What is a business tax receipt in florida – What is a Florida Business Tax Receipt? Understanding this crucial document is key for any entrepreneur starting a business in the Sunshine State. It’s not just a piece of paper; it’s your official authorization to operate legally, signifying your compliance with Florida’s business regulations. This guide unravels the complexities surrounding Florida business tax receipts, covering everything from application processes and fees to exemptions and potential penalties for non-compliance. We’ll demystify the process, making it easier for you to navigate the requirements and ensure your business operates smoothly within the legal framework.

This comprehensive guide will walk you through the process of obtaining and maintaining a Florida Business Tax Receipt, clarifying the differences between a tax receipt and other business licenses. We’ll explore the various fees involved, the implications of different business structures, and address common scenarios where exemptions might apply. We’ll also delve into the nuances of local regulations and how they interact with state-level requirements, ensuring you have a complete understanding of your obligations.

Definition of a Florida Business Tax Receipt

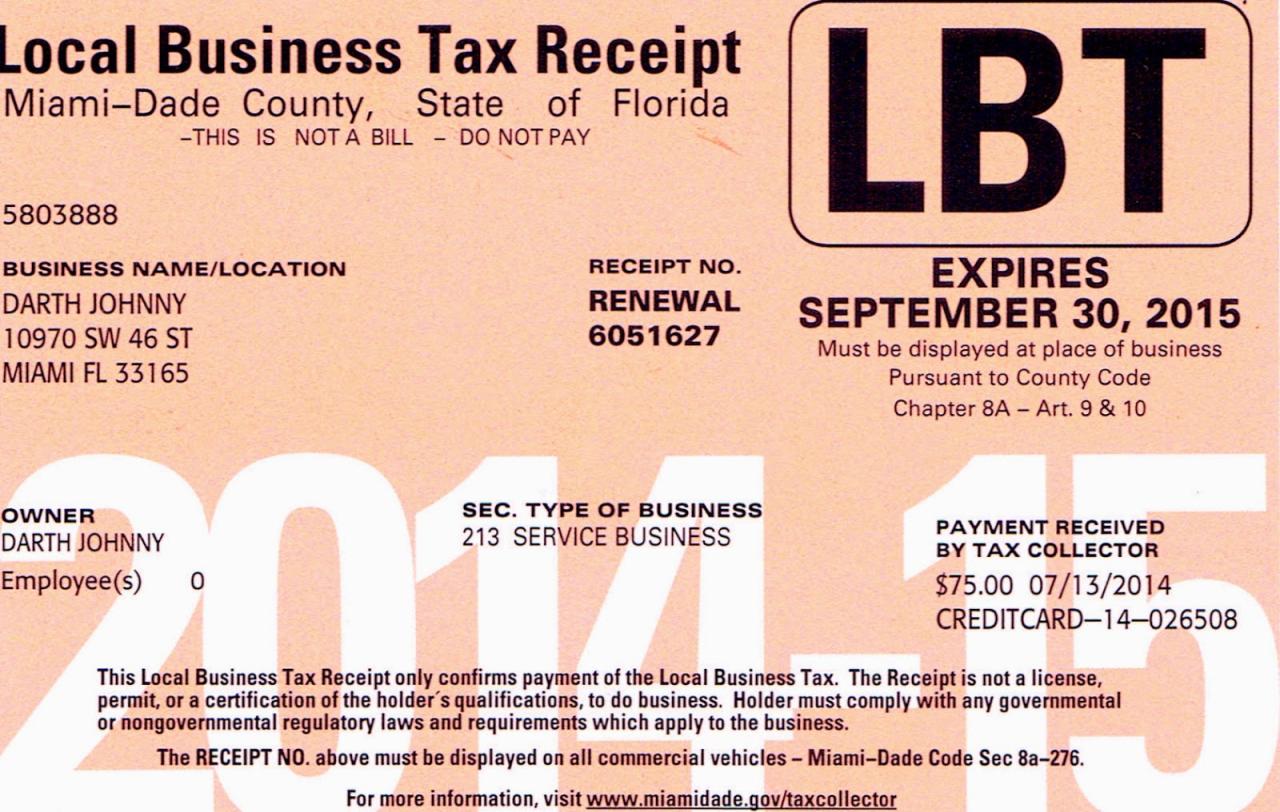

A Florida Business Tax Receipt (BTR) is a crucial document for many businesses operating within the state. It’s not a license to operate in the strictest sense, but rather a receipt demonstrating that the business has paid its local business tax. This tax revenue helps fund essential municipal services within the city or county where the business is located. Understanding the BTR’s purpose and requirements is vital for ensuring legal compliance and avoiding potential penalties.

