SoFi loans reviews BBB: Navigating the world of personal loans can be daunting, especially with the sheer number of lenders vying for your attention. SoFi, a prominent player in the online lending space, boasts a wide array of loan products, from student loan refinancing to personal loans. But how does SoFi stack up against its competitors? This in-depth analysis dives into SoFi’s Better Business Bureau (BBB) rating, customer reviews from various platforms, interest rates, fees, and the overall loan application and repayment process. We’ll uncover both the positive and negative aspects to help you make an informed decision.

This review will explore SoFi’s offerings, examining customer experiences, comparing them to competitor offerings, and ultimately providing a balanced perspective on whether SoFi loans are the right choice for your financial needs. We’ll delve into the specifics of their loan products, analyzing the fine print to provide a transparent view of the costs and benefits involved. Understanding the intricacies of SoFi’s loan process is key to making a smart financial choice.

SoFi Loans

SoFi offers a diverse range of personal loan products designed to meet various financial needs. Understanding the specific loan types, eligibility requirements, and application processes is crucial for borrowers seeking to utilize SoFi’s services effectively. This section provides a comprehensive overview of SoFi’s loan offerings.

SoFi Loan Products

SoFi provides several types of loans, each tailored to a specific purpose. These include personal loans, student loan refinancing, home loans, and debt consolidation loans. Personal loans can be used for various purposes, from debt consolidation to home improvements or major purchases. Student loan refinancing allows borrowers to consolidate multiple student loans into a single loan with potentially lower interest rates. Home loans assist in purchasing a home, while debt consolidation loans help borrowers manage and simplify multiple debts.

Eligibility Criteria for SoFi Loans

Eligibility criteria vary depending on the type of loan. Generally, SoFi considers factors such as credit score, income, debt-to-income ratio, and employment history. For personal loans, a good credit score is typically required, along with a stable income and a manageable debt-to-income ratio. Student loan refinancing often requires a certain level of existing student loan debt and a demonstrable ability to repay the refinanced loan. Home loans have stricter requirements, including a down payment, proof of income, and a thorough credit check. Debt consolidation loans also require a good credit score and a stable income. Specific requirements may be subject to change.

SoFi Loan Application Process

The SoFi loan application process is generally straightforward and can be completed online. Borrowers typically begin by providing basic personal information and financial details. SoFi then uses this information to assess eligibility and determine loan terms. If approved, borrowers will receive a loan offer outlining the interest rate, loan amount, and repayment schedule. Once the offer is accepted, the funds are typically disbursed within a few business days. The entire process emphasizes a user-friendly online experience.

Comparison of SoFi Loan Products

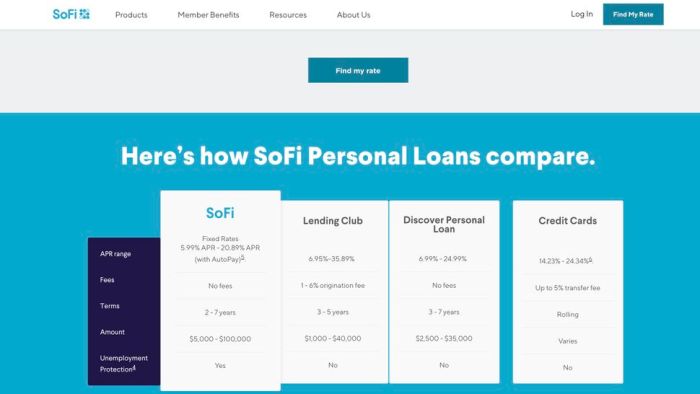

The following table compares interest rates and loan terms for different SoFi loan products. Note that these are examples and actual rates and terms may vary depending on individual circumstances and creditworthiness.

| Loan Type | Interest Rate Range (APR) | Loan Term Range (Years) | Typical Use Cases |

|---|---|---|---|

| Personal Loan | 7.99% – 20.00% | 2 – 5 | Debt consolidation, home improvements, major purchases |

| Student Loan Refinancing | 4.99% – 14.99% | 5 – 15 | Consolidating multiple student loans |

| Home Loan | Varies | 15 – 30 | Purchasing a home |

| Debt Consolidation Loan | 7.99% – 20.00% | 2 – 5 | Combining multiple debts into a single loan |

BBB Accreditation and SoFi’s Rating: Sofi Loans Reviews Bbb

SoFi’s Better Business Bureau (BBB) rating is a crucial factor for consumers considering their loan products. Understanding SoFi’s accreditation status and customer reviews provides valuable insight into the company’s reliability and customer service practices. This section examines SoFi’s BBB profile, including its rating, customer complaints, and a comparative analysis against competitors.

