A strategy of diversifying into unrelated businesses presents a compelling, yet risky, path to growth. This approach, where companies venture beyond their core competencies into entirely new sectors, offers the potential for significant rewards but also carries substantial challenges. Understanding the motivations, implementation hurdles, and long-term implications is crucial for businesses considering this bold strategic move. This exploration will delve into the intricacies of unrelated diversification, examining successful and failed case studies to provide a comprehensive understanding of its potential and pitfalls.

We will dissect the core reasons behind this strategic choice, analyzing the role of risk mitigation, synergy creation, and the stark contrast with related diversification strategies. Furthermore, we’ll navigate the complexities of due diligence, resource allocation, and the potential for management conflicts and cultural clashes. The financial aspects, including ROI modeling and risk assessment, will be examined, alongside a deep dive into long-term sustainability and performance metrics. Through illustrative examples and a robust FAQ section, this guide aims to equip businesses with the knowledge necessary to make informed decisions about venturing into the uncharted waters of unrelated diversification.

Defining Unrelated Diversification

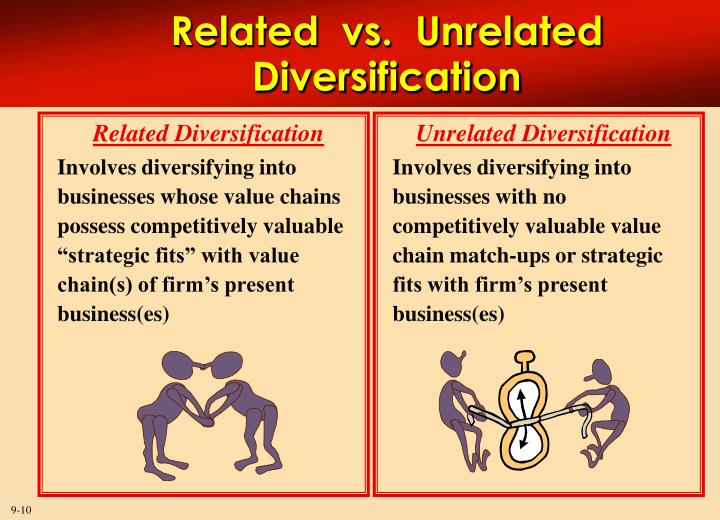

Unrelated diversification, also known as conglomerate diversification, is a corporate strategy where a company expands its operations into industries that are significantly different from its core business. This contrasts with related diversification, where the new ventures share synergies with the existing ones. The key characteristic of unrelated diversification is the lack of any obvious connection between the different businesses under the same corporate umbrella. This strategy aims to reduce risk by spreading investments across multiple, unrelated markets and potentially leverage existing resources in unexpected ways.

Unrelated diversification is driven by a desire to reduce risk, increase profitability, and achieve faster growth. The rationale is that if one market segment performs poorly, the others might offset those losses. However, this strategy is often more complex to manage effectively and requires a high level of expertise across diverse sectors. Successful implementation necessitates a strong corporate management team capable of overseeing disparate operations and allocating resources strategically.

Examples of Successful Unrelated Diversification

Successful unrelated diversification requires careful planning and execution. A classic example is Berkshire Hathaway, under Warren Buffett’s leadership. Starting as a textile company, Berkshire Hathaway expanded into insurance, railroads, energy, and numerous other industries, achieving remarkable success through astute acquisitions and long-term value investing. The company’s success demonstrates the potential for unrelated diversification when guided by a skilled and disciplined management team. Another example is General Electric (GE), which historically operated in a wide range of sectors, from lighting and appliances to finance and aerospace. While GE has faced challenges in recent years, its past success demonstrates the potential of unrelated diversification when properly managed. However, it is important to note that GE’s recent struggles also highlight the risks involved.

