Boro personal loans offer a potential solution for individuals needing quick access to funds. Understanding the intricacies of these loans, however, requires careful consideration of interest rates, repayment terms, and eligibility criteria. This comprehensive guide delves into the specifics of Boro personal loans, comparing them to other lending options and outlining the application process, fees, and potential benefits and drawbacks. We’ll also explore alternative financing solutions and strategies for effective repayment management.

From navigating the application process and understanding the associated fees to exploring alternative financing options and managing repayments effectively, this guide provides a holistic overview of Boro personal loans, empowering you to make informed financial decisions. We’ll cover everything from eligibility requirements and document preparation to comparing Boro’s offerings against competitors and outlining strategies for successful repayment.

Understanding Boro Personal Loans

Boro personal loans offer a potential solution for individuals needing quick access to funds. Understanding their features, eligibility requirements, and how they compare to other loan options is crucial before applying. This section details the key aspects of Boro personal loans to help you make an informed decision.

Boro Personal Loan Features

Boro personal loans typically offer a range of loan amounts, interest rates, and repayment terms. The specific terms offered will vary depending on individual creditworthiness and the lender’s current offerings. Generally, Boro loans are designed for smaller loan amounts, often suitable for covering unexpected expenses or smaller projects. Interest rates are usually competitive, though they can vary significantly based on your credit score and the loan’s terms. Repayment periods are typically flexible, ranging from a few months to several years, allowing borrowers to choose a repayment schedule that aligns with their budget. Precise details on current interest rates, loan amounts, and repayment terms should be obtained directly from Boro or a trusted financial comparison website.

Boro Personal Loan Eligibility Criteria

Eligibility for a Boro personal loan typically involves meeting certain criteria set by the lender. These criteria usually include factors like age (typically 18 or older), citizenship or residency status, employment status (demonstrating a stable income), and a minimum credit score. The specific credit score requirement can vary depending on the lender and the loan amount. Borrowers with higher credit scores generally qualify for better interest rates and loan terms. Providing accurate and complete information during the application process is vital for a successful application. Additional requirements may include providing proof of income, address verification, and bank account details.

Comparison of Boro Personal Loans with Other Loan Types

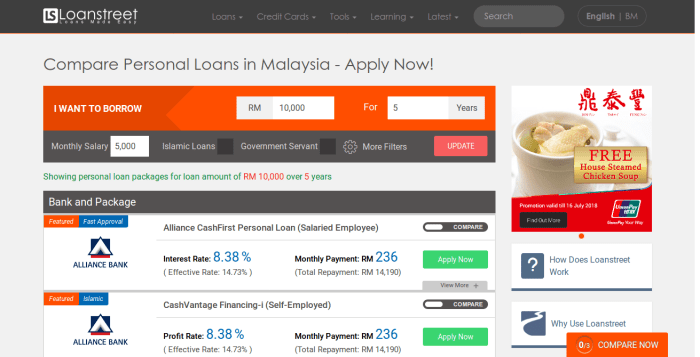

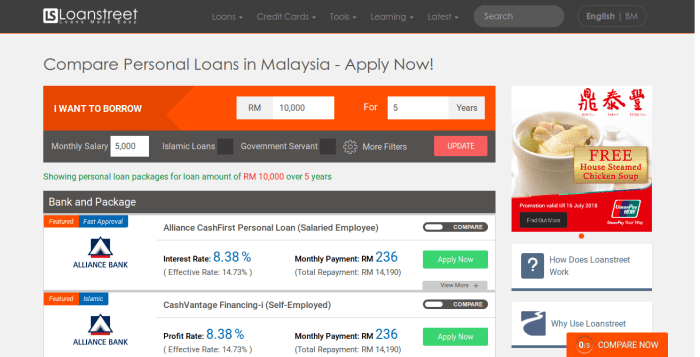

While Boro personal loans cater to specific needs, it’s beneficial to compare them with other personal loan options available in the market. This comparison allows for a more informed decision based on individual circumstances and financial goals. The following table compares Boro (assuming typical offerings) with two other hypothetical lenders, Lender A and Lender B, highlighting differences in interest rates, loan amounts, and repayment periods. Note that these are examples and actual rates and terms can vary considerably.

