How to cash business check – How to cash a business check? It’s a question many entrepreneurs and business owners face. Navigating the process smoothly requires understanding the various methods available, from traditional bank deposits to the convenience of mobile check deposit apps. Each option presents unique advantages and disadvantages regarding fees, processing times, and security risks. This guide unravels the complexities, providing a clear path to cashing your business check efficiently and securely, minimizing potential pitfalls along the way.

We’ll explore the crucial steps involved in verifying the legitimacy of a business check, outlining the essential identification and documentation requirements. From comparing the pros and cons of different cashing methods – including bank deposits, check cashing stores, and mobile apps – to detailing the procedures for each, this comprehensive guide ensures you’re well-equipped to handle your business finances with confidence.

Identifying Legitimate Business Checks

Cashing a business check can be a convenient way to receive payment, but it’s crucial to ensure the check is legitimate to avoid potential financial losses. Fraudulent checks are a significant problem, and understanding how to identify them is vital for protecting yourself. This section Artikels key features of authentic business checks and the risks associated with accepting fraudulent ones.

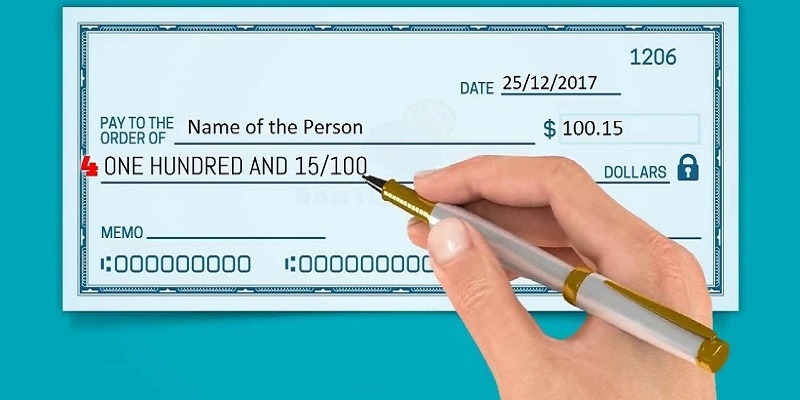

Identifying a legitimate business check involves examining several key features. A fraudulent check may lack one or more of these crucial elements, indicating a potentially risky transaction. Careful examination can significantly reduce the chance of becoming a victim of check fraud.

Key Features of Legitimate Business Checks

Legitimate business checks typically include several security features and specific information. These features help differentiate them from counterfeit checks and minimize the risk of fraud. Missing elements should raise immediate concerns.

- Bank Name and Address: The check should clearly display the issuing bank’s name and address. This information should be easily verifiable through online banking resources or by contacting the bank directly.

- Company Name and Address: The company issuing the check should be clearly identified with its name and address. This information should be consistent with the payer’s known business information.

- Check Number: Each check should have a unique check number sequentially numbered within the checkbook. Discrepancies in numbering might suggest a fraudulent check.

- Micr Line: The Magnetic Ink Character Recognition (MICR) line at the bottom of the check contains account information encoded in magnetic ink. This line is essential for automated check processing and its absence or alteration should be a red flag.

- Watermark or Security Thread: Some high-security business checks include watermarks or security threads that are visible when held up to the light. These are additional security features designed to prevent counterfeiting.

- Properly Printed Information: The information on the check should be clearly printed and not smudged or blurry. Poor printing quality can indicate a counterfeit check.

Risks Associated with Cashing Fraudulent Business Checks

Cashing a fraudulent business check carries significant financial and legal risks. These risks can extend beyond simply losing the money represented by the check.

The most immediate risk is financial loss. If the check bounces due to insufficient funds or is discovered to be fraudulent, you will likely be responsible for the amount of the check. Furthermore, you may incur fees from your bank for processing a returned check or for involvement in a fraudulent transaction. In some cases, you may even face legal repercussions, such as being charged with a crime related to knowingly cashing a fraudulent instrument. This can lead to fines and imprisonment depending on the circumstances and the jurisdiction. Your reputation may also suffer, affecting your future banking relationships and credit score.