Examples of Unsuccessful Unrelated Diversification

Many companies have attempted unrelated diversification with less favorable results. Conglomerates of the 1960s and 70s, built on rapid acquisitions across diverse sectors, often struggled to manage their disparate businesses effectively. Lack of synergy between divisions, management inefficiencies, and difficulties in allocating capital appropriately led to poor performance and eventual restructuring or divestiture of some business units. For example, some large conglomerates from that era experienced significant difficulties integrating acquired companies and realizing the expected synergies, leading to lower overall profitability and shareholder value. The failure often stemmed from a lack of industry expertise and a failure to understand the specific needs of each business unit.

Potential Benefits of Unrelated Diversification

The potential benefits of unrelated diversification include reduced risk through portfolio diversification, access to new markets and revenue streams, and potential for synergistic opportunities, even if indirect. For example, a company with strong financial resources in one sector might leverage this strength to fund acquisitions in unrelated sectors with high growth potential. This strategy can also provide a buffer against economic downturns in specific industries. A diversified conglomerate might be better positioned to weather economic storms than a company concentrated in a single sector.

Potential Drawbacks of Unrelated Diversification

The drawbacks of unrelated diversification are significant. Management complexities increase dramatically as the company attempts to oversee diverse businesses with different needs and strategies. This can lead to inefficiencies, coordination problems, and difficulties in allocating resources effectively. Furthermore, a lack of synergy between divisions can prevent the realization of economies of scale or other cost-saving measures commonly found in related diversification. The lack of industry-specific expertise can also hinder effective management of individual business units, leading to underperformance. Finally, unrelated diversification can lead to a dilution of management focus, resulting in suboptimal performance across all business units.

Motivations for Unrelated Diversification

Companies often pursue unrelated diversification, a strategy involving expansion into industries with little to no connection to their core business, for a variety of compelling reasons. These motivations often revolve around mitigating risk, leveraging existing resources in novel ways, and capitalizing on market opportunities. Understanding these driving forces is crucial for assessing the viability and potential success of such a strategy.

Unrelated diversification is driven by a complex interplay of factors, each contributing to a company’s decision to venture beyond its established market. These motivations can be broadly categorized into risk reduction, resource utilization, and market opportunity exploitation. While seemingly disparate, these elements often intertwine to shape the strategic direction of the firm.

Risk Reduction Through Diversification

A primary motivation behind unrelated diversification is risk mitigation. By investing in diverse industries, companies can reduce their dependence on a single market. A downturn in one sector might be offset by growth in another, leading to greater overall stability. This is particularly attractive to companies operating in volatile or cyclical industries. For example, a company heavily reliant on the construction industry might diversify into the consumer goods sector to cushion the impact of economic downturns that disproportionately affect construction. The inherent instability of one sector is balanced by the potentially steadier performance of the other. This approach aims to reduce the overall business risk profile and enhance long-term survival.

