How to put a lien on a business? It’s a question that arises when significant debts remain unpaid. This guide navigates the complex legal landscape of business liens, explaining the various types, the necessary documentation, and the step-by-step process involved in securing a lien against a business. We’ll explore the differences between filing against sole proprietorships and corporations, and the potential consequences for both the creditor and the debtor. Understanding the legal ramifications is crucial, so we’ll also cover the importance of seeking legal counsel and the potential pitfalls to avoid.

From identifying the grounds for a lien and gathering the required documentation to navigating the filing process and understanding the potential legal repercussions, this comprehensive guide provides a clear path through the intricacies of business liens. We’ll examine the impact on a business’s creditworthiness and explore strategies for lien removal. Real-world examples illustrate the process in various contexts, helping you understand how to proceed effectively and legally.

Understanding Liens on Businesses

Placing a lien on a business is a serious legal action with significant consequences for both the creditor and the debtor. Understanding the different types of liens, the filing requirements, and the legal processes involved is crucial for anyone considering this course of action. This section provides an overview of these key aspects.

Types of Liens on Businesses

Several types of liens can be placed on a business, each with its own specific requirements and implications. The most common include mechanics’ liens, judgment liens, tax liens, and commercial liens. Mechanics’ liens secure payment for work performed on the business’s property, such as construction or repairs. Judgment liens arise from unpaid court judgments. Tax liens are imposed by government agencies for unpaid taxes, and commercial liens can encompass a broader range of secured debts. The specific type of lien will determine the process for filing and enforcement.

Lien Filing Requirements

The requirements for filing a lien against a business vary significantly depending on the jurisdiction. Generally, this involves completing specific forms, providing detailed information about the debt, and filing the paperwork with the appropriate government agency, often a county recorder’s office or a state’s Secretary of State. Each state has its own statutes outlining the necessary steps, including deadlines for filing and the information that must be included in the lien document. Failure to comply with these requirements can invalidate the lien. For example, in California, a mechanics lien must be filed within 90 days of the completion of the work, while in New York, the deadline might be different. It’s crucial to consult with legal counsel familiar with the specific jurisdiction to ensure compliance.

Lien Processes: Sole Proprietorship vs. Corporation

The legal process for placing a lien differs between a sole proprietorship and a corporation. With a sole proprietorship, the lien typically attaches to the owner’s personal assets as well as the business assets, blurring the lines between personal and business liabilities. In contrast, a corporation offers some protection; the lien generally targets the corporation’s assets, shielding the personal assets of the shareholders. However, this protection isn’t absolute; piercing the corporate veil is possible in certain circumstances, potentially exposing personal assets to the lien. The complexity of the process and the potential ramifications for personal assets underscore the need for legal guidance.

Examples of Situations Leading to Business Liens

Liens on businesses frequently arise from unpaid debts. Common scenarios include unpaid construction bills resulting in mechanics’ liens, unpaid judgments from lawsuits leading to judgment liens, and unpaid taxes leading to tax liens. Another common situation involves a business failing to repay a loan secured by its assets, resulting in a commercial lien. For instance, a construction company that fails to pay a subcontractor might face a mechanics lien, impacting its ability to sell or refinance its property. Similarly, a business that loses a lawsuit and fails to pay the judgment could have its assets seized to satisfy the debt. These examples highlight the serious financial consequences of failing to meet financial obligations.

Grounds for Placing a Lien

Placing a lien on a business is a serious legal action taken to secure payment for an outstanding debt. Understanding the legal basis for such action and the necessary documentation is crucial for both creditors and debtors. This section details the grounds for placing a lien, focusing on unpaid debts, the required documentation, and the verification process.

The primary legal basis for placing a lien on a business stems from the existence of a valid and enforceable debt. This debt must be clearly defined and documented, demonstrating a contractual agreement or legal obligation between the creditor and the debtor. The specific type of lien will depend on the nature of the debt and the applicable state or federal laws. For instance, a mechanic’s lien arises from unpaid services rendered to improve real property owned by the business, while a judgment lien is secured after a court ruling in favor of the creditor. Failure to pay these debts can result in the creditor pursuing a lien to secure payment.

