USDA home loans Vancouver WA offer a unique pathway to homeownership, particularly for eligible first-time buyers. These government-backed loans require no down payment and often come with lower interest rates than conventional mortgages. However, understanding the eligibility requirements, application process, and associated costs is crucial for a smooth experience. This comprehensive guide navigates you through every step, from determining your eligibility to closing on your dream home in Vancouver, WA.

We’ll explore income limits, property location stipulations, and the detailed application procedure. We’ll also delve into finding USDA-approved properties, comparing closing costs with conventional loans, and identifying valuable local resources to support your journey. Real-world examples and case studies will illustrate the practical benefits and potential challenges, empowering you to make informed decisions throughout the process.

Understanding USDA Home Loan Eligibility in Vancouver, WA

Securing a USDA home loan in Vancouver, WA, can be a pathway to homeownership for eligible individuals and families. This loan program, backed by the United States Department of Agriculture, offers attractive features like low down payments and competitive interest rates, making it a potentially valuable option for those who meet the specific requirements. Understanding these requirements is crucial for a successful application process.

Income Limitations for USDA Home Loans in Vancouver, WA

Income limits for USDA loans vary depending on household size and the location within Vancouver, WA. These limits are established annually by the USDA and are designed to ensure the program serves those who need it most. To determine the specific income limits applicable to your household, it’s essential to consult the USDA’s official website or contact a local USDA-approved lender. They will provide the most up-to-date information on income thresholds for Vancouver, WA, ensuring your application aligns with the current guidelines. Exceeding these limits would disqualify an applicant from the program. For example, a family of four might have a significantly higher income limit than a single applicant.

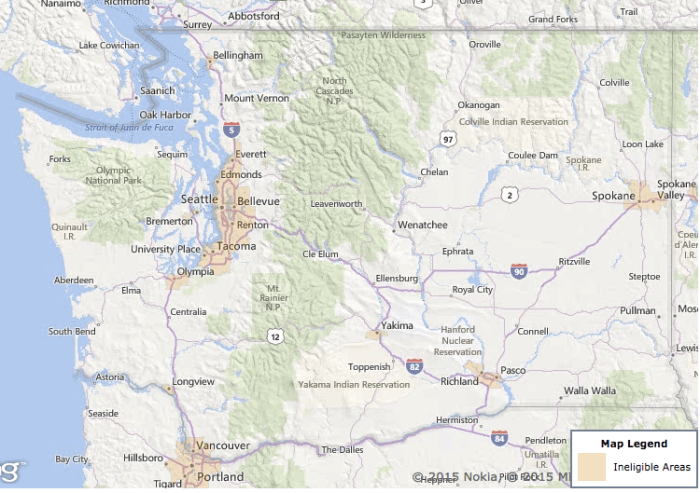

Property Location Requirements for USDA Loans in Vancouver, WA

USDA loans are typically available for properties located in rural areas or eligible suburban areas. Vancouver, WA, encompasses a diverse range of locales, some falling within USDA-defined eligible areas, and others not. The USDA’s eligibility map is a crucial tool to determine if a specific property location qualifies. Properties situated within designated rural development areas are generally eligible. It is crucial to verify a property’s eligibility before initiating the loan application process to avoid delays or rejection. The USDA’s website offers a tool to check property eligibility by entering the address. Properties outside these designated areas, even if within Vancouver city limits, may not qualify.

USDA Loan Eligibility Verification Process, Usda home loans vancouver wa

The verification process for USDA loan eligibility involves several steps. First, potential borrowers must pre-qualify with a USDA-approved lender. This step involves providing documentation like income verification, credit reports, and employment history. The lender will then review the applicant’s financial situation to assess their ability to repay the loan. Second, the property’s eligibility must be confirmed through the USDA’s online mapping tool. This step confirms that the property falls within a designated rural area or eligible suburban area. Third, the lender will review the appraisal report to ensure the property meets the USDA’s minimum property requirements. Finally, the lender will finalize the loan application, ensuring all necessary documentation is complete and accurate before submission to the USDA for final approval.

Comparison of USDA Loans with Other Loan Types in Vancouver, WA

| Loan Type | Down Payment | Credit Score Requirements | Other Requirements |

|---|---|---|---|

| USDA Loan | Often 0% | Generally lower than conventional loans | Income limitations, property location restrictions |

| Conventional Loan | Typically 3-20% | Generally higher than USDA loans | Private mortgage insurance (PMI) may be required with less than 20% down payment |

| FHA Loan | As low as 3.5% | Generally lower than conventional loans | Mortgage insurance premium (MIP) required |

| VA Loan | Often 0% | Variable depending on lender | Must be a veteran or eligible surviving spouse |

The USDA Loan Application Process in Vancouver, WA

Securing a USDA loan in Vancouver, WA, involves a multi-step process requiring careful preparation and attention to detail. Understanding each stage is crucial for a smooth and timely application. This section details the application procedure, required documentation, and potential delays.

