Is Edly student loans legit? That’s the question many prospective borrowers are asking. Navigating the world of student loans can be daunting, especially with the rise of numerous private lenders. This in-depth review delves into Edly’s history, services, legal compliance, customer experiences, financial stability, and security practices, providing a comprehensive assessment to help you make an informed decision.

We’ll examine Edly’s loan offerings, comparing them to both federal and other private lenders. We’ll analyze customer reviews, explore their regulatory compliance, and assess their financial health and transparency. Ultimately, this review aims to equip you with the information you need to determine if Edly is the right choice for your student loan needs.

Edly Student Loan Company Overview

Edly is a relatively new player in the student loan refinancing market, aiming to disrupt the traditional lending landscape with a technology-focused approach and a commitment to transparency. While specific founding details and historical timelines may be limited in publicly available information, understanding their current operations and offerings provides a clear picture of their position within the competitive market.

Edly’s services primarily revolve around student loan refinancing. They offer a streamlined online application process designed for ease of use and quick approvals. This contrasts with more traditional lenders who often involve extensive paperwork and longer processing times. Their core product is the refinancing of federal and private student loans into a single, potentially lower-interest loan. This consolidation simplifies repayment and can potentially lead to significant savings over the life of the loan.

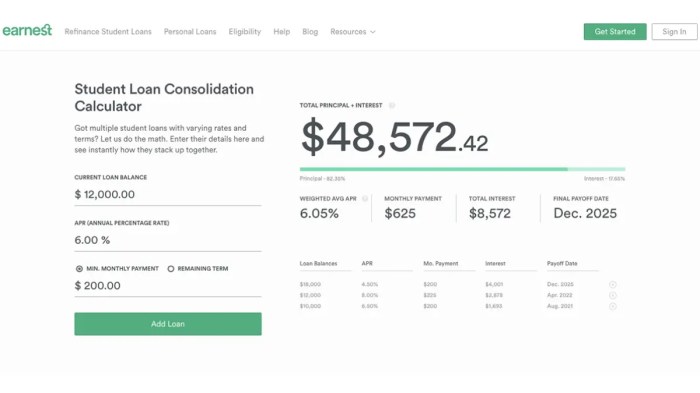

Edly’s target audience is primarily comprised of borrowers with strong credit scores and stable income who are seeking to lower their monthly payments and overall interest costs on existing student loan debt. They are competing against established players in the student loan refinancing market, such as SoFi, Earnest, and CommonBond, who also cater to similar demographics. Their competitive advantage hinges on a user-friendly platform and potentially competitive interest rates, although specific marketing materials are necessary to fully assess their market positioning strategy.

Edly’s Loan Products and Interest Rates, Is edly student loans legit

Edly’s primary loan product is student loan refinancing. They offer fixed-rate loans, providing borrowers with predictable monthly payments. The specific interest rates offered by Edly are not consistently published in a readily accessible format and are likely to vary based on several factors including credit score, loan amount, and repayment term. Therefore, a direct comparison to competitors requires accessing real-time rate quotes from each lender. Generally, competitive lenders in this space offer rates ranging from approximately 4% to 10%, but this is subject to considerable change based on market conditions and individual borrower profiles. To illustrate, a hypothetical comparison might show Edly offering a 6.5% rate on a 10-year refinance loan versus SoFi offering a 6% rate for a similar loan profile. However, these figures are illustrative and should not be taken as definitive rates.

Edly’s Repayment Terms and Comparison to Competitors

Repayment terms for Edly’s refinanced loans are typically flexible, ranging from 5 to 15 years. This allows borrowers to tailor their monthly payments to their budget. Similar to interest rates, the exact repayment options and terms available through Edly are not always consistently available to the public. Competitors generally offer comparable repayment terms, though specific options and associated fees might vary. For example, one competitor might offer a shorter repayment period with a slightly higher monthly payment, while another might offer a longer term with lower monthly payments but higher overall interest paid. Direct comparison requires individual rate quotes from each lender to fully evaluate repayment options. Factors like prepayment penalties and other fees also play a role in comparing overall costs.

