Supreme Lending loan payment processes can seem complex, but understanding the various options and procedures is key to responsible borrowing. This guide unravels the intricacies of making your Supreme Lending loan payments, covering everything from online payments and mail-in options to potential fees and strategies for avoiding late payments. We’ll explore different payment methods, their associated costs, and provide practical tips for managing your account effectively. We also address crucial aspects of securing your payment information and identifying potential fraud, empowering you to navigate the process with confidence.

From step-by-step instructions for online payments to a comparison of processing times and fees for various methods, this comprehensive resource aims to equip you with the knowledge and tools necessary for seamless and stress-free loan repayment. We’ll delve into strategies for avoiding late payment penalties, exploring options like hardship programs when necessary. Ultimately, our goal is to provide a clear and concise understanding of the entire Supreme Lending loan payment system.

Understanding Supreme Lending Loan Payment Processes

Making timely loan payments is crucial for maintaining a positive credit history and avoiding late fees. Understanding the various payment methods and processes offered by Supreme Lending ensures a smooth and efficient repayment experience. This section details the steps involved in making a Supreme Lending loan payment, Artikels the available payment options, and provides a step-by-step guide for online payments.

Supreme Lending offers several convenient ways to make your loan payments. The process generally involves identifying your loan account, selecting your preferred payment method, and submitting the payment information accurately. Failure to make payments on time can result in penalties, impacting your credit score. Therefore, understanding the payment system and adhering to the payment schedule is paramount.

Supreme Lending Loan Payment Methods

Supreme Lending provides borrowers with multiple options for making their loan payments, catering to various preferences and levels of technological comfort. These options ensure accessibility and convenience for all borrowers.

- Online Payments: This method offers the speed and convenience of managing payments through the Supreme Lending website. It typically involves logging into your account, selecting the loan, and entering payment details.

- Mail Payments: Traditional mail payments allow for sending checks or money orders directly to the address provided by Supreme Lending. This method requires sufficient time for postal delivery and processing.

- Phone Payments: Some lenders may offer phone payments, though this may require providing sensitive information over the phone, which might pose security risks. Confirmation should be sought from Supreme Lending to confirm if this is a viable option.

Making an Online Loan Payment

Making an online payment is generally the quickest and most convenient method. The following steps Artikel the typical process for paying a Supreme Lending loan online. Remember to always keep your login credentials secure.

- Access the Supreme Lending Website: Navigate to the official Supreme Lending website using a secure browser.

- Log In to Your Account: Enter your username and password. If you’ve forgotten your login details, use the password recovery option provided on the website.

- Locate Your Loan Account: Once logged in, locate the specific loan account you wish to pay. This might involve navigating to a dashboard displaying your active loans.

- Select “Make a Payment”: Click on the “Make a Payment” button or link associated with the selected loan account.

- Enter Payment Information: Enter the amount you wish to pay and select your preferred payment method (e.g., checking account, savings account, debit card). Ensure all information is accurate to avoid delays or processing errors.

- Review and Submit: Carefully review all entered information before submitting the payment. Once submitted, you will typically receive a confirmation message or email.

Supreme Lending Loan Payment Flowchart

The following description details a flowchart illustrating the Supreme Lending loan payment process. Imagine a flowchart with distinct boxes and arrows connecting them.

The flowchart would begin with a “Start” box. An arrow would lead to a box labeled “Select Payment Method” with branches leading to “Online,” “Mail,” and “Phone.” Each branch would then lead to a series of boxes detailing the steps specific to that payment method (e.g., for “Online,” boxes would represent “Login,” “Select Loan,” “Enter Payment Details,” “Submit Payment,” and “Confirmation”). All branches would ultimately converge at an “End” box indicating successful payment. Each step would have a clear indication of what information or action is required. For example, the “Enter Payment Details” box would specify the need for account numbers, amounts, and payment method selection.

Supreme Lending Loan Payment Options and Fees

Supreme Lending offers several convenient methods for borrowers to make their loan payments. Understanding the available options and associated fees is crucial for effective financial management and avoiding potential penalties. This section details the various payment methods, their processing times, any associated costs, and circumstances where payment flexibility might be available.

