TTCU loan calculator simplifies the often-daunting process of understanding loan costs. Whether you’re planning a new car, home improvements, or a personal loan, this tool empowers you to explore different scenarios, compare loan options, and make informed financial decisions. Understanding how interest rates and loan terms impact your monthly payments and total cost is crucial, and the TTCU loan calculator provides the clarity you need to budget effectively.

This guide delves into the TTCU loan calculator’s functionality, comparing it to other financial institutions’ calculators to highlight its strengths and weaknesses. We’ll explore how to use the calculator to assess loan affordability based on your income and expenses, and we’ll examine advanced features that can help you optimize your repayment strategy. By the end, you’ll be equipped to confidently navigate the world of borrowing with the TTCU loan calculator as your trusted guide.

Understanding TTCU Loan Calculator Functionality

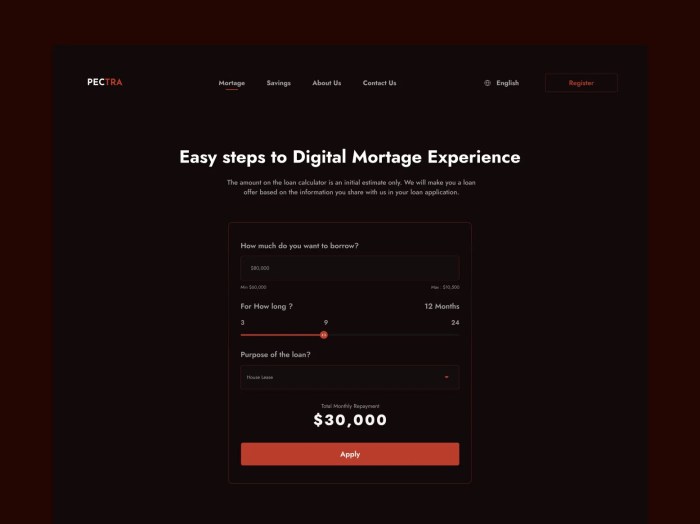

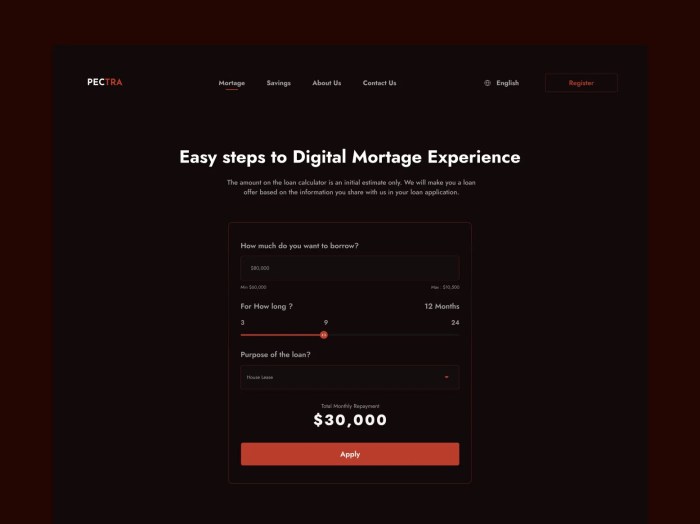

The TTCU loan calculator is a valuable tool for prospective borrowers, providing a quick and easy way to estimate monthly payments and total loan costs before applying for a loan. Understanding its functionality empowers users to make informed financial decisions. This section details the calculator’s features, input parameters, and usage.

Core Features of the TTCU Loan Calculator

A typical TTCU loan calculator offers several core features designed to simplify the loan estimation process. These include the ability to calculate monthly payments, total interest paid, and the total amount repaid over the loan term. The calculator also often provides an amortization schedule, detailing the breakdown of principal and interest payments over the life of the loan. This allows borrowers to visualize how their payments are applied over time. Many calculators also incorporate the ability to compare different loan scenarios, facilitating informed decision-making.

Loan Type Handling

The TTCU loan calculator likely handles different loan types—auto, home, and personal—by adjusting the applicable interest rates and loan terms based on the selected loan type. For instance, auto loans generally have shorter terms and potentially higher interest rates than home loans, which typically have longer terms and lower interest rates. Personal loans fall somewhere in between, with terms and rates varying depending on the lender and the borrower’s creditworthiness. The calculator will use pre-set or user-inputted data to reflect these differences in calculations.

