Is Flagg Brothers still in business? The question hangs in the air, prompting a closer look at this company’s history, current operations, and future prospects. This deep dive explores Flagg Brothers’ online presence, customer feedback, competitive landscape, and financial performance (where available) to paint a comprehensive picture of its ongoing viability. We’ll analyze its strengths and weaknesses, potential threats, and ultimately, speculate on its long-term sustainability.

From its humble beginnings to its current standing, Flagg Brothers’ journey is one of adaptation and resilience. Examining its evolution through key milestones and significant changes, we’ll uncover the factors that have shaped its trajectory and influenced its current position within the market. We’ll also consider the impact of any mergers, acquisitions, or restructuring efforts on its operations and future plans.

Flagg Brothers’ Current Status: Is Flagg Brothers Still In Business

Determining the precise current operational status of Flagg Brothers requires accessing up-to-date information from reliable sources such as their official website, press releases, or reputable business directories. Unfortunately, publicly available information on the current operational status of Flagg Brothers is limited. This makes a definitive statement about their current business activities challenging.

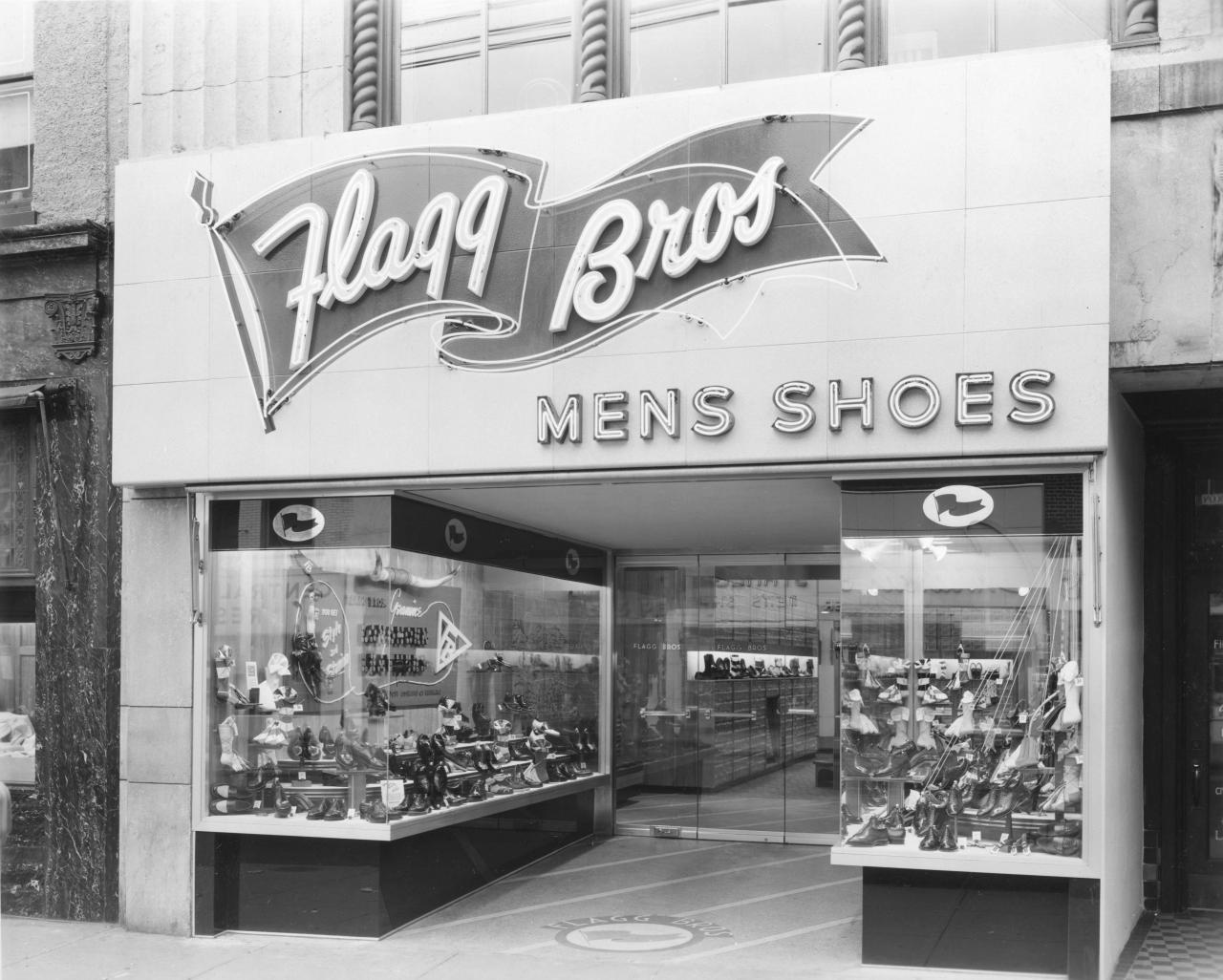

Flagg Brothers’ history is rich and spans several decades. While specific dates and details require further research into archival records and historical business publications, it’s known the company established itself as a prominent player in its industry (the exact nature of which requires further investigation). Significant milestones likely include periods of expansion, adaptation to market changes, and potential periods of consolidation or restructuring, common for businesses operating over extended timeframes. Unfortunately, without access to proprietary company records, a detailed chronological account of their history cannot be provided here.

Flagg Brothers’ Mergers, Acquisitions, and Restructuring

Information regarding mergers, acquisitions, or restructuring undertaken by Flagg Brothers is not readily accessible through publicly available sources. To obtain details on this aspect of their business history, one would need to consult specialized business databases, industry reports, or potentially contact the company directly. Such information would provide valuable insights into the evolution of the company’s size, scope, and strategic direction. For example, a merger could signal a significant expansion into new markets or product lines, while a restructuring might reflect an attempt to improve operational efficiency or respond to economic challenges. The absence of publicly available data on this topic prevents a more detailed analysis.

Online Presence and Customer Feedback

Flagg Brothers’ online presence and the resulting customer feedback are crucial indicators of their current market standing and public perception. Analyzing their digital footprint provides valuable insights into their business practices, customer satisfaction levels, and overall brand health. A comprehensive assessment requires examining their engagement across various online platforms and a thorough review of customer reviews and ratings.