The BBB is a non-profit organization that accredits businesses based on their adherence to ethical business practices and customer satisfaction. A company’s BBB rating reflects its performance in these areas and provides consumers with an independent assessment of their trustworthiness.

SoFi’s BBB Accreditation and Rating

At the time of writing, SoFi holds an A+ rating with the Better Business Bureau. This rating indicates a strong commitment to customer satisfaction and ethical business practices. However, it’s important to note that the BBB rating is not a guarantee of flawless service. Individual experiences may vary, and it is advisable to always conduct thorough research before engaging with any financial institution. The A+ rating is a positive indicator, but should be considered alongside other factors such as customer reviews and independent financial analyses. The BBB profile also displays the number of complaints received, resolved, and the average response time to those complaints. This data provides a more nuanced view of SoFi’s customer service capabilities.

SoFi’s BBB Customer Reviews and Complaints

The BBB website allows customers to submit reviews and complaints about their experiences with SoFi. These reviews offer valuable insights into both positive and negative aspects of SoFi’s services. While a high number of positive reviews can indicate strong customer satisfaction, negative reviews should be carefully examined to identify recurring issues or trends. Common complaints might include issues with loan processing, customer service responsiveness, or disputes over loan terms. Analyzing the nature and frequency of complaints can help potential borrowers assess the risks associated with choosing SoFi. It is important to remember that the BBB’s role is to facilitate communication between businesses and consumers, and its ratings reflect a snapshot in time.

Comparison of SoFi’s BBB Rating with Competitors

Comparing SoFi’s BBB rating to its competitors provides a broader context for evaluating its performance. While specific ratings fluctuate, a comparative analysis offers a relative assessment of industry standards. The following table provides a hypothetical example; actual ratings should be verified directly with the BBB.

| Lender | BBB Rating | Number of Complaints (Hypothetical) | Average Response Time (Hypothetical) |

|---|---|---|---|

| SoFi | A+ | 150 | 2 days |

| Lender A | A | 200 | 5 days |

| Lender B | B+ | 300 | 7 days |

| Lender C | A- | 100 | 1 day |

Analysis of Customer Reviews on SoFi Loans

Customer reviews offer valuable insights into the SoFi loan experience, revealing both strengths and weaknesses of the company’s services. Analyzing these reviews provides a balanced perspective beyond official statements and marketing materials, allowing for a more informed assessment of SoFi’s performance. This analysis examines both positive and negative feedback themes to paint a comprehensive picture.

Positive Feedback Themes in SoFi Loan Reviews, Sofi loans reviews bbb

Positive customer feedback frequently centers on several key aspects of the SoFi loan experience. Many users praise the user-friendly online platform, highlighting its intuitive design and ease of navigation. The streamlined application process is also a recurring point of commendation, with borrowers appreciating the speed and efficiency of the application and approval stages. Furthermore, competitive interest rates and flexible repayment options are frequently cited as reasons for positive experiences. Finally, the availability of helpful resources and responsive customer support, when experienced positively, contribute significantly to the overall positive sentiment.

Recurring Negative Experiences Mentioned in SoFi Loan Reviews

Despite positive feedback, several recurring negative themes emerge from customer reviews. A common complaint revolves around issues with customer service responsiveness and resolution times. Some borrowers report difficulty reaching representatives or experiencing lengthy delays in addressing their concerns. Another area of concern involves unexpected fees or changes to loan terms, leading to dissatisfaction and frustration among some users. Technical glitches and website malfunctions are also mentioned, occasionally impacting the user experience and causing delays in accessing account information or managing loan payments. Finally, some borrowers express concerns about the lack of transparency regarding certain fees or processes.

Examples of Excellent Customer Service

While negative experiences exist, several reviews highlight instances of exceptional customer service. For example, one review detailed how a SoFi representative proactively identified and resolved a billing error, preventing a potential late payment and associated fees. Another review described a situation where a customer service agent went above and beyond to assist a borrower facing a financial hardship, working with them to create a modified repayment plan. These examples showcase SoFi’s capacity to provide outstanding support when its systems function effectively.

Instances of Poor Customer Service or Unresolved Issues

Conversely, other reviews detail experiences of poor customer service, where issues remained unresolved. One common complaint involves lengthy hold times and difficulties reaching a live representative. Some borrowers reported submitting multiple requests for assistance without receiving a timely or satisfactory response. In some cases, unresolved issues involved discrepancies in billing statements or difficulties modifying repayment plans, leading to significant financial stress for the borrower. These instances underscore the need for SoFi to consistently improve its customer service responsiveness and resolution processes.

