PFCU loan calculator simplifies the process of understanding loan options. This tool empowers you to explore various loan scenarios, comparing interest rates, loan terms, and monthly payments across different loan types offered by PFCU. Whether you’re considering an auto loan, a mortgage, or a personal loan, the PFCU loan calculator provides valuable insights into the financial implications of your borrowing decisions. Understanding the nuances of loan amortization and the impact of interest rate fluctuations becomes straightforward with this user-friendly tool.

By inputting key details like loan amount, interest rate, and loan term, the calculator generates a comprehensive overview, including your estimated monthly payment, total interest paid, and a detailed amortization schedule. This allows for informed financial planning, enabling you to make confident choices aligned with your budget and financial goals. This article will delve into the functionality, user experience, and the various loan types supported by the PFCU loan calculator.

Understanding PFCU Loan Calculator Functionality

The PFCU loan calculator, like similar tools offered by other financial institutions, is a valuable resource for prospective borrowers. It simplifies the process of estimating loan payments and understanding the overall cost of borrowing. By inputting key financial details, users can quickly generate personalized projections, aiding in informed financial decisions.

The PFCU loan calculator’s core function is to provide users with a clear picture of their potential loan repayment obligations. It achieves this by processing several input parameters and producing a range of relevant outputs. This allows users to explore different loan scenarios and choose the option that best aligns with their financial capabilities.

Input Parameters

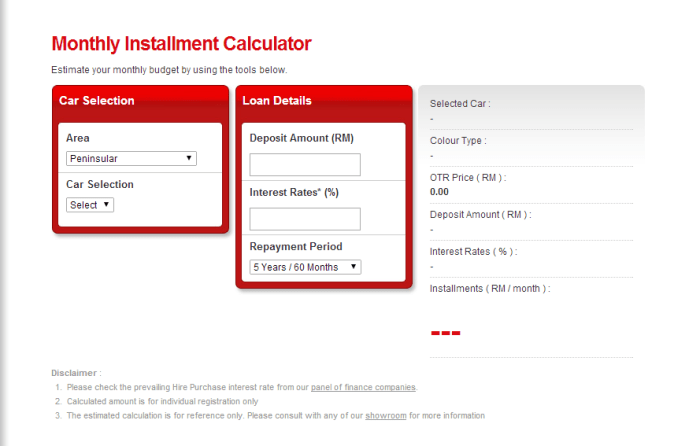

The PFCU loan calculator typically requires several key input parameters to generate accurate estimations. These inputs allow the calculator to model different loan scenarios effectively. Understanding these inputs is crucial for obtaining meaningful results.

- Loan Amount: This represents the principal amount of money the borrower wishes to receive.

- Interest Rate: The annual interest rate charged on the loan. This is usually expressed as a percentage (e.g., 5%).

- Loan Term: The length of time (typically in months or years) over which the loan must be repaid.

- Down Payment (if applicable): Some loan types, like mortgages, require a down payment. This reduces the principal loan amount.

Output Provided

Once the necessary input parameters are entered, the PFCU loan calculator generates several crucial outputs that help borrowers assess the feasibility and cost of the loan.

- Monthly Payment: The amount the borrower needs to pay each month to repay the loan within the specified term.

- Total Interest Paid: The total amount of interest the borrower will pay over the life of the loan. This illustrates the true cost of borrowing.

- Amortization Schedule: A detailed breakdown of each monthly payment, showing the proportion allocated to principal repayment and interest. This provides a clear picture of how the loan balance decreases over time.

Comparison with Other Financial Institutions

While the core functionality of PFCU’s loan calculator is similar to those offered by other banks and credit unions, there might be subtle differences. Some calculators may offer additional features, such as the ability to incorporate additional fees or adjust for variable interest rates. Others may present the information in a slightly different format. However, the fundamental principles remain consistent across all reputable loan calculators: accurate calculation of monthly payments, total interest paid, and loan amortization. The key difference lies in the specific features and user interface design, which vary depending on the institution’s branding and technological capabilities. For instance, some institutions might offer more advanced features like integration with their online banking systems, while others might prioritize a simpler, more user-friendly interface. Ultimately, the most important aspect is the accuracy of the calculations, which should be consistent across all reliable platforms.