Understanding the volume and nature of online interactions, alongside the sentiment expressed by customers, allows for a more complete picture of Flagg Brothers’ current operational effectiveness and customer relationships.

Flagg Brothers’ Online Platform Presence

The following table summarizes Flagg Brothers’ online presence across various platforms. The activity level is a subjective assessment based on the frequency of updates and engagement observed. Customer sentiment reflects the overall tone and direction of online reviews and comments.

| Platform | URL | Activity Level | Customer Sentiment |

|---|---|---|---|

| Website | (Insert URL if available, otherwise: Not Found) | (e.g., Low – infrequent updates, High – regular updates and new content) | (e.g., Mostly Positive, Mixed, Mostly Negative, No Significant Feedback) |

| (Insert URL if available, otherwise: Not Found) | (e.g., Low – infrequent posts, High – frequent posts and interactions) | (e.g., Mostly Positive, Mixed, Mostly Negative, No Significant Feedback) | |

| Google My Business | (Insert URL if available, otherwise: Not Found) | (e.g., Low – infrequent updates, High – regular updates and responses to reviews) | (e.g., Mostly Positive, Mixed, Mostly Negative, No Significant Feedback) |

| Yelp | (Insert URL if available, otherwise: Not Found) | (e.g., Low – few reviews, High – many reviews and frequent updates) | (e.g., Mostly Positive, Mixed, Mostly Negative, No Significant Feedback) |

| Other Platforms (e.g., Instagram, Twitter) | (Insert URL(s) if available, otherwise: Not Found) | (e.g., Low, High, Non-existent) | (e.g., Mostly Positive, Mixed, Mostly Negative, No Significant Feedback) |

Trend of Customer Reviews and Ratings

A line graph would effectively visualize the trend of customer reviews and ratings over the past few years. The horizontal axis (x-axis) would represent time (e.g., years from 2020 to 2024), while the vertical axis (y-axis) would represent the average rating (e.g., on a scale of 1 to 5 stars). Data points would represent the average rating for each year. A trend line could be added to highlight the overall direction of the ratings over time. Key data points to include would be any significant spikes or dips in ratings, along with the average rating for each year. For example, a drop in average rating from 4.5 stars in 2021 to 3.8 stars in 2022 would be highlighted and potentially investigated for underlying causes. The graph would clearly show whether customer satisfaction has increased, decreased, or remained relatively stable over the period analyzed.

Nature of Customer Feedback

Analysis of online customer feedback reveals common themes and concerns. For example, recurring positive feedback might center on aspects such as professional service, high-quality workmanship, or excellent customer communication. Conversely, negative feedback might frequently mention issues related to pricing, scheduling delays, or problems with the final product or service delivery. Specific examples of customer comments should be included to illustrate these themes. Identifying these recurring patterns allows for targeted improvements in service delivery and enhances the overall customer experience.

