Does a freelancer need a business license? This question is crucial for anyone venturing into the freelance world. Navigating the legal landscape of self-employment can be complex, varying significantly depending on your location, profession, and business structure. Understanding licensing requirements is not just about avoiding penalties; it impacts your tax obligations, client relationships, and even your access to certain insurance options. This guide will untangle the complexities, helping you determine whether a business license is necessary for your freelance endeavors and how to obtain one if required.

We’ll explore the legal requirements for freelancers across different states and countries, highlighting the potential penalties for non-compliance. We’ll also delve into the tax implications of having (or not having) a business license, examining how it affects tax filing, deductions, and potential legal ramifications. Furthermore, we’ll discuss how your chosen business structure (sole proprietorship, LLC, etc.) influences licensing needs and the steps involved in the registration process. Finally, we’ll explore the crucial role of insurance and how a business license can impact client perception and trust.

Legal Requirements for Freelancers

Navigating the legal landscape as a freelancer can be complex, varying significantly depending on location and profession. Understanding the specific requirements in your jurisdiction is crucial to avoid penalties and ensure your business operates legally. This section details the legal obligations freelancers face, highlighting the differences across states and countries, the consequences of non-compliance, and examples illustrating when licensing is necessary.

Variations in Business Licensing Requirements

Business licensing for freelancers differs dramatically across states and countries. Some jurisdictions have comprehensive licensing systems encompassing various freelance professions, while others may have more relaxed regulations or focus on specific high-risk industries. For example, a freelance writer in California might face different licensing requirements compared to a freelance graphic designer in the same state, and both will face different rules compared to their counterparts in New York or even a different country like the UK or Canada. The level of regulation often correlates with the perceived risk to public safety or financial well-being. For instance, professions involving financial advice or healthcare often face stricter licensing demands than those with less direct impact.

Penalties for Operating Without Necessary Licenses

Operating a freelance business without the required licenses can lead to severe consequences. Penalties vary depending on the jurisdiction and the severity of the violation, but can include hefty fines, legal action, business closure, and even criminal charges in some cases. For instance, a freelance contractor operating without a required contractor’s license could face substantial fines and be barred from future contracts. Similarly, a freelance healthcare provider working without a license could face malpractice lawsuits and criminal prosecution. The specific penalties are Artikeld in the relevant state or country’s regulations.

Examples of Situations Requiring or Not Requiring a License

Licensing needs depend on the specific freelance profession and location. A freelance writer generally doesn’t need a license unless offering specialized services (like legal writing requiring bar admission) or operating under a business name that requires registration. Conversely, a freelance electrician, plumber, or other tradesperson will almost certainly require a license to operate legally and safely. Similarly, a freelance consultant providing financial advice may require specific certifications or licenses depending on the type of advice given and the jurisdiction. A graphic designer, unless offering services related to regulated fields, may not require a license, though business registration might be necessary.

Licensing Requirements for Different Freelance Professions

Licensing requirements vary considerably across freelance professions. Freelance writers generally face the least stringent regulations, often only requiring business registration if operating under a business name. Graphic designers also typically don’t require specific licenses, though registration might be beneficial. However, professions like freelance accounting, consulting (especially financial consulting), or healthcare (nursing, therapy) often have rigorous licensing and certification requirements that vary significantly by state and country. These differences reflect the varying levels of risk associated with each profession and the need to protect consumers.

Licensing Requirements by State/Country (Example)

Note: This table provides a simplified example and does not represent exhaustive or legally binding information. Always consult official sources for accurate and up-to-date information.

| Profession | California | New York | United Kingdom |

|---|---|---|---|

| Freelance Writer | Generally no license required, business registration may be necessary | Generally no license required, business registration may be necessary | Generally no license required, business registration may be necessary |

| Graphic Designer | Generally no license required | Generally no license required | Generally no license required |

| Freelance Accountant | CPA license required for certain services | CPA license required for certain services | Accountancy qualifications required for certain services |

Tax Implications of Business Licensing (or Lack Thereof)

The decision of whether or not to obtain a business license as a freelancer significantly impacts your tax obligations and potential liabilities. Understanding these implications is crucial for navigating the complexities of self-employment taxation and ensuring compliance with relevant laws. Failing to properly account for these differences can lead to significant financial penalties and legal repercussions.

