5kfunds loan review: This in-depth analysis dives into the features, application process, customer experiences, fees, and overall value proposition of 5kfunds loans. We’ll compare them to competitors, explore potential risks and benefits, and answer your frequently asked questions. Prepare for a transparent and comprehensive look at whether 5kfunds is the right lending solution for you.

From understanding eligibility requirements and navigating the application process to deciphering fees and comparing 5kfunds to other lenders, this review provides a complete picture. We analyze both positive and negative customer feedback to offer a balanced perspective, helping you make an informed decision about securing a 5kfunds loan.

Loan Product Overview

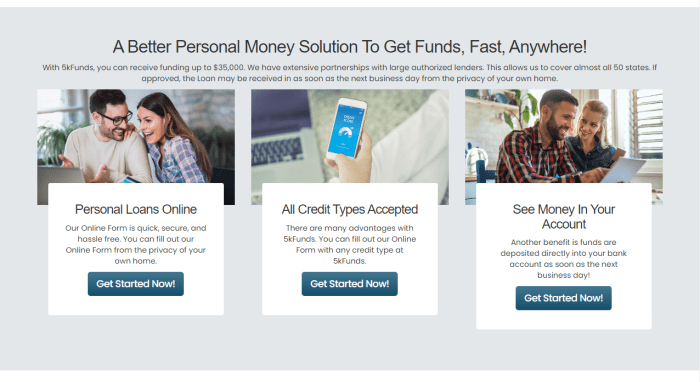

5kfunds offers short-term personal loans designed to provide quick access to funds for various needs. These loans are characterized by their relatively straightforward application process and fast disbursement times, making them a convenient option for borrowers facing immediate financial demands. However, it’s crucial to understand the terms and conditions before applying, as these loans typically come with higher interest rates than traditional longer-term loans.

Loan Features

5kfunds loans typically offer a fixed loan amount of $5,000, although specific amounts may vary depending on lender participation and individual borrower circumstances. Key features often include online application and approval processes, minimizing paperwork and wait times. Funds are generally deposited directly into the borrower’s bank account upon approval. The loans are unsecured, meaning they don’t require collateral, making them accessible to a broader range of borrowers. However, this also typically results in higher interest rates to compensate for the increased risk for the lender.

Eligibility Criteria

To qualify for a 5kfunds loan, applicants usually need to meet certain criteria. These typically include being a legal resident of the United States, possessing a valid Social Security number, and having a consistent source of income, demonstrated through pay stubs or bank statements. A minimum credit score requirement may also be in place, though the specific threshold can vary among lenders. Applicants will generally need to provide personal identification and bank account information as part of the verification process. Finally, the age of the applicant is typically a factor, with a minimum age requirement usually being 18 years or older.

Repayment Terms and Interest Rates

Repayment terms for 5kfunds loans are generally short-term, often ranging from a few weeks to a few months. The exact repayment period will depend on the lender and the borrower’s individual circumstances. Interest rates are typically higher than those found with longer-term loans or loans secured by collateral, reflecting the higher risk associated with short-term, unsecured borrowing. Annual Percentage Rates (APRs) can vary significantly depending on factors like credit score and the lender, so it’s crucial to compare offers from multiple lenders before committing to a loan. For example, an APR might range from 100% to 500% or more, though this is highly variable and dependent on many factors.

Suitable Loan Use Cases

A 5kfunds loan might be suitable for covering unexpected expenses like emergency medical bills, unexpected car repairs, or home maintenance. It could also be used to bridge a short-term financial gap before receiving a larger payment, such as a tax refund or bonus. However, it’s important to carefully consider the high interest rates involved and ensure the loan amount can be repaid within the stipulated timeframe to avoid accumulating substantial debt. For example, someone facing a sudden, unexpected $3,000 veterinary bill for their pet might find a 5kfunds loan a viable short-term solution, while someone needing funds for a larger purchase like a new car would likely be better served by exploring other financing options.

Application Process

Applying for a 5kfunds loan involves a straightforward process designed for efficiency and ease of use. The application, from start to finish, requires careful attention to detail to ensure a smooth and successful outcome. Understanding the steps involved, necessary documentation, and helpful tips will significantly increase your chances of approval.

