RCB Bank loan rates are a key consideration for anyone seeking financing in [Country/Region]. Understanding these rates, the factors influencing them, and how they compare to competitors is crucial for making informed borrowing decisions. This guide delves into the specifics of RCB Bank’s loan offerings, providing a comprehensive overview to empower you with the knowledge you need.

We’ll explore various loan products, detailing eligibility criteria, interest rates, and repayment options. We’ll also examine how factors like credit score, loan amount, and loan type impact the overall cost. A comparison with competitor banks will further illuminate your choices, allowing you to select the most suitable financing solution for your individual needs.

Understanding RCB Bank Loan Products

RCB Bank offers a range of loan products designed to meet diverse financial needs. Understanding the specifics of each loan type, including eligibility criteria and terms, is crucial for borrowers to make informed decisions. This section details the various loan options available, providing examples and clarifying key aspects of each.

RCB Bank Personal Loans

RCB Bank personal loans provide unsecured financing for various personal expenses. These loans are characterized by their flexibility and relatively straightforward application process. Terms and conditions vary depending on the applicant’s creditworthiness and the loan amount. For example, a loan of €5,000 might have a repayment period of 24 months with a fixed interest rate, while a larger loan might extend to 60 months with a potentially higher rate. Eligibility typically involves demonstrating a stable income, a good credit history, and meeting certain age requirements.

RCB Bank Mortgage Loans

Mortgage loans from RCB Bank are designed to finance the purchase of residential properties. These loans are secured by the property itself, offering potentially lower interest rates compared to unsecured loans. Loan terms are typically longer, ranging from 15 to 30 years, and the loan amount is usually a significant percentage of the property’s value. Eligibility for a mortgage requires a comprehensive credit check, proof of income and employment stability, and a down payment. The specific terms and conditions, including interest rates and loan-to-value ratios, depend on various factors, including the property’s location and the borrower’s financial profile. For instance, a borrower with a higher credit score might secure a more favorable interest rate.

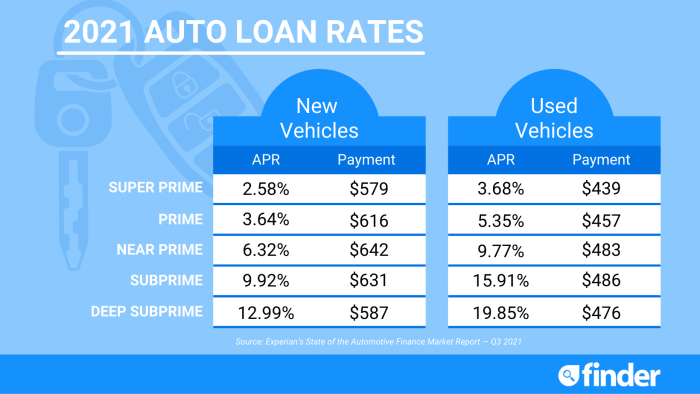

RCB Bank Auto Loans, Rcb bank loan rates

RCB Bank auto loans facilitate the purchase of new or used vehicles. These loans are typically secured by the vehicle itself, meaning the lender has a claim on the asset if payments are not made. Loan terms usually range from 24 to 72 months, with interest rates varying based on the vehicle’s value, the borrower’s creditworthiness, and the loan term. Eligibility requires proof of income, a valid driver’s license, and a satisfactory credit history. For instance, a loan for a new car might have a lower interest rate than a loan for a used car, reflecting the perceived risk associated with each.

Comparison of RCB Bank Loan Products

The following table compares three different loan types offered by RCB Bank, illustrating the differences in interest rates, loan amounts, and repayment periods. Note that these are examples and actual rates and terms may vary based on individual circumstances.

| Loan Type | Interest Rate (Example) | Loan Amount (Example) | Repayment Period (Example) |

|---|---|---|---|

| Personal Loan | 8% – 12% per annum | €5,000 – €25,000 | 12 – 60 months |

| Mortgage Loan | 3% – 6% per annum | €50,000 – €500,000 | 15 – 30 years |

| Auto Loan | 5% – 10% per annum | €10,000 – €50,000 | 24 – 72 months |

Factors Influencing RCB Bank Loan Rates

RCB Bank, like other financial institutions, employs a multifaceted approach to determining loan interest rates. Several key factors interact to shape the final rate offered to a borrower, ensuring a fair and risk-adjusted pricing model. Understanding these factors empowers borrowers to make informed decisions and potentially secure more favorable loan terms.

