Advantis Credit Union auto loan rates offer a compelling entry point into the world of automotive financing. Understanding these rates, however, requires navigating a landscape of factors—credit score, loan term, vehicle type, and more. This guide unravels the complexities, providing a clear picture of what you can expect, from application to approval and beyond. We’ll compare Advantis’s offerings to competitors, explore the benefits, and even walk through illustrative loan scenarios to help you make informed decisions.

We’ll delve into the specifics of Advantis’s various loan types—new car, used car, and refinancing—highlighting the key differences in rates and terms. Crucially, we’ll also dissect the impact of your creditworthiness, the length of your loan, and the type of vehicle you’re financing. By understanding these factors, you’ll be better equipped to negotiate the best possible rate and terms for your unique circumstances. We’ll even provide a step-by-step application guide and address frequently asked questions to streamline the entire process.

Advantis Credit Union Auto Loan Rate Overview

Advantis Credit Union offers a range of auto loan options to its members, with rates varying depending on several key factors. Understanding these factors and comparing them to other lenders is crucial for securing the best possible financing for your vehicle purchase. This overview provides a summary of Advantis’s auto loan offerings and compares them to rates from other major financial institutions.

Advantis Credit Union’s auto loan rates are competitive within the market, but the exact APR (Annual Percentage Rate) you’ll receive depends on several variables. These include your credit score, the loan term (length of the loan), the type of vehicle (new or used), the loan amount, and the vehicle’s year and make/model. Generally, borrowers with higher credit scores and shorter loan terms will qualify for lower interest rates. It’s important to note that rates are subject to change based on prevailing market conditions.

Types of Auto Loans Offered by Advantis Credit Union, Advantis credit union auto loan rates

Advantis Credit Union provides financing options for various automotive needs. These include loans for new vehicles, used vehicles, and refinancing existing auto loans. Each loan type may have slightly different rate structures and eligibility requirements. New car loans typically offer lower interest rates than used car loans due to the lower risk associated with newer vehicles. Refinancing options allow borrowers to potentially lower their monthly payments or shorten their loan term by securing a more favorable interest rate from Advantis.

Comparison of Advantis Credit Union Auto Loan Rates with Competitors

The following table compares Advantis Credit Union’s auto loan rates with those of several major competitors. It’s important to remember that these rates are examples and can fluctuate. Always check with the individual lender for the most current information. Furthermore, individual circumstances significantly impact the final APR received.

| Lender | Loan Type | APR (Example) | Term (Example) |

|---|---|---|---|

| Advantis Credit Union | New Car | 4.5% – 7.5% | 36-72 months |

| Advantis Credit Union | Used Car | 5.0% – 9.0% | 48-60 months |

| Competitor A (e.g., Bank of America) | New Car | 4.0% – 8.0% | 60 months |

| Competitor B (e.g., Chase) | Used Car | 5.5% – 9.5% | 48 months |

| Competitor C (e.g., Capital One) | Refinance | 6.0% – 10.0% | 60 months |

Factors Affecting Advantis Auto Loan Rates: Advantis Credit Union Auto Loan Rates

Securing an auto loan with Advantis Credit Union involves several factors that influence the final interest rate you’ll receive. Understanding these factors allows borrowers to improve their chances of obtaining a favorable rate and ultimately a more affordable loan. This section details the key elements that Advantis considers when assessing loan applications.

