Spire Credit Union auto loan rates offer competitive financing options for new and used vehicles, as well as refinancing opportunities. Understanding these rates, however, requires examining several key factors, including your credit score, the loan term you choose, and any associated fees. This guide will delve into these aspects, comparing Spire’s offerings to those of its competitors to help you make an informed decision.

We’ll explore the various loan types available, the impact of your creditworthiness on the interest rate you receive, and how different loan terms affect your monthly payments and overall cost. We’ll also examine additional fees and the application process, providing a comprehensive overview to empower you in your auto loan search.

Spire Credit Union Auto Loan Rates

Spire Credit Union offers a range of auto loan options designed to meet diverse financial needs and borrowing situations. They provide competitive rates and flexible terms, aiming to make purchasing a vehicle a manageable and accessible experience for their members. Understanding their rates and the factors influencing them is crucial for securing the best possible financing.

Spire Credit Union Auto Loan Types

Spire Credit Union typically offers auto loans for new and used vehicles, as well as refinancing options for existing auto loans. New car loans are designed for the purchase of brand-new vehicles directly from dealerships. Used car loans facilitate the purchase of pre-owned vehicles from private sellers or dealerships. Refinancing allows members to potentially lower their interest rate or monthly payment by consolidating existing auto loan debt. The specific terms and conditions for each loan type will vary.

Factors Influencing Spire Auto Loan Interest Rates

Several key factors determine the interest rate a member receives on their Spire Credit Union auto loan. These factors are carefully assessed during the loan application process. A lower credit score generally leads to a higher interest rate, reflecting a higher perceived risk to the lender. The loan term, or length of the loan, also plays a significant role; longer loan terms typically result in higher overall interest paid, but lower monthly payments. The type of vehicle (new or used) and its age also impact the interest rate, with newer vehicles often commanding lower rates. The loan amount itself can influence the rate, as larger loan amounts might attract slightly higher rates. Finally, the prevailing market interest rates significantly affect the rates offered by Spire Credit Union, reflecting broader economic conditions. It’s important to note that individual circumstances may result in variations from these general trends.

Rate Comparison with Competitors

Choosing the right auto loan requires careful consideration of interest rates and terms. This section compares Spire Credit Union’s auto loan rates with those of three major competitors in a similar geographic area, highlighting key differences to aid in your decision-making process. Note that rates are subject to change and are based on current market conditions and individual creditworthiness.

Direct comparison of auto loan rates necessitates understanding that advertised rates often represent the best possible scenario for borrowers with excellent credit scores. Factors such as credit history, loan amount, loan term, and the type of vehicle being financed significantly impact the final interest rate. This comparison provides a general overview and should not be considered a definitive guide to individual loan offers.

Auto Loan Rate Comparison Table, Spire credit union auto loan rates

The following table compares Spire Credit Union’s auto loan rates with three hypothetical competitors (Competitor A, Competitor B, and Competitor C) representing typical offerings in a similar market. These are illustrative examples and actual rates may vary.

| Lender | APR (Example) | Loan Term Options (Years) | Additional Fees |

|---|---|---|---|

| Spire Credit Union | 4.5% – 8.0% | 24, 36, 48, 60, 72 | Origination fee (may vary) |

| Competitor A | 5.0% – 9.0% | 36, 48, 60 | Origination fee, prepayment penalty (potential) |

| Competitor B | 4.8% – 8.5% | 24, 36, 48 | None |

| Competitor C | 5.5% – 10.0% | 36, 60, 72 | Origination fee, late payment fees |

Key Differences in Terms and Conditions

Significant differences exist between lenders regarding loan terms and conditions. For example, loan term options vary, influencing the monthly payment amount. Longer loan terms result in lower monthly payments but accrue more interest over the life of the loan. Shorter terms mean higher monthly payments but less interest paid overall. Additionally, some lenders may impose prepayment penalties, charging a fee if you pay off the loan early, while others may not. The presence or absence of origination fees also varies, impacting the total cost of borrowing.

