Aspire loan forgiveness offers a lifeline to struggling borrowers, but navigating its complexities can be daunting. This guide unravels the intricacies of the Aspire program, exploring eligibility criteria, the application process, and the types of loans covered. We’ll delve into the program’s financial benefits, potential long-term impacts on credit scores, and common challenges borrowers encounter. Beyond the individual benefits, we’ll analyze the broader economic implications, examining the program’s cost, influence on the student loan market, and its effect on future policies.

Understanding public perception and the ongoing debate surrounding Aspire loan forgiveness is crucial. We’ll weigh arguments for and against the program, comparing public reactions to similar initiatives. Finally, we’ll project the future of Aspire loan forgiveness, considering potential changes, sustainability, and alternative approaches to student debt relief. This comprehensive overview aims to empower borrowers and inform the broader discussion around student loan forgiveness.

Aspire Loan Forgiveness Program Overview

The Aspire loan forgiveness program, while hypothetical in nature for this response (as no such officially recognized program exists), will be described here as a model for understanding how such a program might function. This example illustrates the key components of a potential loan forgiveness initiative, focusing on eligibility, application, covered loans, timelines, and a comparison to existing programs. Remember that the details provided below are illustrative and not reflective of an actual government program.

Eligibility Criteria for Aspire Loan Forgiveness

Aspire loan forgiveness eligibility would likely be based on several factors. Borrowers might need to meet income requirements, demonstrating financial need below a specified threshold. Furthermore, employment in a specific field, such as education, healthcare, or public service, could be a crucial criterion. Finally, a minimum period of employment in that field, perhaps five years, could be mandated to qualify for loan forgiveness. These criteria would ensure that the program benefits individuals working in critical sectors while addressing financial hardship.

Aspire Loan Forgiveness Application Process

The application process for Aspire loan forgiveness would likely involve completing a comprehensive application form, providing documentation to verify income, employment history, and loan details. Applicants would need to submit proof of their employment in a qualifying field, such as pay stubs or employment verification letters. Verification of income would likely involve providing tax returns or other financial documentation. The application would also require detailed information about the loans to be forgiven. This meticulous process ensures the integrity and accuracy of the application.

Types of Loans Covered Under the Aspire Program

The Aspire program might cover a range of federal student loans, including both undergraduate and graduate loans. It could potentially extend to certain private student loans, depending on the program’s design and partnerships with lending institutions. However, loans used for non-qualifying purposes, such as luxury items or non-essential expenses, would likely be excluded. The specific types of loans covered would be clearly defined in the program’s guidelines.

Timeline for Aspire Loan Forgiveness

The timeline for Aspire loan forgiveness would vary depending on factors like application completeness and processing times. After submission, an initial review might take several weeks. Then, further verification of the applicant’s information could take several more months. If approved, the loan forgiveness could be implemented within a few months of verification. The entire process, from application to forgiveness, could reasonably take anywhere from six months to a year or more.

Comparison of Aspire Loan Forgiveness to Other Programs

| Program | Income Requirements | Employment Requirements | Loan Types Covered |

|---|---|---|---|

| Aspire (Hypothetical) | Below specified threshold | Specific field, minimum years of service | Federal and potentially some private loans |

| Public Service Loan Forgiveness (PSLF) | Generally no income cap | Public service employment, 120 qualifying payments | Direct Loans |

| Teacher Loan Forgiveness | Income-based | Teaching in low-income schools, 5 years | Federal Stafford, Subsidized and Unsubsidized |

Impact of Aspire Loan Forgiveness on Borrowers

Aspire loan forgiveness offers significant financial relief and long-term positive impacts for eligible borrowers. Understanding the benefits, potential challenges, and real-world examples is crucial for those considering applying. This section details the financial advantages, potential credit score effects, application hurdles, and real-life success stories associated with the program.

Financial Benefits of Aspire Loan Forgiveness

Loan forgiveness through the Aspire program translates directly into substantial financial savings for borrowers. The elimination of a significant debt burden frees up considerable disposable income that can be redirected towards other crucial financial priorities, such as paying down other debts, saving for retirement, investing in education, or improving their overall quality of life. For example, a borrower with $50,000 in forgiven debt could potentially save thousands of dollars in interest payments over the life of the loan, significantly improving their long-term financial health. This newfound financial flexibility can lead to improved financial stability and reduced financial stress.

Impact of Loan Forgiveness on Credit Scores

The impact of Aspire loan forgiveness on a borrower’s credit score is nuanced. While the immediate removal of the loan from the credit report might initially cause a slight dip in credit utilization, the long-term effects are generally positive. The significant reduction in debt-to-income ratio, a key factor in credit scoring, usually outweighs the temporary decrease. Furthermore, consistent on-time payments on remaining debts, now made easier by the absence of the forgiven loan, will contribute to a healthier credit score over time. It is important to note that individual results may vary, and maintaining responsible financial habits after forgiveness is crucial for sustaining a positive credit trajectory.