Checklist for Verifying Business Checks

Before cashing any business check, a thorough verification process is essential. This checklist helps to mitigate the risk of accepting a fraudulent check.

- Verify the Issuer: Independently confirm the identity and legitimacy of the company issuing the check. Use online resources, directories, or contact the company directly to verify their address and business operations.

- Examine the Check Carefully: Inspect the check for all the key features mentioned above. Look for any signs of alteration, inconsistencies, or poor printing quality.

- Check the Bank Information: Contact the bank listed on the check to verify its legitimacy and confirm the account information. Don’t rely solely on the information printed on the check.

- Consider the Payment Method: If possible, opt for safer payment methods such as electronic transfers or wire transfers instead of relying on checks.

- Document the Transaction: Keep a detailed record of the transaction, including the check number, date, amount, and the issuer’s information. This documentation is crucial in case of disputes or fraudulent activity.

Methods for Cashing a Business Check

Cashing a business check can be straightforward, but understanding the various methods and their associated costs is crucial for maximizing efficiency and minimizing fees. The best approach depends on factors like the check amount, your banking relationship, and your urgency. This section details three common methods, comparing their advantages and disadvantages.

Business Check Cashing Methods Compared

Several options exist for cashing a business check, each with its own set of benefits and drawbacks. The primary methods include depositing the check into your bank account, using a mobile check deposit app, or cashing it at a check cashing store.

Bank Deposit

Depositing a business check directly into your bank account is generally the safest and most cost-effective method. Most banks offer this service either through a teller or an ATM equipped with check deposit functionality. This method typically avoids fees, unless the check is from an out-of-state bank or exceeds a certain limit, which can trigger additional processing fees.

Mobile Check Deposit, How to cash business check

Many banks and credit unions offer mobile check deposit through their banking apps. This convenient method allows you to deposit checks remotely using your smartphone. While generally free, some banks might impose limits on the number or value of checks you can deposit this way monthly. It’s also important to ensure the check is properly endorsed and photographed clearly.

Check Cashing Store

Check cashing stores provide a quick cashing service for various checks, including business checks. However, these services usually come with significant fees, often a percentage of the check’s value, plus a fixed fee. Processing times are generally fast, but this convenience comes at a considerable cost. It’s vital to choose a reputable establishment with transparent fee structures to avoid scams.

Comparison Table: Business Check Cashing Methods

| Method | Fees | Processing Time | Risks |

|---|---|---|---|

| Bank Deposit (In-Person or ATM) | Generally none; potential out-of-state or large check fees | 1-3 business days (deposit), immediate access to funds (if available) | Minimal risk if using a reputable bank; potential for delays with out-of-state checks. |

| Mobile Check Deposit | Generally none; potential limits on number or value of checks | 1-2 business days; potentially faster than in-person deposit | Risk of check rejection due to poor image quality or insufficient funds; potential for app-related technical issues. |

| Check Cashing Store | High percentage fee + fixed fee; varies significantly by location | Immediate cash | High risk of scams or predatory lending practices; potential for significantly higher fees than other methods. |

Requirements for Cashing a Business Check

Cashing a business check often involves more stringent requirements than cashing a personal check. This is due to the higher value transactions typically involved and the increased risk of fraud. Financial institutions need to verify both the identity of the presenter and the legitimacy of the business issuing the check to protect themselves and their customers.

Successfully cashing a business check hinges on providing the necessary identification and business documentation. Failure to do so will likely result in the check being refused. The specific requirements may vary slightly depending on the financial institution, but the following guidelines generally apply.

