How to reject a business proposal politely is a crucial skill for professionals. Navigating the delicate balance between honesty and maintaining a positive relationship requires tact and strategic communication. This guide provides a comprehensive framework for crafting polite rejections, covering everything from understanding the context of the rejection to offering alternatives and following up appropriately. We’ll explore various scenarios, providing practical examples and templates to help you handle these situations with grace and professionalism.

From understanding the nuances of different rejection scenarios—budget constraints, strategic misalignment, or simply a lack of resources—to crafting the perfect email or letter, we’ll equip you with the tools to navigate these challenging conversations effectively. We’ll also delve into the art of offering alternatives and maintaining a positive relationship even after delivering unwelcome news. This guide will leave you confident in your ability to handle business proposal rejections with both diplomacy and clarity.

Understanding the Context of Rejection

Rejecting a business proposal requires tact and sensitivity. A poorly handled rejection can damage relationships and future opportunities, while a well-crafted response can preserve professional goodwill. Understanding the context of the rejection – the reasons behind it and the proposer’s potential feelings – is crucial for a polite and effective response.

Considering the proposer’s feelings is paramount. Remember, they’ve invested time, effort, and potentially resources into developing their proposal. A blunt rejection can be demoralizing and damaging to their confidence. A thoughtful response, even if negative, demonstrates respect for their work and maintains a positive professional relationship. This is particularly important if you anticipate future collaborations or if the proposer is a key stakeholder in your industry.

Rejection Scenarios and Appropriate Responses

Several scenarios necessitate a polite rejection. Understanding these scenarios helps tailor your response to be both effective and empathetic. Common reasons for rejection include budget constraints, strategic misalignment, lack of resources, and the existence of a superior alternative proposal.

Budget Constraints

Budget limitations are a frequent reason for rejecting proposals. In these situations, transparency and honesty are key. Avoid vague statements; instead, clearly explain that the proposal is excellent but exceeds the currently allocated budget. Emphasize that this is a budgetary issue and not a reflection of the proposal’s quality. For example, you might say:

“While we were very impressed with your proposal and the innovative solutions offered, our current budget constraints unfortunately prevent us from moving forward at this time. We appreciate you taking the time to present such a comprehensive plan.”

Strategic Misalignment

Sometimes, a proposal might be well-executed but simply doesn’t align with the company’s overall strategic goals. In this case, clearly explain the strategic direction and how the proposal doesn’t fit within that framework. Avoid criticizing the proposal itself; focus instead on the mismatch between the proposal’s objectives and the company’s priorities. A suitable phrase could be:

“We appreciate the time and effort you put into this proposal. However, it doesn’t quite align with our current strategic priorities. We’re focusing on [mention strategic priority] at the moment, and this proposal, while impressive, doesn’t fit within that framework.”

Lack of Resources

Insufficient resources, including personnel, technology, or time, can prevent a company from accepting a proposal. Clearly state the resource limitations, emphasizing that the rejection is not due to the proposal’s shortcomings. An example of a polite response is:

“Your proposal is well-structured and detailed, and we appreciate the thoroughness of your submission. However, due to current resource constraints, we are unable to proceed with this project at this time. We wish you all the best in your future endeavors.”

Crafting a Polite Rejection Letter or Email

Rejecting a business proposal requires tact and professionalism. A well-crafted rejection letter or email can maintain a positive relationship with the proposer, even while conveying a firm “no.” The key lies in delivering the news clearly and respectfully, minimizing any potential for misunderstanding or offense. This involves careful consideration of both the language used and the overall tone of the communication.

