Cap loan AAFMAA offers a unique financial product tailored to the needs of military members. This guide delves into the intricacies of AAFMAA’s cap loan program, exploring its features, eligibility requirements, application process, and comparison with other military lending options. We’ll examine interest rates, fees, repayment options, and provide real-world examples to illustrate how these loans can benefit service members. Understanding the advantages and disadvantages is crucial before making a financial decision, and we’ll cover that thoroughly, too.

We’ll also compare AAFMAA cap loans with other loan types available to military personnel, such as VA loans and personal loans, highlighting key differences in terms, rates, and eligibility. Finally, we’ll discuss how an AAFMAA cap loan can fit into a broader financial plan and offer guidance on responsible borrowing practices.

AAFMAA Cap Loan Overview

AAFMAA, a military-focused financial institution, offers a cap loan program designed to assist members in managing their financial obligations. This program provides a unique set of features and benefits tailored to the specific needs of military personnel and their families. Understanding the intricacies of this program, including eligibility criteria and the application process, is crucial for those considering this financial option.

AAFMAA Cap Loan Features

AAFMAA cap loans are designed to consolidate existing high-interest debts into a single, lower-interest loan. This simplification streamlines debt management, reducing monthly payments and providing a clearer financial picture. The program often includes features such as flexible repayment terms, allowing borrowers to choose a repayment schedule that aligns with their budget and financial stability. Additionally, AAFMAA may offer competitive interest rates compared to other lending institutions, potentially saving borrowers significant amounts of money over the life of the loan. These features collectively contribute to a more manageable and less stressful financial situation for borrowers.

AAFMAA Cap Loan Eligibility Requirements

Eligibility for AAFMAA cap loans is primarily determined by membership status within the AAFMAA organization. Applicants generally must be current members in good standing. Beyond membership, AAFMAA will likely assess creditworthiness through a credit check, considering factors such as credit score, debt-to-income ratio, and overall financial history. Specific income requirements may also apply, ensuring the applicant’s ability to comfortably manage monthly loan payments. Finally, the type and amount of existing debt will be a factor in determining loan eligibility and approval. Meeting these criteria is essential for securing an AAFMAA cap loan.

AAFMAA Cap Loan Application Process

The application process for an AAFMAA cap loan typically begins with an online application or a contact with an AAFMAA representative. Applicants will need to provide necessary documentation to verify their identity, membership status, income, and existing debts. This documentation might include pay stubs, tax returns, and statements from creditors. Once the application is submitted, AAFMAA will review the information and determine loan eligibility. If approved, the loan terms will be finalized, and the funds will be disbursed, typically used to pay off existing high-interest debts. The entire process is designed to be efficient and straightforward, minimizing the time and effort required from the applicant.

Comparison of AAFMAA Cap Loans with Other Military Lending Options

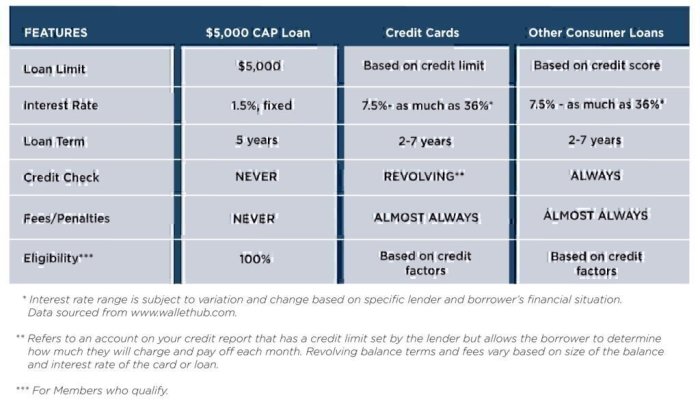

AAFMAA cap loans offer a competitive alternative to other military lending options, such as those provided by credit unions or banks offering military-specific programs. A direct comparison requires evaluating several key factors: interest rates, fees, repayment terms, and eligibility requirements. While credit unions often offer competitive rates and personalized service, AAFMAA’s focus on military members might provide unique benefits and understanding of the financial challenges faced by those serving. Banks may offer a wider range of loan products, but their interest rates and fees may not always be as favorable as those offered by AAFMAA or military-focused credit unions. Ultimately, the best option depends on the individual’s specific financial situation and needs. Careful consideration of all available options is recommended before making a decision.