Unique Features and Benefits of Spire Credit Union

Spire Credit Union may offer unique benefits compared to its competitors. These could include membership requirements, specific programs for members, or a focus on community engagement that resonates with potential borrowers. For instance, they might offer preferential rates to members who maintain a specific relationship with the credit union, such as having a checking or savings account. They might also have a streamlined application process or offer additional financial education resources. It’s crucial to directly compare the specifics of each lender’s offerings to determine which best suits individual needs and financial goals.

Impact of Credit Score on Rates

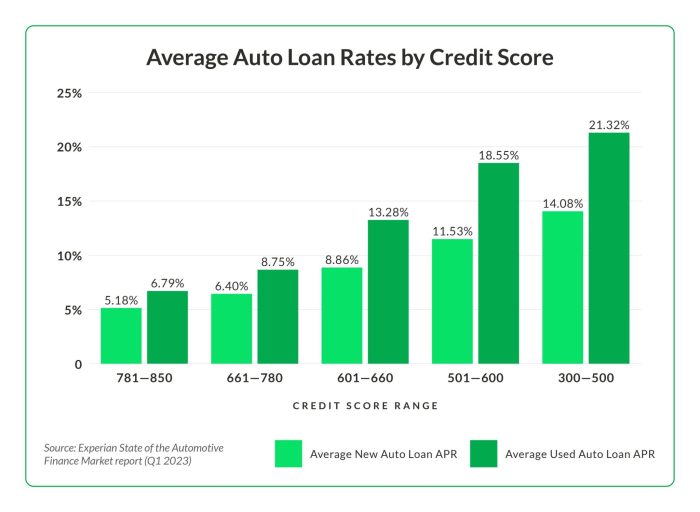

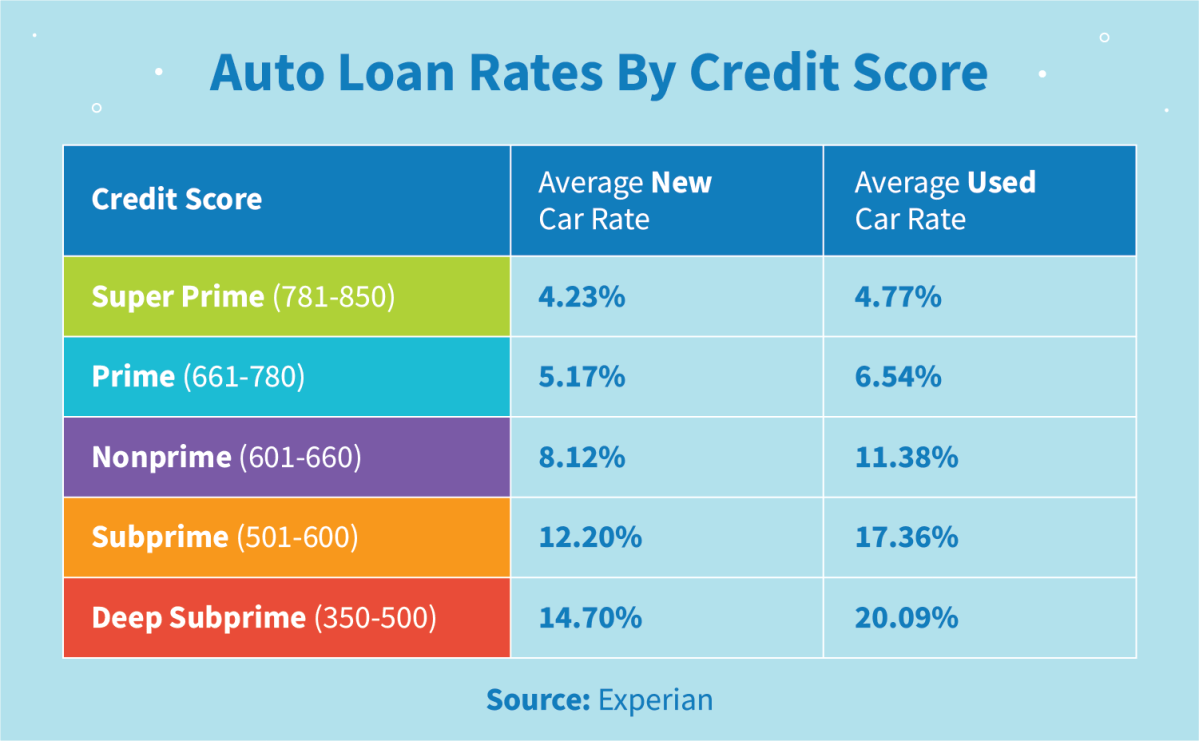

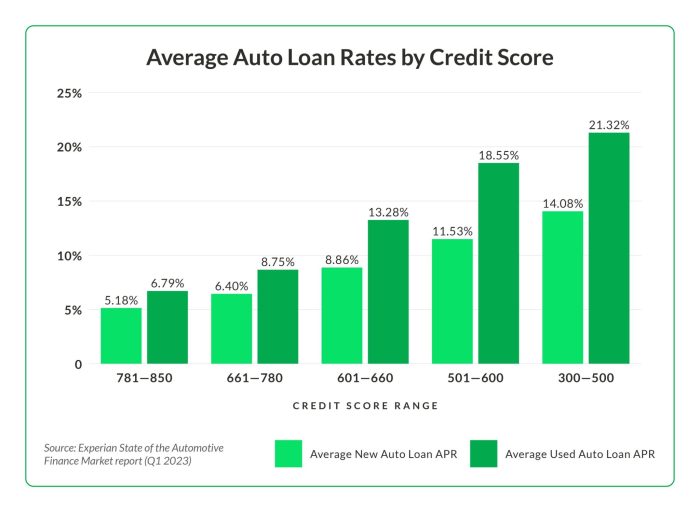

Your credit score is a crucial factor influencing the interest rate Spire Credit Union offers on auto loans. Lenders use credit scores to assess the risk of lending you money; a higher score indicates a lower risk, leading to more favorable interest rates. Conversely, a lower score suggests a higher risk, resulting in higher interest rates or even loan denial. Understanding this relationship is vital for securing the best possible terms on your auto loan.

Your credit score acts as a predictor of your likelihood to repay the loan. A strong credit history, reflected in a high score, demonstrates responsible financial behavior to lenders. This translates into greater confidence in your ability to make timely payments, allowing Spire Credit Union to offer you a lower interest rate. The lower the rate, the less you’ll pay in total interest over the life of the loan, saving you considerable money.

Credit Score and Interest Rate Ranges

The following table illustrates the general relationship between credit scores and the potential interest rate ranges offered by Spire Credit Union for auto loans. These ranges are estimates and can vary based on other factors such as the loan amount, loan term, and the type of vehicle being financed. It is always advisable to contact Spire Credit Union directly for the most current and accurate rate information.