Necessary Documentation to Support a Lien Claim

Sufficient documentation is essential to successfully claim a lien against a business. This documentation serves as proof of the debt and the creditor’s entitlement to pursue legal recourse. The required documents can vary depending on the type of lien and the jurisdiction, but generally include the original contract outlining the terms of the agreement, invoices detailing goods or services provided, proof of delivery or service completion, and evidence of multiple attempts to collect the debt. This could include correspondence, payment reminders, and potentially, previous legal notices. Failure to provide comprehensive documentation may weaken the creditor’s claim and potentially lead to the dismissal of the lien.

Verifying the Validity of a Debt Before Filing a Lien

Before filing a lien, thorough verification of the debt’s validity is paramount. This involves confirming the accuracy of the amount owed, ensuring all relevant invoices and documentation are correct and complete, and verifying the debtor’s identity and legal standing. A creditor should meticulously review all supporting documentation, comparing it against the original contract or agreement. Discrepancies should be resolved before proceeding. Furthermore, attempting to contact the debtor to resolve the matter amicably is often advisable before resorting to legal action. This not only fulfills a legal obligation but also potentially avoids costly litigation.

Step-by-Step Guide for Documenting the Debt

The process of documenting a debt before filing a lien requires a systematic approach. This ensures a comprehensive and legally sound record of the transaction.

- Gather all relevant documentation: This includes contracts, invoices, receipts, delivery records, emails, and any other evidence of the agreement and the unpaid debt.

- Create a detailed record of communications: Maintain a log of all attempts to contact the debtor, including dates, times, methods of contact, and the substance of each conversation or correspondence.

- Calculate the precise amount owed: Accurately determine the principal amount owed, including any applicable interest, late fees, and other charges as per the agreement.

- Organize and chronologically arrange all documents: This ensures a clear and easily understandable record for review and potential legal proceedings.

- Verify the accuracy of all information: Double-check all figures, dates, and details to ensure accuracy and prevent any potential challenges to the validity of the claim.

The Lien Filing Process

Filing a lien against a business is a legal process that requires careful attention to detail and adherence to specific procedures. Failure to follow the correct steps can invalidate your lien, leaving you without recourse for recovering your debt. This section details the steps involved, necessary documentation, associated fees, and potential pitfalls to avoid.

Lien Filing Process Flowchart

The following flowchart visually represents the steps involved in filing a lien against a business. Note that specific steps and requirements may vary by jurisdiction. Always consult local laws and regulations for accurate and up-to-date information.

[Imagine a flowchart here. The flowchart would begin with “Determine if a Lien is Appropriate,” branching to “Yes” and “No.” The “Yes” branch would lead to “Prepare Necessary Documents,” followed by “File the Lien with the Appropriate Agency,” then “Serve Notice to the Business,” and finally “Monitor and Enforce the Lien.” The “No” branch would lead to “Explore Alternative Debt Recovery Methods.” Each step would ideally be represented by a rectangle, with the decision point represented by a diamond.]

Required Forms and Documents

The specific forms and documents required for filing a lien vary depending on the type of lien (mechanic’s lien, judgment lien, etc.) and the jurisdiction. However, the following table provides a general overview of commonly required documentation.

| Document Name | Purpose | Required Information | Where to Obtain |

|---|---|---|---|

| Lien Affidavit/Claim | Formal statement of the debt owed. | Detailed description of services/goods provided, dates of service, amount owed, debtor’s information, creditor’s information. | Court Clerk’s office or relevant government agency. May be available online. |

| Proof of Service | Evidence that the debtor was properly notified of the lien. | Date of service, method of service (e.g., personal service, certified mail), recipient’s signature (if applicable), and any other relevant details. | Generated after service is completed; may require a specific form provided by the court or agency. |

| Contract/Invoice | Supporting documentation of the agreement and the debt. | Detailed description of services/goods provided, agreed-upon price, payment terms, signatures of both parties. | Provided by the creditor; it’s the original contract or invoice. |

| Business Registration Documents | Verify the legal status and address of the business. | Business name, registration number, address, and other identifying information. | Secretary of State’s office or relevant business registration agency. |

Lien Filing Fees, How to put a lien on a business

Filing fees for liens vary significantly depending on the jurisdiction, the type of lien, and the amount of the claim. These fees typically cover the cost of processing and recording the lien document. Expect to pay anywhere from a few hundred dollars to several thousand dollars, depending on the circumstances. It is crucial to contact the relevant government agency (county clerk’s office, for example) to obtain the most up-to-date fee schedule. For example, in some counties, a mechanic’s lien might cost $50-$100, while a more complex judgment lien could cost significantly more.