Synergy Creation in Unrelated Businesses

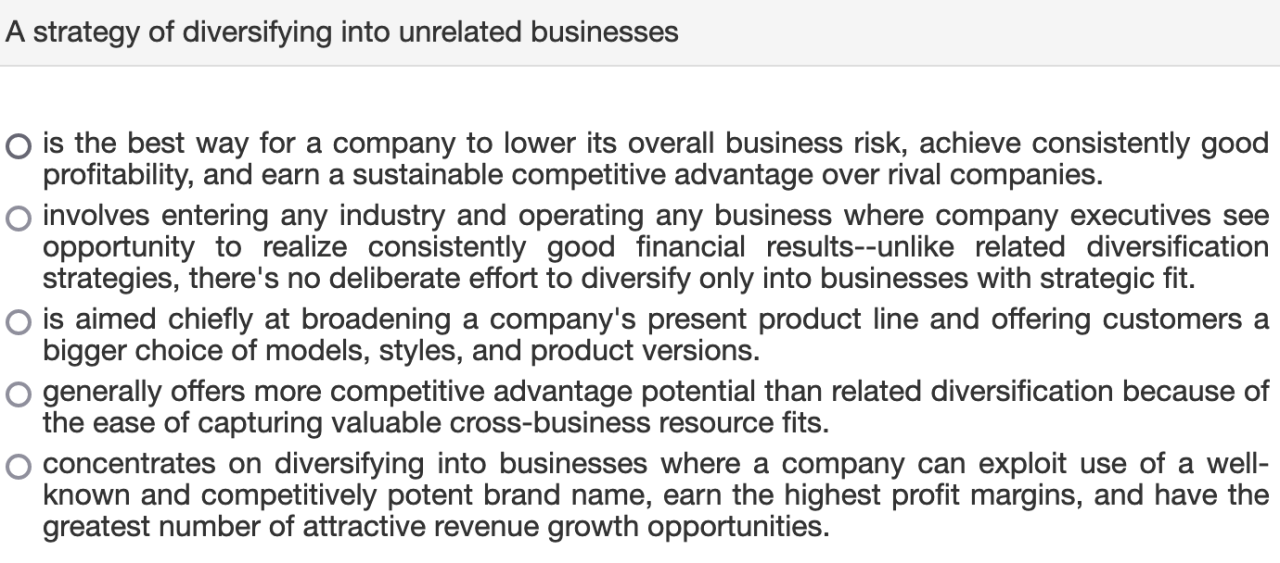

While counterintuitive, unrelated diversification can, in certain circumstances, create synergy. This synergy is often less operational and more financial or managerial. For instance, a large conglomerate might leverage its strong financial resources and established management expertise to improve the performance of acquired businesses in unrelated sectors. This “parenting advantage” can manifest in improved financial management, efficient resource allocation, and the application of best practices across diverse units. A well-known example is Berkshire Hathaway, which holds a diverse portfolio of companies ranging from insurance to railroads, demonstrating the potential for financial synergy across unrelated businesses. The conglomerate’s strong financial standing allows it to provide capital and strategic guidance to its diverse subsidiaries, fostering growth across the board.

Comparison of Unrelated and Related Diversification

Unrelated diversification contrasts sharply with related diversification, where companies expand into industries with synergies or shared resources. Related diversification leverages existing competencies, technologies, or distribution channels to enter new markets. For example, a beverage company might expand into the food industry, leveraging its existing distribution network and brand recognition. In contrast, unrelated diversification involves venturing into entirely new areas with minimal shared resources. The key difference lies in the presence or absence of readily transferable resources and capabilities between the core business and the new ventures. While related diversification emphasizes operational synergies, unrelated diversification focuses more on financial synergies and risk reduction. The choice between these strategies depends heavily on the company’s specific goals, resources, and risk tolerance.

Implementation Challenges of Unrelated Diversification

Unrelated diversification, while potentially lucrative, presents significant hurdles for even the most seasoned businesses. Successfully navigating these challenges requires meticulous planning, robust due diligence, and a deep understanding of the inherent risks involved. Failure to adequately address these issues can lead to substantial financial losses and reputational damage.

Major Challenges in Implementing Unrelated Diversification

Implementing unrelated diversification strategies introduces a unique set of complexities not encountered in related diversification. These challenges stem from the lack of synergies between the existing business and the new venture, demanding a different skill set and approach to management. Key challenges include a lack of managerial expertise in the new sector, difficulties in integrating disparate corporate cultures, and the increased financial risk associated with entering unfamiliar markets. Overcoming these obstacles requires a proactive and strategic approach, starting with a thorough assessment of the target industry and a realistic appraisal of the company’s capabilities.

Due Diligence and Acquisition Process in Unrelated Sectors

A robust due diligence and acquisition process is crucial for successful unrelated diversification. This process should go beyond simple financial analysis and delve into the operational, managerial, and cultural aspects of the target company. The process should be structured in several phases. First, a thorough market analysis of the target sector is needed, identifying key players, market trends, and potential risks. Second, a detailed assessment of the target company’s financial health, operational efficiency, and management team is crucial. Third, a cultural audit should be conducted to identify potential compatibility issues with the acquiring company. Finally, a comprehensive integration plan needs to be developed, outlining the steps required to smoothly integrate the new business into the existing corporate structure. Failure to properly execute this plan can result in operational inefficiencies, employee attrition, and ultimately, a failed acquisition.