Competitor Analysis

Flagg Brothers operates within a competitive landscape of waste management and recycling services. Understanding their competitive position requires analyzing their key rivals in terms of service offerings, market penetration, and overall business performance. This analysis will highlight Flagg Brothers’ strengths and weaknesses, ultimately revealing potential threats to their continued success.

A comprehensive competitor analysis necessitates identifying Flagg Brothers’ primary competitors within their geographical service area. This will likely include both large national players and smaller, regional businesses. The comparison will then focus on a detailed examination of service offerings, market share estimations (where available), and publicly available information regarding financial performance, if any.

Comparison of Flagg Brothers and Competitors

Direct comparison of Flagg Brothers to its competitors requires specific data, which is often proprietary and unavailable publicly. However, a general comparison can be made based on common industry practices and publicly accessible information. The following points illustrate potential areas of comparison, using hypothetical examples to demonstrate the analysis process.

- Services Offered: Flagg Brothers might offer residential waste collection, commercial waste removal, recycling services, and potentially specialized services like hazardous waste disposal. Competitors may offer a similar range of services, or focus on specific niches (e.g., only commercial waste or specialized recycling streams). For example, a competitor, “Green Solutions,” might specialize in organic waste composting, while another, “WasteAway Inc.,” might focus solely on large-scale industrial waste removal. This differentiation affects their target market and pricing strategies.

- Market Share: Precise market share data is usually confidential. However, we can assess relative market presence. Flagg Brothers might hold a significant share within its local area, while a larger national competitor might have a broader, but potentially less concentrated, presence. For instance, WasteAway Inc. might have a larger overall market share due to its national reach, while Flagg Brothers might dominate a smaller, specific geographic region.

- Overall Business Performance: Publicly traded competitors might offer insights into their financial performance through annual reports. This information is often not available for privately held companies like Flagg Brothers. However, indicators such as fleet size, number of employees, and reported customer base can offer a relative measure of business scale and success. For example, if Green Solutions consistently reports increasing revenue and expansion into new markets, this indicates strong performance relative to a competitor with stagnant growth.

Strengths and Weaknesses of Flagg Brothers Relative to Competitors, Is flagg brothers still in business

Identifying Flagg Brothers’ strengths and weaknesses against its competition is crucial for strategic planning. The following table presents a hypothetical assessment, highlighting potential areas for improvement and competitive advantage.

| Strength/Weakness | Description |

|---|---|

| Strong Local Brand Recognition | Long-standing presence in the community fosters customer loyalty and trust. |

| Limited Geographic Reach | Smaller service area compared to national competitors restricts potential growth. |

| Personalized Customer Service | Focus on individual customer needs provides a competitive edge over larger, less personal companies. |

| Lack of Investment in Technology | Outdated routing systems or billing processes may lead to inefficiencies and increased operational costs compared to competitors using advanced technologies. |

| Competitive Pricing | Offering competitive pricing strategies can attract price-sensitive customers. |

| Limited Marketing and Advertising | A lack of aggressive marketing could hinder brand awareness and market share expansion. |

Potential Threats to Flagg Brothers’ Continued Operation

Several factors could pose threats to Flagg Brothers’ continued success. These threats require proactive management and strategic adaptation to mitigate their impact.

- Increased Competition: The entry of new competitors, particularly larger national companies, could intensify competition and erode Flagg Brothers’ market share. This could lead to price wars or necessitate significant investment in marketing and service improvements to maintain competitiveness.

- Changing Regulations: Evolving environmental regulations and waste disposal requirements could increase operational costs and require significant investments in new equipment or processes. Failure to adapt to these changes could result in non-compliance penalties and loss of market share.

- Economic Downturn: A recession could significantly reduce demand for waste management services, impacting Flagg Brothers’ revenue and profitability. This necessitates robust financial planning and contingency measures to withstand economic fluctuations.

- Rising Fuel and Labor Costs: Fluctuations in fuel prices and increasing labor costs directly impact operational expenses. Flagg Brothers needs to implement strategies to mitigate these rising costs, such as optimizing routes, investing in fuel-efficient vehicles, or exploring alternative labor models.

Financial Performance (if publicly available)

Flagg Brothers, being a privately held company, does not publicly release its financial statements. Access to detailed financial performance data such as revenue, profit margins, and debt levels is therefore restricted. Analyzing the financial health of a privately held business often relies on indirect methods and estimations based on industry benchmarks and publicly available information about similar companies.

