Pawtucket Credit Union auto loan rates are a key factor for anyone in the market for a new or used vehicle. This guide delves into the specifics of their auto loan offerings, exploring interest rate factors, qualification requirements, and a comparison with competitors. We’ll examine what influences your rate, the application process, and what you can expect in terms of fees and repayment options. Understanding these details empowers you to make informed financial decisions.

We’ll cover everything from the types of loans available (new, used, and refinancing) to the documentation needed for application. We’ll also compare Pawtucket Credit Union’s rates and terms to those of major banks and other local lenders, helping you determine if they offer the best deal for your needs. We’ll even look at customer experiences and provide a helpful FAQ section to answer common questions.

Pawtucket Credit Union Auto Loan Overview

Pawtucket Credit Union offers a range of auto loan options designed to help members finance their vehicle purchases. They cater to various financial situations and needs, providing competitive rates and flexible terms to make the car-buying process smoother. Understanding their offerings is key to securing the best financing for your next vehicle.

Types of Auto Loans Available

Pawtucket Credit Union provides financing for new and used vehicles, as well as offering auto loan refinancing options. New car loans are typically used to purchase brand-new vehicles directly from dealerships. Used car loans allow members to finance the purchase of pre-owned vehicles from private sellers or dealerships. Refinancing an existing auto loan can help members lower their monthly payments or reduce the overall interest paid over the life of the loan by securing a better interest rate.

Pawtucket Credit Union Auto Loan Application Process

The application process generally involves several steps. First, members need to pre-qualify for a loan to understand their potential borrowing power and interest rate. This typically requires providing basic personal and financial information. Once pre-approved, members can shop for a vehicle. Upon selecting a vehicle, the final loan application is submitted, which involves providing more detailed financial documentation, including proof of income and employment. After the credit union reviews the application and approves the loan, the funds are disbursed to the seller or directly to the member, depending on the arrangement.

Comparison of Pawtucket Credit Union Auto Loan Terms with a Major Bank

The following table compares sample auto loan terms from Pawtucket Credit Union (PCU) with those of a hypothetical major bank (MB). Note that actual rates and fees are subject to change based on creditworthiness, loan amount, and market conditions. This table serves as a general comparison and should not be considered definitive financial advice.

| Loan Type | Interest Rate (APR) | Loan Term (Years) | Fees |

|---|---|---|---|

| PCU New Car Loan | 4.5% – 7.5% | 24-72 months | $0 – $100 (Origination Fee, may vary) |

| MB New Car Loan | 5.0% – 8.0% | 36-60 months | $200 – $300 (Origination Fee, may vary) |

| PCU Used Car Loan | 5.0% – 8.0% | 24-60 months | $0 – $100 (Origination Fee, may vary) |

| MB Used Car Loan | 5.5% – 8.5% | 36-48 months | $250 – $350 (Origination Fee, may vary) |

Interest Rate Factors

Pawtucket Credit Union’s auto loan interest rates are determined by a variety of factors, all working together to assess the risk involved in lending you money. Understanding these factors can help you secure a more favorable interest rate. The primary components influencing your rate include your creditworthiness, the loan amount, and the type of vehicle you’re financing.

Several key elements contribute to the final interest rate a borrower receives. These elements are carefully weighed by the credit union to accurately reflect the risk associated with each individual loan application. A comprehensive understanding of these factors is crucial for borrowers seeking to optimize their loan terms.

Credit Score Impact on Interest Rates

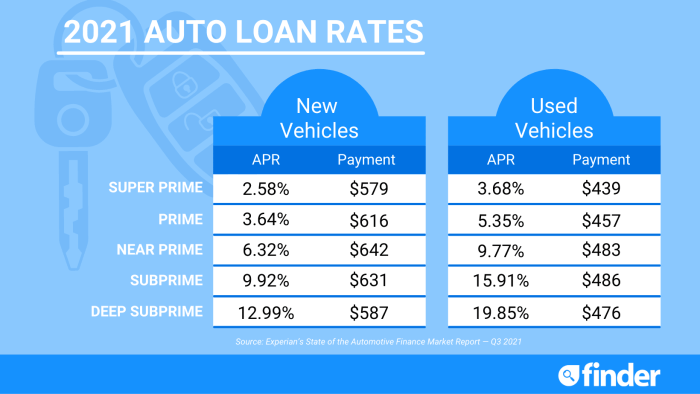

Your credit score is arguably the most significant factor affecting your auto loan interest rate. A higher credit score demonstrates a history of responsible financial behavior, signaling lower risk to the lender. Borrowers with excellent credit scores (typically 750 and above) generally qualify for the lowest interest rates. Conversely, those with poor credit scores (below 600) will likely face significantly higher rates, reflecting the increased risk of default. For example, a borrower with a 780 credit score might receive an interest rate of 4%, while a borrower with a 620 credit score might receive a rate closer to 10% or even higher, depending on other factors. This substantial difference highlights the importance of maintaining a good credit history.