Required Documentation for a 5kfunds Loan Application

To process your loan application effectively, 5kfunds requires specific documentation to verify your identity, income, and creditworthiness. Providing complete and accurate information upfront minimizes processing time and potential delays. Missing or incomplete documentation can lead to application delays or rejection.

Generally, you will need to provide the following:

- Government-issued photo identification (e.g., driver’s license, passport)

- Proof of income (e.g., pay stubs, bank statements, tax returns)

- Proof of address (e.g., utility bill, bank statement)

- Bank account details for direct deposit of loan funds

Specific requirements may vary depending on individual circumstances and the loan amount requested. It’s always best to check directly with 5kfunds for the most up-to-date requirements before submitting your application.

Tips for a Successful 5kfunds Loan Application

A successful loan application hinges on accuracy and completeness. Following these tips will improve your chances of approval and expedite the process.

Here are some key strategies to consider:

- Accurate Information: Double-check all information for accuracy before submitting your application. Inaccurate information can lead to delays or rejection.

- Complete Documentation: Ensure you have all required documentation readily available before starting the application process. Gather all necessary documents in advance to streamline the process.

- Timely Submission: Submit your application during business hours to ensure prompt processing. Avoid submitting applications at the last minute, as this can lead to delays.

- Maintain Good Credit: A strong credit history positively influences loan approval. Addressing any existing credit issues before applying can significantly improve your chances.

- Realistic Expectations: Apply for a loan amount you can comfortably repay. Borrowing responsibly reduces the risk of default and protects your credit score.

Step-by-Step Guide to the 5kfunds Loan Application Process

The application process is designed to be user-friendly and efficient. This step-by-step guide provides a clear overview of what to expect. Remember that processing times are estimates and may vary based on individual circumstances and 5kfunds’ workload.

| Step | Description | Required Documents | Estimated Timeframe |

|---|---|---|---|

| 1. Online Application | Complete the online application form on the 5kfunds website, providing accurate personal and financial information. | None (at this stage) | 15-30 minutes |

| 2. Document Upload | Upload the required supporting documents as specified in the application. | Government-issued ID, proof of income, proof of address, bank details | 10-15 minutes |

| 3. Application Review | 5kfunds reviews your application and supporting documentation. | N/A | 24-48 hours (typically) |

| 4. Approval/Rejection Notification | You receive notification via email or phone regarding the approval or rejection of your loan application. | N/A | Immediate upon completion of review |

| 5. Loan Disbursement (if approved) | Funds are deposited directly into your designated bank account. | N/A | 1-3 business days (typically) |

Customer Reviews and Experiences: 5kfunds Loan Review

Understanding customer feedback is crucial for assessing the overall quality and reliability of 5kfunds loans. Analyzing both positive and negative reviews provides a balanced perspective on the borrower experience, allowing for a more informed evaluation of the service. This section examines various customer testimonials to highlight both strengths and weaknesses of 5kfunds.

Positive customer reviews frequently praise 5kfunds for its relatively quick application and approval process. Many borrowers appreciate the convenience of online application and the speed at which funds are disbursed once approved. Several reviews mention helpful and responsive customer service representatives who were readily available to answer questions and address concerns throughout the loan process. The ease of repayment, often highlighted as a positive aspect, contributes to the overall positive perception of the service for some borrowers.

Negative Customer Experiences

Conversely, negative reviews often center around issues with interest rates and fees. Some borrowers express dissatisfaction with the perceived high cost of borrowing compared to other lenders. Complaints regarding hidden fees or unclear terms and conditions also appear frequently. Delayed payments or difficulties contacting customer service representatives are recurring themes in negative reviews. These negative experiences underscore the importance of carefully reviewing all terms and conditions before accepting a loan from 5kfunds.

Comparison with Similar Loan Providers

Compared to other online loan providers offering similar small-dollar loans, 5kfunds occupies a middle ground. While some competitors may offer lower interest rates, 5kfunds’ speed and convenience often serve as a key differentiator. Other providers might excel in customer service responsiveness, but may have lengthier application processes. A direct comparison requires careful consideration of individual needs and priorities, as the optimal choice depends on factors like the urgency of the need for funds, the borrower’s credit score, and their tolerance for interest rates and fees.

