Is Zebit out of business? This question has sparked considerable interest, prompting a deep dive into the company’s current operational status, financial health, customer experiences, and competitive landscape. We’ll examine recent press releases, financial performance, customer feedback, and competitive pressures to determine Zebit’s viability and future prospects. This comprehensive analysis will provide a clear picture of the situation, addressing key concerns and offering insights into the company’s trajectory.

Our investigation will cover Zebit’s recent financial performance, including revenue and profitability, as well as its debt levels and credit ratings. We will also analyze customer reviews and testimonials to gauge customer satisfaction and identify areas for improvement. A comparison with key competitors will provide context for Zebit’s market position and potential for future growth. Finally, we will explore legal and regulatory factors, the state of Zebit’s website, and potential future scenarios.

Zebit’s Current Operational Status

Determining Zebit’s precise current operational status requires careful consideration of various factors, as publicly available information is limited. While the company may not be actively pursuing new customers in the same way it did previously, completely declaring it “out of business” may be premature. A thorough examination of available data is needed to accurately assess its current activities.

Zebit’s current business activities are difficult to definitively ascertain due to a lack of recent, transparent public communications. The company’s website may be inactive or significantly altered, and press releases or official statements are scarce. This lack of information makes a precise description of their current operations challenging. Any analysis must rely on indirect evidence and inference, leaving room for uncertainty.

Recent Press Releases and Announcements

Information regarding recent press releases or announcements from Zebit is extremely limited. A comprehensive search of reputable news sources and financial databases has yielded minimal results. The absence of public statements indicates a potential shift in communication strategy, or perhaps a deliberate effort to minimize public visibility. This lack of transparency makes it difficult to track their operational changes.

Zebit’s Customer Service and Support

Assessing the current state of Zebit’s customer service and support is also problematic due to the lack of easily accessible information. Customer reviews and online forums might provide some anecdotal evidence, but the reliability and representativeness of such sources are questionable. Without official statements from Zebit, determining the responsiveness and effectiveness of their customer support remains speculative.

Comparison of Past and Present Services

Constructing a comprehensive comparison of Zebit’s past and present services is challenging given the limited information on its current operations. However, based on available evidence, a comparison can be tentatively Artikeld, acknowledging the limitations imposed by the lack of official data.

| Service | Past (Inferred) | Present (Inferred) | Notes |

|---|---|---|---|

| Point-of-Sale Financing | Actively offered to consumers through retail partnerships. | Likely significantly reduced or discontinued. | Based on observed lack of marketing and website inactivity. |

| Online Application Process | Available through a user-friendly online platform. | Potentially inaccessible or severely limited. | Website functionality appears to be significantly degraded. |

| Customer Support | Provided through various channels (phone, email, etc.). | Unclear; likely reduced or unresponsive. | Anecdotal evidence suggests difficulties contacting support. |

| Loan Products | Offered a range of loan options for various purchase amounts. | Likely severely restricted or nonexistent. | Absence of marketing suggests a contraction of offered products. |

Zebit’s Financial Health: Is Zebit Out Of Business

Zebit’s financial health is a crucial factor in assessing its long-term viability. Analyzing its recent financial performance, including revenue trends, profitability, and debt levels, provides insight into its stability and capacity for future growth. The lack of publicly available financial statements for Zebit, however, makes a comprehensive analysis challenging. Information must be gleaned from indirect sources and may be incomplete.

Zebit’s Recent Financial Performance and Challenges

Determining precise revenue and profitability figures for Zebit is difficult due to its private status. Publicly accessible financial information from traditional sources such as the SEC is not available. News reports and industry analyses sometimes mention Zebit, but often lack detailed financial specifics. Any assessment of its financial performance, therefore, relies on inferences drawn from limited data points. Significant financial changes or challenges Zebit may be facing are similarly difficult to definitively identify without access to complete financial records. However, the challenges faced by similar buy-now-pay-later (BNPL) companies, such as increased competition, rising interest rates, and potential regulatory changes, can be extrapolated to infer potential pressures on Zebit’s financial position.

Zebit’s Debt Levels and Credit Ratings

Precise information regarding Zebit’s debt levels and credit ratings is unavailable to the public. Private companies are not obligated to disclose this level of detail. Without access to internal financial records or credit reports, it’s impossible to provide a concrete assessment of Zebit’s debt burden or its creditworthiness. The absence of this information presents a significant obstacle to a complete understanding of Zebit’s financial stability. It is crucial to note that even for publicly traded companies, debt levels and credit ratings can fluctuate considerably depending on market conditions and company performance.