The purpose of a Florida Business Tax Receipt is primarily to generate revenue for local governments. These funds are then used to support various public services, such as infrastructure maintenance, public safety initiatives, and community programs. Obtaining a BTR also helps local governments track and regulate businesses operating within their jurisdictions, contributing to efficient economic management and planning.

Businesses Requiring a Florida Business Tax Receipt

The need for a Florida Business Tax Receipt depends on the type of business, its location, and the specific services offered. Generally, most businesses operating within Florida municipalities are required to obtain a BTR. This includes a broad range of businesses, from sole proprietorships and partnerships to corporations and limited liability companies (LLCs). Exceptions may exist for certain types of businesses or those operating solely online without a physical presence in Florida. It’s crucial to check with the relevant county or municipal government to determine specific requirements.

Definition of a Florida Business Tax Receipt for a General Audience

A Florida Business Tax Receipt is proof that a business has paid its local business tax to the city or county where it operates. Think of it as a receipt showing you’ve fulfilled your tax obligation at the local level, allowing you to legally operate your business in that specific area. It’s a necessary document for many businesses, helping ensure they’re compliant with local regulations.

Comparison of a Florida Business Tax Receipt with Other Business Licenses or Permits

A Florida Business Tax Receipt differs significantly from other business licenses and permits. While a BTR primarily confirms the payment of local business taxes, other licenses and permits authorize specific activities or operations. For example, a contractor needs a contractor’s license to perform construction work, irrespective of having a BTR. Similarly, a restaurant requires a food service permit to operate, in addition to the BTR. A BTR is a fundamental requirement for many businesses, but it doesn’t replace the need for other industry-specific licenses or permits required to legally operate. Think of the BTR as a foundational document, while other licenses and permits address specific operational aspects.

Obtaining a Florida Business Tax Receipt: What Is A Business Tax Receipt In Florida

Securing a Florida Business Tax Receipt (BTR) is a crucial step for any business operating within the state. This receipt signifies compliance with local business regulations and allows your business to legally operate. The application process, while straightforward, requires careful attention to detail to ensure accurate and timely processing.