Interest Rates and Fees: Cap Loan Aafmaa

AAFMAA offers competitive interest rates on its Capital Loan, designed to help members finance various needs. However, the exact interest rate is not publicly fixed and varies based on several factors, including creditworthiness, loan amount, and prevailing market conditions. Understanding these rates and associated fees is crucial before applying.

AAFMAA’s Capital Loan interest rates are typically presented as an Annual Percentage Rate (APR). The APR reflects the total cost of borrowing, encompassing the interest rate and any applicable fees. It’s important to note that AAFMAA does not publicly advertise specific interest rate ranges. To obtain a personalized rate quote, applicants must submit a complete loan application. This application process allows AAFMAA to assess individual creditworthiness and provide a tailored rate based on the applicant’s financial profile.

Associated Fees

AAFMAA may charge fees associated with the Capital Loan application and origination process. These fees can include, but are not limited to, application fees, origination fees, and potentially late payment fees. The exact fees and their amounts are not consistently published and are determined on a case-by-case basis. Contacting AAFMAA directly or reviewing their loan documents is essential to understand all applicable fees for a specific loan. It’s advisable to inquire about all potential costs before proceeding with the loan application.

AAFMAA Interest Rates Compared to Competitors

Direct comparison of AAFMAA’s Capital Loan interest rates with competitors requires accessing current rates from various lenders. Since AAFMAA’s rates are not publicly listed, a precise comparison table is impossible to create without specific loan applications and resulting offers. However, the table below illustrates a hypothetical comparison using example rate ranges, acknowledging that actual rates may differ significantly based on lender, credit score, and loan specifics.

| Lender | APR Range (Example) | Loan Type | Notes |

|---|---|---|---|

| AAFMAA (Hypothetical) | 6.5% – 12% | Capital Loan | Rates vary based on creditworthiness and loan terms. Contact AAFMAA for a personalized quote. |

| Navy Federal Credit Union (Example) | 5% – 10% | Personal Loan | Rates are subject to change and are based on creditworthiness and loan amount. |

| USAA (Example) | 7% – 13% | Personal Loan | Rates are subject to change. Check USAA’s website for current rates. |

| PenFed Credit Union (Example) | 6% – 11% | Personal Loan | Rates are subject to change. Contact PenFed for current rates. |

Disclaimer: The APR ranges provided in the table above are hypothetical examples only and do not represent actual rates offered by any lender. Actual interest rates will vary depending on individual creditworthiness, loan amount, and other factors. Always consult the respective lender for the most up-to-date information.

Repayment Options and Terms

AAFMAA offers flexible repayment options for its capital loans, designed to accommodate the diverse financial situations of its members. Understanding these options and the associated loan terms is crucial for borrowers to make informed decisions and manage their debt effectively. The terms, including loan length and amortization schedule, are clearly Artikeld during the application process and are based on several factors including the loan amount and the borrower’s creditworthiness.

AAFMAA Capital Loans typically offer a range of repayment options, though the specific choices available may depend on the individual loan and the borrower’s circumstances. These options often include variations in repayment frequency and overall loan duration, allowing borrowers to tailor their payments to their budget. Careful consideration of each option is vital to ensure long-term financial stability.

Loan Terms and Length

AAFMAA capital loans typically have terms ranging from several years to potentially over a decade. The exact length of the loan term is determined at the time of loan approval and depends on factors such as the loan amount, the borrower’s credit history, and the type of loan. Longer loan terms generally result in lower monthly payments but lead to a higher total interest paid over the life of the loan. Shorter loan terms mean higher monthly payments but less interest paid overall. Borrowers should carefully weigh these factors when choosing a loan term.

Amortization Schedule

An amortization schedule details the breakdown of each payment made toward the principal and interest over the life of the loan. This schedule shows the allocation of each payment, illustrating how much of each payment goes towards reducing the principal balance and how much goes towards paying the interest. Understanding the amortization schedule allows borrowers to track their loan progress and anticipate future payments. AAFMAA provides borrowers with a detailed amortization schedule upon loan approval.

Sample Amortization Schedule

The following table provides a hypothetical example of an AAFMAA capital loan amortization schedule. Note that this is a simplified example and actual schedules will vary based on the loan amount, interest rate, and loan term. This example assumes a $20,000 loan at a 6% annual interest rate, amortized over 5 years (60 months).

