What does AUV mean in business? The answer, surprisingly, isn’t singular. AUV, a deceptively simple acronym, holds diverse meanings across various industries, acting as both a metric for performance and a descriptive term within specific business functions. This exploration delves into the multifaceted world of AUV, revealing its different interpretations and applications, from marketing strategies to financial calculations, showcasing its impact on overall business success. We’ll uncover the historical context, explore common usage examples, and examine its relationship to other key business terms.

Understanding AUV requires navigating its various contexts. In some sectors, it represents a specific financial metric, while in others, it might describe a process or operational element. We’ll dissect these differences, providing clear definitions, illustrative examples, and practical applications to help you confidently understand and utilize AUV within your own business context. This exploration will equip you with the knowledge to interpret and effectively employ AUV regardless of its specific meaning within your industry.

AUV in the Context of Business Acronyms

The acronym AUV holds diverse meanings across various business sectors, often depending on the specific industry and context. Understanding the intended meaning requires careful consideration of the surrounding information. While not as ubiquitous as some other business acronyms, AUV’s usage is notable within specific niches.

The most common interpretations of AUV center around its use in the automotive and underwater vehicle industries. However, less frequent, but still relevant, applications exist within other sectors. Tracing the historical usage of AUV reveals a gradual specialization of the acronym, initially encompassing broader concepts before narrowing to its current predominant meanings.

Common Meanings of AUV Across Industries

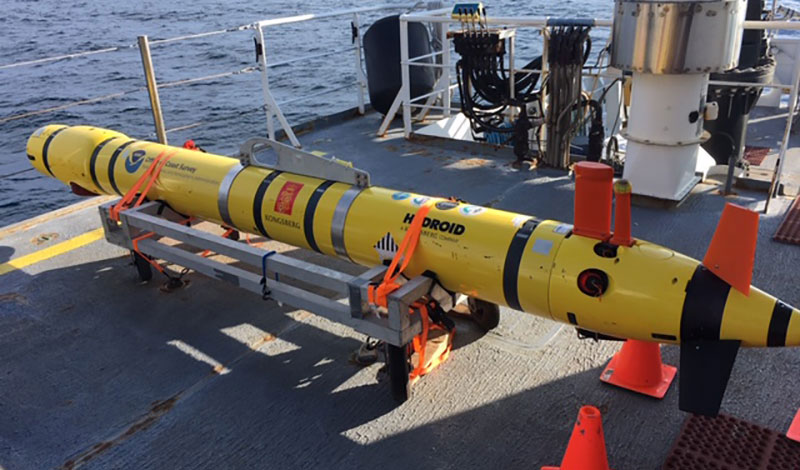

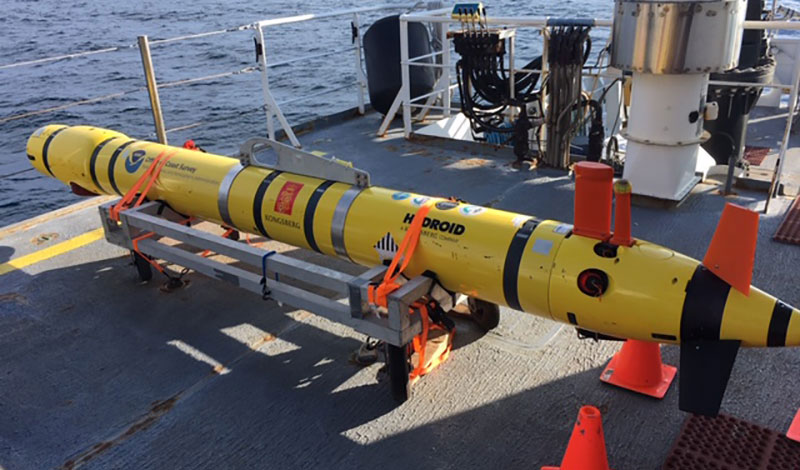

AUV most frequently represents “Average Unit Value” in the context of sales and retail. This metric is crucial for understanding the average price of goods sold, providing insights into pricing strategies, profitability, and overall business performance. In the automotive industry, AUV might sometimes, though less commonly, refer to “Autonomous Underwater Vehicle,” reflecting the increasing integration of technology into various sectors. This meaning, however, is far less prevalent in business contexts compared to its usage in marine technology. Within the broader technology sector, AUV might, in very rare cases, represent a specific software or hardware designation, but this requires contextual clarification.

