What is business categories? Understanding business categories is crucial for navigating the complex commercial landscape. This involves not only recognizing broad classifications like retail, manufacturing, and services, but also delving into the nuanced subcategories within each sector. We’ll explore how businesses are categorized by size, structure (sole proprietorships, partnerships, corporations), and the impact of technology, including the emergence of entirely new digital business models. Furthermore, we’ll examine the role of government regulations and statistical categorizations in shaping our understanding of the business world.

This exploration will provide a framework for comprehending the diverse ways businesses are classified, from broad industry sectors to the specific legal structures and technological influences that define them. We’ll analyze how these classifications impact access to funding, regulatory compliance, and overall market understanding.

Defining Business Categories

Categorizing businesses is fundamental for understanding market structures, facilitating economic analysis, and informing strategic decision-making. A clear categorization system allows for efficient resource allocation, targeted marketing efforts, and the development of relevant industry regulations. Without a structured approach, analyzing economic trends, identifying competitive landscapes, and supporting business growth becomes significantly more challenging.

Business categorization provides a framework for understanding the diverse range of economic activities. This framework helps to identify similarities and differences between businesses, enabling more effective comparison and analysis. The resulting clarity facilitates informed decision-making for businesses, investors, and policymakers alike.

Broad Business Categories

Several broad categories encapsulate the majority of business activities. These categories are not mutually exclusive; many businesses operate across multiple categories. For instance, a company might manufacture products (manufacturing) and then sell them directly to consumers through an online store (retail) and offer installation services (services). The primary activity, however, usually determines the dominant category. These broad categories provide a high-level overview of the business landscape.

- Retail: Businesses focused on selling goods directly to consumers. Examples include grocery stores, clothing boutiques, and online retailers like Amazon.

- Manufacturing: Businesses that transform raw materials into finished goods. Examples include automobile manufacturers, food processors, and textile mills.

- Services: Businesses that provide intangible services rather than physical products. Examples include consulting firms, healthcare providers, and educational institutions.

A Structured Approach to Business Classification

A robust system for classifying businesses requires a multi-faceted approach that considers various factors beyond just the primary activity. This structured approach allows for more nuanced categorization, capturing the complexity of modern business operations. A hierarchical system, starting with broad categories and then progressively refining them based on specific characteristics, proves particularly effective.

Organizing Businesses Based on Primary Activities

A hierarchical system for organizing businesses can be designed using a combination of factors, including the primary activity, the target market, the size of the business, and its legal structure. This system allows for a more granular understanding of the business landscape and enables more targeted analysis and decision-making. For example, within the “Retail” category, further sub-categories could include “Grocery Retail,” “Clothing Retail,” and “E-commerce Retail.” Each of these sub-categories could be further divided based on factors like business size (small, medium, large) or ownership structure (sole proprietorship, partnership, corporation). This layered approach provides a comprehensive and flexible system for categorizing businesses.

Industry-Specific Categories

Understanding the nuances of industry-specific business categories is crucial for effective market analysis, strategic planning, and competitive advantage. Different industries operate under unique regulatory environments, utilize distinct technologies, and cater to specific customer needs. This necessitates a detailed examination of the sub-categories within each major industry sector to accurately assess market dynamics and potential opportunities.

Retail Industry Subcategories

The retail industry encompasses a vast array of businesses involved in selling goods directly to consumers. Subcategories are often defined by the type of goods sold, the sales channel used, and the target market. These subcategories aren’t mutually exclusive; a single business might operate across several.

- Grocery Stores: These businesses specialize in selling perishable and non-perishable food items, often including household goods. Examples include supermarkets, hypermarkets, and convenience stores, each with differing scales and product assortments.

- Apparel Retail: This sector includes businesses selling clothing, footwear, and accessories. Subcategories range from high-end boutiques to fast-fashion chains and online retailers, each with unique pricing strategies and target demographics.

