Do you need to close a business bank account? This seemingly simple question can trigger a complex chain of considerations, impacting everything from legal compliance to your financial stability. Closing a business account isn’t a decision to take lightly; it involves navigating legal requirements, transferring funds securely, and potentially facing financial penalties if not handled correctly. This guide explores the multifaceted aspects of closing a business bank account, providing a comprehensive overview to help you make an informed decision.

We’ll delve into the common reasons businesses choose to close their accounts, examining scenarios where closure is advisable and others where it might prove detrimental. We’ll also cover the legal and financial implications, offering step-by-step guidance on transferring funds and assets, and outlining the procedures for account closure. Finally, we’ll explore viable alternatives to closure, such as account consolidation or changing account types, to ensure you choose the best path for your business.

Reasons for Closing a Business Bank Account

Closing a business bank account is a significant decision with potential financial and operational implications. Understanding the reasons behind such a move, and carefully evaluating the consequences, is crucial for responsible business management. This section Artikels common scenarios where account closure might be necessary, and highlights potential pitfalls to avoid.

Common Reasons for Business Account Closure

Businesses close their bank accounts for a variety of reasons, often stemming from dissatisfaction with the bank’s services, changes in business operations, or strategic financial decisions. These reasons can range from high fees and poor customer service to mergers, acquisitions, or the simple need to consolidate financial accounts. A thorough evaluation is always recommended before taking action.

Evaluating the Necessity of Closing a Business Bank Account

Before initiating the closure process, a comprehensive evaluation is critical. This involves assessing the impact on cash flow, potential disruption to business operations, and the availability of suitable alternative banking solutions. Consider the implications for payroll processing, vendor payments, and the overall management of business finances. A detailed cost-benefit analysis should be undertaken, weighing the potential savings against any potential negative consequences.

Scenarios Where Closing a Business Bank Account is Advisable

Several situations clearly indicate the advisability of closing a business bank account. For example, if a business is experiencing consistently high fees disproportionate to the services received, a switch to a more cost-effective option is often warranted. Similarly, if a bank consistently provides poor customer service or lacks the necessary features to support the business’s needs (e.g., insufficient online banking capabilities), closing the account and finding a more suitable alternative is justified. Finally, if a business is dissolving or merging with another entity, closing the original account becomes a necessary administrative step.

Examples of Detrimental Premature Account Closures

Prematurely closing a business bank account can have severe consequences. For instance, a business might inadvertently disrupt its credit history if the account is closed before all outstanding debts are settled, potentially affecting future loan applications. Furthermore, if a business closes its account without having secured a replacement, it risks significant delays in processing payments and managing its finances, potentially harming its reputation and operations. The sudden loss of access to funds can also create significant cash flow problems. For example, a small bakery relying on a specific bank’s automated payment system for supplier payments might face severe operational disruption if the account is closed before an alternative system is fully implemented.

Pros and Cons of Closing a Business Bank Account

| Pros | Cons |

|---|---|

| Reduced banking fees | Potential disruption to cash flow |

| Improved customer service | Impact on credit history (if debts are outstanding) |

| Access to better banking features | Administrative burden of transferring funds and updating records |

| Consolidation of accounts for simplified financial management | Potential delays in payments to vendors and employees |

Legal and Financial Implications

Closing a business bank account involves more than simply informing the bank of your intentions. Several legal and financial factors must be considered to ensure a smooth and compliant closure, avoiding potential penalties and future complications. Failure to adhere to proper procedures can lead to unforeseen difficulties with tax authorities and creditors.

Legal Requirements for Closing a Business Bank Account

The specific legal requirements for closing a business bank account vary depending on the type of business entity (sole proprietorship, partnership, LLC, corporation), the jurisdiction, and the bank’s internal policies. However, some common legal aspects include providing proper authorization for closure, ensuring all outstanding transactions are settled, and obtaining necessary documentation confirming account closure. This often involves submitting a formal closure request, possibly signed by all authorized signatories on the account. Failure to obtain proper authorization could lead to legal disputes later if the account is subsequently accessed or used without consent. Furthermore, any outstanding debts or liabilities associated with the account must be resolved before closure is finalized.

Potential Financial Penalties for Premature Closure

Some banks may impose penalties for closing a business account prematurely, especially if the account is subject to specific terms and conditions, such as those related to promotional offers or minimum balance requirements. These penalties can vary widely depending on the bank and the specific contract. For instance, a bank might charge a fee for early termination of a promotional period offering reduced fees or interest rates. Additionally, if the account is closed before meeting agreed-upon minimum balance requirements, fees might apply. It’s crucial to review the account agreement carefully before initiating the closure process to understand any potential financial ramifications.