The USDA Loan Application Procedure

The USDA loan application process is a systematic progression through several key stages, each building upon the previous one. A successful application requires thorough preparation and accurate documentation from the outset. Failure to provide complete information can lead to significant delays.

- Pre-qualification: This initial step involves contacting a USDA-approved lender to determine your eligibility based on your income, credit score, and debt-to-income ratio. This stage helps you understand the loan amount you qualify for and sets the foundation for your application.

- Property Search: Once pre-qualified, you can begin searching for a suitable property within a USDA-eligible area. Not all properties qualify for USDA loans; it’s crucial to verify eligibility with your lender before making an offer.

- Formal Application: After selecting a property, you’ll submit a formal loan application to your lender. This includes completing the necessary forms and providing supporting documentation (detailed below).

- Underwriting: The lender will review your application and supporting documentation, verifying your income, creditworthiness, and the property’s value. This is a crucial stage, and any inaccuracies or missing documents can cause delays.

- Appraisal: An independent appraiser will assess the property’s market value to ensure it aligns with the loan amount. If the appraisal comes in lower than expected, you may need to adjust your offer or explore alternative financing options.

- Loan Closing: Once underwriting and appraisal are complete, the loan is ready for closing. This involves signing all the necessary documents and finalizing the transfer of funds.

Required Documentation for a USDA Loan Application

Providing complete and accurate documentation is essential for a timely application. Missing or incomplete documents will significantly delay the process.

Generally, lenders require the following documents, but this list is not exhaustive and may vary depending on the lender:

- Completed loan application

- Proof of income (pay stubs, tax returns, W-2s)

- Credit report

- Bank statements

- Proof of assets (e.g., savings, investments)

- Property purchase agreement

- Social Security number

- Valid photo ID

- Copies of any relevant legal documents (e.g., divorce decrees, court orders)

Potential Delays and Complications in the USDA Loan Application Process

Several factors can cause delays or complications during the USDA loan application process. Proactive planning and meticulous attention to detail can help mitigate these risks.

- Incomplete or inaccurate documentation: Missing or inaccurate information will inevitably delay the underwriting process. Ensure all documentation is complete and accurate before submission.

- Credit score issues: A low credit score can significantly impact your eligibility and may require additional steps to improve your creditworthiness.

- Appraisal issues: If the appraisal comes in lower than the purchase price, it can delay or even prevent the loan from closing. Working with a real estate agent experienced with USDA loans can help minimize this risk.

- Income verification challenges: Verifying income can be complex, especially for self-employed individuals. Providing comprehensive documentation is crucial to avoid delays.

- Property-related issues: Problems with the property’s condition or title can delay the closing process. A thorough home inspection is highly recommended.

Finding USDA-Approved Properties in Vancouver, WA

Securing a USDA loan opens doors to homeownership in Vancouver, WA, but finding a suitable property requires understanding the market and the program’s requirements. This section details the types of properties typically eligible, the advantages and disadvantages of using a USDA loan in this area, and resources to aid your search.

Finding the right property is crucial for a successful USDA loan application. Vancouver, WA offers a diverse housing market, and understanding the nuances of property eligibility under the USDA program is key to a smooth process.

Eligible Property Types in Vancouver, WA

USDA loans typically support the purchase of single-family homes, including townhouses and some condos. In Vancouver, WA, this translates to a range of properties, from smaller starter homes in established neighborhoods to larger homes on slightly larger lots in newer suburban developments. Eligible properties generally meet specific criteria regarding size, condition, and location, ensuring they are suitable for long-term occupancy and meet minimum habitability standards. Examples include modest ranch-style homes in older neighborhoods like Hazel Dell, or newer townhouses in the rapidly developing areas near the Columbia River. Properties must also meet the USDA’s requirements for rural areas, which may include certain geographic boundaries and population density limitations.

Advantages and Disadvantages of Using a USDA Loan in Vancouver, WA

Using a USDA loan in Vancouver offers several benefits. The most significant is the ability to purchase a home with no down payment, making homeownership accessible to a wider range of buyers. Moreover, USDA loans often come with lower interest rates compared to conventional loans, resulting in lower monthly mortgage payments. However, USDA loans may require additional fees and closing costs, which should be factored into the overall budget. Furthermore, the geographic limitations of the USDA program may restrict the choice of neighborhoods compared to conventional loans, potentially limiting the range of available properties. Property appraisal requirements can also be more stringent, potentially leading to delays or loan denials.