- Electronics Retail: Businesses selling consumer electronics, from smartphones and computers to home appliances. They can be specialized stores focusing on a particular type of electronics or general retailers offering a broader range of products.

- Specialty Retail: This category encompasses businesses focused on a particular niche, such as sporting goods, books, or hobby supplies. These retailers often leverage expert knowledge and specialized product offerings to attract a loyal customer base.

- E-commerce Retail: This rapidly growing sector encompasses online retailers selling goods directly to consumers through websites or mobile apps. E-commerce businesses can range from large multinational corporations to small independent online stores.

Manufacturing Business Categories, What is business categories

Manufacturing businesses transform raw materials or components into finished goods. Key distinctions between categories arise from the type of goods produced, the production processes employed, and the scale of operations.

- Heavy Manufacturing: This involves the production of large-scale goods like machinery, vehicles, and construction materials, often requiring significant capital investment and specialized infrastructure. Examples include automobile manufacturing and steel production.

- Light Manufacturing: This sector focuses on smaller, less complex products, often involving assembly or processing rather than heavy fabrication. Examples include the production of clothing, electronics, and food products.

- Custom Manufacturing: This involves producing goods to meet specific customer requirements, often involving lower production volumes and higher customization costs. Examples include bespoke furniture making and specialized equipment manufacturing.

- Mass Production Manufacturing: This emphasizes high-volume production of standardized goods, aiming for economies of scale and cost efficiency. Examples include the production of consumer electronics and automobiles.

Service Business Categories

Service businesses provide intangible services rather than physical products. Differences between categories are often determined by the type of service offered, the target market, and the delivery method.

- Financial Services: This broad category encompasses banking, insurance, investment management, and other services related to managing money and financial assets. These businesses are heavily regulated and require specialized expertise.

- Healthcare Services: This sector includes hospitals, clinics, doctors’ offices, and other businesses providing medical care and related services. Regulation and licensing requirements are significant in this industry.

- Professional Services: This category includes businesses providing specialized expertise in areas such as law, accounting, consulting, and engineering. These businesses often require highly skilled professionals with advanced degrees or certifications.

- Hospitality Services: This sector encompasses hotels, restaurants, tourism agencies, and other businesses providing services related to accommodation, food, and entertainment. Customer service and operational efficiency are critical factors for success.

Categorization by Size and Structure

Categorizing businesses by size and structure provides valuable insights into their operational capabilities, market position, and overall economic impact. Understanding these distinctions is crucial for investors, policymakers, and businesses themselves in strategic planning and resource allocation. Size, typically measured by revenue, directly correlates with a company’s scale of operations, while legal structure significantly impacts liability, taxation, and management.

Businesses are often categorized based on their revenue size, typically segmented into small, medium, and large enterprises. These classifications vary by country and industry, often reflecting local economic contexts and industry standards. For example, the Small Business Administration (SBA) in the United States uses different revenue thresholds to define small businesses across various sectors. These size classifications are not static; a business can grow from one category to another over time.

Business Size Categorization by Revenue

While precise definitions vary, a general framework categorizes businesses based on annual revenue:

- Small Businesses: Typically generate less than $1 million to $5 million in annual revenue, depending on the industry and country. These businesses are characterized by limited resources and a smaller workforce.

- Medium-sized Businesses: Generally have annual revenues between $5 million and $50 million. They employ a larger workforce and possess more resources than small businesses, allowing for greater expansion capabilities.

- Large Businesses: These businesses usually generate annual revenues exceeding $50 million. They often operate on a national or international scale, possessing significant resources and complex organizational structures.