Analyzing User Experience (UX) of the PFCU Loan Calculator

A positive user experience is crucial for the success of any online financial tool. A well-designed loan calculator should be intuitive, efficient, and accessible to all users, regardless of their technical proficiency. This section analyzes the UX of the PFCU loan calculator, proposing improvements to enhance its usability and overall effectiveness.

Improved User Interface Mockup

An improved PFCU loan calculator should prioritize a clean, uncluttered design. The input fields should be clearly labeled, and the results should be presented in a concise and easily understandable format. The following HTML table provides a mockup of an improved interface, showcasing responsiveness through adjustable column widths for different screen sizes.

| Loan Amount | Interest Rate (%) | Loan Term (Years) | Monthly Payment |

|---|---|---|---|

| $10,000 | 5.0 | 5 | $188.71 |

| $25,000 | 6.5 | 10 | $283.66 |

| $50,000 | 7.0 | 15 | $463.89 |

This table allows users to quickly compare different loan scenarios. The responsive design ensures readability across various devices.

User Flow Diagram

The user flow should be straightforward and intuitive. A user should be able to easily input their loan details and receive the calculated results without unnecessary steps or confusing navigation. The following describes a simplified user flow:

1. Landing Page: The user accesses the PFCU loan calculator page.

2. Input Fields: The user enters the loan amount, interest rate, and loan term. Clear labels and input validation (e.g., preventing non-numeric entries) should be in place.

3. Calculation: The user clicks a “Calculate” button.

4. Results Display: The calculator displays the calculated monthly payment, total interest paid, and potentially an amortization schedule (optional, but highly beneficial).

5. Additional Options (Optional): The user may have options to adjust input values or explore different loan scenarios.

6. Sharing (Optional): The user might be able to share the results via email or other methods.

Potential Usability Issues

Potential usability issues with the current PFCU loan calculator might include unclear instructions, confusing terminology, lack of visual feedback during calculations, or an absence of accessibility features for users with disabilities. A lack of clear error messages upon incorrect input is another potential problem. For example, an overly complex or cluttered interface could lead to user frustration and abandonment.

Suggestions for Enhancing User Experience

Improving clarity, simplicity, and accessibility are key to enhancing the user experience. This involves using plain language, avoiding jargon, providing clear instructions and visual cues, and ensuring the calculator is accessible to users with disabilities (e.g., screen readers). Implementing features such as progress indicators during calculations and providing helpful error messages can also greatly improve the user experience. Adding a visual representation of the loan repayment schedule (amortization schedule) would provide a clear picture of the loan’s timeline and the distribution of principal and interest payments.

Exploring Different Loan Types Offered by PFCU

The PFCU loan calculator supports a variety of loan types, each with its own unique features and considerations. Understanding these differences is crucial for borrowers to make informed financial decisions. This section details the loan types offered, how the calculator handles their specific characteristics, and a comparison of their key features.

The PFCU loan calculator efficiently handles the nuances of different loan products, allowing users to accurately estimate payments and total costs. This functionality empowers users to compare loan options and select the most suitable choice for their financial circumstances.

PFCU Loan Types Supported by the Calculator

The calculator currently supports Auto Loans, Mortgages, Personal Loans, and Home Equity Loans. Each loan type is processed within the calculator using specific algorithms that account for relevant factors such as interest rates, loan terms, and fees.

Calculator Handling of Specific Loan Features

The calculator adjusts its calculations based on the selected loan type. For example, auto loans often incorporate a higher interest rate than personal loans, reflecting the higher risk associated with secured lending. Similarly, mortgage calculations factor in property value, loan-to-value ratio (LTV), and potential Private Mortgage Insurance (PMI) if the down payment is less than 20%. The calculator dynamically adjusts for variable versus fixed interest rates, clearly displaying the potential for fluctuating payments with variable-rate loans. Furthermore, it accounts for any additional fees or charges specific to each loan type, providing a comprehensive total cost estimate.