Management Skills Needed for Various Unrelated Business Types

The skills required to manage different business types vary significantly. A company experienced in manufacturing may lack the expertise to effectively manage a technology startup, for instance. This highlights the need for either acquiring companies with strong management teams or investing heavily in training and development.

| Business Type | Required Management Skills | Existing Company Strengths (Example) | Required Skill Gaps (Example) |

|---|---|---|---|

| Manufacturing | Supply chain management, production optimization, quality control | Strong operational efficiency, established supply chains | Marketing and sales in new sectors, digital transformation |

| Technology Startup | Innovation management, agile development, fundraising | Financial resources, established brand recognition | Understanding of rapid technological changes, managing a highly dynamic environment |

| Retail | Customer service, inventory management, sales forecasting | Strong distribution network, established customer base | E-commerce expertise, data analytics for customer behavior |

| Healthcare | Regulatory compliance, patient care, medical expertise | Strong financial resources, established brand reputation | Deep understanding of healthcare regulations, managing complex medical procedures |

Potential for Management Conflicts and Cultural Clashes

Integrating businesses from unrelated sectors often leads to management conflicts and cultural clashes. Differing management styles, corporate cultures, and communication practices can create friction and hinder integration efforts. For example, a hierarchical, process-driven manufacturing company might clash with a flat, agile technology startup. This can manifest as disagreements over decision-making processes, resource allocation, and performance evaluation methods. To mitigate these risks, companies should invest in cross-cultural training programs, establish clear communication channels, and foster a culture of collaboration and mutual respect. Proactive conflict resolution mechanisms should also be in place to address disagreements promptly and effectively.

Financial Aspects of Unrelated Diversification

Unrelated diversification, while offering potential benefits in terms of risk mitigation and growth opportunities, presents significant financial implications that require careful consideration. Investing in unrelated businesses necessitates a thorough understanding of the associated costs, potential returns, and the overall impact on a company’s financial health. This section explores the key financial aspects of this strategy, providing a framework for evaluating its viability.

Investing in unrelated businesses requires substantial capital outlay, often involving significant upfront costs for acquisitions, new ventures, or infrastructure development. Furthermore, integrating disparate operations can incur considerable expenses related to management, restructuring, and potential redundancies. The initial investment may tie up significant portions of a company’s resources, potentially limiting its ability to invest in core businesses or respond to unexpected market changes. Conversely, successful unrelated diversification can generate substantial returns through access to new markets, synergies, and economies of scale, but these benefits are not guaranteed and require effective management.

Return on Investment Models for Unrelated Diversification

Analyzing the potential return on investment (ROI) for unrelated diversification requires a multifaceted approach. A simplified model could compare the projected net present value (NPV) of the diversified portfolio against the NPV of the company’s existing operations. This model would factor in projected cash flows, discount rates reflecting the risk associated with each business unit, and the time horizon for the investment. For example, consider a company currently focused on manufacturing with an annual NPV of $10 million. If they diversify into technology with a projected NPV of $5 million annually and the acquisition cost is $20 million, a simple calculation would be necessary to determine the long-term financial viability of the diversification. A more sophisticated model would account for potential synergies and risk mitigation effects. Furthermore, scenario planning, considering optimistic, pessimistic, and most likely outcomes, is crucial for realistic ROI projections.

Financial Metrics for Assessing Success

Several financial metrics can be used to assess the success of unrelated diversification. Key performance indicators (KPIs) should be tailored to the specific businesses acquired or created. Profitability metrics, such as return on assets (ROA) and return on equity (ROE), provide insights into the overall profitability of the diversified portfolio. Cash flow analysis is crucial, examining both operating cash flow and free cash flow to assess the ability of the diversified entity to generate sufficient funds for reinvestment and debt servicing. Furthermore, market capitalization and shareholder value provide a broader view of the market’s perception of the diversification strategy’s success. A comparison of these metrics pre- and post-diversification offers valuable insights into the impact of the strategy. For instance, a significant increase in ROA across the diversified portfolio compared to the pre-diversification ROA for the core business would indicate a successful integration and value creation.