| Credit Score Range | Approximate Interest Rate Range |

|---|---|

| 750-850 (Excellent) | 3.00% – 5.00% |

| 700-749 (Good) | 5.00% – 7.00% |

| 650-699 (Fair) | 7.00% – 9.00% |

| 600-649 (Subprime) | 9.00% – 12.00% |

| Below 600 (Poor) | 12.00% and above, or loan denial |

Improving Your Credit Score for Better Rates

Improving your credit score can significantly lower the interest rate you receive on your auto loan. Several strategies can help you achieve this. Consistent and responsible financial behavior is key.

- Pay Bills on Time: Payment history accounts for a significant portion of your credit score. Make all payments – credit cards, loans, and utilities – on time, every time. Even a single late payment can negatively impact your score.

- Keep Credit Utilization Low: Avoid maxing out your credit cards. Aim to keep your credit utilization ratio (the amount of credit you use compared to your total available credit) below 30%. A lower ratio indicates responsible credit management.

- Maintain a Diverse Credit Mix: Having a mix of different types of credit accounts (credit cards, installment loans) can positively affect your score, demonstrating your ability to manage various credit products responsibly.

- Check for Errors on Your Credit Report: Review your credit reports regularly from all three major credit bureaus (Equifax, Experian, and TransUnion) for any inaccuracies. Dispute any errors you find to ensure your credit score reflects your true financial standing.

- Don’t Open Too Many New Accounts: Applying for multiple credit accounts in a short period can lower your score. Only apply for credit when truly necessary.

Loan Term Length and its Effect: Spire Credit Union Auto Loan Rates

Choosing the right loan term for your auto loan significantly impacts your monthly payments and the total cost of borrowing. A longer loan term results in lower monthly payments, but you’ll pay substantially more in interest over the life of the loan. Conversely, a shorter loan term means higher monthly payments but significantly less interest paid overall. Understanding this trade-off is crucial for making an informed financial decision.

