Auto loan rates Albuquerque are a crucial factor when buying a car in the Duke City. Understanding the local market, including the influence of Albuquerque’s economic climate and the offerings from various banks and credit unions, is key to securing the best possible financing. This guide will delve into the specifics of auto loan rates in Albuquerque, helping you navigate the process and make informed decisions about your next vehicle purchase.

We’ll explore factors influencing interest rates, such as your credit score, the vehicle’s condition, and loan term length. We’ll also provide practical tips for securing a lower interest rate, including strategies for negotiating with lenders and utilizing online resources to compare offers. By the end, you’ll be equipped to confidently navigate the Albuquerque auto loan market and find the financing solution that best suits your needs.

Understanding Albuquerque’s Auto Loan Market

Albuquerque’s auto loan market, like any other, is intricately tied to the city’s economic health and national lending trends. Factors such as unemployment rates, inflation, and consumer confidence directly influence interest rates and the overall availability of credit. Understanding these dynamics is crucial for securing the best possible auto loan terms.

Albuquerque’s Economic Climate and Auto Loan Rates

Albuquerque’s economy, while generally stable, experiences fluctuations that affect borrowing costs. Periods of economic growth often correlate with lower interest rates as lenders compete for borrowers. Conversely, economic downturns or increased inflation can lead to higher rates as lenders become more risk-averse. For example, during periods of high inflation, the Federal Reserve may raise interest rates to combat inflation, leading to higher auto loan rates across the board, including in Albuquerque. Conversely, during periods of low inflation and economic expansion, the opposite can be true. Analyzing local economic indicators, such as employment figures and housing market activity, can provide insights into the prevailing lending environment.

Major Lenders in Albuquerque

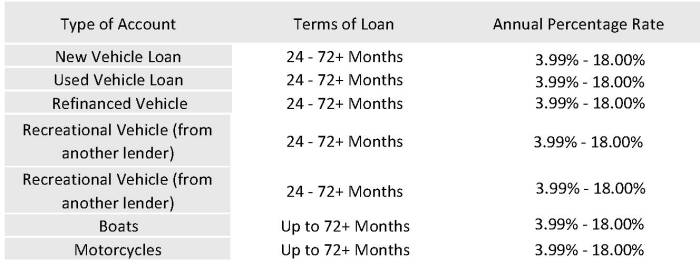

Several major banks and credit unions offer auto loans in Albuquerque, providing borrowers with a range of options. Prominent banks include Wells Fargo, Bank of America, and US Bank, all with established presences in the city. Credit unions, such as Sandia Area Federal Credit Union and Albuquerque Teachers Federal Credit Union, often offer more competitive rates and personalized service due to their member-owned structure. It’s important to compare offers from both banks and credit unions to find the best deal.

Types of Auto Loans Available

Auto loans in Albuquerque generally fall into two categories: new car loans and used car loans. New car loans typically come with higher interest rates compared to used car loans, reflecting the higher initial value of the vehicle. The terms of the loan, including the length of the loan (short-term vs. long-term), also significantly impact the total cost. Short-term loans (e.g., 36 months) result in higher monthly payments but less interest paid over the life of the loan. Long-term loans (e.g., 72 or 84 months) offer lower monthly payments but accumulate significantly more interest over time. The optimal loan term depends on individual financial circumstances and risk tolerance.

Comparison of Auto Loan Rates from Albuquerque Lenders

| Lender | Interest Rate (APR) | Loan Term Options (Months) | Special Offers |

|---|---|---|---|

| Wells Fargo | 3.99% – 18.99% (Variable) | 24, 36, 48, 60, 72 | Potential for discounted rates with autopay |

| Sandia Area Federal Credit Union | 2.99% – 14.99% (Variable) | 36, 48, 60, 72, 84 | Member discounts, potential for lower rates with good credit |

| US Bank | 4.49% – 17.99% (Variable) | 36, 48, 60, 72 | Online application discounts |

*Note: Interest rates are approximate and subject to change based on creditworthiness, loan amount, and prevailing market conditions. Always check with the lender for the most current rates.*

Factors Influencing Auto Loan Rates in Albuquerque

Securing an auto loan in Albuquerque, like in any other location, involves a complex interplay of factors that significantly impact the interest rate you’ll receive. Understanding these factors empowers borrowers to negotiate better terms and potentially save thousands of dollars over the life of their loan. This section will delve into the key elements that lenders consider when determining your auto loan rate.