| Loan Provider | Interest Rate (APR) | Loan Amount Range | Repayment Period Range |

|---|---|---|---|

| Boro (Example) | 8-18% | $500 – $5,000 | 3-24 months |

| Lender A (Example) | 6-15% | $1,000 – $30,000 | 12-60 months |

| Lender B (Example) | 10-20% | $500 – $10,000 | 6-36 months |

Application Process and Requirements

Applying for a Boro personal loan is designed to be a straightforward process. The application itself is completed online, requiring minimal paperwork and offering a quick turnaround time for approval. This section details the steps involved, the necessary documentation, and the verification process.

The entire process is built around convenience and transparency, aiming to provide borrowers with a clear understanding of each stage. This approach minimizes delays and ensures a smooth application experience.

Steps to Apply for a Boro Personal Loan

The application process for a Boro personal loan is typically completed entirely online through the Boro platform. The following steps Artikel the typical procedure:

- Visit the Boro Website and Create an Account: Begin by navigating to the official Boro website and creating a personal account. This usually involves providing basic information such as your name, email address, and phone number.

- Complete the Online Application Form: Once logged in, you’ll be presented with an online application form. This form will request detailed personal and financial information, including your income, employment history, and desired loan amount. Accurate and complete information is crucial for a timely processing.

- Upload Required Documents: As part of the application, you will need to upload supporting documents to verify your identity and financial situation. These documents are Artikeld in the next section.

- Review and Submit Your Application: Before submitting, carefully review all the information you’ve provided to ensure accuracy. Once you’re satisfied, submit your application for review.

- Receive Approval Decision: Boro will review your application and notify you of their decision. This typically happens within a short timeframe, depending on the completeness of your application and the verification process.

Required Documents for Application

Providing the necessary documentation is essential for a smooth and efficient loan application process. Incomplete applications may result in delays or rejection. The specific documents required might vary slightly depending on individual circumstances, but generally include:

- Government-Issued Photo ID: A valid driver’s license, passport, or other government-issued photo identification is typically required to verify your identity.

- Proof of Income: This might include pay stubs, bank statements showing regular deposits, tax returns, or other documentation demonstrating your income and its consistency.

- Proof of Address: Utility bills, bank statements, or rental agreements can be used to verify your current residential address.

- Employment Verification (if applicable): In some cases, Boro may require direct verification of employment from your employer.

Verification Process and Borrower Expectations

After submitting your application, Boro initiates a verification process to ensure the accuracy of the information provided. This involves checking the details you’ve submitted against various databases and potentially contacting your employer or financial institutions.

During this stage, borrowers should expect to receive communication from Boro, possibly via email or phone, requesting additional information or clarification if needed. Open communication and prompt responses to any requests from Boro will expedite the verification process and ultimately the loan approval.

It’s important to note that the verification process is designed to protect both the borrower and Boro, ensuring responsible lending practices. Providing accurate and complete information upfront significantly reduces the time required for verification and increases the likelihood of a successful application.

Fees and Charges Associated with Boro Personal Loans

Understanding the complete cost of a Boro personal loan requires a thorough examination of all associated fees and charges. These fees, while seemingly minor individually, can significantly impact the total amount repaid over the loan’s term. Transparency regarding these costs is crucial for borrowers to make informed financial decisions.

Boro personal loans, like many other lending products, involve various fees beyond the principal loan amount and interest. These fees can vary depending on the loan amount, creditworthiness of the borrower, and specific loan terms. It’s essential to carefully review the loan agreement before accepting the loan to fully understand the financial implications.

Origination Fees

Origination fees are charges levied by Boro to cover the administrative costs associated with processing the loan application. These fees are typically a percentage of the total loan amount and are deducted from the disbursed funds. For example, a 1% origination fee on a $5,000 loan would result in a $50 fee, meaning the borrower would receive $4,950.