The Application Process for a Florida Business Tax Receipt

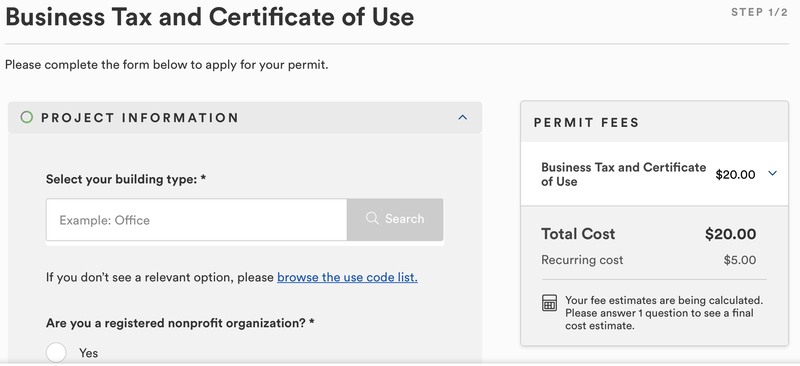

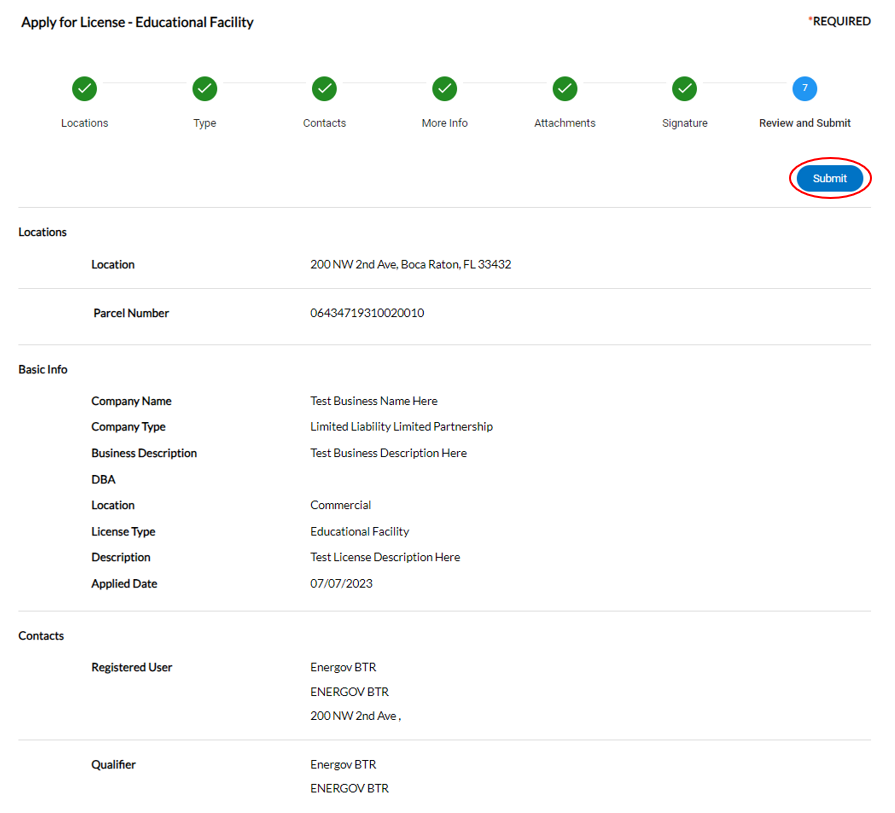

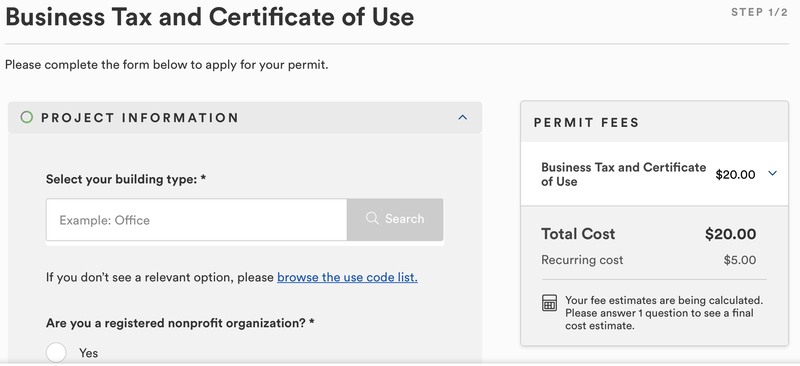

The application process for a Florida BTR varies slightly depending on the location of your business (county and municipality). Generally, you can apply either online through your local county’s website or in person at the designated tax collector’s office. Online applications often streamline the process, allowing for immediate submission and quicker processing times. However, in-person applications may be necessary for businesses requiring more personalized assistance or those with complex situations.

Required Documentation for Obtaining a Tax Receipt

Before beginning the application, gather all necessary documentation. This typically includes information about your business’s legal structure (sole proprietorship, partnership, LLC, corporation), owner(s) information, business address, business activity description (using the appropriate North American Industry Classification System [NAICS] code), and any relevant licenses or permits required for your specific business type. You may also need to provide proof of your business address, such as a utility bill or lease agreement. Failure to provide complete and accurate information can lead to delays or rejection of your application.

Renewing a Florida Business Tax Receipt

Renewing your Florida BTR is generally an annual process. The exact renewal date will be specified on your current receipt. The renewal process is similar to the initial application, typically involving an online portal or in-person visit to the tax collector’s office. You’ll need to update any changes to your business information and pay the applicable renewal fee. Failing to renew your BTR by the deadline can result in penalties and potential legal consequences.

Applying for a Florida Business Tax Receipt Online: A Step-by-Step Guide

Applying online is often the most efficient method. While specific steps may vary slightly depending on the county, the general process is similar.

- Navigate to the County Website: Begin by visiting the official website of the county where your business is located. Look for a section dedicated to “Business Taxes,” “Tax Collector,” or a similar designation. The website typically features a prominent link or search function to easily find the application portal. Imagine a website with a clean, modern design. The main navigation bar includes links such as “Home,” “Property Taxes,” “Vehicle Registration,” and “Business Taxes.” Clicking on “Business Taxes” takes you to a page with detailed information and a prominent “Apply Online” button.

- Locate the Online Application: Once on the business tax page, you should find a clear link to the online application for a BTR. The page may contain helpful FAQs, downloadable forms, and contact information. This page might include a brief overview of the application process and a list of required documents. The “Apply Online” button is clearly visible and prominently displayed near the top of the page.