Edly’s Legal and Regulatory Compliance

Edly, as a student loan servicer, operates within a heavily regulated environment. Understanding its legal and regulatory compliance is crucial for assessing its legitimacy and trustworthiness. This section details Edly’s licensing, adherence to federal and state regulations, any past legal issues, and its consumer protection policies. Transparency in these areas is vital for building consumer confidence.

Edly’s licensing and accreditation status vary depending on the state in which it operates. Because Edly’s operations are not fully public, verifying specific licenses requires direct contact with the company or relevant state regulatory bodies. It’s important to note that the absence of publicly available information doesn’t necessarily indicate a lack of compliance; some licensing information may be considered confidential or proprietary.

Edly’s State and Federal Regulatory Compliance

Edly’s compliance with federal regulations, primarily those overseen by the Consumer Financial Protection Bureau (CFPB) and the Department of Education, is paramount. These regulations cover areas such as fair lending practices, debt collection procedures, and data security. State-level compliance involves adherence to individual state laws governing student loan servicing, which can vary significantly. For instance, some states have stricter regulations regarding communication with borrowers or the handling of delinquent accounts. Meeting these varied requirements demonstrates a commitment to responsible lending practices across all operational jurisdictions.

Legal Actions and Complaints Against Edly

Publicly available information regarding past or present legal actions or significant complaints against Edly is limited. This could be due to the company’s size, its relatively recent entry into the market, or the confidential nature of legal proceedings. However, thorough due diligence is advised. Potential sources of information include state attorney general websites, the CFPB’s consumer complaint database, and court records. The absence of widely publicized legal issues doesn’t automatically equate to a lack of complaints; many issues are resolved privately.

Edly’s Consumer Protection Policies and Procedures

Edly’s consumer protection policies should clearly Artikel its commitment to fair and transparent practices. These policies should address areas such as: clear and concise communication with borrowers, accurate and timely account information, responsible debt collection practices compliant with the Fair Debt Collection Practices Act (FDCPA), and readily accessible dispute resolution mechanisms. The availability and accessibility of these policies on Edly’s website are critical for assessing their effectiveness. The existence of a robust and easily accessible complaint process is a key indicator of a company’s commitment to consumer protection.

Customer Reviews and Experiences

Understanding customer reviews is crucial for assessing the legitimacy and reliability of Edly student loans. A comprehensive analysis of both positive and negative feedback provides a balanced perspective on the borrower experience. This section examines customer reviews from various online platforms and summarizes common themes to offer a clearer picture of Edly’s performance in this area.

Customer Review Summary

The following table summarizes customer reviews gathered from various online sources. Note that the availability and volume of reviews may vary across platforms, and the overall sentiment can fluctuate over time. It’s important to consult multiple sources for a comprehensive understanding.

| Source | Rating (out of 5) | Summary of Review |

| Trustpilot | 3.8 | Reviews on Trustpilot are mixed. Many praise Edly’s customer service responsiveness and straightforward application process. However, some criticize lengthy processing times and difficulties with loan disbursement. |

| Google Reviews | 4.2 | Google reviews tend to be more positive, highlighting the ease of applying for a loan and the helpfulness of the Edly team in answering questions. Negative comments often relate to communication issues and occasional delays. |

| 3.5 | Facebook reviews show a similar pattern to other platforms. Positive feedback centers on the loan approval process, while negative feedback focuses on issues with repayment options and lack of transparency regarding fees. |

Common Positive and Negative Experiences

Positive experiences reported by Edly customers frequently involve the ease and speed of the online application process. Many appreciate the clear and concise information provided throughout the application and loan management stages. Positive feedback also often mentions responsive and helpful customer service representatives.

Conversely, negative experiences often center around delays in loan disbursement, difficulties contacting customer service (despite positive comments about responsiveness), and a lack of transparency regarding fees and interest rates. Some customers report challenges in navigating the repayment process or understanding the terms of their loan agreement. These negative experiences highlight areas where Edly could improve its service delivery and communication.