Credit Score’s Role in Determining Auto Loan Rates

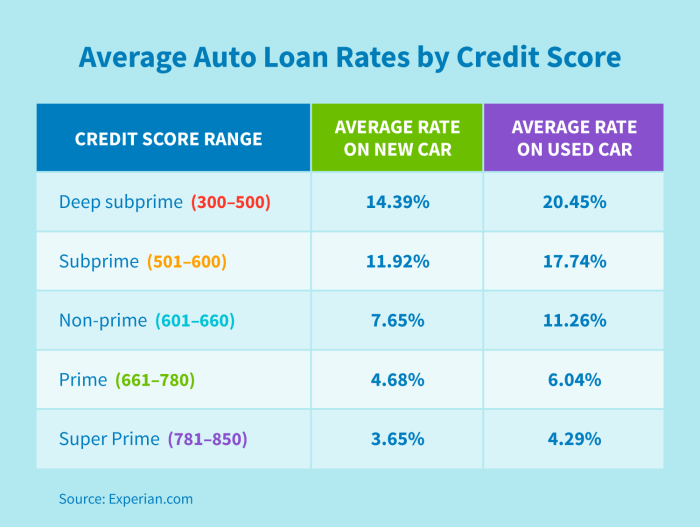

Your credit score is arguably the most crucial factor influencing your auto loan rate. Lenders use credit scores to assess your creditworthiness – essentially, your likelihood of repaying the loan as agreed. A higher credit score indicates a lower risk to the lender, resulting in a more favorable interest rate. Conversely, a lower credit score signals higher risk, leading to higher interest rates or even loan denial. For example, a borrower with a credit score above 750 might qualify for rates as low as 3%, while a borrower with a score below 600 could face rates exceeding 15%, or might be unable to secure a loan at all from traditional lenders. The difference in monthly payments and total interest paid over the life of the loan can be substantial.

Vehicle’s Age and Condition’s Impact on Loan Approval and Interest Rates

The age and condition of the vehicle you’re financing directly impact both your loan approval and the interest rate offered. Newer vehicles, particularly those with low mileage and excellent condition, are considered less risky assets by lenders. This is because they typically retain their value better over time, providing a safety net for the lender in case of default. Older vehicles, especially those with high mileage or significant wear and tear, are viewed as higher risk, leading to higher interest rates or potentially hindering loan approval altogether. A lender might be more willing to offer a favorable rate on a nearly new car with a low odometer reading compared to a used car that’s several years old and has a history of mechanical issues.

Loan Term Length’s Influence on Overall Loan Cost

The length of your auto loan significantly affects the total cost. While a longer loan term (e.g., 72 or 84 months) results in lower monthly payments, it also leads to significantly higher overall interest paid. This is because you’re paying interest over a longer period. Conversely, a shorter loan term (e.g., 36 or 48 months) results in higher monthly payments but substantially reduces the total interest paid. For instance, a $20,000 loan at 5% interest over 60 months will cost significantly less in total interest than the same loan spread over 72 months.

Down Payment Size’s Effect on Offered Interest Rate

The size of your down payment is another critical factor influencing your interest rate. A larger down payment reduces the loan amount, thus lowering the lender’s risk. This typically translates to a lower interest rate. Conversely, a smaller down payment or no down payment increases the lender’s risk, leading to higher interest rates. A substantial down payment, perhaps 20% or more of the vehicle’s price, can demonstrably improve your chances of securing a lower interest rate. Lenders perceive borrowers with larger down payments as more committed to repaying the loan.

Finding the Best Auto Loan Rate in Albuquerque: Auto Loan Rates Albuquerque

Securing a favorable auto loan rate in Albuquerque requires a strategic approach. By understanding the market, comparing offers, and negotiating effectively, borrowers can significantly reduce their overall loan cost. This section provides a step-by-step guide to navigate the process and achieve the best possible terms.

Steps to Shop for Auto Loans in Albuquerque

Finding the best auto loan rate involves a systematic process. Begin by pre-qualifying for a loan to understand your borrowing power. Then, compare offers from multiple lenders, considering interest rates, terms, and fees. Finally, negotiate the terms to secure the most advantageous deal. This structured approach minimizes the risk of overpaying and maximizes your chances of obtaining a competitive rate.

- Pre-qualify for a loan: Check your credit score and obtain pre-qualification offers from several lenders. This allows you to understand your potential interest rates before applying formally.

