Can two businesses share the same address? The answer, as with most legal and operational questions, is nuanced. Sharing a business address presents a complex interplay of legal compliance, logistical practicality, brand perception, and financial considerations. This exploration delves into the potential benefits and pitfalls, offering guidance for businesses considering this arrangement.

From navigating the complexities of licensing and permits to managing mail and maintaining distinct brand identities, the decision to share an address requires careful planning and execution. This guide will help you weigh the pros and cons, ensuring you make an informed choice that aligns with your business goals and legal obligations.

Legal and Regulatory Implications

Sharing a single business address between two distinct entities carries significant legal and regulatory ramifications. The implications extend beyond simple administrative concerns, impacting everything from licensing and taxation to liability and legal standing. Understanding these implications is crucial for businesses considering this arrangement to ensure compliance and avoid potential legal pitfalls.

Business Licenses and Permits

The impact on business licenses and permits is substantial. Many jurisdictions require businesses to have a separate license or permit for each distinct legal entity, regardless of shared physical location. Obtaining a license often involves providing a business address, and using the same address for multiple businesses could lead to license applications being rejected or revoked. This is because regulators need to ensure proper accountability and prevent fraud. Furthermore, the specific requirements vary greatly depending on the type of business and the local regulations. For example, a restaurant needs different permits than a software company, even if they share an address. Failure to comply can result in significant fines and legal action.

Industry-Specific Restrictions

Certain industries face stricter regulations regarding address sharing. For instance, financial institutions, healthcare providers, and businesses handling controlled substances are subject to heightened scrutiny. These industries often have stringent regulations designed to prevent money laundering, fraud, patient privacy violations, and misuse of controlled substances. Sharing an address in these sectors might trigger increased regulatory oversight and potentially jeopardize licenses and operational permits. The government might see this as a red flag indicating a lack of proper internal controls or increased risk of illicit activity.