The primary impact of business licensing lies in how it shapes your tax filing procedures and the deductions you can claim. While a license doesn’t automatically reduce your tax burden, it opens doors to certain tax advantages unavailable to unlicensed freelancers. Conversely, operating without a license may inadvertently restrict your tax-saving options.

Tax Advantages and Disadvantages of Business Licensing

Obtaining a business license offers several potential tax advantages. It allows you to operate under a distinct business entity (sole proprietorship, LLC, etc.), potentially offering liability protection and influencing how your business income is taxed. This can lead to lower overall tax liabilities in some circumstances, depending on the chosen business structure and applicable tax laws. However, the process of setting up and maintaining a business license itself incurs costs, which may offset some of the potential tax benefits. Furthermore, the increased record-keeping requirements associated with a licensed business can be time-consuming and require specialized accounting knowledge.

Impact of Business Licensing on Tax Filing Procedures

Business licensing significantly alters your tax filing procedures. A licensed freelancer typically files taxes using a designated business tax form (e.g., Schedule C for sole proprietorships), providing detailed income and expense information related to their business activities. This contrasts with an unlicensed freelancer, who might simply report business income as self-employment income on their personal tax return, potentially with fewer deduction opportunities. The level of detail required in tax reporting is considerably higher for licensed businesses, necessitating more comprehensive record-keeping.

Increased Tax Deductions with a Business License

A business license allows for a broader range of tax deductions. Licensed freelancers can often deduct expenses directly related to their business operations, including office supplies, equipment, professional development, and a portion of home office expenses, significantly reducing their taxable income. These deductions are often more clearly defined and easier to justify when operating under a formal business structure. Conversely, an unlicensed freelancer might face limitations in claiming certain deductions, as the IRS may scrutinize the connection between expenses and business activities more closely. The availability and legitimacy of deductions are directly tied to the appropriate documentation and record-keeping practices, which are more readily established under a business license.

Legal Ramifications of Incorrect Tax Payment

Failing to pay taxes correctly as a freelancer, regardless of licensing status, carries significant legal ramifications. This can include penalties, interest charges, and even legal action from the tax authorities. The severity of the consequences depends on the extent of non-compliance and the deliberate nature of the tax evasion. In extreme cases, it can lead to criminal prosecution and substantial fines. For licensed freelancers, the penalties can be amplified due to the greater expectation of accurate record-keeping and tax compliance. The IRS utilizes sophisticated methods for detecting tax discrepancies, and the penalties for underreporting income are substantial.

Tax Implications: Licensed vs. Unlicensed Freelancers

The following table summarizes the key tax differences between licensed and unlicensed freelancers:

| Feature | Licensed Freelancer | Unlicensed Freelancer |

|---|---|---|

| Tax Filing | Uses business tax forms (e.g., Schedule C) | May report income on personal tax return |

| Deductions | Greater range of business-related deductions | More limited deduction options |

| Liability Protection | Potential for limited liability protection | Personal liability for business debts |

| Record-Keeping | More extensive record-keeping required | Less stringent record-keeping requirements |

| Tax Complexity | Higher tax complexity | Relatively simpler tax filing |

Business Structure and Licensing

Choosing the right business structure is crucial for freelancers, as it significantly impacts licensing requirements and overall legal and tax obligations. The structure you select dictates the level of personal liability you face and the administrative burden involved in operating your freelance business. Understanding these implications is essential before launching your freelance career.

Sole Proprietorship Licensing Needs

Sole proprietorships are the simplest business structure. The business and the owner are legally indistinguishable. Licensing requirements for sole proprietorships vary significantly by location and industry. Some jurisdictions may only require a general business license, while others may demand specific licenses based on the services offered. For example, a freelance writer may only need a general business license, whereas a freelance contractor working with electricity would require additional licensing to ensure safety and compliance. The process typically involves registering the business name (if different from the owner’s name) and obtaining the necessary licenses from the relevant local, state, and potentially federal authorities.