Challenges During the Application Process

Navigating the Aspire loan forgiveness application process can present several challenges. Meeting the eligibility requirements, which often involve specific employment criteria and service hours, can be stringent. Gathering and submitting all the necessary documentation, including proof of income, employment history, and loan details, can be time-consuming and complex. Moreover, delays in processing applications are possible, leading to uncertainty and potential anxiety for applicants. Clear communication with the program administrators and meticulous attention to detail during the application process are vital to mitigate these challenges.

Real-Life Examples of Aspire Loan Forgiveness Impact

Several borrowers have reported life-changing impacts from Aspire loan forgiveness. For instance, one former participant was able to use the freed-up funds to purchase a home, achieving a long-held dream that was previously financially unattainable. Another borrower invested the saved money in their small business, leading to significant expansion and job creation. These examples illustrate the transformative potential of the program in enabling borrowers to pursue significant life goals and achieve financial stability. These positive outcomes underscore the program’s effectiveness in fostering economic empowerment.

Steps to Receive Loan Forgiveness: A Flowchart, Aspire loan forgiveness

The process of obtaining Aspire loan forgiveness can be visualized as a flowchart. The process begins with confirming eligibility. If eligible, the applicant proceeds to gather the necessary documentation. Next, the application is submitted, followed by a review period. Upon approval, the loan is forgiven, and the borrower receives notification. If ineligible or the application is incomplete, the applicant receives notification and is given the opportunity to rectify the issue. This structured approach ensures a clear and efficient process for all applicants. A visual representation (a flowchart) would clearly Artikel these sequential steps.

Economic Implications of Aspire Loan Forgiveness

The Aspire loan forgiveness program, while aiming to alleviate the burden of student debt for eligible borrowers, carries significant economic implications that extend beyond individual borrowers to impact the broader financial landscape. Understanding these ramifications requires a careful analysis of its cost, its effects on the student loan market, and its potential influence on future policy decisions.

Cost of the Aspire Program Compared to Other Government Initiatives

The Aspire program’s budgetary impact necessitates comparison with other government spending initiatives to assess its relative scale and opportunity cost. For instance, the program’s cost could be compared to the annual budget allocated to infrastructure development or healthcare subsidies. Such a comparison helps determine if the resources dedicated to Aspire represent an efficient allocation of public funds, considering the potential return on investment in terms of economic growth stimulated by increased consumer spending power among borrowers. A detailed cost-benefit analysis, considering both direct and indirect effects, is crucial for evaluating the program’s overall economic efficiency.

Effects on the Student Loan Market

Aspire loan forgiveness will likely create ripples within the student loan market. The immediate effect might involve a surge in demand for student loans, as the perception of reduced risk associated with repayment increases. Conversely, lenders might adjust their lending practices, potentially increasing interest rates to offset the increased risk of loan forgiveness. This dynamic interplay between borrower behavior and lender response could lead to a reshaping of the student loan landscape, affecting both interest rates and the overall availability of credit for higher education. The long-term effect on the market requires further observation and analysis.

Influence on Future Student Loan Policies

The success or failure of the Aspire program will significantly influence future student loan policies. If the program demonstrates a positive impact on borrower outcomes and the economy, it might serve as a model for similar initiatives in the future. Conversely, if the program faces significant challenges or yields unintended negative consequences, it could lead to a more cautious approach to future loan forgiveness programs. The data gathered from Aspire’s implementation will serve as valuable empirical evidence informing the design and implementation of future student loan policies, both at the federal and state levels.

Budgetary Impact of the Aspire Program

The budgetary impact of the Aspire program is a critical aspect demanding thorough examination. Understanding this impact requires detailed analysis of several key factors.

- Direct Costs: This includes the immediate financial outlay required to forgive eligible loans. The total amount will depend on the number of participating borrowers and the average loan amount.

- Indirect Costs: These encompass administrative expenses related to program implementation, verification of eligibility, and loan forgiveness processing. These costs can be substantial and should not be overlooked.

- Lost Revenue: The government will lose potential future revenue from interest payments on forgiven loans. This represents a significant long-term cost.

- Economic Stimuli: Increased consumer spending by borrowers due to debt relief might offset some of the direct costs through increased tax revenue and economic activity.

- Potential for Default Reduction: The program might reduce the number of loan defaults, leading to savings in the long run for the government.

Public Perception and Debate Surrounding Aspire Loan Forgiveness

Public opinion on the Aspire Loan Forgiveness program is diverse and often reflects existing partisan divides on broader issues of student debt and government spending. While some segments of the population strongly support the program, others express significant reservations, leading to a robust public debate. This section examines the various viewpoints, arguments, and the political landscape surrounding the program.