Impact on Financial Risk Profile

Unrelated diversification can significantly alter a company’s financial risk profile. While it may reduce overall business risk by mitigating the impact of sector-specific downturns, it can also increase financial risk due to increased complexity and the need to manage diverse businesses with varying operational characteristics. Financial leverage, or the proportion of debt financing, will likely increase during the initial phase of diversification. This necessitates careful management of debt levels and interest rate risk. Furthermore, the increased complexity of operations can lead to higher management costs and potentially greater information asymmetry, making it harder to accurately assess and manage the overall financial performance of the diversified entity. A comprehensive risk assessment, incorporating quantitative and qualitative factors, is crucial for managing the financial risks associated with unrelated diversification. For example, a company highly leveraged before diversification might find its financial risk profile exacerbated by the acquisition of an unrelated business with high operating costs and volatile cash flows.

Strategic Fit and Resource Allocation

Unrelated diversification, while offering potential benefits like risk reduction and market expansion, presents significant challenges in strategic fit and resource allocation. Successfully navigating these challenges requires a meticulous approach that considers both the individual strengths of each business unit and the synergistic potential (or lack thereof) across the entire portfolio. Effective resource allocation is crucial for maximizing returns and minimizing the risks inherent in this complex strategy.

Effective resource allocation across unrelated business units demands a clear understanding of each unit’s unique needs and strategic priorities. Ignoring strategic fit can lead to misallocation of resources, hindering the performance of individual units and the overall corporate strategy. A successful strategy necessitates a rigorous assessment of the potential synergies, if any, between seemingly disparate businesses.

Assessing Strategic Fit in Unrelated Diversification

Assessing strategic fit in unrelated diversification involves a thorough examination of whether the acquisition or creation of a new business aligns with the overall corporate goals and capabilities. This goes beyond simply evaluating financial performance; it necessitates a deep dive into the target’s management team, operational efficiency, and cultural compatibility. For example, a technology company diversifying into the food industry must consider the vastly different operational requirements, supply chains, and customer expectations. A successful assessment will highlight potential areas of conflict and identify opportunities for leveraging existing resources or expertise across the different business units, even if those opportunities are limited in unrelated diversification.

Resource Allocation Strategies for Unrelated Businesses

Effective resource allocation in unrelated diversification often involves a portfolio approach. This entails allocating capital and other resources based on a business unit’s potential for growth and return on investment (ROI), independent of its relationship to other units. A company might adopt a “star” strategy, focusing resources on high-growth, high-market-share businesses, while divesting or minimally supporting “dogs” (low-growth, low-market-share businesses). Another approach is a balanced portfolio, maintaining a mix of businesses across various growth stages and risk profiles to mitigate overall risk. This necessitates a robust system for performance measurement and regular portfolio reviews to adjust resource allocation as needed. For instance, a conglomerate with businesses in finance, manufacturing, and retail might allocate a larger share of resources to the finance unit during periods of high economic growth, shifting resources to the retail unit during economic downturns.

Evaluating Value Creation in Unrelated Acquisitions

Evaluating the potential for value creation in unrelated acquisitions requires a comprehensive due diligence process that extends beyond traditional financial metrics. This involves assessing the target company’s intangible assets, such as brand reputation, intellectual property, and management expertise. Furthermore, a thorough market analysis is crucial to understand the competitive landscape and the target’s potential for growth within its industry. Value creation can also stem from operational synergies, although these are less common in unrelated diversification. For example, a company might acquire a smaller firm with superior distribution channels, leveraging those channels to boost sales of its existing product lines, even if the products themselves are completely different. A key metric is the acquisition premium—the difference between the purchase price and the target’s intrinsic value. A high acquisition premium suggests a potential overvaluation and a reduced likelihood of value creation.