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,000.00 | $376.89 | $100.00 | $276.89 | $19,723.11 |

| 2 | $19,723.11 | $376.89 | $98.62 | $278.27 | $19,444.84 |

| 3 | $19,444.84 | $376.89 | $97.22 | $279.67 | $19,165.17 |

| … | … | … | … | … | … |

| 60 | $276.89 | $376.89 | $1.38 | $375.51 | $0.00 |

Benefits and Drawbacks

AAFMAA’s cap loan offers a unique financial solution for military members, but like any financial product, it presents both advantages and disadvantages. Understanding these aspects is crucial for making an informed decision about whether this loan type is the right choice for your specific financial situation. A thorough comparison with other available options is also essential.

AAFMAA cap loans provide several key benefits. Primarily, they offer competitive interest rates, often lower than those available through other lenders, particularly for those with limited credit history or facing financial challenges. This competitive pricing can translate to significant savings over the loan’s lifetime. Furthermore, AAFMAA, as a member-owned organization, prioritizes the financial well-being of its members, potentially leading to more flexible repayment options and a higher degree of personalized customer service. The application process may also be streamlined for AAFMAA members, reducing the administrative burden associated with securing a loan.

Advantages of AAFMAA Cap Loans

The competitive interest rates offered by AAFMAA cap loans are a significant advantage. These rates can be considerably lower than those charged by commercial lenders, especially for service members who may have less-than-perfect credit scores. This can lead to substantial savings on interest payments over the life of the loan. Additionally, AAFMAA’s focus on member service can result in a smoother and more supportive borrowing experience compared to dealing with larger, impersonal financial institutions. For instance, AAFMAA may offer more flexible repayment options or be more understanding of the unique financial challenges faced by military personnel.

Disadvantages and Limitations of AAFMAA Cap Loans

While AAFMAA cap loans offer several benefits, potential drawbacks exist. Loan amounts might be capped at a specific maximum, potentially limiting their usefulness for larger purchases or refinancing needs. The eligibility criteria might be stricter than some commercial lenders, potentially excluding some service members. For example, AAFMAA may require a minimum membership duration or specific service history. Moreover, while interest rates are generally competitive, they might not always be the absolute lowest available in the market. Borrowers should always compare rates from multiple sources before making a final decision.

Comparison with Other Financial Products for Military Members, Cap loan aafmaa

AAFMAA cap loans should be compared to other financial options available to military personnel, such as federal loans (like those offered through the Department of Veterans Affairs), credit unions, and commercial banks. Federal loans often offer very favorable terms, especially for education or home purchases, but may have specific eligibility requirements. Credit unions frequently provide competitive rates and personalized service, similar to AAFMAA, while commercial banks offer a wide range of loan products but may have higher interest rates and stricter lending criteria. The best choice depends on individual circumstances, the loan amount needed, the repayment terms desired, and the borrower’s creditworthiness. For example, a service member needing a large loan for a home purchase might find a VA loan more suitable, while a smaller loan for debt consolidation might be better served by an AAFMAA cap loan.

Real-World Examples

AAFMAA’s Cap Loan program offers flexible financing options for military members facing diverse financial situations. The following examples illustrate how these loans have been utilized to address specific needs and achieve financial goals. These are representative scenarios and individual experiences may vary.

Understanding how other service members have leveraged AAFMAA Cap Loans provides valuable insight into the program’s practical applications. The examples below showcase the versatility of the loan and its potential to address a range of financial challenges.

Home Purchase Using an AAFMAA Cap Loan

An active-duty Air Force Captain, stationed in Colorado, used an AAFMAA Cap Loan to purchase his first home. Facing high housing costs in the area, he found that the competitive interest rates and flexible repayment terms offered by AAFMAA made homeownership a realistic possibility. The loan allowed him to secure a mortgage with a manageable monthly payment, enabling him to build equity and avoid the uncertainties of renting. This example demonstrates how AAFMAA Cap Loans can facilitate significant life milestones like homeownership for military personnel.

Debt Consolidation with an AAFMAA Cap Loan

A Navy Lieutenant Commander, struggling with multiple high-interest credit card debts, consolidated his balances into a single, lower-interest AAFMAA Cap Loan. This strategy simplified his finances, reducing his monthly payments and providing a clearer path towards becoming debt-free. The streamlined repayment plan helped him regain control of his finances and improve his credit score. This illustrates the potential of AAFMAA Cap Loans for managing and resolving complex debt situations.

