Does inventory come with the business in an acquisition? This crucial question shapes the financial landscape of any merger or acquisition. Understanding how inventory is treated—from its definition and valuation to its contractual transfer and post-acquisition management—is paramount for both buyers and sellers. This comprehensive guide unravels the complexities surrounding inventory in acquisitions, offering insights into due diligence, contractual considerations, and post-acquisition integration strategies. We’ll explore various inventory valuation methods, potential risks, and best practices to ensure a smooth and profitable transaction.

The process involves a meticulous examination of the target company’s inventory records, verifying quantity, quality, and value. This due diligence process is critical in identifying potential risks, such as inaccurate records, obsolescence, or even fraudulent activity. Legal and accounting implications are significant, impacting the final purchase price and post-acquisition operations. Understanding the contractual aspects, including clauses specifying inventory ownership and transfer, is essential to avoid disputes and ensure a seamless transition.

Defining “Inventory” in Acquisitions

Inventory represents a crucial asset in many business acquisitions. Its accurate valuation and proper transfer of ownership are essential for a successful transaction. Understanding the nuances of inventory in this context requires careful consideration of its various forms, legal implications, and accounting treatments.

Inventory Types in Acquisitions

Inventory, within the context of a business acquisition, encompasses all goods held for sale in the ordinary course of business. This broadly categorizes into raw materials, work-in-progress (WIP), and finished goods. Raw materials are the basic inputs used in production. Work-in-progress represents partially completed goods undergoing manufacturing processes. Finished goods are completed products ready for sale to customers. The specific composition and value of inventory significantly impact the overall valuation of the acquired business.

Legal and Accounting Implications of Inventory Transfer

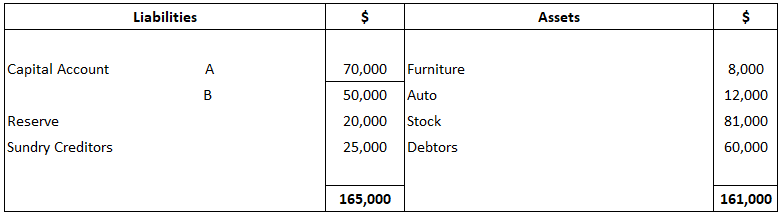

The transfer of inventory ownership during an acquisition is governed by the terms of the purchase agreement. This agreement explicitly details which inventory items are included in the transaction, their condition, and the responsibility for any potential liabilities (e.g., damaged or obsolete goods). From an accounting perspective, the inventory is recorded at its fair market value at the acquisition date, as per generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). This often involves a thorough inventory audit and valuation process to ensure accuracy. Any discrepancies between the book value and fair market value will be reflected in the purchase price adjustments.

Inventory Valuation Methods in Acquisitions

Several methods exist for valuing inventory in acquisitions, each with its implications on the final purchase price. The most common methods include First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Weighted-Average Cost. FIFO assumes that the oldest inventory items are sold first, while LIFO assumes the newest items are sold first. The weighted-average cost method calculates the average cost of all inventory items. The choice of method can significantly affect the reported cost of goods sold and net income, thus influencing the valuation of the acquired company. The selection of the method should be consistent with the target company’s existing practices and justifiable based on the specific circumstances.

Examples of Inventory Types and Acquisition Treatment

| Inventory Type | Description | Typical Acquisition Treatment | Valuation Method Example |

|---|---|---|---|

| Raw Materials | Basic inputs (e.g., wood for furniture, steel for cars) | Included in asset acquisition; valued at fair market value | Weighted-Average Cost |

| Work-in-Progress (WIP) | Partially completed goods (e.g., furniture frames, car chassis) | Included in asset acquisition; valued based on completion percentage and market value of comparable finished goods | FIFO |

| Finished Goods | Completed products ready for sale (e.g., finished furniture, assembled cars) | Included in asset acquisition; valued at market price less any necessary discounts or allowances for obsolescence | LIFO |

| Obsolete Inventory | Outdated or unsaleable goods | May be excluded or valued at significantly reduced amounts, potentially resulting in a reduction of the purchase price | Net Realizable Value |

Inventory Due Diligence

Inventory due diligence is a critical phase in any acquisition process, impacting the final purchase price and the success of the post-acquisition integration. A thorough examination of the target company’s inventory ensures that the buyer is aware of the true assets being acquired and avoids potentially costly surprises after the deal closes. This process involves a multi-faceted approach to verifying the quantity, quality, and value of the inventory, as well as assessing the accuracy and reliability of the existing inventory records.

