Do I need insurance for a cottage food business? This crucial question faces many aspiring entrepreneurs venturing into the delicious world of homemade goods. The answer, however, isn’t a simple yes or no. It hinges on several factors, including the type of food produced, the scale of operations, and your state’s specific regulations. Understanding the potential risks—from product liability to property damage—is paramount to making an informed decision about protecting your business and your future.

This guide navigates the complexities of insurance for cottage food businesses, examining various policy types, state-specific regulations, and alternative risk management strategies. We’ll explore the differences between a cottage food operation and a larger commercial enterprise, outlining the potential liabilities inherent in each. By the end, you’ll have a clear understanding of whether insurance is necessary for your unique circumstances and how to choose the right coverage.

Cottage Food Business Definition and Scope

A cottage food business is a small-scale food production operation typically run from a home kitchen. These businesses are often characterized by their limited production volume, direct-to-consumer sales, and adherence to specific state or local regulations designed to ensure food safety. They represent a popular avenue for entrepreneurs to launch food-related ventures with minimal initial investment and overhead.

Cottage food operations differ significantly from larger commercial food businesses in terms of production scale, regulatory oversight, and distribution channels. Understanding these differences is crucial for aspiring cottage food entrepreneurs to ensure compliance and build a successful business.

Cottage Food Product Examples

Cottage food businesses produce a variety of non-potentially hazardous foods. These products are typically shelf-stable or require minimal refrigeration, reducing the risk of foodborne illness. Common examples include baked goods like breads, cookies, and cakes; jams, jellies, and preserves; honey; and certain types of candies. Many states also permit the sale of dried fruits and vegetables, as well as some types of nuts and seeds. The specific permitted products vary significantly depending on the state’s regulations.

Legal and Regulatory Differences Between Cottage Food Businesses and Commercial Food Operations

The primary difference lies in the regulatory framework. Cottage food businesses operate under less stringent regulations than commercial food operations. Commercial food businesses are subject to extensive inspections, licensing requirements, and adherence to strict food safety guidelines, often including Hazard Analysis and Critical Control Points (HACCP) plans. These businesses typically must operate out of licensed commercial kitchens that meet specific building codes and sanitation standards. Cottage food businesses, on the other hand, often have less rigorous inspections and may operate under simpler licensing procedures. However, they are still required to comply with food safety regulations applicable to their specific products and state. The permitted products and sales methods are usually more restricted for cottage food operations. For example, they may be prohibited from selling at farmers’ markets or wholesale to retailers.

Production Scale Comparison: Cottage Food Businesses vs. Larger Food Businesses

The following table illustrates the key differences in production scale between cottage food businesses and larger food businesses:

| Feature | Cottage Food Business | Larger Food Business |

|---|---|---|

| Production Volume | Small-scale; often limited by state regulations | Large-scale; capable of producing significant quantities |

| Production Facility | Home kitchen (subject to state regulations) | Licensed commercial kitchen; meets stringent building codes and sanitation standards |

| Distribution Channels | Direct-to-consumer sales (farmers’ markets, online, etc., often with limitations); limited wholesale opportunities | Diverse distribution channels; wholesale to retailers, restaurants, and other food service establishments; broader reach |

| Regulatory Oversight | Less stringent regulations; simplified licensing procedures; focused on food safety | Extensive regulations; frequent inspections; adherence to HACCP and other food safety standards |

Types of Insurance Relevant to Cottage Food Businesses

Operating a cottage food business, while offering the appeal of independence and flexibility, presents several potential risks that entrepreneurs must consider. These risks can significantly impact profitability and even the future viability of the business. Understanding these risks and implementing appropriate mitigation strategies, including insurance coverage, is crucial for success.

Potential Risks for Cottage Food Businesses

Cottage food businesses face a unique set of risks due to the nature of their operations. These risks fall broadly into three categories: food safety, liability, and property. Addressing these risks proactively through appropriate insurance is essential for protecting the business and its owner.

Foodborne Illness Insurance

Foodborne illnesses, resulting from contaminated food products, pose a significant threat to cottage food businesses. A single incident can lead to substantial medical expenses for affected consumers, legal fees, and reputational damage. While not a specific type of insurance policy, general liability insurance typically covers claims arising from foodborne illnesses, provided the business adhered to safe food handling practices. For example, if a customer falls ill after consuming a product from your cottage food business and claims negligence in food preparation, your general liability insurance could help cover legal costs and any settlements.