Supreme Lending Payment Methods

Supreme Lending provides a range of payment options to cater to diverse borrower preferences. These options vary in terms of speed of processing and any associated fees. Choosing the most suitable method depends on individual circumstances and priorities.

| Payment Method | Processing Time | Fees | Notes |

|---|---|---|---|

| Online Payment (Website/App) | Immediate | None | Generally the fastest and most convenient option. |

| Automated Clearing House (ACH) | 1-3 Business Days | None | Requires setting up recurring payments from a bank account. |

| Mail (Check or Money Order) | 5-7 Business Days | None | Payment must be mailed to the address specified on the loan statement. Allow sufficient time for processing. |

| Phone Payment | 1-3 Business Days | May vary; check with Supreme Lending | Requires contacting customer service; may incur a small fee depending on the payment method used. |

| In-Person Payment | Immediate | May vary; check with Supreme Lending | Requires visiting a Supreme Lending office (if available) and may incur fees. |

Late Payment Fees and Penalties

Late payments can result in significant financial consequences. Supreme Lending, like most lenders, imposes late fees for payments received after the due date. The exact amount of the late fee is typically specified in the loan agreement and can vary depending on the loan type and the borrower’s payment history. Repeated late payments may further impact credit scores and could lead to more severe penalties, including loan acceleration (requiring immediate repayment of the entire loan balance). It’s crucial to contact Supreme Lending immediately if facing difficulties making a payment to explore potential solutions.

Payment Flexibility and Hardship Programs

Supreme Lending may offer payment flexibility or hardship programs under specific circumstances. For example, borrowers experiencing temporary financial difficulties due to job loss, illness, or unexpected expenses might be eligible for a short-term payment modification, such as a reduced payment amount or a temporary suspension of payments. These programs are designed to help borrowers avoid default and maintain their good standing. Eligibility for these programs depends on individual circumstances and requires submitting a formal request to Supreme Lending, typically providing documentation to support the claim of hardship. The terms and conditions of any such program will be Artikeld in a separate agreement.

Managing Your Supreme Lending Loan Account and Payments

Effective management of your Supreme Lending loan account is crucial for maintaining a positive credit history and avoiding unnecessary financial burdens. This involves proactive engagement with your account, understanding your payment schedule, and utilizing available resources to ensure timely payments and efficient communication with the lender. Proactive account management can significantly reduce stress and prevent potential late payment penalties.

Successfully navigating your Supreme Lending loan requires a combination of organizational skills, financial awareness, and the utilization of the tools and resources provided by Supreme Lending. By understanding your payment options, setting up automated payments, and regularly monitoring your account activity, you can minimize the risk of missed payments and maintain a healthy financial standing.

Best Practices for Effective Loan Account Management

Several key strategies contribute to effective Supreme Lending loan account management. These practices promote financial responsibility and help borrowers avoid potential issues.

- Understand Your Loan Agreement: Carefully review your loan agreement to fully grasp the terms and conditions, including the repayment schedule, interest rate, and any associated fees. This foundational step prevents misunderstandings and ensures you are aware of your obligations.

- Set Up Automatic Payments: Automating your loan payments through online banking or direct debit eliminates the risk of forgetting a payment and ensures timely remittance. This streamlined approach simplifies the payment process and minimizes the chance of late fees.

- Monitor Your Account Regularly: Regularly access your online account to review your payment history, outstanding balance, and upcoming payments. This proactive approach allows for early identification of any potential issues and enables timely corrective action.

- Maintain Accurate Contact Information: Ensure your contact information (address, phone number, email) is up-to-date with Supreme Lending. This ensures you receive timely notifications regarding your account and prevents missed communication.

Strategies for Avoiding Late Payments and Minimizing Penalties

Late payments can negatively impact your credit score and incur significant financial penalties. Implementing preventative measures is vital for maintaining a positive financial standing.

- Budgeting and Financial Planning: Create a realistic budget that allocates sufficient funds for your loan payment each month. This proactive approach prevents unexpected shortfalls and ensures timely payments.

- Payment Reminders: Set up payment reminders on your calendar or utilize online banking features to receive notifications before your payment is due. This serves as a crucial safeguard against oversight.

- Explore Payment Options: If you anticipate difficulty making a payment, contact Supreme Lending immediately to explore potential options, such as a payment plan or deferment. Proactive communication can prevent late payment penalties.

- Emergency Fund: Maintaining an emergency fund can provide a financial buffer in case of unexpected expenses that could jeopardize your ability to make timely loan payments.

Accessing and Reviewing Online Loan Statements and Payment History

Supreme Lending provides online access to account information, allowing borrowers to conveniently review their statements and payment history. This self-service capability promotes transparency and empowers borrowers to actively manage their finances.