Steps Involved in Inventory Due Diligence

A comprehensive inventory due diligence process typically involves several key steps. First, a detailed review of the target company’s existing inventory records is conducted. This includes examining inventory management systems, purchase orders, sales invoices, and other relevant documentation to understand the inventory flow and valuation methods employed. Second, physical inventory counts are often performed, either by the buyer’s team or an independent third-party specialist, to verify the accuracy of the recorded inventory levels. Third, an assessment of the quality and condition of the inventory is undertaken. This may involve visual inspections, testing, or sampling, depending on the nature of the inventory. Finally, the valuation of the inventory is determined, taking into account factors such as obsolescence, damage, and market prices. Discrepancies between recorded and physical inventory counts are investigated thoroughly to understand their causes.

Potential Risks Associated with Inaccurate Inventory Records

Inaccurate or incomplete inventory records pose significant risks to buyers. Overstated inventory values can lead to an inflated purchase price, while understated values may result in missed opportunities for profit or even operational disruptions post-acquisition. Obsolete or damaged inventory may not be readily apparent from the records and can represent a significant financial liability. Furthermore, inaccurate inventory data can hinder effective post-acquisition planning and integration, leading to difficulties in managing inventory levels, forecasting demand, and optimizing supply chains. For example, a company acquiring a retailer with inflated inventory figures might overestimate future sales, leading to incorrect pricing strategies and ultimately, financial losses.

Best Practices for Verifying Inventory Quantity, Quality, and Value

Several best practices can improve the accuracy and effectiveness of inventory due diligence. Employing independent third-party experts to conduct physical inventory counts and quality assessments adds objectivity and reduces the risk of bias. Utilizing advanced inventory management systems and technologies, such as RFID tracking, can improve the accuracy of inventory records and streamline the verification process. Comparing inventory records with historical sales data can help identify potential discrepancies and areas requiring further investigation. Finally, thorough documentation of the entire due diligence process is crucial, ensuring a clear audit trail and facilitating the resolution of any discrepancies or disputes.

Methods to Detect Potential Inventory Fraud or Misrepresentation

Detecting inventory fraud or misrepresentation requires a thorough and skeptical approach. Analyzing inventory turnover ratios and comparing them to industry benchmarks can highlight potential anomalies. Investigating unusual fluctuations in inventory levels or discrepancies between physical counts and recorded data should trigger further investigation. Reviewing internal controls and segregation of duties within the target company’s inventory management processes can identify weaknesses that could be exploited for fraudulent activities. Finally, conducting interviews with key personnel involved in inventory management can provide valuable insights and uncover potential red flags. For instance, unusually high write-offs or unexplained discrepancies in inventory records might indicate potential fraudulent activities requiring deeper investigation.

Post-Acquisition Inventory Management

Successfully integrating inventory systems and processes after an acquisition is crucial for maximizing profitability and minimizing disruptions. Failure to effectively manage inventory post-acquisition can lead to significant financial losses, operational inefficiencies, and even jeopardize the success of the merger itself. A well-defined plan, executed diligently, is paramount.

Integrating Inventory Systems and Processes

Merging inventory systems from two distinct organizations presents significant challenges. Differences in software, data formats, reporting structures, and even basic accounting practices can create substantial integration hurdles. For example, one company might use a first-in, first-out (FIFO) inventory costing method, while the other uses last-in, first-out (LIFO). Reconciling these discrepancies requires careful planning and potentially significant investment in system upgrades or custom integrations. Data migration is a particularly critical aspect, requiring meticulous cleansing and validation to ensure accuracy and consistency. A phased approach, starting with critical data elements and gradually incorporating others, can mitigate risks and allow for thorough testing at each stage. Furthermore, establishing clear communication channels and assigning dedicated personnel to oversee the integration process is essential for successful implementation.

Optimizing Inventory Levels and Reducing Waste

Post-acquisition, optimizing inventory levels is key to improving cash flow and minimizing storage costs. This involves analyzing the combined inventory holdings of both companies to identify redundancies, excess stock, and slow-moving items. Techniques like ABC analysis, which categorizes inventory based on value and consumption, can help prioritize efforts. Implementing a just-in-time (JIT) inventory system, where materials are received only as needed, can significantly reduce storage costs and minimize waste. Furthermore, leveraging data analytics to forecast demand more accurately can further optimize inventory levels, preventing overstocking and stockouts. For example, a company acquiring a retailer might use historical sales data from both organizations to predict future demand for seasonal items, ensuring optimal stock levels without excess inventory.