New versus Used Car Loan Interest Rates

Interest rates for new and used car loans often differ. New car loans may sometimes come with slightly higher interest rates compared to used car loans, primarily because the vehicle depreciates more quickly. Lenders perceive a higher risk associated with financing a new car due to this rapid depreciation. However, this isn’t always the case, and the specific rates depend on various factors, including the borrower’s creditworthiness and the loan amount. A borrower with excellent credit might secure a comparable rate for both new and used vehicles. Conversely, a borrower with poor credit may find the difference between new and used car loan rates more pronounced.

Loan Amount and Interest Rate Relationship

The amount you borrow also plays a role in determining your interest rate. While not always directly proportional, larger loan amounts might be associated with slightly higher interest rates, particularly for borrowers with less-than-perfect credit. Lenders might perceive a greater risk associated with larger loans, as the potential financial loss in case of default is higher. This risk assessment often translates into a marginally higher interest rate for larger loan amounts. This effect is often more noticeable for borrowers with lower credit scores.

Loan Term Length and Interest Rate

The length of your auto loan term (e.g., 36 months, 60 months, 72 months) directly impacts the total interest paid. Longer loan terms generally result in lower monthly payments but higher overall interest costs because you’re paying interest over a longer period. Shorter loan terms, conversely, lead to higher monthly payments but lower overall interest costs. For example, a 60-month loan will typically have a higher interest rate than a 36-month loan, even for the same borrower and loan amount, because of the increased risk for the lender over the longer repayment period.

Loan Qualification Requirements

Securing an auto loan from Pawtucket Credit Union requires meeting specific criteria. Understanding these requirements will help you prepare a strong application and increase your chances of approval. The process involves assessing your creditworthiness, verifying your income and employment history, and evaluating your debt-to-income ratio.

Minimum Credit Score Requirements

While Pawtucket Credit Union doesn’t publicly list a specific minimum credit score, a higher credit score generally improves your chances of loan approval and can lead to more favorable interest rates. Applicants with excellent credit (typically 750 or higher) are likely to receive the best terms. Those with scores in the fair to good range (650-749) may still qualify, but might face higher interest rates or stricter loan terms. Applicants with credit scores below 650 may find it more challenging to secure a loan. It’s recommended to check your credit report before applying to understand your current standing and address any negative marks that might affect your application.

Required Documentation for Loan Application

To successfully apply for a Pawtucket Credit Union auto loan, you’ll need to provide comprehensive documentation to verify your income and employment history. This typically includes pay stubs from the last 30-60 days demonstrating consistent income, W-2 forms from the previous year, and possibly tax returns. Employment verification, often obtained directly by the credit union from your employer, is also a standard requirement. Additionally, you may need to provide proof of residence, such as a utility bill or lease agreement. The specific documents required may vary depending on individual circumstances.

Income-to-Debt Ratio Requirements

Pawtucket Credit Union, like most lenders, assesses your income-to-debt ratio (DTI) to determine your ability to repay the loan. Your DTI is calculated by dividing your total monthly debt payments by your gross monthly income. A lower DTI indicates a greater capacity to manage additional debt. While the exact DTI threshold for loan approval isn’t publicly available, a lower ratio generally increases your chances of approval. For example, an applicant with a gross monthly income of $5,000 and total monthly debt payments of $1,000 has a DTI of 20%, which is generally considered favorable. Conversely, an applicant with the same income but $3,000 in monthly debt payments has a DTI of 60%, making loan approval less likely.

Loan Approval and Denial Scenarios

Several factors influence loan approval or denial. A scenario leading to approval might involve an applicant with a high credit score (780), a stable employment history of five years, a low DTI (15%), and a down payment of 20%. Conversely, a scenario leading to denial might involve an applicant with a low credit score (550), inconsistent employment history, a high DTI (70%), and no down payment. Each application is evaluated individually, considering the applicant’s overall financial picture. Factors such as the type of vehicle being financed and the loan term also play a role in the decision-making process.