Borrowers can typically access their account information through the Supreme Lending website or mobile app. The online portal usually offers features to download statements, view payment history, and check the current loan balance. Detailed instructions on accessing this information are generally available on the Supreme Lending website or within the online account itself.

Resources for Borrowers Needing Payment Assistance

Supreme Lending likely offers various resources to assist borrowers experiencing financial difficulties. These resources can provide crucial support and prevent potential defaults.

Contacting Supreme Lending’s customer service department is the first step. They can provide information on available programs, such as hardship programs or payment plans, designed to help borrowers manage their loan payments during challenging times. The lender’s website may also list resources and contact information for financial counseling services or debt management programs.

Securing and Verifying Supreme Lending Loan Payment Information

Protecting your financial information is paramount when making loan payments. Secure payment practices are essential to prevent fraud and ensure your payments reach Supreme Lending safely and efficiently. Understanding how to verify the legitimacy of payment portals and reporting suspicious activity are key components of responsible financial management.

Supreme Lending utilizes robust security measures to protect your data. However, proactive steps on your part are equally important in preventing fraudulent activities. This section details how to verify the authenticity of Supreme Lending’s communication and payment methods, and Artikels the procedures for reporting any suspected fraudulent activity.

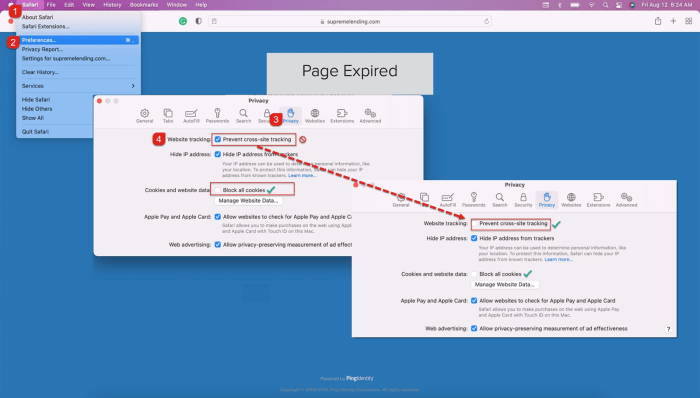

Verifying Supreme Lending Payment Portals

Supreme Lending’s official website will always be the primary source for information regarding payment methods and portals. Look for a secure connection (HTTPS) indicated by a padlock icon in your browser’s address bar. The website should clearly display contact information, including phone numbers and physical addresses. Any discrepancies between the information presented on the website and other sources should raise immediate concerns. Before entering any sensitive information, carefully examine the website’s URL for misspellings or unusual characters. Legitimate Supreme Lending communication will never request sensitive information via informal channels like unsolicited emails or text messages.

Verifying Supreme Lending Communication Channels

Supreme Lending will primarily communicate with borrowers through official channels, such as their website, secure email addresses, and designated phone numbers listed on their official website. Be wary of unsolicited emails, phone calls, or text messages requesting payment information. Legitimate communication will typically include your account number or other identifying information, but will never demand immediate payment without prior notification through established channels. Always verify the sender’s identity before responding to any communication.

Reporting Suspected Fraudulent Activity

If you suspect fraudulent activity related to your Supreme Lending loan payments, report it immediately. Contact Supreme Lending directly using the official contact information found on their verified website. Provide them with all relevant details, including dates, amounts, communication methods, and any suspicious links or websites. Also, report the incident to your local law enforcement authorities and consider filing a complaint with the appropriate consumer protection agencies. Quick action can help mitigate potential losses and prevent others from becoming victims.

Warning Signs of Fraudulent Payment Requests

It is crucial to be aware of common warning signs that could indicate a fraudulent payment request. These can help you avoid becoming a victim of financial scams.

The following points highlight common red flags to watch out for:

- Unsolicited communication via email, text message, or phone call requesting immediate payment.

- Requests for payment through unusual methods, such as wire transfers to unfamiliar accounts or prepaid debit cards.

- Communication containing grammatical errors, spelling mistakes, or unprofessional language.

- Threats or aggressive pressure to make a payment immediately.

- A request for payment that is significantly different from your agreed-upon payment amount.

- Websites or emails that look similar to Supreme Lending’s official website but have subtle differences in the URL or design.

- Requests for personal information not necessary for processing payments.