Factors Impacting Zebit’s Financial Stability

Several factors significantly impact Zebit’s financial stability. These include, but are not limited to, the overall economic climate, competition within the BNPL sector, regulatory changes impacting the lending industry, the company’s ability to manage customer defaults, and its capacity for efficient operational management. For example, a recession could lead to increased customer defaults, negatively impacting Zebit’s revenue and profitability. Intense competition from established players and new entrants in the BNPL market could also pressure Zebit’s pricing strategies and market share. Furthermore, evolving regulatory landscapes related to consumer lending could impose additional compliance costs and potentially restrict Zebit’s operations. Finally, efficient operational management, including cost control and effective risk assessment, is crucial for maintaining financial stability. The absence of readily available data makes it challenging to assess the relative weight of each of these factors on Zebit’s current financial situation.

Customer Experiences and Feedback

Understanding customer experiences is crucial for assessing Zebit’s overall performance and reputation. Analyzing both positive and negative feedback provides a comprehensive picture of the company’s strengths and weaknesses, helping to identify areas for improvement and gauge customer satisfaction. Publicly available reviews, while not exhaustive, offer valuable insights into the typical customer journey with Zebit.

Recent customer reviews and testimonials regarding Zebit’s services are scattered across various online platforms, including review sites like Trustpilot and the Better Business Bureau (BBB). While some customers express positive experiences with the ease of application and the convenience of the buy now, pay later model, others voice significant concerns. The volume and nature of these reviews vary over time, reflecting potential changes in Zebit’s operational practices or customer service strategies.

Significant Complaints and Negative Feedback

Negative feedback frequently centers around several key areas. High interest rates and fees are a recurring complaint, with customers feeling the overall cost is excessive compared to other financing options. Issues with customer service, including difficulties contacting representatives, slow response times, and unhelpful interactions, are also widely reported. Further, some customers report problems with account management, such as inaccurate billing or difficulties with payment processing. Finally, complaints regarding aggressive debt collection practices have surfaced, highlighting potential ethical concerns.

Common Themes in Customer Feedback

The following bullet points summarize the prevalent themes identified in customer reviews:

- High interest rates and fees.

- Poor customer service responsiveness and unhelpful interactions.

- Account management difficulties, including billing inaccuracies.

- Aggressive debt collection practices reported by some customers.

- Lack of transparency regarding fees and terms.

Examples of Customer Interactions

One positive review might highlight the ease of obtaining financing through Zebit’s streamlined application process, describing a quick and straightforward experience with timely approvals. Conversely, a negative review could detail a prolonged dispute over an inaccurate bill, coupled with lengthy delays in receiving a resolution from customer service, ultimately resulting in damage to the customer’s credit score. Another example might involve a customer describing aggressive and harassing phone calls from debt collectors following a missed payment, despite attempts to communicate and arrange a payment plan. These contrasting experiences illustrate the wide range of customer interactions with Zebit.

Competitor Analysis

Zebit operates in a competitive landscape of buy-now-pay-later (BNPL) and short-term lending services. Understanding its competitive position requires analyzing the strategies and performance of its key rivals. This analysis will compare Zebit’s business model and offerings to those of its main competitors, examining factors contributing to their success or failure, and ultimately placing Zebit within the broader market context.