Corporate Governance in Managing a Diversified Portfolio

Effective corporate governance plays a vital role in managing a diversified portfolio of unrelated businesses. A clear organizational structure, with well-defined responsibilities and reporting lines, is essential for ensuring accountability and efficient decision-making. A strong board of directors, with diverse expertise and experience, can provide valuable oversight and strategic guidance. Furthermore, robust internal controls and risk management systems are necessary to mitigate the increased complexity and risk associated with unrelated diversification. Independent audits and regular performance reviews can help ensure transparency and accountability across all business units. This is particularly crucial given the potential for conflicts of interest that can arise when managing a portfolio of diverse and independent businesses. A well-defined corporate governance framework helps to minimize such conflicts and maintain a cohesive strategy across the entire organization.

Long-Term Sustainability and Performance

Unrelated diversification, while offering potential benefits like risk reduction and growth opportunities, presents significant challenges to long-term sustainability. The success of this strategy hinges on effective management, resource allocation, and a clear understanding of the inherent risks. A comparison with firms focusing on core competencies reveals crucial differences in performance trajectories and long-term viability.

The long-term sustainability of unrelated diversification strategies is contingent upon several factors. Successful implementation requires a robust corporate governance structure, capable management teams with expertise across diverse sectors, and a well-defined process for evaluating and integrating acquisitions. Furthermore, a flexible and adaptable organizational structure is essential to navigate the complexities of managing multiple, unrelated businesses. A lack of synergy between divisions can lead to inefficiencies and ultimately hinder long-term performance. Conversely, focusing on core competencies often results in greater operational efficiency and deeper market penetration, potentially leading to more consistent and predictable returns.

Performance Comparison: Unrelated Diversification vs. Core Competency Focus

Studies comparing the performance of companies employing unrelated diversification with those focusing on core competencies have yielded mixed results. Some research suggests that unrelated diversification can lead to lower profitability and shareholder returns compared to focused strategies. This is often attributed to the increased complexity of management, difficulties in resource allocation, and a lack of operational synergy between disparate businesses. However, other studies have found that successful unrelated diversification can lead to superior performance, particularly when executed strategically and with careful consideration of market dynamics and resource capabilities. The key differentiator often lies in the effectiveness of the firm’s management in integrating and coordinating its diverse operations. For example, a conglomerate with strong central management and a proven track record of successful acquisitions might outperform a company solely focused on its core business, especially in periods of economic uncertainty or industry disruption.

Case Study: Berkshire Hathaway

Berkshire Hathaway, under the leadership of Warren Buffett, stands as a prominent example of successful long-term unrelated diversification. While initially focused on textiles, Berkshire Hathaway strategically expanded into insurance, railroads, energy, and numerous other industries. Buffett’s disciplined approach to investment, a focus on acquiring undervalued assets, and a long-term perspective have allowed the company to achieve remarkable financial success. The company’s decentralized management structure, which allows subsidiaries to operate independently while benefiting from Berkshire’s financial strength and resources, has been a key factor in its sustained growth. This success, however, is not replicable by all companies attempting unrelated diversification, highlighting the importance of exceptional management and a strategic, value-driven approach.

Risks Associated with Long-Term Unrelated Diversification and Mitigation Strategies

The long-term pursuit of unrelated diversification carries several inherent risks. Careful planning and proactive risk mitigation are crucial for long-term success.

The following points highlight potential risks and their corresponding mitigation strategies:

- Risk: Managerial Overextension: Difficulty in effectively managing diverse businesses leading to inefficiencies and poor performance. Mitigation: Develop strong centralized management systems with clear reporting structures and performance metrics. Invest in training and development programs to enhance managerial capabilities across diverse sectors.

- Risk: Lack of Synergies: Absence of cross-business synergies leading to duplicated efforts and reduced efficiency. Mitigation: Carefully evaluate potential acquisitions for strategic fit and potential for synergy creation. Implement cross-functional teams to foster collaboration and knowledge sharing between divisions.

- Risk: Financial Strain: High capital expenditure requirements and potential for financial distress due to poor performance in one or more divisions. Mitigation: Diversify funding sources and maintain a strong financial position. Implement robust financial controls and risk management systems.