- Create an Account (If Necessary): Some counties require users to create an online account before accessing the application. This usually involves providing basic information such as your email address and creating a password. A typical registration page would include fields for email address, password, password confirmation, and possibly a security question. Once registered, you’ll receive a confirmation email and can proceed to the application.

- Complete the Application Form: The online application form will require detailed information about your business, including legal structure, owner(s) details, business address, NAICS code, and a description of your business activities. The form will guide you through each field, often with clear instructions and validation checks to ensure accuracy. Imagine a multi-page form with clearly labeled fields and helpful tooltips explaining what information to enter in each section.

- Upload Supporting Documents: Upload any necessary supporting documents, such as proof of address, copies of licenses, or other relevant permits. The online portal usually has a dedicated section for document uploads, often with file size and type restrictions. A sample upload section might display a drag-and-drop area, along with a list of accepted file types (e.g., PDF, JPG) and maximum file size limits.

- Review and Submit: Carefully review all the information you’ve entered to ensure accuracy. Once you’re satisfied, submit your application. You will likely receive a confirmation number or email confirming the submission of your application. A confirmation page might display your application number, a summary of your submitted information, and instructions on what to expect next.

Fees and Renewal

The cost of obtaining and renewing a Florida Business Tax Receipt varies depending on the type of business and its location. Understanding these fees and the penalties for late renewal is crucial for maintaining compliance and avoiding unnecessary financial burdens. This section details the fee structure, payment options, and consequences of late renewal.

Fee Structure for Florida Business Tax Receipts

The fees associated with a Florida Business Tax Receipt are determined by the county in which the business operates. While there isn’t a statewide standardized fee, most counties base their fees on the type of business and sometimes the number of employees. It’s essential to check with your county’s tax collector’s office for the precise fee schedule. The following table provides a sample fee structure; however, these amounts should be considered estimates and may not reflect the actual fees in all counties. Always confirm fees with the relevant local authority.

| Business Type | County Fee (Example – May Vary) | State Fee (Example – May Vary) | Total Estimated Fee |

|---|---|---|---|

| Retail Sales | $50 | $0 | $50 |

| Service Business | $40 | $0 | $40 |

| Manufacturing | $75 | $0 | $75 |

| Wholesale | $60 | $0 | $60 |

Penalties for Late Renewal

Late renewal of a Florida Business Tax Receipt results in penalties. These penalties typically involve late fees, which increase over time. The exact amount of the penalty varies by county, but it’s common to see a percentage increase added to the original fee for each month the renewal is delayed. In some instances, the business might face additional administrative fees or even suspension of the business license until the receipt is renewed and penalties paid. For example, a late fee might start at 10% of the original fee for the first month of delay and increase to 20% for the second month, and so on. Prompt renewal is highly recommended to avoid these additional costs.

Acceptable Payment Methods

Most county tax collector’s offices offer a variety of payment methods for Business Tax Receipt fees. Common options include:

* Online Payment: Many counties provide online portals for convenient payment using credit cards (Visa, Mastercard, American Express, Discover), debit cards, or electronic checks.

* Mail: Payment can often be submitted via mail with a check or money order made payable to the county tax collector.

* In-Person Payment: Payments can usually be made in person at the county tax collector’s office, often using cash, check, money order, or credit/debit cards.

* Payment Kiosks: Some counties might have payment kiosks located in convenient public places.

Business Structure and Tax Receipts

The business structure you choose significantly impacts your Florida Business Tax Receipt application process and subsequent tax obligations. Understanding these differences is crucial for compliance and efficient business operation. Different structures have varying reporting requirements and tax liabilities, impacting both the application process and ongoing financial responsibilities.

The type of business entity you select dictates the information required on your application. Sole proprietorships, for instance, require different documentation than LLCs or corporations. This impacts not only the initial application but also the ongoing renewal process. Accurate identification of your business structure is paramount for a smooth and successful application.

Business Structure Requirements for Tax Receipt Applications

The following list details the specific requirements for different business structures when applying for a Florida Business Tax Receipt. Note that these requirements may be subject to change, so it’s always advisable to consult the official Florida Department of Revenue website for the most up-to-date information.

- Sole Proprietorship: Requires the owner’s Social Security number, name, and business address. Simple and straightforward, this structure directly links the business’s financial activity to the owner’s personal taxes. The application process generally involves providing basic business information and owner identification.

