Can you file your business and personal taxes separately? This crucial question impacts every business owner, from solo entrepreneurs to larger corporations. Understanding the nuances of separate filing—its legal ramifications, financial implications, and record-keeping requirements—is paramount to minimizing tax liabilities and maximizing financial health. This guide unravels the complexities, offering clarity on the advantages and disadvantages, common pitfalls, and the importance of seeking professional guidance when navigating this intricate tax landscape.

We’ll explore the different business structures and their respective tax implications, examining how the choice between separate or combined filing affects liability, asset protection, and overall financial strategy. We’ll provide practical advice on maintaining meticulous financial records, claiming legitimate deductions, and avoiding common mistakes that can lead to costly penalties. Ultimately, this guide empowers you to make informed decisions regarding your tax obligations, ensuring compliance and optimizing your financial well-being.

Business vs. Personal Tax Structures

Understanding the differences between business and personal tax structures is crucial for any entrepreneur or business owner in the US. Failure to properly delineate these structures can lead to significant tax liabilities and penalties. This section will clarify the fundamental distinctions, outlining various business entity types and their tax implications, and comparing the relevant tax forms.

Business Entity Types and Their Tax Implications

The choice of business structure significantly impacts tax obligations. Sole proprietorships, partnerships, Limited Liability Companies (LLCs), and corporations each have unique tax treatments. Selecting the appropriate structure requires careful consideration of factors such as liability protection, administrative burden, and tax efficiency.

Tax Forms Used for Business and Personal Returns

Personal income tax is reported using Form 1040, while business tax filings vary depending on the entity type. Sole proprietorships report business income and expenses on Schedule C (Form 1040), while partnerships use Form 1065 (U.S. Return of Partnership Income). LLCs, depending on their classification, may file as sole proprietorships, partnerships, or corporations. Corporations file Form 1120 (U.S. Corporate Income Tax Return). Understanding the specific form required for your business structure is paramount to accurate and timely filing.

Comparison of Tax Structures for Different Business Entities

The following table summarizes key tax differences between common business structures in the US. Note that this is a simplified overview, and specific tax situations can be complex, requiring professional advice.

| Entity Type | Filing Requirements | Tax Rates | Deductions |

|---|---|---|---|

| Sole Proprietorship | Schedule C (Form 1040) | Individual income tax rates | Business expenses, qualified business income (QBI) deduction |

| Partnership | Form 1065; partners report share of income on Form 1040, Schedule K-1 | Individual income tax rates (for partners) | Business expenses, pass-through deductions |

| LLC (as disregarded entity) | Schedule C (Form 1040) | Individual income tax rates | Business expenses, qualified business income (QBI) deduction |

| LLC (as partnership) | Form 1065; members report share of income on Form 1040, Schedule K-1 | Individual income tax rates (for members) | Business expenses, pass-through deductions |

| LLC (as S corporation) | Form 1120-S | Individual income tax rates (for shareholders) | Business expenses, pass-through deductions |

| C Corporation | Form 1120 | Corporate income tax rates | Business expenses |

Legal and Financial Implications of Separate Filing: Can You File Your Business And Personal Taxes Separately

Filing business and personal taxes separately has significant legal and financial implications for business owners. The decision to do so hinges on a careful assessment of potential benefits and drawbacks, considering factors such as liability, asset protection, and tax optimization strategies. Understanding these implications is crucial for making informed decisions that align with individual circumstances and long-term financial goals.

Liability and Asset Protection

Separating business and personal finances through separate tax filings offers a degree of liability protection. In the event of lawsuits or business debts, creditors generally cannot access personal assets if the business is structured as a separate legal entity (like an LLC or corporation) and maintained with meticulous financial separation. However, this protection isn’t absolute. Failure to maintain a strict separation between business and personal finances, including commingling funds or neglecting to properly document transactions, can weaken this protection and expose personal assets to liability. Courts may disregard the separate legal entity if they find evidence of inadequate separation. For instance, if a sole proprietor commingles personal and business funds in the same bank account, a court might pierce the corporate veil and allow creditors to seize personal assets to satisfy business debts.

Tax Advantages and Disadvantages of Separate Filing

Separate filing can offer tax advantages, depending on the business structure and profitability. For example, a small business structured as an S-corporation or LLC might allow for the owner to take a salary and distribute profits as dividends, potentially reducing the overall tax burden by utilizing different tax brackets. However, separate filing can also lead to increased administrative complexity and professional fees for tax preparation. Furthermore, certain deductions or credits may be unavailable when filing separately, especially for businesses with significant losses. Consider a small business owner with a net loss. While this loss might offset personal income if filed jointly, separate filing might not allow for this offset, resulting in a higher overall tax burden that year.