Managing Inventory Obsolescence and Write-Downs

Inventory obsolescence is a significant risk post-acquisition, particularly when merging companies with different product lifecycles or market positions. A thorough assessment of the combined inventory is crucial to identify items at risk of becoming obsolete. This might involve reviewing product lifecycles, market trends, and technological advancements. Strategies for mitigating obsolescence include aggressive promotional pricing to accelerate sales, exploring alternative uses for the products, or even liquidating the inventory at a loss. Accurate valuation of inventory is critical, requiring careful consideration of obsolescence risk. Write-downs may be necessary to reflect the reduced value of obsolete or slow-moving items, impacting profitability. A robust inventory management system that tracks product lifecycles and market trends is essential for early detection and proactive management of obsolescence.

Creating a Post-Acquisition Inventory Management Plan

A comprehensive post-acquisition inventory management plan should Artikel the integration strategy, optimization targets, and risk mitigation measures. This plan should include a detailed timeline for system integration, a clear definition of roles and responsibilities, and key performance indicators (KPIs) to track progress. The plan should also address potential challenges, such as data discrepancies and system failures, and Artikel contingency plans to mitigate risks. Regular reviews and adjustments to the plan are crucial to ensure its effectiveness and adaptability to changing circumstances. The plan should be aligned with the overall post-merger integration strategy, ensuring a cohesive approach to achieving business objectives. A successful plan requires strong leadership, effective communication, and collaboration between teams from both acquired and acquiring companies.

Illustrative Examples: Does Inventory Come With The Business In An Acquisition

Understanding how inventory is handled in an acquisition is crucial for both the buyer and seller. The inclusion or exclusion of inventory significantly impacts the transaction’s financial aspects and operational continuity. The following scenarios illustrate these contrasting approaches.

Inventory Explicitly Included in Acquisition

In this scenario, a thriving bakery, “Sweet Success,” is acquired by a larger food conglomerate, “Gourmet Group.” The acquisition agreement explicitly includes all of Sweet Success’s existing inventory – flour, sugar, butter, pre-made dough, and finished goods like cakes and pastries. The valuation of this inventory was conducted using a combination of methods, including the first-in, first-out (FIFO) method for raw materials and the weighted-average cost method for finished goods. A physical inventory count was performed by an independent third-party auditor to verify quantities. The agreed-upon value was $50,000, and this amount was incorporated into the overall purchase price. The transfer of inventory involved a detailed handover process, including documentation of quantities, locations, and condition. Sweet Success’s existing inventory management system was integrated into Gourmet Group’s larger system to ensure seamless tracking and control.

Inventory Excluded from Acquisition, Does inventory come with the business in an acquisition

Consider the acquisition of a small software company, “CodeCrafters,” by a tech giant, “TechTitan.” In this case, CodeCrafters’ inventory (primarily consisting of unsold software licenses and physical media) was explicitly excluded from the acquisition. The reason for exclusion was twofold: first, the software licenses were tied to specific client contracts, and their transfer would require separate negotiations with those clients. Second, the physical media (CDs and DVDs) were considered obsolete in the digital distribution landscape, and their value was deemed negligible compared to the company’s intellectual property and customer base. The exclusion of inventory resulted in a lower purchase price for TechTitan, and CodeCrafters retained ownership and responsibility for managing its remaining stock. This meant CodeCrafters continued to manage sales of these remaining licenses and physical media after the acquisition, and it assumed all related risks and liabilities.

Comparative Table: Inventory Inclusion vs. Exclusion

| Feature | Inventory Included | Inventory Excluded |

|---|---|---|

| Valuation | Explicitly valued and included in purchase price. Methods like FIFO, weighted average cost, or market value may be used. | Not included in purchase price; may be valued separately or deemed negligible. |

| Transfer | Formal transfer process involving physical inventory count, documentation, and system integration. | No formal transfer; ownership remains with the seller. |

| Risk & Liability | Risk and liability for inventory transfer to the buyer. | Risk and liability for inventory remains with the seller. |

| Purchase Price | Higher purchase price reflecting inventory value. | Lower purchase price due to exclusion of inventory. |

Inventory Transfer Process in a Successful Acquisition

Imagine a flowchart. First, a comprehensive inventory count and valuation are conducted. This is followed by a detailed agreement outlining the terms of transfer, including the valuation method, transfer date, and responsibilities. Next, a physical transfer of inventory occurs, potentially involving transportation and logistics. Simultaneously, data related to inventory is migrated from the seller’s system to the buyer’s system. Finally, a post-transfer audit is performed to verify the accuracy and completeness of the transfer, confirming that all assets and liabilities have been correctly accounted for. This entire process requires meticulous planning and coordination between the buyer, seller, and potentially external auditors.