Common Themes in Customer Reviews

The following bullet points summarize common themes emerging from customer reviews of 5kfunds:

- Fast Application and Approval: Many borrowers praise the speed and efficiency of the application and approval process.

- High Interest Rates and Fees: A significant number of negative reviews cite high interest rates and fees as a major drawback.

- Customer Service Responsiveness: Reviews are mixed, with some praising helpful customer service while others report difficulty in contacting representatives or receiving timely assistance.

- Transparency and Clarity of Terms: Concerns regarding the clarity of terms and conditions, particularly regarding fees, are frequently raised in negative reviews.

- Ease of Repayment: Positive reviews often highlight the ease and convenience of the repayment process.

Fees and Charges

Understanding the complete cost of a 5kfunds loan is crucial before applying. This section details all associated fees and charges, their calculation methods, and a comparison with competitor offerings. Transparency in pricing is paramount, and we aim to provide a clear picture of what borrowers can expect.

5kfunds loans typically involve several fees. These fees can vary depending on the loan amount, the borrower’s creditworthiness, and the loan term. It’s important to carefully review the loan agreement before accepting any loan offer to ensure you understand all associated costs.

Interest Calculation

The interest charged on 5kfunds loans is typically calculated using a simple interest method. This means the interest is calculated only on the principal loan amount. The annual percentage rate (APR) will be clearly stated in the loan agreement. The total interest paid over the loan term is determined by multiplying the principal amount by the APR and the loan term (in years). For example, a $5,000 loan with a 10% APR over a 1-year term would accrue $500 in interest ($5,000 x 0.10 x 1). However, some loans might use a different calculation, so checking the specific terms is essential.

Origination Fee

5kfunds may charge an origination fee, which is a percentage of the loan amount. This fee covers the administrative costs associated with processing the loan application. The origination fee is usually deducted from the loan amount before the funds are disbursed to the borrower. For instance, a 3% origination fee on a $5,000 loan would be $150, resulting in the borrower receiving $4,850.

Late Payment Fees

Late payment fees are assessed if a borrower fails to make a payment by the due date. These fees can vary depending on the lender’s policy, but they typically range from a fixed amount to a percentage of the missed payment. Consistent on-time payments are vital to avoid incurring these additional charges.

Other Potential Fees

Depending on the specific loan terms, other fees might apply. These could include prepayment penalties (for paying off the loan early), returned check fees (if a payment bounces), or other administrative fees. It’s crucial to read the loan agreement carefully to understand all potential fees and charges.

Fee Comparison with Competitors

Comparing the fee structure of 5kfunds with competitors requires careful analysis of APRs, origination fees, and other charges. Direct comparison is challenging without specific competitor data for similar loan amounts and terms. However, a general comparison can highlight potential differences. For example, some competitors might offer lower APRs but higher origination fees, while others might have a higher APR but waive origination fees. Borrowers should compare total costs, including all fees and interest, to determine the most cost-effective option.

Fee Summary Table, 5kfunds loan review

| Fee Type | Description | Amount |

|---|---|---|

| Interest | Calculated based on APR and loan term (varies). | Varies |

| Origination Fee | Percentage of the loan amount (varies). | Varies |

| Late Payment Fee | Charged for late payments (varies). | Varies |

| Prepayment Penalty (Potential) | Fee for paying off the loan early (may not apply). | Varies |

| Returned Check Fee (Potential) | Fee for bounced checks (may not apply). | Varies |

Customer Service and Support

Accessing reliable and responsive customer service is crucial when dealing with financial products like loans. 5kfunds’ customer service effectiveness directly impacts borrower satisfaction and the overall loan experience. Understanding their support channels and typical interactions helps potential borrowers make informed decisions.

5kfunds offers multiple avenues for customer support, aiming to cater to diverse communication preferences. The availability and efficiency of these channels, however, can significantly influence the overall customer experience.

Available Customer Service Channels

5kfunds typically provides customer service through phone, email, and a frequently asked questions (FAQ) section on their website. The responsiveness and helpfulness of each channel can vary depending on factors such as time of day, volume of inquiries, and the specific issue at hand. While a dedicated phone line might offer immediate assistance, email support might involve longer wait times for responses. The FAQ section, while useful for common questions, may not address all individual concerns.