Scenario: Financial Implications for a Small Business Owner

Let’s consider Sarah, a freelance graphic designer operating as a sole proprietor. If Sarah files jointly, any business losses could potentially offset her personal income, reducing her overall tax liability. However, if she incorporates her business as an LLC and files separately, she could potentially deduct business expenses, such as software subscriptions and office supplies, reducing her business tax liability. However, she’ll also incur accounting and legal fees associated with maintaining the separate entity. The financial advantage of separate filing depends on the magnitude of her business expenses, her profit margins, and the cost of professional services. If her business generates significant profits, the potential tax savings from separate filing, coupled with the enhanced liability protection, might outweigh the additional costs. Conversely, if her business operates at a loss or with low profits, the additional expenses might negate any tax benefits.

Record Keeping and Documentation

Maintaining meticulous financial records is paramount for both business and personal tax filings. Accurate record-keeping simplifies tax preparation, minimizes the risk of errors, and significantly reduces the likelihood of an audit. It also provides valuable insights into your financial health, allowing for better financial planning and decision-making. The specific requirements vary depending on your business structure and personal circumstances, but the core principles of organization and accuracy remain consistent.

Proper record-keeping is crucial for minimizing tax liabilities and avoiding audits. The IRS and other tax authorities expect taxpayers to maintain comprehensive and accurate records. Failure to do so can result in penalties, interest charges, and even legal action. Furthermore, well-maintained records provide a clear and readily available audit trail, simplifying the process should an audit occur and demonstrating compliance with tax laws. This proactive approach can save significant time, money, and stress.

Key Documents for Business and Personal Tax Filings

This section details the essential documents needed for both business and personal tax returns. Having these readily accessible ensures a smooth and efficient tax filing process.

- Business Tax Filings: This includes income statements (profit and loss statements), balance sheets, bank statements, invoices, receipts for expenses, payroll records (if applicable), loan documents, depreciation schedules, and any other documentation related to business income and expenses. For example, a sole proprietor might need detailed records of all income and expenses related to their business, while an LLC might need more complex financial statements reflecting the entity’s structure.

- Personal Tax Filings: These typically include W-2 forms (for wages), 1099 forms (for independent contractor income), interest statements (1099-INT), dividend statements (1099-DIV), mortgage interest statements, charitable donation receipts, and records of other income and deductions. For instance, if you itemize deductions, you’ll need detailed records of your medical expenses, state and local taxes, and charitable contributions to support your deductions.

Essential Financial Records Categorized

Organizing financial records by category simplifies access and analysis. The following categories represent a comprehensive framework for maintaining organized records.

- Income: This includes all sources of income, such as wages, salaries, self-employment income, investment income (interest, dividends), rental income, and capital gains. Each income source should be meticulously documented with supporting evidence. For example, a freelancer should keep detailed records of each client invoice and payment received.

- Expenses: This category encompasses all business and personal expenses. For businesses, this includes cost of goods sold, rent, utilities, salaries, marketing expenses, and professional fees. For personal taxes, this includes mortgage interest, property taxes, charitable contributions, medical expenses, and educational expenses. Each expense should be supported by a receipt or other documentation. For instance, a business owner should keep receipts for all office supplies purchased.

- Assets: This includes a record of all assets owned, such as real estate, vehicles, investments, and business equipment. Documentation might include purchase agreements, titles, and investment statements. For example, a business owner needs to track the value and depreciation of business equipment.

- Liabilities: This category lists all outstanding debts, including loans, mortgages, credit card balances, and business lines of credit. Documentation should include loan agreements and statements showing outstanding balances. For instance, a business should maintain records of all outstanding business loans and credit card debts.

Tax Deductions and Credits

Filing business and personal taxes separately allows for a more precise allocation of deductions and credits, optimizing tax liability. Understanding the differences between business and personal deductions is crucial for maximizing tax savings. This section details common deductions and credits available, highlighting the key distinctions and requirements for claiming them.

Business Versus Personal Tax Deductions

Business deductions reduce your business’s taxable income, while personal deductions reduce your personal taxable income. The key difference lies in the source of the expense: business-related expenses are deductible on your business return, while personal expenses are deductible on your personal return. However, some expenses can blur the lines, particularly for self-employed individuals or small business owners operating from home. Proper categorization is vital to avoid IRS penalties.

Claiming Business-Related Deductions on a Personal Return

For self-employed individuals, business expenses are often claimed as itemized deductions on Schedule C (Profit or Loss from Business) of Form 1040, the U.S. individual income tax return. This schedule requires detailed record-keeping and documentation to substantiate each deduction. Failure to provide sufficient documentation can lead to the IRS disallowing the deduction. Accurate record-keeping is paramount.