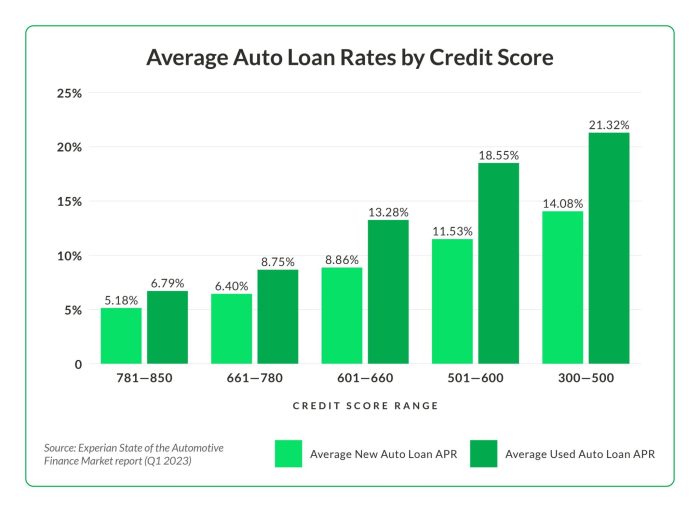

Credit Score Requirements and Interest Rate Impact

Your credit score is a crucial determinant of your auto loan interest rate. Lenders like Advantis use credit scores to assess your creditworthiness and risk. A higher credit score, generally above 700, indicates a lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score, often below 600, signifies a higher risk, leading to a higher interest rate or even loan denial. The impact can be significant; a difference of even 50 points can translate to a noticeable variation in your monthly payments over the loan’s life. For example, a borrower with a 750 credit score might qualify for a rate of 4%, while a borrower with a 650 credit score might receive a rate of 7%, significantly increasing the total cost of the loan.

Loan Term Length and Total Loan Cost

The length of your auto loan significantly impacts the total cost. Longer loan terms (e.g., 72 or 84 months) result in lower monthly payments but higher overall interest paid. Shorter loan terms (e.g., 36 or 48 months) lead to higher monthly payments but substantially lower total interest paid. Choosing a loan term requires careful consideration of your budget and financial goals. For instance, a $20,000 loan at 5% interest over 60 months will cost significantly less in total interest than the same loan spread over 84 months.

Loan Amount and Vehicle Type

The loan amount directly influences the interest rate. Larger loan amounts often carry slightly higher interest rates due to the increased risk for the lender. The type of vehicle also plays a role. New cars typically command lower interest rates than used cars because they depreciate less quickly, representing a lower risk for the lender. The perceived resale value of the vehicle is a key factor in the lender’s risk assessment. For example, a loan for a new, fuel-efficient vehicle might receive a more favorable rate than a loan for an older, high-mileage vehicle.

Other Factors Affecting Approval and Interest Rate

Several additional factors can influence your auto loan approval and interest rate. A substantial down payment demonstrates your commitment and reduces the lender’s risk, potentially leading to a lower rate. Your income and debt-to-income ratio (DTI) are also critical. A higher income and a lower DTI (the percentage of your monthly income dedicated to debt payments) generally improve your chances of approval and can result in a better interest rate. Consistent employment history also strengthens your application. Finally, the lender might consider your relationship with the credit union, rewarding long-standing members with preferential rates.

Application and Approval Process

Securing an auto loan from Advantis Credit Union involves a straightforward process designed for efficiency and transparency. The application, whether initiated online or in person, requires specific documentation to ensure a smooth and timely approval. Understanding the steps involved and the necessary paperwork will significantly expedite the loan acquisition.

The application process for an Advantis Credit Union auto loan is designed to be user-friendly, whether you prefer applying online or visiting a branch. Applicants should expect a relatively quick turnaround time, although processing speed can vary based on the completeness of the application and supporting documentation.

Application Steps

The application process typically involves several key steps. Completing each step accurately and efficiently will contribute to a faster approval.

- Pre-qualification (Optional): Before formally applying, you may choose to pre-qualify to get an estimate of your potential loan terms and interest rate. This helps you understand your borrowing power and plan accordingly. This step is not mandatory but can save time.

- Complete the Application: This involves filling out an application form, either online or at a branch. The form will request personal information, employment details, and information about the vehicle you intend to purchase.

- Submit Required Documentation: Gather and submit all necessary documentation, including proof of income, residence, and identification. A complete application with all supporting documents significantly speeds up the process.

- Credit Check: Advantis Credit Union will perform a credit check to assess your creditworthiness. Your credit score and history will directly influence the interest rate and loan terms offered.

- Loan Approval/Denial: Upon review of your application and supporting documentation, Advantis will notify you of their decision. If approved, you will receive details about the loan terms, interest rate, and repayment schedule.

- Loan Closing: Once you accept the loan terms, you will complete the final loan documents and receive the funds. This typically involves signing the loan agreement and providing any remaining necessary documentation.