LLC Licensing Needs

Limited Liability Companies (LLCs) offer more legal protection than sole proprietorships, separating the owner’s personal assets from business liabilities. While the specific licensing requirements depend on location and industry, LLCs generally need to register with the state and obtain a business license. Some states might require additional licenses based on the nature of the business. The registration process typically involves filing articles of organization with the state and obtaining an EIN (Employer Identification Number) from the IRS, even if you are a single-member LLC. This provides a distinct tax identification number for the business, facilitating separate financial management.

Partnership Licensing Needs

Partnerships involve two or more individuals who agree to share in the profits or losses of a business. Licensing requirements for partnerships are similar to those of LLCs, with variations depending on the jurisdiction and the specific services offered. Each partner shares responsibility for obtaining and maintaining the necessary licenses. The partnership agreement should clearly Artikel the responsibilities of each partner, including compliance with licensing regulations. Registration typically involves filing a partnership agreement with the relevant authorities and obtaining the necessary business licenses.

Business Structure Influence on Licensing

The chosen business structure directly impacts licensing requirements. Sole proprietorships often have simpler licensing needs compared to LLCs or partnerships. LLCs and partnerships, with their more complex legal structures, may require more extensive registration and licensing processes. The level of formality and legal protection associated with each structure influences the regulatory oversight and licensing demands. For instance, a freelancer operating as a sole proprietor might only need a general business license, while a freelance design firm structured as an LLC may need multiple licenses and permits, including those related to intellectual property or specific software usage.

Registering a Business and Obtaining Licenses

Registering a business and obtaining the necessary licenses generally involves these steps:

- Choose a business name and structure.

- Register the business name (if applicable) with the state.

- Obtain an Employer Identification Number (EIN) from the IRS (for LLCs and partnerships).

- Identify required licenses and permits at the local, state, and federal levels.

- Complete and submit the applications for each license and permit.

- Pay the associated fees.

- Maintain compliance with ongoing licensing requirements.