- Compare offers from multiple lenders: Contact local banks, credit unions, and online lenders in Albuquerque. Request quotes specifying the vehicle’s make, model, year, and price. Carefully review each offer, comparing APRs, loan terms, and fees.

- Negotiate the terms: Once you’ve identified a preferred lender, don’t hesitate to negotiate. A higher credit score, a larger down payment, or a shorter loan term can often lead to a lower interest rate. Be prepared to walk away if you don’t feel the terms are favorable.

Tips for Negotiating a Lower Interest Rate

Negotiating a lower interest rate requires preparation and confidence. Knowing your credit score, having a strong down payment, and shopping around for the best offers are crucial steps. Highlighting your financial stability and demonstrating your commitment to repayment can significantly improve your negotiating position. Remember, lenders are more likely to negotiate with informed and prepared borrowers.

- Improve your credit score: A higher credit score directly translates to lower interest rates. Before applying for a loan, take steps to improve your credit profile if necessary.

- Make a larger down payment: A substantial down payment reduces the lender’s risk, making them more inclined to offer a lower interest rate. This demonstrates your financial commitment and reduces the loan amount.

- Choose a shorter loan term: While monthly payments will be higher, a shorter loan term results in less interest paid over the life of the loan. This can significantly reduce the overall cost.

- Shop around and compare: Armed with multiple loan offers, you have more leverage to negotiate with your preferred lender. Highlighting better offers from competitors can often lead to a more favorable deal.

Resources for Researching and Comparing Auto Loan Offers

Several resources are available to assist consumers in Albuquerque with their auto loan research and comparison. These include online comparison tools, consumer financial websites, and local credit unions and banks. Utilizing these resources can streamline the process and ensure a thorough comparison of available options.

- Online comparison tools: Websites such as Bankrate, NerdWallet, and LendingTree allow you to compare auto loan rates from various lenders.

- Consumer financial websites: Websites like the Consumer Financial Protection Bureau (CFPB) offer educational resources and guidance on navigating the auto loan process.

- Local credit unions and banks: Credit unions often offer competitive rates and personalized service. Visit local branches to discuss your options and compare offers.

Auto Loan Comparison Checklist

A structured checklist ensures you compare apples to apples when reviewing different auto loan offers. Focus on key aspects like the APR, loan term, monthly payment, and total interest paid. A thorough comparison allows you to make an informed decision and select the most suitable loan for your financial situation.

| Factor | Description |

|---|---|

| Annual Percentage Rate (APR) | The total cost of borrowing, including interest and fees. |

| Loan Term | The length of the loan in months or years. |

| Monthly Payment | The amount you will pay each month. |

| Total Interest Paid | The total amount of interest you will pay over the life of the loan. |

| Fees | Any additional charges associated with the loan, such as origination fees or prepayment penalties. |

| Prepayment Penalty | A fee charged if you pay off the loan early. |

Illustrative Examples of Auto Loan Scenarios in Albuquerque

Understanding the financial implications of different auto loan options is crucial for making informed decisions. This section provides concrete examples to illustrate how interest rates, loan terms, and credit scores impact monthly payments and the overall cost of borrowing in Albuquerque.

Monthly Payment Differences Based on Interest Rates

The following table demonstrates how varying interest rates affect the monthly payment for a $20,000 auto loan over 60 months. A lower interest rate results in significantly lower monthly payments and total interest paid over the life of the loan. These calculations are based on simple interest and do not include potential fees.

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 3% | $360.18 | $1810.80 |

| 5% | $386.66 | $3600.00 |

| 7% | $414.26 | $5655.60 |

Impact of Credit Score on Interest Rate, Auto loan rates albuquerque

A higher credit score typically translates to a lower interest rate. For instance, consider two borrowers seeking a $20,000 auto loan for 60 months. Borrower A has an excellent credit score (750+), securing a 3% interest rate, resulting in a monthly payment of $360.18. Borrower B, with a fair credit score (650), receives a 7% interest rate, leading to a monthly payment of $414.26. The difference in monthly payments is $54.08, highlighting the substantial financial benefit of maintaining a good credit history.

Comparison of Loan Terms: 36 Months vs. 72 Months

Choosing a shorter loan term (like 36 months) means higher monthly payments but significantly less interest paid over the loan’s life. Conversely, a longer loan term (like 72 months) results in lower monthly payments but substantially more interest paid. Let’s assume a $20,000 loan at a 5% interest rate. A 36-month loan would have a monthly payment of approximately $591.56 and total interest paid around $1336.00. A 72-month loan would have a monthly payment of approximately $320.11 and total interest paid around $7667.60. The longer loan term almost quintuples the total interest paid.

