What’s the difference between a company and a business? This seemingly simple question unveils a complex world of legal structures, ownership models, and operational scales. Understanding these distinctions is crucial for entrepreneurs, investors, and anyone navigating the business landscape. This guide delves into the core differences, exploring legal formations, ownership structures, operational sizes, strategic goals, funding methods, and marketing approaches, providing a comprehensive overview to clarify the often-blurred lines between these two terms.

While often used interchangeably, “company” and “business” represent distinct legal and operational realities. A business can be a sole proprietorship run from a home office, while a company might be a publicly traded corporation with thousands of employees. This exploration will illuminate the key differentiators, helping you understand the implications of choosing one structure over the other. We’ll unpack the legal complexities, ownership dynamics, and resource implications inherent in each, providing a practical framework for informed decision-making.

Legal Structure and Formation

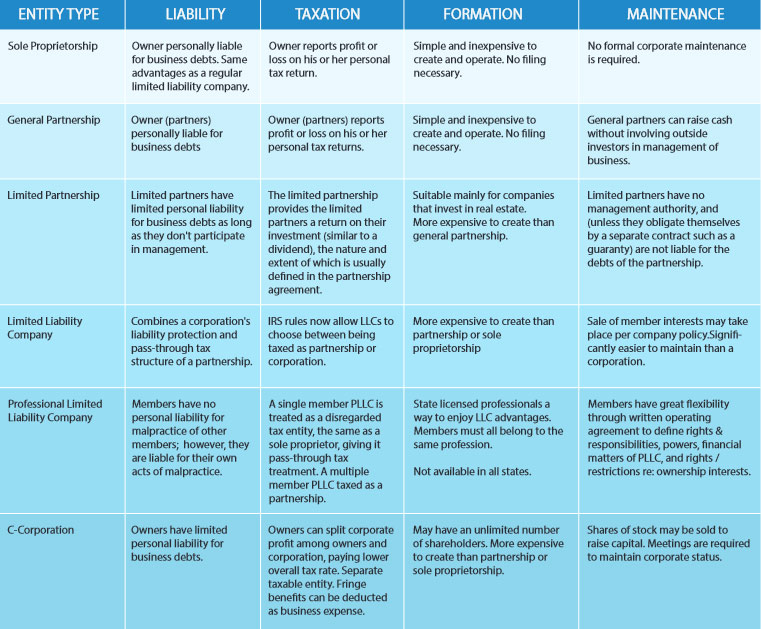

Choosing the right legal structure is a crucial first step for any business, significantly impacting liability, taxation, and administrative burden. The distinction between a “company” and a “business” often blurs because the term “company” generally refers to a specific type of business structure (typically a corporation or LLC), while “business” encompasses a broader range of structures. Understanding these differences is vital for navigating the legal landscape.

Available Legal Structures for Companies and Businesses

Businesses can operate under various legal structures, each offering a unique blend of advantages and disadvantages. Sole proprietorships are the simplest, with the business and owner legally indistinguishable. Partnerships involve two or more individuals sharing ownership and responsibility. Limited Liability Companies (LLCs) offer the benefit of limited liability, separating personal assets from business debts. Corporations, either S corporations or C corporations, are more complex, offering limited liability and potential tax advantages but demanding more stringent regulatory compliance. “Companies,” as a term, often refers to LLCs and corporations, implying a more formal and structured entity.

Company and Business Formation Processes

Forming a sole proprietorship or partnership typically involves minimal paperwork; often, it’s as simple as starting operations under a chosen business name. LLCs and corporations, however, require more formal registration with the relevant state authorities. This process includes filing articles of organization (LLC) or articles of incorporation (corporation), choosing a registered agent, and adhering to ongoing compliance requirements such as annual reports and franchise taxes. The complexity and cost of formation increase significantly as the legal structure becomes more formal.

Liability Implications for Owners

The legal structure significantly impacts the owner’s personal liability. In a sole proprietorship or partnership, the owner(s) are personally liable for all business debts and obligations. This means personal assets are at risk if the business incurs debt or faces lawsuits. LLCs and corporations offer limited liability, protecting personal assets from business liabilities. However, there are exceptions, such as cases of personal guarantees or fraudulent actions. The level of protection offered by limited liability varies slightly depending on the jurisdiction and the specifics of the business operation.