Late Payment Penalties

Late payment penalties are imposed when a borrower fails to make a payment by the due date. These penalties can range from a fixed dollar amount to a percentage of the missed payment. Consistent late payments can severely damage a borrower’s credit score and lead to further financial difficulties. Boro’s specific late payment penalty policy should be clearly Artikeld in the loan agreement.

Prepayment Charges

Prepayment charges are fees assessed when a borrower repays the loan in full before the scheduled maturity date. While some lenders charge prepayment penalties, Boro’s policy on prepayment charges needs to be explicitly checked in their loan agreement. The absence or presence of such charges significantly impacts a borrower’s flexibility in managing their debt.

Comparison of Fee Structures

Comparing Boro’s fee structure with competitors provides valuable context for assessing the overall cost of borrowing. The following table illustrates a hypothetical comparison, highlighting potential variations in fees across different lenders. Note that these are illustrative examples and actual fees may vary depending on the lender and specific loan terms.

| Lender | Origination Fee | Late Payment Penalty | Prepayment Penalty |

|---|---|---|---|

| Boro | 1-3% of loan amount | $25 or 5% of missed payment (whichever is higher) | None |

| Competitor A | 2% of loan amount | $30 + 5% of missed payment | 1% of remaining balance |

| Competitor B | 0% | $15 per missed payment | None |

| Competitor C | 0.5% of loan amount | 5% of missed payment | 2% of prepaid amount |

Impact of Fees on Overall Borrowing Cost

The cumulative effect of these fees can substantially increase the total cost of the loan. For instance, a seemingly small origination fee of 1% on a large loan can translate to a significant amount. Similarly, repeated late payment penalties can quickly accumulate, adding hundreds or even thousands of dollars to the final repayment amount. Therefore, careful consideration of all fees is crucial to accurately assess the true cost of borrowing and to make informed financial decisions.

Benefits and Drawbacks of Boro Personal Loans

Choosing a personal loan can be a significant financial decision. Understanding the advantages and disadvantages of a Boro personal loan, compared to other options like credit cards or bank loans, is crucial for making an informed choice. This section will Artikel the key benefits and drawbacks to help you assess whether a Boro personal loan aligns with your specific financial needs and circumstances.

Advantages of Boro Personal Loans

The appeal of Boro personal loans stems from several key features that make them attractive to borrowers. These advantages often outweigh the drawbacks for specific financial situations. Consider the following points when weighing your options.

- Potential for Faster Approval: Boro often boasts a quicker application and approval process compared to traditional banks, potentially providing access to funds more rapidly.

- Accessibility for Individuals with Less-Than-Perfect Credit: While credit score is a factor, Boro may be more willing to lend to individuals with less-than-perfect credit histories than some traditional lenders, providing a lifeline for those who might be otherwise excluded.

- Transparent Fee Structure: Boro aims for transparency in its fee structure, making it easier for borrowers to understand the total cost of the loan upfront, minimizing unexpected charges.

- Convenient Online Application Process: The online application process simplifies the borrowing experience, saving time and effort compared to in-person visits to a bank branch.

- Flexible Repayment Options: Depending on the specific loan terms offered, Boro might provide flexible repayment options tailored to individual financial situations, easing the burden of repayment.

Disadvantages of Boro Personal Loans

While Boro personal loans offer several benefits, it’s important to acknowledge the potential drawbacks. Understanding these potential downsides will help you manage expectations and make a responsible borrowing decision.

- Higher Interest Rates: Compared to loans from traditional banks or credit unions, Boro personal loans may come with higher interest rates, potentially leading to a greater overall cost of borrowing. This is often a trade-off for the speed and accessibility of the loan.

- Shorter Repayment Terms: Boro loans may have shorter repayment periods than other loan options. While this can lead to quicker debt repayment, it also means higher monthly payments, which could strain your budget.

- Potential for Additional Fees: While Boro aims for transparency, there might be additional fees associated with the loan, such as late payment fees or origination fees, that can increase the overall cost. Carefully reviewing the loan agreement is essential.

- Risk of Debt Trap: Like any loan, failing to manage repayments responsibly can lead to a debt trap, with accumulating interest and fees further impacting your financial stability. Careful budgeting and responsible borrowing habits are paramount.