Examples of AUV Usage in Different Sectors

The following examples illustrate the varied applications of AUV across different business sectors.

| Industry | AUV Meaning | Example Usage | Related Terms |

|---|---|---|---|

| Retail | Average Unit Value | A retailer calculates the AUV of its clothing line by dividing the total revenue from clothing sales by the total number of clothing items sold. A high AUV might indicate successful premium pricing. | Revenue, Sales, Price, Cost of Goods Sold (COGS), Gross Profit Margin |

| Automotive (Rare) | Autonomous Underwater Vehicle (contextual) | A company developing underwater sensors for autonomous vehicles might use “AUV” in internal documentation referring to the integration of their sensors into such systems. This is not a standard business usage. | Autonomous Vehicle, Sensor Technology, Underwater Robotics |

| Finance (Rare) | Account Unit Value (contextual) | In very niche financial applications, “AUV” could potentially represent the value of a specific account unit, but this is highly context-dependent and not a standard business term. | Account Value, Portfolio Value, Asset Valuation |

Historical Evolution of AUV in Business Contexts

The acronym AUV’s business usage has primarily evolved from its core meaning in retail and sales analysis. “Average Unit Value” has become a standard metric in business intelligence and market research, offering a straightforward way to track the average price of sold products. The emergence of autonomous systems in various industries, particularly marine technology, has led to the secondary, less common, use of AUV in reference to Autonomous Underwater Vehicles. However, this usage is largely confined to technical specifications and research papers rather than general business communication. There is no significant historical shift in the core meaning of AUV; its usage remains relatively consistent, with the primary distinction being the context-dependent application of the term.

AUV as a Metric or Measurement

Average Unit Value (AUV) is a crucial metric in various business contexts, offering insights into the average revenue generated per unit sold. Understanding AUV allows businesses to track pricing strategies, product profitability, and overall sales performance. Its application spans diverse industries, from e-commerce to manufacturing, providing a valuable tool for informed decision-making.

AUV can be interpreted as a key performance indicator (KPI) in several ways, reflecting different aspects of business health. It can signify the effectiveness of pricing strategies, the desirability of products, and the overall efficiency of the sales process. A rising AUV might indicate successful premium pricing or increased demand for higher-value products. Conversely, a declining AUV could signal the need for pricing adjustments or a shift in market demand towards lower-priced alternatives.

AUV Calculation in Different Business Scenarios

The calculation of AUV is straightforward: it’s the total revenue generated divided by the total number of units sold. However, the application and interpretation vary depending on the business context.

In an e-commerce setting, AUV might be calculated by dividing the total revenue from online sales by the total number of items sold during a specific period. For instance, if an online retailer generated $100,000 in revenue from selling 1,000 units, the AUV would be $100. This calculation could be further segmented by product category, customer segment, or marketing campaign to gain deeper insights.

In the manufacturing sector, AUV could represent the average revenue per unit produced. This would involve dividing the total revenue from product sales by the total number of units manufactured during a specific period. Factors like production costs and material expenses would need to be considered alongside AUV to fully assess profitability.

For a subscription-based business, AUV might represent the average monthly recurring revenue (MRR) per subscriber. This would involve dividing the total MRR by the total number of active subscribers. Churn rate and customer acquisition cost would be relevant factors to analyze in conjunction with AUV.

Advantages and Disadvantages of Using AUV as a Metric

Using AUV as a metric offers several advantages. It provides a clear and concise measure of average revenue per unit, simplifying the assessment of pricing strategies and product profitability. It also facilitates easy comparison across different periods and product lines, allowing for the identification of trends and areas for improvement. Tracking AUV over time provides valuable insights into the overall health and performance of a business.

However, relying solely on AUV can be misleading. AUV doesn’t account for other critical factors such as production costs, marketing expenses, and operational efficiency. A high AUV might be accompanied by high production costs, resulting in low profitability. Therefore, AUV should be used in conjunction with other metrics, such as gross profit margin and return on investment (ROI), for a comprehensive assessment of business performance.

