How to start dog breeding business – How to start a dog breeding business? This question opens the door to a world of responsible pet ownership, ethical breeding practices, and potentially lucrative entrepreneurship. Starting a dog breeding business isn’t just about making money; it’s about carefully selecting healthy dogs, providing exceptional care, and finding loving homes for puppies. This guide delves into the essential steps, from market research and financial planning to legal considerations and marketing strategies, equipping aspiring breeders with the knowledge to navigate this rewarding yet challenging path.

Success in dog breeding requires a deep commitment to animal welfare, a strong business acumen, and a thorough understanding of the chosen breed. This involves meticulous planning, significant upfront investment, and ongoing dedication to the health and well-being of your dogs and their offspring. From selecting genetically sound breeding stock to marketing your puppies effectively, every stage demands careful consideration and responsible execution. This guide aims to provide a comprehensive roadmap for aspiring breeders to embark on this journey responsibly and successfully.

Market Research and Business Planning

Launching a successful dog breeding business requires meticulous planning and a deep understanding of the market. This involves more than just a love for dogs; it necessitates a robust business strategy encompassing market analysis, financial projections, and a comprehensive understanding of the legal and ethical considerations involved. Failing to adequately address these aspects can lead to significant financial losses and reputational damage.

Market research forms the cornerstone of any viable business plan. A thorough understanding of your target market, including breed preferences, pricing sensitivities, and competitive landscape, is crucial for success. Similarly, a well-defined business plan provides a roadmap for navigating the complexities of starting and operating a dog breeding business, ensuring its long-term sustainability and profitability.

Market Demand Analysis for Dog Breeds

Determining the demand for specific dog breeds in your region is paramount. This involves researching local trends, analyzing sales data from local breeders and shelters, and surveying potential customers to gauge interest in various breeds. For example, a region with a high proportion of active individuals might show a preference for energetic breeds like Border Collies or Australian Shepherds, while a more suburban area might favor smaller, less demanding breeds such as Poodles or Shih Tzus. This data will inform your breeding choices and minimize the risk of breeding dogs with low market demand. Analyzing online classifieds, pet adoption websites, and social media groups dedicated to specific breeds can also provide valuable insights into local breed popularity.