Resources for Locating USDA-Approved Properties

Several resources can assist in finding USDA-approved properties in Vancouver, WA. Real estate agents specializing in USDA loans possess in-depth knowledge of eligible properties and the application process. Online real estate portals, such as Realtor.com and Zillow, allow filtering properties based on USDA eligibility, though it’s crucial to verify eligibility with a lender before making an offer. Directly contacting USDA loan lenders in the Vancouver area can also provide access to property listings and personalized guidance. Working with a lender early in the process allows them to help identify suitable properties based on your financial situation and the program’s requirements.

Tips for Finding Suitable Properties

Finding the right property requires a strategic approach.

- Work with a USDA-approved lender early: Pre-qualification helps determine your buying power and allows lenders to guide you toward eligible properties.

- Use online search filters: Utilize online real estate portals to filter for USDA-eligible properties.

- Partner with a real estate agent experienced in USDA loans: Their expertise ensures you focus on properties that meet the program’s requirements.

- Thoroughly research the neighborhood: Consider factors like schools, commute times, and amenities.

- Be prepared to act quickly: Competitive markets require decisive action once a suitable property is identified.

Closing Costs and Fees Associated with USDA Home Loans in Vancouver, WA

Securing a USDA home loan in Vancouver, WA, involves understanding the associated closing costs, which can significantly impact your budget. These costs differ from conventional loans, and careful planning is essential to avoid unexpected expenses. This section details the common closing costs, explains the calculation process, and provides a sample budget to help you prepare.

Comparison of Closing Costs: USDA vs. Conventional Loans in Vancouver, WA

While both USDA and conventional loans involve closing costs, the specifics and overall amount can vary. Conventional loans often have higher upfront costs, particularly private mortgage insurance (PMI), which USDA loans typically avoid. However, USDA loans may include guarantee fees that conventional loans do not. The actual difference depends on factors such as the loan amount, the property’s location in Vancouver, WA, and the individual lender’s fees. A thorough comparison of loan estimates from multiple lenders is crucial for informed decision-making. For example, a $300,000 loan might see a difference of several thousand dollars in total closing costs between a USDA and conventional loan, with the USDA loan potentially being less expensive due to the absence of PMI.

Common Closing Costs and Fees Associated with USDA Loans in Vancouver, WA

Several standard fees are associated with USDA home loans in Vancouver, WA. These include loan origination fees (charged by the lender for processing the loan), appraisal fees (to assess the property’s value), title insurance (protecting against title defects), recording fees (government fees for registering the deed), and the USDA guarantee fee (a percentage of the loan amount paid to the USDA). Other potential costs may include survey fees, homeowner’s insurance premiums, property taxes, and prepaid interest. The exact amount of each fee will vary depending on the specifics of the loan and the services provided. For instance, a complex property survey in a hilly area of Vancouver might result in higher survey fees compared to a simpler survey on a flat lot.

Calculating Total Closing Costs

Calculating total closing costs involves summing all individual fees. It’s recommended to obtain a Loan Estimate (LE) from your lender, which provides a detailed breakdown of all anticipated closing costs. This LE is required by law and provides transparency. However, it’s prudent to independently review the LE and confirm the accuracy of each fee with the lender. The total closing costs are crucial for determining your overall budget and ensuring you have sufficient funds available at closing. For example, if the Loan Estimate lists $5,000 in loan origination fees, $1,000 in appraisal fees, $2,000 in title insurance, $500 in recording fees, and a $1,500 USDA guarantee fee, the total closing costs would be $10,000.

Budgeting for Closing Costs: A Sample Calculation

Let’s consider a hypothetical scenario: A buyer in Vancouver, WA, is securing a $300,000 USDA loan. Based on estimates from various lenders, their closing costs are anticipated to be approximately 3% of the loan amount, or $9,000. This includes the fees listed above and other potential expenses. To budget effectively, the buyer should save at least this amount, plus additional funds for any unforeseen expenses. This ensures they are financially prepared for closing and can avoid last-minute financial stress. If the buyer has a limited savings, they may explore options like gift funds from family members or closing cost assistance programs, though lender approval is necessary.

Local Resources and Support for USDA Home Loans in Vancouver, WA

Securing a USDA home loan in Vancouver, WA, often benefits from leveraging local expertise and support systems. Understanding the available resources can streamline the process and increase your chances of a successful application. This section details local lenders, housing authorities, and government programs that can assist you throughout your USDA home loan journey.

Navigating the USDA loan process can be complex, and having access to local resources can significantly simplify the experience. These resources offer guidance on eligibility, application procedures, and finding suitable properties, ultimately contributing to a smoother home-buying process.

Local Lenders Specializing in USDA Home Loans

Several lenders in the Vancouver, WA area specialize in USDA home loans, offering tailored services and expertise. These lenders often have a deep understanding of the USDA loan program’s requirements and can guide you through the application process efficiently. Directly contacting these lenders is crucial for obtaining personalized advice and determining which best suits your needs. It is important to compare interest rates, fees, and loan terms offered by different lenders before making a decision.