Input Parameters

To use the TTCU loan calculator effectively, users need to provide several key input parameters. These primarily include the loan amount (the principal amount borrowed), the annual interest rate (the cost of borrowing money, expressed as a percentage), and the loan term (the length of the loan, typically expressed in months or years). Additional parameters may include any upfront fees or closing costs associated with the loan. Accurate input is crucial for obtaining a reliable estimate.

Step-by-Step Guide to Using the TTCU Loan Calculator

1. Select Loan Type: Choose the type of loan you are interested in (auto, home, or personal).

2. Enter Loan Amount: Input the desired loan amount.

3. Enter Interest Rate: Input the annual interest rate offered by TTCU.

4. Enter Loan Term: Input the desired loan term in months or years.

5. Input Additional Parameters (if applicable): Enter any additional fees or costs, as prompted.

6. Calculate: Click the “Calculate” or similar button to generate the results.

7. Review Results: Examine the calculated monthly payment, total interest paid, and total amount repaid. Review the amortization schedule (if available) for a detailed breakdown of payments.

Example Loan Scenarios, Ttcu loan calculator

The following table illustrates example loan scenarios and their calculated results. Note that these are examples and actual results may vary based on TTCU’s current rates and fees.

| Loan Type | Loan Amount | Interest Rate | Loan Term (Months) | Estimated Monthly Payment |

|---|---|---|---|---|

| Auto Loan | $20,000 | 6% | 60 | $386.66 |

| Home Loan | $200,000 | 4% | 360 | $954.83 |

| Personal Loan | $5,000 | 10% | 36 | $161.65 |

| Auto Loan (Higher Interest) | $20,000 | 9% | 60 | $411.55 |

Comparison with Other Loan Calculators

TTCU’s loan calculator offers a valuable tool for prospective borrowers, but its functionality and features differ from those provided by other major financial institutions. A direct comparison reveals both strengths and weaknesses, helping consumers make informed decisions about which calculator best suits their needs. This section analyzes TTCU’s calculator against two prominent examples, highlighting key distinctions in their design and capabilities.

This comparison focuses on the core features, user interface, and overall user experience of each loan calculator. We will analyze how effectively each calculator presents information and assists users in understanding loan terms and potential costs.

TTCU Loan Calculator Compared to Bank of America’s Loan Calculator

Both TTCU and Bank of America offer online loan calculators, but their interfaces and features differ significantly. TTCU’s calculator generally prioritizes simplicity and ease of use, focusing on the core elements of loan calculation. Bank of America, on the other hand, offers a more comprehensive and feature-rich calculator, incorporating more variables and advanced options.

- Interface and User Experience: TTCU’s calculator presents a clean, straightforward interface, prioritizing ease of navigation. Bank of America’s calculator, while more comprehensive, can appear more cluttered and complex to first-time users.

- Features: TTCU’s calculator focuses primarily on calculating monthly payments, total interest paid, and loan amortization schedules. Bank of America’s calculator often includes additional features such as the ability to compare different loan terms, explore various loan types, and potentially integrate with other financial planning tools.

- Advantages and Disadvantages: TTCU’s simplicity is advantageous for users seeking a quick and easy calculation. However, this simplicity comes at the cost of reduced functionality. Bank of America’s comprehensive features are beneficial for those needing a detailed analysis, but the complexity can be overwhelming for less financially-literate users.

TTCU Loan Calculator Compared to Wells Fargo’s Loan Calculator

Wells Fargo’s loan calculator presents another point of comparison, showcasing a different approach to loan calculation and user experience than TTCU’s. While both aim to provide helpful tools for prospective borrowers, the design philosophies and resulting features differ notably.

- Data Input and Presentation: TTCU’s calculator typically uses a streamlined input process, requesting only essential loan details. Wells Fargo’s might offer more granular input options, potentially allowing users to specify additional factors influencing the loan calculation. The presentation of results may also vary, with one favoring concise summaries and the other providing more detailed breakdowns.

- Loan Type Options: The range of loan types supported by each calculator can vary substantially. TTCU might focus on a specific range of loans (e.g., auto loans, personal loans), while Wells Fargo might offer a broader selection, encompassing mortgages, home equity lines of credit, and more. This directly impacts the applicability of each calculator to a user’s specific financial needs.