Product Liability Insurance

Product liability insurance protects against financial losses resulting from injuries or damages caused by a defective product. In the context of a cottage food business, this could involve claims related to allergic reactions to ingredients not clearly labeled, or injuries caused by a poorly packaged product. For instance, if a customer is injured by a broken jar containing your homemade jam, product liability insurance would cover the associated medical expenses and legal costs. It’s important to note that many general liability policies include some product liability coverage, but a dedicated product liability policy offers more comprehensive protection.

General Liability Insurance

General liability insurance is a broad policy covering a wide range of potential incidents that could occur on your business premises or in relation to your business activities. This includes bodily injury to customers visiting your business (if applicable), property damage, and advertising injury. For a cottage food business, this might cover a customer slipping and falling at a farmers’ market stall where you sell your products, or damage to a client’s property caused by your delivery service. This policy provides essential protection against unforeseen accidents and related legal expenses.

Commercial Auto Insurance

If you use a vehicle to transport your products to farmers’ markets, deliver orders to customers, or travel to source ingredients, commercial auto insurance is essential. This insurance protects against accidents involving your vehicle, covering damage to your vehicle, injuries to others, and property damage. For example, if you are involved in a car accident while transporting your goods, commercial auto insurance would cover the costs of repairs to your vehicle and any medical expenses or property damage caused to others involved in the accident. This is separate from personal auto insurance and offers broader coverage for business-related activities.

Insurance Types, Coverage, and Costs, Do i need insurance for a cottage food business

| Insurance Type | Coverage | Typical Annual Cost (Estimate) | Scenario Example |

|---|---|---|---|

| General Liability | Bodily injury, property damage, advertising injury, foodborne illness (often included) | $500 – $1,500 | Customer slips and falls at your farmers market booth. |

| Product Liability | Injuries or damages caused by your product | $500 – $1,000 | Customer has an allergic reaction to an ingredient not clearly listed on your label. |

| Commercial Auto | Accidents involving your business vehicle | $500 – $2,000+ (depending on vehicle and coverage) | Accident while transporting products to a delivery location. |

Note: Insurance costs are estimates and vary significantly based on factors like location, coverage limits, and business specifics. It is crucial to obtain quotes from multiple insurance providers to compare options.

State and Local Regulations Regarding Cottage Food Businesses and Insurance

State and local regulations significantly impact the need for insurance in cottage food operations. These laws vary widely, dictating permissible products, labeling requirements, and sales channels, all of which influence the potential risks and thus the necessity of insurance coverage. Understanding these regulations is crucial for both legal compliance and risk mitigation.

State and local laws often determine the types and extent of insurance needed. For example, regulations might mandate specific food safety certifications or limit sales to direct-to-consumer channels, reducing the need for certain types of liability insurance. Conversely, more permissive regulations might necessitate broader coverage. Failure to comply with these regulations can lead to significant legal and financial repercussions.

Insurance Requirements Across Different States

This section compares insurance requirements for cottage food businesses in three states: California, Texas, and New York. It’s important to note that these are examples, and specific requirements can change; therefore, always consult the most up-to-date information from the relevant state agencies.

California’s Cottage Food Operation Law allows for the production and sale of certain non-hazardous foods, but it doesn’t explicitly mandate specific insurance types. However, carrying general liability insurance is strongly recommended to protect against potential accidents or injuries on the premises or resulting from the consumption of products. Product liability insurance is also advisable to cover claims related to foodborne illnesses.

Texas’s Cottage Food Law, similarly, doesn’t mandate specific insurance, but liability insurance is highly recommended. The potential for claims related to foodborne illnesses, property damage, or customer injuries remains, regardless of regulatory compliance. The scope of potential liability is largely dependent on the type and volume of food produced and sold.

New York’s cottage food law is more restrictive than California or Texas, limiting the types of food that can be produced and sold. While specific insurance isn’t mandated, the limited scope of operations might reduce the overall risk, potentially lessening the need for extensive coverage. However, general liability insurance remains a prudent measure.

