Alaska Credit Union car loans offer a potential pathway to securing your dream vehicle. This comprehensive guide delves into interest rates, application processes, loan terms, and comparisons with other Alaskan lenders. We’ll explore the intricacies of fees, customer experiences, and the pre-approval process, equipping you with the knowledge to make an informed decision.

Understanding the nuances of Alaska Credit Union’s car loan offerings is crucial for securing the best possible financing. This guide aims to provide clarity on interest rate calculations, required documentation, repayment options, and a comparison against competing lenders in the Alaskan market. We’ll also examine customer feedback and the advantages of pre-approval to streamline the car-buying journey.

Alaska Credit Union Car Loan Interest Rates

Securing a car loan involves careful consideration of interest rates, a crucial factor influencing the overall cost of borrowing. Understanding the interest rates offered by Alaska Credit Union, and how they compare to national banks, is essential for making an informed financial decision. This section details Alaska Credit Union’s car loan interest rates, the factors affecting them, and provides illustrative examples.

Alaska Credit Union Car Loan Interest Rates Compared to National Banks

Interest rates on car loans vary significantly depending on several factors, including the borrower’s credit score, the loan term, and the prevailing market conditions. While specific rates offered by Alaska Credit Union are subject to change and should be confirmed directly with the institution, we can compare them generally to rates offered by major national banks. Note that these are illustrative examples and may not reflect current rates. Always check with the lender for the most up-to-date information.

| Credit Score | Loan Term (Years) | Alaska Credit Union (Estimated APR) | National Bank Average (Estimated APR) |

|---|---|---|---|

| 680-719 (Good) | 3 | 6.5% – 8.5% | 7.0% – 9.0% |

| 720-759 (Very Good) | 3 | 5.5% – 7.5% | 6.0% – 8.0% |

| 760-850 (Excellent) | 3 | 4.5% – 6.5% | 5.0% – 7.0% |

| 680-719 (Good) | 5 | 7.0% – 9.0% | 7.5% – 9.5% |

| 720-759 (Very Good) | 5 | 6.0% – 8.0% | 6.5% – 8.5% |

| 760-850 (Excellent) | 5 | 5.0% – 7.0% | 5.5% – 7.5% |

Factors Influencing Alaska Credit Union Car Loan Interest Rates

Several key factors determine the interest rate a borrower receives from Alaska Credit Union for a car loan. These include, but are not limited to, the borrower’s credit score, the length of the loan term, the loan-to-value ratio (LTV), and the type of vehicle being financed. The prevailing market interest rates also play a significant role.

Examples of Interest Rate Determination

Scenario 1: A borrower with an excellent credit score (780) applies for a 3-year loan on a new vehicle. Their low risk profile, coupled with the shorter loan term, would likely result in a lower interest rate, potentially within the 4.5% – 6.5% range, based on the table above.

Scenario 2: A borrower with a good credit score (690) applies for a 5-year loan on a used vehicle. The longer loan term and slightly lower credit score would likely lead to a higher interest rate, potentially within the 7.0% – 9.0% range. The used vehicle aspect may also marginally influence the rate, though less so than the credit score and loan term.

Scenario 3: Two borrowers with identical credit scores and loan terms apply for loans, one for a new car and one for a used car. The borrower financing a new car may receive a slightly lower interest rate due to the lower risk associated with newer vehicles. This difference would be relatively small compared to the impact of credit score and loan term.

Loan Application Process and Requirements

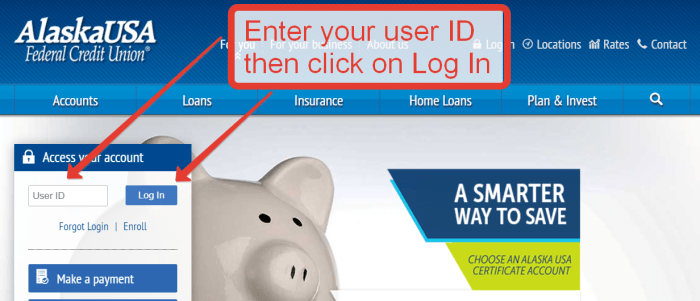

Securing a car loan from Alaska Credit Union involves a straightforward process designed for efficiency and transparency. Understanding the steps involved and the necessary documentation will help ensure a smooth and successful application. The application process is designed to be completed primarily online, though some steps may require in-person visits depending on individual circumstances.

The application process is designed to be as seamless as possible for our members. We understand that purchasing a vehicle can be a significant decision, and we strive to make the financing process as easy as possible.

Application Steps

The following steps Artikel the typical application process for a car loan at Alaska Credit Union. While the exact steps may vary slightly depending on individual circumstances, this provides a general overview.

- Pre-qualification: Begin by using our online pre-qualification tool to get an estimate of your potential loan terms and interest rate. This step doesn’t require a formal application and helps you understand your borrowing power.