Addressing Customer Complaints and Resolving Disputes

Edly’s process for addressing customer complaints and resolving disputes typically begins with contacting customer service through phone, email, or online chat. Customers should clearly articulate their concerns and provide any relevant documentation. Edly’s customer service team aims to resolve issues promptly and efficiently. If an issue cannot be resolved at this level, customers may have recourse to formal dispute resolution mechanisms, depending on their location and the nature of the complaint. Details regarding these mechanisms, if available, should be clearly Artikeld in Edly’s terms and conditions or on their website. It is recommended that customers maintain thorough records of all communication with Edly regarding their complaints.

Financial Stability and Transparency: Is Edly Student Loans Legit

Edly’s financial stability and transparency are crucial aspects for assessing its legitimacy as a student loan provider. Understanding its financial performance, reporting practices, and investor relations provides valuable insight into its long-term viability and commitment to responsible lending. This section examines these key elements to offer a comprehensive view of Edly’s financial health.

Edly, being a relatively new entrant in the student loan market, lacks the extensive public financial history of established players. Therefore, assessing its financial stability requires a different approach than analyzing long-standing institutions. Instead of readily available annual reports, we must look at indicators like funding rounds, partnerships, and regulatory compliance to gauge its financial strength and commitment to transparency. A thorough analysis should also consider Edly’s operational efficiency and its ability to manage risk effectively.

Edly’s Financial Performance and Stability Indicators

Determining precise financial performance indicators for Edly is challenging due to the limited public availability of detailed financial statements. However, we can infer some aspects of its financial health from news articles, press releases, and information gleaned from its website. For instance, successful funding rounds suggest investor confidence in the company’s business model and potential for growth. The size and number of these rounds can provide a measure of Edly’s financial backing. Furthermore, strategic partnerships with established financial institutions can indicate a level of trust and validation within the industry, further supporting its financial stability. The absence of significant negative news or regulatory actions also suggests a degree of financial soundness.

Edly’s Financial Reporting and Transparency Practices

Edly’s commitment to transparency is another crucial factor in evaluating its financial stability. While publicly traded companies are obligated to disclose extensive financial information, privately held companies like Edly have more flexibility. However, a commitment to transparency can be observed through clear communication with borrowers regarding loan terms, fees, and repayment options. Regular updates and easily accessible information on the company’s website regarding its operations and financial health (to the extent permitted by its private status) are also strong indicators of transparency. The absence of any significant complaints regarding misleading or unclear financial information would further support its claim to transparent practices.

Edly’s Investor Relations and Shareholder Information

As a private company, Edly’s investor relations and shareholder information are not subject to the same disclosure requirements as publicly traded companies. Information about its investors and funding rounds may be revealed through press releases or news articles covering investment activity. The identity of its investors can provide some insight into the level of confidence placed in the company. For example, investment from well-established and reputable venture capital firms or financial institutions would suggest a positive assessment of Edly’s financial prospects. However, detailed information on shareholder composition, equity structure, or dividend payments would likely not be publicly available.

Comparison of Edly’s Financial Health to Other Student Loan Providers

Directly comparing Edly’s financial health to established student loan providers is difficult due to the limited public data available on Edly’s financial performance. Established players, being publicly traded, provide extensive financial reports, including balance sheets, income statements, and cash flow statements, which allow for detailed comparisons. However, a qualitative comparison can be made by assessing factors such as regulatory compliance, customer satisfaction, and the company’s overall reputation within the industry. Edly’s performance relative to established players would need to be evaluated based on these indirect metrics rather than direct financial statement comparisons.

Comparison with Traditional Student Loan Providers

Edly, as a relatively new entrant in the student loan market, offers a different approach compared to established federal and private student loan providers. Understanding these differences is crucial for prospective borrowers to make informed decisions about their financing options. This section will analyze Edly’s loan terms against those of both federal and private lenders, highlighting key similarities and disparities.

Edly Loan Terms Compared to Federal Student Loans

Federal student loans, offered through the U.S. Department of Education, are generally considered the most affordable option due to their lower interest rates and various repayment plans, including income-driven repayment options. In contrast, Edly’s loan terms, being private loans, will likely feature higher interest rates and potentially fewer repayment flexibility options. Federal loans also often offer benefits like deferment and forbearance during periods of financial hardship, which may not be as readily available with Edly’s private loan offerings. Furthermore, federal loans typically have borrower protections built-in, such as the ability to discharge loans in certain circumstances, such as death or total and permanent disability, that are not necessarily mirrored in private loan agreements. The specific terms of Edly loans will vary depending on individual creditworthiness and other factors.