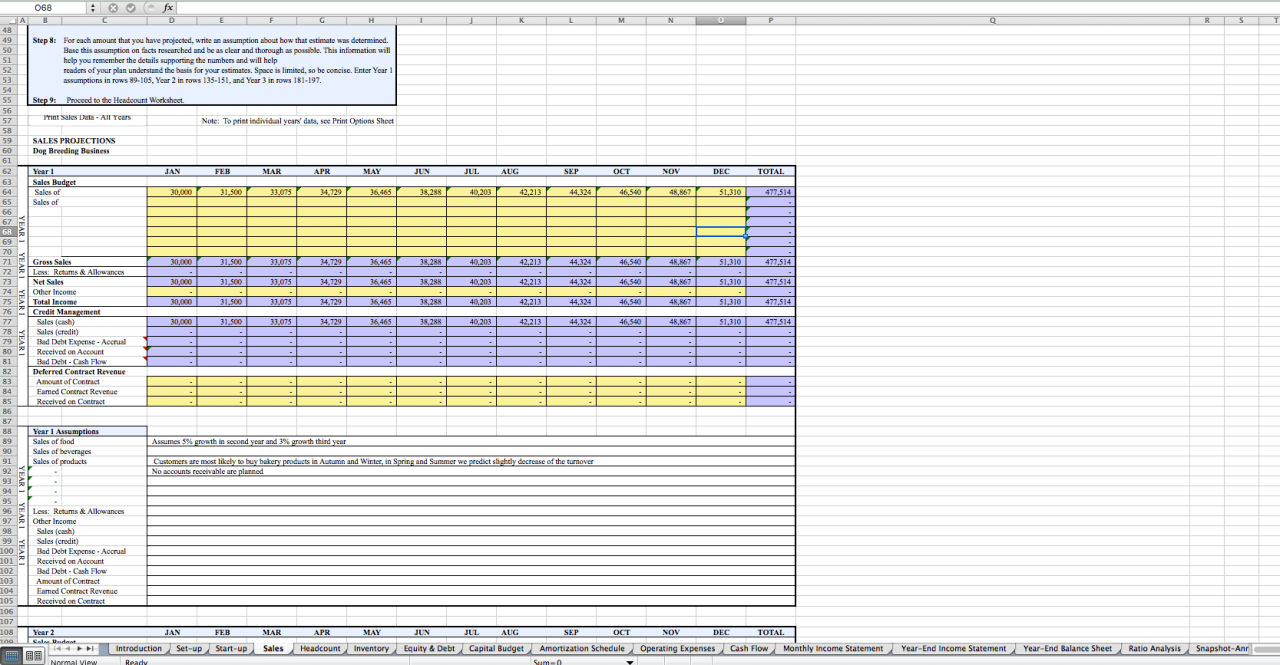

Business Plan Development and Financial Projections

A comprehensive business plan is essential for securing funding and guiding your business’s growth. This plan should detail startup costs, including breeding stock acquisition, veterinary care, facility setup (kennels, equipment), advertising, and insurance. Projected revenue should be based on realistic estimates of litter sizes, puppy sales prices, and potential additional income streams such as stud services or dog training. A three-year financial projection should illustrate your expected income, expenses, and profitability, accounting for potential fluctuations in demand and unexpected costs. For instance, a realistic projection might assume an average of six puppies per litter, sold at a price point competitive with other reputable breeders in the area, and factor in costs associated with health testing, vaccinations, and potential emergency veterinary care. It’s crucial to build in a buffer for unforeseen expenses to mitigate financial risks.

SWOT Analysis for Dog Breeding Businesses

Conducting a SWOT analysis helps identify the internal strengths and weaknesses of your business, as well as external opportunities and threats. Strengths might include access to high-quality breeding stock, expertise in a specific breed, or a strong online presence. Weaknesses could be limited experience, lack of sufficient capital, or inadequate facilities. Opportunities could involve untapped market segments (e.g., breeding rare breeds), partnerships with local pet stores or veterinary clinics, or expanding into related services like dog training. Threats might include increased competition, changes in legislation affecting dog breeding, or economic downturns affecting consumer spending on pets. A thorough SWOT analysis allows you to proactively address potential challenges and capitalize on emerging opportunities.

Comparison of Business Structures

Choosing the right business structure is crucial for legal and financial reasons. A sole proprietorship offers simplicity but exposes personal assets to business liabilities. A partnership shares responsibilities and resources but necessitates a comprehensive partnership agreement. An LLC (Limited Liability Company) offers limited liability protection, separating personal and business assets, and provides greater flexibility in terms of taxation and management. The choice depends on factors like risk tolerance, financial resources, and long-term goals. For example, a large-scale breeding operation might benefit from the limited liability protection of an LLC, while a smaller, home-based operation might find a sole proprietorship sufficient, provided appropriate insurance is in place. Consulting with a legal and financial professional is advisable to determine the optimal business structure for your specific circumstances.

Selecting Breeding Dogs

Selecting breeding dogs is a crucial step in establishing a successful and ethical dog breeding business. The health, temperament, and genetic background of your breeding stock directly impact the health and well-being of future generations of puppies, as well as the reputation of your kennel. Careful consideration of several key factors is essential to ensure the responsible and successful breeding of healthy, well-adjusted dogs.

Health Testing Requirements

Comprehensive health testing is paramount to minimizing the risk of passing on genetic diseases to offspring. This involves a series of tests specific to the breed, often including hip and elbow dysplasia screenings (x-rays), eye examinations (to detect conditions like progressive retinal atrophy), cardiac evaluations (for heart conditions), and DNA tests for breed-specific genetic disorders. The results of these tests should be reviewed by a veterinarian experienced in canine genetics to assess the overall health status of the potential breeding dog. Only dogs with results deemed acceptable within breed standards should be considered for breeding. Failure to conduct thorough health testing can result in the birth of puppies with debilitating conditions, leading to ethical concerns, financial losses, and reputational damage. Organizations like the Orthopedic Foundation for Animals (OFA) and the Canine Health Information Center (CHIC) provide valuable resources and databases for verifying health test results.