Examples of Effective and Ineffective Customer Support Interactions

Effective interactions are characterized by prompt responses, accurate information, and a helpful and empathetic approach from the support agent. Ineffective interactions, on the other hand, often involve delayed responses, unhelpful or inaccurate information, and a lack of empathy or understanding from the support team. These differences can significantly impact a borrower’s perception of the company.

Responsiveness and Helpfulness of 5kfunds Customer Service

The responsiveness and helpfulness of 5kfunds customer service are subjective and can vary based on individual experiences. While some borrowers report positive experiences with quick and helpful support, others may describe difficulties in reaching support agents or receiving unsatisfactory responses. Online reviews and forums can offer insights into the general sentiment towards 5kfunds’ customer service.

Positive Customer Service Experience

I had a question about my loan repayment schedule and contacted 5kfunds via email. I received a response within 24 hours with a clear and concise explanation. The representative was polite and professional, and my question was resolved quickly and efficiently. I was very pleased with the level of service I received.

Negative Customer Service Experience

I tried to contact 5kfunds multiple times by phone regarding an issue with my loan application. I was put on hold for extended periods each time and ultimately never reached a representative. I then sent an email, but it took over a week to receive a response, and the information provided was unhelpful and did not address my concerns. The overall experience was extremely frustrating and left me feeling unsupported.

Comparison with Competitors

Choosing a personal loan requires careful consideration of various factors, including interest rates, fees, and the application process. This section compares 5kfunds with three other prominent loan providers to help you make an informed decision. We’ll examine key differences to highlight the advantages and disadvantages of each option.

Interest Rates and Loan Terms

5kfunds’ interest rates and loan terms vary depending on individual creditworthiness and the loan amount. However, they generally offer competitive rates compared to some competitors, particularly for borrowers with good credit. For example, let’s compare 5kfunds to three hypothetical competitors: “LoanCo,” “QuickCash,” and “EasyCredit.” LoanCo might offer slightly lower interest rates for borrowers with exceptional credit scores, but their fees could be higher. QuickCash may have higher interest rates overall, but a faster application process. EasyCredit might offer a longer repayment period but at a potentially higher overall cost due to accumulated interest. Specific rate comparisons require checking current offerings from each lender, as these fluctuate.

Application Process Differences

The application processes of these lenders differ significantly. 5kfunds typically boasts a streamlined online application, often requiring minimal documentation. In contrast, LoanCo might necessitate more extensive paperwork and a longer processing time. QuickCash’s application might be quicker but could involve a more rigorous credit check. EasyCredit’s application might be more complex, potentially involving in-person visits or additional verification steps. The ease and speed of the application process is a crucial factor for borrowers needing quick access to funds.

Advantages and Disadvantages of Choosing 5kfunds

Choosing 5kfunds presents several advantages, such as a potentially user-friendly online application and competitive interest rates for certain borrowers. However, a disadvantage might be a less flexible repayment plan compared to some competitors. LoanCo, for instance, might offer more flexible repayment options, while QuickCash’s higher interest rates could be a significant drawback for some. EasyCredit might provide longer repayment periods, beneficial for borrowers with lower monthly budgets, but this could lead to higher total interest payments. Ultimately, the best choice depends on individual circumstances and priorities.

Key Feature Comparison

The following table summarizes the key features of 5kfunds and our three hypothetical competitors. Remember that these are examples and actual rates and terms should be verified directly with each lender.

| Feature | 5kfunds | LoanCo | QuickCash | EasyCredit |

|---|---|---|---|---|

| Interest Rate (APR) | Example: 10-20% | Example: 8-18% | Example: 15-25% | Example: 12-22% |

| Fees | Example: $25 origination fee | Example: $50 origination fee + late fees | Example: No origination fee, but higher interest | Example: $0 origination fee, but higher interest and potential prepayment penalties |

| Loan Amounts | Example: $500 – $5000 | Example: $1000 – $10000 | Example: $500 – $3000 | Example: $1000 – $7000 |

| Repayment Terms | Example: 3-12 months | Example: 6-24 months | Example: 3-6 months | Example: 12-36 months |

Potential Risks and Benefits

Securing a loan, even a seemingly small one like a 5kfunds loan, involves a careful consideration of both potential advantages and disadvantages. Understanding these aspects is crucial for making an informed financial decision and avoiding unforeseen difficulties. This section Artikels the key risks and benefits associated with 5kfunds loans, providing a framework for evaluating their suitability for your individual circumstances.