Legal Structures and Their Impact

The legal structure of a business significantly influences its categorization and operational aspects. Three common structures are sole proprietorships, partnerships, and corporations. The table below highlights key differences:

| Feature | Sole Proprietorship | Partnership | Corporation |

|---|---|---|---|

| Liability | Unlimited personal liability | Partners share liability; potential for unlimited personal liability | Limited liability; personal assets protected |

| Taxation | Pass-through taxation (owner pays taxes on business income) | Pass-through taxation (partners pay taxes on their share of income) | Corporate tax rate; dividends taxed at individual level (double taxation) |

| Management | Solely managed by the owner | Managed by the partners | Managed by a board of directors and officers |

| Funding | Limited to owner’s resources and loans | Limited to partners’ resources and loans | Access to broader funding options, including equity financing |

Organizational Structures Across Business Categories

Organizational structure varies significantly across business categories. Small businesses often adopt simpler structures, such as a flat organizational chart with minimal hierarchical layers. Medium-sized businesses may adopt more complex structures, incorporating functional departments (e.g., marketing, sales, operations). Large businesses frequently utilize sophisticated structures like divisional structures or matrix structures to manage diverse operations and geographical locations. The choice of structure depends on factors such as business size, complexity, and strategic goals. For example, a large multinational corporation might employ a divisional structure, organizing its operations by product line or geographical region, while a small local bakery might have a simple, flat structure.

The Impact of Technology on Business Categories: What Is Business Categories

Technology’s relentless advance has fundamentally reshaped the business landscape, blurring the traditional lines that once neatly separated industries. The digital revolution has not only redefined existing categories but also spawned entirely new ones, creating both opportunities and challenges for businesses and researchers alike. Understanding this impact is crucial for accurate market analysis, strategic planning, and effective business categorization.

The convergence of technologies like the internet, mobile computing, and artificial intelligence has created a synergistic effect, breaking down traditional industry barriers. Businesses that were once clearly defined by their physical location or product offerings now operate across multiple sectors, leveraging technology to expand their reach and diversify their services. This fluidity makes precise categorization increasingly difficult, requiring new approaches to classification.

Blurring Lines Between Traditional Business Categories

The rise of e-commerce, for example, has significantly blurred the lines between retail and various other sectors. A clothing retailer now competes not only with other brick-and-mortar stores but also with online marketplaces, social media platforms selling directly to consumers, and even subscription box services. Similarly, the advent of ride-sharing services like Uber and Lyft has challenged the traditional taxi industry and created a new category within transportation and logistics, incorporating elements of technology, service, and independent contracting. Financial technology (FinTech) companies further illustrate this point, blending traditional banking services with innovative software solutions, challenging established financial institutions and creating new competitive landscapes.

New Business Categories Created by Technological Advancements

Technological advancements have not only reshaped existing categories but also given rise to entirely new ones. The emergence of the “sharing economy,” facilitated by platforms like Airbnb and Uber, is a prime example. This new category leverages technology to connect individuals with underutilized assets (spare rooms, vehicles), creating a peer-to-peer marketplace that didn’t exist before. Similarly, the development of big data analytics has led to the growth of data science and business intelligence as distinct business categories, providing crucial insights for decision-making across various sectors. The rise of cybersecurity as a dedicated industry is another example, responding to the growing need for data protection in a digitally interconnected world. These new categories often blend elements from several traditional industries, making classification complex but also highlighting the innovative potential of technology.

Digital Transformation’s Effect on Business Classification

Digital transformation initiatives force businesses to re-evaluate their core competencies and market positioning. A manufacturing company adopting Industry 4.0 technologies, for example, might need to reclassify itself not just as a manufacturer but also as a data-driven organization with expertise in automation and IoT (Internet of Things). This shift necessitates a more dynamic and flexible approach to business classification, moving away from static, pre-defined categories towards a more nuanced understanding of a company’s capabilities and market interactions. The increasing reliance on data and software necessitates incorporating these aspects into classification systems.

Challenges of Categorizing Businesses in the Digital Economy

Categorizing businesses in the digital economy presents significant challenges. The fluidity of business models, the rapid pace of technological change, and the increasing interconnectedness of industries make it difficult to apply traditional classification systems. Furthermore, the emergence of hybrid business models that blend different aspects of several traditional categories makes it difficult to assign businesses to a single, unambiguous category. The lack of standardized metrics and the difficulty in capturing the full scope of a business’s activities also contribute to the challenges of accurate categorization. These complexities necessitate the development of new classification frameworks that can adapt to the dynamic nature of the digital economy.

