A business form giving written acknowledgement for cash received is crucial for maintaining accurate financial records and protecting your business from potential disputes. This seemingly simple document serves as irrefutable proof of payment, safeguarding both the payer and the payee. We’ll explore the essential elements, legal implications, and best practices for creating and managing these vital forms, covering everything from simple receipts to more formal invoice acknowledgements, ensuring you’re equipped to handle cash transactions with confidence and compliance.

This guide delves into the critical components of a well-structured cash receipt, including details like date, amount, payment method, and party identification. We’ll provide practical examples and templates, addressing common errors and offering solutions for seamless integration with your accounting systems. Learn how to secure your records, maintain compliance, and leverage these forms for efficient financial management.

Defining the Business Form

A written acknowledgement for cash received is a crucial business document providing proof of payment. Its primary purpose is to protect both the payer and the payee, establishing a clear record of a financial transaction. This simple form serves as legal evidence in case of disputes or discrepancies. The lack of such documentation can lead to significant complications in accounting and legal proceedings.

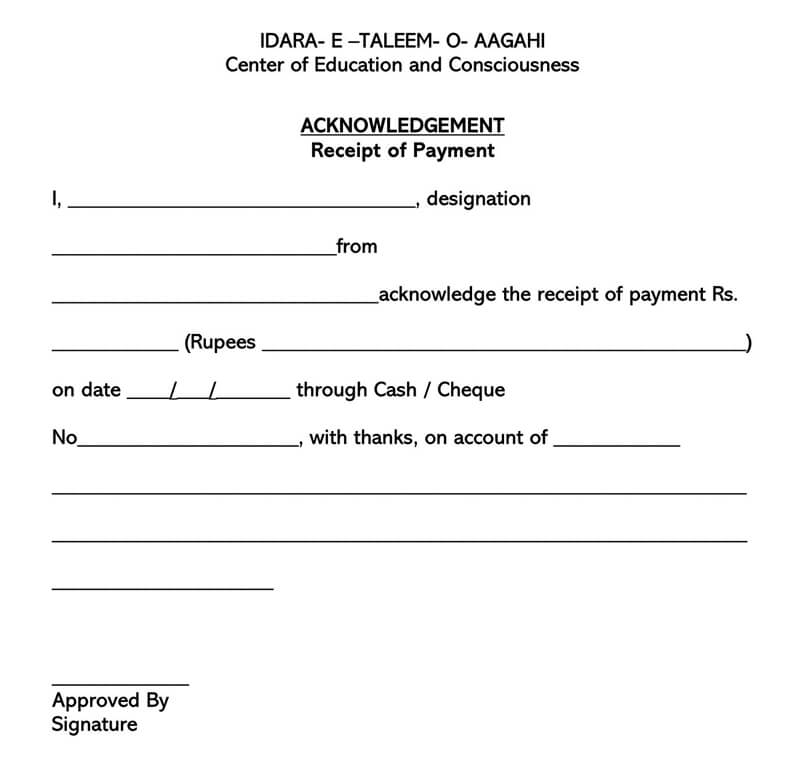

Essential elements of a written acknowledgement for cash received include the date of the transaction, the amount received, a description of the goods or services provided (if applicable), the names and addresses of both the payer and the payee, and the signature of the recipient. While seemingly straightforward, the specific details and format can vary considerably depending on the context of the transaction.

