Do I need a business license for rental property? This crucial question impacts landlords across the nation, varying wildly depending on location, property type, and the number of units involved. Navigating the complex web of licensing requirements can be daunting, but understanding the nuances is vital for legal compliance and avoiding hefty fines. This guide breaks down the essential aspects of rental property licensing, offering clarity and guidance to help you make informed decisions.

From single-family homes to sprawling apartment complexes, the legal landscape surrounding rental properties is multifaceted. This guide explores the different types of business licenses you might need, the jurisdictional variations across states and cities, potential exemptions, and the significant legal and financial implications of non-compliance. We’ll provide a framework to help you determine your specific licensing needs and ensure you’re operating within the bounds of the law.

Defining “Rental Property”

The term “rental property” encompasses a broad range of real estate assets leased to tenants for compensation. Understanding the precise definition is crucial for determining licensing requirements, as regulations vary significantly depending on the property type, its location, and the number of units involved. This often depends on local, state, and sometimes even federal laws. Failure to comply with licensing regulations can result in significant fines and legal repercussions.

Different types of rental properties trigger different licensing requirements. A single-family home rented out by an individual owner might have different regulations compared to a large apartment complex managed by a property management company. The number of units, the type of lease agreement, and the services provided to tenants all play a role in determining licensing needs.

Types of Rental Properties and Licensing Requirements

The legal definition of “rental property” is not universally consistent. Jurisdictions often define it based on factors such as the number of units, the duration of the lease, and the nature of the tenant-landlord relationship. For example, some jurisdictions might specifically exclude short-term rentals (like those offered through Airbnb) from the definition of a “rental property” subject to traditional landlord-tenant laws and licensing requirements, while others might include them. Conversely, some jurisdictions might have different licensing requirements for properties rented for less than 30 days versus those rented for longer periods. The specific regulations often vary significantly.

| Property Type | Location | Licensing Requirement | Specific Regulations |

|---|---|---|---|

| Single-family home | Suburban area, California | May not require a license, depending on local ordinances; business license may be needed if operating as a business | Check local county and city regulations for business licenses and landlord registration requirements. |

| Duplex | Urban area, New York City | Likely requires a license; specific requirements vary by borough | Regulations may include requirements for fire safety, habitability standards, and registration with the city’s Department of Housing Preservation and Development (HPD). |

| Apartment complex (10+ units) | Chicago, Illinois | Requires a license; likely subject to more stringent regulations | Regulations will likely include requirements for building permits, fire safety inspections, regular maintenance, and compliance with the city’s landlord-tenant laws. |

| Short-term rental (Airbnb) | Miami, Florida | May require a license or permit, possibly subject to occupancy taxes and short-term rental regulations | Regulations may include restrictions on the number of days a property can be rented out per year, background checks for hosts, and the collection of tourist taxes. |

| Commercial property (office space) | Austin, Texas | Likely requires a business license, potentially additional licenses depending on the type of business operating within the space | Regulations may include compliance with zoning laws, building codes, and accessibility requirements. |

Jurisdictional Requirements

Licensing requirements for rental properties vary significantly depending on location. Understanding these differences is crucial for landlords to ensure legal compliance and avoid potential penalties. This section will explore how these requirements differ across various jurisdictions, providing guidance on identifying the relevant authorities and outlining potential consequences of non-compliance.

Locating the Relevant Licensing Authority

Determining the correct licensing authority requires a multi-step process. First, landlords should identify their specific city, county, and state. Next, they should check the websites of their city and county government, often under a section dedicated to business licenses, permits, or rental properties. State-level agencies may also have relevant information, particularly regarding broader landlord-tenant regulations. If the online search proves inconclusive, contacting the local city hall or county clerk’s office directly is recommended. They can provide definitive information regarding the necessary licenses and the application process.

Licensing Requirements in Three Jurisdictions

Licensing requirements differ substantially across states. The following examples illustrate this variability:

- California: California’s regulations are complex and vary significantly by city and county. Many cities require business licenses for rental properties, and some may have additional permits depending on the number of units or the type of property. Additionally, landlords must comply with extensive state-level regulations regarding tenant rights and safety standards, which are enforced by various state and local agencies. Specific requirements are often found on the websites of individual cities and counties. Failure to obtain necessary licenses can result in significant fines and potential legal action.