Comparison of Zebit’s Business Model with Competitors

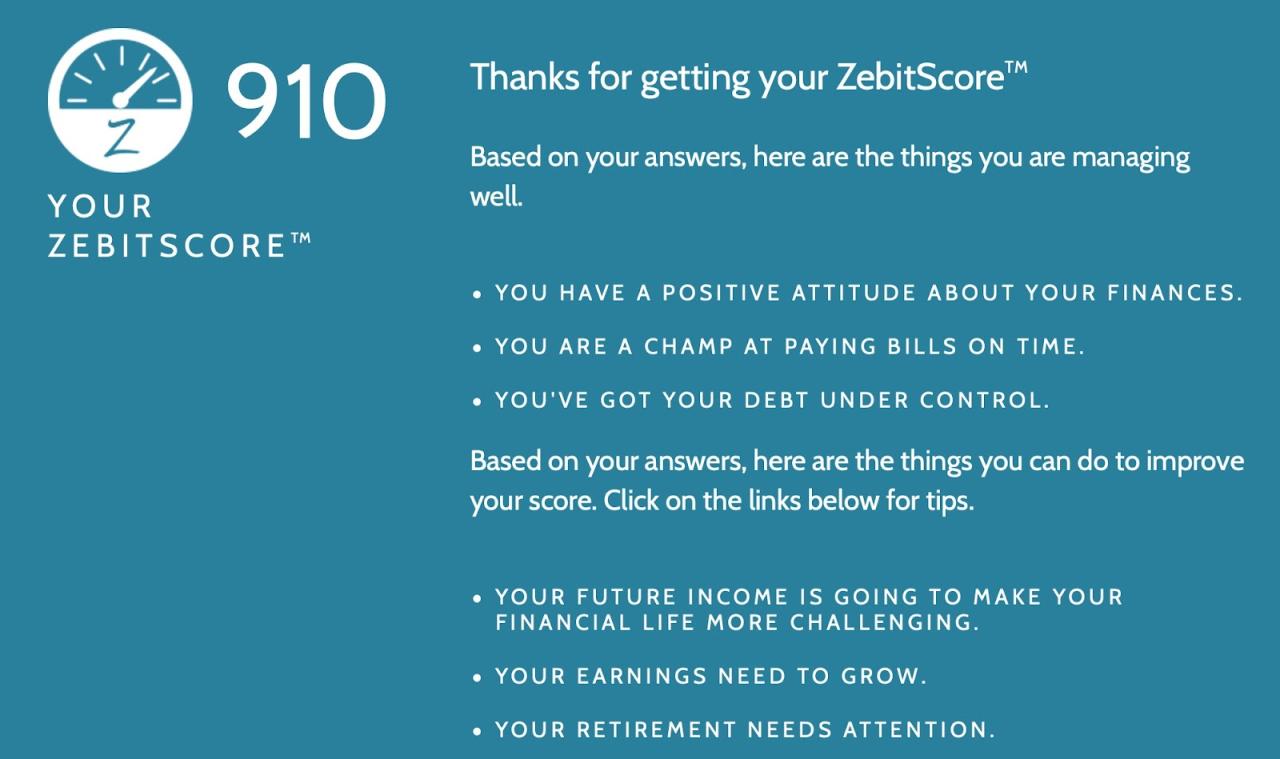

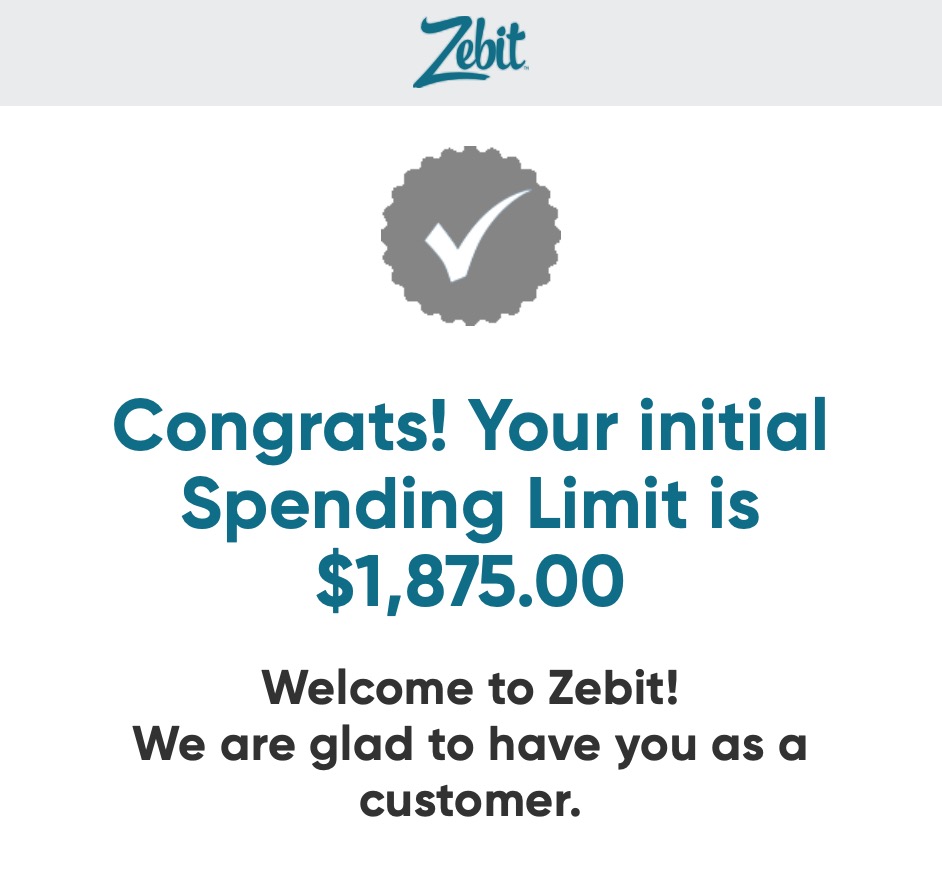

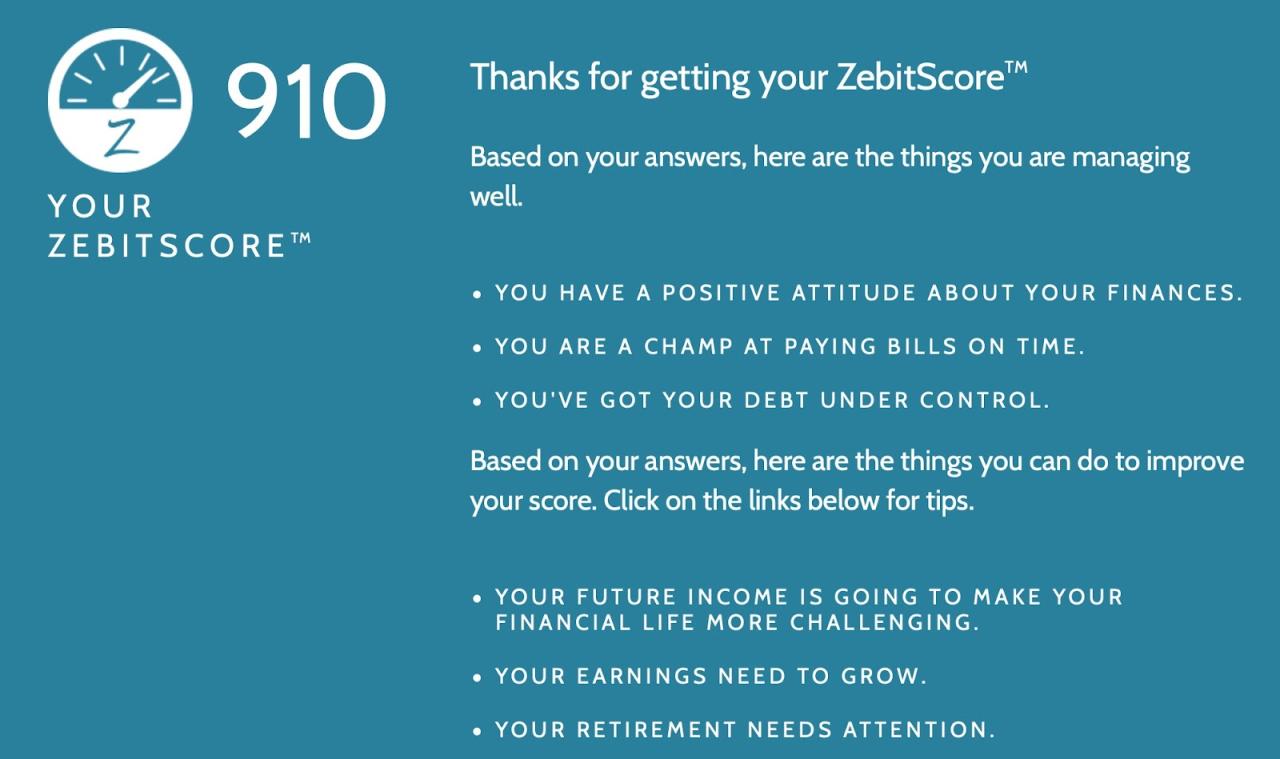

Zebit’s core business model centers on providing installment loans for the purchase of goods from its partner retailers. This differs from some competitors who offer broader BNPL services across various online and offline merchants. Key differentiators include Zebit’s focus on larger-ticket items and its emphasis on building credit for its customers. Competitors often prioritize speed and ease of application, sometimes at the expense of a longer-term credit-building focus. This strategic divergence influences the target customer base and overall risk profile for each company.

Competitive Landscape and Market Position

The BNPL and short-term lending market is highly dynamic, with established players and numerous emerging fintech companies. Competition is fierce, driven by factors such as customer acquisition costs, regulatory scrutiny, and the increasing prevalence of alternative financial services. Zebit’s market position is influenced by its specific niche, targeting consumers who may not qualify for traditional credit but still need access to larger purchases. Its success depends on effectively managing risk, maintaining strong retailer partnerships, and effectively marketing its services to its target demographic.