Credit Score’s Impact on Loan Rates

A borrower’s credit score is a pivotal factor influencing the interest rate offered by RCB Bank. A higher credit score, reflecting a history of responsible borrowing and repayment, signals lower risk to the lender. This, in turn, translates to a lower interest rate. Conversely, a lower credit score, indicative of past payment issues or high debt levels, indicates higher risk, resulting in a higher interest rate. For example, a borrower with an excellent credit score might qualify for a significantly lower interest rate compared to a borrower with a poor credit history, even for the same loan amount and term. The specific impact of credit score on the interest rate varies depending on other factors, but its influence is undeniable.

Secured vs. Unsecured Loan Interest Rates

Secured loans, backed by collateral such as property or a vehicle, typically carry lower interest rates than unsecured loans. This is because the collateral provides a safety net for the lender, mitigating their risk in case of default. Unsecured loans, lacking such collateral, present a higher risk to the lender, leading to higher interest rates to compensate for this increased risk. The difference in interest rates between secured and unsecured loans can be substantial, sometimes amounting to several percentage points. A borrower considering a large loan might find it advantageous to use a valuable asset as collateral to secure a lower rate.

Loan Amount and Repayment Period’s Influence

The amount borrowed and the repayment period also significantly impact the overall cost of borrowing. Larger loan amounts generally come with higher interest rates due to the increased risk involved. Similarly, longer repayment periods, while offering lower monthly payments, often result in higher overall interest costs because the borrower pays interest over a longer period. For instance, a 30-year mortgage will typically accrue significantly more interest than a 15-year mortgage, even if the interest rate is the same. Borrowers should carefully weigh the advantages of lower monthly payments against the potential increase in total interest paid when choosing a repayment term.

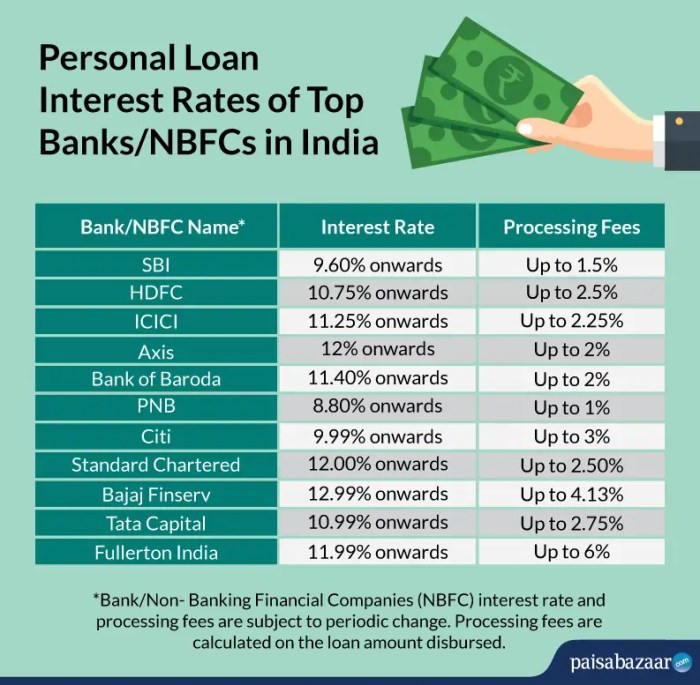

Comparing RCB Bank Loan Rates with Competitors

Choosing the right bank for a loan requires careful consideration of interest rates, fees, and the overall loan terms. This section compares RCB Bank’s loan rates with those of two other major banks operating in a similar region, providing a clearer picture to aid your decision-making process. Note that loan rates are subject to change, and these figures represent a snapshot in time. Always confirm current rates directly with the respective banks.

Loan Rate Comparison Table

Understanding the differences in loan rates across various banks is crucial for securing the most favorable financial terms. The following table compares RCB Bank’s loan rates with those of two hypothetical competitor banks, Bank A and Bank B, for personal and mortgage loans. Specific details, including APR and associated fees, are presented for illustrative purposes and should be verified with each bank individually. The region of operation is assumed to be Cyprus, but this can be adjusted based on your specific needs.

| Loan Type | RCB Bank | Bank A | Bank B |

|---|---|---|---|

| Personal Loan (5-year term) | APR: 8.5%, Setup Fee: €50 | APR: 9.0%, Setup Fee: €75 | APR: 8.0%, Setup Fee: €25, Monthly Fee: €5 |

| Mortgage Loan (20-year term) | APR: 4.2%, Valuation Fee: €200, Legal Fees: €500 | APR: 4.5%, Valuation Fee: €150, Legal Fees: €400 | APR: 4.0%, Valuation Fee: €250, Legal Fees: €600, Early Repayment Fee: 2% |

Advantages and Disadvantages of Choosing RCB Bank

This section Artikels the potential benefits and drawbacks of selecting RCB Bank for your loan needs, compared to the competitor banks mentioned above. These points are based on general observations and the illustrative data provided; individual experiences may vary.