Alternatives to Boro Personal Loans

Securing a personal loan can be a crucial step in managing unexpected expenses or funding significant life events. While Boro personal loans offer a specific set of features and terms, it’s vital to explore alternative financing options to determine the best fit for individual circumstances. Understanding the nuances of these alternatives empowers borrowers to make informed decisions aligned with their financial goals and risk tolerance.

Several alternatives exist, each possessing unique advantages and disadvantages compared to Boro personal loans. The optimal choice depends on factors like credit score, loan amount needed, repayment timeframe, and the borrower’s overall financial situation. A thorough comparison helps identify the most suitable option for individual needs.

Alternative Financing Options

Several viable alternatives to Boro personal loans cater to diverse financial needs and circumstances. These include options such as bank personal loans, credit unions, peer-to-peer lending platforms, and balance transfers.

| Financing Option | Pros | Cons | Suitable Situations |

|---|---|---|---|

| Bank Personal Loans | Generally lower interest rates than some other options; established reputation and regulatory oversight; potentially larger loan amounts available. | Stricter credit score requirements; longer application process; potentially higher fees. | Individuals with good credit seeking larger loans with fixed repayment terms; borrowers prioritizing lower interest rates and established lender security. For example, someone needing $20,000 to consolidate high-interest debt. |

| Credit Union Personal Loans | Often offer lower interest rates than banks; member-owned, potentially offering more personalized service; may have more flexible lending criteria. | Membership requirements; potentially smaller loan amounts available compared to banks; limited geographic reach. | Borrowers who qualify for membership and prioritize lower interest rates and potentially more flexible terms; individuals seeking a more community-oriented lending experience. For example, a teacher needing a loan for home repairs. |

| Peer-to-Peer (P2P) Lending | Potentially faster approval process than traditional banks; may be more accessible to borrowers with less-than-perfect credit; potential for lower interest rates depending on creditworthiness. | Higher interest rates than traditional lenders are possible; less regulatory oversight compared to banks and credit unions; potential for higher fees. | Borrowers with fair to good credit seeking a faster loan approval process; individuals comfortable with less traditional lending options. For instance, a freelancer needing quick funding for a project. |

| Balance Transfer Credit Cards | Potential to lower interest payments on existing high-interest debt; often offer introductory 0% APR periods; can consolidate multiple debts into a single payment. | High interest rates after introductory period expires; potential for increased debt if not managed carefully; balance transfer fees may apply. | Individuals with high-interest credit card debt seeking to consolidate and reduce interest payments during the introductory period; borrowers with good credit management skills. For example, someone with multiple credit cards with high balances. |

Managing Boro Personal Loan Repayments

Effective management of your Boro personal loan repayments is crucial for maintaining a healthy credit score and avoiding potential financial penalties. Understanding your repayment options and employing proactive strategies will ensure a smooth repayment process. This section details various repayment methods, provides strategies for successful repayment, and offers a step-by-step guide to contacting Boro customer service for assistance.

Boro Personal Loan Repayment Methods

Boro likely offers several convenient methods for repaying your personal loan. These typically include online payments through the Boro app or website, automated clearing house (ACH) transfers from your bank account, and potentially debit card payments. Some lenders also allow for payments via mail, though this method is generally slower and less efficient. It’s essential to confirm the specific payment options available to you directly through Boro’s official channels, as these may vary. Choosing a method that best suits your financial habits and technological comfort is key to consistent and timely payments.

Strategies for Effective Loan Repayment Management

Successful loan repayment hinges on careful planning and consistent effort. Budgeting is paramount; allocate a specific amount each month for loan repayment, ensuring it’s factored into your overall monthly expenses. Setting up automatic payments can eliminate the risk of missed payments due to oversight. Consider creating a dedicated savings account specifically for loan repayments to ensure funds are readily available. Regularly checking your loan account online to monitor your balance and upcoming payments promotes proactive management and helps identify potential issues early. Should unforeseen circumstances impact your ability to make a payment, contact Boro customer service immediately to explore options such as payment deferrals or extensions, rather than simply missing a payment.