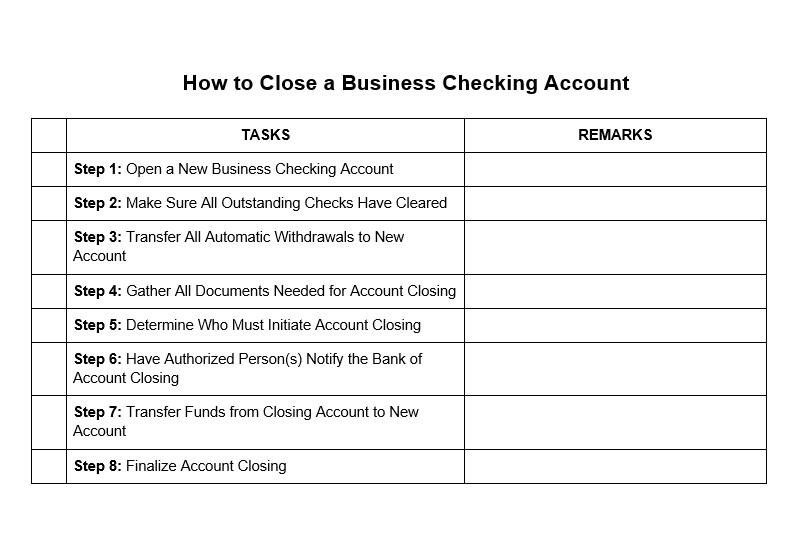

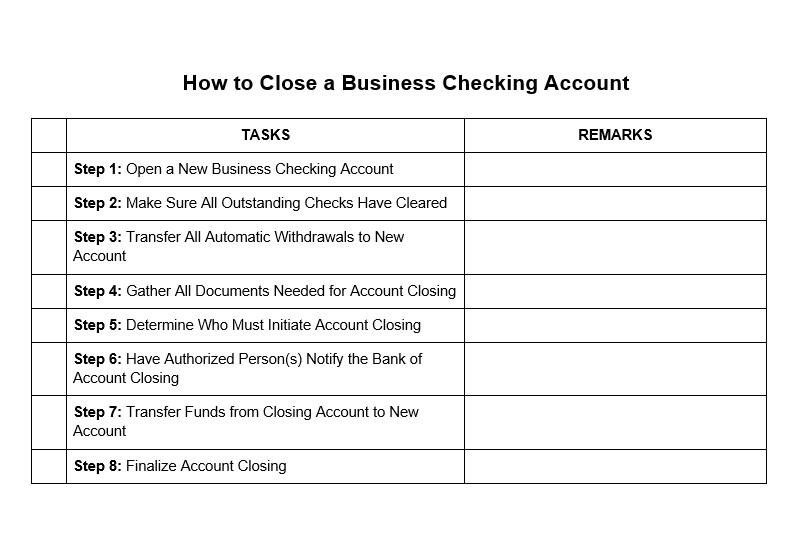

Steps for a Smooth and Compliant Closure Process, Do you need to close a business bank account

A systematic approach to closing a business bank account minimizes the risk of complications. This involves initiating the closure process formally with the bank, ensuring all outstanding transactions are cleared, and obtaining confirmation of closure in writing. This written confirmation serves as crucial documentation for future financial and legal matters. It’s also essential to inform relevant parties, such as creditors and tax authorities, of the account closure and provide them with the necessary updated banking information if applicable. This proactive approach helps maintain a clear financial record and prevents any potential misunderstandings or delays in future transactions.

Procedures for Closing Different Types of Business Accounts

The procedures for closing various types of business accounts—such as checking, savings, or money market accounts—may differ slightly depending on the bank’s policies. However, the fundamental steps generally remain the same. For example, while the process of closing a sole proprietorship’s checking account may be relatively straightforward, closing a corporate account might require additional authorizations and documentation from company officers. It’s always advisable to contact the bank directly to inquire about the specific procedures for the type of business account being closed to ensure a smooth and compliant process.

Checklist of Actions Before Closing a Business Bank Account

Before initiating the closure of your business bank account, it is vital to meticulously review and complete the following steps:

- Review your account agreement to understand any penalties or fees associated with early closure.

- Settle all outstanding transactions and ensure the account balance is zero or transferred to another account.

- Inform relevant parties, including creditors and tax authorities, of the account closure.

- Obtain all necessary documentation, including bank statements and closure confirmation.

- Update your business records with the new banking information (if applicable).

- Verify the closure of any associated services, such as online banking or debit cards.

- Confirm the account is officially closed with the bank in writing.

Transferring Funds and Assets

Closing a business bank account necessitates the careful and secure transfer of all funds and assets to a new account or designated recipient. This process requires meticulous planning and execution to avoid errors, delays, and potential financial losses. Failing to properly transfer assets could lead to complications with taxes, legal liabilities, and future business operations.

Transferring Funds to a New Account

The process of transferring funds involves initiating a transfer from your closing business account to a new account, either a personal account or a new business account. This typically involves providing the new account details (account number, bank name, routing number, etc.) to your current bank. Most banks offer online transfer options, providing speed and convenience. Alternatively, you can initiate a wire transfer for larger sums or for quicker processing, although wire transfers usually incur fees. Always confirm the transfer with both banks to ensure the transaction is complete and accurate. For larger sums, consider breaking the transfer into smaller, more manageable amounts to minimize risk in case of errors.