Major Home Repair Following a Natural Disaster

A retired Army Sergeant Major’s home sustained significant damage during a hurricane. An AAFMAA Cap Loan provided the necessary funds for repairs, allowing him to rebuild and restore his property without depleting his retirement savings. The loan’s flexible repayment options accommodated his fixed income, offering a solution that ensured both financial stability and peace of mind. This scenario showcases the program’s value in assisting members facing unforeseen and significant financial hardships.

Funding Educational Expenses with an AAFMAA Cap Loan

A National Guard member used an AAFMAA Cap Loan to finance his Master’s degree in engineering. This investment in his education enabled him to pursue career advancement opportunities and improve his earning potential. The manageable repayment plan allowed him to balance his studies with his military obligations and avoid accumulating high-interest student loan debt. This example highlights how AAFMAA Cap Loans can facilitate professional development and future financial security.

Customer Experiences

AAFMAA’s cap loan program has garnered a range of experiences from its members. Understanding both positive and negative feedback provides a comprehensive view of the program’s effectiveness and areas for potential improvement. This section details anecdotal accounts, highlighting both successful loan applications and instances where challenges arose and were subsequently resolved. All identifying information has been omitted to protect privacy.

Positive AAFMAA Cap Loan Experiences

Many members reported overwhelmingly positive experiences with the AAFMAA cap loan process. Several described the application process as straightforward and efficient, with quick processing times and minimal paperwork. One common theme was the helpfulness and responsiveness of AAFMAA’s customer service representatives. Members appreciated the clear communication throughout the loan process, receiving timely updates and prompt responses to their inquiries. The competitive interest rates and flexible repayment options were also frequently cited as significant advantages. The overall sentiment was one of satisfaction and relief, with many borrowers expressing gratitude for the financial assistance provided.

Negative AAFMAA Cap Loan Experiences and Resolutions

While the majority of experiences were positive, some borrowers encountered challenges. A few instances involved delays in processing applications, often attributed to incomplete documentation or unforeseen circumstances. In these cases, AAFMAA customer service proactively contacted borrowers to clarify the required information, ensuring a timely resolution. Another issue reported was a misunderstanding regarding repayment terms. These situations were typically resolved through clear communication and adjustments to the repayment schedule to better align with the borrower’s financial situation. AAFMAA demonstrated flexibility in these instances, prioritizing customer satisfaction and working collaboratively to find solutions.

Summary of Customer Experiences

| Aspect | Positive Experience | Negative Experience | Resolution |

|---|---|---|---|

| Application Process | Straightforward, efficient, minimal paperwork, quick processing. | Delays due to incomplete documentation. | Proactive communication from AAFMAA to request missing information. |

| Customer Service | Helpful, responsive, timely updates and prompt responses. | Difficulty reaching customer service representatives. | Improved communication channels and increased staffing. (Note: This resolution is inferred based on common practices to address such issues.) |

| Interest Rates and Fees | Competitive interest rates and transparent fee structure. | Misunderstanding of fees. | Clear explanation of fees and adjustments to the loan agreement. |

| Repayment Options | Flexible repayment options tailored to individual needs. | Misunderstanding of repayment terms. | Revised repayment schedule to accommodate borrower’s financial situation. |

Comparison with Other Loan Types

AAFMAA CAP loans, while offering attractive features for military members, aren’t the only financing option available. Understanding how they stack up against other popular loan types, such as VA loans and personal loans, is crucial for making an informed decision. This comparison will highlight key differences in terms, interest rates, eligibility, and overall suitability for various financial needs.

AAFMAA CAP loans primarily target active-duty and retired military personnel and their families, offering competitive rates and flexible repayment options tailored to their unique circumstances. However, VA loans and personal loans cater to broader populations and offer distinct advantages and disadvantages.