Examples of Common Business Deductions

Properly categorizing expenses is key to maximizing deductions. Here are some examples:

- Home Office Deduction: If a portion of your home is exclusively used for business, you can deduct a percentage of your home-related expenses, such as mortgage interest, rent, utilities, and depreciation. The portion of your home used for business must be regularly and exclusively used for business purposes. The IRS provides detailed guidelines on calculating this deduction.

- Vehicle Expenses: If you use your vehicle for business, you can deduct expenses such as gas, oil, repairs, insurance, and depreciation. You can use either the standard mileage rate or the actual expense method to calculate your deduction. Accurate mileage logs are essential for substantiating this deduction.

- Office Supplies and Equipment: The cost of office supplies, software, and equipment used for your business is deductible. This includes items such as pens, paper, computers, and printers. Costs are typically expensed in the year they are purchased unless they qualify for depreciation.

- Professional Fees: Fees paid to accountants, lawyers, and other professionals for business-related services are deductible. Retain invoices and receipts as proof of payment.

Criteria for Claiming Specific Business Tax Credits

Business tax credits directly reduce your tax liability, unlike deductions which reduce taxable income. Eligibility criteria vary widely depending on the specific credit. For example:

- Research and Development Tax Credit: This credit is available for businesses that invest in qualified research activities. Specific criteria regarding the type of research and the expenses qualify must be met. Detailed documentation of research expenses is necessary.

- Work Opportunity Tax Credit (WOTC): This credit incentivizes hiring individuals from certain targeted groups, such as veterans or ex-offenders. The employer must meet specific hiring requirements and documentation needs to claim this credit.

Careful review of IRS publications and consultation with a tax professional are recommended to ensure eligibility for any business tax credit. Meeting all requirements is essential to avoid potential audit issues.

Common Mistakes and How to Avoid Them

Filing separate business and personal taxes offers significant advantages, but navigating the complexities can lead to errors. Understanding common pitfalls and implementing preventative measures is crucial for minimizing tax liabilities and avoiding penalties. This section details frequent mistakes, their consequences, and practical strategies for accurate filing.

Incorrect Classification of Expenses

One of the most prevalent errors involves misclassifying business and personal expenses. Improperly allocating expenses can lead to an underpayment of business taxes or an overstatement of business losses, resulting in audits and potential penalties. For instance, claiming personal travel as a business expense or vice-versa can trigger IRS scrutiny. To avoid this, maintain meticulous records separating business and personal expenditures. Use dedicated business credit cards and bank accounts, and meticulously categorize all receipts and invoices. Detailed expense reports, categorized by tax code, are essential. Remember that the IRS scrutinizes deductions, so substantiation is paramount. Failure to accurately categorize expenses can result in penalties ranging from 20% to 40% of the underpaid tax, plus interest.

Ignoring Estimated Tax Payments

Self-employed individuals and business owners are responsible for making estimated tax payments quarterly. Failing to pay estimated taxes on time or in the correct amount results in penalties and interest charges. The penalty for underpayment can be substantial, accumulating interest from the due date of each payment. Accurate income projection is key to avoiding this mistake. Consult a tax professional to determine the appropriate payment schedule based on your anticipated income and deductions. Utilizing tax software or online tools can aid in accurate estimations. Keeping detailed records of income and expenses throughout the year is crucial for accurate projections.

Inconsistent Record Keeping

Maintaining consistent and organized records is paramount. Lack of proper documentation makes it difficult to substantiate deductions and credits, leading to disallowed claims and potential audits. The IRS requires taxpayers to maintain sufficient records to support their tax filings. This includes receipts, invoices, bank statements, and other relevant documents. A disorganized record-keeping system can lead to significant time and financial burdens during tax season, increasing the risk of errors and penalties. Implementing a robust record-keeping system, perhaps utilizing accounting software or a dedicated filing system, will mitigate this risk. Regularly review and update records to ensure accuracy and completeness.