Desirable Temperament and Physical Characteristics

Beyond physical health, the temperament and conformation of breeding dogs are vital. The desired temperament will vary depending on the breed standard. For example, a working breed like a Border Collie should exhibit high intelligence, energy, and a strong work ethic, while a companion breed like a Cavalier King Charles Spaniel should display a gentle, affectionate, and adaptable nature. Similarly, physical characteristics should adhere to the breed standard, emphasizing soundness of structure and movement. Dogs with significant deviations from the breed standard, such as structural defects that could impair their health or functionality, should not be used for breeding. A breeder should strive to consistently improve the breed by selecting dogs that exemplify the ideal characteristics as defined by the breed club or kennel club.

Pedigree Research and Genetic Defects

Thorough pedigree research is essential to identify potential genetic weaknesses within a dog’s lineage. By analyzing several generations of ancestry, breeders can identify any recurring health problems or undesirable traits. Software and online databases dedicated to canine pedigrees can assist in this process. Dogs with a history of genetic defects, such as hip dysplasia or certain eye conditions, should be avoided as breeding stock, even if they appear healthy themselves. The goal is to minimize the risk of perpetuating these problems within the breed and to ensure the overall genetic health of future generations. Selecting dogs with minimal genetic defects is crucial for ethical and responsible breeding practices.

Cost Comparison of Breeding Dogs

The cost of acquiring breeding dogs varies significantly depending on the quality and pedigree of the dog. The following table illustrates the potential cost differences:

| Quality Level | Acquisition Cost | Additional Costs | Total Estimated Cost |

|---|---|---|---|

| Pet Quality | $500 – $1500 | Health Testing, Vaccinations | $800 – $2000 |

| Show Quality (Non-Champion) | $1500 – $5000 | Health Testing, Show Entry Fees, Training | $2500 – $7000 |

| Champion Bloodlines | $5000+ | Extensive Health Testing, Show Entry Fees, Stud Fees, Professional Handling | $10,000+ |

Breeding and Puppy Care: How To Start Dog Breeding Business

Responsible dog breeding extends far beyond the initial mating; it encompasses meticulous planning, careful monitoring throughout pregnancy, and diligent care for the newborn puppies. Success hinges on a deep understanding of canine reproductive biology and a commitment to the well-being of both the mother and her offspring. Neglect in any of these areas can lead to significant health problems and compromised puppy development.

Timing of Breeding and Monitoring Pregnancy

Optimal breeding timing is crucial for maximizing the chances of a successful pregnancy and healthy puppies. This involves understanding the bitch’s estrous cycle, specifically the period of heat (estrus) when she is receptive to mating. Veterinary guidance is invaluable in determining the precise moment for breeding, often using hormone testing to pinpoint ovulation. Throughout pregnancy, regular veterinary checkups are essential to monitor the mother’s health and the development of the puppies. Ultrasound scans can confirm pregnancy and track fetal growth, while blood tests can assess the mother’s overall health and detect potential complications. Weight gain, appetite changes, and behavioral shifts in the mother should also be carefully observed and documented. Any unusual signs should be immediately reported to the veterinarian.

Whelping Assistance

The birthing process (whelping) can be a challenging time for both the mother and the breeder. While many bitches whelp naturally without assistance, being prepared for potential complications is crucial. A clean, quiet, and safe whelping box should be prepared in advance, equipped with soft bedding and a heat source if necessary. The breeder should monitor the mother closely for signs of labor, including restlessness, panting, and nesting behavior. Assistance may be required if the mother is struggling to deliver puppies, if there are prolonged intervals between puppies, or if there are signs of dystocia (difficult birth). Veterinary intervention might be necessary in such situations. Post-whelping, the breeder should monitor the mother and puppies for any signs of infection, bleeding, or weakness.