Required Documentation

Providing complete and accurate documentation is crucial for a swift loan approval. Failure to provide necessary documentation may delay the process.

- Government-issued photo identification: Such as a driver’s license or passport.

- Proof of income: Pay stubs, W-2 forms, tax returns, or bank statements demonstrating consistent income.

- Proof of residence: Utility bills, lease agreements, or mortgage statements showing your current address.

- Vehicle information: Details about the vehicle you intend to finance, including the year, make, model, VIN, and purchase price.

- Down payment information: Proof of funds for your down payment, if applicable.

Processing Time

The time it takes to process an auto loan application varies. While Advantis Credit Union strives for efficiency, several factors can influence processing time.

Generally, expect the application process to take anywhere from a few days to a couple of weeks. A complete application with all necessary documentation will typically result in faster processing. Applications submitted during peak seasons or with incomplete information may experience longer processing times. For example, an application submitted during the holiday season might take longer to process than one submitted during a less busy period. Similarly, an application missing crucial documentation will require additional time for the missing information to be obtained and verified.

Advantis Credit Union Auto Loan Features and Benefits

Choosing an auto loan involves careful consideration of various factors beyond just the interest rate. Advantis Credit Union offers a comprehensive package of features and benefits designed to make the car-buying process smoother and more affordable for its members. These advantages, coupled with competitive rates, often position Advantis favorably against other lenders, both credit unions and banks.

Advantis’s commitment to member service is a key differentiator. They often provide personalized support throughout the loan process, assisting members with understanding their options and navigating the complexities of financing a vehicle. This personalized approach contrasts with the sometimes impersonal experience found with larger banks.

Competitive Interest Rates and Loan Terms

Advantis strives to offer competitive interest rates on auto loans, aiming to be among the most affordable options available to its members. The specific rate offered will depend on several factors, including credit score, loan term, and the vehicle being financed, as discussed previously. Longer loan terms generally result in lower monthly payments but higher overall interest paid, while shorter terms mean higher monthly payments but less interest paid over the life of the loan. Advantis typically provides a range of loan terms to allow members to tailor their payments to their budget. Comparing Advantis’ rates to those of other credit unions and banks in the same geographic area is crucial for determining the best value.

Flexible Loan Options

Advantis often provides various loan options to cater to diverse needs. This could include loans for new or used vehicles, potentially offering different rates or terms based on the vehicle’s age and condition. They may also offer options for refinancing existing auto loans, potentially lowering monthly payments or shortening the loan term. The availability of these options varies and should be confirmed directly with Advantis. Many banks offer similar options, but the specific terms and conditions may differ significantly.

Member Benefits and Services

Beyond competitive rates and loan terms, Advantis, as a credit union, offers a range of member benefits that extend beyond just auto loans. These may include access to financial education resources, online banking tools, and other financial products and services. These additional services provide a holistic financial experience, differentiating Advantis from many banks that primarily focus on individual financial products. The specific benefits offered can vary depending on membership status and location.

Transparent and Straightforward Application Process

Advantis aims for a transparent and straightforward application process, making it easier for members to understand the requirements and timelines involved. This often involves clear communication throughout the application and approval process, providing regular updates to members. While many banks and other credit unions also strive for transparency, Advantis’s focus on member service often results in a more personalized and supportive experience.

Illustrative Examples of Advantis Auto Loan Scenarios

Understanding the total cost of an auto loan requires careful consideration of interest rates, loan amounts, and loan terms. The following examples illustrate how these factors interact to determine the final cost. Remember that these are illustrative examples and actual rates and costs may vary based on individual creditworthiness and Advantis’s current lending policies.