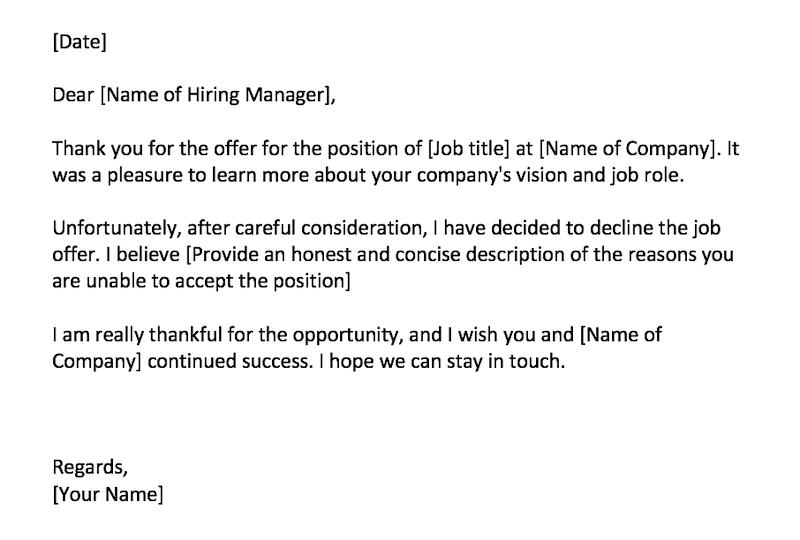

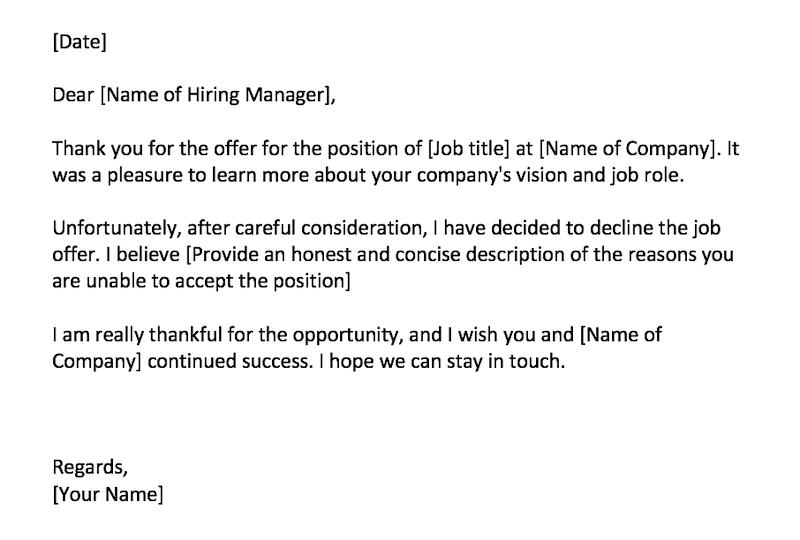

Email Template for Rejecting a Business Proposal

A structured template can ensure all necessary elements are included while maintaining a professional and courteous tone. This template provides a framework; adjust it to fit the specific circumstances of each rejection.

Subject: Regarding Your Business Proposal – [Proposal Name or Brief Description]

Opening: Begin by thanking the proposer for their time and effort in submitting the proposal. Acknowledge receipt and briefly mention the proposal’s key aspects. For example: “Thank you for taking the time to submit your proposal for [Project Name]. We appreciate the thoroughness of your submission and the innovative ideas presented.”

Body: Clearly and concisely explain the reasons for rejection without being overly critical or detailed. Focus on the business rationale, avoiding personal opinions or subjective judgments. For example: “While your proposal demonstrated strong potential in [specific area], our current priorities and strategic direction necessitate a different approach. [Optional: Briefly explain the conflicting priority or strategic direction without going into excessive detail.]”

Closing: Reiterate your appreciation for their effort and leave the door open for future collaboration, if appropriate. For example: “We wish you the best in your future endeavors and appreciate your interest in partnering with [Your Company Name]. We may reach out again in the future should a suitable opportunity arise.” Offer a polite closing such as “Sincerely,” or “Best regards,” followed by your name and title.

Examples of Professional and Courteous Language

Using appropriate language is crucial in maintaining a positive tone. Avoid negative or dismissive language. Instead, opt for phrases that convey understanding and respect.