Newborn Puppy Care

The first few weeks of a puppy’s life are critical for their development and survival. A consistent daily routine is essential for their well-being. Newborn puppies are entirely dependent on their mother for warmth, nourishment, and hygiene. The mother will typically nurse her puppies frequently, and the breeder should ensure that all puppies have access to the teats and are nursing effectively. Regular weighing of the puppies is crucial to monitor their growth and identify any potential problems. The whelping box should be kept clean and dry, and soiled bedding should be changed frequently. The puppies’ eyes and ears should be cleaned gently with a soft cloth and warm water if necessary. Early socialization, involving gentle handling and exposure to various sights and sounds, is also important for their development. The breeder should carefully handle each puppy daily, ensuring they are stimulated and encouraged to interact.

Providing a Safe and Stimulating Environment

Creating a safe and stimulating environment is vital for the healthy development of puppies. The whelping area should be secure, draft-free, and protected from extreme temperatures. As the puppies grow, they will need access to a progressively larger area for exploration and play. This space should be puppy-proofed to prevent accidents and ingestion of harmful substances. Providing a variety of toys and enrichment activities, such as puzzle feeders and chew toys, will help stimulate their senses and encourage healthy development. The environment should also offer a balance of quiet rest periods and opportunities for interaction and play.

Routine Veterinary Care Schedule

A comprehensive veterinary care schedule is crucial for both the mother and the puppies. The mother should receive a pre-breeding checkup to assess her overall health and reproductive fitness. Post-whelping, she will need regular checkups to monitor her recovery and identify any potential complications. The puppies should receive their first veterinary examination within the first few weeks of life, including vaccinations and deworming. Subsequent vaccinations and deworming will be scheduled according to the veterinarian’s recommendations. Regular health checks will help identify and address any potential health problems early on. This proactive approach to veterinary care is essential for ensuring the health and well-being of both the mother and her offspring.

Legal and Ethical Considerations

Launching a dog breeding business requires navigating a complex web of legal and ethical responsibilities. Failure to comply with regulations or adhere to ethical breeding practices can lead to significant legal penalties, reputational damage, and animal welfare concerns. Understanding these aspects is crucial for establishing a successful and responsible breeding program.

Relevant Regulations for Dog Breeding

Federal, state, and local laws significantly impact dog breeding operations. Federal regulations often focus on animal welfare, encompassing the Animal Welfare Act (AWA) which regulates the treatment of animals in research, exhibition, transport, and by dealers. State laws vary considerably, often addressing issues such as licensing requirements, zoning restrictions, and specific breeding practices. Local ordinances might include noise restrictions, limitations on the number of animals allowed on a property, and waste disposal regulations. Breeders must research and comply with all applicable laws at each jurisdictional level to avoid legal issues. For example, some states require breeders to obtain a license, undergo inspections, and meet specific standards of care. Others might have stricter regulations on certain breeds considered dangerous or prone to specific health issues. Local zoning regulations may limit the number of animals allowed on a property based on its size and location. Ignoring these regulations can result in fines, legal action, and the seizure of animals.

Ethical Considerations in Dog Breeding

Ethical dog breeding prioritizes the health and well-being of the animals above profit. Responsible breeders conduct thorough health screenings for genetic diseases, ensuring the health of parent dogs and minimizing the risk of inherited conditions in puppies. They avoid breeding dogs with known health problems, selecting only those with excellent temperaments and conformation that meet breed standards. Furthermore, ethical breeders carefully plan matings to reduce the risk of inbreeding and maintain genetic diversity within the breed. Preventing puppy mills, large-scale commercial breeding operations that prioritize profit over animal welfare, is a key ethical concern. Puppy mills often house dogs in unsanitary conditions, lack veterinary care, and engage in unethical breeding practices. Supporting responsible breeders directly combats the proliferation of puppy mills.