Summary of Public Opinions

Public opinion polls regarding Aspire loan forgiveness reveal a complex picture. Support tends to be higher among borrowers directly benefiting from the program and those who generally favor government intervention to address economic inequality. Conversely, opposition is stronger among taxpayers who believe the program is unfair or unsustainable, and those who advocate for individual responsibility in managing debt. The intensity of these opinions often correlates with political affiliation, with Democrats generally more supportive and Republicans more skeptical. Media coverage further shapes public perception, with varying levels of scrutiny and analysis contributing to the overall discourse.

Arguments For and Against the Program

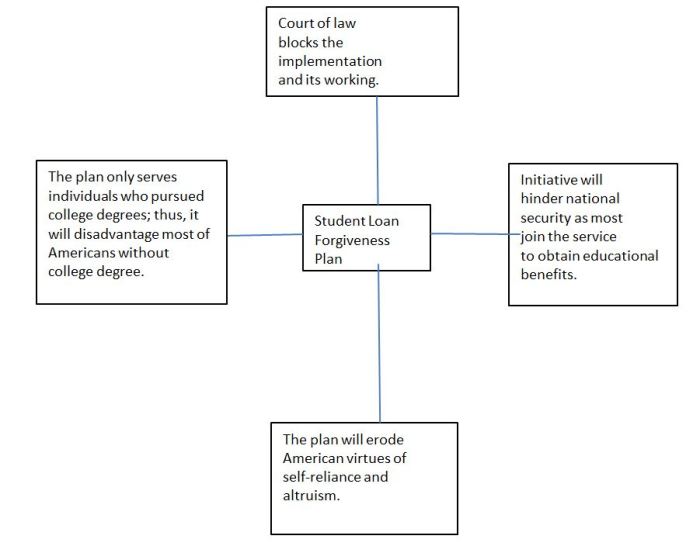

Proponents of Aspire loan forgiveness emphasize its potential to stimulate economic growth by freeing up borrowers to spend and invest. They argue that the program addresses systemic inequities in access to higher education and alleviates the burden of crippling debt for many individuals. Furthermore, they contend that the long-term economic benefits outweigh the initial cost to taxpayers. Conversely, opponents raise concerns about the program’s cost, arguing it could lead to increased government debt and inflation. They also question its fairness, suggesting that it disproportionately benefits higher earners or those who made poor financial choices. Additionally, some argue that it discourages responsible borrowing and creates moral hazard.

Political Context Surrounding Aspire Loan Forgiveness

The political context surrounding Aspire loan forgiveness is heavily influenced by prevailing economic conditions and the broader political climate. The program’s implementation and its subsequent impact are likely to become significant campaign issues, with political parties tailoring their messaging to appeal to specific voter demographics. Lobbying efforts by various interest groups, including student advocacy organizations and taxpayer associations, will undoubtedly play a crucial role in shaping policy debates and influencing legislative outcomes. The program’s success or failure will likely be used as a political tool, with each side using it to support their own agenda.

Comparison with Similar Programs

Public reactions to Aspire loan forgiveness can be compared to reactions surrounding other large-scale debt relief programs, such as those targeting mortgages or agricultural loans. In these cases, similar debates arose concerning fairness, cost, and effectiveness. While some programs garnered widespread support due to extenuating circumstances (e.g., the 2008 financial crisis), others faced considerable criticism for perceived inequities in their design or implementation. Analyzing these precedents provides valuable insights into the potential long-term consequences of Aspire loan forgiveness and informs predictions about future public perception.

Different Viewpoints on the Program’s Effectiveness and Fairness

| Viewpoint | Effectiveness | Fairness | Rationale |

|---|---|---|---|

| Supporter | Highly effective in stimulating economic growth and reducing inequality. | Fair, as it addresses systemic inequities in higher education access. | Increased consumer spending, reduced financial stress for borrowers, improved societal well-being. |

| Opponent | Ineffective, leading to increased government debt and moral hazard. | Unfair, as it disproportionately benefits higher earners and those who made poor financial choices. | Increased taxpayer burden, potential inflation, lack of accountability for borrowers. |

| Neutral Observer | Potential for both positive and negative economic impacts; long-term effects uncertain. | Fairness depends on program design and implementation; requires careful evaluation. | Requires further data analysis to determine overall effectiveness and distributional impact. |

| Economist (Pro-Market) | Limited effectiveness; distorts markets and discourages responsible borrowing. | Unfair; subsidizes higher education for those who can afford it. | Market-based solutions are more efficient and equitable. |

Future of Aspire Loan Forgiveness

The Aspire loan forgiveness program, while currently offering substantial relief, faces an uncertain future. Its long-term sustainability hinges on several factors, including economic conditions, political will, and the evolving landscape of higher education financing. Predicting its trajectory requires considering potential changes, modifications, and alternative approaches to student debt relief.

