What category do refunds fall under in tracking business transactions? This seemingly simple question reveals a complex reality for businesses of all sizes. Accurate refund tracking is crucial for maintaining accurate financial records, understanding business performance, and complying with tax regulations. This guide delves into the various accounting methods, transaction tracking systems, and procedural considerations surrounding refunds, offering a comprehensive overview to streamline your processes and ensure financial clarity.

From understanding the different general ledger accounts used to record refunds to navigating the intricacies of manual versus automated transaction tracking systems, we’ll explore the best practices for categorizing refunds effectively. We’ll also examine the impact of refunds on key performance indicators (KPIs) and discuss strategies for analyzing refund data to improve operational efficiency and customer satisfaction. Finally, we’ll address the tax implications of refunds and provide practical guidance for navigating relevant regulations.

Accounting Classification of Refunds

Refunds represent a reduction in revenue and require careful accounting treatment to accurately reflect a company’s financial position. Proper classification ensures compliance with accounting standards and provides a clear picture of financial performance. Understanding how refunds impact both the balance sheet and income statement is crucial for accurate financial reporting.

General Ledger Accounts for Refunds

Refunds are typically recorded in several general ledger accounts, depending on the nature of the refund and the company’s accounting policies. The most common accounts include Sales Returns and Allowances, Customer Refunds Payable, and Cash. The specific account used will depend on whether the refund relates to goods sold, services rendered, or other transactions. Incorrect classification can lead to misstated financial results.

Impact of Refunds on Financial Statements

Refunds directly impact both the balance sheet and the income statement. On the income statement, refunds reduce net sales revenue, thereby decreasing gross profit and potentially net income. This reduction is shown as a contra-revenue account, offsetting the initial sales revenue. On the balance sheet, a refund increases the liability account “Customer Refunds Payable” if the refund hasn’t been processed yet, and decreases the asset account “Cash” once the refund is paid. For example, a $100 refund increases the Customer Refunds Payable liability and decreases Cash. If the refund is for defective goods, the cost of goods sold may also be adjusted.

Chart of Accounts Entries for Processing a Refund

Processing a refund involves several journal entries depending on the stage of the refund process and whether the initial sale was recorded. If the customer returns the merchandise, a debit to Sales Returns and Allowances (a contra-revenue account) and a credit to Inventory (to reflect the returned goods) are made. If the refund is cash, a debit to Customer Refunds Payable (liability) and a credit to Cash (asset) is recorded. If the merchandise is not returned, the entry might simply be a debit to Sales Returns and Allowances and a credit to Cash. Accurate recording is critical for accurate financial reporting.

Example Chart of Common Refund Accounting Entries

The following table illustrates common accounting entries for processing refunds. Note that specific account names might vary depending on a company’s chart of accounts.

| Date | Account Debit | Account Credit | Description |

|---|---|---|---|

| 2024-03-15 | Sales Returns and Allowances | Accounts Receivable | Customer returned defective goods; refund approved. |

| 2024-03-15 | Inventory | Cost of Goods Sold | Restoration of inventory value. |

| 2024-03-18 | Customer Refunds Payable | Cash | Refund processed and paid to customer. |

| 2024-03-20 | Sales Returns and Allowances | Cash | Cash refund issued for non-returned goods. |

Transaction Tracking Systems and Refund Categorization

Effective transaction tracking is crucial for maintaining accurate financial records and ensuring smooth business operations. This involves not only recording sales and purchases but also meticulously managing refunds, which represent a significant aspect of financial activity for many businesses. The chosen system for tracking transactions directly impacts the accuracy and efficiency of refund processing and reporting.

Transaction tracking systems vary significantly depending on the size and complexity of a business. Small businesses might rely on simple spreadsheets or accounting software with basic features, while larger enterprises often utilize sophisticated enterprise resource planning (ERP) systems or specialized accounting platforms. Regardless of the scale, a robust system must accommodate the unique challenges of tracking refunds accurately and efficiently.