Hypothetical Case Study: AUV in a Coffee Shop

Let’s consider a coffee shop chain aiming to improve profitability. Their current AUV is $5 (total revenue of $50,000 divided by 10,000 drinks sold). They decide to implement a loyalty program offering discounts on premium drinks. After three months, their total revenue increases to $60,000, but the number of drinks sold rises to 12,000. This results in a new AUV of $5. While the revenue increased, the AUV remained unchanged, indicating that the loyalty program hasn’t yet impacted the average price point. Further analysis is needed to assess the program’s effectiveness, perhaps by segmenting AUV by drink type or customer loyalty tier. This highlights the importance of considering AUV in conjunction with other metrics and a detailed breakdown of sales data.

AUV in Specific Business Functions

Average User Value (AUV) transcends simple metric status; it becomes a powerful tool when strategically integrated into various business functions. Understanding its application across departments allows for a more holistic and effective approach to business optimization. This section explores AUV’s role in specific business areas, highlighting both its benefits and potential drawbacks.

AUV in Marketing and Sales

In marketing and sales, AUV serves as a crucial indicator of customer lifetime value. High AUV suggests a customer base that generates substantial revenue over time, justifying increased investment in customer retention strategies. Conversely, low AUV might necessitate a reassessment of marketing campaigns and sales processes. Marketing teams can leverage AUV data to refine targeting, personalize messaging, and optimize channel allocation, focusing efforts on segments with higher AUV potential. Sales teams can utilize this metric to prioritize high-value customers, tailor their sales pitches, and improve upselling and cross-selling strategies. For example, a subscription-based SaaS company might use AUV to identify customers likely to upgrade to premium plans, allowing sales to focus their efforts on those individuals.

AUV in Different Business Departments

The application of AUV varies across departments. In finance, AUV informs budgeting and forecasting. Predicting future revenue based on AUV allows for better resource allocation and investment decisions. Operations teams can use AUV to streamline processes and optimize resource deployment, focusing on activities that maximize customer value. For instance, a retail company could use AUV data to determine optimal stock levels for high-value products. In contrast, the human resources department might utilize AUV insights to understand the correlation between employee performance and customer value, helping to design targeted training programs. The finance department’s use of AUV differs from operations in its focus on long-term financial planning versus short-term operational efficiency.

Benefits and Drawbacks of Using AUV

Understanding the potential benefits and drawbacks of AUV implementation is crucial for effective utilization.

The following list details potential benefits:

- Improved customer segmentation and targeting.

- Enhanced customer retention strategies.

- Optimized resource allocation across departments.

- More accurate revenue forecasting and budgeting.

- Data-driven decision-making across the organization.

However, there are also potential drawbacks:

- Requires accurate and comprehensive customer data.

- Can be complex to calculate and interpret, especially for businesses with diverse customer segments.

- May not be suitable for all business models or industries.

- Over-reliance on AUV can lead to neglecting other important metrics.

- Requires ongoing monitoring and adjustment to ensure accuracy and relevance.

AUV Integration into a Business Workflow

The following flowchart illustrates a simplified example of AUV integration into a business workflow:

[Imagine a flowchart here. The flowchart would begin with “Customer Acquisition,” branching to “Data Collection (Customer behavior, purchase history, etc.),” then to “AUV Calculation,” followed by branches to “Marketing Campaign Optimization,” “Sales Strategy Adjustment,” “Product Development,” and finally “Revenue Forecasting and Budgeting.” Each branch would have a brief description of the process.]

AUV and its Relationship to Other Business Terms: What Does Auv Mean In Business

Average Unit Value (AUV) doesn’t exist in isolation; its significance is deeply intertwined with other key performance indicators (KPIs) and business strategies. Understanding its relationship with these other metrics allows for a more holistic view of business performance and facilitates more effective strategic decision-making. This section explores the interconnectedness of AUV with other crucial business terms and concepts.

AUV’s interaction with other business concepts significantly influences strategic planning and resource allocation. For instance, a high AUV might suggest a premium pricing strategy, requiring a focus on brand building and customer loyalty rather than high-volume sales. Conversely, a low AUV might indicate a need to explore upselling, cross-selling, or improving product offerings to increase profitability. Analyzing AUV in conjunction with other metrics allows businesses to identify areas for improvement and optimize their overall performance.

AUV and Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) represents the total revenue a business expects to generate from a single customer throughout their relationship. A higher AUV directly contributes to a higher CLTV, as each transaction generates more revenue. Businesses can leverage this relationship by focusing on strategies that increase both AUV and customer retention to maximize CLTV. For example, a subscription service with a high AUV per subscription and high customer retention will have a significantly higher CLTV than a one-time purchase business with a low AUV.