Registering Dogs with Kennel Clubs

Registering dogs with reputable kennel clubs like the American Kennel Club (AKC) or the United Kennel Club (UKC) provides several benefits. Registration establishes a dog’s lineage, verifies its breed, and helps maintain breed standards. It also provides access to health testing programs and breed-specific information. The registration process typically involves submitting an application with the dog’s pedigree and relevant documentation. Kennel club registration is not mandatory for all breeders, but it enhances credibility and provides a level of assurance to potential buyers that the breeder is committed to responsible breeding practices.

Resources for Responsible Breeders

Numerous organizations provide resources and support for responsible dog breeders. The AKC, UKC, and breed-specific clubs offer valuable information on health testing, breeding practices, and ethical considerations. Veterinarians specializing in canine reproduction can provide guidance on breeding strategies and health management. Organizations like the American Veterinary Medical Association (AVMA) and the Orthopedic Foundation for Animals (OFA) offer resources on canine health and genetic testing. These resources can help breeders stay informed about best practices and maintain high ethical standards in their breeding programs. Additionally, many online forums and communities connect responsible breeders, providing opportunities for collaboration and information sharing. These resources collectively contribute to the improvement of canine health and welfare.

Marketing and Sales

Successfully launching a dog breeding business requires a robust marketing and sales strategy to connect with potential puppy buyers and establish your brand. This involves a multi-faceted approach encompassing both online and offline channels, carefully crafted marketing materials, and a rigorous screening process to ensure responsible pet ownership.

A comprehensive marketing plan should target various demographics interested in specific breeds. This includes utilizing both traditional and digital marketing methods to maximize reach and brand awareness. Understanding your target audience’s preferences and behaviors is key to developing effective marketing campaigns.

Online Marketing Strategies

The internet offers powerful tools for reaching potential puppy buyers. A strong online presence is crucial for building trust and showcasing your breeding program. This includes utilizing various digital platforms to connect with your target audience and build a loyal customer base.

- Website Development: A professional, informative website is essential. It should feature high-quality photos and videos of your dogs and puppies, detailed breed information, your breeding philosophy, testimonials from previous buyers, and clear contact information. Consider incorporating a blog to share updates, educational content, and build community engagement. A well-designed website enhances credibility and showcases your professionalism.

- Social Media Marketing: Utilize platforms like Instagram, Facebook, and TikTok to share captivating visuals and engaging content. Showcase your dogs’ personalities, share puppy updates, and run targeted advertising campaigns to reach potential buyers based on location, interests, and demographics. Regular posts, interactive stories, and engaging videos are key to attracting and retaining followers. Consistent brand messaging across all platforms is important for maintaining a unified image.

- Search Engine Optimization (): Optimize your website and online content for relevant s to improve your search engine ranking. This will help potential buyers find your business when searching for specific breeds or dog breeders in their area. is a long-term strategy requiring consistent effort but offers significant returns in organic traffic.

Offline Marketing Strategies

While online marketing is crucial, offline strategies remain important for reaching a wider audience and building local relationships. These traditional methods offer a tangible connection and can build trust within your community.

- Local Partnerships: Collaborate with local veterinarians, pet supply stores, and dog trainers to promote your breeding program. This can involve cross-promotion, referral programs, or joint events. Building relationships with trusted local businesses increases your credibility and expands your reach within the community.

- Print Advertising: Consider placing ads in local newspapers or magazines that cater to pet owners. While less targeted than online advertising, print ads can still reach a significant segment of the population, particularly those who may not be as active online.

- Dog Shows and Events: Participate in local dog shows and events to showcase your dogs and connect with potential buyers in person. This offers an opportunity to build relationships, answer questions directly, and build trust through face-to-face interaction.

Marketing Materials

Effective marketing materials are essential for conveying your brand message and attracting potential buyers. High-quality visuals and compelling copy are key to making a positive impression.

- Website Copy: The website copy should be informative, engaging, and professional. It should clearly communicate your breeding philosophy, the health and temperament of your dogs, and the process of acquiring a puppy. Use high-quality images and videos to showcase your dogs and puppies.

- Brochures: Create visually appealing brochures with high-quality images of your dogs and puppies, key information about your breeding program, and contact details. Brochures can be distributed at dog shows, pet supply stores, and other relevant locations.