RCB Bank’s advantages might include (depending on specific offers and the individual’s circumstances): potentially competitive APRs on certain loan types, established reputation, and possibly a streamlined application process. However, disadvantages could include higher associated fees compared to some competitors, potentially less flexible loan terms, or a less extensive branch network. Bank A and Bank B may offer lower fees or better interest rates in specific cases, while possibly lacking in other areas such as customer service or loan product diversity. A thorough comparison of individual loan offers is recommended before making a final decision.

Illustrative Loan Scenarios with RCB Bank

This section presents three hypothetical loan scenarios to illustrate the potential costs and repayment options available through RCB Bank. These examples use realistic figures for illustrative purposes only and should not be considered a definitive offer or guarantee of loan terms. Actual loan terms and conditions will vary based on individual circumstances and RCB Bank’s prevailing lending policies.

Mortgage Loan Scenario

This scenario Artikels a typical mortgage loan for purchasing a property. The example demonstrates the impact of different repayment periods on the total cost.

Let’s assume a borrower wants to purchase a property valued at €250,000. They secure a mortgage from RCB Bank for 80% of the property value (€200,000), with an interest rate of 4.5% per annum. We will compare two repayment options: a 20-year term and a 25-year term.

- Scenario 1: 20-Year Term: The monthly repayment would be approximately €1,267. The total interest paid over the 20-year period would be approximately €124,080, resulting in a total repayment of €324,080.

- Scenario 2: 25-Year Term: The monthly repayment would be approximately €1,067. The total interest paid over the 25-year period would be approximately €166,750, resulting in a total repayment of €366,750.

This illustrates that a longer repayment term reduces monthly payments but significantly increases the total interest paid over the loan’s life.

Personal Loan Scenario

This scenario details a personal loan for debt consolidation or home improvements. It highlights the differences in total cost depending on the loan term.

Suppose a borrower needs a €10,000 personal loan from RCB Bank to consolidate existing debts. The interest rate offered is 8% per annum. We will again examine two repayment options: a 3-year term and a 5-year term.

- Scenario 1: 3-Year Term: The monthly repayment would be approximately €313. The total interest paid over the 3-year period would be approximately €1,676, resulting in a total repayment of €11,676.

- Scenario 2: 5-Year Term: The monthly repayment would be approximately €203. The total interest paid over the 5-year period would be approximately €2,150, resulting in a total repayment of €12,150.

Shorter loan terms result in higher monthly payments but significantly lower overall interest costs.

Business Loan Scenario

This scenario Artikels a business loan for expansion or equipment purchase, demonstrating how loan amount and term impact total cost.

Imagine a small business seeking a €50,000 loan from RCB Bank for purchasing new equipment. The interest rate is 6% per annum. We will consider two scenarios: a 7-year term and a 10-year term.

- Scenario 1: 7-Year Term: The monthly repayment would be approximately €790. The total interest paid over the 7-year period would be approximately €17,140, resulting in a total repayment of €67,140.

- Scenario 2: 10-Year Term: The monthly repayment would be approximately €590. The total interest paid over the 10-year period would be approximately €26,000, resulting in a total repayment of €76,000.

While a longer term reduces monthly payments, it leads to a substantially higher total interest cost for the business.

Understanding RCB Bank’s Loan Application Process

Applying for a loan with RCB Bank involves a structured process designed to assess your financial eligibility and ensure a smooth borrowing experience. This guide Artikels the steps involved, necessary documentation, the approval process, and potential challenges applicants may encounter. Understanding these aspects can significantly improve your chances of a successful application.

The Step-by-Step Loan Application Process

The application process generally begins with an initial assessment of your needs and financial situation. This often involves an online pre-qualification or a consultation with a loan officer. Following this preliminary step, the application itself is submitted, typically online or in person at a branch. After submission, the bank reviews the application and supporting documents, followed by a credit check and potential further verification steps. Finally, if approved, the loan is disbursed according to the agreed-upon terms.

Required Documentation for Different Loan Types

The specific documents required vary depending on the type of loan. For example, a personal loan might necessitate proof of income, identity documents, and bank statements. A mortgage application will require significantly more documentation, including property appraisals, title deeds, and potentially additional financial statements to demonstrate the applicant’s ability to repay the loan over the longer term. Business loans will demand comprehensive financial statements, business plans, and potentially projections for future revenue. It’s crucial to contact RCB Bank directly to confirm the exact requirements for your specific loan application.