- Partnership: Requires the Social Security numbers and names of all partners, along with the business address. Partnerships are required to file a partnership return, even though each partner reports their share of the income on their individual tax returns. The application process will require detailed information on all partners.

- Limited Liability Company (LLC): Requires the LLC’s name, registered agent information, and the Taxpayer Identification Number (TIN) (either an Employer Identification Number (EIN) from the IRS or the Social Security Number of the owner if it’s a single-member LLC). The application process involves providing more formal documentation related to the LLC’s legal structure.

- Corporation (S Corp or C Corp): Requires the corporation’s name, registered agent information, and the EIN. Corporations have a more complex application process due to their formal legal structure and separate tax identity. Detailed corporate information, including officers and directors, will be required.

Tax Obligations for Different Business Structures in Florida

The tax obligations for different business structures vary significantly in Florida. Understanding these differences is essential for accurate tax filing and compliance. Failure to comply can result in penalties and legal repercussions.

- Sole Proprietorship: Profits and losses are reported on the owner’s personal income tax return (Form 1040, Schedule C). The owner pays self-employment taxes. This structure offers simplicity but lacks liability protection.

- Partnership: Income and losses are reported on a partnership return (Form 1065), and each partner reports their share of the income or loss on their individual tax returns. Partners pay self-employment taxes on their share of the partnership’s income.

- Limited Liability Company (LLC): Taxation depends on how the LLC is structured. A single-member LLC is typically taxed as a sole proprietorship, while a multi-member LLC is usually taxed as a partnership. LLCs offer limited liability protection, separating the owner’s personal assets from business liabilities.

- Corporation (S Corp or C Corp): S corporations pass their income through to their shareholders, who report it on their personal income tax returns. C corporations pay corporate income tax on their profits and shareholders pay taxes on dividends received. Corporations offer the strongest liability protection but come with increased administrative and tax complexities.

Exemptions and Exceptions

Not all businesses operating in Florida require a Business Tax Receipt (BTR). Several exemptions exist, depending on the nature of the business and its activities. Understanding these exemptions is crucial for compliance and avoiding potential penalties. Incorrectly assuming an exemption without proper verification can lead to significant legal and financial repercussions.

Certain business activities and structures are specifically excluded from the requirement to obtain a BTR. The process for claiming an exemption involves providing documentation to the relevant county or municipality to support the claim. Failure to comply with the BTR requirements can result in fines and other penalties.

Businesses Typically Exempt from BTR Requirements

Businesses operating under specific circumstances or engaging in particular activities are often exempt from needing a Florida Business Tax Receipt. These exemptions are clearly defined within Florida statutes and local ordinances. It is essential to carefully review these regulations to determine eligibility.

Examples of businesses typically exempt include:

- Certain non-profit organizations: Organizations that meet specific criteria for tax-exempt status under the Internal Revenue Code may be exempt from BTR requirements. This typically requires demonstrating a charitable purpose and meeting specific organizational requirements.

- Federal and state government agencies: These entities are generally exempt from local business licensing and taxation.

- Religious organizations: Religious institutions conducting activities consistent with their religious purpose may qualify for exemption.

- Businesses operating solely online without a physical presence in Florida: This can be a complex area, and the specific rules vary depending on the nature of the online business and its interaction with Florida consumers. A thorough understanding of Florida’s sales tax regulations is essential.

Applying for a BTR Exemption

The application process for a BTR exemption varies depending on the specific county or municipality. It typically involves submitting a detailed application outlining the reasons for claiming the exemption, along with supporting documentation that substantiates the claim. This documentation might include articles of incorporation, IRS determination letters, or other relevant legal documents.

Generally, the application should include:

- A completed application form obtained from the relevant county or municipal government.

- Supporting documentation proving eligibility for the claimed exemption.

- A clear and concise explanation of the business activities and why they qualify for the exemption.

Consequences of Operating Without a Required BTR

Operating a business in Florida without a required Business Tax Receipt can result in significant consequences. These consequences are intended to ensure compliance with local regulations and to prevent unfair competition.

Potential penalties include:

- Fines: The amount of the fine varies depending on the municipality and the length of time the business operated without a receipt.

- Suspension of business operations: The county or municipality may suspend operations until the BTR is obtained.

- Legal action: In some cases, the business may face legal action for non-compliance.

- Inability to obtain necessary licenses and permits: A valid BTR is often a prerequisite for obtaining other business licenses and permits.