Identification Documents Required

Verifying your identity is paramount when cashing a business check. Financial institutions utilize various methods to confirm your identity, ensuring you are the rightful recipient of the funds. This process minimizes the risk of fraud and protects the institution’s financial interests. Typically, you’ll need to present a government-issued photo ID, such as a driver’s license or passport. These documents are essential for confirming your identity and matching it to the information provided on the check and any accompanying business documentation.

Business Documentation Requirements

Beyond personal identification, providing proof of your business’s legitimacy is crucial. This step helps financial institutions verify that the check originates from a genuine and authorized source. The specific documents required might include a copy of your business license, articles of incorporation, or your Employer Identification Number (EIN) from the IRS. The presenter might also need to provide documentation linking them to the business, such as a payroll statement or a letter from the business owner. These documents provide an audit trail, reducing the risk of fraudulent activities.

Consequences of Providing False Information

Submitting fraudulent information when cashing a business check can have serious repercussions. This includes, but is not limited to, rejection of the check, potential legal action, and a damaged credit history. Financial institutions have robust fraud detection systems, and providing false information can lead to investigations and potential prosecution under laws related to fraud and identity theft. The consequences can range from financial penalties to criminal charges depending on the severity of the offense. In short, honesty and accuracy are paramount when cashing any check, especially a business check.

Cashing a Business Check at a Bank

Cashing a business check at a bank offers a secure and reliable method for converting your business funds into readily accessible cash. This process is generally straightforward, but understanding the procedure and potential challenges can ensure a smooth transaction. This section Artikels the steps involved, highlights the advantages of a business account, and addresses potential issues you might encounter.

The process of cashing a business check at a bank typically involves presenting the check and your identification to a bank teller. The teller will verify the check’s legitimacy, confirm the funds are available, and then process the transaction, dispensing cash or crediting your account. However, specific requirements and procedures may vary slightly depending on the bank and the type of check.

Step-by-Step Procedure for Cashing a Business Check at a Bank

The steps for cashing a business check at a bank generally follow a standardized procedure. While individual banks may have minor variations, the core steps remain consistent.

- Present the Check and Identification: Begin by presenting the business check to the bank teller. Along with the check, you will need to provide valid photo identification, such as a driver’s license, passport, or state-issued ID. The identification must match the name on the check’s payee line.

- Verification and Endorsement: The teller will examine the check for any signs of alteration or fraud. They will also verify the signature on the check matches the signature card on file (if you have a business account) or the signature provided on the check itself. You may be required to endorse the check by signing the back.

- Funds Verification: The teller will verify that sufficient funds are available in the account from which the check was drawn. This step ensures the check is not fraudulent or returned due to insufficient funds (NSF).

- Transaction Processing: Once the check is verified, the teller will process the transaction. This might involve dispensing cash directly or crediting the funds to your personal or business account, depending on your preference and the bank’s policies.

- Receipt and Record Keeping: After the transaction is complete, the teller will provide you with a receipt confirming the cashing of the check. Maintain accurate records of all business check transactions for accounting and tax purposes.

Benefits of a Business Account for Cashing Checks

Having a business account offers several advantages when cashing business checks. These advantages extend beyond simply convenience and include enhanced security and better financial management.

- Simplified Transactions: Cashing checks directly into your business account streamlines your financial processes and eliminates the need for separate cash handling.

- Improved Record Keeping: All transactions are automatically recorded, simplifying bookkeeping and tax preparation. This eliminates the risk of losing track of cash transactions.

- Enhanced Security: Business accounts provide a secure method for managing funds, reducing the risk of loss or theft compared to carrying large sums of cash.

- Credit Building: Regularly depositing business checks into a business account helps build your business’s credit history, which can be crucial for obtaining loans or credit lines in the future.

Potential Issues When Cashing a Business Check at a Bank and Their Resolution

While generally straightforward, cashing a business check can sometimes present challenges. Understanding these potential issues and how to address them can prevent delays and frustrations.

- Insufficient Funds (NSF): If the account from which the check was drawn lacks sufficient funds, the check will bounce. In this case, contact the issuer of the check immediately to resolve the issue. You may need to wait for the funds to clear before attempting to cash the check again.