AUV and Gross Merchandise Value (GMV)

Gross Merchandise Value (GMV) is the total value of goods sold through a platform, often used in e-commerce. AUV is a component of GMV; it represents the average value of each transaction contributing to the overall GMV. Understanding the AUV allows businesses to analyze the average transaction size and identify opportunities to increase the value of individual sales, thereby directly impacting the overall GMV. A business with a high GMV but low AUV might be selling many low-priced items, indicating a need to focus on higher-margin products or upselling strategies.

AUV and Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) represents the cost of acquiring a new customer. The relationship between AUV and CAC is crucial for profitability. A high AUV can offset a higher CAC, as each customer generates more revenue. Businesses need to carefully balance their acquisition costs with the average value each customer brings. A low AUV coupled with a high CAC indicates an unsustainable business model. Strategies to reduce CAC or increase AUV are crucial for profitability in such scenarios. For example, a SaaS company might justify a high CAC if their AUV is sufficiently high and customers have long-term contracts.

Comparison of AUV with Similar Business Acronyms

Understanding AUV’s place within the broader business landscape requires comparing it to related metrics. The following list illustrates the distinctions and overlaps:

- AUV vs. Average Revenue Per User (ARPU): While similar, ARPU focuses on revenue per user over a period, whereas AUV focuses on the average value of a single transaction. ARPU is useful for subscription models, while AUV is more relevant for transactional businesses.

- AUV vs. Average Order Value (AOV): AOV is specifically focused on the average value of an order, while AUV can encompass various types of transactions, including individual sales and orders. In an e-commerce context, AOV is a subset of AUV.

- AUV vs. Revenue Per Customer (RPC): RPC considers total revenue generated by a customer over a given period, encompassing multiple transactions. AUV focuses on the average value of a single transaction, making it a component of RPC.

Illustrative Examples of AUV in Business

Understanding Average Unit Value (AUV) requires examining its practical application within different business contexts. The following scenarios illustrate how AUV significantly impacts operational decisions and strategic planning. Each example highlights the specific influence of AUV on business outcomes, along with the challenges and opportunities it presents.

Scenario 1: E-commerce Retail, What does auv mean in business

An online retailer selling handcrafted jewelry experiences fluctuating sales. While the number of units sold varies monthly, management focuses on increasing the AUV to boost overall revenue. They achieve this by introducing higher-priced, premium jewelry lines alongside their existing offerings, promoting bundles and curated collections, and personalizing marketing messages to target customers with higher purchasing power.

The impact of focusing on AUV in this scenario is a potential increase in overall revenue, even if the number of units sold remains relatively stable. This strategy shifts the focus from high volume to high value sales. The challenges include maintaining a balance between attracting new customers with lower-priced items and retaining existing high-value customers. Opportunities lie in identifying and targeting profitable customer segments through data analysis and personalized marketing, leading to increased customer lifetime value and improved profit margins.

Scenario 2: Subscription-Based Software

A SaaS company offering project management software analyzes its AUV to identify areas for improvement. They discover that a significant portion of their user base is only utilizing the basic features of their platform. To increase AUV, they implement a tiered pricing model offering premium features and enhanced support, incentivizing users to upgrade their subscriptions.

Increasing AUV in this scenario directly translates to higher recurring revenue. The company can invest more in research and development, marketing, and customer support, leading to improved product offerings and a stronger market position. The challenge lies in balancing the pricing strategy to avoid alienating existing customers while attracting new, higher-paying users. Opportunities exist in developing more valuable features and creating compelling reasons for users to upgrade, such as integration with popular third-party applications or enhanced security features.

Scenario 3: Restaurant Industry

A fast-casual restaurant chain uses AUV to assess the effectiveness of its menu and pricing strategies. They notice that despite high customer traffic, their AUV is lower than expected. After analyzing sales data, they discover that many customers are opting for lower-priced items, resulting in lower overall revenue. They respond by introducing higher-margin premium menu items and implementing targeted promotions to encourage customers to purchase more expensive options.

The impact on this restaurant chain is a potential increase in profitability. By focusing on increasing the average order value, they can improve their revenue even if customer traffic remains constant. The challenge is to avoid alienating price-sensitive customers while attracting those willing to pay more for premium offerings. Opportunities exist in menu engineering, optimizing pricing strategies, and employing effective promotional campaigns to encourage upselling and cross-selling.