Illustrative Scenarios of Supreme Lending Loan Payments

Understanding how loan payments are calculated and the impact of various factors is crucial for effective financial planning. This section provides illustrative scenarios to clarify the Supreme Lending loan payment process, demonstrating calculations and the effects of different payment strategies.

Loan Payment Calculation Using Different Amortization Schedules

Different amortization schedules affect the allocation of principal and interest payments over the loan term. A common method is the standard amortization schedule, where payments remain constant throughout the loan’s life. Another approach is an accelerated amortization schedule, where larger payments are made early in the loan term, leading to faster principal reduction and lower overall interest paid. The calculation of the monthly payment uses a formula that considers the loan amount, interest rate, and loan term. While the exact formula is complex, most lenders use automated systems to calculate the payment. Let’s consider two examples: a standard and an accelerated schedule. In a standard schedule, a $200,000 loan at 6% interest over 30 years might have a monthly payment around $1,200. This payment remains consistent for the entire 30 years. In contrast, an accelerated schedule for the same loan might involve higher initial payments, perhaps $1,500, leading to a shorter repayment period. The specific payment amount depends on the chosen accelerated payment plan.

Detailed Example of a Loan Payment Scenario

Let’s consider a $150,000 loan from Supreme Lending with a 5% annual interest rate and a 15-year term. Assume a monthly payment of $1,185.71 (calculated using standard amortization). In the first month, a significant portion of the payment goes towards interest. For example, the interest portion might be approximately $625, while the principal portion is about $560.71. As payments continue, the proportion allocated to principal gradually increases while the interest portion decreases. Fees, such as late payment fees or origination fees, are typically added to the monthly payment or may be paid separately, depending on Supreme Lending’s policies. Late payment fees, for instance, could add $50 or more to the monthly payment if the payment is late. Origination fees, paid upfront, might be a percentage of the loan amount. Always check Supreme Lending’s fee schedule for accurate information.

Impact of Extra Payments on Loan Repayment Timeline, Supreme lending loan payment

Making extra payments on a Supreme Lending loan can significantly reduce the overall repayment time and the total interest paid. Suppose, in our $150,000 example, an extra $200 is paid each month. This additional payment directly reduces the principal balance, leading to a shorter amortization period and lower cumulative interest. A simple illustration: with consistent extra payments, the 15-year loan could potentially be paid off in under 12 years. The exact impact depends on the amount of extra payments and how they are applied (to principal or interest). Supreme Lending’s policies should clarify how extra payments are handled to ensure accurate application.

Visual Representation of Loan Payment Interrelationships

Imagine a three-dimensional graph. The X-axis represents the loan term (in years), the Y-axis represents the monthly payment amount, and the Z-axis represents the annual interest rate. A longer loan term (X-axis increases) would generally result in a lower monthly payment (Y-axis decreases) for a fixed loan amount and interest rate. Conversely, a higher interest rate (Z-axis increases) leads to a higher monthly payment (Y-axis increases) for a given loan term and amount. The graph would show a complex, three-dimensional surface illustrating the interconnectedness of these three variables. Points on this surface would represent various loan scenarios, highlighting the trade-offs between loan term, payment amount, and interest rate. For example, a point with a long term (e.g., 30 years), low monthly payment, and a relatively high interest rate would be distinct from a point with a short term (e.g., 15 years), high monthly payment, and a lower interest rate.

Wrap-Up

Mastering Supreme Lending loan payments requires a blend of understanding and proactive management. By familiarizing yourself with the various payment methods, associated fees, and best practices for account management, you can significantly reduce stress and financial burdens. Remember to always prioritize secure payment practices and be vigilant against potential fraud. This guide serves as your comprehensive resource, empowering you to navigate the loan repayment process with confidence and efficiency. Proactive management ensures a smoother repayment journey, allowing you to focus on your financial goals.

Clarifying Questions

What happens if I miss a Supreme Lending loan payment?

Missing a payment can result in late fees and negatively impact your credit score. Contact Supreme Lending immediately to discuss potential payment arrangements.

Can I make extra payments on my Supreme Lending loan?

Yes, making extra payments can shorten your loan term and reduce the total interest paid. Check your loan agreement for details on how to make extra payments.

How can I verify the legitimacy of a Supreme Lending communication?

Contact Supreme Lending directly using their official website or phone number to verify any communication you receive. Never share sensitive information unless you’re certain of the source’s authenticity.

Where can I find my Supreme Lending loan statement?

Your loan statement is typically accessible online through your Supreme Lending account. Check your account portal for access instructions.