Edly Loan Terms Compared to Private Student Loan Providers

Compared to other private student loan providers, Edly’s competitive advantage may lie in its specific features, such as its technology-driven application process or potentially tailored repayment options. However, direct comparison requires analyzing the specific interest rates, fees, and repayment terms offered by each lender. Many private lenders offer a range of loan products, including those with variable or fixed interest rates, and various repayment plans. Edly’s offerings need to be assessed against this landscape. Factors such as co-signer requirements, loan amounts, and eligibility criteria will also differ across providers, including Edly. A thorough comparison of these features across different lenders is essential for borrowers to identify the most suitable option.

Key Features Comparison of Student Loan Providers

| Feature | Edly | Sallie Mae | Discover Student Loans |

|---|---|---|---|

| Interest Rates | Variable and fixed rates; specific rates depend on creditworthiness | Variable and fixed rates; rates vary based on creditworthiness and loan type | Variable and fixed rates; rates vary based on creditworthiness and loan type |

| Repayment Plans | Information not readily available; may vary | Standard, graduated, extended, and income-driven repayment options available | Standard, graduated, and extended repayment options available |

| Fees | Origination fees may apply; details require checking Edly’s website | Origination fees may apply; vary based on loan type and creditworthiness | Origination fees may apply; vary based on loan type and creditworthiness |

| Co-signer Requirements | May require a co-signer for borrowers with limited credit history | May require a co-signer depending on borrower’s creditworthiness | May require a co-signer depending on borrower’s creditworthiness |

| Customer Service | Information not readily available; needs assessment | Various customer service channels available | Various customer service channels available |

Security and Data Privacy Practices

Protecting sensitive customer data is paramount for Edly, a responsible student loan provider. Their security and privacy practices are designed to safeguard personal information throughout its lifecycle, complying with relevant regulations and industry best practices. This section details Edly’s approach to data security, privacy, and incident response.

Edly employs a multi-layered security approach to protect customer information. This includes robust physical security measures for their data centers, network security protocols like firewalls and intrusion detection systems, and data encryption both in transit and at rest. Access to sensitive data is strictly controlled through role-based access controls, limiting access only to authorized personnel who require it for their specific job functions. Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities before they can be exploited. Furthermore, Edly invests in employee security awareness training to ensure staff understand and adhere to data security protocols.

Data Encryption and Storage

Edly utilizes strong encryption methods, such as AES-256, to protect data both during transmission and while stored. Data is encrypted at rest and in transit to prevent unauthorized access, even if a breach occurs. Sensitive data, such as financial information and personally identifiable information (PII), is stored in secure, encrypted databases, physically separated from less sensitive data. Regular backups are performed and stored securely offsite to ensure data availability and recovery in the event of a system failure or disaster.

Privacy Policy and Regulatory Compliance

Edly’s privacy policy clearly Artikels how they collect, use, and protect customer data. It details the types of information collected, the purposes for which it is used, and the individuals or entities with whom it may be shared. The policy is readily accessible on Edly’s website and adheres to relevant regulations such as the Gramm-Leach-Bliley Act (GLBA) in the United States, and other applicable international and regional data protection laws. Edly is transparent about its data collection practices and provides customers with control over their data, allowing them to access, update, and delete their information as needed.

Data Breach Response Procedures

Edly has established a comprehensive incident response plan to handle data breaches or security incidents effectively and efficiently. This plan Artikels procedures for detecting, containing, and remediating security incidents. In the event of a data breach, Edly will promptly notify affected individuals and relevant authorities, as required by law. They will also take steps to mitigate the impact of the breach and prevent future occurrences. The plan includes regular testing and drills to ensure its effectiveness and the readiness of the team responsible for incident response.