Methods for Tracking Transactions and Refunds

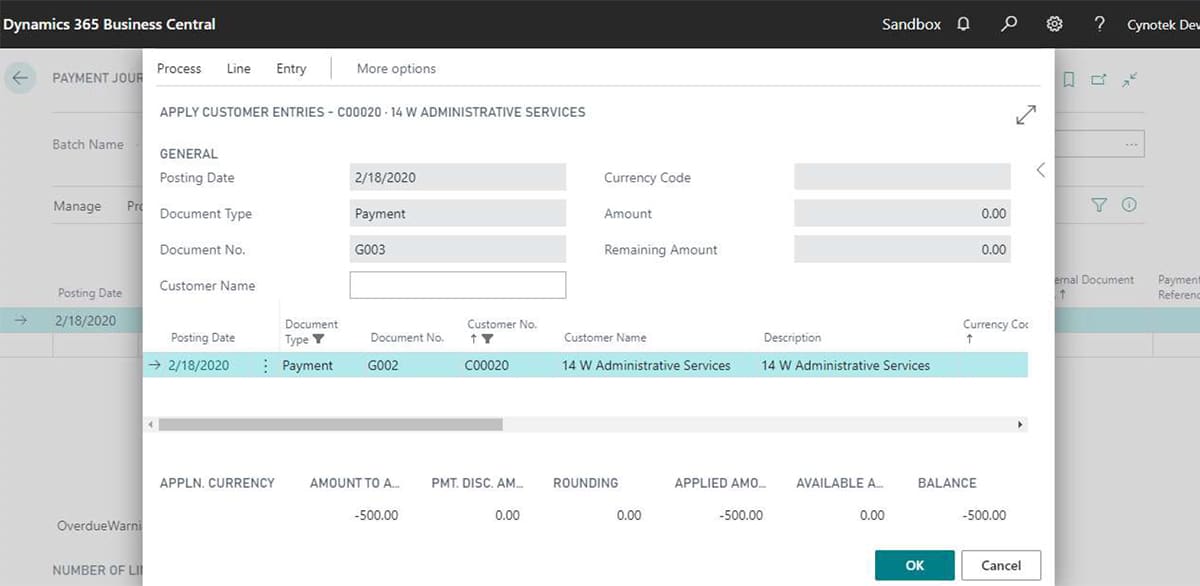

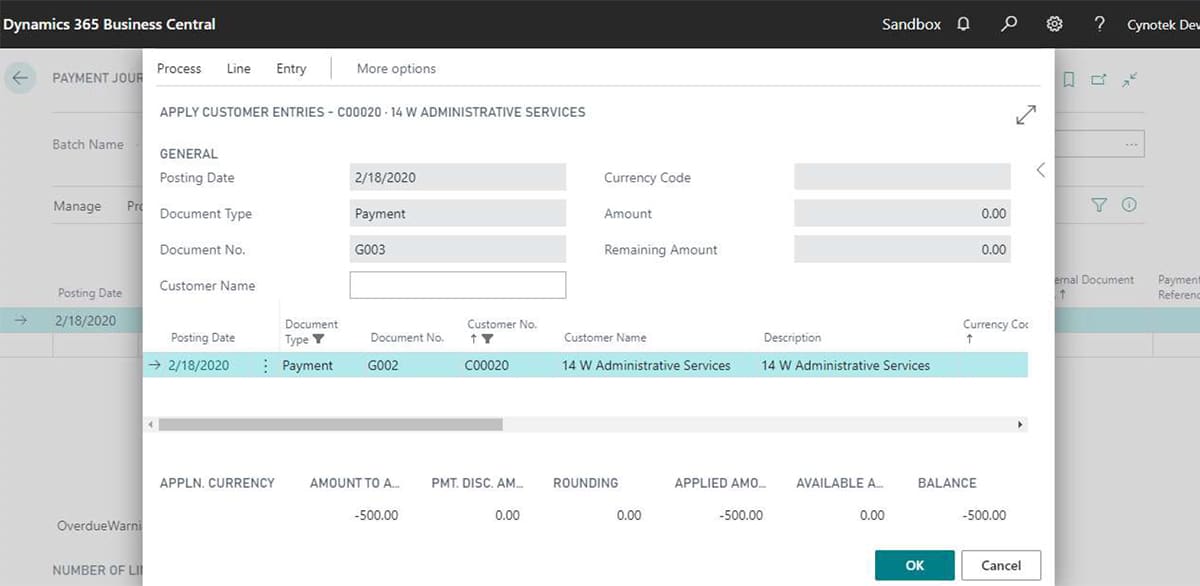

Businesses employ several methods to track transactions, each with varying degrees of automation and sophistication. Manual systems, such as spreadsheets, require manual data entry for every transaction, including refunds. This is prone to errors and time-consuming, especially for businesses with high transaction volumes. Automated systems, such as point-of-sale (POS) systems integrated with accounting software, automatically record transactions and refunds, reducing the risk of human error and freeing up staff time. More advanced systems, including ERP systems, offer comprehensive transaction tracking capabilities, integrating data from various departments and providing real-time insights into financial performance, including refund rates and trends. These systems often include features for automated reconciliation and reporting, further enhancing accuracy and efficiency. Examples of such systems include SAP, Oracle NetSuite, and Microsoft Dynamics 365.

Manual vs. Automated Refund Handling

Manual refund processing involves manually updating accounting records, issuing refund checks or transferring funds, and potentially requiring multiple steps involving different departments. This process is time-consuming, error-prone, and lacks the audit trail provided by automated systems. Automated systems, on the other hand, streamline the refund process. For instance, a customer return might trigger an automated refund in the POS system, which is automatically reflected in the accounting software, generating a notification to the customer and creating an audit trail. This automation reduces processing time, minimizes errors, and improves customer satisfaction. The difference in efficiency can be substantial; a manual system might take several days to process a refund, while an automated system could complete it within minutes or hours.

Importance of Consistent Refund Categorization