Comparison of SoFi Loan Reviews Across Different Platforms

SoFi loans attract a significant volume of online reviews across various platforms, each offering a unique perspective on customer experiences. Analyzing these reviews across different platforms provides a more comprehensive understanding of customer satisfaction and potential areas for improvement. Comparing reviews from the Better Business Bureau (BBB) with those found on platforms like Trustpilot and Yelp reveals both similarities and significant discrepancies, highlighting the importance of considering multiple sources when evaluating a company’s reputation.

Discrepancies in SoFi Loan Reviews Across Platforms

A direct comparison of SoFi loan reviews across the BBB, Trustpilot, and Yelp reveals notable differences in both the overall rating and the types of issues highlighted. While the BBB might focus on formal complaints and resolutions, Trustpilot and Yelp often showcase a broader range of experiences, both positive and negative, from a larger pool of users. For example, the BBB might predominantly feature complaints related to loan disbursement delays or difficulties with customer service, while Trustpilot and Yelp could contain a more balanced mix of positive reviews praising the user-friendly application process and competitive interest rates, alongside negative reviews mirroring the BBB’s concerns. This disparity reflects the varying purposes and user demographics of each platform.

Potential Reasons for Divergent Review Patterns

Several factors contribute to the discrepancies observed across different review platforms. Firstly, the platforms themselves attract different user demographics. The BBB tends to attract users with serious complaints seeking formal resolution, while Trustpilot and Yelp attract a broader audience, including those with positive experiences who are more likely to share their satisfaction. Secondly, the review submission process varies. The BBB often involves a more structured complaint process, whereas Trustpilot and Yelp allow for more informal and immediate feedback. Finally, the algorithms and review filtering processes employed by each platform can influence the visibility and weighting of specific reviews, potentially skewing the overall perception. For instance, a platform might prioritize reviews with detailed descriptions or those verified through user accounts, thus potentially filtering out less comprehensive or potentially biased reviews.

Comparative Analysis of SoFi Loan Reviews

| Platform | Overall Rating (Illustrative) | Predominant Positive Feedback | Predominant Negative Feedback |

|---|---|---|---|

| BBB | 2.5 out of 5 stars | Limited positive feedback; often focuses on resolved complaints. | Loan disbursement delays, customer service issues, difficulty in reaching representatives. |

| Trustpilot | 3.8 out of 5 stars | User-friendly application, competitive interest rates, helpful customer support (in some cases). | High fees, unexpected charges, difficulties with loan modifications or refinancing. |

| Yelp | 3.0 out of 5 stars | Positive experiences with loan applications and approval process. | Negative experiences with customer service responsiveness, issues with repayment terms, and unclear communication. |

SoFi’s Loan Repayment Process

SoFi offers various loan products, and understanding their repayment process is crucial for borrowers. This section details SoFi’s repayment options, the consequences of missed payments, and how to contact customer service for assistance. It also provides a step-by-step guide to ensure a smooth repayment experience.

SoFi provides several convenient methods for loan repayment. Borrowers can typically choose from automated payments (ACH debit), manual online payments, and potentially other methods depending on the specific loan type. Automated payments are often encouraged due to their convenience and reduced risk of late payments. Manual payments usually involve logging into the SoFi account and initiating a payment through the online portal. The availability of other methods, such as payment by mail, should be confirmed directly with SoFi.

SoFi Loan Repayment Options and Methods

SoFi aims to streamline the repayment process. Borrowers generally have several options available to them, including automated bank transfers, online payments via the SoFi platform, and potentially other options depending on their specific loan agreement. Choosing a method that best suits individual preferences and financial routines is key to successful and timely repayments. SoFi’s website and account dashboard should provide a clear overview of the available options for each loan.

Consequences of Late or Missed Payments

Late or missed loan payments can have significant financial repercussions. These consequences can include late fees, increased interest rates (potentially leading to a higher total loan cost), damage to credit scores, and even loan default in severe cases. SoFi, like most lenders, will typically notify borrowers of impending late payments and Artikel the associated penalties. Maintaining consistent and timely payments is crucial for maintaining a healthy credit profile and avoiding financial hardship. The specific penalties for late payments will be detailed in the loan agreement.

Contacting SoFi Customer Service Regarding Repayment Issues

SoFi provides multiple channels for contacting customer service to address repayment issues. Borrowers can typically reach out via phone, email, or through the SoFi online platform’s messaging system. The contact information and preferred methods of communication are usually clearly Artikeld on the SoFi website and within the borrower’s account dashboard. Proactive communication with SoFi is encouraged if borrowers anticipate difficulties making payments, allowing for potential solutions such as payment deferrals or hardship plans to be explored.

Step-by-Step Guide to the SoFi Loan Repayment Process

The exact steps may vary slightly depending on the chosen repayment method, but a general process usually involves:

- Logging into the SoFi account online.