Comparison of AAFMAA CAP Loans, VA Loans, and Personal Loans

The following table summarizes the key differences between AAFMAA CAP loans, VA loans, and personal loans, allowing for a clearer understanding of their respective strengths and weaknesses. It’s important to note that specific rates and terms can vary depending on individual creditworthiness and the lender.

| Feature | AAFMAA CAP Loan | VA Loan | Personal Loan |

|---|---|---|---|

| Eligibility | Active-duty, retired military, and their families. | Eligible veterans, service members, and surviving spouses. Specific requirements vary by program. | Generally available to individuals with sufficient credit history and income. |

| Loan Purpose | Debt consolidation, home improvements, major purchases. | Primarily for purchasing a home or refinancing an existing mortgage. | Highly versatile; can be used for various purposes, including debt consolidation, home improvements, or major purchases. |

| Interest Rates | Competitive rates, often lower than average personal loans, but may vary based on credit score and loan amount. | Rates are typically lower than conventional mortgages, determined by market conditions and the veteran’s creditworthiness. | Rates vary significantly based on credit score, loan amount, and lender. Generally higher than VA or AAFMAA CAP loans. |

| Down Payment | Down payment requirements vary depending on the loan amount and purpose. | VA loans often require no down payment, but may require a funding fee. | Down payment requirements vary widely depending on the lender and loan type. Often higher than VA loans. |

| Fees | Fees may include origination fees, application fees, and other charges. Details should be reviewed carefully. | Funding fees are common, though they may be financed into the loan. Closing costs are also applicable. | Fees can include origination fees, application fees, and prepayment penalties. Fees vary considerably among lenders. |

| Repayment Terms | Flexible repayment options are available, tailored to individual needs. | Repayment terms are typically longer than personal loans, often spanning decades for mortgages. | Repayment terms vary widely, ranging from a few months to several years. |

Financial Planning Considerations

Integrating an AAFMAA CAP loan into your overall financial strategy requires careful consideration of your current financial situation and long-term goals. Understanding the loan’s terms, potential impact on your credit, and how it aligns with your broader financial objectives is crucial for responsible borrowing. Failure to do so can lead to unforeseen financial difficulties.

Responsible borrowing with an AAFMAA CAP loan hinges on a clear understanding of your budget and debt capacity. Before applying, meticulously assess your monthly income and expenses to determine your ability to comfortably make the required loan payments without compromising other essential financial obligations. This includes factoring in potential fluctuations in income and unexpected expenses.

Responsible Borrowing Practices

Responsible use of an AAFMAA CAP loan involves several key practices. First, thoroughly review the loan agreement to fully understand the terms and conditions, including interest rates, fees, and repayment schedule. Second, only borrow the amount you absolutely need; avoid overextending yourself financially. Third, create a realistic budget that incorporates the monthly loan payment and stick to it. Finally, explore all available repayment options to find one that best suits your financial circumstances and minimizes potential financial strain. Failing to adhere to these practices can lead to late payments, increased debt, and damage to your credit score.

Impact on Credit Score

An AAFMAA CAP loan, like any other loan, can impact your credit score. Responsible management, characterized by timely payments and maintaining a low debt-to-income ratio, will generally have a positive effect or at least a neutral one. Conversely, missed or late payments can significantly lower your credit score, making it more difficult to obtain future loans or secure favorable interest rates. The impact on your credit score is directly related to your repayment behavior. For instance, consistently making on-time payments will help build your credit history, while consistent late payments can severely damage it. The severity of the impact depends on the extent and duration of delinquency. A single missed payment might have a minor effect, while repeated late payments can lead to substantial negative consequences. Moreover, factors such as your credit utilization ratio (the amount of credit you use compared to your total available credit) and your overall credit history will also play a role in determining the overall impact.

Last Word

Securing the right financial product is paramount for military members, and AAFMAA cap loans offer a potential solution for various financial needs. By carefully considering the information presented—including interest rates, fees, repayment options, and comparisons with other loan types—military personnel can make informed decisions that align with their individual financial goals. Remember to always explore all available options and consult with a financial advisor to ensure the best fit for your specific circumstances.

Question Bank

What credit score is needed for an AAFMAA cap loan?

AAFMAA’s specific credit score requirements aren’t publicly listed. However, a good to excellent credit score is generally needed for loan approval, similar to most financial institutions.

Can I use an AAFMAA cap loan for home improvement?

While primarily used for debt consolidation or large purchases, depending on the loan terms and your approval, you may be able to use an AAFMAA cap loan for home improvements. It’s best to contact AAFMAA directly to confirm.

What happens if I miss a payment on my AAFMAA cap loan?

Missing payments will negatively impact your credit score and may incur late fees. Contact AAFMAA immediately if you anticipate difficulty making a payment to explore potential solutions.

Are there prepayment penalties with AAFMAA cap loans?

AAFMAA’s loan terms regarding prepayment penalties should be clearly Artikeld in your loan agreement. Review this document carefully to understand any associated fees.