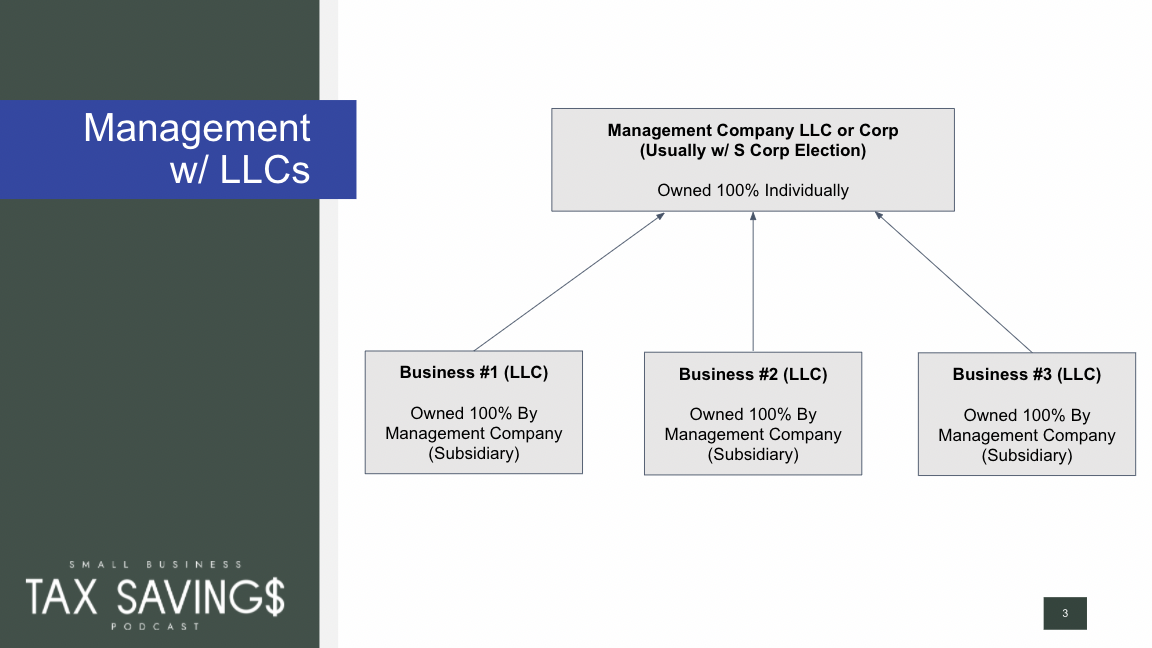

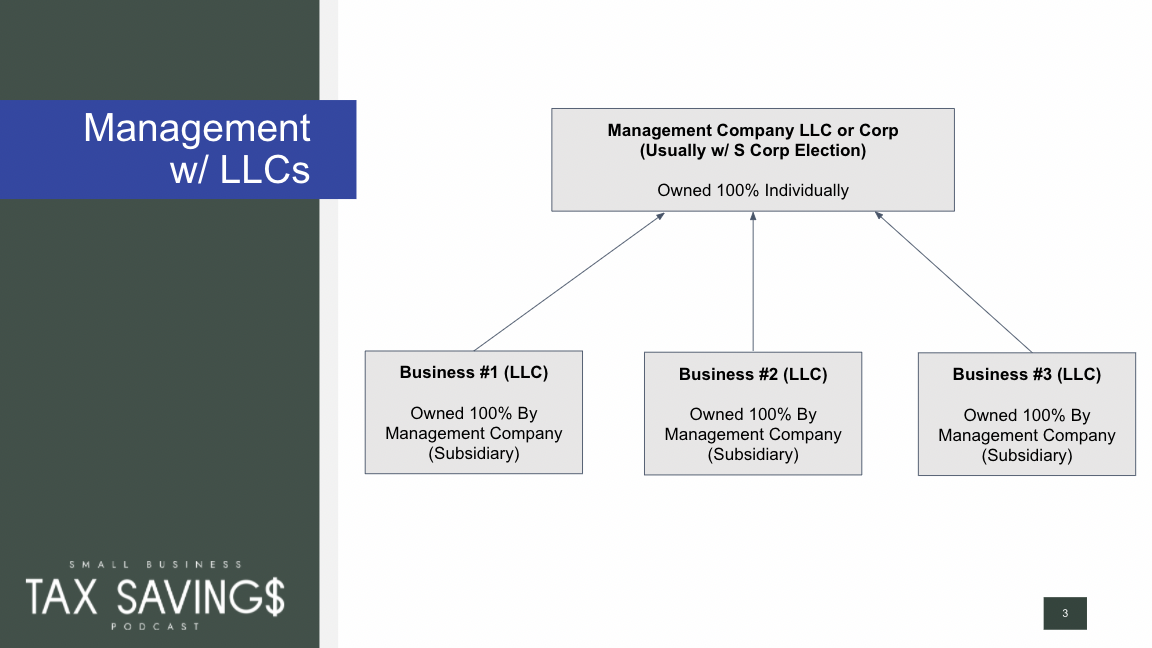

Regulations for Different Business Structures

The legal implications of address sharing also vary depending on the business structure. A sole proprietorship might face fewer regulatory hurdles compared to a limited liability company (LLC) or corporation, especially if the shared address is for businesses with vastly different operational characteristics. However, even for sole proprietorships, using the same address for multiple businesses might create confusion in tax filings or liability issues. LLCs and corporations, with their more complex legal structures, often face stricter compliance requirements and increased scrutiny. This is particularly true if the businesses share owners or officers, as this could raise concerns about conflicts of interest or commingling of funds. For example, an LLC operating a bar sharing an address with an LLC operating a daycare center would likely face greater scrutiny than two separate sole proprietorships.

Potential Legal Risks Associated with Shared Addresses

| Business Structure | License/Permit Issues | Liability Risks | Tax Implications |

|---|---|---|---|

| Sole Proprietorship | Potential for denial or revocation if not explicitly allowed | Increased personal liability if businesses are not clearly separated | Potential for confusion in tax reporting and audits |

| LLC | Stricter scrutiny; potential for denial if not compliant with specific requirements | Limited liability protection might be compromised if commingling of funds or assets occurs | Requires meticulous record-keeping to avoid penalties |

| Corporation | Similar to LLCs, with added complexities due to corporate structure | Shareholder liability generally limited, but improper separation can lead to issues | Complex tax reporting and potential for increased audits |

Mail and Package Handling

Sharing a business address presents unique challenges for mail and package management. Efficient systems are crucial to prevent delays, lost items, and confusion amongst clients and employees. Careful planning and clear processes are essential for smooth operations.

Efficient mail sorting and distribution require a well-defined system to ensure each piece of correspondence reaches the intended recipient promptly. Failure to establish such a system can lead to significant delays and potential damage to business relationships.

Mail Sorting and Distribution Strategies

Implementing a robust mail sorting system begins with designating a central location for all incoming mail. This area should be easily accessible to both businesses but secure enough to prevent unauthorized access. A clear visual system, such as color-coded bins or labeled trays, should be used to separate mail for each business. Consider using a system that categorizes mail by type (e.g., invoices, marketing materials, personal correspondence) as well as by recipient business. Regularly scheduled mail sorting times can ensure efficiency and prevent backlogs. Larger businesses might benefit from utilizing mailroom software to track and manage mail volume.