Contact Information for Relevant Housing Authorities and Organizations

Various housing authorities and non-profit organizations in Vancouver, WA, provide valuable support to prospective homebuyers, particularly those utilizing USDA loans. These organizations often offer counseling services, educational workshops, and resources to assist with navigating the complexities of homeownership. Contacting these organizations can provide valuable insights and support throughout the process. Some may even offer pre-purchase counseling to help you prepare financially for homeownership.

Local Government Programs Supplementing USDA Loans

While the USDA loan program itself offers significant advantages, local government programs in Vancouver, WA, may offer supplemental assistance to homebuyers. These programs might include down payment assistance, closing cost assistance, or other incentives aimed at making homeownership more accessible. Researching and identifying these local programs is essential, as they can significantly reduce the financial burden associated with purchasing a home.

Table of Local Resources and Contact Information

The following table provides contact information for several key resources in Vancouver, WA, that can assist with USDA home loans. Note that this information is subject to change, and it is recommended to verify details directly with the respective organizations.

| Organization Name | Address | Phone Number | Website (if available) |

|---|---|---|---|

| [Lender Name 1] | [Address] | [Phone Number] | [Website] |

| [Lender Name 2] | [Address] | [Phone Number] | [Website] |

| [Housing Authority Name] | [Address] | [Phone Number] | [Website] |

| [Non-profit Organization Name] | [Address] | [Phone Number] | [Website] |

Illustrative Examples of USDA Home Loans in Vancouver, WA

Understanding the practical application of USDA loans is crucial for prospective homebuyers in Vancouver, WA. The following examples illustrate the financial benefits and the application process, providing a clearer picture of how these loans work in a real-world context.

First-Time Homebuyer Scenario

Imagine Sarah, a first-time homebuyer working as a teacher in Vancouver, WA. She’s been saving diligently and has a stable income, but struggles to afford a down payment for a conventional mortgage. A USDA loan allows her to purchase a modest home valued at $400,000 with no down payment, significantly reducing her initial financial burden. This eliminates the need to save for a substantial down payment, allowing her to enter the housing market sooner. The reduced upfront costs, coupled with potentially lower interest rates, make homeownership a more attainable goal. The USDA loan’s guarantee helps her secure financing despite having a smaller down payment.

Financial Implications of a USDA Loan

Let’s consider a hypothetical scenario involving a $350,000 home in Vancouver, WA, financed through a USDA loan. Assuming a current interest rate of 6.5% for a 30-year fixed-rate mortgage, and no down payment, the monthly principal and interest payment would be approximately $2,210. This excludes property taxes, homeowner’s insurance, and potential Private Mortgage Insurance (PMI), which are typical costs associated with homeownership regardless of loan type. It’s important to note that interest rates are subject to change based on market conditions. A lower interest rate would result in a lower monthly payment. This example demonstrates the affordability a USDA loan can offer, particularly to those with limited savings.

Successful USDA Loan Application Case Study

John and Mary, a young couple in Vancouver, WA, recently purchased their first home using a USDA loan. They found a charming three-bedroom house valued at $380,000. Meeting the USDA income and property location requirements, they applied through a local USDA-approved lender. The lender guided them through the process, assisting with documentation and ensuring their application was complete and accurate. Their application was approved within a reasonable timeframe, and they successfully closed on their home. The USDA loan enabled them to purchase a property they otherwise wouldn’t have been able to afford, achieving their dream of homeownership in their desired community. Their experience highlights the importance of working with a knowledgeable lender who specializes in USDA loans.

Outcome Summary: Usda Home Loans Vancouver Wa

Securing a USDA home loan in Vancouver, WA, can be a rewarding experience, opening doors to homeownership for many. By carefully reviewing eligibility criteria, meticulously completing the application, and leveraging available resources, you can navigate the process effectively. Remember to thoroughly research property options, understand associated costs, and utilize the support network of local lenders and organizations. With diligent planning and preparation, achieving your dream of homeownership in Vancouver, WA, through a USDA loan is entirely attainable.

FAQ Summary

What credit score is needed for a USDA loan in Vancouver, WA?

While there’s no minimum credit score requirement, lenders generally prefer applicants with scores above 620. Higher scores often result in better interest rates.

Can I use a USDA loan to buy a multi-family home in Vancouver, WA?

Yes, USDA loans can be used to purchase multi-family homes, provided they meet specific property eligibility requirements and the borrower intends to occupy one of the units as their primary residence.

Are there any pre-payment penalties with USDA loans?

No, USDA loans typically do not have pre-payment penalties, allowing you to pay off your mortgage early without incurring additional fees.

What are the property location restrictions for USDA loans in Vancouver, WA?

The property must be located in a rural area or eligible town designated by the USDA. You’ll need to verify the property’s eligibility through the USDA’s online tools or a lender.