Consistent categorization of refunds within a transaction tracking system is paramount for generating accurate financial reports and identifying trends. Without a standardized approach, it becomes difficult to analyze refund data effectively. Consistent categorization enables businesses to track refund rates by product, reason for return, or customer segment. This data can inform crucial business decisions, such as improving product quality, refining customer service strategies, or optimizing inventory management. For example, a consistent categorization of refunds related to defective products could highlight the need for improved quality control measures.

Challenges in Accurate Refund Categorization

Accurately categorizing refunds can present several challenges. Inconsistent data entry by employees, lack of clear guidelines for categorization, and insufficient training can lead to inaccuracies. The complexity of refund reasons can also make categorization difficult. For instance, a refund might be due to a damaged product, customer dissatisfaction, or a simple change of mind, each requiring a different categorization for meaningful analysis. Another challenge lies in integrating data from multiple sources, such as online sales platforms, physical stores, and customer service interactions. Without a unified system, maintaining consistent categorization across all channels becomes significantly more difficult. Furthermore, the lack of standardized codes or categories can lead to inconsistencies across different departments or over time, hampering accurate reporting and analysis.

Refund Processing Procedures and Documentation

Efficient and accurate refund processing is crucial for maintaining customer satisfaction and financial integrity. A well-defined procedure, coupled with meticulous documentation and robust internal controls, minimizes errors and protects against fraud. This section details the necessary steps, documentation, and controls for effective refund management.

Step-by-Step Refund Processing Procedure, What category do refunds fall under in tracking business transactions

A standardized procedure ensures consistency and minimizes discrepancies. The following steps Artikel a typical refund processing workflow:

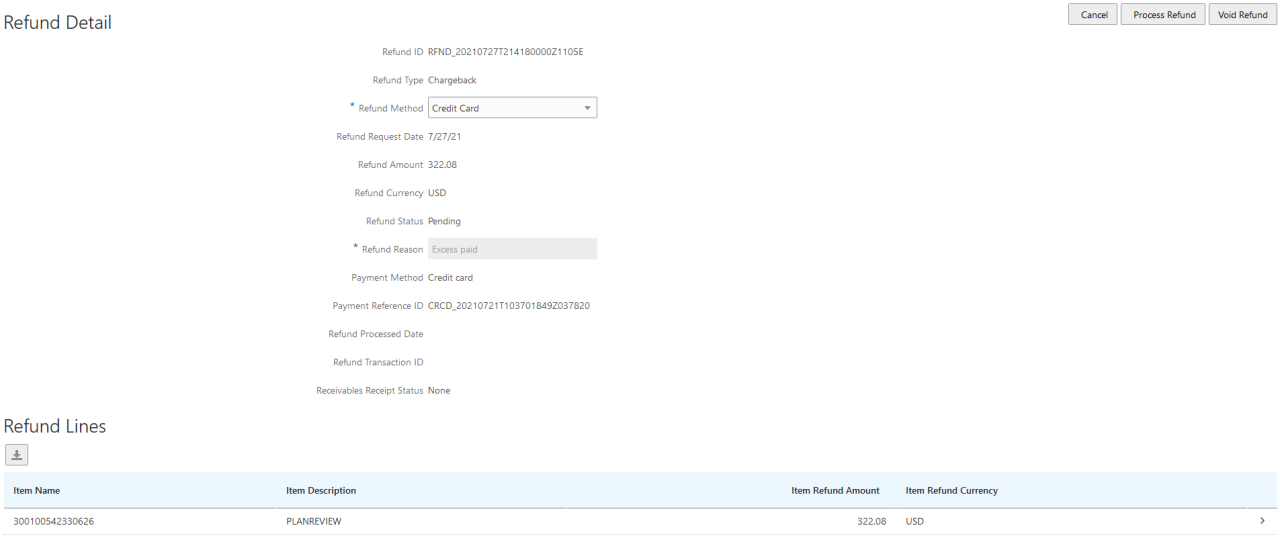

- Customer Contact and Verification: The refund request should be received and verified. This involves confirming the customer’s identity and the validity of their purchase. This may involve checking order numbers, dates, and payment methods.

- Reason for Return: Document the reason for the return. This is essential for tracking trends and improving products or services. Common reasons include damaged goods, incorrect items, or buyer’s remorse.

- Return Authorization (RA): Issue a Return Authorization number. This number uniquely identifies the refund request and facilitates tracking throughout the process. The RA should include details like the customer’s information, the items being returned, and the refund amount.

- Goods Inspection (if applicable): If the goods are being returned, inspect them upon arrival to ensure they meet the return policy’s conditions. Note any discrepancies in the condition of the returned goods.

- Refund Processing: Once the return is authorized and (if applicable) inspected, process the refund using the appropriate payment method. This might involve issuing a credit to the original payment method or issuing a store credit.

- Transaction Recording: Record the refund transaction in the accounting system. This ensures accurate financial reporting and reconciliation. The entry should include the RA number, date, amount, and payment method.

- Customer Notification: Notify the customer that their refund has been processed. Provide them with a confirmation number or tracking information, if applicable.

Required Documentation for Refunds

Comprehensive documentation is vital for auditing and resolving discrepancies. Necessary documentation includes:

- Refund Request Form: A standardized form capturing customer details, reason for return, and requested refund amount.

- Return Authorization (RA) Number: Unique identifier for each refund request.

- Proof of Purchase: Order confirmation, receipt, or other evidence of the original purchase.

- Return Shipping Label (if applicable): Documentation showing the return shipping details.

- Goods Inspection Report (if applicable): A report documenting the condition of the returned goods.

- Refund Transaction Record: Record of the refund processed in the accounting system.

- Customer Communication Records: Emails, chat logs, or phone call notes related to the refund request.

Recording and Reconciling Refund Transactions

Accurate recording and reconciliation are crucial for financial accuracy. Refunds should be recorded in the general ledger as a reduction in sales revenue and an increase in a refund liability account. Regular reconciliation of the refund account with the bank statement is necessary to identify and resolve any discrepancies. This involves comparing the recorded refunds with the actual funds received or credited. Discrepancies should be investigated and corrected promptly.

Internal Controls to Prevent Refund Fraud

Robust internal controls are essential to deter and detect refund fraud. These controls might include:

- Segregation of Duties: Different individuals should handle different aspects of the refund process (authorization, processing, and recording) to prevent collusion.

- Authorization Limits: Establish clear limits on the amount that can be refunded without managerial approval.

- Regular Audits: Conduct regular audits of refund transactions to identify any unusual patterns or discrepancies.

- Secure Data Storage: Store all refund-related documentation securely to prevent unauthorized access.

- Monitoring of Refund Requests: Regularly review refund requests for unusual patterns or high volumes from a single customer or IP address.

- Two-Factor Authentication: Implement two-factor authentication for access to the refund processing system.

Impact of Refunds on Business Metrics: What Category Do Refunds Fall Under In Tracking Business Transactions

Refunds significantly impact a business’s financial health and customer perception. Understanding this impact is crucial for effective financial planning and strategic decision-making. Analyzing refund data allows businesses to identify areas for improvement and ultimately enhance profitability and customer loyalty.