Package Labeling and Identification

Clear and unambiguous labeling is paramount to prevent packages from being misdirected. Each package should be clearly labeled with the recipient business name, complete address (including suite or unit number if applicable), and contact information. The use of distinct colors or logos for each business can further aid in quick identification. Employing barcodes or tracking numbers adds an additional layer of security and allows for efficient tracking of packages. Internal systems should also clearly identify the intended recipient within each business.

Establishing a Mail Handling System

A well-defined system for handling incoming and outgoing mail is essential for maintaining order and efficiency. Here’s a step-by-step procedure:

1. Designated Receiving Area: Establish a central location for receiving all mail and packages.

2. Initial Sorting: Sort mail by business upon arrival.

3. Distribution: Deliver sorted mail to designated areas within each business.

4. Outgoing Mail Preparation: Clearly label all outgoing mail and packages.

5. Metered Mail: Use a postage meter to streamline the mailing process and reduce postage costs.

6. Tracking: Implement a tracking system for outgoing mail and packages, especially for valuable items.

7. Regular Audits: Conduct periodic audits to identify any areas for improvement in the mail handling process.

Best Practices for Avoiding Mail Mix-Ups, Can two businesses share the same address

Implementing these best practices minimizes the risk of mail mix-ups:

- Use separate mailboxes or mail slots for each business.

- Clearly label all internal mailboxes and delivery points.

- Establish a system for handling returned mail.

- Regularly review and update address information for both businesses.

- Train all employees on proper mail handling procedures.

- Consider using a third-party mail service for high-volume mailings.

- Maintain a log of all incoming and outgoing mail, especially for important documents.

Customer Perception and Branding: Can Two Businesses Share The Same Address

Sharing a business address can significantly impact customer perception and brand identity. While cost-effective, it presents challenges in maintaining distinct brand images and avoiding customer confusion. Successfully navigating this requires a strategic approach to visual branding, communication, and overall customer experience.

The perception of two businesses sharing an address can range from neutral to highly negative, depending on various factors. Customers may associate the businesses with each other, regardless of their actual relationship, potentially transferring positive or negative perceptions from one to the other. This is especially true if the businesses operate in similar industries or target overlapping customer demographics. For example, a high-end boutique sharing an address with a discount clothing store might negatively impact the boutique’s perceived prestige. Conversely, a reputable law firm sharing space with a well-regarded accounting firm could benefit both through positive association. However, this is not guaranteed and depends heavily on effective brand management.

Impact on Individual Brand Identities

Sharing an address can blur the lines between distinct brand identities. Customers might perceive a lack of individuality, leading to confusion about each business’s unique offerings and target audience. This is particularly problematic if the businesses have contrasting brand personalities or marketing strategies. For instance, a modern, tech-focused startup sharing space with a traditional, established business could confuse customers who associate the startup with outdated practices or the established business with a lack of innovation. Maintaining distinct brand identities requires deliberate effort to counteract the inherent blurring effect of shared address.

Strategies for Maintaining Distinct Brand Identities

Several strategies can help maintain distinct brand identities while sharing a physical location. These include meticulous attention to signage, separate entrances (if possible), distinct marketing materials, and consistent communication across all channels emphasizing the individual businesses’ unique value propositions. For example, separate websites, social media profiles, and email addresses can further reinforce the separation. A clear and consistent brand voice in all communication is crucial to avoid any ambiguity in the customer’s mind. Companies could also consider organizing separate customer service channels, ensuring that each brand maintains its own customer relationship management (CRM) system.

Importance of Clear Signage and Visual Distinctions

Clear and visually distinct signage is paramount. Signage should be prominent, easy to read from a distance, and clearly identify each business’s name and logo. The design should reflect each brand’s individual aesthetic, ensuring no visual confusion. For instance, a shared building could feature separate entrances with prominently displayed signage for each business, accompanied by distinct color schemes and brand fonts. Indoor signage should also be considered, guiding customers to the appropriate business within the shared space. This clear separation visually communicates the distinct nature of each business.

Communicating Separate Identities to Customers

A comprehensive communication plan is crucial to successfully convey the distinct identities of the businesses. This plan should encompass all customer touchpoints, from initial website visits to in-person interactions. Consistent messaging across all platforms – website, social media, email marketing, and physical materials – is essential. Furthermore, employee training should emphasize the importance of clearly distinguishing between the two businesses and addressing customer inquiries accurately. A well-defined brand guide can help maintain consistency in all communications. For example, customer service representatives should be equipped to handle questions about both businesses while clearly delineating their separate services and offerings.