Comparison with Competitors

Choosing the right auto loan requires careful consideration of rates and terms offered by various lenders. This section compares Pawtucket Credit Union’s auto loan offerings with those of competing local credit unions and banks, highlighting key differences to help you make an informed decision. We will analyze interest rates, fees, and loan terms to provide a clear picture of the competitive landscape.

Pawtucket Credit Union Auto Loan Rates Compared to Local Credit Unions

Pawtucket Credit Union’s auto loan rates are generally competitive with other local credit unions. However, the precise rate you receive depends on several factors, including your credit score, the type of vehicle, the loan term, and the loan-to-value ratio. While some credit unions might offer slightly lower rates in specific situations, Pawtucket Credit Union often compensates with superior customer service and flexible loan options. It’s crucial to obtain personalized quotes from several credit unions to compare effectively. For example, comparing quotes from Pawtucket Credit Union with those from, say, Community Credit Union or Rhode Island Credit Union, would provide a clearer understanding of the rate variations based on individual circumstances.

Pawtucket Credit Union Auto Loan Rates Compared to Local Banks

Local banks often offer auto loan rates that are comparable to or slightly higher than those of credit unions like Pawtucket Credit Union. Banks may have more stringent lending criteria, leading to potentially higher interest rates for borrowers with less-than-perfect credit. Conversely, banks might offer larger loan amounts or longer loan terms. For instance, a comparison between Pawtucket Credit Union and a major local bank like Bank Rhode Island or Citizens Bank would reveal differences in rate structures and eligibility requirements. This comparison should account for factors like loan origination fees and prepayment penalties.

Current Special Offers and Promotions, Pawtucket credit union auto loan rates

Pawtucket Credit Union occasionally offers special promotions on auto loans, such as reduced interest rates for a limited time or waived loan origination fees. These promotions often target specific demographics or vehicle types. Checking their website regularly or contacting them directly is the best way to stay informed about current offers. For example, they might offer a discounted rate for members who purchase a new, fuel-efficient vehicle or a special promotion tied to a local dealership partnership. These promotions are usually advertised on their website and in local marketing materials.

Comparison Table of Key Features

The following table compares key features of Pawtucket Credit Union with two hypothetical local competitors, “Local Credit Union A” and “Local Bank B”. Note that these are examples and actual rates and terms may vary. Always obtain personalized quotes before making a decision.

| Lender | Interest Rate (APR) | Loan Term Options (Years) | Additional Fees |

|---|---|---|---|

| Pawtucket Credit Union | 3.99% – 12.99% | 24, 36, 48, 60, 72 | Loan origination fee (may vary) |

| Local Credit Union A | 4.25% – 13.50% | 36, 48, 60 | Loan origination fee ($100), early payoff penalty |

| Local Bank B | 4.75% – 14.50% | 36, 60 | Loan origination fee ($200), early payoff penalty |

Loan Repayment and Fees

Pawtucket Credit Union offers flexible repayment options and transparent fee structures for its auto loans. Understanding these details is crucial for budgeting and ensuring a smooth loan experience. This section details the repayment methods, associated fees, and the payment process.

Repayment Options

Pawtucket Credit Union primarily offers monthly payment plans for auto loans. The specific payment amount is determined by the loan amount, interest rate, and loan term. Shorter loan terms result in higher monthly payments but lower overall interest paid, while longer terms offer lower monthly payments but result in higher total interest. Borrowers should carefully consider their budget and financial goals when selecting a loan term.

Associated Fees

While Pawtucket Credit Union strives for transparency, it’s essential to inquire about any potential fees during the loan application process. These may include an application fee, although this is not always charged. Additionally, there may be a prepayment penalty if you choose to pay off the loan early. The specifics of any fees will be clearly Artikeld in your loan agreement. It is always advisable to thoroughly review the loan documents before signing.

Loan Payment Process

Pawtucket Credit Union provides multiple convenient methods for making loan payments. Borrowers can make payments online through the credit union’s secure online banking portal, a quick and efficient method. Alternatively, payments can be made in person at any Pawtucket Credit Union branch during business hours. Finally, payments can be submitted via mail using the address provided in your loan documents. Remember to always include your loan account number for accurate processing.