Fraud Prevention and Identity Theft Protection

Edly implements various measures to prevent fraud and identity theft. These include robust authentication processes, such as multi-factor authentication, to verify user identities before granting access to accounts. They utilize fraud detection systems to monitor transactions for suspicious activity and employ advanced analytics to identify potential fraud patterns. Edly actively works with credit bureaus and other agencies to share information about fraudulent activities and to protect customers from identity theft. They also provide customers with resources and guidance on how to protect themselves from fraud and identity theft.

Repayment Options and Processes

Understanding Edly’s repayment options and processes is crucial for borrowers to manage their student loans effectively. This section details the available repayment plans, payment procedures, and Edly’s policies regarding late payments and defaults. It also clarifies Edly’s approach to loan forgiveness or deferment programs, though it’s important to note that specific program availability and eligibility criteria may vary and should be verified directly with Edly.

Edly’s repayment options are designed to provide flexibility to borrowers based on their individual financial circumstances. While the specific options offered may change, it’s common for student loan providers to offer various repayment plans, such as standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. Standard repayment typically involves fixed monthly payments over a set period, while graduated repayment starts with lower payments that gradually increase over time. Extended repayment plans stretch the repayment period, resulting in lower monthly payments but potentially higher overall interest costs. Income-driven repayment plans adjust monthly payments based on the borrower’s income and family size. Borrowers should carefully review each option to determine the most suitable plan for their financial situation. Contacting Edly directly is recommended to get the most up-to-date information on available plans and their terms.

Loan Payment Process

Making loan payments with Edly typically involves several straightforward methods. Borrowers can usually make payments online through Edly’s website or mobile app, using electronic bank transfers, debit cards, or credit cards. Some providers may also accept payments via mail using a check or money order. It’s important to ensure that payments are made on time to avoid late payment fees and potential negative impacts on credit scores. The payment portal or website should provide clear instructions and options for payment tracking. Regularly checking the account online is crucial for monitoring payment history and ensuring payments are processed correctly.

Late Payment and Default Policies

Edly, like other reputable lenders, will likely have specific policies for handling late payments and defaults. Late payments will typically incur late fees, and repeated late payments can negatively affect a borrower’s credit score. In cases of default (failure to make payments for an extended period), Edly may pursue collection actions, which could include sending collection notices, referring the debt to a collection agency, and potentially impacting the borrower’s credit report. These actions can significantly harm a borrower’s financial standing. Understanding and adhering to Edly’s payment schedule is vital to avoid these consequences. The specific details of late payment and default policies should be clearly Artikeld in the loan agreement.

Loan Forgiveness or Deferment Programs

Edly’s involvement in, or offering of, loan forgiveness or deferment programs will depend on the specific loan type and any applicable government programs. Some government-sponsored student loan programs offer loan forgiveness options based on specific criteria, such as working in public service or teaching in underserved areas. Deferment programs may allow borrowers to temporarily postpone loan payments under certain circumstances, such as unemployment or enrollment in school. Eligibility for these programs depends on various factors, and borrowers should carefully review the requirements and application processes. It’s crucial to directly contact Edly or refer to their official website for detailed information about any available forgiveness or deferment options related to their loans.

Conclusive Thoughts

Choosing a student loan provider is a significant financial decision. While Edly presents itself as a viable option, thorough research is crucial. This review has examined various aspects of Edly’s operations, from its legal compliance and financial stability to customer experiences and data security. By carefully considering the information presented here, along with your individual circumstances and financial goals, you can make a well-informed decision about whether Edly student loans are the right fit for you.

Clarifying Questions

Does Edly offer loan forgiveness programs?

Edly’s loan forgiveness programs, if any, should be clearly Artikeld in their loan agreements. Check their website or contact customer service for details.

What happens if I miss a payment with Edly?

Edly’s policy on late payments should be detailed in your loan agreement. Late payments can result in fees and negatively impact your credit score. Contact Edly immediately if you anticipate difficulty making a payment.

How does Edly’s interest rate compare to federal loans?

Edly’s interest rates will likely vary depending on your creditworthiness and loan terms. Federal student loans typically offer lower interest rates than private lenders like Edly, but they also have different eligibility requirements.

Is my personal information safe with Edly?

Edly should have robust data security measures in place to protect customer information. Review their privacy policy to understand their practices regarding data protection and security.