Location and Jurisdiction

The location of your business in Florida significantly impacts the process of obtaining a business tax receipt. This is because Florida’s business tax receipt system is decentralized, meaning that while the state provides the overall framework, the specific requirements and application processes are often determined at the county and municipal levels. Understanding these local variations is crucial for compliance.

County and municipal governments have the authority to impose their own regulations on businesses operating within their jurisdictions, in addition to the state’s requirements. These local regulations can include additional fees, specific licensing requirements, or zoning restrictions that impact where a business can operate. This layered approach means that securing a business tax receipt involves navigating both state and local regulations, a process that can vary considerably depending on the location.

County and Municipal Regulation Differences

Local regulations frequently deviate from state-level requirements. For example, while the state might mandate a general business license, a specific county could require additional permits based on the nature of the business (e.g., a food service permit for restaurants, a contractor’s license for construction businesses). Similarly, the fees associated with obtaining a business tax receipt can vary substantially across different counties and municipalities. Some jurisdictions might have higher fees for certain business types or locations, reflecting their local economic priorities or infrastructure costs. Zoning regulations also play a role, dictating where specific types of businesses are permitted to operate. A business operating in a residential zone might face stricter regulations than one located in a designated commercial area.

Comparative Table of Requirements Across Florida Counties

The following table offers a simplified comparison. Note that this is not exhaustive and local regulations are subject to change. Always consult the relevant county and municipal websites for the most up-to-date information.

| County | Additional Local Fees (Example) | Specific Licensing Requirements (Example) | Zoning Considerations (Example) |

|---|---|---|---|

| Miami-Dade | $100-$500 (depending on business type) | Food service permit, occupational license | Strict zoning regulations in certain areas |

| Broward | $50-$200 (depending on business type and location) | Business license, signage permits | Regulations vary based on location (urban vs. rural) |

| Orange | Variable, often included in overall business license fee | Permits dependent on industry (e.g., alcohol sales) | Emphasis on environmental impact assessments in some areas |

| Hillsborough | $75-$300 (depending on business classification) | Fire safety inspections, health inspections (where applicable) | Mixed-use zoning common, leading to varied requirements |

Resources and Further Information

Securing a Florida Business Tax Receipt involves understanding various resources and accessing support from relevant agencies. This section provides crucial information to aid in the process, from navigating official websites to contacting support services. Knowing where to find the right information can significantly streamline the application process and avoid potential delays.

Government Websites and Contact Information, What is a business tax receipt in florida

The Florida Department of Revenue’s website is the primary source for information regarding business taxes and related matters. It provides comprehensive details on tax receipt applications, renewal procedures, and frequently asked questions. The website also offers downloadable forms and guides. Contact information, including phone numbers and email addresses for specific inquiries, is readily available on the site. Additionally, the website for your specific county’s tax collector’s office will provide local details and contact information relevant to your business location. These county offices often handle the processing of business tax receipts.

Assistance for Small Business Owners

Numerous resources are available to assist small business owners in navigating the complexities of obtaining and maintaining a Florida Business Tax Receipt. The Florida Small Business Development Centers (SBDCs) offer free counseling and workshops on various business-related topics, including tax compliance. These centers provide expert guidance and support tailored to the needs of small businesses. Furthermore, the U.S. Small Business Administration (SBA) provides a wealth of resources, including online tools, publications, and workshops, that address various aspects of business management, including tax regulations and compliance. Local chambers of commerce also often offer support and networking opportunities for small business owners in their community, which can include assistance with understanding and applying for business licenses and permits.

Frequently Asked Questions (FAQs)

Understanding common questions and their answers can prevent confusion and delays during the application process. Here are some frequently asked questions and their corresponding answers:

- What is the difference between a business tax receipt and a business license? A business tax receipt is a proof of payment of business taxes in Florida, while a business license is a separate permit required for certain businesses to operate legally. Some businesses may require both.

- How long does it take to receive a business tax receipt after applying? The processing time varies depending on the county and the completeness of the application. However, most applications are processed within a few business days to a couple of weeks.

- What happens if I don’t renew my business tax receipt on time? Failure to renew your receipt on time may result in penalties and potential legal issues, including suspension of business operations.

- Can I apply for a business tax receipt online? Many counties allow online applications, but some may still require paper applications. Check your county’s tax collector’s website for specific instructions.

- What information do I need to provide when applying for a business tax receipt? The required information typically includes your business name, address, owner information, type of business, and the North American Industry Classification System (NAICS) code for your business.