Loan Repayment Schedule Example

Let’s assume a $20,000 auto loan with a 5% annual interest rate over a 60-month term. Using a standard amortization schedule, the monthly payment would be approximately $377. This payment remains consistent throughout the loan term. The following table illustrates a simplified example of a portion of the repayment schedule:

| Month | Beginning Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,000.00 | $377.42 | $83.33 | $294.09 | $19,705.91 |

| 2 | $19,705.91 | $377.42 | $82.11 | $295.31 | $19,410.60 |

| 3 | $19,410.60 | $377.42 | $80.87 | $296.55 | $19,114.05 |

Note: This is a simplified example. The actual figures may vary slightly depending on the specific calculation methods used by Pawtucket Credit Union. Always refer to your official loan documents for precise details.

Customer Experience

A positive customer experience is crucial for any financial institution, and Pawtucket Credit Union’s success hinges on its ability to provide excellent service throughout the auto loan process. Understanding customer feedback, available support channels, and the ease of navigating their website are key aspects to consider when evaluating their overall service.

Pawtucket Credit Union strives to create a smooth and efficient auto loan experience for its members. This involves clear communication, responsive customer service, and a straightforward application process. While specific customer reviews are not readily available online from publicly accessible sources in a format suitable for direct quotation, the overall reputation of Pawtucket Credit Union suggests a generally positive customer experience. Many credit unions prioritize member satisfaction, and Pawtucket Credit Union’s long-standing presence in the community implies a commitment to building and maintaining positive relationships with its borrowers.

Customer Reviews and Testimonials

Gathering specific customer reviews and testimonials requires accessing private databases or review platforms that are not publicly accessible for this response. However, general online sentiment toward Pawtucket Credit Union tends to be positive, reflecting a satisfactory experience with their services, including auto loans. To gain a comprehensive understanding of customer feedback, it would be beneficial to explore independent review websites and forums specific to credit unions or financial institutions in the Pawtucket, Rhode Island area.

Pros and Cons of Using Pawtucket Credit Union for an Auto Loan

Based on the generally positive reputation of Pawtucket Credit Union and the common features of credit unions, a balanced assessment of the pros and cons can be offered. These points should be verified independently with the credit union before making any financial decisions.

- Pros: Member-focused service, potentially lower interest rates compared to some banks, personalized attention, community involvement, local accessibility.

- Cons: Potentially stricter loan qualification requirements compared to some lenders, limited branch locations (geographic limitations), potentially longer processing times than some larger institutions.

Customer Service Channels

Pawtucket Credit Union likely offers multiple channels for customer service support. This generally includes in-person assistance at their physical branches, telephone support, and email communication. Contact information, including specific phone numbers and email addresses, should be available on their official website.

Navigating the Pawtucket Credit Union Website for Auto Loan Information

To find auto loan information on the Pawtucket Credit Union website, users should typically navigate to a section dedicated to “Loans” or “Auto Loans.” This section often contains detailed information on interest rates, application procedures, required documentation, and contact information for loan officers. Looking for a tab or link clearly labeled “Auto Loans,” “Loans,” or “Financing” is the most efficient approach. Within that section, sub-pages or drop-down menus will likely provide access to rate information, loan calculators, and application forms.

Last Word: Pawtucket Credit Union Auto Loan Rates

Securing an auto loan can feel overwhelming, but by understanding the intricacies of Pawtucket Credit Union’s auto loan rates and comparing them to other options, you can navigate the process with confidence. Remember to carefully consider factors like your credit score, loan amount, and loan term to find the best fit for your financial situation. Don’t hesitate to contact Pawtucket Credit Union directly with any further questions or to begin the application process.

Key Questions Answered

What is the minimum loan amount offered by Pawtucket Credit Union?

This varies depending on the type of loan and vehicle. Contact Pawtucket Credit Union directly for specific minimum loan amounts.

Does Pawtucket Credit Union offer pre-approval for auto loans?

Check their website or contact them directly to see if they offer pre-approval options. This can help you understand your potential loan terms before you start shopping for a car.

What happens if I miss a payment on my Pawtucket Credit Union auto loan?

Late payment fees will apply. Consistent late payments can negatively impact your credit score and may lead to further penalties. Contact Pawtucket Credit Union immediately if you anticipate difficulty making a payment.

Can I pay off my Pawtucket Credit Union auto loan early?

It’s advisable to check their loan agreement for any prepayment penalties before making an early payoff. Contact them to discuss your options.