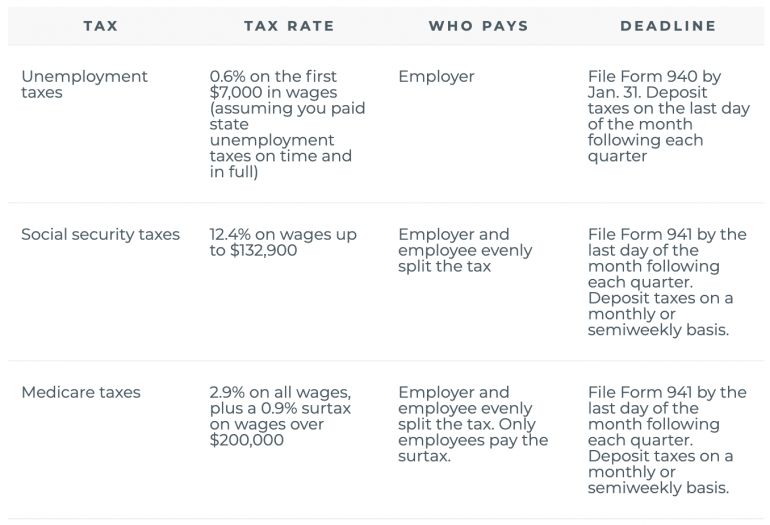

Failure to Understand Self-Employment Taxes

Self-employed individuals are responsible for paying both income tax and self-employment tax, which covers Social Security and Medicare taxes. Failing to accurately calculate and pay self-employment taxes leads to penalties and interest charges. Self-employment taxes are calculated on a portion of net earnings. Understanding this calculation and accurately reporting it is crucial. Incorrect calculation of self-employment taxes can result in significant penalties and interest. Consult a tax professional to ensure accurate calculation and timely payment.

Flowchart for Accurate Tax Filing

The following flowchart illustrates the steps involved in accurately filing both business and personal tax returns:

[A textual description of a flowchart is provided below, as image generation is outside the scope of this response. The flowchart would visually represent the steps.]

Start -> Gather all financial records (business and personal) -> Categorize expenses (business vs. personal) -> Calculate business income and expenses -> Calculate personal income and expenses -> Prepare business tax return -> Prepare personal tax return -> Review both returns for accuracy -> File both returns by the deadline -> End. Each step could have branching pathways for additional considerations, such as estimated tax payments or consulting a tax professional.

Seeking Professional Advice

Navigating the complexities of filing separate business and personal taxes can be challenging, even for experienced individuals. The potential for errors, missed deductions, and penalties is significant, highlighting the considerable value of seeking professional guidance. A qualified tax professional can provide expertise, ensuring compliance and maximizing tax benefits.

The benefits of consulting a tax professional extend beyond simple compliance. They offer a deeper understanding of tax laws, helping you strategically plan for future tax liabilities and identify opportunities for optimization. This proactive approach can save you significant time and money in the long run, minimizing the risk of costly mistakes.

Types of Tax Professionals

Several types of professionals specialize in tax preparation and planning. Certified Public Accountants (CPAs) are licensed professionals who have passed rigorous examinations and meet stringent experience requirements. They possess extensive knowledge of accounting principles and tax laws, often offering a broader range of financial services beyond tax preparation. Enrolled Agents (EAs) are federally licensed tax practitioners who specialize in representing taxpayers before the IRS. They undergo rigorous testing and have extensive experience in tax resolution and preparation. Tax attorneys, while not solely focused on tax preparation, possess legal expertise in tax law and can provide valuable counsel on complex tax matters, particularly those involving legal disputes or significant financial implications. Choosing the right professional depends on your specific needs and the complexity of your tax situation.

Situations Requiring Professional Tax Advice, Can you file your business and personal taxes separately

Professional tax advice is crucial in several situations. For example, if you operate a complex business structure, such as an S corporation or LLC, understanding the nuances of pass-through taxation and related regulations requires specialized knowledge. Similarly, significant business investments, international transactions, or high-income situations necessitate professional guidance to ensure accurate reporting and compliance. Individuals facing an IRS audit or tax dispute will greatly benefit from the expertise of a tax professional who can represent them and navigate the complex legal processes. Finally, those planning major life events like starting a business, retirement, or significant inheritance should consult a tax professional to optimize their financial and tax strategies.

Checklist of Questions for a Tax Professional

Before engaging a tax professional, it’s essential to gather relevant information and formulate targeted questions. This proactive approach ensures you’re comfortable with their expertise and approach.

A comprehensive checklist of questions might include:

- What are your qualifications and experience in handling situations similar to mine?

- What is your fee structure, and what services are included?

- What is your approach to minimizing my tax liability while ensuring compliance?

- What software and technology do you use for tax preparation and filing?

- How will you communicate with me throughout the tax process, and how quickly can I expect responses to my questions?

- What is your process for handling potential IRS audits or disputes?

- Can you provide references from previous clients?

- What are your credentials and professional affiliations?

- What is your experience with the specific tax issues relevant to my business and personal situation (e.g., pass-through entities, international transactions)?

- What is your policy on handling sensitive financial information?