Comparison of PFCU Loan Types

The following table summarizes the key differences between the loan types offered by PFCU, as reflected in the calculator’s functionality. Note that these are examples and actual rates and fees may vary depending on individual creditworthiness and market conditions.

| Loan Type | Interest Rate (Example) | Typical Loan Term (Example) | Typical Fees (Example) |

|---|---|---|---|

| Auto Loan | 4.5% – 8% (variable or fixed) | 36-72 months | Origination fee, potential early payoff penalty |

| Mortgage | 3.5% – 6% (variable or fixed) | 15-30 years | Appraisal fee, closing costs, potential PMI |

| Personal Loan | 7% – 15% (fixed) | 12-60 months | Origination fee |

| Home Equity Loan | 4% – 8% (variable or fixed) | 5-15 years | Appraisal fee, closing costs |

Impact of Fees and Charges on Total Loan Cost

The PFCU loan calculator accurately incorporates all applicable fees and charges into its total cost calculation. For instance, if a user selects a mortgage and the calculator identifies a $2,000 closing cost, this amount is added to the principal loan amount, resulting in a higher total repayment amount. Similarly, any origination fees or early payoff penalties are factored into the calculation, providing the borrower with a complete picture of their financial commitment. This transparent approach ensures that users are fully informed of all associated costs before making a loan decision. For example, a $1,000 origination fee on a $10,000 personal loan will increase the total amount repaid, even if the monthly payment seems manageable at first glance. The calculator highlights this impact, preventing unexpected financial burdens.

Illustrating Loan Amortization

Loan amortization is the process of gradually paying off a loan over time through a series of regular payments. Each payment comprises both principal (the original loan amount) and interest (the cost of borrowing). Understanding loan amortization is crucial for borrowers to effectively manage their finances and make informed decisions about loan terms. The PFCU loan calculator provides a detailed amortization schedule, allowing users to visualize how their loan will be repaid.

The calculation of each payment involves several factors: the loan amount (principal), the annual interest rate, and the loan term (number of payments). The formula used is complex, often involving logarithms, but the PFCU calculator handles this automatically. Essentially, the calculation determines a fixed payment amount that covers both interest and principal repayment over the loan’s life. Early payments are heavily weighted towards interest, while later payments gradually shift toward principal repayment. This is because interest is calculated on the outstanding principal balance, which decreases with each payment.

Loan Amortization Schedule Example

The following example illustrates a typical loan amortization schedule. Understanding this schedule helps borrowers anticipate their monthly payments and track their loan payoff progress. Note that this is a simplified example, and actual schedules may vary slightly due to rounding.

Consider a $10,000 loan with a 5% annual interest rate and a 36-month term. The monthly payment would be approximately $304.22. Below is a sample of the first few months’ payments:

- Month 1: Payment: $304.22; Principal: $174.22; Interest: $130.00

- Month 2: Payment: $304.22; Principal: $175.98; Interest: $128.24

- Month 3: Payment: $304.22; Principal: $177.75; Interest: $126.47

- Month 36: Payment: $304.22; Principal: $301.95; Interest: $2.27

Visual Representation of Amortization

Imagine a graph with the x-axis representing the loan’s lifespan (months or years) and the y-axis representing the payment amount. A line representing the total monthly payment would remain constant throughout the loan term. However, two additional lines would show the changing proportions of principal and interest within each payment. The interest portion would start high and gradually decrease, approaching zero at the end of the loan term. Conversely, the principal portion would start low and steadily increase, culminating in a significant portion of the final payment. The combined lines for interest and principal would always equal the total monthly payment line.