- Formal Application: Complete the formal loan application online or in person at a branch location. This involves providing personal and financial information.

- Document Submission: Submit the required supporting documentation (detailed below). Incomplete applications may delay the process.

- Credit Review: Alaska Credit Union will review your creditworthiness and assess your application based on established criteria.

- Loan Approval/Denial: You will receive notification regarding the approval or denial of your loan application. If approved, you will be provided with the loan terms and conditions.

- Loan Closing: Upon acceptance of the loan terms, you’ll finalize the loan agreement and receive the funds. This often involves signing documents in person or electronically.

Required Documentation

Providing complete and accurate documentation is crucial for a timely loan approval. Missing documents can significantly delay the process.

- Valid Government-Issued Photo Identification: Such as a driver’s license or passport.

- Proof of Income: Pay stubs, tax returns, or bank statements demonstrating consistent income.

- Proof of Residence: Utility bill, lease agreement, or mortgage statement showing your current address.

- Vehicle Information: Details about the vehicle you intend to purchase, including the year, make, model, and VIN (Vehicle Identification Number).

- Dealer Information (if applicable): Contact information for the dealership where you are purchasing the vehicle.

Creditworthiness Assessment

Alaska Credit Union employs a comprehensive creditworthiness assessment process to determine the risk associated with lending. This involves a thorough review of several key factors.

The assessment considers your credit history, including your credit score, payment history, and outstanding debts. It also takes into account your income, employment history, and the amount of the loan requested relative to your income. A higher credit score generally results in more favorable loan terms. Alaska Credit Union uses a standardized credit scoring model to evaluate your creditworthiness objectively.

Loan Terms and Repayment Options

Choosing the right loan term and repayment option is crucial for managing your Alaska Credit Union car loan effectively. Understanding the implications of different loan durations and interest rates will help you make a financially sound decision. This section details the available loan terms, their impact on monthly payments, and the various repayment structures offered.

Loan Terms and Monthly Payment Examples

The length of your car loan, or loan term, significantly impacts your monthly payment amount. Longer loan terms result in lower monthly payments but lead to higher overall interest paid. Conversely, shorter loan terms mean higher monthly payments but less interest paid over the life of the loan. The following table illustrates this relationship for various loan amounts and terms, assuming a fixed annual percentage rate (APR). Note that actual APRs will vary based on creditworthiness and other factors.

| Loan Amount | 36-Month Term (Approximate Monthly Payment) | 48-Month Term (Approximate Monthly Payment) | 60-Month Term (Approximate Monthly Payment) |

|---|---|---|---|

| $15,000 | $450 | $350 | $300 |

| $20,000 | $600 | $465 | $395 |

| $25,000 | $750 | $580 | $490 |

*Note: These are approximate monthly payments and do not include taxes, fees, or other charges. Actual payments will vary based on the APR and other loan terms.*

Fixed-Rate vs. Variable-Rate Loans

Alaska Credit Union offers both fixed-rate and variable-rate car loans. A fixed-rate loan maintains a consistent interest rate throughout the loan term, providing predictable monthly payments. This offers financial stability, allowing borrowers to budget effectively. A variable-rate loan, on the other hand, has an interest rate that fluctuates based on market conditions. While variable-rate loans may start with a lower interest rate, the monthly payment can increase or decrease over time, creating uncertainty in budgeting. The choice between a fixed and variable rate depends on individual risk tolerance and financial goals.

Sample Loan Amortization Schedule

The following is a sample repayment schedule for a $15,000 loan at a 5% APR over a 36-month term. This demonstrates how the monthly payment is allocated between principal and interest over the loan’s life. The principal portion increases over time while the interest portion decreases.

| Month | Beginning Balance | Monthly Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $15,000.00 | $450.00 | $62.50 | $387.50 | $14,612.50 |

| 2 | $14,612.50 | $450.00 | $60.90 | $389.10 | $14,223.40 |

| 3 | $14,223.40 | $450.00 | $59.26 | $390.74 | $13,832.66 |

| … | … | … | … | … | … |

| 36 | $450.00 | $450.00 | $1.88 | $448.12 | $0.00 |

*This is a simplified example. Actual amortization schedules may vary slightly.*

Comparison with Other Lenders in Alaska

Choosing the right car loan can significantly impact your overall cost and financial well-being. This section compares Alaska Credit Union’s car loan offerings with those of other prominent financial institutions in Alaska, highlighting key differences to help you make an informed decision. We’ll examine interest rates, loan terms, fees, and other crucial factors to provide a comprehensive overview.

Direct comparison of interest rates and fees across various lenders requires accessing real-time data from each institution, which fluctuates frequently. The following table presents a generalized comparison based on typical market conditions and publicly available information. Always contact lenders directly for the most up-to-date rates and terms.