Refunds directly affect several key performance indicators (KPIs), providing valuable insights into operational efficiency and customer satisfaction. A comprehensive understanding of these impacts is essential for proactive management and informed business strategies.

Refund Impact on Revenue and Profit Margin

Refunds directly reduce a company’s revenue. The magnitude of this reduction depends on the refund amount and the frequency of refunds. Furthermore, refunds negatively affect profit margins because the associated costs (production, shipping, etc.) are already incurred, resulting in a loss on each refunded transaction. For example, a business with a 5% refund rate on $1 million in sales will experience a $50,000 revenue loss. This loss further impacts the profit margin, reducing the overall profitability of the business. To mitigate this, businesses should focus on improving product quality, enhancing customer service, and streamlining the return process.

Analyzing Refund Data to Improve Operations

Analyzing refund data offers opportunities to improve business operations. By categorizing refunds (e.g., product defects, shipping issues, customer dissatisfaction), businesses can pinpoint recurring problems. For instance, a high number of refunds due to damaged goods indicates potential problems in the packaging or shipping process. Similarly, frequent refunds related to customer service issues might highlight the need for improved training or support systems. This data-driven approach enables businesses to address root causes, prevent future refunds, and optimize operational efficiency.

High Refund Rates as Indicators of Operational Problems

High refund rates often signal underlying problems within a business. Persistently elevated refund rates might indicate issues with product quality, inaccurate product descriptions, poor customer service, or a cumbersome return process. For example, consistently high refund rates for a specific product might point to a design flaw or manufacturing defect. Similarly, a large number of refunds due to customer dissatisfaction with the return policy indicates a need for a more customer-friendly process. Analyzing the reasons behind refunds is crucial for identifying and rectifying these operational weaknesses.

Impact of Different Refund Scenarios on Key Business Metrics

| Scenario | Revenue Impact | Profit Margin Impact | Customer Satisfaction Impact |

|---|---|---|---|

| High-quality product, simple return | Slight decrease | Minor decrease | Positive (enhanced trust) |

| Defective product, complex return | Significant decrease | Large decrease | Negative (damaged reputation) |

| Misleading product description, easy return | Moderate decrease | Moderate decrease | Neutral (process efficiency matters) |

| Excellent customer service, timely refund | Decrease (but less negative) | Decrease (but less negative) | Positive (customer loyalty) |

Types of Refunds and Their Categorization

Understanding the various types of refunds and their associated accounting treatments is crucial for accurate financial reporting and efficient business operations. Different refund scenarios necessitate distinct processing procedures and impact business metrics in varying ways. This section categorizes common refund types, compares their accounting implications, and highlights their handling within transaction tracking systems.

Full Refunds

A full refund represents the complete return of the purchase price to the customer. This typically occurs when a product is defective, damaged, or doesn’t meet the customer’s expectations. The accounting treatment involves debiting sales revenue and crediting accounts receivable (or cash, if the refund is issued directly). Transaction tracking systems record this as a complete reversal of the original sale, often with a specific refund transaction code.

- Characteristics: Complete reimbursement of the purchase price; typically initiated by the customer due to product defects or dissatisfaction; requires a return of the goods (in most cases).

- Accounting Entry: Debit: Sales Returns and Allowances; Credit: Accounts Receivable (or Cash).

- Transaction Tracking: Recorded as a negative transaction linked to the original sale; often requires manual intervention or specific approval workflows.

Partial Refunds

Partial refunds involve returning only a portion of the purchase price. This might occur if a customer receives a damaged product but decides to keep it after a price reduction or if a service is partially rendered and the customer requests a proportional refund. Accounting treatment mirrors that of a full refund, but only the amount of the partial refund is credited. Transaction tracking systems should clearly distinguish the partial refund amount from the original transaction.

- Characteristics: Reimbursement of a portion of the purchase price; may be due to partial damage, partial service delivery, or customer negotiation; the goods are typically not returned.

- Accounting Entry: Debit: Sales Returns and Allowances; Credit: Accounts Receivable (or Cash).

- Transaction Tracking: Recorded as a partial reversal of the original sale; requires specific fields to denote the refund reason and amount.