Potential Pitfalls and Common Mistakes

Several pitfalls and common mistakes can occur during the lien filing process. These include:

* Filing with the wrong agency: Ensuring the correct agency is crucial. Incorrect filing leads to wasted time and money and may invalidate the lien.

* Inaccurate or incomplete documentation: Missing or incorrect information can render the lien invalid. Meticulous attention to detail is critical.

* Failure to properly serve notice: The debtor must be properly notified of the lien. Improper notice can invalidate the lien. Proper service methods vary by jurisdiction.

* Missing deadlines: Liens are subject to strict deadlines. Missing a deadline can render the lien unenforceable.

* Failure to comply with all legal requirements: Lien laws are complex and vary by jurisdiction. Consult with legal counsel to ensure full compliance. For example, failing to include all necessary information on the lien document or not following the prescribed format can lead to rejection.

Consequences of a Business Lien

Placing a lien on a business has significant repercussions, impacting its financial health, creditworthiness, and operational capabilities. Understanding these consequences is crucial for both creditors seeking to recover debts and businesses facing the threat of a lien. The severity of the impact depends on the type of lien, its amount, and the business’s overall financial stability.

A lien acts as a cloud over a business’s assets, creating considerable challenges. It severely restricts the business’s financial flexibility and can lead to a cascade of negative consequences.

Impact on Credit Rating and Financial Standing

A lien significantly damages a business’s credit rating. Credit reporting agencies view liens as indicators of financial distress, leading to a lower credit score. This, in turn, makes it more difficult for the business to secure favorable terms on loans, leases, and other credit facilities. The lower credit score can also affect the business’s ability to attract investors or secure advantageous contracts with suppliers. For example, a small business with a lien might find its credit line reduced or even canceled, hindering its ability to manage cash flow and meet operational expenses. The negative impact on the credit report can persist for several years even after the lien is removed, making it a long-term financial burden.

Effect on Obtaining Loans or Financing

The presence of a lien makes it significantly harder for a business to obtain loans or other forms of financing. Lenders view liens as a substantial risk, as they represent a prior claim on the business’s assets. This makes them hesitant to provide funding, or they may offer less favorable terms, such as higher interest rates or stricter collateral requirements. A business burdened with a lien might find itself unable to secure crucial funding for expansion, equipment upgrades, or even day-to-day operations, potentially leading to further financial instability and even business failure. Securing a loan with a lien on record often requires a significantly larger down payment or a higher interest rate to compensate for the increased risk.

Lien Removal Process

Removing a lien typically involves satisfying the underlying debt that led to the lien’s placement. This often means paying the full amount owed to the creditor. Once the debt is settled, the creditor is legally obligated to file a release of lien, officially removing the encumbrance from the business’s assets. The process can be complex and time-consuming, requiring careful documentation and adherence to legal procedures. In some cases, negotiation with the creditor may be necessary to reach a mutually agreeable settlement. Failure to properly follow the legal procedures for lien removal can result in continued negative impacts on the business’s credit and financial standing.

Legal Implications of Different Lien Types

Different types of liens have varying legal implications. For example, a mechanic’s lien, which secures payment for services rendered to a business’s property, has different legal ramifications than a judgment lien, which arises from a court judgment against the business. A mechanic’s lien typically only affects the specific property where the services were performed, while a judgment lien can extend to all the business’s assets. Understanding the specific type of lien placed on the business is critical in determining the appropriate steps for removal and mitigating its potential impact. The legal complexities of different lien types often require the assistance of legal counsel to navigate effectively.

Legal Considerations and Advice: How To Put A Lien On A Business

Placing a lien on a business is a serious legal action with significant ramifications for both the creditor and the debtor. Understanding the legal landscape before proceeding is crucial to avoid costly mistakes and potential legal challenges. Improperly filed liens can lead to substantial financial penalties and damage your credibility. Seeking professional legal counsel is highly recommended.

The potential legal repercussions of improperly filing a lien are substantial. These can include the dismissal of your lien, legal fees and court costs assessed against you, and even potential civil lawsuits for damages caused by the wrongful action. Furthermore, damaging your reputation through frivolous legal action can have long-term consequences, impacting your ability to secure credit or engage in future business transactions. A thorough understanding of the relevant laws and regulations governing liens in your jurisdiction is paramount.