- Customization and Advanced Features: While TTCU might offer a basic loan calculator, Wells Fargo could include features like loan pre-qualification tools or integration with other financial management services. These advanced features can be valuable for users who want a more integrated financial planning experience, but they also increase the complexity of the tool.

Impact of Interest Rates and Loan Terms

Understanding the interplay between interest rates and loan terms is crucial for making informed borrowing decisions. The TTCU loan calculator allows users to visualize this relationship, enabling them to compare different scenarios and optimize their loan choices based on their financial capabilities and goals. This section will explore the effects of varying interest rates and loan durations on the total cost of a loan.

Interest rates directly influence the overall cost of borrowing. A higher interest rate translates to increased interest payments over the life of the loan, resulting in a significantly larger total repayment amount. Conversely, a lower interest rate reduces the total interest paid, leading to lower overall loan costs. The loan term, or repayment period, also significantly impacts both monthly payments and the total interest paid.

Interest Rate’s Effect on Total Loan Cost

A higher interest rate increases the total interest paid over the life of the loan. For example, consider a $10,000 loan. A 5% interest rate over 5 years might result in a total repayment of $11,000 (including principal and interest), while a 10% interest rate over the same period could increase the total repayment to $12,000 or more. This demonstrates the substantial impact even small interest rate increases can have on the final cost. The TTCU loan calculator allows users to input various interest rates to see the immediate effect on the total amount repaid.

Loan Term’s Effect on Monthly Payments and Total Interest

Longer loan terms generally result in lower monthly payments. However, this comes at the cost of paying significantly more interest over the extended repayment period. For instance, a $10,000 loan with a 5% interest rate spread over 5 years will have higher monthly payments compared to the same loan spread over 10 years. But, the total interest paid over the 10-year period will be considerably higher. Shorter loan terms lead to higher monthly payments but significantly reduce the total interest paid. The TTCU calculator allows users to compare these trade-offs effectively.

Relationship Between Interest Rate, Loan Term, and Total Cost

The following table illustrates the relationship between interest rate, loan term, and total loan cost for a $10,000 loan. The table visually represents how these factors interact to determine the final cost. It shows that increasing either the interest rate or the loan term substantially increases the total cost. The visual representation would show a three-dimensional graph, where the x-axis represents the interest rate, the y-axis represents the loan term, and the z-axis represents the total loan cost. The graph would depict a surface rising steeply as either the interest rate or loan term increases, clearly illustrating the compounding effect of these variables on the overall loan expense.

| Interest Rate | Loan Term (Years) | Total Repayment (Approximate) |

|---|---|---|

| 5% | 5 | $11,000 |

| 5% | 10 | $12,500 |

| 10% | 5 | $12,000 |

| 10% | 10 | $16,000 |

Analyzing Loan Affordability

Determining your ability to comfortably repay a loan is crucial before applying. A thorough assessment of your income and expenses, coupled with the use of a loan calculator like TTCU’s, provides a realistic picture of loan affordability and helps avoid potential financial strain. This section Artikels strategies for evaluating loan affordability and demonstrates how the TTCU loan calculator facilitates this process.

Strategies for Determining Loan Affordability

Assessing loan affordability involves a careful comparison of your monthly income against your regular expenses and the projected loan payments. A general rule of thumb is to keep your total debt payments (including the new loan) below 36% of your gross monthly income. However, a more comprehensive analysis considers individual financial circumstances. Factors such as unexpected expenses, savings goals, and desired lifestyle should also be incorporated into the affordability assessment. This ensures that the loan doesn’t negatively impact other essential financial aspects of your life.

Using the Calculator for Loan Repayment Budgeting

The TTCU loan calculator simplifies the budgeting process by providing a clear breakdown of monthly payments based on the loan amount, interest rate, and loan term. Users can input different loan scenarios to see how changes in these parameters affect the monthly payment. This allows for a realistic assessment of how the loan repayment will integrate into their existing budget. By comparing the projected monthly payment to their current income and expenses, borrowers can determine if the loan is financially feasible without compromising other financial priorities.

Impact of Income and Expense Changes on Loan Affordability

Changes in income or expenses significantly influence loan affordability. For instance, a sudden increase in income might allow for a larger loan amount or a shorter repayment period. Conversely, a decrease in income or an unexpected expense (like a major car repair) could severely impact affordability, potentially making the loan unmanageable. The TTCU calculator helps visualize these impacts. Consider this example: if a borrower’s monthly income is $4,000 and their expenses are $2,500, they have $1,500 available for debt payments. If a loan requires a $500 monthly payment, they have $1,000 remaining. However, if their income drops to $3,500, the remaining amount for debt payments decreases to $500, making the loan repayment considerably more challenging.