Positive phrasing examples:

* Instead of: “Your proposal was not up to par.” Use: “While your proposal demonstrated strengths in [area], it did not fully align with our current needs.”

* Instead of: “Your pricing is too high.” Use: “Our current budget constraints unfortunately prevent us from proceeding with this proposal at this time.”

* Instead of: “Your idea is unrealistic.” Use: “While innovative, the proposed solution presents challenges in terms of [specific challenge], which makes it unsuitable for our current project.”

Maintaining a Positive and Respectful Tone, How to reject a business proposal politely

A positive and respectful tone throughout the communication is paramount. This shows professionalism and helps maintain a good business relationship. Avoid overly formal or overly casual language. Maintain a consistent, professional tone throughout the entire email. Proofread carefully to eliminate any grammatical errors or typos, as these can undermine the overall impression of professionalism and respect. The goal is to leave the proposer feeling valued and understood, even though their proposal wasn’t selected.

Addressing Specific Concerns in the Rejection: How To Reject A Business Proposal Politely

Rejecting a business proposal requires tact and diplomacy. A well-crafted rejection, however, goes beyond simply saying “no.” It involves addressing the proposal’s shortcomings in a way that is both constructive and respectful, leaving the door open for future collaborations while managing expectations appropriately. This involves understanding the underlying reasons for the rejection and communicating them clearly and concisely.

Explaining the reasons for rejection without being overly critical requires a delicate balance. You need to provide enough information for the proposer to understand your decision without being unnecessarily harsh or detailed. Focus on objective factors and avoid subjective opinions or personal criticisms. Remember, your goal is to maintain a professional relationship, even in the face of a negative outcome.

Common Reasons for Rejection and Tailored Responses

Several common reasons lead to business proposal rejections. Understanding these reasons and preparing appropriate responses can help maintain professional relationships and potentially foster future opportunities. These reasons often revolve around factors such as budget constraints, strategic misalignment, competitive offerings, and perceived risks. A tailored response acknowledges the proposer’s effort while clearly stating the reasons for the rejection.

Rejection Scenarios and Appropriate Language

The following table Artikels different rejection scenarios, the underlying reasons, appropriate language to use, and example phrases to guide your response.

| Scenario | Reason for Rejection | Appropriate Language | Example Phrase |

|---|---|---|---|

| Proposal lacks market fit | The product or service doesn’t align with current market demands or company strategy. | Emphasize market factors, avoid criticizing the proposal itself. | “While the proposal is well-written, our current market focus is on [specific area], and this proposal doesn’t quite align with that strategy.” |

| Budgetary constraints | The proposal’s cost exceeds the allocated budget. | Be upfront about financial limitations, suggest alternative solutions if appropriate. | “We appreciate the thoroughness of your proposal, however, the proposed budget exceeds our current financial capabilities for this project.” |

| Superior competing offer | Another proposal offered a better solution or a more favorable deal. | Avoid direct comparison, focus on your company’s needs. | “After careful consideration of several proposals, we’ve chosen a solution that better meets our immediate needs.” |

| Unrealistic timelines | The proposed timeline is not feasible given the company’s existing commitments. | Explain the timeline limitations without blaming the proposer. | “The proposed timeline presents challenges given our current project commitments. We appreciate your work, but this timeframe isn’t currently feasible for us.” |

Offering Alternatives and Future Collaboration

Rejecting a business proposal doesn’t have to be a complete closure. Offering alternative solutions or suggesting future collaborations can soften the blow and maintain a positive professional relationship. This approach demonstrates respect for the proposer’s time and effort, leaving the door open for potential future engagement. A well-crafted suggestion of alternative paths can transform a rejection into a valuable learning experience for both parties.

By proposing alternative approaches or suggesting future collaborations, you can mitigate any negative feelings associated with the rejection and potentially pave the way for future beneficial partnerships. This strategy focuses on building long-term relationships rather than solely focusing on the immediate proposal. Consider the proposer’s strengths and your company’s needs to identify mutually beneficial avenues for future cooperation.