Potential Legal Defenses Against a Lien

A business facing a lien may have several legal defenses available to challenge its validity. The success of these defenses depends on the specific circumstances of the case and the strength of the evidence presented. It’s important for the business to consult with legal counsel to explore all possible avenues of defense.

- Lack of Proper Notice: The business may argue that the creditor failed to provide adequate notice of the debt or the intention to file a lien, as required by law. This often involves demonstrating that the notice was not delivered correctly or that the required waiting period before filing was not observed.

- Statute of Limitations: If the debt is beyond the statute of limitations for the jurisdiction, the business may argue that the lien is unenforceable. The statute of limitations varies by state and the type of debt.

- Improper Lien Filing: The business can challenge the lien if it was not properly filed according to the legal requirements, such as incorrect documentation or failure to meet specific procedural steps.

- Dispute Over the Debt: The business may have a valid defense if it disputes the amount owed or the validity of the underlying debt itself. This could involve presenting evidence of payment, errors in billing, or other reasons why the debt is not legitimate.

- Fraud or Misrepresentation: If the creditor obtained the debt through fraudulent means or misrepresented material facts, the business may be able to challenge the lien on the grounds of fraud.

Sample Legal Notice Letter

This sample letter is for informational purposes only and should not be considered legal advice. You should always consult with an attorney to ensure the letter complies with all applicable laws and regulations in your jurisdiction.

To: [Business Name]

[Business Address]From: [Your Name/Company Name]

[Your Address]Date: [Date]

Subject: Notice of Intent to File a Mechanic’s Lien

This letter serves as formal notice of our intent to file a mechanic’s lien against your business, [Business Name], located at [Business Address], for the unpaid amount of $[Amount] for [Services Rendered/Goods Provided]. This debt is due and owing as of [Date]. A detailed invoice outlining the services provided and the amount due is attached.

You have [Number] days from the date of this letter to remit full payment of $[Amount]. Failure to make full payment within this timeframe will result in the filing of a mechanic’s lien against your business property. This action will negatively impact your credit rating and could lead to further legal action to recover the debt.

We urge you to contact us immediately at [Phone Number] or [Email Address] to discuss this matter and arrange payment.

Sincerely,

[Your Name/Company Name]

Illustrative Examples

Understanding the process of filing a lien can be challenging. These examples illustrate how liens are applied in different business contexts, clarifying the steps involved and the potential outcomes.

Mechanic’s Lien on a Construction Company

Acme Construction, a small business specializing in residential renovations, contracted with a homeowner to renovate a kitchen. “ABC Plumbing,” a subcontractor hired by Acme, completed plumbing work valued at $15,000 but was not paid by Acme despite repeated requests. To recover the debt, ABC Plumbing initiated the process of filing a mechanic’s lien against Acme Construction. This involved providing Acme with a written notice of intent to lien, detailing the unpaid amount and the project. Following a legally mandated waiting period (typically 30-90 days, depending on state law), and having received no payment, ABC Plumbing filed the lien with the appropriate county clerk’s office, providing documentation such as the contract with Acme, invoices, proof of completed work, and the notice of intent. The lien was then recorded publicly, placing a claim against Acme Construction’s property related to the project. This action legally prevents Acme from selling or refinancing the property until the debt is settled.

Supplier Lien Against a Retail Business

“Widgets R Us,” a retail store selling novelty items, ordered $10,000 worth of inventory from “Supplier Solutions” in January. Payment was due in 30 days. Widgets R Us failed to pay, despite multiple reminders in February and March. In April, Supplier Solutions sent a formal demand letter outlining the outstanding debt. After receiving no response, Supplier Solutions filed a lien against Widgets R Us in May. This involved submitting the required documentation, including the sales invoices, the demand letter, and the lien form to the appropriate state or county office. The lien was recorded, creating a public record of the debt owed. This lien can impact Widgets R Us’ creditworthiness and ability to secure future loans or credit.