- Missing or Incorrect Information: Ensure the check is completed correctly and includes all necessary information, such as the date, payee’s name, amount, and the issuer’s signature. Inaccurate information can lead to delays or rejection of the check.

- Stale-Dated Checks: Checks that are significantly past their date are considered stale-dated and may be refused. Contact the issuer to request a new check.

- Identification Issues: Ensure your identification is valid and matches the information on the check. If there are discrepancies, you may need to provide additional identification or documentation.

Cashing a Business Check at a Check Cashing Store

Check cashing stores offer a convenient alternative to banks for cashing business checks, particularly for individuals or businesses without traditional bank accounts. However, it’s crucial to understand the associated costs and limitations before opting for this method. This section details the process, fees, and security considerations involved in cashing business checks at these establishments.

Cashing a business check at a check cashing store typically involves presenting the check, along with valid identification, to a store representative. The representative will verify the check’s legitimacy, confirm the payer’s information, and check the recipient’s identification against the check’s payee information. Once verification is complete, the store will deduct its fees and disburse the remaining amount in cash. The specific procedures may vary slightly depending on the individual store’s policies and the type of business check.

Fees and Limitations of Check Cashing Stores

Check cashing stores charge fees for their services, which are usually calculated as a percentage of the check’s value. These fees can be significantly higher than bank fees or even nonexistent fees associated with personal checking accounts. The percentage charged often depends on the check amount; larger checks might incur lower percentage fees, while smaller checks may have a fixed minimum fee. Additionally, there are often limitations on the types of checks accepted, with some stores refusing to cash checks from unfamiliar businesses or those exceeding a certain amount. Some stores may also require additional identification or proof of address for larger checks. For example, a store might charge a 3% fee on a $500 check, resulting in a $15 fee, while a $100 check might incur a fixed $5 fee, making it proportionally more expensive.

Security Measures at Banks vs. Check Cashing Stores

Banks generally employ more robust security measures when handling business checks compared to check cashing stores. Banks have sophisticated systems for fraud detection, verification processes, and secure storage of financial documents. They also have trained personnel who are experienced in identifying fraudulent checks and verifying the authenticity of signatures. Check cashing stores, while implementing some security measures, typically have less stringent procedures. They may rely more heavily on visual inspection and readily available databases for verification, potentially leaving them more vulnerable to fraudulent checks. The level of security varies widely among different check cashing stores, with some adhering to more stringent practices than others. The security of a check cashing store is often tied to the level of anti-fraud software and training that the company invests in.

Mobile Check Deposit

Mobile check deposit, a feature offered by many banking apps, provides a convenient way to deposit checks without visiting a physical branch. This method is particularly useful for business owners who need to deposit checks quickly and efficiently. However, it’s crucial to understand the limitations and potential issues before relying on this method for all your business check deposits.

Mobile check deposit streamlines the process of depositing checks, allowing for immediate credit to your account in most cases. The convenience factor is significant, saving time and travel costs compared to traditional in-person deposits. However, it’s important to be aware of the limitations inherent in the technology.

Mobile Check Deposit Process

The process typically involves opening your banking app, navigating to the deposit section, and selecting “Mobile Deposit” or a similar option. You’ll then be prompted to endorse the back of the check, usually with a notation like “For Mobile Deposit Only.” Next, you’ll need to take clear photos of both the front and back of the check, ensuring the entire check is visible and in focus. The app will guide you through the process, indicating where to position the check for optimal image capture. Finally, you’ll review the images and submit the deposit. A confirmation screen will usually appear once the deposit is successfully processed.