- Social Media Posts: Create visually appealing and engaging social media posts with high-quality images and videos. Use relevant hashtags to increase visibility and reach a wider audience. Consider running contests and giveaways to increase engagement and brand awareness.

Screening Potential Puppy Buyers

Responsible breeders prioritize finding suitable homes for their puppies. A thorough screening process is crucial to ensure the well-being of the puppies and prevent them from ending up in unsuitable environments. This process should be implemented for every prospective buyer.

- Application Process: Require potential buyers to complete a detailed application that includes questions about their lifestyle, experience with dogs, housing situation, and commitment to providing proper care. This helps you assess their suitability as pet owners.

- Home Visits: Conduct home visits to assess the environment where the puppy will live. This allows you to evaluate the safety and suitability of the home, ensuring the puppy will have a secure and enriching environment.

- Reference Checks: Contact references provided by potential buyers to verify their information and assess their character and responsibility.

- Contractual Agreements: Use a comprehensive contract that Artikels the responsibilities of both the breeder and the buyer, including provisions for the return of the puppy if necessary. This protects both parties and ensures the puppy’s welfare.

Financial Management

Successful dog breeding requires meticulous financial management. Ignoring this aspect can quickly lead to losses, even with healthy puppy sales. A robust financial system is crucial for tracking income, managing expenses, and ensuring the long-term viability of your business. This section details strategies for effective financial management in a dog breeding operation.

Income and Expense Tracking

Implementing a reliable system for tracking income and expenses is paramount. This involves meticulously recording all revenue streams, including puppy sales, stud fees, and any additional income generated from services like dog training or grooming. Simultaneously, all expenses must be documented, categorized, and tracked. This includes costs for food, veterinary care, breeding supplies, marketing, insurance, and housing. Utilizing accounting software, spreadsheets, or dedicated business management apps can streamline this process and provide valuable insights into your business’s financial health. Regularly reviewing these records allows for informed decision-making and identifies areas for potential cost savings. For example, a detailed record of veterinary expenses might reveal a specific breed’s predisposition to a particular illness, informing future breeding decisions.

Cash Flow Management and Budgeting for Unexpected Costs

Effective cash flow management is vital for the stability of any business, particularly one as unpredictable as dog breeding. Unexpected veterinary emergencies, sudden illnesses, or unforeseen breeding complications can significantly impact cash flow. Developing a comprehensive budget that accounts for both regular and potential emergency expenses is essential. This budget should include a contingency fund specifically allocated for unexpected costs. Regularly reviewing and adjusting your budget based on actual income and expenses ensures your business remains financially sound. For instance, a breeder might set aside 10% of their monthly revenue for unforeseen veterinary bills, while another might allocate a specific sum based on past experience with veterinary costs for their breed. This proactive approach minimizes financial disruptions during challenging periods.

Maintaining Accurate Financial Records

Maintaining accurate and up-to-date financial records is not merely a good practice; it’s a legal necessity. Accurate records are crucial for tax purposes, securing loans, and demonstrating the financial health of your business to potential investors or partners. These records should adhere to generally accepted accounting principles (GAAP) and be easily accessible for audits. Consider consulting with an accountant or bookkeeper to ensure your records are properly maintained and compliant with all relevant regulations. The consequences of inaccurate record-keeping can range from penalties and fines to legal issues, severely impacting the business’s reputation and future prospects. Regularly backing up your financial data is also crucial to mitigate the risk of data loss.

Puppy Pricing Strategies

Pricing puppies effectively is crucial for profitability. Several factors influence puppy pricing, including breed, lineage, health testing results, demand, and the breeder’s overhead costs. Different pricing strategies exist. Cost-plus pricing involves calculating all breeding-related expenses and adding a desired profit margin. Value-based pricing focuses on the perceived value of the puppy based on its qualities and pedigree. Competitive pricing involves analyzing the prices of similar puppies from other breeders. A combination of these methods is often employed to arrive at a fair and profitable price. For example, a breeder might use cost-plus pricing as a baseline, then adjust the price upwards based on the puppy’s exceptional pedigree or unique traits, reflecting value-based pricing. Regular market research helps refine pricing strategies and ensure competitiveness.