- Texas: Texas generally does not mandate state-level licenses specifically for rental properties. However, cities and counties may impose their own licensing or registration requirements. Landlords should check with their local authorities to determine if any local permits or licenses are needed. Furthermore, Texas has specific landlord-tenant laws that must be adhered to, regardless of licensing requirements. Non-compliance with these laws can lead to legal challenges from tenants.

- New York: New York City, in particular, has stringent regulations for rental properties. Landlords must obtain various licenses and permits, depending on the size and type of the property. This can include a business license, a multiple dwelling registration, and possibly other permits related to building codes and safety regulations. The New York State Department of State also oversees certain aspects of landlord-tenant relations. Violations of these regulations can result in substantial fines, legal action, and even property seizure.

Penalties for Operating Without Necessary Licenses

Operating a rental property without the required licenses can lead to serious consequences. These penalties can include:

- Fines: Significant financial penalties are common, often increasing with each violation or day of non-compliance. The amount of the fine can vary widely based on the jurisdiction and the severity of the offense.

- Legal Action: Lawsuits from tenants or legal action initiated by the relevant authorities are possible. This can lead to costly legal fees and potential judgments against the landlord.

- Property Seizure: In severe cases, particularly involving repeated violations or egregious disregard for regulations, authorities may seize the rental property.

- Business Closure: The rental operation may be forced to cease operations until all necessary licenses are obtained and outstanding violations are rectified.

Failure to obtain the proper licenses can expose landlords to significant financial and legal risks. Proactive compliance is crucial for mitigating these risks.

Types of Business Licenses

Securing the necessary licenses to operate a rental property can be complex, varying significantly based on location and the specific nature of your rental business. Understanding the different types of licenses and their associated requirements is crucial to ensuring legal compliance and avoiding potential penalties. This section details the common types of business licenses you might need, their application processes, and the information typically required.

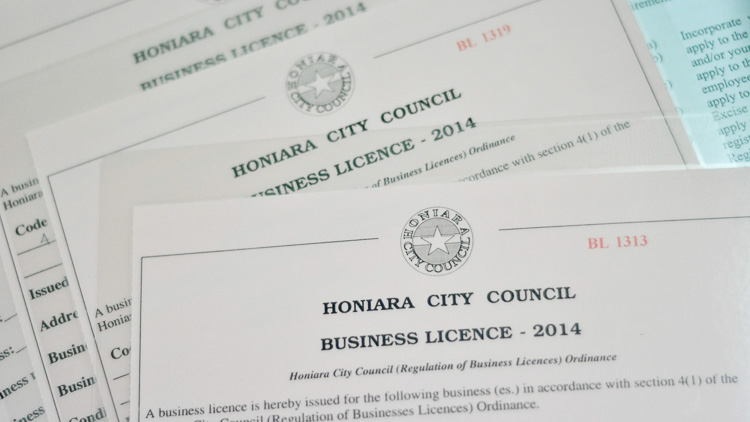

General Business License

A general business license is a fundamental requirement for many businesses, including rental property operations, in numerous jurisdictions. This license signifies that your business is registered with the local government and operates within legal parameters. The application process usually involves submitting a completed application form, providing proof of identity and business address, and potentially paying a fee. Required information typically includes the business name, owner’s information, business address, type of business (rental property management), and the number of rental units managed. The application process and specific requirements will vary based on the local municipality or county. For example, the City of Austin, Texas, might have different requirements than Los Angeles County, California.

Rental License or Permit, Do i need a business license for rental property

Many localities require a specific rental license or permit, separate from a general business license. This license often involves a more rigorous vetting process, ensuring the property meets specific safety and housing codes. Applications typically necessitate inspections of the property to verify compliance with building codes, fire safety regulations, and occupancy limits. The information required often includes details about the property’s address, number of units, the owner’s contact information, and proof of liability insurance. Some jurisdictions may also require background checks on the property owner or manager. For instance, a city might require proof of smoke detector installation and working carbon monoxide detectors in every unit.

Occupancy Permit

An occupancy permit confirms that a building or unit meets all applicable building codes and is safe for habitation. This is distinct from a rental license; a rental license might be required even if the property already possesses an occupancy permit. Obtaining an occupancy permit usually involves a thorough inspection by a building inspector to verify compliance with relevant regulations. Information required for the application may include building plans, electrical and plumbing permits, and proof of completion of any necessary renovations or repairs. The process typically culminates in the issuance of a certificate or permit allowing occupancy. Failure to obtain an occupancy permit can result in hefty fines and potential legal action.