The length of your auto loan directly affects the total interest you pay. This is because interest accrues over time. A longer loan term provides more time for interest to accumulate, leading to a higher total interest cost. Conversely, a shorter loan term reduces the accumulation period, resulting in lower overall interest charges. This relationship is not linear; the longer the term, the more exponentially the interest increases.

Loan Term Comparison: Monthly Payments and Total Cost

The following table illustrates the difference in monthly payments and total cost for a hypothetical $20,000 auto loan at a fixed interest rate of 5% for various loan terms. These figures are for illustrative purposes only and actual rates may vary based on creditworthiness and other factors.

| Loan Term (Months) | Monthly Payment | Total Interest Paid | Total Amount Paid |

|---|---|---|---|

| 36 | $587.00 | $1,532.13 | $21,532.13 |

| 60 | $377.00 | $4,619.00 | $24,619.00 |

| 72 | $322.00 | $6,462.67 | $26,462.67 |

Advantages and Disadvantages of Shorter and Longer Loan Terms

Shorter loan terms offer the advantage of paying significantly less interest overall, resulting in substantial long-term savings. However, this comes at the cost of higher monthly payments, which might strain your budget. Longer loan terms, on the other hand, result in lower monthly payments, making them more manageable for borrowers with tighter budgets. The trade-off is the significantly higher total interest paid, which increases the overall cost of the vehicle. The optimal choice depends on individual financial circumstances and priorities. For example, a borrower with a higher disposable income might prioritize paying less interest overall and opt for a shorter term, while a borrower with a lower income might prioritize affordability and choose a longer term.

Additional Fees and Charges

Understanding the total cost of an auto loan extends beyond the interest rate. Spire Credit Union, like other lenders, may impose various additional fees that significantly impact the final loan amount. It’s crucial to be aware of these potential costs before committing to a loan. This section details the common additional fees associated with Spire Credit Union auto loans and compares them to industry practices.

While Spire Credit Union’s website should provide the most up-to-date information on their fees, it’s important to independently verify this information before signing any loan documents. Fee structures can change, and individual circumstances may influence the fees applied.

Potential Fees at Spire Credit Union

Several fees could be associated with a Spire Credit Union auto loan. These fees can vary depending on the loan specifics and your individual situation. Always confirm the exact fees with a loan officer before proceeding.

- Origination Fee: This fee covers the administrative costs associated with processing your loan application. The percentage or fixed amount of this fee varies among lenders and may not always be explicitly stated upfront. Some lenders waive origination fees for certain loan types or borrowers with excellent credit.

- Late Payment Fee: Missed or late payments typically incur a penalty fee. The amount of this fee varies depending on the lender and is usually clearly Artikeld in the loan agreement. Consistent on-time payments avoid this additional cost.

- Returned Check Fee: If a payment is returned due to insufficient funds, a returned check fee will be charged. This fee can range from a few dollars to tens of dollars, depending on the lender’s policy.

- Prepayment Penalty: This fee is charged if you pay off your loan early. While some lenders do not charge this fee, others may impose a penalty. It’s vital to check Spire Credit Union’s policy on prepayment penalties to avoid unexpected charges.

Fee Comparison with Competitors

Direct comparison of fees across different lenders requires accessing the specific fee schedules of each institution. This information is often found on their websites or through direct inquiry. However, it’s generally observed that origination fees can range from 0% to 2% of the loan amount, late payment fees can range from $25 to $50, and returned check fees are usually between $25 and $35. Prepayment penalties, when present, can vary significantly.

For example, a competitor like a large national bank might offer a lower interest rate but charge a higher origination fee, while a smaller local credit union might have a slightly higher interest rate but waive origination fees. Careful consideration of all fees, not just the interest rate, is essential for determining the most cost-effective loan option.

Application Process and Requirements

Applying for an auto loan at Spire Credit Union involves a straightforward process designed for efficiency and convenience. The application can be initiated online, by phone, or in person at a branch location. The entire process, from initial application to loan approval, is intended to be transparent and easily understandable.