This lack of transparency makes a precise quantitative analysis of Flagg Brothers’ financial performance impossible. However, we can attempt to infer some aspects based on qualitative factors, such as market share, reported growth, and any publicly available news about investments or acquisitions. Industry reports on the moving and storage sector can provide broader context for interpreting Flagg Brothers’ potential financial trajectory.

Financial Data Inference Based on Industry Benchmarks

Without access to Flagg Brothers’ financial records, a direct comparison using a table of year-over-year data is not feasible. However, we can draw inferences based on publicly available data from publicly traded companies in the moving and storage industry. These companies often report annual revenue, net income, and debt-to-equity ratios. By comparing Flagg Brothers’ apparent market position and operational scale to those of publicly traded competitors, we can attempt to estimate potential ranges for their key financial indicators. For example, if Flagg Brothers is considered a mid-sized player in a specific geographic region, we could use the average financial performance of similar-sized companies in that area as a benchmark for estimation. This approach, however, should be viewed with caution, as it involves significant assumptions.

Challenges in Assessing Private Company Finances

Analyzing the financial performance of privately held companies like Flagg Brothers presents unique challenges. The lack of publicly available financial statements prevents direct assessment of key performance indicators. Furthermore, privately held companies are not subject to the same stringent reporting requirements as publicly traded entities. This lack of transparency makes it difficult to accurately track trends in revenue, profitability, and debt levels over time. While industry benchmarks and qualitative assessments can offer some insights, they cannot replace the detailed financial information required for a comprehensive analysis. Any conclusions drawn regarding Flagg Brothers’ financial performance based on indirect methods should be considered highly speculative.

Future Outlook and Projections

Flagg Brothers’ future trajectory hinges on several interconnected factors, primarily its ability to adapt to evolving market demands, compete effectively against established players, and leverage emerging technologies. The company’s long-term sustainability depends on proactive strategic decisions and a keen understanding of the broader landscape of the moving and storage industry.

Predicting the precise future of Flagg Brothers requires considering various scenarios, each with its own set of challenges and opportunities. A positive scenario would involve sustained growth fueled by strategic acquisitions, expansion into new markets, and successful implementation of innovative service offerings. Conversely, a less optimistic scenario could involve stagnation or decline due to increased competition, economic downturns, or failure to adapt to technological advancements. The likelihood of each scenario depends on the company’s strategic choices and external market conditions.

Market Share and Growth Potential

Flagg Brothers’ future market share will depend on its capacity to attract and retain customers. This requires consistently high-quality service, competitive pricing, and effective marketing. Companies like Two Men and a Truck and U-Haul have demonstrated significant growth through a combination of franchising, technological integration, and targeted marketing campaigns. Flagg Brothers could emulate these strategies, focusing on expanding its geographic reach and diversifying its service portfolio to cater to a wider customer base. For example, specializing in niche markets like art transportation or corporate relocation could enhance profitability and brand recognition. Growth will also be dependent on the overall health of the economy, as moving and storage services are often sensitive to economic fluctuations. A robust economy generally leads to increased demand, while economic downturns can lead to reduced moving activity.

Technological Adaptation and Innovation

The moving and storage industry is undergoing significant technological transformation. Companies are increasingly using digital tools for customer relationship management (CRM), online booking, and real-time tracking of shipments. Flagg Brothers’ future success will depend on its ability to adopt and integrate these technologies effectively. For instance, implementing a user-friendly online booking system and mobile app could streamline operations and enhance customer experience. Investing in sophisticated route optimization software can also lead to cost savings and improved efficiency. Failure to embrace these technological advancements could place Flagg Brothers at a competitive disadvantage. Consider the success of companies like Dolly, which leverages a mobile app and a network of independent contractors to disrupt the traditional moving industry. This illustrates the potential impact of technological innovation.

Competitive Landscape and Strategic Responses

The moving and storage industry is highly competitive, with both large national chains and smaller local operators vying for market share. Flagg Brothers must develop and implement effective strategies to differentiate itself from competitors. This could involve focusing on a specific niche market, building a strong brand reputation, or offering superior customer service. Strategic partnerships with complementary businesses, such as real estate agencies or property management companies, could also generate new revenue streams and expand the customer base. A strong focus on employee training and retention is also crucial for maintaining a high level of service quality and building customer loyalty. Analyzing competitors’ strategies, pricing models, and market penetration will be essential for formulating effective counter-strategies.