Returns

A return involves the customer sending back a product for a full or partial refund. This differs from a simple refund in that it requires the physical return of goods. The accounting treatment depends on whether the return results in a full or partial refund, as detailed above. Transaction tracking systems should track the return authorization, the shipment of the returned goods, and the subsequent refund processing.

- Characteristics: Involves the physical return of goods; typically requires a return authorization number; may lead to a full or partial refund.

- Accounting Entry: Varies depending on whether it’s a full or partial refund; may include entries for inventory adjustments.

- Transaction Tracking: Requires tracking of the return authorization, shipping information, and the eventual refund.

Exchanges

An exchange involves the customer returning a product for a different product of equal or greater value. While not strictly a refund, exchanges require similar tracking and accounting considerations. If the exchanged product has a higher value, the customer may need to pay the difference. If the exchanged product has a lower value, a partial refund might be issued. Transaction tracking systems should record the original sale, the return, and the new sale as separate transactions.

- Characteristics: Replacement of a product with another; may involve a price adjustment; doesn’t always involve a monetary refund.

- Accounting Entry: Records the return of the original product and the sale of the new product as separate transactions.

- Transaction Tracking: Tracks the original sale, the return, and the new sale as distinct entries; may involve adjustments to inventory levels.

Tax Implications of Refunds

Issuing and receiving refunds carries significant tax implications for both businesses and customers. Understanding these implications is crucial for accurate financial reporting and compliance with tax regulations. Failure to properly account for refunds can lead to penalties and legal issues.

Refund accounting affects a business’s taxable income and, consequently, its tax liability. For customers, refunds can impact their taxable income, potentially reducing their tax burden or creating a need for amended returns. The specific tax treatment depends heavily on the nature of the refund, the type of business involved, and the relevant tax jurisdiction.

Tax Reporting of Refunds for Businesses

Businesses must carefully track and report refunds on their tax returns. The method of reporting depends on the nature of the refund. For example, refunds related to sales of goods or services typically reduce the business’s reported revenue. Refunds for returned goods might be deducted from the cost of goods sold. The specific accounting treatment will influence the business’s net income and, consequently, its tax liability. Accurate record-keeping is essential to ensure compliance. For instance, a retail business issuing refunds for defective products would deduct the refund amount from its gross sales revenue when calculating its taxable income. A software company offering a refund for a faulty software license would adjust its revenue accordingly and may need to consider the timing of the refund relative to the initial sale for tax purposes. These actions directly impact the company’s income tax liability for the relevant tax period.

Tax Reporting of Refunds for Customers

For customers, refunds received generally do not impact their taxable income unless the refund relates to a prior year’s tax deduction. For example, if a customer received a refund for medical expenses they had previously deducted, this refund may be considered taxable income in the year it was received. Conversely, refunds for returned goods or services generally do not have tax implications for the customer. The customer should retain records of the refund transaction for potential audit purposes, but it usually does not necessitate an adjustment to their tax return unless a previous deduction is involved.

Relevant Tax Regulations Pertaining to Refunds

Tax regulations regarding refunds vary across jurisdictions and are often complex. Businesses should consult with tax professionals or refer to their country’s specific tax code for detailed guidance. Generally, the regulations emphasize accurate record-keeping and proper documentation of all refund transactions. This includes details such as the date of the refund, the reason for the refund, and the amount refunded. These records are crucial for both tax audits and for ensuring accurate financial reporting. Failure to maintain proper records can result in penalties. For example, the IRS in the United States has specific requirements for documenting business expenses and revenue, including refunds, which must be adhered to.

Variations in Tax Laws Based on Business Type and Refund Situation

Tax laws relating to refunds differ depending on the type of business and the specific circumstances of the refund. For instance, a service-based business might handle refunds differently than a retail business. A refund for a faulty service might be treated differently from a refund for a returned product. Furthermore, the tax treatment of refunds can vary depending on whether the refund is issued for a defective product, a change of mind, or other reasons. A sole proprietorship will report refunds differently than a corporation, affecting their respective tax returns and calculations of taxable income. For example, a sole proprietor might directly deduct a refund from their gross income, while a corporation might need to make adjustments to its revenue and cost of goods sold depending on the nature of the refund. Consulting with a tax advisor is crucial for businesses to understand the specific tax implications of refunds relevant to their circumstances.