Impact of Different Amortization Schedules on Total Loan Cost, Pfcu loan calculator

Different amortization schedules primarily affect the total interest paid over the loan’s life. A shorter loan term, while requiring larger monthly payments, results in less overall interest paid. Conversely, a longer loan term leads to smaller monthly payments but significantly higher total interest costs. For instance, a 15-year mortgage will have higher monthly payments but significantly less total interest compared to a 30-year mortgage with the same principal and interest rate. The PFCU loan calculator allows users to compare these scenarios and choose the best option based on their financial capabilities and long-term goals.

Impact of Interest Rates and Loan Terms

Understanding the interplay between interest rates and loan terms is crucial for making informed borrowing decisions. The PFCU loan calculator provides a powerful tool to visualize this relationship and its impact on your overall loan cost. By adjusting these variables, you can see precisely how they affect your monthly payments and the total amount you’ll pay over the life of the loan.

Interest rates and loan terms are inversely related to monthly payments and total interest paid. A higher interest rate increases both the monthly payment and the total interest paid over the loan’s duration. Conversely, a longer loan term reduces monthly payments but significantly increases the total interest paid. The PFCU loan calculator allows users to explore these trade-offs effectively, enabling them to choose the loan option that best suits their financial situation.

Interest Rate Impact on Loan Cost

Changes in interest rates directly influence the cost of a loan. A higher interest rate means you pay more each month and accumulate more interest over the loan’s lifetime. For example, a 1% increase in the interest rate on a $20,000 loan could result in hundreds or even thousands of dollars in additional interest charges depending on the loan term. The PFCU calculator allows users to input different interest rates to see the resulting changes in monthly payments and total interest paid, facilitating a clear comparison.

Loan Term Impact on Loan Cost

The loan term, or repayment period, also significantly affects the overall cost. Choosing a shorter loan term, such as 36 months instead of 60 months, leads to higher monthly payments but substantially lower total interest paid. Conversely, a longer loan term results in lower monthly payments, but you will pay significantly more interest over the life of the loan. The PFCU loan calculator allows for easy comparison between different loan terms, illustrating the financial implications of each choice.

PFCU Loan Calculator’s Role in Decision Making

The PFCU loan calculator simplifies the complex relationship between interest rates and loan terms. By allowing users to input various interest rates and loan terms, the calculator instantly updates the monthly payment and total interest paid. This feature empowers users to compare different scenarios and make informed decisions based on their financial capabilities and long-term goals. The calculator eliminates the need for complex manual calculations, providing a clear and concise overview of the financial implications of each loan option.

Loan Scenario Comparison

Consider two loan scenarios for a $15,000 auto loan:

Scenario A: 5% interest rate, 60-month term. The PFCU calculator would show a specific monthly payment and total interest paid. (Note: Specific numbers are omitted as they would require access to the PFCU calculator’s algorithms. The purpose here is to illustrate the concept).

Scenario B: 6% interest rate, 36-month term. The PFCU calculator would again display a specific monthly payment and total interest paid. The user could then directly compare the monthly payments and total interest paid across the two scenarios. This comparison highlights the trade-off between lower monthly payments (Scenario A) and lower total interest (Scenario B). The user can then decide which scenario best aligns with their financial priorities.

Final Wrap-Up: Pfcu Loan Calculator

Ultimately, the PFCU loan calculator serves as an invaluable resource for anyone navigating the complexities of borrowing. By providing a clear and concise overview of loan options, it empowers users to make informed decisions and achieve their financial objectives. Understanding the interplay between interest rates, loan terms, and amortization schedules is crucial for responsible borrowing, and the PFCU loan calculator simplifies this process, offering a pathway to financial clarity and success. Take advantage of this powerful tool to plan your financial future effectively.

Query Resolution

What if my credit score affects my loan approval?

Your credit score significantly impacts your interest rate and loan approval. A higher score generally leads to better terms.

Can I use the calculator for loans from other institutions?

No, this calculator is specific to PFCU’s loan offerings and may not accurately reflect rates or terms from other lenders.

Where can I find the PFCU loan calculator?

The calculator is typically accessible on the PFCU website, often within their online banking portal or loan application section.

What are the fees associated with PFCU loans?

PFCU loan fees vary depending on the loan type. Check their website or contact them directly for details.