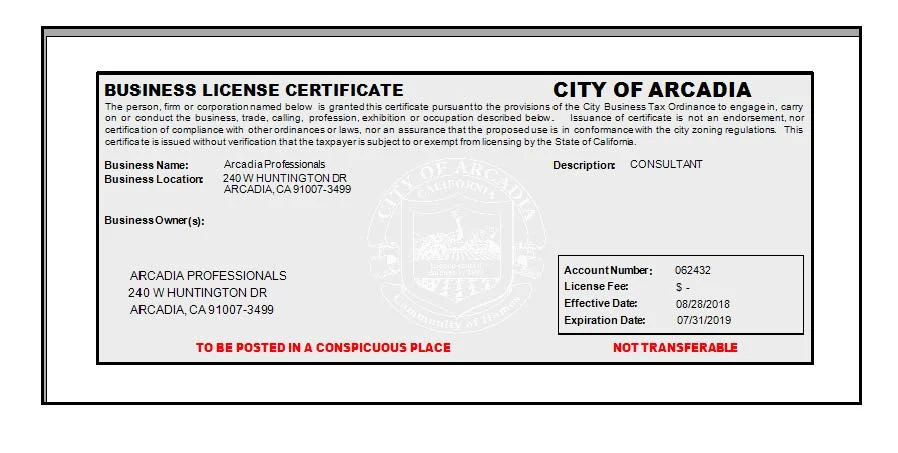

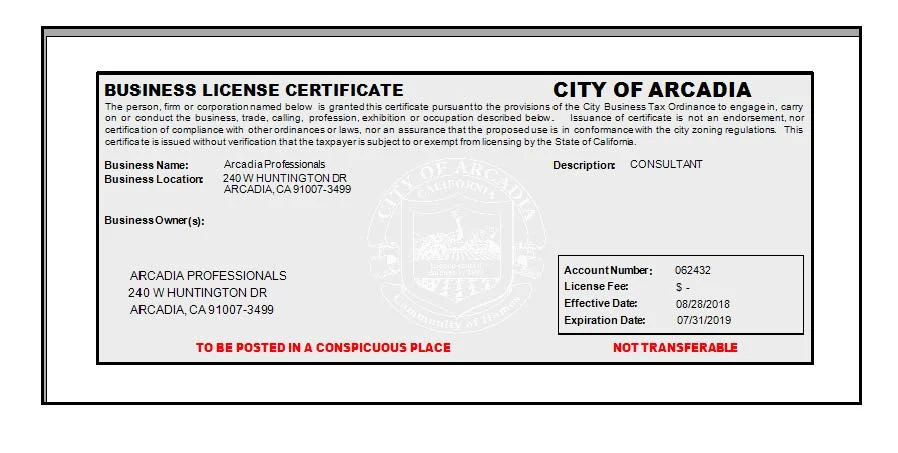

Business License and Permit Examples for Freelancers

Freelancers might need various licenses and permits depending on their profession and location. Examples include:

- General Business License: A basic license required by many jurisdictions for operating a business.

- Professional License: Licenses specific to professions like engineering, medicine, or law.

- Sales Tax Permit: Required for collecting and remitting sales tax on goods or services sold.

- Building Permits: Needed for construction or renovation work.

- Occupational Licenses: Specific licenses for certain trades or professions.

- Home Occupation Permit: Required if operating a business from a residential property.

Obtaining a Business License: A Flowchart

A flowchart illustrating the process would begin with “Decide on Business Structure,” branching to “Sole Proprietorship,” “LLC,” or “Partnership.” Each branch would then lead to “Register Business Name (if applicable),” followed by “Obtain EIN (if applicable),” then “Identify Required Licenses/Permits,” and finally “Apply for and Obtain Licenses/Permits.” A final box would indicate “Maintain Compliance.” This visual representation would clearly depict the different paths based on business structure and the common steps involved in obtaining the necessary licenses.

Insurance and Business Licensing: Does A Freelancer Need A Business License

While a business license doesn’t automatically mandate specific insurance coverage, the two are closely intertwined, particularly regarding risk management and professional credibility. Obtaining a license often signals a commitment to professional standards, which, in turn, can influence the types and levels of insurance considered necessary. The absence of a license, however, doesn’t eliminate the need for insurance; in fact, it might even heighten the risks and the importance of adequate coverage.

Professional liability insurance, also known as errors and omissions (E&O) insurance, is a key consideration for freelancers, regardless of licensing status. This insurance protects against claims of negligence or mistakes in professional services. A business license might influence the *level* of coverage deemed appropriate – a licensed professional might be expected to carry higher limits – but the fundamental need remains the same. Furthermore, some clients may require proof of insurance before engaging a freelancer, regardless of licensing requirements.

Types of Insurance for Freelancers

Freelancers should carefully assess their specific risks and choose appropriate coverage. The costs associated with insurance vary widely depending on factors like the type of work, coverage limits, and the freelancer’s experience and location. Generally, higher risk professions or those with a history of claims will result in higher premiums.

Insurance Costs: Licensed vs. Unlicensed Freelancers

The cost of insurance isn’t directly determined by licensing status. Instead, factors like the freelancer’s profession, experience, claims history, and the chosen coverage limits are the primary drivers of premium costs. A licensed freelancer might choose higher coverage limits due to increased liability, resulting in a higher premium. Conversely, an unlicensed freelancer might opt for lower limits, leading to lower premiums but potentially inadequate protection. However, the difference in cost between a licensed and unlicensed freelancer in the same profession, with similar coverage, would likely be minimal.