Formats for Cash Receipt Acknowledgements

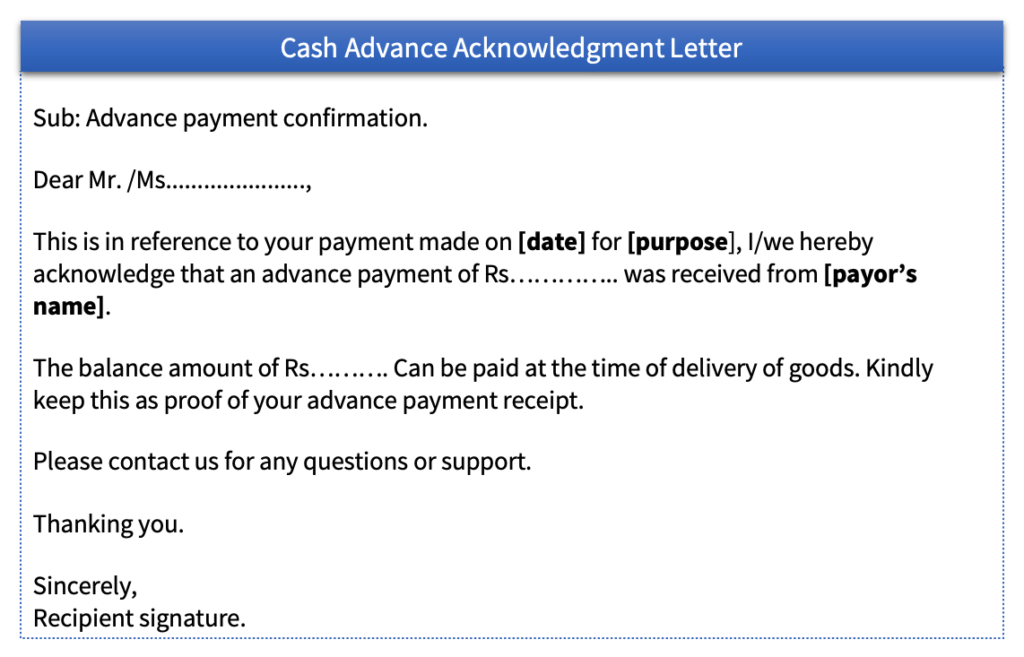

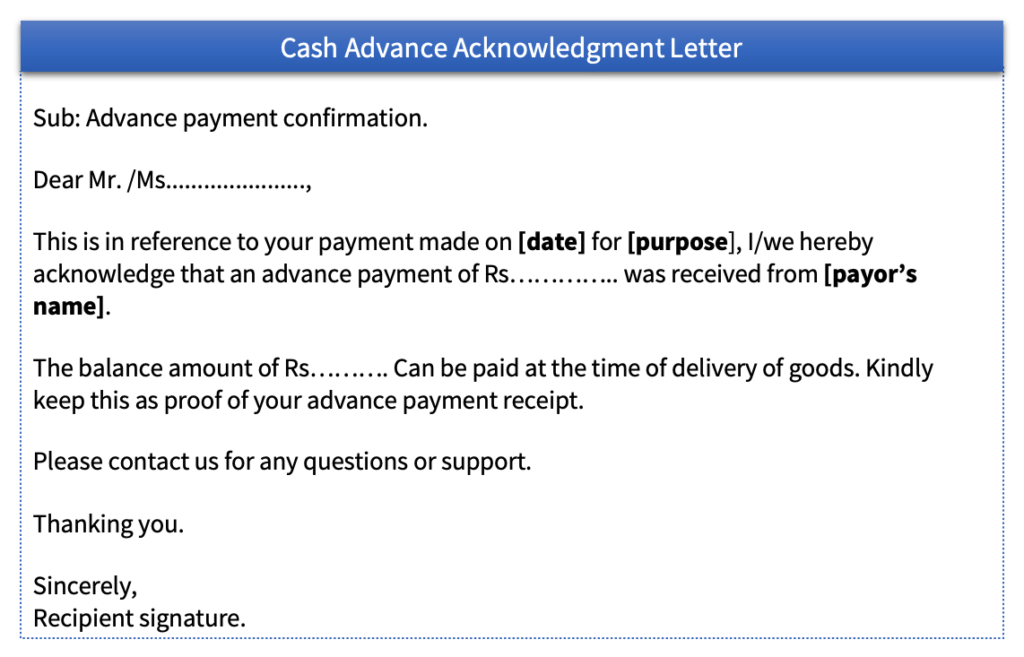

Different business situations call for different formats. A simple receipt might suffice for small, informal transactions, while a formal invoice incorporating payment acknowledgement is more appropriate for larger, complex deals. A simple receipt might only include the date, amount, and a brief description, whereas a formal invoice will also include itemized details, tax information, payment terms, and possibly reference numbers.

A simple receipt might look like this: “Received from [Payer Name] the sum of [Amount] on [Date] for [Description]. [Signature]”. A more formal invoice with payment acknowledgement would include a unique invoice number, detailed product/service description, quantity, unit price, subtotal, tax, total amount due, payment method (cash), and a clear “Payment Received” stamp or signature.

Legal Implications of Issuing a Cash Receipt

Issuing a written acknowledgement for cash received carries significant legal implications. This document serves as prima facie evidence of the transaction in a court of law. Accuracy is paramount; any discrepancies or inconsistencies could undermine its validity. The form must clearly reflect the details of the transaction to avoid potential disputes. Failure to provide a receipt, especially in situations requiring formal documentation, can leave the payee vulnerable to accusations of non-payment or fraud.

For example, a business that consistently fails to provide receipts for cash transactions might face difficulties during tax audits, as the absence of proper documentation makes it hard to verify income. Conversely, a customer who paid cash but lacks proof of payment could struggle to resolve disputes concerning goods or services received.