Health and Welfare

Responsible dog breeding prioritizes the health and well-being of both parent dogs and their offspring. A comprehensive health management program is crucial for preventing disease, ensuring healthy development, and minimizing suffering. This involves preventative healthcare, early detection of potential problems, and maintaining a clean and stimulating environment.

Preventative Healthcare Measures for Breeding Dogs and Puppies

Preventative healthcare is the cornerstone of responsible breeding. This encompasses regular veterinary check-ups, vaccinations, parasite control, and a balanced diet tailored to the dog’s life stage and breed-specific needs. Regular veterinary visits allow for early detection of any health issues, enabling prompt intervention and potentially preventing more serious problems down the line. Vaccinations protect against contagious diseases, while parasite control (fleas, ticks, worms) minimizes the risk of infection and associated health complications. A nutritionally balanced diet provides the essential nutrients for optimal growth, reproduction, and overall health. For pregnant and lactating females, nutritional requirements are significantly higher and should be carefully managed under veterinary guidance. This may involve specialized diets or supplements.

Common Health Problems and Prevention Strategies

The prevalence of specific health issues varies greatly depending on the breed. For example, hip dysplasia is a common concern in larger breeds like German Shepherds and Golden Retrievers. Careful selection of breeding stock, utilizing hip and elbow scoring, and implementing breeding strategies that minimize the risk of inheriting this condition are crucial. Other common issues include eye diseases (e.g., progressive retinal atrophy), heart conditions (e.g., dilated cardiomyopathy), and certain types of cancer. Breed-specific health testing, conducted by veterinary professionals, can identify carriers of genetic diseases and help breeders make informed decisions about which dogs to breed. By selecting healthy breeding stock and implementing appropriate screening, breeders can significantly reduce the incidence of these hereditary conditions in future generations. Furthermore, maintaining a healthy weight and providing regular exercise can help prevent or mitigate some health issues.

Maintaining a Clean and Sanitary Environment, How to start dog breeding business

Maintaining a clean and sanitary environment is paramount for preventing the spread of disease and promoting the overall well-being of dogs. This involves regular cleaning and disinfection of kennels, bedding, food and water bowls, and all other surfaces the dogs come into contact with. Appropriate waste disposal is essential to prevent parasite infestations and the spread of infectious agents. Proper ventilation is crucial to prevent the build-up of ammonia and other harmful gases. Regular pest control measures should be implemented to minimize the risk of flea and tick infestations. The breeding environment should be designed to minimize stress and provide ample space for the dogs to move around comfortably. Cleanliness is a fundamental aspect of preventing disease and ensuring a healthy living environment for breeding dogs and their puppies.

Daily Health Monitoring Checklist

A daily health monitoring checklist helps breeders promptly identify any deviations from normal health. This proactive approach allows for timely intervention, potentially preventing minor issues from escalating into major health problems.

- Body Condition Score: Assess the dog’s weight and body condition. Is the dog maintaining a healthy weight, or is it overweight or underweight?

- Appetite and Water Intake: Note any changes in appetite or water consumption. A significant decrease or increase can indicate illness.

- Fecal and Urinary Output: Observe the consistency, color, and frequency of bowel movements and urination. Changes can be indicative of digestive or urinary tract problems.

- Coat Condition: Examine the coat for any signs of dryness, dullness, matting, or parasites.

- Skin Condition: Check for any redness, irritation, lesions, or parasites.

- Eyes, Ears, and Nose: Inspect the eyes for discharge, cloudiness, or redness. Check the ears for redness, inflammation, or discharge. Examine the nose for any unusual discharge.

- Temperament and Behavior: Observe the dog’s behavior for any signs of lethargy, depression, aggression, or unusual vocalizations.

- Temperature: Regularly check the dog’s temperature, especially during illness or pregnancy. A rectal temperature above 102°F (39°C) warrants veterinary attention.