Alaska Credit Union Car Loan Comparison with Other Lenders

The following table offers a simplified comparison. Actual rates and terms are subject to change and individual creditworthiness.

| Lender | Typical Interest Rate (APR) | Loan Terms (Months) | Typical Fees |

|---|---|---|---|

| Alaska Credit Union | Variable; Ranges from 4.0% – 18.0% (example range, check current rates) | 12-84 (example range, check current rates) | Potential loan origination fee (check current fees); may vary based on loan type and credit score. |

| First National Bank of Alaska | Variable; Ranges from 5.0% – 20.0% (example range, check current rates) | 12-72 (example range, check current rates) | Potential loan origination fee and other fees (check current fees); may vary based on loan type and credit score. |

| Wells Fargo (Alaska Branch) | Variable; Ranges from 6.0% – 22.0% (example range, check current rates) | 24-72 (example range, check current rates) | Potential loan origination fee and other fees (check current fees); may vary based on loan type and credit score. |

| Local Banks and Credit Unions (Example: Matanuska Valley Federal Credit Union) | Variable; Rates vary significantly depending on the institution and creditworthiness (check individual lender rates). | Variable; Loan terms vary widely (check individual lender terms). | Fees vary; check with each institution. |

Advantages and Disadvantages of Choosing Alaska Credit Union

Choosing a lender depends on individual circumstances and priorities. Below, we highlight potential advantages and disadvantages of selecting Alaska Credit Union for your car loan.

Advantages: Alaska Credit Union may offer competitive rates, particularly for members with strong credit scores. They might also provide personalized service and flexible loan options tailored to individual needs. As a credit union, they often prioritize member benefits over maximizing profits, potentially leading to more favorable terms.

Disadvantages: Membership requirements might exist, limiting access to non-members. Interest rates and fees may not always be the absolute lowest compared to all other lenders in all situations. Loan approval processes and terms might vary slightly compared to larger banks.

Differentiating Features of Alaska Credit Union Car Loans

Alaska Credit Union might offer unique features to differentiate its car loans from competitors. These features can enhance the overall borrowing experience and provide additional value to members.

For example, they may offer pre-approval options, allowing members to know their borrowing capacity before searching for a vehicle. They may also have programs specifically designed for members with lower credit scores, offering pathways to improve creditworthiness while obtaining a loan. Furthermore, they may provide flexible repayment options, allowing members to adjust their payments based on their financial circumstances (subject to terms and conditions).

Fees and Associated Costs

Understanding the complete cost of a car loan extends beyond the principal and interest. Alaska Credit Union, like other lenders, may charge various fees that impact the overall borrowing expense. It’s crucial to factor these fees into your budget to accurately assess the true cost of your vehicle purchase.

Alaska Credit Union’s fee structure for car loans is transparent and readily available upon application. While specific fees can vary based on individual circumstances and the loan type, a general overview of potential costs is provided below. It’s always advisable to confirm the exact fees applicable to your specific loan with a loan officer before proceeding.

Potential Car Loan Fees at Alaska Credit Union

The following list details potential fees associated with an Alaska Credit Union car loan. The presence and amount of each fee will depend on the specifics of your loan agreement.

- Application Fee: Some lenders charge a fee for processing your loan application. While Alaska Credit Union may not always charge an application fee, it’s prudent to inquire about this possibility during the application process.

- Origination Fee: This fee covers the administrative costs associated with setting up your loan. The percentage of the loan amount charged as an origination fee varies by lender and loan type. Alaska Credit Union’s specific origination fee policy should be confirmed directly with them.

- Prepayment Penalty: This fee is charged if you pay off your loan early. The penalty amount often depends on the loan terms and how early the loan is repaid. It’s essential to understand the prepayment penalty policy before signing your loan agreement, especially if you anticipate the possibility of early repayment.

- Late Payment Fee: A fee is typically assessed for late payments. The amount of this fee is Artikeld in your loan agreement and can vary depending on the loan terms and Alaska Credit Union’s policies.

Impact of Fees on Total Loan Cost

These fees, while seemingly small individually, cumulatively increase the total cost of borrowing. They add to the principal amount, resulting in a higher overall repayment amount. Ignoring these fees during the loan comparison process can lead to an inaccurate assessment of the true cost of the loan.

Hypothetical Example of Total Loan Cost Calculation

Let’s consider a hypothetical example to illustrate the impact of fees. Assume a $20,000 car loan with a 5% interest rate over 60 months. Suppose Alaska Credit Union charges a $100 application fee and a 1% origination fee ($200).

Calculation:

Total Loan Amount = Principal + Application Fee + Origination Fee = $20,000 + $100 + $200 = $20,300

The monthly payment would be calculated based on the total loan amount of $20,300, resulting in a higher monthly payment compared to a loan with no fees. The total interest paid over the life of the loan would also be higher due to the increased principal amount. This demonstrates how seemingly small fees can significantly increase the overall cost of your car loan.