The application process itself typically begins with providing some basic personal and financial information. This is followed by a review of your credit history and the submission of supporting documentation. Once approved, the funds are disbursed and you can proceed with your vehicle purchase.

Required Documentation

Providing the necessary documentation expedites the loan application process and ensures a timely response from Spire Credit Union. Incomplete applications may result in delays.

To complete your application, you will need to gather the following documents:

- Completed loan application form.

- Valid government-issued photo identification (driver’s license or passport).

- Proof of income (pay stubs, tax returns, or bank statements).

- Proof of residence (utility bill or lease agreement).

- Vehicle information (Vehicle Identification Number (VIN), make, model, year).

- Details of your trade-in vehicle (if applicable), including the VIN and estimated value.

- Information on your down payment (proof of funds).

Loan Application Processing Time

The time it takes for Spire Credit Union to process your auto loan application varies depending on several factors, including the completeness of your application, your credit score, and the complexity of the loan.

While Spire Credit Union strives for quick processing, applicants should anticipate a processing time ranging from a few days to several weeks. For instance, applications with readily available documentation and strong credit history tend to receive faster approval. Conversely, applications requiring further verification or involving complex financial situations may take longer to process. Maintaining open communication with your loan officer can provide updates on the progress of your application.

Illustrative Example

This section presents a hypothetical auto loan scenario from Spire Credit Union to illustrate the practical application of the information previously discussed regarding interest rates, loan terms, and associated fees. This example uses estimated figures and should not be considered a formal loan offer. Always consult Spire Credit Union directly for current rates and terms.

Let’s assume Sarah is purchasing a used car for $20,000. After a down payment, she needs to finance $15,000. Based on her excellent credit score (750+), she qualifies for Spire Credit Union’s lowest advertised auto loan rate of 4.5% APR. She chooses a 60-month loan term.

Loan Details and Monthly Payment Calculation

Using a standard auto loan amortization calculator (readily available online), we can determine Sarah’s monthly payment. The calculation considers the principal loan amount, the interest rate, and the loan term. In this scenario, Sarah’s monthly payment would be approximately $277. This calculation does not include any additional fees.

Total Loan Cost

Over the 60-month loan term, Sarah will pay a total of $16,620. This includes the principal loan amount of $15,000 and the total interest paid, which is approximately $1,620. This figure represents the total cost of borrowing.

Additional Fees

While the above calculation illustrates the core loan cost, it’s crucial to remember that Spire Credit Union, like most lenders, may charge additional fees. These could include origination fees (a percentage of the loan amount), late payment fees, or other processing fees. Let’s assume, for this example, that Spire Credit Union charges a one-time origination fee of $200. This fee would be added to the total cost of the loan, bringing the grand total to $16,820.

Impact of Credit Score

It’s important to note that Sarah’s excellent credit score significantly impacted her interest rate. If her credit score were lower, for instance, in the fair to poor range (below 670), her interest rate would likely be higher, resulting in a significantly larger total loan cost. A higher interest rate would lead to higher monthly payments and a greater overall expense over the life of the loan. For example, a 7% APR could increase her monthly payment and total cost considerably.

Last Recap

Securing the best auto loan rate involves careful consideration of multiple factors. By understanding the nuances of Spire Credit Union’s auto loan offerings and comparing them to competitors, you can make a financially sound choice. Remember to check your credit score, explore different loan terms, and be aware of any additional fees. Armed with this knowledge, you can confidently navigate the auto loan process and drive away with the best possible deal.

FAQ Section

What documents do I need to apply for a Spire Credit Union auto loan?

Typically, you’ll need proof of income, identification, and information about the vehicle you’re financing. Specific requirements may vary; check with Spire directly.

What is Spire Credit Union’s prepayment penalty policy?

Spire’s policy on prepayment penalties should be clearly Artikeld in your loan agreement. Contact them directly to confirm if any penalties apply.

How long does it take for Spire Credit Union to process a loan application?

Processing times vary but generally range from a few days to a couple of weeks. Factors like the complexity of your application can influence this timeline.

Can I apply for a Spire Credit Union auto loan online?

Check Spire Credit Union’s website for online application options. Many credit unions offer online application portals for convenience.