Successful Negotiation of a Lower Interest Rate

Maria, a resident of Albuquerque, needed a $15,000 auto loan. She shopped around, receiving offers from three different lenders: Lender A offered a 6% interest rate, Lender B offered 5.5%, and Lender C offered 5%. By presenting Lender A with the lower offer from Lender C, Maria successfully negotiated her interest rate down to 5.2%, saving several hundred dollars in interest over the life of her loan. This illustrates the importance of comparing offers and using them as leverage during negotiations.

Potential Risks and Considerations

Securing an auto loan, while essential for many, involves inherent risks, particularly when interest rates are high. Understanding these risks and potential hidden costs is crucial for responsible borrowing and avoiding financial hardship. This section details potential pitfalls and offers strategies for mitigating them.

High interest rates significantly increase the total cost of the loan. Borrowers pay more in interest over the loan’s life, extending the repayment period and potentially leading to substantial overpayment. This can severely impact personal finances, limiting the ability to save, invest, or address unexpected expenses. For example, a seemingly small difference in interest rates (e.g., 5% vs. 10%) can translate to thousands of dollars in additional interest paid over the loan term. Careful consideration of the interest rate is therefore paramount.

High-Interest Rate Risks

High interest rates dramatically increase the overall cost of borrowing. The longer the loan term, the more interest accumulates. This can lead to a situation where the total amount repaid far exceeds the original loan amount. Furthermore, a high interest rate can negatively impact a borrower’s credit score if payments are missed or become consistently late, making it harder to secure favorable financing in the future. Consider a scenario where a borrower takes out a $20,000 loan at 15% interest for five years versus a 7% interest rate for the same term. The higher interest rate would result in significantly larger monthly payments and a substantially higher total amount repaid.

Potential Hidden Fees and Charges

Auto loans often include fees beyond the principal and interest. These can include origination fees, documentation fees, prepayment penalties (for paying off the loan early), and late payment fees. Some lenders may also charge for optional products like gap insurance or extended warranties. It’s critical to review the loan agreement meticulously to understand all associated charges before signing. Failure to do so can lead to unexpected costs and financial strain. For instance, a seemingly small origination fee of $500 can add considerably to the overall loan cost, especially for smaller loan amounts.

Importance of Understanding Loan Terms and Conditions

The loan agreement is a legally binding contract. Thoroughly understanding its terms is paramount. This includes the interest rate, loan term, monthly payment amount, any prepayment penalties, and the total amount to be repaid. Understanding these terms empowers borrowers to make informed decisions and avoid potential financial surprises. Failing to fully grasp the terms can lead to financial difficulties, including default and potential legal action. It is advisable to seek clarification on any unclear clauses from the lender before signing the agreement.

Strategies for Managing Auto Loan Debt Responsibly

Responsible auto loan management involves several key strategies. Firstly, budgeting carefully is crucial to ensure timely payments. Secondly, making extra payments when possible accelerates loan repayment, reducing the total interest paid. Thirdly, maintaining a good credit score is essential for securing favorable loan terms in the future. Finally, in case of financial difficulties, contacting the lender proactively to discuss potential repayment options can help avoid default and its negative consequences. For example, exploring options such as loan modification or refinancing can provide relief in challenging circumstances.

Closure

Securing a favorable auto loan rate in Albuquerque requires careful planning and research. By understanding the factors influencing interest rates, comparing offers from multiple lenders, and negotiating effectively, you can significantly reduce the overall cost of your vehicle purchase. Remember to always read the fine print, understand the terms and conditions, and choose a loan that aligns with your financial capabilities. Armed with the knowledge gained from this guide, you can confidently navigate the auto loan process and drive away in your new car with peace of mind.

General Inquiries

What documents do I need to apply for an auto loan in Albuquerque?

Typically, you’ll need proof of income, residence, identification, and your vehicle’s information (VIN, year, make, model).

Can I refinance my auto loan to get a lower interest rate?

Yes, if your credit score has improved or interest rates have fallen, refinancing can potentially lower your monthly payments.

What is the average auto loan interest rate in Albuquerque?

The average rate varies based on credit score, loan term, and vehicle type. Checking rates from multiple lenders is crucial to determine your personal average.

What happens if I miss an auto loan payment?

Late payments can negatively impact your credit score and may incur late fees. Contact your lender immediately if you anticipate difficulty making a payment.