Tax Implications of Different Business Structures

The tax implications of different structures vary considerably. The following table summarizes key differences:

| Structure | Taxation | Filing Requirements | Tax Rate |

|---|---|---|---|

| Sole Proprietorship | Pass-through taxation (owner’s personal income tax) | Schedule C with personal income tax return | Individual income tax brackets |

| Partnership | Pass-through taxation (partners’ personal income tax) | Partnership return (Form 1065) and individual tax returns | Individual income tax brackets |

| LLC (Single-Member) | Pass-through taxation (owner’s personal income tax) or can elect to be taxed as a corporation | Schedule C or Form 1120 | Individual income tax brackets or corporate tax rates |

| LLC (Multi-Member) | Pass-through taxation (members’ personal income tax) or can elect to be taxed as a corporation | Form 1065 or Form 1120 | Individual income tax brackets or corporate tax rates |

| S Corporation | Pass-through taxation (shareholders’ personal income tax) | Form 1120-S | Individual income tax brackets |

| C Corporation | Corporate income tax and potentially double taxation on dividends | Form 1120 | Corporate tax rates |

Ownership and Control

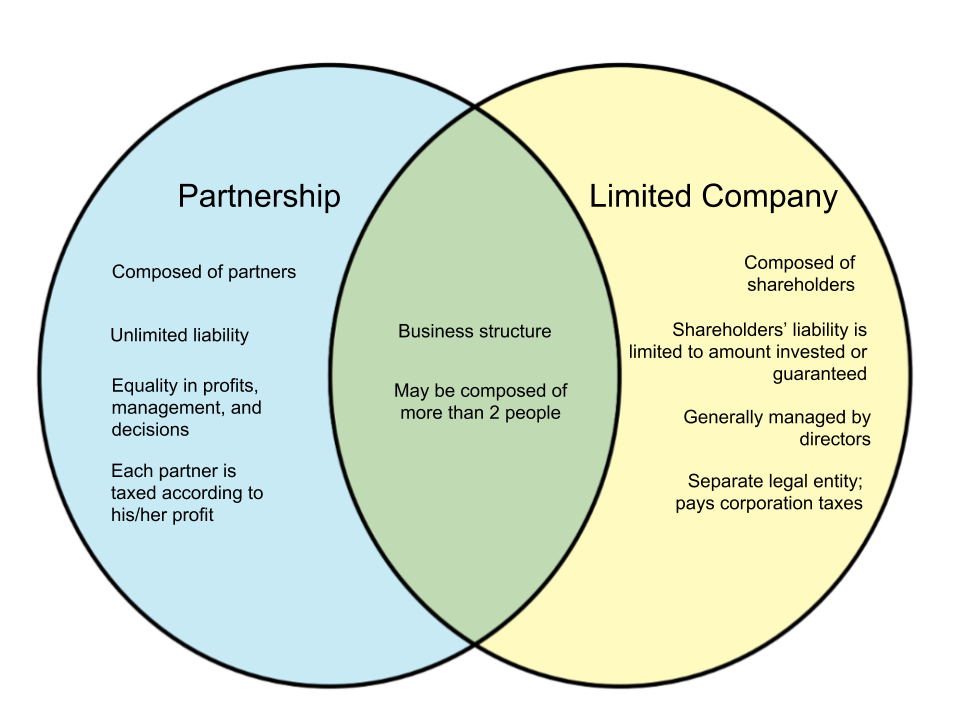

The fundamental difference between a company and a business lies in their ownership and control structures. While the term “business” encompasses a broad range of organizational forms, the term “company” typically refers to a legally incorporated entity, significantly impacting ownership and control distribution. This section will delve into the nuances of these differences, examining key stakeholders and decision-making processes.

Companies, particularly corporations, often exhibit a separation of ownership and control. Shareholders own the company, holding equity representing their ownership stake. However, day-to-day management and strategic decision-making are typically delegated to a board of directors and professional management. In contrast, businesses operating as sole proprietorships or partnerships have a more direct alignment between ownership and control, with owners directly involved in managing the operations.