Step-by-Step Procedure for Assessing Loan Affordability with the TTCU Calculator

A systematic approach using the TTCU loan calculator ensures a comprehensive assessment of loan affordability.

- Gather Financial Information: Collect data on your gross monthly income, regular monthly expenses (housing, utilities, food, transportation, etc.), and existing debt payments.

- Input Loan Details: Enter the desired loan amount, interest rate, and loan term into the TTCU loan calculator.

- Analyze Monthly Payment: Note the calculated monthly payment displayed by the calculator.

- Assess Affordability: Add the calculated monthly loan payment to your existing debt payments. Compare the total debt payments to your gross monthly income. If this total exceeds 36%, consider adjusting the loan amount, term, or explore alternative financing options.

- Adjust Inputs (if needed): Experiment with different loan amounts, interest rates, and loan terms in the calculator to find a manageable monthly payment that fits your budget. This iterative process helps identify a loan structure that balances your financial needs with responsible borrowing.

- Review Budget: After identifying a suitable loan structure, thoroughly review your budget to ensure the loan payment is incorporated without compromising essential expenses or savings goals.

Exploring Advanced Features (if applicable)

The TTCU loan calculator, while seemingly straightforward, may offer advanced features beyond basic loan calculations. These features can significantly enhance the user experience and provide valuable insights for informed financial decision-making. Understanding and utilizing these features can lead to better loan management and potentially substantial savings over the loan’s lifespan.

Depending on the specific TTCU loan calculator’s implementation, advanced features might include detailed amortization schedules, options for incorporating extra payments, and perhaps even scenarios for different interest rate fluctuations. The availability of these features varies across different loan calculators, so it’s crucial to explore the TTCU calculator’s interface thoroughly to identify all available functionalities.

Amortization Schedules

Amortization schedules provide a detailed breakdown of each loan payment, showing the allocation of principal and interest over the loan’s term. This granular view allows borrowers to visualize how their payments are reducing the loan’s principal balance over time. Understanding this breakdown is critical for effective financial planning and managing debt. The TTCU calculator’s amortization schedule (if available) likely presents a table displaying the payment number, payment amount, interest paid, principal paid, and remaining balance for each payment period. This feature is particularly helpful in understanding the long-term cost of a loan and allows borrowers to monitor their progress.

Extra Payment Options

Many loan calculators offer the ability to simulate the impact of making extra payments. This feature is invaluable for borrowers who want to explore strategies to accelerate loan repayment and reduce overall interest paid. By inputting extra payment amounts and frequencies into the TTCU calculator (if available), users can see how these additions affect the loan’s total interest cost, the length of the loan term, and the overall repayment schedule. This allows for a comparative analysis of different repayment strategies, enabling borrowers to choose the most financially advantageous approach.

For example, consider a $20,000 loan at 6% interest over 5 years. By adding an extra $100 per month, a borrower could potentially save thousands of dollars in interest and pay off the loan significantly earlier. The TTCU calculator, with its extra payment feature, would allow a user to easily visualize this savings and optimize their repayment strategy accordingly.

Final Conclusion: Ttcu Loan Calculator

Mastering the TTCU loan calculator unlocks financial empowerment. By understanding its features and applying the strategies Artikeld here, you can confidently compare loan options, assess affordability, and plan for responsible borrowing. Remember, informed decisions lead to better financial outcomes. Use this tool wisely to make your borrowing experience smoother and more financially sound.

Essential FAQs

What types of loans can the TTCU loan calculator handle?

Typically, it handles auto, home, and personal loans, but specific offerings may vary.

Can I factor in extra payments with the TTCU loan calculator?

Some advanced TTCU loan calculators allow you to input extra payments to see how they affect your loan payoff timeline and total interest.

What happens if my income changes after I take out a loan?

A change in income can impact your loan affordability. It’s advisable to re-evaluate your budget and loan repayment plan using the calculator if your income significantly increases or decreases.

Where can I find the TTCU loan calculator?

The calculator is usually accessible on the official TTCU website’s loan section.