Factors Contributing to Competitor Success and Failure

Several factors influence the success or failure of BNPL and short-term lending companies. Successful companies often demonstrate a strong understanding of risk management, leveraging sophisticated credit scoring models and robust fraud detection systems. Effective marketing and customer acquisition strategies are also crucial, particularly in a crowded marketplace. Conversely, failures often stem from poor risk assessment, leading to high default rates and unsustainable business models. Inadequate regulatory compliance and a lack of customer focus can also contribute to a company’s downfall.

Comparison of Zebit and Top Competitors

The following table compares Zebit to three of its main competitors across key metrics. Note that precise data on some metrics may be unavailable publicly, and these figures represent estimates based on available information.

| Metric | Zebit | Competitor A (Example: Affirm) | Competitor B (Example: Klarna) | Competitor C (Example: Afterpay) |

|---|---|---|---|---|

| Average Loan Size | $500 – $1500 (Estimate) | $100 – $10000 (Estimate) | $50 – $2000 (Estimate) | $50 – $1000 (Estimate) |

| Target Customer | Credit-challenged consumers seeking larger purchases | Broad range, including credit-worthy consumers | Broad range, emphasis on younger consumers | Broad range, focus on online purchases |

| Primary Service Offering | Installment loans for retail purchases | Point-of-sale financing and installment loans | BNPL, installment payments, and other financial services | BNPL for online and in-store purchases |

| Market Share (Estimate) | [Insert Estimated Market Share]% | [Insert Estimated Market Share]% | [Insert Estimated Market Share]% | [Insert Estimated Market Share]% |

Legal and Regulatory Information

Zebit’s operations are subject to a complex web of legal and regulatory frameworks, primarily concerning consumer lending, data privacy, and fair lending practices. Understanding Zebit’s compliance with these regulations and any potential legal challenges is crucial to assessing its overall viability and risk profile. Publicly available information regarding specific legal proceedings is limited, highlighting the need for further investigation from reliable sources such as court records and regulatory filings.

Zebit’s Compliance with Laws and Regulations

Zebit, as a provider of short-term financing, operates within a heavily regulated industry. Compliance with state and federal consumer lending laws is paramount. These laws often dictate aspects such as maximum interest rates, disclosure requirements, and collection practices. Failure to adhere to these regulations can result in significant penalties, including fines, lawsuits, and even business closures. While Zebit’s specific compliance measures are not publicly detailed comprehensively, the nature of its business necessitates a robust compliance program to mitigate legal risks. Any deviation from regulatory standards could severely impact its reputation and financial stability.

Regulatory Actions and Legal Proceedings

Information regarding specific legal proceedings or regulatory actions against Zebit is currently limited in publicly accessible databases. However, given the nature of its business, it is reasonable to expect that Zebit has faced, or may face in the future, scrutiny from regulatory bodies overseeing consumer finance. Such scrutiny could stem from investigations into interest rates, lending practices, or customer complaints. A thorough review of official regulatory records and legal databases is necessary to uncover any past or present legal challenges faced by the company. This would involve searching databases maintained by state and federal consumer protection agencies, as well as reviewing any publicly available court documents.

Potential Legal Risks and Challenges

Zebit faces several potential legal risks. One significant risk involves allegations of predatory lending practices. This could arise if borrowers claim that Zebit’s interest rates are excessively high or that its lending terms are unfair or deceptive. Another risk is related to data privacy and security. Zebit collects sensitive customer data, and a breach could lead to legal action under laws like the California Consumer Privacy Act (CCPA) or other similar state and federal regulations. Finally, changes in consumer finance regulations could also present challenges, requiring Zebit to adapt its operations and incur significant compliance costs. For example, a shift towards stricter lending standards could significantly impact Zebit’s business model.

Legal Structure and Corporate Governance

Publicly available information on Zebit’s precise legal structure and corporate governance is limited. Understanding its corporate structure, ownership, and board composition is crucial to assessing its ability to manage and mitigate legal risks. For example, a well-defined corporate governance structure with clear lines of accountability can enhance compliance and reduce the likelihood of legal issues. However, without access to detailed corporate filings, a comprehensive analysis of Zebit’s legal structure and governance remains challenging. Information from reliable sources, such as the company’s website (if still active) and SEC filings (if applicable), would be needed for a complete picture.