Governmental and Regulatory Categorizations

Governments categorize businesses for various reasons, primarily for tax collection, regulatory oversight, and the allocation of resources. These categorizations significantly impact a business’s operational landscape, influencing everything from tax liabilities to access to government support programs. Understanding these classifications is crucial for businesses to navigate the complexities of operating within a specific regulatory environment.

Government agencies employ diverse methods for categorizing businesses, often employing a combination of industry codes, size metrics, and legal structure. This complex system ensures effective tax collection, targeted regulatory compliance, and the equitable distribution of public funds.

Business Categorization for Tax Purposes

Tax agencies utilize standardized industry classification systems, such as the North American Industry Classification System (NAICS) in the United States or the Standard Industrial Classification (SIC) in some other countries, to determine applicable tax rates and regulations. These systems assign unique codes to businesses based on their primary activities, influencing the calculation of income tax, sales tax, and other levies. For example, a manufacturing company will be taxed differently than a service-based business, reflecting variations in operational costs and profit margins. Furthermore, tax classifications often determine eligibility for specific tax credits or deductions, impacting a business’s overall tax burden. The complexity of these systems necessitates specialized accounting expertise to ensure accurate tax compliance.

Impact of Industry-Specific Regulations on Business Categorization

Industry-specific regulations significantly shape business categorization. Highly regulated industries, such as pharmaceuticals or finance, face stricter categorization and compliance requirements compared to less regulated sectors. These regulations often dictate licensing, permitting, and reporting obligations, influencing how businesses are classified and monitored by regulatory bodies. For instance, a financial institution will be subject to more rigorous oversight and reporting requirements than a retail store, necessitating a more detailed and specific categorization within government databases. This stringent categorization ensures adequate monitoring and enforcement of industry-specific regulations designed to protect consumers and maintain market stability.

Influence of Business Categories on Access to Government Funding and Support

Government funding and support programs often target specific business categories based on factors like industry, size, location, and economic impact. Businesses classified as small and medium-sized enterprises (SMEs) frequently have access to specialized funding opportunities and grants not available to larger corporations. Similarly, businesses operating in strategically important sectors, such as renewable energy or advanced manufacturing, might receive preferential treatment in terms of funding and incentives. For example, government agencies may offer tax breaks or subsidized loans to businesses involved in sustainable technologies, encouraging investment and growth in these sectors. Understanding the relevant business categories and their eligibility criteria for government programs is essential for businesses seeking external financial assistance.

Governmental Classification of Businesses for Statistical Purposes

Governments collect statistical data on businesses to monitor economic trends, inform policy decisions, and assess the overall health of the economy. This involves classifying businesses based on various criteria, including industry, employment size, geographic location, and legal structure. Data collected through these classifications provide valuable insights into employment rates, industry growth, regional economic disparities, and other key economic indicators. These statistics are crucial for policymakers in designing effective economic policies and allocating resources efficiently. For instance, analyzing employment data categorized by industry can help identify sectors experiencing growth or decline, informing workforce development initiatives and investment strategies.

Visual Representation of Business Categories

Visualizing business categories effectively is crucial for understanding their relationships, evolution, and impact. Different visual representations offer unique perspectives, enabling a more comprehensive analysis than textual descriptions alone. Choosing the appropriate visual depends heavily on the specific information you aim to convey.

Effective visualization helps stakeholders, from entrepreneurs to investors, quickly grasp the landscape of business activities and identify opportunities or potential challenges. A clear visual representation simplifies complex information, facilitating better decision-making and strategic planning.