The Loan Approval Process and Typical Timelines

Once the application is submitted with all necessary documents, RCB Bank’s credit department reviews the application. This involves a thorough assessment of your credit history, income, and debt-to-income ratio. The review process can take several days to several weeks, depending on the complexity of the loan and the volume of applications. After the review, applicants are notified of the decision. If approved, the loan agreement is finalized, and the funds are disbursed. Delays can occur if additional information is required or if discrepancies are found in the provided documentation. For example, a missing document or an inconsistency in financial information may delay the approval process.

Potential Challenges During the Application Process

Applicants may encounter several challenges during the application process. One common issue is providing incomplete or inaccurate documentation. This can lead to delays or even rejection of the application. Another potential challenge is having a low credit score, which may affect the approval chances or result in less favorable interest rates. Insufficient income relative to the loan amount can also present a significant hurdle. Finally, providing a weak business plan (for business loans) or failing to meet the bank’s specific requirements can negatively impact the application outcome. Proactive preparation and careful attention to detail can mitigate these potential challenges.

Potential Fees and Charges Associated with RCB Bank Loans

Securing a loan involves more than just the interest rate; various fees and charges can significantly impact the overall cost. Understanding these potential expenses is crucial for borrowers to accurately assess the true cost of borrowing from RCB Bank. This section details the potential fees you might encounter when applying for and maintaining an RCB Bank loan. It’s important to note that specific fees and their amounts can vary depending on the loan type, amount, and individual circumstances. Always confirm the applicable fees with RCB Bank directly before proceeding with a loan application.

The following Artikels potential fees and charges associated with RCB Bank loans. While this list aims to be comprehensive, it’s advisable to contact RCB Bank for the most up-to-date and precise information regarding your specific loan application.

Application Fees

An application fee may be charged to cover the administrative costs associated with processing your loan application. This fee is typically a fixed amount and is payable upon submission of your application. The exact amount will be disclosed during the application process.

Appraisal Fees

If your loan requires a property appraisal (such as for a mortgage), you will likely incur appraisal fees. These fees cover the cost of an independent professional assessment of the property’s value. The borrower is typically responsible for paying these fees directly to the appraiser.

Legal Fees

Depending on the loan type and complexity, legal fees might be necessary. These fees cover the costs associated with reviewing loan documents and ensuring compliance with legal requirements. These fees are usually paid separately to the legal professional involved.

Early Repayment Charges

Prepaying your loan before its scheduled maturity date might incur early repayment charges. These penalties compensate the bank for lost interest income. The specific penalty amount will be Artikeld in your loan agreement and will vary depending on the remaining loan term and the outstanding principal balance. For example, a borrower might face a penalty equivalent to several months’ worth of interest if they repay a significant portion of the loan early.

Late Payment Fees

Late payment fees are charged if you fail to make your loan repayments on time. These fees are typically a percentage of the missed payment or a fixed amount, as stipulated in your loan agreement. Consistent late payments can negatively impact your credit score.

Account Maintenance Fees

Some loan products might involve account maintenance fees. These fees cover the administrative costs associated with managing your loan account. The amount and frequency of these fees will be specified in your loan agreement.

Default Fees

If you default on your loan (fail to make payments according to the agreement), you may incur significant default fees. These fees can be substantial and are designed to cover the bank’s costs associated with recovering the outstanding debt. Default can also severely damage your credit rating.

Other Potential Fees

Other potential fees may apply depending on specific circumstances. These might include fees for document preparation, insurance requirements, or other services related to the loan. It is crucial to thoroughly review all loan documentation to understand all associated costs before signing the agreement.

Final Conclusion

Securing a loan can feel overwhelming, but understanding the intricacies of RCB Bank loan rates empowers you to navigate the process confidently. By carefully considering the factors influencing interest rates, comparing options with competitors, and planning for potential fees, you can make a well-informed decision that aligns with your financial goals. Remember to always review the terms and conditions carefully before committing to any loan agreement.

FAQ Insights

What documents are typically required for an RCB Bank loan application?

Required documents vary by loan type but generally include proof of identity, income verification, and asset documentation. Specific requirements will be Artikeld during the application process.

What is the typical processing time for an RCB Bank loan application?

Processing times vary depending on the loan type and the completeness of your application. Expect a timeframe ranging from a few days to several weeks.

Can I prepay my RCB Bank loan?

The possibility of prepayment and any associated penalties are detailed in your loan agreement. It’s advisable to review this section carefully before considering prepayment.

What happens if I miss a loan payment with RCB Bank?

Missing a payment can result in late fees and negatively impact your credit score. Contact RCB Bank immediately if you anticipate difficulties making a payment to discuss potential solutions.