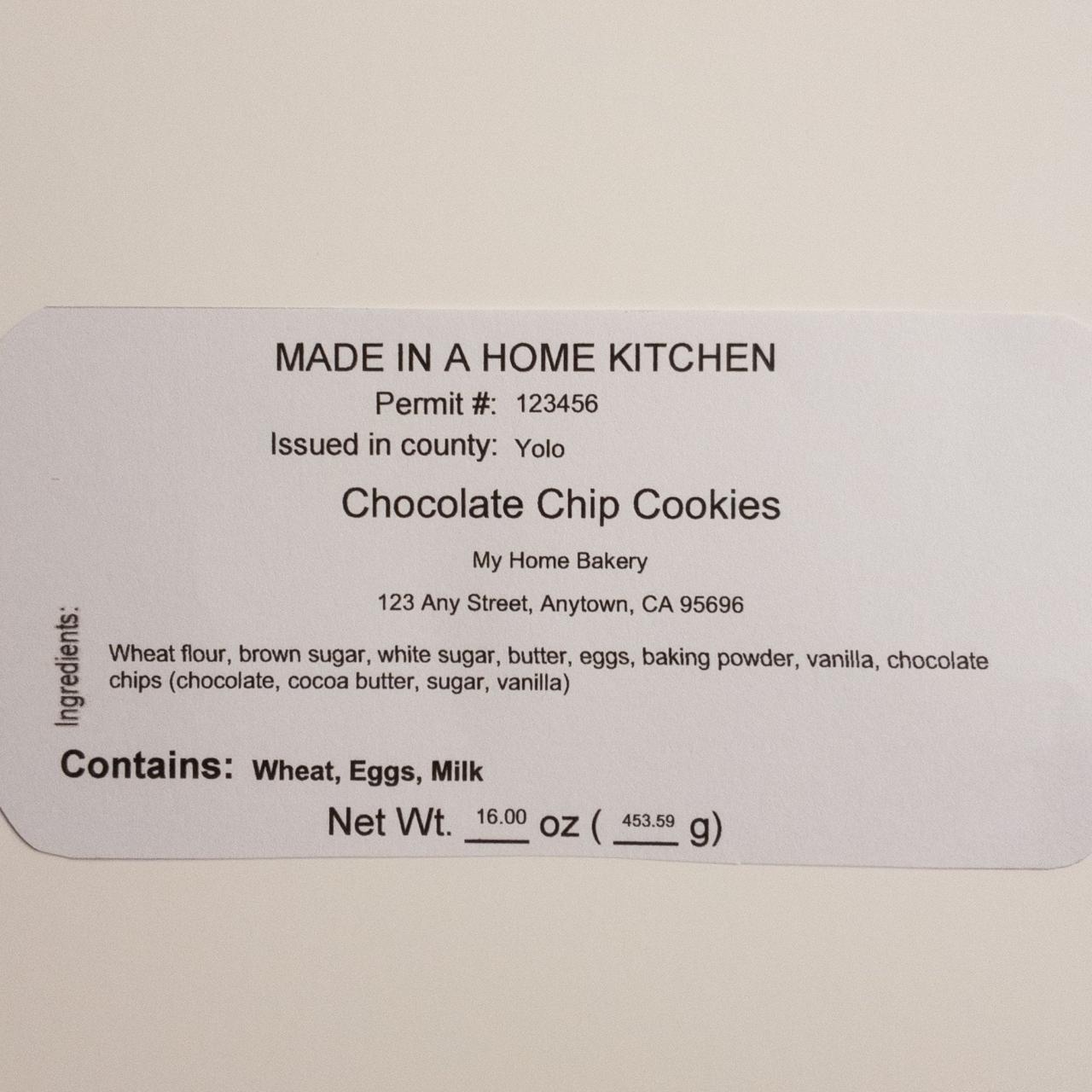

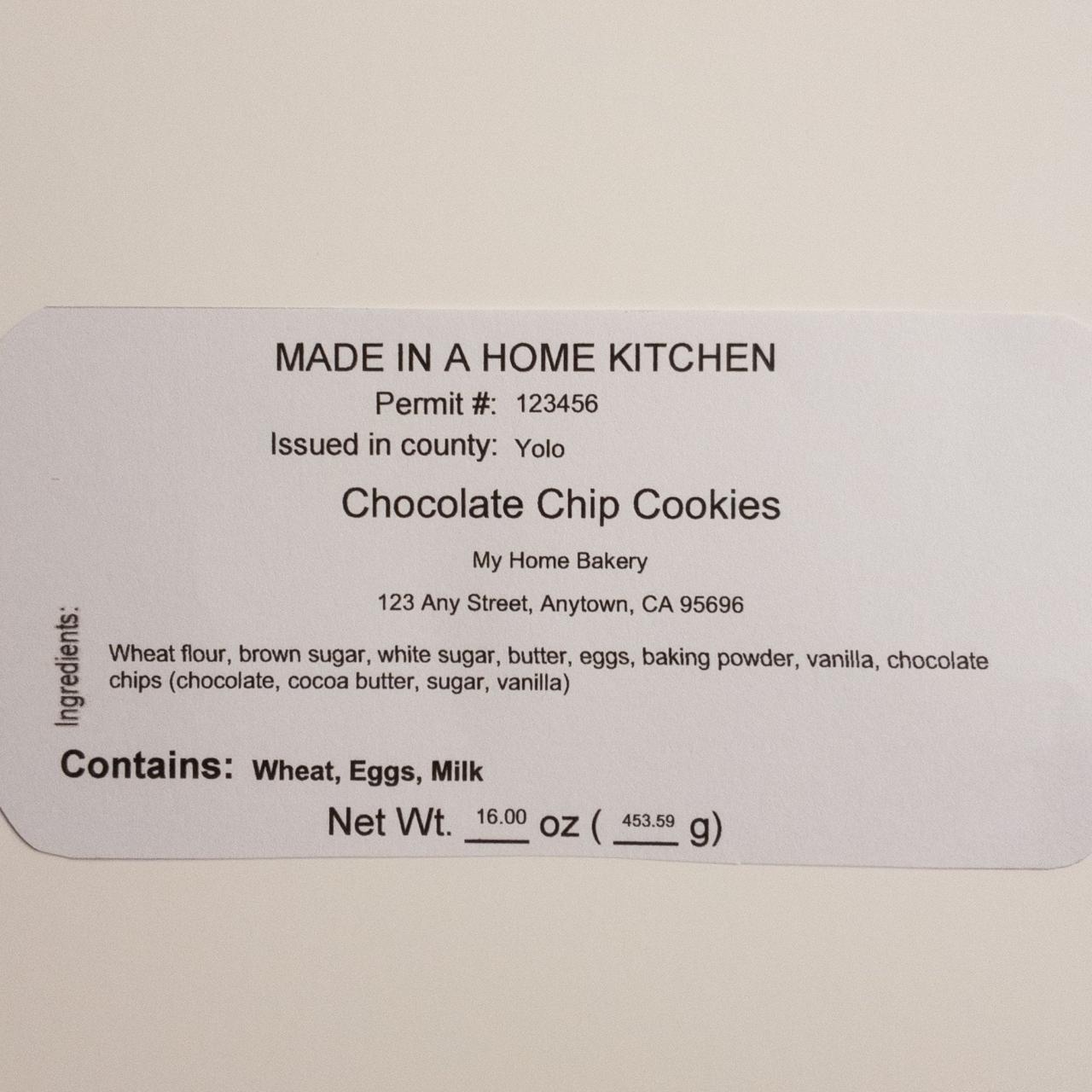

Examples of Non-Compliance Leading to Legal Issues

Non-compliance with cottage food regulations can result in various legal issues. For instance, failing to properly label products with allergen information could lead to severe allergic reactions and subsequent lawsuits. Similarly, operating without the necessary permits or exceeding permitted sales limits can result in fines and legal action from health departments. Inadequate food safety practices leading to foodborne illnesses could result in substantial legal and financial repercussions, including product recalls and lawsuits. Ignoring these regulations places the business owner at significant risk.

Resources for Finding State-Specific Information

Finding accurate and up-to-date information on cottage food regulations is crucial. The following resources provide a starting point:

- State Department of Agriculture: Each state’s Department of Agriculture typically manages cottage food laws and regulations. Their websites are the primary source for specific requirements.

- State Health Department: State health departments often have guidelines related to food safety and handling, which are vital for compliance.

- Small Business Administration (SBA): The SBA offers resources and guidance for small businesses, including information on state-specific regulations.

- Local Health Departments: Local health departments provide specific information regarding permits and inspections within a particular county or city.

- State Bar Associations: Consulting with legal professionals specializing in food law and business law can provide valuable insights and guidance on navigating legal complexities.

Factors Determining Insurance Needs

The insurance needs of a cottage food business are not uniform; they depend on several key factors, primarily the nature of the food produced, the scale of operations, and the desired level of liability protection. Understanding these factors is crucial for selecting the appropriate and cost-effective insurance coverage. Failing to adequately assess these needs can leave a business vulnerable to significant financial losses in the event of an accident or claim.