Ownership Structures and Decision-Making

The ownership structure profoundly impacts the decision-making process. In a sole proprietorship, the owner holds absolute control, making all decisions independently. A partnership involves shared ownership and control, potentially leading to collaborative decision-making or, if disagreements arise, conflict. Corporations, with their numerous shareholders, typically rely on a hierarchical structure. Major decisions are often made by the board of directors, representing shareholder interests, while smaller operational decisions are handled by management. For example, a small family-owned bakery (a business) might have the owner decide on a new menu item based on personal preference, while a publicly traded food company (a company) would likely conduct market research and analyze financial projections before launching a new product. This difference reflects the broader scope and complexity inherent in larger corporate structures.

Key Stakeholders in Companies and Businesses

The stakeholders involved also differ significantly. A sole proprietorship’s key stakeholders are primarily the owner and their immediate family, potentially including creditors. A partnership adds the partners themselves. In contrast, a company’s stakeholders are far more diverse, including shareholders, board members, employees, customers, creditors, and the community. A publicly traded company must consider the interests of all these stakeholders, especially shareholders, as their decisions directly impact the company’s stock price and overall performance. For instance, a small family-run restaurant (a business) prioritizes the owner’s family’s income and customer satisfaction. A large restaurant chain (a company), however, must balance profitability with employee wages, food sourcing ethics, and investor returns.

Control Mechanisms in Companies and Businesses

Control mechanisms also vary. In a sole proprietorship or partnership, control is directly exercised by the owners. In companies, control is more dispersed. Shareholders exert influence through voting rights, electing the board of directors. The board then appoints executives who manage the day-to-day operations. Mechanisms such as shareholder agreements, voting rights structures, and corporate governance codes further define the distribution and exercise of control. For example, a privately held company might have a controlling shareholder with a significant ownership stake who wields substantial influence. Conversely, a publicly traded company’s control is more diffuse, distributed among many shareholders, with management exercising operational control under the oversight of the board of directors. This creates a system of checks and balances designed to protect shareholder interests and prevent mismanagement.

Size and Scale of Operations

Companies and businesses differ significantly in their size and scale of operations. This difference is a key factor influencing their strategic choices, resource allocation, and overall market impact. While the line between a “company” and a “business” can be blurry, understanding the typical operational differences helps clarify the distinctions.

The typical size and scale of operations vary considerably between companies and businesses. Businesses, particularly small businesses, often operate on a smaller scale, serving a niche market or local community. Companies, on the other hand, tend to be larger, with operations spanning multiple locations, often nationally or internationally, and catering to a broader customer base. This scale difference significantly impacts their operational complexity, resource requirements, and market reach.

Industry Predominance

Small businesses are prevalent in industries like restaurants, retail (especially independent shops), personal services (hairdressers, plumbers), and local artisan crafts. These industries often require lower initial investment and can be more easily managed by a small team or even a single individual. Conversely, large companies dominate industries such as manufacturing (automotive, aerospace), technology (software development, telecommunications), finance (banking, insurance), and energy (oil, gas). These industries require substantial capital investment, complex infrastructure, and large workforces.

Resource Access and Market Opportunities

Size directly influences access to resources and market opportunities. Large companies typically have greater access to capital through various funding channels, including equity financing, debt financing, and bond issuances. They also benefit from economies of scale, allowing them to produce goods and services at lower unit costs. Their extensive resources enable them to invest heavily in research and development, marketing, and distribution, providing access to wider market opportunities, both domestically and internationally. Smaller businesses often face challenges securing funding and may rely on personal savings, loans from family and friends, or smaller business loans. Their market reach is often more limited, focusing on local or regional markets. However, smaller businesses can also leverage agility and adaptability to respond quickly to market changes and customer needs, providing a competitive advantage in certain sectors.

Small Businesses vs. Large Companies: Key Characteristics, What’s the difference between a company and a business

The following table summarizes key characteristics differentiating small businesses from large companies:

| Characteristic | Small Business | Large Company |

|---|---|---|

| Size | Small workforce, limited geographic reach | Large workforce, extensive geographic reach (often multinational) |

| Ownership | Often sole proprietorship, partnership, or small number of owners | Typically publicly traded or owned by a large number of shareholders |

| Funding | Relies on personal savings, loans, or smaller business loans | Access to various funding channels, including equity financing, debt financing, and bond issuances |

| Management | Often owner-managed or managed by a small team | Complex organizational structure with multiple layers of management |

| Market Reach | Typically serves a local or regional market | Serves a broad national or international market |

| Growth Potential | Growth potential can be limited by resources and market size | Significant growth potential due to access to resources and market opportunities |

| Risk Tolerance | Higher risk tolerance often needed due to limited resources | Risk management is more sophisticated and resources are available to mitigate risk |

Goals and Objectives

Companies and businesses, while often used interchangeably, diverge significantly in their overarching goals and objectives. This difference stems from their fundamental structures, ownership, and operational scales, all impacting their long-term vision and short-term strategies. Understanding these distinctions is crucial for navigating the complexities of the business world.