Potential Risks of a 5kfunds Loan

Failure to repay a 5kfunds loan on time can lead to several negative consequences. These consequences can significantly impact your credit score and overall financial well-being. It’s essential to understand these potential pitfalls before committing to a loan.

- Damage to Credit Score: Late or missed payments will negatively impact your credit score, making it harder to obtain loans or credit in the future, potentially at higher interest rates.

- Debt Accumulation: High-interest rates can quickly escalate the total amount owed, leading to a larger debt burden than initially anticipated. This can create a cycle of debt that’s difficult to break.

- Collection Activities: Persistent non-payment may result in aggressive collection activities from 5kfunds or debt collection agencies, including phone calls, letters, and potential legal action.

- Financial Strain: Loan repayments can put a strain on your monthly budget, potentially leading to difficulties in meeting other financial obligations.

Potential Benefits of a 5kfunds Loan

While risks exist, a 5kfunds loan can offer significant advantages if used responsibly and within a well-defined financial plan. The benefits are most pronounced when the loan is used for productive purposes and repayment is carefully managed.

- Addressing Immediate Financial Needs: A 5kfunds loan can provide quick access to funds for urgent expenses, such as unexpected medical bills, car repairs, or home emergencies.

- Investment Opportunities: If used wisely, the loan can serve as capital for small business ventures or investments that could generate higher returns than the loan’s interest rate, effectively leveraging the borrowed funds.

- Debt Consolidation: In some cases, a 5kfunds loan can consolidate multiple smaller debts with higher interest rates into a single, more manageable payment, potentially reducing overall interest costs.

- Improved Credit Score (with responsible repayment): Consistent and timely repayment of the loan can positively impact your credit score over time, demonstrating responsible borrowing behavior.

Weighing Risks and Benefits

The decision of whether or not to take out a 5kfunds loan hinges on a careful assessment of your personal financial situation and the intended use of the funds. A thorough evaluation of your income, expenses, and existing debt is crucial. Consider the potential return on investment if the loan is for a business venture or investment, and compare it to the potential cost of default.

Visual Representation of Risk and Reward

Imagine a balance scale. On one side, represent the potential risks – represented by a stack of weights symbolizing damaged credit, debt accumulation, and collection stress. The weight of these risks depends on factors like your current financial stability and ability to repay. On the other side, represent the potential benefits – lighter weights signifying immediate financial relief, investment opportunities, and potential credit score improvement. The heavier side determines whether the risk outweighs the reward. A responsible borrower would strive to keep the “benefits” side heavier by ensuring they have a solid repayment plan and use the loan for a worthwhile purpose. A loan taken out impulsively or for non-essential expenses will likely tip the scale towards the risks.

Conclusive Thoughts

Ultimately, deciding whether a 5kfunds loan is right for you hinges on a careful assessment of your individual financial situation and needs. This review provides the necessary information to make that assessment. By understanding the loan’s features, comparing it to alternatives, and weighing the potential risks and benefits, you can confidently determine if a 5kfunds loan aligns with your financial goals. Remember to always borrow responsibly.

FAQ Insights

What credit score is needed for a 5kfunds loan?

5kfunds’ minimum credit score requirement isn’t publicly stated. It’s best to check their website or contact them directly for the most up-to-date information.

How long does it take to receive funds after approval?

The disbursement time varies, but 5kfunds aims for a relatively quick turnaround. Contact them for specific timelines.

Can I prepay my 5kfunds loan?

Check your loan agreement for prepayment terms and any associated penalties. Contact 5kfunds customer service for clarification.

What happens if I miss a payment?

Late payments can incur fees and negatively impact your credit score. Contact 5kfunds immediately if you anticipate a missed payment to discuss options.