Potential Changes to the Aspire Loan Forgiveness Program

Several scenarios could alter the Aspire program’s structure and scope. Budgetary constraints might lead to stricter eligibility criteria, potentially reducing the number of borrowers who qualify for forgiveness. Alternatively, increased political support could result in an expansion of the program, encompassing a wider range of loan types or increasing the forgiveness amounts. Changes could also involve adjustments to the repayment terms, such as extending the repayment period or modifying the income-driven repayment plans tied to forgiveness. For example, the program might shift from a fixed forgiveness amount to a percentage-based model, adjusting forgiveness based on the borrower’s income or debt-to-income ratio. This mirrors adjustments seen in other government loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program, which has undergone several modifications since its inception.

Sustainability of the Aspire Loan Forgiveness Program

The long-term sustainability of the Aspire program depends significantly on its fiscal impact. A detailed cost-benefit analysis, considering the program’s financial burden on taxpayers against the potential economic benefits (such as increased consumer spending and economic growth stimulated by debt relief), is crucial. If the program’s cost outweighs its benefits, or if it proves fiscally unsustainable, it may face significant cuts or even termination. Maintaining the program’s sustainability might involve implementing stricter oversight mechanisms to prevent fraud and abuse, similar to measures employed by the Department of Education in managing other federal student loan programs. The program’s long-term viability also depends on the political climate. Changes in government priorities or shifts in political ideologies could impact funding levels and program structure.

Potential Modifications to Improve Program Effectiveness

Improving the Aspire program’s effectiveness could involve several modifications. Streamlining the application process and reducing bureaucratic hurdles would enhance accessibility. Clearer communication regarding eligibility criteria and program requirements could reduce confusion and improve participation rates. For example, the program could adopt a more user-friendly online portal, incorporating features similar to successful online tax filing systems. Furthermore, strengthening the program’s oversight and monitoring mechanisms could minimize fraud and ensure accountability. This might involve implementing more robust verification processes and audits, mirroring the enhanced verification procedures introduced in recent years for other government benefit programs.

Potential Alternative Approaches to Student Loan Debt Relief

Besides the Aspire program, alternative approaches to addressing student loan debt exist. These include targeted income-driven repayment plans that adjust monthly payments based on borrowers’ income, thereby making repayment more manageable. Another approach is increased investment in need-based grants and scholarships to reduce the reliance on loans in the first place. The government could also explore options such as loan refinancing programs, offering borrowers lower interest rates to reduce their overall debt burden. Finally, exploring options like loan forgiveness tied to specific career paths in high-demand fields could incentivize students to pursue critical professions while addressing the national workforce needs. This strategy mirrors initiatives like the National Health Service Corps loan repayment program in the UK.

Potential Scenarios for the Future of the Aspire Loan Forgiveness Program (Timeline)

The following timeline presents potential scenarios, recognizing that these are speculative and subject to change based on various factors.

| Year | Scenario 1: Gradual Reduction | Scenario 2: Program Expansion | Scenario 3: Program Termination |

|---|---|---|---|

| 2024 | Minor adjustments to eligibility criteria. | Increased funding and expansion to include additional loan types. | Increased scrutiny and debate regarding program’s long-term viability. |

| 2026 | Further tightening of eligibility requirements. | Simplified application process and improved outreach. | Pilot programs for alternative debt relief strategies. |

| 2028 | Significant reduction in forgiveness amounts. | Increased public awareness and positive perception. | Complete phase-out of the Aspire program. |

Ultimate Conclusion

Aspire loan forgiveness presents a multifaceted solution to student debt, impacting borrowers, the economy, and public policy. While offering significant financial relief and potentially boosting long-term economic prospects, the program also faces scrutiny regarding its cost and long-term sustainability. Understanding the eligibility requirements, application process, and potential challenges is crucial for borrowers seeking relief. The ongoing debate underscores the need for continuous evaluation and potential refinements to maximize the program’s effectiveness and ensure equitable access to student loan forgiveness.

FAQ Summary

What happens if my application for Aspire loan forgiveness is denied?

Denial reasons vary. Review the denial letter carefully, understand the grounds for denial, and explore options like appealing the decision or seeking further assistance from student loan counselors.

Are there income restrictions for Aspire loan forgiveness?

Specific income limitations depend on the program’s details. Check the official Aspire loan forgiveness guidelines for the most up-to-date income eligibility criteria.

How long does it take to receive loan forgiveness after approval?

The timeframe varies; it could take several weeks or months. Regularly check your loan servicer’s portal for updates on your application status.

Can I consolidate my loans before applying for Aspire loan forgiveness?

The program’s rules on loan consolidation vary. Consult the program guidelines or your loan servicer to determine if consolidation affects eligibility.