Food Product Type and Insurance Needs

The type of food product significantly influences the insurance requirements. For example, a business producing high-risk foods, such as baked goods containing nuts or dairy, faces a greater potential for allergic reactions and subsequent liability claims compared to a business selling shelf-stable goods like jams or jellies. Foods requiring specific handling and storage (e.g., perishable items) might also necessitate broader coverage to account for spoilage or contamination risks. Businesses making products with a higher potential for causing foodborne illnesses, such as unpasteurized products, would require more comprehensive coverage than those with lower risk items. The complexity of the production process and the ingredients used also factor into the risk assessment.

Business Scale and Insurance Requirements

The scale of the cottage food business directly impacts its insurance needs. A small operation selling only online or through a local farmers’ market typically has lower liability exposure than a larger business supplying products to multiple retailers or restaurants. Online sales, while potentially reaching a wider audience, might reduce direct customer interaction, thus lowering certain liability risks compared to in-person sales. However, online sales introduce other potential risks related to shipping and delivery, which may require additional coverage. Expanding distribution channels, such as supplying local stores or catering events, increases the potential for incidents and, consequently, the need for higher liability limits.

Liability Limits and Policy Selection

Liability limits define the maximum amount the insurance company will pay for covered claims. Choosing appropriate liability limits is critical. Low limits might not adequately protect the business from significant financial losses in the event of a serious incident, such as a widespread foodborne illness outbreak. Higher limits offer greater protection but come with increased premiums. The decision involves balancing the cost of premiums against the potential for substantial financial losses. For instance, a business with high-risk products and wider distribution might opt for higher liability limits, even if the premiums are higher, to safeguard against potentially devastating lawsuits. Businesses should consult with insurance providers to determine appropriate liability limits based on their specific circumstances and risk profile.

Cost and Benefits of Different Coverage Levels

Cottage food businesses can choose from various insurance coverage levels, each with varying costs and benefits. Basic liability insurance offers fundamental protection against claims of bodily injury or property damage. More comprehensive policies may include product liability coverage, which protects against claims arising from defects in the food products. Additional coverage options might encompass business interruption insurance (covering losses during business disruptions), professional liability insurance (for errors or omissions in advice or services), and workers’ compensation insurance (if employees are involved). While higher coverage levels offer greater protection, they also come with higher premiums. A cost-benefit analysis is essential to determine the optimal level of coverage that balances risk protection with financial feasibility. For example, a business with limited assets might choose a lower coverage level to minimize premiums, accepting a higher level of self-insured risk.

Alternatives to Traditional Insurance

Cottage food businesses, while often operating on a smaller scale than larger food production facilities, still face risks that could significantly impact their operations and profitability. While traditional insurance provides a safety net, it can be expensive and may not be accessible to all businesses. Fortunately, several alternative risk management strategies can mitigate these risks and potentially reduce the need for comprehensive insurance coverage. These strategies focus on proactive measures to prevent incidents and careful planning to manage potential losses.

Implementing alternative risk management strategies can significantly reduce the likelihood of incidents requiring insurance payouts. These strategies focus on proactive measures to minimize risk, careful planning for potential issues, and establishing robust operational procedures. By combining these strategies, cottage food businesses can create a more resilient operation and potentially reduce their reliance on expensive insurance policies. However, it’s crucial to remember that these alternatives are not a complete replacement for insurance in all cases; they should be viewed as complementary risk mitigation tools.

Thorough Record-Keeping and Traceability Systems

Maintaining meticulous records is paramount for any cottage food business. This includes detailed ingredient sourcing documentation, production logs tracking dates, batches, and quantities produced, and sales records indicating where and when products were sold. Such comprehensive records are crucial not only for complying with regulatory requirements but also for quickly identifying the source of a problem in case of a product recall. Effective traceability allows for swift and efficient removal of affected products from the market, limiting potential damage to the business’s reputation and financial losses. Without thorough records, a recall could become a much more complex and costly undertaking. For example, a bakery failing to track its flour supplier might struggle to determine if a contaminated batch was used in its products, delaying the recall and escalating the potential harm.

Robust Product Recall Plan

A well-defined product recall plan is essential. This plan should detail the steps to take in the event of a product contamination or other safety issue. This should include procedures for identifying affected products, notifying relevant authorities and customers, and effectively removing the products from circulation. The plan should also Artikel communication strategies for handling customer inquiries and maintaining transparency. Regular practice drills can help ensure the plan’s effectiveness and familiarize employees with their roles during a recall. A poorly planned recall can damage a business’s reputation and lead to significant financial losses. A well-executed plan, however, demonstrates responsibility and can mitigate the impact of a crisis. For instance, a company with a clear recall plan might limit its losses to the cost of the recalled products and associated communication, while a company lacking a plan might face lawsuits and irreparable reputational damage.