Contacting Boro Customer Service for Repayment Assistance

If you encounter any difficulties with your Boro personal loan repayments, contacting their customer service department promptly is crucial. A step-by-step guide for effective contact is as follows:

- Locate Contact Information: Find Boro’s customer service contact details on their official website. This typically includes phone numbers, email addresses, and possibly a live chat option.

- Gather Necessary Information: Before contacting them, gather your loan account number, personal identification details, and a clear explanation of the issue you are facing. This will expedite the process.

- Choose Your Contact Method: Select the contact method most convenient for you (phone, email, or live chat). Consider the urgency of your situation when making your choice.

- Clearly Explain Your Situation: When contacting customer service, clearly and concisely explain your situation, providing all necessary information. Be polite and professional.

- Document the Interaction: Keep a record of your communication with Boro customer service, including dates, times, and the names of any representatives you speak with. This record can be helpful for future reference.

Illustrative Example of a Boro Personal Loan Scenario

Let’s consider a hypothetical scenario to illustrate how a Boro personal loan might work in practice. This example uses estimated figures and should not be considered financial advice. Always check the current Boro loan terms and conditions for the most up-to-date information.

Imagine Sarah, a freelance graphic designer, needs a $5,000 personal loan to purchase new equipment for her business. She applies for and is approved for a Boro personal loan with a 12-month repayment term and an annual interest rate of 10%.

Loan Details and Repayment Schedule

Sarah’s loan details are as follows: Loan Amount: $5,000; Interest Rate: 10% per annum; Loan Term: 12 months. The monthly interest rate is calculated as 10%/12 = 0.83%. Using a simple interest calculation (which might differ slightly from Boro’s actual calculation method), her monthly payment would be approximately $438. This is calculated by dividing the total loan amount plus interest ($5,500) by the number of months (12). This represents a simplified calculation; the actual repayment amount might vary slightly depending on Boro’s specific amortization schedule. The amortization schedule details the breakdown of each payment into principal and interest over the loan term.

Total Cost of the Loan

The total cost of the loan includes the principal amount and the total interest paid over the 12-month period. In this example, Sarah would pay approximately $500 in interest ($5,500 total repayment – $5,000 principal). This represents a simplified example; the exact interest charged will depend on Boro’s specific interest calculation method. Additional fees, such as origination fees or late payment fees, could also increase the total cost. Let’s assume for this example that there are no additional fees.

Impact on Monthly Budget, Boro personal loan

To assess the impact on Sarah’s monthly budget, we need to consider her existing expenses. Let’s assume her monthly expenses before taking out the loan total $3,000. Adding the $438 monthly loan repayment increases her total monthly expenses to $3,438. This increase requires Sarah to carefully manage her budget and ensure she can comfortably afford the additional expense. This might involve adjusting her spending in other areas or increasing her income through additional freelance work. Careful budgeting is crucial to avoid loan defaults.

Closing Notes

Securing a personal loan, especially one like a Boro personal loan, requires careful planning and understanding. This guide has provided a comprehensive overview, from application to repayment, highlighting the key features, benefits, and potential drawbacks. By carefully weighing the pros and cons and exploring alternative options, you can make an informed decision that aligns with your financial goals and circumstances. Remember to always review the terms and conditions carefully before committing to any loan agreement.

Questions Often Asked

What credit score is needed for a Boro personal loan?

Boro’s specific credit score requirements aren’t publicly listed. However, like most lenders, they likely prefer applicants with good or excellent credit. Checking your credit report beforehand is recommended.

Can I prepay my Boro personal loan?

Whether you can prepay and if there are any associated prepayment penalties should be detailed in your loan agreement. Contact Boro customer service to confirm.

What happens if I miss a payment on my Boro personal loan?

Missing a payment will likely result in late fees and negatively impact your credit score. Contact Boro immediately if you anticipate difficulty making a payment to explore potential solutions.

How long does it take to get approved for a Boro personal loan?

The approval process timeframe varies. Boro’s website or customer service can provide a more accurate estimate.