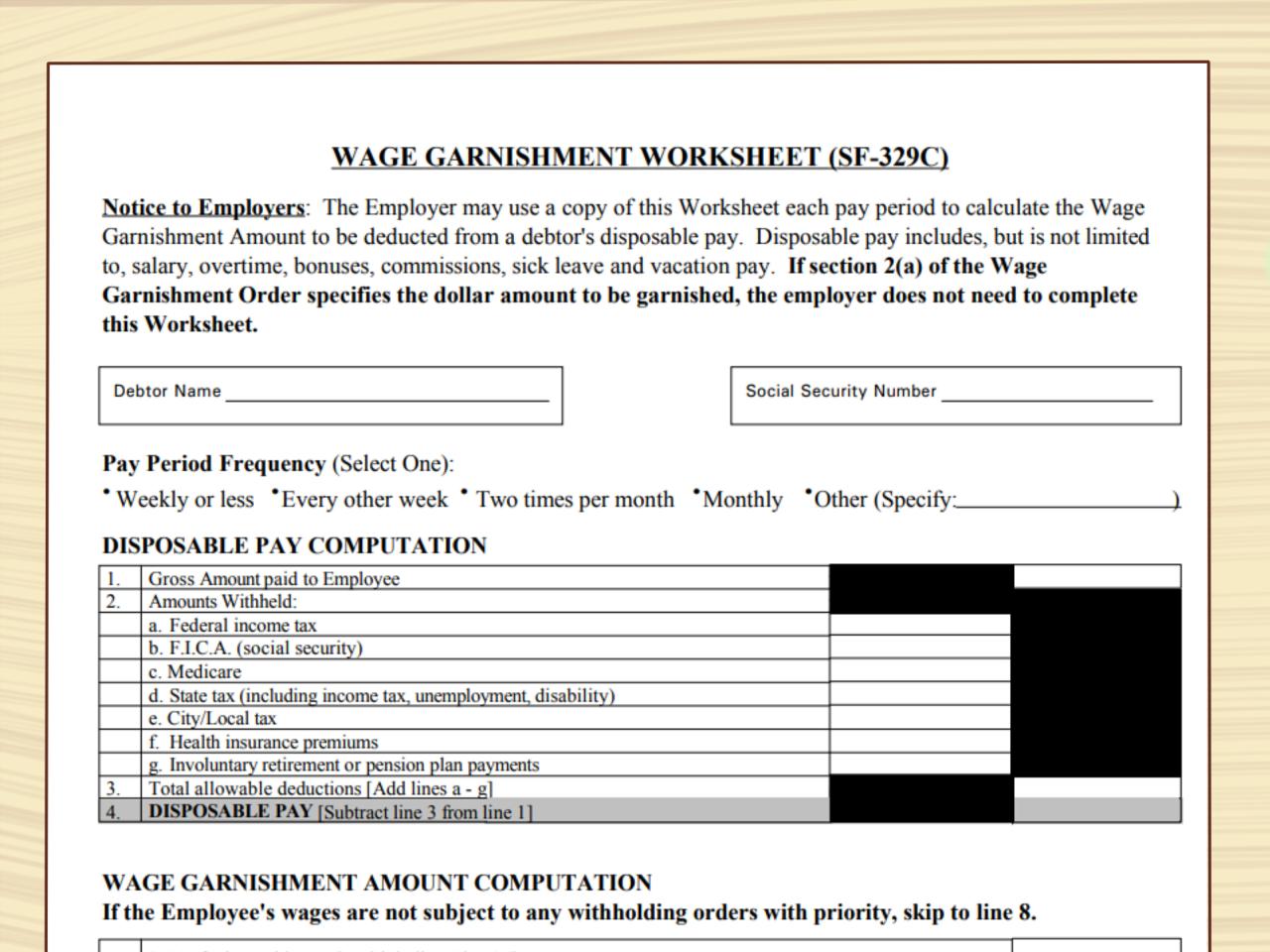

Visual Representation of a Lien Form

A correctly filled lien form typically includes a header clearly identifying it as a “Notice of Lien” or similar designation, and indicates the relevant jurisdiction. The form will require detailed information about the claimant (the party filing the lien), including their name, address, and contact information. Similarly, it necessitates precise details about the debtor (the business against which the lien is filed), encompassing their name, address, and business registration details. The form also needs to specify the nature of the debt, including the amount owed, a description of the services rendered or goods supplied, dates of service/delivery, and supporting documentation references (invoices, contracts, etc.). Crucially, it must accurately describe the property subject to the lien, including the legal description and address. Finally, it typically requires the claimant’s signature and notarization, ensuring the authenticity and validity of the document. The form itself often follows a standardized format, dictated by the state or county regulations. The layout is generally clear and concise, with designated spaces for each piece of required information to minimize ambiguity and ensure accuracy.