- Risk: Integration Challenges: Difficulties in integrating acquired businesses into the existing corporate structure, leading to culture clashes and operational disruptions. Mitigation: Develop clear integration plans with defined timelines and responsibilities. Prioritize cultural compatibility during acquisition evaluations. Implement comprehensive communication strategies to ensure smooth transitions.

- Risk: Loss of Focus: Spreading resources too thinly across diverse businesses, hindering the development of core competencies and competitive advantage. Mitigation: Prioritize investments in high-potential businesses. Regularly review portfolio performance and divest underperforming assets.

Illustrative Examples of Unrelated Diversification Strategies: A Strategy Of Diversifying Into Unrelated Businesses

Unrelated diversification, while often risky, can yield significant rewards if executed strategically. The success hinges on careful assessment of market opportunities, efficient resource allocation, and a robust management structure capable of overseeing disparate business units. Examining real-world examples reveals both the potential triumphs and pitfalls of this complex strategy.

Virgin Group’s Diversification

Virgin Group, founded by Richard Branson, exemplifies a successful, albeit somewhat chaotic, approach to unrelated diversification. Starting with a mail-order record business, Virgin expanded into airlines, mobile phones, trains, space travel, and even soft drinks. Their strategy relied heavily on the “Virgin” brand, leveraging its association with innovation and rebellion to attract customers across diverse sectors.

The strategic reasoning behind Virgin’s diversification centered on brand recognition and the ability to tap into various market segments. Implementation involved acquiring existing businesses, launching new ventures, and strategically licensing the Virgin brand. While the diverse portfolio presented significant management challenges, Virgin’s successes in several sectors, particularly airlines and mobile, outweigh its failures. However, some ventures, like Virgin Cola, proved less successful, highlighting the risks associated with this strategy.

Berkshire Hathaway’s Conglomerate Structure

Berkshire Hathaway, under Warren Buffett’s leadership, showcases a different approach to unrelated diversification. Instead of focusing on a single brand, Berkshire Hathaway operates as a conglomerate, owning a diverse portfolio of companies spanning insurance, railroads, energy, and consumer goods. Their strategy is based on identifying undervalued companies with strong management and long-term growth potential.

Berkshire Hathaway’s strategic reasoning emphasizes value investing and long-term growth. Implementation involves strategic acquisitions and significant financial investment in well-established businesses. Their success stems from a disciplined investment approach, coupled with a decentralized management structure that allows subsidiary companies to operate autonomously. While the conglomerate structure adds complexity, Berkshire Hathaway’s track record demonstrates the potential for significant returns through carefully selected acquisitions and long-term holding. Failures are rare, largely due to their rigorous due diligence process.

General Electric’s Diversification and Subsequent Restructuring, A strategy of diversifying into unrelated businesses

General Electric (GE), once a symbol of diversified success, provides a cautionary tale. GE’s unrelated diversification spanned finance, energy, healthcare, and media. However, this strategy ultimately led to significant financial difficulties and a major restructuring.

GE’s initial strategic reasoning was based on leveraging synergies across diverse sectors and reducing cyclical risk. Implementation involved extensive acquisitions and internal development across various industries. However, the complexity of managing such a diverse portfolio, coupled with poor risk management in the financial sector, resulted in significant losses. The subsequent restructuring involved divesting many non-core businesses, highlighting the risks associated with poorly managed unrelated diversification. This example underscores the importance of strategic fit, competent management, and robust risk assessment in implementing a successful unrelated diversification strategy.

| Company | Strategy | Successes | Failures |

|---|---|---|---|

| Virgin Group | Brand-led diversification | Success in airlines, mobile; strong brand recognition | Failures in some ventures (e.g., Virgin Cola); management complexity |

| Berkshire Hathaway | Value investing and acquisitions | Strong financial performance; long-term growth | Relatively few failures due to rigorous due diligence |

| General Electric | Broad diversification across sectors | Initial success in various sectors | Financial difficulties; required major restructuring; poor risk management |