Tax and Financial Considerations

Sharing a business address can significantly impact the tax and financial aspects of both businesses involved. Understanding these implications is crucial for maintaining compliance and optimizing financial outcomes. Failure to properly address these issues can lead to penalties, audits, and other financial complications.

Tax Filings and Reporting Requirements

Sharing an address doesn’t inherently change the fundamental tax filing requirements for each business. Each business remains a separate legal entity and must file its own tax returns, reporting its own income, expenses, and deductions. However, the shared address might necessitate careful record-keeping to ensure accurate allocation of expenses related to the shared space. For example, if both businesses share the cost of rent, utilities, and cleaning services, meticulous documentation is essential to accurately deduct these expenses on their respective tax returns. Failure to do so could lead to IRS scrutiny and potential penalties. The IRS expects clear and distinct financial records for each business, even if they share a physical address.

Liability and Insurance Implications

Sharing an address doesn’t automatically create joint liability between the businesses. Each business remains separately liable for its own debts and actions. However, shared liability can arise from specific contractual agreements or if one business’s actions cause harm to the other or to a third party. Comprehensive liability insurance policies are vital for each business, clearly outlining coverage for potential risks associated with the shared space, such as accidents occurring on the premises. A thorough review of insurance policies is necessary to ensure adequate coverage and to avoid potential gaps in protection. For example, if one business is involved in a lawsuit related to its operations at the shared address, its insurance policy should cover the legal costs and potential damages, without impacting the other business’s insurance.

Shared Expense Allocation

Accurate and equitable allocation of shared expenses is critical. A written agreement outlining the allocation method (e.g., based on square footage occupied, revenue generated, or a predetermined percentage) is recommended. This agreement should be detailed and transparent, specifying how each expense is calculated and documented. For instance, if rent is $3,000 per month and one business occupies 60% of the space while the other occupies 40%, the rent allocation would be $1,800 and $1,200, respectively. This meticulous record-keeping ensures each business accurately reports its expenses and avoids disputes. Without a clear agreement, disagreements can arise, potentially impacting the relationship between the businesses and their tax filings.

Accounting Implications of Shared vs. Separate Locations

Sharing an address simplifies some aspects of accounting, such as the tracking of shared expenses. However, it requires rigorous record-keeping to maintain the separate identities of each business. A separate accounting system for each business is strongly recommended, even if they share an address. This allows for clear financial reporting and simplifies tax preparation. Having separate locations eliminates the complexities of shared expense allocation, but it increases overall costs associated with rent, utilities, and other operational expenses. The choice between shared and separate locations should be based on a careful cost-benefit analysis, considering both financial and operational implications.

Potential Tax Advantages and Disadvantages of Shared Addresses

Sharing an address might offer limited tax advantages, primarily in the form of reduced overhead costs (e.g., rent, utilities). However, these savings must be carefully weighed against the potential administrative burden of meticulous record-keeping and expense allocation. A significant disadvantage is the increased risk of errors in tax reporting if expenses are not properly allocated. This can lead to audits, penalties, and potential legal disputes. Accurate and transparent accounting practices are crucial to mitigating these risks. Furthermore, the perceived image of a shared address might negatively affect creditworthiness or investor perception, potentially hindering access to funding or investment opportunities.

Operational Efficiency and Shared Resources

Sharing an address often leads to the opportunity to share resources between businesses. This can significantly impact operational efficiency, potentially leading to substantial cost savings and improved productivity. However, it’s crucial to carefully consider the potential drawbacks and implement robust management strategies to avoid conflicts and ensure a smooth-running operation.

Sharing resources like office space, utilities, and even administrative staff can create economies of scale, reducing individual business overhead. For example, two businesses might split the cost of rent, internet, and cleaning services, leading to a lower cost per square foot for each. This shared cost model can be particularly beneficial for startups or small businesses with limited budgets. Conversely, poorly managed shared resources can lead to friction, inefficiencies, and ultimately, higher costs if disputes arise or resources are misused.

Benefits of Shared Resources

Sharing resources offers several key advantages. Reduced operational costs are paramount; splitting expenses for utilities, rent, and maintenance directly impacts the bottom line. Improved resource utilization is another benefit; shared equipment and personnel are more efficiently used, avoiding duplication of effort and investment. Increased collaboration can also emerge from a shared workspace, fostering innovation and the exchange of ideas between different business teams. Finally, a shared space can lead to a sense of community and mutual support, particularly valuable for smaller businesses.