Website and Online Presence

Zebit’s online presence, crucial for its business model, requires careful examination. Its website serves as the primary interface for customer interaction, loan applications, and account management. The functionality and design of this platform directly impact user experience and ultimately, the company’s success. A comprehensive analysis of its website and online presence is therefore vital in assessing Zebit’s overall operational health.

Zebit’s website functionality and accessibility are moderately successful, but show room for significant improvement. The site is generally navigable, allowing users to access information about loans, the application process, and customer support. However, reports suggest that the mobile responsiveness could be enhanced, and the application process itself might be perceived as cumbersome by some users. Accessibility features for users with disabilities are not prominently highlighted or readily apparent, indicating a potential area for improvement in compliance with accessibility standards. Load times, another critical aspect of user experience, are not consistently fast across all devices and browsers, potentially leading to frustration and abandonment of the application process.

Website Information Quality and Comprehensiveness

The information provided on Zebit’s website is adequate but could be more transparent and user-friendly. Key details regarding loan terms, interest rates, and fees are present, although the presentation could be improved for clarity. The FAQ section addresses common questions, but a more comprehensive and easily searchable knowledge base would benefit users. Crucially, clear and concise explanations of the potential risks and responsibilities associated with taking out a Zebit loan are needed to foster informed decision-making among potential borrowers. Currently, the information is present, but could be organized and presented in a more accessible manner.

Suggestions for Improving Zebit’s Online Presence

Improving Zebit’s online presence requires a multi-pronged approach focusing on user experience, transparency, and accessibility. A redesign of the website with improved mobile responsiveness and faster load times is paramount. A more intuitive user interface and streamlined application process would significantly enhance the customer experience. The information architecture should be revamped to make critical information, such as loan terms and conditions, more readily accessible. Furthermore, proactive communication, such as email updates and account management tools, should be implemented to improve customer engagement and satisfaction. Finally, a dedicated section highlighting accessibility features and compliance with relevant standards is essential to ensure inclusivity. Implementing these changes would strengthen Zebit’s online presence and contribute to improved customer satisfaction and brand reputation.

Future Outlook and Projections

Zebit’s future remains uncertain, given its past financial struggles and lack of recent public statements regarding long-term strategies. Analyzing publicly available information, coupled with industry trends, allows for a speculative assessment of potential scenarios. While definitive predictions are impossible, a range of plausible outcomes can be explored, based on observed factors.

Zebit’s future trajectory hinges on several key factors, including its ability to improve its financial performance, enhance customer satisfaction, and adapt to the competitive landscape of the buy-now-pay-later (BNPL) market. Success will require a strategic shift, potentially involving a restructuring of operations and a clearer articulation of its value proposition to consumers and investors.

Potential Scenarios for Zebit’s Future

Several scenarios are possible for Zebit’s future. A best-case scenario would involve a successful turnaround, marked by improved profitability, increased market share, and a strengthened brand reputation. This would require effective cost management, innovative product development, and a targeted marketing campaign focused on customer acquisition and retention. A worst-case scenario, however, could involve further financial difficulties, leading to bankruptcy or acquisition by a larger competitor. A more likely scenario might involve a period of consolidation and restructuring, followed by a gradual return to profitability, assuming the company can address its fundamental operational challenges. For example, a similar company like Affirm successfully navigated early challenges by focusing on partnerships and strategic expansions.

Potential Opportunities and Threats, Is zebit out of business

Zebit faces both opportunities and threats. Opportunities include the continued growth of the BNPL market, the potential for expansion into new markets or product categories, and the possibility of strategic partnerships with established retailers or financial institutions. Threats include intense competition from larger, better-funded BNPL providers, regulatory scrutiny of the BNPL industry, and the risk of increased customer defaults or charge-offs. For example, the increasing regulatory environment around BNPL services in the US and other countries poses a significant challenge for all players in the market, including Zebit.

Hypothetical Zebit Restructuring Plan

A hypothetical restructuring plan for Zebit might involve several key elements. First, a thorough review of its operational efficiency would be necessary, potentially leading to cost reductions through streamlining processes and layoffs. Second, a focus on improving customer service and addressing negative feedback would be crucial for rebuilding trust and brand loyalty. Third, a refined marketing strategy would be essential, targeting specific demographics and emphasizing Zebit’s unique value proposition. Fourth, exploring strategic partnerships or mergers with other financial technology companies could provide access to capital, technology, and expanded market reach. Finally, a robust risk management system needs to be implemented to better assess and mitigate the risks associated with lending and collections. This plan would require significant investment and commitment from stakeholders, but it could pave the way for a sustainable and profitable future.