Template for a Legally Sound Cash Receipt

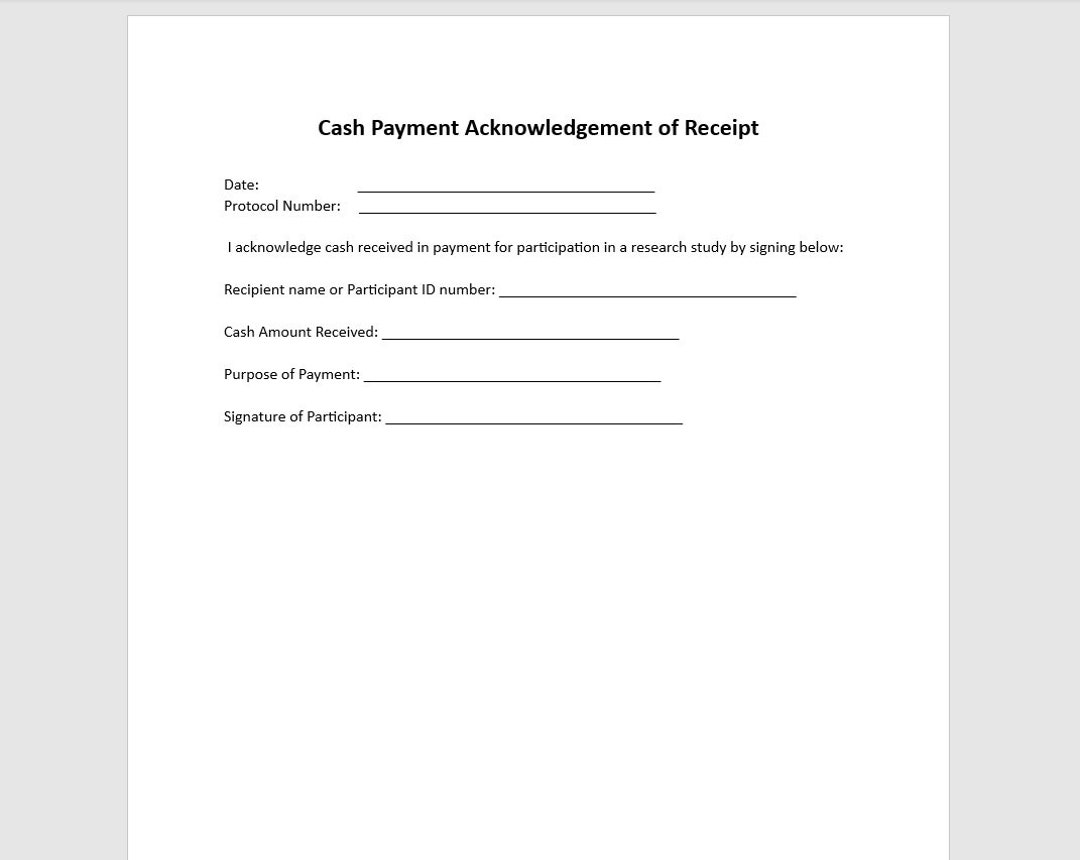

A simple, yet legally sound, template should include the following:

Date: _____________

Received from: _________________________ (Payer Name)

Address: _________________________

The sum of: _____________ (Amount in words) / _____________ (Amount in numbers)

For: _________________________ (Description of goods/services)

Payment Method: Cash

Received by: _________________________ (Payee Name)

Address: _________________________

Signature: _________________________

This template ensures all essential elements are present, minimizing the risk of legal complications. The inclusion of both the numerical and written amount further reduces the chance of errors or disputes regarding the amount received. The clear identification of the payer and payee adds another layer of security.

Content and Structure of the Form: A Business Form Giving Written Acknowledgement For Cash Received

A well-structured cash receipt form ensures clarity, minimizes errors, and provides a legally sound record of a financial transaction. This section details the essential components and best practices for creating such a form. A clear and concise design facilitates efficient processing and reduces potential disputes.

The crucial information to include on a cash receipt form ensures comprehensive documentation of the transaction. This includes details about the payment itself, the parties involved, and the reason for the payment. Omitting any of these elements can lead to ambiguity and complications later.