Flowchart Illustrating License Acquisition

A flowchart would visually represent the steps involved in obtaining the necessary licenses. It would begin with determining the specific jurisdictional requirements (local, county, state). Next, it would branch into separate paths for obtaining a general business license, a rental license/permit, and an occupancy permit. Each path would depict the required steps, such as completing applications, providing documentation, undergoing inspections, and paying fees. Finally, the flowchart would converge, showing the successful acquisition of all necessary licenses, signaling readiness to legally operate the rental property. The flowchart would clearly show the sequential nature of the process and the potential for parallel or sequential acquisition of different licenses depending on the jurisdiction.

Exemptions and Exceptions

Obtaining a business license for rental properties is generally mandated, but certain circumstances allow for exemptions or exceptions. Understanding these nuances is crucial to ensure compliance with local regulations and avoid potential penalties. These exemptions are not universal and vary significantly depending on location, the type of rental property, and the number of units involved. Always consult your local government’s licensing authorities for definitive answers.

Exemptions often hinge on the scale and nature of the rental operation. The specific criteria for claiming an exemption are typically defined in local ordinances and statutes. These legal documents explicitly Artikel the conditions under which a landlord may be relieved of the business licensing requirement. Failure to meet these criteria can result in fines or other legal consequences.

Criteria for Exemptions from Licensing Requirements

Determining eligibility for an exemption requires a careful examination of local ordinances. These ordinances frequently specify the number of rental units, the owner’s residency status, and the type of property. For example, a single-family home rented out by the owner might qualify for an exemption, while a multi-unit apartment complex managed by a property management company almost certainly would not. The key is to thoroughly review the specific language of the applicable regulations. Consider consulting with a legal professional if you are unsure about your eligibility.

Specific Legal Language Outlining Exceptions to Licensing Regulations

Precise legal language varies widely by jurisdiction. However, many ordinances use phrases like “owner-occupied,” “single-family dwelling,” or “non-commercial rental” to delineate exemptions. These terms have specific legal definitions that must be adhered to. For instance, “owner-occupied” might require the owner to reside on the property for a minimum number of days per year. Similarly, “single-family dwelling” might exclude duplexes or triplexes. The legal definitions of these terms can be complex and may include specific requirements regarding the number of bedrooms, bathrooms, or kitchen facilities. The legal language may also specify the maximum number of rental units allowed under an exemption. A careful review of the relevant ordinances is essential for accurate interpretation.

Common Exemptions

The availability of exemptions varies significantly by location. However, some common scenarios where a business license might not be required include:

- Owner-occupied single-family homes: Renting out a single-family home where the owner resides is frequently exempt, especially if it’s not considered a commercial venture.

- Rental of secondary units on owner-occupied properties: This could include renting out a basement apartment or guest house on the owner’s primary residence, subject to local regulations.

- Short-term rentals under specific thresholds: Some jurisdictions have exemptions for short-term rentals (e.g., Airbnb) below a certain number of days or nights per year.

- Rentals managed by a property management company representing the owner: In some cases, the property management company may be required to obtain the license, while the owner might be exempt, provided specific conditions are met.

Legal and Financial Implications: Do I Need A Business License For Rental Property

Operating a rental property without the necessary business licenses exposes landlords to significant legal and financial risks. Failure to comply with licensing requirements can lead to substantial penalties and hinder your ability to effectively manage your investment. Understanding these implications is crucial for responsible property management.

Potential Legal Consequences of Operating Without a Required License

Operating a rental property without a required license can result in a range of legal consequences, depending on the jurisdiction. These can include hefty fines, cease-and-desist orders forcing you to stop renting the property until you obtain the necessary licenses, and even criminal charges in some cases. Furthermore, lack of a license can weaken your legal standing in disputes with tenants, making it harder to enforce lease agreements or evict tenants who violate the terms of their lease. The severity of the penalties varies greatly, but the potential for substantial financial and legal repercussions is undeniable. For example, in some cities, unlicensed rental operations can face daily fines that quickly accumulate to significant amounts. This can severely impact your profitability and even lead to the loss of your property.

Financial Implications of Obtaining and Maintaining Various Licenses

The financial implications of obtaining and maintaining business licenses for rental properties vary widely depending on location, the type of license required, and the complexity of your operation. The initial cost of application and processing fees can range from a few hundred dollars to several thousand, depending on the specific requirements of the local jurisdiction. Annual renewal fees also add to the ongoing expenses. Furthermore, obtaining certain licenses might require professional assistance, such as from a lawyer or accountant, which further increases the cost. It’s essential to factor these expenses into your overall rental property budget. For instance, a business license for a small rental property might cost a few hundred dollars annually, while a license for a large apartment complex could run into the thousands.

