the associated risks, regulations, and available alternatives is paramount. This guide has provided a comprehensive overview of payday loans in Junction City, KS, equipping residents with the knowledge needed to make informed financial decisions. Remember to explore alternative options and prioritize financial literacy to build long-term financial stability. Always compare loan offers, understand the total cost, and avoid predatory lending practices.

Clarifying Questions

What are the typical fees associated with payday loans in Junction City, KS?

Fees vary by lender but often include origination fees and potentially high interest rates. It’s crucial to compare fees across different lenders before borrowing.

What happens if I can’t repay my payday loan?

Failure to repay can lead to additional fees, collection efforts, and damage to your credit score. Contact your lender immediately if you anticipate difficulties in repayment.

Where can I find free financial counseling in Junction City, KS?

Local credit unions, non-profit organizations, and government agencies often offer free financial counseling services. Online resources can also provide valuable information and support.

Are there any income requirements for payday loans in Junction City, KS?

Lenders typically require proof of regular income to assess your ability to repay the loan. Specific requirements vary by lender.