Employee Training and Hygiene Protocols

Investing in thorough employee training on food safety and hygiene practices is crucial. This includes proper handwashing techniques, safe food handling procedures, and the importance of maintaining a clean and sanitary workspace. Regular training sessions and refresher courses reinforce these best practices and help prevent contamination. Clear hygiene protocols should be established and visibly displayed in the workspace. These protocols should cover all aspects of food preparation, storage, and handling. A documented training program and regular hygiene audits can demonstrate a commitment to food safety, potentially reducing the likelihood of incidents and insurance claims. A business with trained employees and robust protocols will be better positioned to avoid contamination events, minimizing risk and the potential need for expensive insurance coverage.

Risk Assessment and Mitigation

Regular risk assessments identify potential hazards within the business operations. This systematic process involves identifying potential dangers, analyzing their likelihood and potential impact, and developing strategies to mitigate these risks. This could involve implementing new safety measures, improving equipment, or enhancing training programs. For example, a risk assessment might reveal a risk of slips and falls in the workspace, leading to the implementation of non-slip flooring and improved lighting. This proactive approach minimizes the chance of accidents and reduces the need for insurance payouts associated with workplace injuries.

| Feature | Traditional Insurance | Alternative Risk Management |

|---|---|---|

| Cost | Can be significant, varying by coverage and risk profile. | Lower upfront cost, but requires ongoing investment in training, systems, and procedures. |

| Protection | Provides financial protection against covered losses. | Reduces the likelihood of incidents requiring insurance payouts, but doesn’t offer financial protection for unforeseen events. |

| Control | Limited control over the claims process. | Greater control over risk mitigation and response to incidents. |

| Complexity | Can be complex to understand and manage. | Requires commitment to implementing and maintaining procedures, but generally simpler to manage than insurance policies. |

Illustrative Scenarios: Do I Need Insurance For A Cottage Food Business

Understanding the need for insurance in a cottage food business often depends on the specifics of the operation. Several scenarios illustrate the varying levels of risk and the corresponding insurance requirements.

Product Liability Insurance Scenario

Imagine Sarah, who runs a cottage food business specializing in handcrafted jams. One batch of her popular blackberry jam contains a piece of contaminated fruit, causing several customers to experience mild food poisoning. While the illness is not severe, the customers seek medical attention and some file claims against Sarah for their medical expenses and discomfort. In this instance, product liability insurance would cover Sarah’s legal fees and any compensation she is required to pay to the affected customers. The policy would protect her from potentially devastating financial losses stemming from a product defect.

General Liability Insurance Scenario

Consider Mark, who sells his homemade bread at local farmers’ markets. During a busy Saturday market, a customer trips over a display bucket and sustains a minor injury. The customer seeks compensation for their medical bills and lost wages. Mark’s general liability insurance would cover the customer’s medical expenses, legal costs associated with the claim, and any potential settlement. This scenario highlights the importance of general liability coverage for protecting against accidents that occur on the premises where the products are sold, even if the business operates from a home kitchen.

Scenario Where Insurance Might Not Be Necessary

A cottage food business operating on a very small scale, selling only to close friends and family, and producing very low-risk items like simple cookies, might find that the risk is minimal. The potential for significant liability claims is substantially lower in this case, and the financial burden of a minor incident might be manageable without insurance. However, it’s crucial to carefully weigh the potential risks even in low-volume, low-risk operations, as a single incident could still have serious consequences.

Hypothetical Cottage Food Business and Insurance Needs

Let’s consider “The Honeycomb Haven,” a cottage food business specializing in artisan honey-based products. They produce honey-infused cakes, honey-glazed nuts, and honey-lavender soap. They sell their products primarily through online orders and local craft fairs. Their potential risks include product spoilage (honey can crystallize), allergic reactions (to honey or other ingredients), and accidents at craft fairs (customer injury). Given their multiple product lines and sales channels, “The Honeycomb Haven” would benefit significantly from both product liability insurance to cover claims related to product defects or allergic reactions and general liability insurance to protect against injuries or property damage at craft fairs or during deliveries. Additionally, they might consider purchasing a business owners policy (BOP), which bundles general liability and property insurance. A BOP could cover damage to their equipment or inventory from events such as a fire or theft.