Cost Comparison of Different License Types

A direct cost comparison of different license types is difficult without specifying a particular location. Licensing requirements vary dramatically from state to state, county to county, and even city to city. However, we can illustrate the potential range. A simple business license might cost only a few hundred dollars annually, while a more comprehensive license, such as a real estate broker’s license (if you manage multiple properties or act as a broker), could cost significantly more, potentially involving substantial upfront fees and ongoing professional development costs. Additionally, some jurisdictions might require multiple licenses to operate legally. For example, a landlord might need a business license, a rental license, and potentially a permit for specific renovations or alterations. The cumulative cost of these multiple licenses could substantially increase the overall expense.

Impact of Licensing on Insurance Costs

Obtaining the necessary licenses can potentially influence your insurance costs. Insurance companies often consider licensing status when assessing risk. Having the appropriate licenses demonstrates compliance with regulations and might lead to lower premiums or increased coverage options. Conversely, operating without the required licenses could lead to higher premiums or even difficulty securing insurance coverage altogether. Insurance companies might view unlicensed operations as higher risk, increasing the likelihood of claims and potentially impacting your ability to obtain liability insurance, which is crucial for protecting you against potential lawsuits from tenants or other parties. Therefore, obtaining the necessary licenses can be a proactive step towards reducing insurance costs and securing better coverage.

Resources and Further Information

Navigating the complexities of rental property licensing can be challenging. Fortunately, numerous resources exist to guide you through the process, ensuring compliance and avoiding potential legal pitfalls. Understanding where to find this information is crucial for property owners.

Finding the right information requires a multi-pronged approach, encompassing government websites, professional organizations, and local ordinances. This section details how to access and interpret this crucial information.

Government Websites for Licensing Information

Most state and local governments maintain websites dedicated to business licensing. These sites typically follow a similar structure. They usually offer search functionalities allowing users to input their location (city, county, or state) and type of business (rental property). The results usually provide detailed information on licensing requirements, application forms, fees, and contact information for relevant agencies. Many sites also include FAQs and helpful guides to simplify the process. Navigation is generally intuitive, often with clear menus and categories for easy access to specific information. The content is usually presented in a formal, official tone, ensuring accuracy and clarity. Some sites even offer online application portals, streamlining the licensing process.

Professional Organizations Offering Guidance

Several professional organizations cater specifically to landlords and property managers. These organizations often provide valuable resources, including information on licensing requirements, best practices, and legal updates. Membership often includes access to legal advice, educational materials, and networking opportunities. These organizations can act as a valuable resource for navigating the intricacies of rental property management and ensuring compliance with all relevant regulations. They often host conferences and workshops providing up-to-date information and opportunities for professional development. Their websites usually contain detailed information about their services and resources, including links to relevant state and local government agencies.

Locating and Interpreting Local Ordinances

Local ordinances related to rental property licensing are typically accessible through the municipality’s official website. These ordinances often detail specific requirements for licensing, such as inspections, insurance, and tenant protections. Locating the ordinances may involve searching the website for terms like “rental licensing,” “landlord regulations,” or “property management ordinances.” The language used in these ordinances can be complex, so careful review is essential. If necessary, consulting with a legal professional is recommended to ensure a complete understanding of all requirements. Many municipalities also offer public access to their ordinance codes, allowing for direct access to the relevant legal documents.

Resources for Obtaining Business Licenses in Different Locations

| Location | Website/Organization | Contact Information | Relevant Documents |

|---|---|---|---|

| Example City, State | [Example City Website – Business Licensing Department] | [Example Phone Number, Email Address] | [Application Form, Fee Schedule, Ordinance] |

| Example County, State | [Example County Website – Business Licensing Division] | [Example Phone Number, Email Address] | [Application Form, Fee Schedule, Ordinance] |

| Example State | [Example State Website – Secretary of State] | [Example Phone Number, Email Address] | [Application Form, Fee Schedule, State Statutes] |

| Example Country (if applicable) | [Example National Website – Relevant Ministry/Agency] | [Example Phone Number, Email Address] | [Application Form, Fee Schedule, National Regulations] |