Drawbacks of Shared Resources

Despite the potential benefits, sharing resources also presents challenges. Conflicts over resource allocation are a significant concern; disagreements over usage times, equipment access, or shared personnel can lead to tension and reduced productivity. Maintaining confidentiality can also be problematic; sharing a physical space requires careful consideration of data security and the potential for unintentional disclosure of sensitive information. Different business cultures and operational styles can also create friction; businesses with varying levels of formality or communication preferences may struggle to find a common ground. Finally, the lack of dedicated space can impact employee focus and productivity, leading to a decrease in overall efficiency.

Strategies for Efficiently Managing Shared Resources

Effective resource management is key to maximizing the benefits of sharing. Clear agreements, specifying resource allocation, usage rights, and responsibilities, are fundamental. These agreements should be legally sound and cover all aspects of shared resources, including dispute resolution mechanisms. Establishing a transparent and easily accessible system for tracking resource usage is also critical; this could involve a shared calendar, booking system, or online platform. Regular communication and collaboration between businesses are vital for addressing any emerging issues promptly and maintaining a positive working relationship. Finally, implementing a system for regular review and adjustment of resource allocation ensures the system remains effective and responsive to changing needs.

Establishing a System for Tracking Shared Resource Usage

A robust system for tracking shared resource usage is crucial for preventing conflicts and ensuring fairness. The first step is to identify all shared resources; this includes office equipment, meeting rooms, utilities, and shared personnel. Next, a method for booking or reserving resources must be established; this could involve a shared calendar, online booking system, or a simple sign-up sheet. Third, a system for recording resource usage should be implemented; this could be a spreadsheet, database, or dedicated software. Fourth, a process for resolving disputes or addressing misuse of resources must be defined. Finally, regular reviews of the tracking system and usage data should be conducted to ensure its effectiveness and identify areas for improvement.

Workflow for Managing Shared Resources

[A flowchart would be inserted here. It would visually represent the process, starting with resource identification, proceeding through booking/reservation, usage tracking, dispute resolution, and ending with regular review. The flowchart would use standard flowchart symbols (rectangles for processes, diamonds for decisions, etc.) to depict the workflow clearly.] For example, the flowchart would show a path from “Resource Booking Request” to a “Resource Availability Check,” then to “Booking Confirmation/Rejection,” followed by “Resource Usage,” “Usage Recording,” and finally “Regular Review and Adjustment.” Alternative paths would represent dispute resolution.

Illustrative Examples

Sharing a single business address can yield significant advantages or drawbacks depending on the specific circumstances. The nature of the businesses, their relationship, and their target markets all play crucial roles in determining the overall success or failure of such an arrangement. Understanding these nuances is vital before implementing a shared address strategy.

Beneficial Scenario: Shared Office Space for Complementary Businesses

Imagine two startups, “EcoChic,” a sustainable fashion brand, and “GreenGoods,” a retailer of eco-friendly home goods. Both businesses target environmentally conscious consumers and benefit from a similar brand aesthetic. Sharing a small, stylish office space allows them to reduce individual overhead costs significantly. They might even collaborate on marketing initiatives, leveraging their combined customer base for cross-promotional opportunities. For instance, EcoChic could offer a discount to GreenGoods customers, and vice-versa, boosting sales for both. This shared space fosters a collaborative environment, potentially leading to innovation and the development of new product lines or services. The long-term impact could involve increased brand recognition, enhanced customer loyalty, and greater financial stability for both businesses, allowing them to invest more in growth and expansion. The potential challenges could include disagreements over office space usage or differing business hours, but with clear communication and a well-defined agreement, these issues can be mitigated.

Detrimental Scenario: Conflicting Brands Sharing an Address

Consider a scenario where “PowerTech,” a high-end technology firm, shares an address with “BudgetFix,” a low-cost appliance repair service. These businesses have drastically different brand images and target audiences. Customers expecting the sleek professionalism of PowerTech might be negatively impacted by the perception of BudgetFix’s more informal, budget-oriented approach. The shared address could dilute PowerTech’s brand image, leading to reduced customer trust and potentially impacting its premium pricing strategy. Similarly, BudgetFix’s customers might perceive a lack of professionalism, associating them with the perceived higher-end nature of PowerTech. This misalignment can create confusion and harm the reputation of both brands. The long-term impact could involve a loss of customers, damage to brand reputation, and decreased profitability. Despite potential cost savings from shared rent, the negative branding consequences far outweigh the benefits in this instance. Challenges could include logistical issues arising from conflicting business operations and the need for strict separation of customer interactions and branding elements to avoid negative associations.