Suggesting Alternative Solutions

When rejecting a proposal, consider if aspects of the proposal hold merit, even if the overall concept isn’t feasible at this time. Perhaps a modified version of the proposal, focusing on a smaller scale or a different target audience, could be more suitable. Alternatively, you might identify a specific component of the proposal that aligns with your current business needs. Offering concrete suggestions demonstrates your genuine consideration of their work and strengthens your professional image.

For example, if a proposal involves a large-scale marketing campaign, you could suggest a pilot program focusing on a smaller segment of your target market. This allows you to test the proposed strategy’s effectiveness before committing to a larger investment. Alternatively, if the proposal’s core technology is valuable, you could suggest integrating a modified version of that technology into an existing project.

Phrases for Offering Future Opportunities

The following phrases can be effectively used to offer future opportunities while still conveying the current rejection:

“While we’re unable to proceed with this proposal at this time, we’re impressed with [specific aspect of the proposal]. We’d be interested in exploring a collaboration on [alternative project/area] in the future.”

“Although this particular proposal doesn’t align with our current strategic priorities, we see significant potential in your approach. We’d be happy to discuss alternative projects or collaborations that leverage your expertise in [relevant area] down the line.”

“Thank you for your detailed proposal. While we’ve decided not to move forward with this specific project, we appreciate your innovative thinking and would be keen to explore potential future collaborations when the opportunity arises.”

Benefits of Suggesting Alternative Approaches

Offering alternative approaches or suggesting future collaborations provides several significant benefits:

- Maintains Positive Relationships: A respectful rejection preserves professional goodwill and keeps the door open for future collaborations.

- Demonstrates Consideration: It shows that you value the proposer’s time and effort, even if you can’t adopt their proposal as presented.

- Identifies Potential Synergies: It allows for the discovery of hidden opportunities and mutually beneficial partnerships.

- Enhances Reputation: A reputation for fairness and consideration attracts high-quality proposals in the future.

- Avoids Legal Issues: A well-crafted rejection with alternative suggestions reduces the risk of future disputes or legal complications.

Visual Aids for Communication

Visual aids significantly enhance the effectiveness of communicating a business proposal rejection. They help convey complex information concisely and ensure the message is understood clearly, minimizing any potential for misinterpretation or hurt feelings. A well-designed visual can reinforce the politeness and professionalism of the rejection, leaving the door open for future collaboration.

Flowchart Illustrating Polite Proposal Rejection

This flowchart visually Artikels the steps involved in politely rejecting a business proposal. The flowchart uses a clean, modern design with a predominantly white background to enhance readability. The steps are presented in distinct boxes, each with rounded corners for a softer, less formal feel. A light blue is used for the main process boxes, with a slightly darker shade of blue for decision points (e.g., “Is the proposal suitable?”). Green is used to highlight the positive outcomes, such as acknowledging the effort and expressing future interest, while a muted grey is used for the final “Rejection” box to soften the impact. The layout is linear, following a top-to-bottom flow, making the process easy to follow. Each step includes a concise description, using clear and professional language. Arrows connecting the boxes are thin and light blue, providing visual direction without being intrusive. The overall aesthetic is professional yet approachable, reflecting the tone of a polite rejection.

Visual Metaphor: Balancing Politeness and Clarity

The visual metaphor chosen is a carefully balanced scale. On one side, a feather represents politeness – light, delicate, and suggestive of a gentle approach. On the other side, a precisely cut diamond represents clarity – sharp, precise, and representing the need for unambiguous communication. The scale is perfectly balanced, illustrating the delicate equilibrium required when rejecting a business proposal. The background is a soft, neutral grey, emphasizing the importance of maintaining a professional and objective tone. The scale itself is made of polished dark wood, suggesting strength and stability in the decision-making process. The overall image communicates the necessity of both elements – politeness prevents causing offense, while clarity ensures the rejection is understood without ambiguity. The balance symbolizes the need for a measured approach, where neither politeness nor clarity overshadows the other.