Insurance Options for Freelancers and Their Costs

| Type of Insurance | Description | Potential Annual Cost (USD) | Notes |

|---|---|---|---|

| Professional Liability (E&O) | Covers claims of negligence or errors in professional services. | $500 – $2,000+ | Cost varies greatly depending on profession, coverage limits, and claims history. |

| General Liability | Protects against bodily injury or property damage caused by the freelancer’s business operations. | $300 – $1,000+ | Essential if clients visit the freelancer’s workspace or if the freelancer works on-site. |

| Workers’ Compensation | Covers medical expenses and lost wages for employees injured on the job. | Varies greatly by state and number of employees. | Only necessary if the freelancer employs others. |

| Commercial Auto Insurance | Covers accidents involving the freelancer’s vehicle used for business purposes. | $500 – $2,000+ | Required if the freelancer uses a vehicle for business-related travel. |

Scenarios Requiring Insurance for Freelancers

Insurance is crucial in several scenarios, regardless of licensing. For example, a web developer whose code causes a client’s website to crash, resulting in financial losses, could face a lawsuit. Similarly, a freelance photographer who accidentally damages a client’s property during a photoshoot could be held liable. Even a freelance writer who delivers plagiarized content might face legal action. In all these cases, insurance would provide financial protection and legal representation.

Client Relationships and Licensing

A business license, while not always legally mandated for freelancers, significantly impacts client perception and the overall business relationship. Its presence or absence influences trust, contract negotiations, and the overall professional image projected to clients. Understanding this impact is crucial for freelancers aiming to build a successful and reputable career.

Business License Influence on Client Trust and Perception

Holding a business license projects professionalism and legitimacy. Clients are more likely to trust a freelancer who has taken the steps to formally establish their business, demonstrating a commitment to their work and a willingness to adhere to legal and business standards. This perceived legitimacy can be particularly important when dealing with larger clients or those in regulated industries. The license acts as a form of third-party validation, assuring clients that the freelancer is a serious and credible professional. Conversely, the lack of a license might raise questions about the freelancer’s commitment and reliability, potentially leading to hesitation or rejection.

Benefits of Showcasing a Business License to Prospective Clients

Showcasing a business license can be a powerful marketing tool. Including it on proposals, websites, or business cards immediately communicates professionalism and adherence to legal requirements. It can serve as a differentiator from competitors who may not have taken this step. This visible demonstration of legitimacy can significantly increase client confidence and lead to increased conversion rates, especially when competing for projects with other freelancers. For instance, a graphic designer showcasing their business license alongside their portfolio might attract clients seeking a more established and reliable professional.

Impact of Business License on Contract Negotiations

A business license can positively influence contract negotiations. Clients might be more willing to negotiate favorable terms with a licensed freelancer, recognizing their established business status. This could translate to higher project fees, more flexible payment terms, or greater trust in the freelancer’s ability to deliver on their commitments. Conversely, the absence of a license might lead to more stringent contract terms imposed by the client to mitigate perceived risks associated with working with an unlicensed individual. This could result in lower fees, stricter payment schedules, or more complex contractual obligations for the freelancer.

Negative Effects of a Lack of License on Client Relationships, Does a freelancer need a business license

A lack of a business license can negatively impact client relationships. It might raise concerns about the freelancer’s professionalism, legal compliance, and insurance coverage. Clients might be hesitant to engage in long-term projects or large-scale collaborations without the assurance provided by a business license. In cases of disputes or legal issues, the absence of a license could complicate matters, potentially placing the freelancer at a disadvantage. This lack of perceived legitimacy can hinder the establishment of strong and trusting client relationships.

Scenario: Licensed vs. Unlicensed Freelancer

Consider two freelance web developers bidding on a project for a large corporation. One developer holds a business license, showcasing a professional website and detailed business plan. The other developer lacks a license and presents a less polished portfolio. The corporation, seeking a reliable and established partner, is more likely to choose the licensed developer, perceiving them as less risky and more likely to deliver a high-quality product. The licensed developer is likely to command a higher fee and negotiate more favorable contract terms due to the perceived value and reduced risk. The unlicensed developer, on the other hand, might struggle to secure the project or might be forced to accept less favorable terms to compensate for the perceived higher risk.