Companies, particularly larger, publicly traded ones, often prioritize shareholder value maximization. This translates into a focus on profitability, consistent growth, and increasing market share. Their objectives are frequently articulated in formal strategic plans, outlining measurable targets and timelines. Businesses, on the other hand, may have more diverse and flexible goals, encompassing profit generation but also potentially prioritizing factors like community impact, employee well-being, or maintaining a specific lifestyle for the owner.

Long-Term versus Short-Term Planning

Companies typically engage in extensive long-term planning, often projecting five, ten, or even twenty years into the future. This involves detailed market analysis, competitive assessments, and financial modeling to guide strategic investments and resource allocation. Such long-term vision is essential for sustained growth and competitiveness in the long run. Short-term planning, while necessary for operational efficiency, is firmly grounded within the context of the overarching long-term strategy. Businesses, conversely, might focus more on shorter-term goals, adapting quickly to changing market conditions and prioritizing immediate profitability or operational needs. While long-term vision may exist, it is often less formalized and more readily adjusted based on immediate circumstances.

Strategies for Achieving Goals

Companies frequently employ sophisticated strategies involving mergers and acquisitions, strategic alliances, and extensive marketing campaigns to achieve their objectives. These strategies are often supported by substantial financial resources and a dedicated team of specialists. Their approach is typically more systematic and data-driven, relying on market research and analytical tools to guide decision-making. Businesses, in contrast, may adopt more agile and adaptable strategies, leveraging personal networks, creative marketing tactics, and flexible operational models to reach their goals. Their approach often relies on the owner’s entrepreneurial skills and adaptability to changing market dynamics.

Metrics for Measuring Success

The metrics used to measure success differ significantly between companies and businesses.

| Metric | Company | Business |

|---|---|---|

| Profitability | Return on Equity (ROE), Return on Assets (ROA), Net Profit Margin | Gross profit, Net profit, Cash flow |

| Growth | Revenue growth rate, Market share, Earnings per share (EPS) | Customer growth, Revenue growth (often less formalized), Expansion into new markets |

| Market Position | Brand recognition, Market capitalization, Competitive advantage | Local market share, Customer loyalty, Brand awareness within a specific niche |

| Efficiency | Inventory turnover, Asset turnover, Operating efficiency ratios | Operational efficiency measured through streamlined processes and cost control, often less formalized |

Funding and Resources: What’s The Difference Between A Company And A Business

Companies and businesses differ significantly in their approaches to securing funding and accessing resources. While both require capital and resources to operate, the scale, methods, and associated transparency vary considerably depending on their legal structure and overall ambitions. This section will explore these key distinctions.

Companies, particularly larger corporations, often have access to a wider array of funding options and resources compared to smaller businesses. This disparity stems from factors like established track records, stronger creditworthiness, and greater investor confidence. Conversely, smaller businesses frequently rely on more limited funding avenues and may face greater challenges in securing significant capital investments.

Funding Sources for Companies and Businesses

The methods employed to secure funding differ considerably between companies and businesses. Companies, due to their size and established presence, often utilize a mix of debt and equity financing, including large-scale bank loans, bond issuances, and private equity investments. Businesses, conversely, may rely more heavily on bootstrapping, smaller business loans, crowdfunding, or angel investors.

- Companies: Typically utilize a diverse portfolio of funding options, including bank loans, corporate bonds, venture capital, private equity, and initial public offerings (IPOs). Large corporations might issue bonds to raise capital directly from the public market. Venture capital firms invest significant sums in high-growth companies in exchange for equity, while private equity firms acquire existing companies or invest in their expansion. An IPO allows a company to raise capital by selling shares of its stock to the public on a stock exchange.

- Businesses: Often rely on more limited funding sources, including small business loans from banks or credit unions, lines of credit, crowdfunding platforms (e.g., Kickstarter, Indiegogo), angel investors (high-net-worth individuals who provide funding in exchange for equity), and personal savings (bootstrapping). Small business loans often come with stricter requirements and higher interest rates than those available to larger companies.