Limitations of Mobile Check Deposit for Business Checks

Several factors can affect the successful deposit of business checks using mobile banking apps. One common limitation is check size. Many apps have size restrictions, rejecting oversized or unusually shaped checks. The quality of the image is also critical. Poor lighting, blurry images, or images with glare can result in rejection. The app may also reject checks with damaged or faded ink, or those that are torn or creased. Furthermore, some banks may impose daily or monthly limits on the value of checks deposited via mobile. It’s crucial to check your bank’s specific terms and conditions regarding mobile check deposits to avoid potential delays or rejection of your deposits.

Step-by-Step Guide to Mobile Check Deposit

To illustrate the process, let’s walk through a hypothetical example. Assume you’re using the “EasyBank” mobile banking app.

1. App Launch and Navigation: The app’s home screen displays your account balance and quick access options. You tap on the “Deposit” button, usually located near the bottom of the screen. A screenshot of this would show the main screen with the “Deposit” button clearly highlighted.

2. Check Endorsement: The next screen displays instructions to endorse the back of the check with “For Mobile Deposit Only” and your company’s name. The screenshot would show these instructions, possibly with a visual representation of where to endorse the check.

3. Image Capture: The app then prompts you to take photos of the front and back of the check. A visual guide shows the correct positioning and orientation of the check. The screenshot would display the camera viewfinder with clear instructions and a frame overlay for proper check alignment.

4. Review and Submission: After capturing the images, the app displays a preview of both the front and back of the check. You can review for clarity and accuracy before submitting the deposit. The screenshot would show the preview images of the check’s front and back, along with a “Submit” button.

5. Confirmation: Once submitted, the app displays a confirmation screen showing the deposit amount and a transaction ID. This screen may also show an estimated time for the funds to be available in your account. The screenshot would display this confirmation message with the transaction details.

Risks and Security Precautions: How To Cash Business Check

Cashing a business check, while a common transaction, carries inherent risks. Understanding these risks and implementing appropriate security measures is crucial to protecting yourself from potential financial loss or identity theft. Failing to do so could result in significant consequences.

Potential risks primarily revolve around fraud and theft. Counterfeit checks, altered checks, and checks drawn on closed accounts are all possibilities. Furthermore, the physical handling of the check and the cash received exposes you to the risk of robbery or loss. Even seemingly legitimate checks can be part of larger fraudulent schemes.

Identifying Potentially Fraudulent Checks

Careful examination of a business check before cashing is paramount. Look for inconsistencies in printing, unusual watermarks, or discrepancies between the check number and the bank’s information. Verify the signature against known signatures of authorized signatories if possible. A poorly printed check, missing security features, or an unfamiliar bank are all red flags that warrant extra caution. Cross-referencing the check information with the business’s online presence can also help validate its authenticity. If any doubt exists, err on the side of caution and do not cash the check.

Mitigating Risks During Cashing

Several strategies can significantly reduce the risks associated with cashing business checks. Cashing checks during business hours at a reputable bank or financial institution is the safest option. Avoid cashing checks at locations with minimal security or in poorly lit areas. If using a check cashing store, choose one with a strong reputation and visible security measures. Always count the cash received immediately and in the presence of the cashier. Consider using a mobile check deposit app for added security, especially for larger amounts. Finally, keep records of all transactions, including copies of checks and receipts.

Security Flowchart

The following flowchart Artikels the steps to safely cash a business check:

[Begin] –> [Examine Check for Fraudulent Indicators (printing quality, signatures, etc.)] –> [Is the Check Suspicious? (Yes/No)] –> [Yes: Do Not Cash Check; Report Suspicions] –> [No: Verify Business Information (online presence, contact details)] –> [Is Business Information Valid? (Yes/No)] –> [Yes: Proceed to Cashing Location (Bank, reputable check cashing store)] –> [No: Do Not Cash Check] –> [Cash Check at Chosen Location] –> [Count Cash Immediately] –> [Record Transaction Details] –> [End]

This flowchart emphasizes a cautious, multi-step approach, prioritizing verification and security at each stage. The decision points highlight the importance of critical thinking and the need to reject potentially fraudulent checks. Following these steps helps minimize the risk of financial loss or identity theft.