Sample Auto Loan Scenarios

The table below presents three distinct auto loan scenarios, highlighting the impact of varying loan amounts, interest rates, and loan terms on the total cost. These scenarios assume no additional fees beyond the interest.

| Scenario | Loan Amount | Interest Rate | Total Cost |

|---|---|---|---|

| Scenario 1: Short-Term, Lower Amount | $15,000 | 5% | $16,125 (approximate, assuming simple interest calculation for brevity) |

| Scenario 2: Medium-Term, Higher Amount | $25,000 | 6% | $31,500 (approximate, assuming simple interest calculation for brevity) |

| Scenario 3: Long-Term, Highest Amount | $35,000 | 7% | $48,050 (approximate, assuming simple interest calculation for brevity) |

Sample Amortization Schedule

An amortization schedule details the breakdown of each loan payment into principal and interest over the loan’s lifespan. Let’s consider a simplified example of a $10,000 loan at 5% interest over 36 months. The schedule would show a monthly payment (calculated using standard amortization formulas) and would break down each payment. For example, the first payment might allocate $100 to interest and $200 to principal. Subsequent payments would gradually reduce the interest portion and increase the principal portion. As the loan progresses, a larger percentage of each payment would go towards principal repayment until the loan is fully paid off at the end of the 36 months. The schedule would clearly display the remaining principal balance after each payment. This visual representation allows borrowers to track their loan payoff progress and understand how their payments are being applied.

Beneficial Refinancing Scenario

Refinancing an auto loan with Advantis can be advantageous if a borrower secures a lower interest rate than their current loan. For instance, if a borrower has an existing auto loan with a 9% interest rate and their credit score has improved significantly, they could refinance with Advantis at a potentially lower rate, say 6%. This lower rate would translate to reduced monthly payments and lower overall interest paid over the life of the loan, resulting in substantial savings. This is especially beneficial for borrowers with longer loan terms. The potential savings would depend on the difference in interest rates, the remaining loan balance, and the new loan term.

Customer Experiences and Reviews (Indirect Approach)

Understanding the overall customer sentiment surrounding Advantis Credit Union’s auto loan services requires examining publicly available information, focusing on recurring themes and patterns rather than individual reviews. This indirect approach provides a broader perspective on the general experience.

Analyzing aggregated feedback reveals several key areas consistently mentioned in relation to Advantis Credit Union’s auto loan offerings. These areas offer valuable insights into the customer journey and the overall reputation of the credit union in this specific financial product area.

Application Process Feedback

Publicly available information suggests that the application process for Advantis Credit Union auto loans is generally perceived as straightforward and efficient. While some anecdotal evidence may point to occasional delays, the overall impression is one of a relatively smooth and uncomplicated application procedure. This positive perception likely stems from the credit union’s potentially streamlined online application system and potentially clear communication throughout the process.

Customer Service Perceptions

Customer service experiences with Advantis Credit Union related to auto loans appear to be generally favorable. While specific incidents may vary, the overall sentiment suggests a helpful and responsive customer service team. This positive perception may contribute to a higher level of customer satisfaction and loyalty. Efficient communication and problem resolution seem to be key factors in this positive perception.

Overall Reputation for Auto Loans

Based on publicly accessible information, Advantis Credit Union maintains a generally positive reputation for its auto loan services. This positive perception is likely reinforced by competitive interest rates, a variety of loan options, and a user-friendly application process. The credit union’s commitment to customer service and its overall financial stability likely contribute to this favorable reputation. However, it is important to note that individual experiences can vary.

Final Wrap-Up

Securing an auto loan can feel overwhelming, but with a clear understanding of Advantis Credit Union’s auto loan rates and the factors that influence them, the process becomes significantly more manageable. Remember to carefully consider your credit score, desired loan term, and the type of vehicle you’re purchasing. By comparing Advantis’s rates to those of competitors and utilizing the information and insights provided in this guide, you can confidently navigate the path to securing the best possible financing for your next vehicle. Don’t hesitate to explore all your options and choose the financing solution that best aligns with your financial goals.

Top FAQs

What documents do I need to apply for an Advantis auto loan?

Typically, you’ll need proof of income, identification, and vehicle information (VIN, etc.). Specific requirements may vary, so check with Advantis directly.

How long does the Advantis auto loan application process take?

Processing times vary but generally range from a few days to a couple of weeks, depending on factors like the completeness of your application.

Can I pre-qualify for an Advantis auto loan online?

Check Advantis’s website; many credit unions offer online pre-qualification tools to give you an estimate before a formal application.

What happens if my auto loan application is denied?

Advantis will usually provide reasons for denial. You can review your credit report and address any issues before reapplying or exploring alternative lenders.