Access to Resources

The disparity in funding translates directly into access to resources. Companies generally possess greater access to human capital (skilled employees), advanced technology, and robust infrastructure. This is largely due to their ability to attract and retain top talent through competitive salaries and benefits packages, invest in cutting-edge technology, and establish extensive operational networks. Businesses, particularly smaller ones, may struggle to compete on these fronts, often relying on leaner teams and more cost-effective solutions.

- Companies: Often have dedicated departments for human resources, research and development, and information technology, enabling them to attract and retain skilled employees, develop innovative technologies, and maintain sophisticated infrastructure. They can afford to invest in extensive training programs and cutting-edge technologies, giving them a competitive edge.

- Businesses: May have limited resources and rely on outsourcing or partnerships to access specialized skills or technology. Their infrastructure is often smaller and less sophisticated than that of larger companies, impacting their ability to scale operations quickly.

Financial Reporting and Transparency

Companies, particularly publicly traded ones, face significantly stricter financial reporting and transparency requirements compared to businesses. Public companies are obligated to adhere to stringent accounting standards (e.g., Generally Accepted Accounting Principles or GAAP) and regularly disclose financial information to investors and regulatory bodies. This level of scrutiny ensures accountability and protects investors. Businesses, depending on their legal structure and size, may have less stringent reporting requirements.

- Companies (Public): Subject to rigorous auditing and reporting requirements, often involving quarterly and annual financial statements, SEC filings (in the US), and independent audits. This ensures transparency and accountability to shareholders and the public.

- Businesses: Reporting requirements vary widely based on legal structure and size. Sole proprietorships and partnerships may have less stringent reporting requirements than LLCs or corporations. Smaller businesses may only need to file basic tax returns.

Marketing and Branding

Companies and businesses, while sharing the fundamental goal of profit generation, often diverge significantly in their marketing and branding approaches. These differences stem from variations in size, resources, target audience, and long-term strategic objectives. Understanding these nuances is crucial for effective market positioning and sustainable growth.

Companies, typically larger organizations with established brand recognition, often leverage extensive resources for sophisticated marketing campaigns. Businesses, conversely, may rely on more targeted, cost-effective strategies due to their smaller scale and often limited budgets. This difference significantly impacts the scope and reach of their marketing efforts.

Marketing Strategy Comparisons

Large companies frequently utilize multi-channel marketing strategies encompassing television advertising, print media, extensive digital campaigns (including , SEM, social media marketing, and content marketing), and public relations. They often invest heavily in brand building, aiming for broad market penetration and widespread brand awareness. Businesses, on the other hand, may focus on more localized marketing tactics, such as direct mail, local advertising, community engagement, and targeted online advertising. They may prioritize building strong relationships with individual customers over broad brand recognition. For example, a large multinational corporation might launch a national television campaign, while a local bakery might focus on building a loyal customer base through loyalty programs and community events.

Branding Differences Between Large Companies and Smaller Businesses

Large companies often cultivate a strong, consistent brand identity across all platforms. Their branding is typically well-defined, with established logos, brand guidelines, and messaging. This consistency helps build brand recognition and trust. Smaller businesses may have a less formally defined brand identity, relying more on word-of-mouth marketing and personal connections to establish brand reputation. For example, a well-known tech company like Apple maintains a meticulous and globally consistent brand image, while a local artisan might primarily rely on the quality of their handcrafted products and positive customer reviews to build their brand.

Target Audience Differences

Companies typically target large, diverse market segments. Their marketing materials aim to appeal to a broad range of demographics and interests. Businesses, in contrast, often focus on niche markets or specific customer segments. They tailor their marketing messages to resonate with the unique needs and preferences of their target audience. A large clothing retailer might target a broad demographic of young adults, while a specialized boutique might focus on a specific style or body type.

Examples of Marketing Materials

To illustrate the differences, consider these examples: A large corporation might release a visually stunning, emotionally resonant television commercial during a prime-time slot, showcasing its brand values and aspirational lifestyle. In contrast, a small business might create a simple, informative flyer detailing their products or services and distributing it within the local community. A large company might run a sophisticated digital advertising campaign targeting specific online user demographics based on extensive data analysis, while a small business might use social media to engage directly with its customers and build relationships.