Essential Information for a Cash Receipt Form

The following table Artikels the essential information and its optimal placement within a four-column responsive form layout. This structure allows for easy readability and efficient data entry, regardless of screen size.

| Column 1: Transaction Details | Column 2: Payer Information | Column 3: Recipient Information | Column 4: Payment Purpose |

|---|---|---|---|

| Date: (MM/DD/YYYY) Amount Received: (Currency and numerical value) Payment Method: (Cash) |

Payer Name: Payer Address: Payer Contact Number: |

Recipient Name (Business Name): Recipient Address: Recipient Contact Number: |

Brief Description of Payment: (e.g., Invoice #123, Service Fee, Product Purchase) |

Potential Errors to Avoid

Several common errors can undermine the effectiveness of a cash receipt form. Careful planning and attention to detail are crucial to prevent these issues.

- Missing or Incomplete Information: Ensure all fields are filled accurately and completely. Incomplete forms can lead to confusion and disputes.

- Inconsistent Formatting: Maintain consistent formatting throughout the form, including date formats, currency symbols, and capitalization.

- Ambiguous Wording: Use clear and concise language to avoid any possibility of misinterpretation. Avoid jargon or technical terms that the payer might not understand.

- Lack of Authorization: Include a space for a signature or stamp to authenticate the receipt. This provides legal validity to the document.

- Errors in Calculations: Double-check all numerical values to ensure accuracy. Errors in amounts can lead to significant financial discrepancies.

Best Practices for Clear and Concise Wording

Using precise language is paramount in preventing misunderstandings. Clear wording ensures both parties are on the same page regarding the transaction.

- Use Plain Language: Avoid jargon or technical terms. Write in a style that is easily understood by everyone.

- Be Specific: Provide precise details about the payment, avoiding vague or ambiguous descriptions.

- Use Consistent Terminology: Use the same terms and phrases throughout the form to maintain consistency and avoid confusion.

- Proofread Carefully: Thoroughly review the form for any grammatical errors, typos, or inconsistencies before printing or distributing.

Security and Record Keeping

Maintaining the security and proper record-keeping of cash receipt forms is crucial for the financial health and legal compliance of any business. Negligence in these areas can lead to significant financial losses, legal repercussions, and damage to the company’s reputation. A robust system ensures accurate financial reporting, simplifies audits, and protects against fraud.

Implementing effective security measures safeguards against unauthorized access, alteration, or theft of these crucial documents, preserving the integrity of financial records. A well-defined record-keeping system ensures easy retrieval of information, simplifies tax compliance, and facilitates efficient financial management. This system must comply with relevant legal and accounting standards, such as those related to tax reporting and audit trails.

Secure Storage Methods for Cash Receipt Forms

Secure storage protects physical forms from damage, loss, or unauthorized access. Options include fire-resistant safes, locked filing cabinets in secure areas, and off-site storage facilities. Digital storage offers additional benefits, such as easy retrieval, searchability, and backup capabilities. However, digital storage requires robust security measures, including password protection, encryption, and access controls. Cloud-based storage, when utilized, should be with reputable providers offering encryption and data security features. For example, a small business might use a locked filing cabinet, while a larger corporation might utilize a combination of secure on-site storage and encrypted cloud backups.

Archiving Procedures for Cash Receipt Forms

Retention policies for cash receipt forms vary depending on legal and accounting requirements and internal policies. These policies dictate how long forms must be stored. Typically, forms should be stored for a minimum of seven years, often longer depending on the jurisdiction and specific tax regulations. A clearly defined retention schedule is crucial. Forms should be organized chronologically or numerically for easy retrieval. Regular backups of digital records are essential, stored in separate locations to protect against data loss. Physical archives should be stored in a climate-controlled environment to prevent damage from moisture or extreme temperatures. For example, a company might use a combination of physical filing and cloud storage, regularly backing up digital records to an offsite server.

Tracking Cash Receipts

A well-organized system for tracking cash receipts is essential for accurate financial reporting and efficient cash flow management. This system should include a unique identifier for each receipt, such as a sequential number or date stamp. Detailed information, including the date, amount, payer, and purpose of the payment, should be recorded. Regular reconciliation of cash receipts with bank statements is critical to detect discrepancies and prevent errors. Software solutions, such as accounting software, can automate this process and improve accuracy. For example, a simple spreadsheet can be used for smaller businesses, while larger companies may utilize enterprise resource planning (ERP) systems to manage cash receipts.

Integration with Accounting Systems

Efficient integration of cash receipt acknowledgement forms with accounting systems is crucial for streamlined financial management. This ensures accurate record-keeping, minimizes manual data entry, and reduces the risk of errors. Seamless integration allows for automatic updates to accounting records, providing a real-time view of cash flow.