Methods for Transferring Assets

Beyond funds, a business bank account might hold various assets. These could include stocks, bonds, or other investment instruments held in brokerage accounts linked to the business bank account. Transferring these requires contacting the relevant brokerage firm and initiating a transfer of ownership to the new account. Similarly, any physical assets, such as equipment or inventory, held in the name of the business will need to be transferred via a formal process, often involving legal documentation and potentially a bill of sale. Intellectual property rights require specific legal procedures for transfer of ownership.

Step-by-Step Guide for Securely Transferring Funds and Assets

- Account Reconciliation: Verify the balance of your business bank account and all linked accounts. This step helps identify any discrepancies before the transfer.

- Gather Necessary Information: Collect all required information for the new account (account number, bank name, routing number, etc.) and any relevant information for asset transfers (account numbers for brokerage accounts, titles for physical assets, etc.).

- Initiate Transfers: Begin transferring funds using online banking, wire transfers, or checks, depending on the amount and the type of account. For assets, follow the specific procedures Artikeld by the relevant institution or legal requirements.

- Confirmation and Verification: Obtain confirmation from both your old and new banks or relevant institutions that all transfers have been completed successfully. This includes verifying the amounts transferred and the ownership transfer of assets.

- Documentation: Maintain thorough records of all transfers, including dates, amounts, and confirmation numbers. This documentation is crucial for auditing and tax purposes.

Best Practices for Minimizing Risk During the Transfer Process

Careful planning and adherence to best practices are crucial to minimize risks. This includes verifying all account details before initiating any transfers to avoid sending funds to the wrong account. Regularly monitor the transfer process and promptly report any discrepancies or delays to your bank or relevant institutions. Consider using secure transfer methods such as wire transfers for large sums and employing multiple verification steps to ensure accuracy. Maintaining detailed records of all transactions is vital for auditing purposes and dispute resolution.

Flowchart Illustrating the Steps Involved in Transferring Funds and Assets

Alternatives to Closing the Account: Do You Need To Close A Business Bank Account

Before definitively closing a business bank account, exploring alternative options can often prove beneficial. Maintaining a business banking relationship, even in a modified form, can offer advantages in terms of credit history, access to financial services, and streamlined financial management. Several viable alternatives exist, each with its own set of benefits and drawbacks. Careful consideration of your specific circumstances is crucial in selecting the most appropriate course of action.

Account Consolidation

Consolidating multiple business bank accounts into a single account can simplify financial management and potentially reduce fees. This approach streamlines record-keeping, improves oversight of cash flow, and can lead to more favorable terms with the bank if you consolidate into a higher-tier account with greater benefits. However, the process of transferring funds and updating records can be time-consuming, and it might not be suitable for businesses with complex financial structures requiring separate accounts for distinct purposes (e.g., separate accounts for payroll, taxes, and investments). For instance, a small bakery with separate accounts for operating expenses and loan repayments might find account consolidation less practical than a larger company with simpler financial needs.

Changing Account Types

Switching to a different type of business bank account, rather than closing the account entirely, can address specific needs without the disruption of closing and opening a new account. For example, a business might transition from a basic checking account to a business savings account to better manage cash reserves, or from a standard account to a high-yield account to maximize interest earnings. However, changing account types may involve fees or minimum balance requirements, and it might not be suitable if the existing account type is fundamentally unsuitable for the business’s needs. A sole proprietorship that initially opened a personal account for business purposes might find that transitioning to a dedicated business checking account is a more appropriate alternative to closing the account entirely.

Maintaining a Dormant Account

In situations where the business is temporarily inactive but anticipates future activity, maintaining a dormant account can be a sensible approach. This avoids the hassle of reopening an account later, preserving the business’s banking history and relationship with the financial institution. However, dormant accounts may still incur maintenance fees, and they may not offer the same level of access to financial services as an active account. A seasonal business, such as a Christmas tree farm, might opt to maintain a dormant account during the off-season to avoid the inconvenience of re-establishing banking services when operations resume.

Negotiating with the Bank

Before deciding to close the account, consider negotiating with your bank. You might be able to renegotiate fees, minimum balance requirements, or other terms that are causing dissatisfaction. This can be particularly effective if you have a long-standing relationship with the bank or have a significant volume of business with them. However, banks are not always willing to negotiate, and this option requires time and effort on the part of the business owner. A business that consistently maintains a high balance in its account may have greater leverage in negotiating favorable terms.

Decision Tree for Choosing the Best Option

The following decision tree can help guide businesses in selecting the most appropriate alternative to closing a business bank account:

- Are there multiple business accounts?

- Yes: Consider Account Consolidation.

- No: Proceed to the next question.

- Is the current account type appropriate for your business needs?

- No: Consider Changing Account Types.

- Yes: Proceed to the next question.

- Is the business temporarily inactive?

- Yes: Consider maintaining a Dormant Account.

- No: Proceed to the next question.

- Are you dissatisfied with current account terms?

- Yes: Attempt to Negotiate with the Bank.

- No: Consider closing the account.