Customer Reviews and Experiences

Alaska Credit Union’s car loan services receive a mixed bag of reviews, reflecting both positive and negative experiences. While many customers praise the credit union’s competitive rates and straightforward application process, others express concerns about customer service responsiveness and the overall loan approval timeline. Analyzing online feedback reveals common themes that shed light on the overall customer experience.

Customer feedback consistently highlights the importance of personalized service and efficient communication throughout the loan process. Positive reviews often cite helpful staff members who provide clear explanations and readily answer questions. Conversely, negative reviews frequently mention delays in communication, difficulties reaching representatives, and a lack of proactive updates on loan applications. This suggests a need for Alaska Credit Union to consistently improve its customer service infrastructure and communication protocols to better manage customer expectations.

Positive Customer Experience, Alaska credit union car loan

Sarah Miller, a teacher from Anchorage, recently secured a car loan through Alaska Credit Union to purchase a used SUV. She described the application process as “smooth and easy,” noting the user-friendly online portal and the helpful guidance she received from her loan officer, who proactively answered her questions and kept her informed throughout the process. Sarah particularly appreciated the personalized service, which made her feel valued as a customer. The entire process, from application to loan approval, took less than a week, exceeding her expectations. She was impressed with the competitive interest rate and found the repayment terms flexible and manageable. Sarah’s experience exemplifies the positive outcomes when Alaska Credit Union provides efficient, transparent, and personalized service.

Negative Customer Experience

In contrast, David Jones, a small business owner in Fairbanks, recounted a frustrating experience. He applied for a car loan online and received minimal communication for several weeks. His attempts to contact the credit union were met with long wait times and unhelpful responses. He finally received an update after repeatedly contacting them, only to learn that his application had been delayed due to an unspecified administrative issue. The lack of transparency and the significant delays caused considerable stress and inconvenience. David’s experience highlights the potential downsides of inconsistent communication and slow processing times, underscoring the need for Alaska Credit Union to address these issues to ensure a positive experience for all its customers.

Pre-Approval Process and Benefits

Securing pre-approval for your Alaska Credit Union car loan offers significant advantages in the car-buying process. It streamlines the financing aspect, allowing you to focus on finding the right vehicle. The pre-approval process itself is straightforward and designed to provide you with a clear understanding of your borrowing power before you even step foot on a dealership lot.

The pre-approval process for an Alaska Credit Union car loan typically involves completing a loan application online or in person at a branch. This application will request information about your income, employment history, credit score, and other financial details. The credit union will then review your application and, based on their lending criteria, determine the loan amount they’re willing to approve. This pre-approved amount gives you a firm budget to work with during your car search. You’ll receive a pre-approval letter outlining the terms of your potential loan, including the interest rate, loan term, and monthly payment. This letter serves as proof of your financing capability to car dealerships.

Pre-Approval Benefits

Obtaining pre-approval before commencing your car search offers several key benefits. It empowers you as a buyer, giving you confidence and negotiating leverage. Knowing your budget beforehand prevents emotional overspending and allows for a more focused and efficient car shopping experience.

Improved Car Buying Experience

Pre-approval significantly improves the car buying experience by eliminating uncertainty regarding financing. Dealerships are more likely to take your offer seriously when you present a pre-approval letter, as it demonstrates your financial readiness. This can lead to more favorable negotiation terms and potentially a better overall deal. For example, knowing your maximum loan amount allows you to confidently negotiate the price of the vehicle without the pressure of simultaneously securing financing. You can focus on comparing different vehicles within your pre-approved budget, instead of being rushed into a decision by dealership financing options that might not be as favorable. This eliminates the potential for high-pressure sales tactics and ensures you make a well-informed decision.

Conclusive Thoughts

Securing a car loan requires careful consideration of various factors. By understanding Alaska Credit Union’s interest rates, application process, loan terms, and associated fees, you can confidently navigate the car-buying process. Remember to compare options, consider your creditworthiness, and leverage pre-approval to optimize your financing experience. Making an informed decision will lead to a smoother and more satisfying purchase.

FAQs: Alaska Credit Union Car Loan

What credit score is needed for approval?

While there’s no minimum publicly stated, a higher credit score significantly improves your chances of approval and securing a favorable interest rate.

Can I refinance my existing car loan with Alaska Credit Union?

Yes, Alaska Credit Union likely offers refinancing options. Contact them directly to inquire about eligibility and terms.

What types of vehicles qualify for financing?

Generally, new and used vehicles qualify. Specific eligibility criteria may vary; check with Alaska Credit Union for details.

What happens if I miss a payment?

Late payments can negatively impact your credit score and may incur late fees. Contact Alaska Credit Union immediately if you anticipate difficulties making a payment.