This form’s design facilitates integration with various accounting software and spreadsheet programs. Data from the completed form, specifically the date, amount received, payer information, and payment method, can be directly transferred into the accounting system. This transfer can be achieved through manual entry, import via CSV or other file formats, or through API integration if the accounting software supports it. The choice of method depends on the specific software and the volume of transactions.

Data Transfer Methods

Several methods exist for transferring data from the cash receipt acknowledgement form to accounting software. Manual data entry, while straightforward, is prone to errors and time-consuming, especially for high-volume transactions. Importing data via CSV files offers a more efficient solution, allowing for bulk uploads. However, this method requires consistent formatting of the form data. API integration provides the most seamless and automated approach, automatically updating accounting records in real-time. This reduces the risk of human error and saves significant time.

Recording Cash Receipts, A business form giving written acknowledgement for cash received

The process of recording cash receipts involves several steps. First, the completed cash receipt acknowledgement form is reviewed for accuracy and completeness. Next, the relevant data—date, amount, payer information, payment method, and any relevant reference numbers—is extracted. This data is then entered into the accounting software, usually within a journal entry or a dedicated cash receipts module. The entry will typically debit the cash account and credit the appropriate revenue account. Finally, the form is filed for record-keeping purposes.

Challenges and Solutions

Integrating this form with existing accounting systems may present challenges. Inconsistencies in data formatting between the form and the accounting software can lead to import errors. For instance, if the form uses a different date format than the software, the data will not be imported correctly. Solutions include standardizing the form’s data format to match the software’s requirements, or using data transformation tools to convert the data before importing. Another challenge is the lack of API integration with older accounting systems. In such cases, using CSV import or manual entry may be necessary.

Reconciliation Process

Reconciling cash receipts from this form involves a step-by-step process to ensure accuracy. First, a report of all cash receipts is generated from the accounting software for a specific period. This report is then compared to the total of all cash receipt acknowledgement forms for the same period. Any discrepancies are investigated to identify the source of the error. This might involve reviewing individual forms for inaccuracies, checking bank statements for matching deposits, or investigating potential data entry errors in the accounting software. Once all discrepancies are resolved, the reconciliation is complete, confirming the accuracy of cash receipts recording.

Illustrative Examples

This section provides three diverse examples of completed cash receipt forms, illustrating variations in payment methods, purposes, and transaction types. These examples showcase the form’s adaptability across different business scenarios, highlighting its versatility and practicality. Following these examples, we will examine specific scenarios involving large and small cash payments, and analyze the form’s application in business-to-business (B2B) and business-to-consumer (B2C) contexts.

Completed Cash Receipt Form Examples

The following examples demonstrate the completed form for different scenarios. Each example includes the date, recipient details, payer details, payment amount, payment method, and a brief description of the goods or services received.

| Example | Date | Recipient | Payer | Amount | Payment Method | Description |

|---|---|---|---|---|---|---|

| 1 | 2024-10-27 | Acme Corp | John Smith | $100.00 | Cash | Payment for consulting services |

| 2 | 2024-10-28 | ABC Company | Jane Doe | $500.00 | Cash & Check (Check #12345) | Partial payment for office supplies; balance due $200 |

| 3 | 2024-10-29 | XYZ Ltd. | Green Valley Farms | $2500.00 | Cash | Payment for bulk purchase of produce |

Large Cash Payment Scenario

Consider a scenario where a real estate company receives a $50,000 cash deposit as a down payment on a property. In this case, enhanced security measures are crucial. These would include having two employees present during the transaction, meticulously counting the cash in front of the payer, and immediately depositing the cash into a secure bank account. Detailed photographic evidence of the cash and the payer’s identification could be added to the receipt, along with the signatures of both employees involved. A pre-numbered receipt and a sequentially numbered duplicate receipt kept in a secure location are also essential.

Small Cash Payment Scenario

A simple transaction like a customer paying $10 cash for a coffee at a small cafe illustrates the form’s efficiency. The cashier fills out the form quickly, providing a receipt to the customer. The simplicity of this transaction highlights the form’s effectiveness in handling small cash payments, ensuring accurate record-keeping even for low-value transactions.

Business-to-Business (B2B) vs. Business-to-Consumer (B2C) Transactions

In a B2B transaction, the cash receipt form would include more detailed information, such as invoice numbers, purchase order numbers, and potentially tax identification numbers. The payer and recipient would likely be businesses with established business addresses and contact details. Conversely, a B2C transaction would feature simpler details, with the payer being an individual customer and the transaction description potentially being less specific. The level of detail required reflects the complexity and nature of the respective transaction.