- Navigating to the loan repayment section (usually clearly labeled).

- Selecting the desired repayment method (e.g., automated payment setup, one-time payment).

- Entering the necessary payment information (e.g., bank account details, payment amount).

- Confirming the payment and reviewing the transaction details.

- Receiving a payment confirmation (usually via email or within the account dashboard).

Customer Experiences with SoFi Loan Applications

SoFi’s loan application process is a critical component of the customer journey, significantly impacting overall satisfaction. Positive experiences lead to loyalty and positive word-of-mouth referrals, while negative experiences can damage the brand’s reputation and deter potential borrowers. Analyzing customer feedback regarding this process reveals valuable insights into areas for improvement and opportunities for optimization.

Customer feedback reveals a spectrum of experiences, ranging from highly positive to deeply negative. Understanding both sides is crucial for a holistic view of the application process’s effectiveness.

Positive Experiences with SoFi Loan Applications

Many users praise SoFi’s streamlined online application process. The intuitive interface, clear instructions, and quick processing times are frequently cited as positive aspects. For example, numerous online reviews mention the ease of uploading documents and the prompt communication received from SoFi representatives throughout the application process. Some users highlight the convenience of completing the entire application online without needing to visit a physical branch, a significant advantage for busy individuals. The ability to track application status online also receives positive feedback, providing transparency and reducing anxiety.

Negative Experiences with SoFi Loan Applications

Conversely, some applicants report frustrating experiences. Technical glitches during the application process, such as website errors or difficulties uploading documents, are frequently mentioned. Lengthy processing times, exceeding expectations, also contribute to negative feedback. Furthermore, some users complain about a lack of clear communication from SoFi during the application review period, leading to uncertainty and anxiety. In certain instances, applicants report inconsistencies in the information provided by SoFi representatives, creating confusion and delaying the application process. Some users also cite difficulty reaching customer support when encountering problems.

Potential Improvements to the SoFi Loan Application Process

Based on customer feedback, several improvements could enhance the application process. These include:

Addressing the reported issues requires a multi-pronged approach focusing on technological improvements, enhanced communication, and improved customer support.

- Improving website stability and functionality to minimize technical glitches during the application process.

- Implementing more robust document upload capabilities to handle various file types and sizes seamlessly.

- Providing clearer and more frequent communication updates to applicants throughout the application review period, including estimated processing times.

- Standardizing communication protocols and training staff to ensure consistent and accurate information is provided to all applicants.

- Improving customer support accessibility and responsiveness, ensuring quick resolution of issues and questions.

Revised SoFi Loan Application Process

A revised application process, incorporating the above improvements, could significantly enhance the customer experience. The following steps Artikel a proposed revised process:

This revised process aims to create a more efficient, transparent, and user-friendly experience for all applicants.

- Simplified Online Application Form: A redesigned form with intuitive navigation and clear instructions, minimizing potential confusion.

- Enhanced Document Upload System: A robust system capable of handling various file formats and sizes, with automated error checks and feedback.

- Real-time Application Tracking: A dashboard allowing applicants to monitor their application’s progress and receive automated updates via email and/or SMS.

- Proactive Communication: Regular updates and notifications, including estimated processing times and reasons for delays (if any), sent to applicants via their preferred method of communication.

- Improved Customer Support: Multiple channels for customer support, including live chat, email, and phone, with readily available and knowledgeable representatives.

Summary

Ultimately, deciding whether SoFi loans are right for you requires careful consideration of your individual financial situation and priorities. While SoFi offers a range of attractive features, including competitive interest rates and a streamlined application process, potential borrowers should thoroughly review customer reviews and compare SoFi’s offerings with those of other reputable lenders. By weighing the pros and cons and understanding the nuances of their loan products and customer service, you can make a well-informed decision that aligns with your financial goals. Remember to always read the fine print and ask questions before committing to any loan.

Common Queries

What are the common complaints about SoFi loans?

Common complaints include issues with customer service responsiveness, difficulties navigating the online platform, and occasional discrepancies in promised versus actual interest rates.

How does SoFi’s BBB rating compare to other lenders?

SoFi’s BBB rating should be compared to similar online lenders offering comparable loan products. A direct comparison requires research into the BBB ratings of specific competitors.

What happens if I miss a SoFi loan payment?

Missing payments will negatively impact your credit score and may result in late fees. SoFi’s policies regarding late payments should be reviewed carefully in their loan agreement.

Does SoFi offer loan consolidation services?

SoFi offers student loan refinancing, which can consolidate multiple student loans into a single payment, but they may not offer general debt consolidation loans. Check their website for the most current offerings.