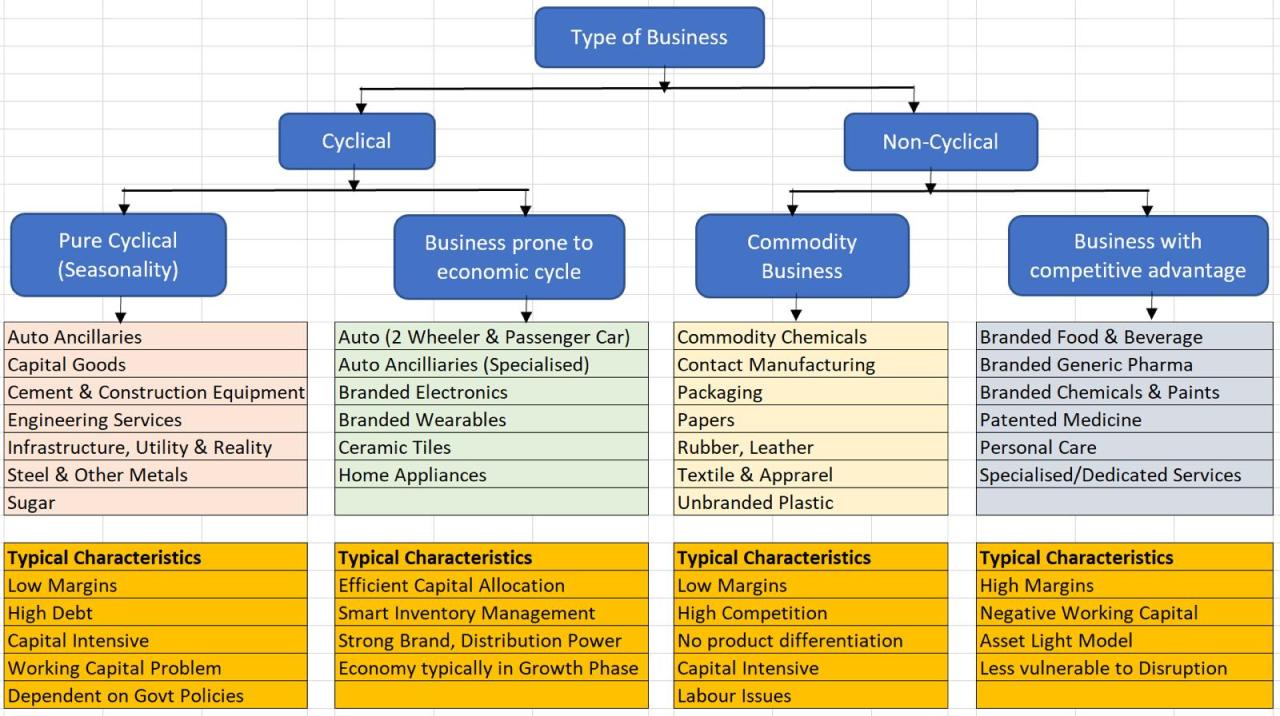

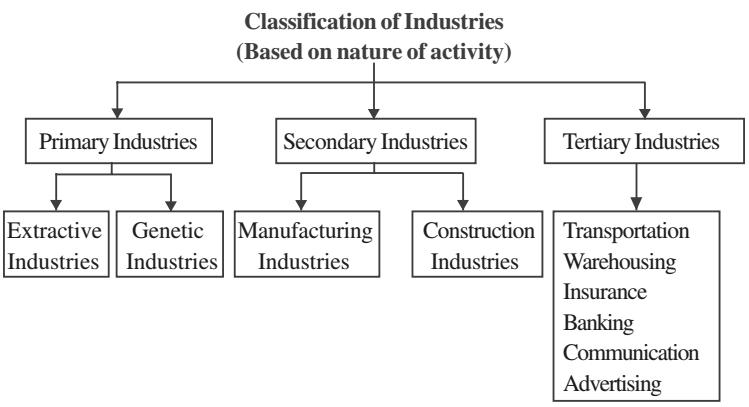

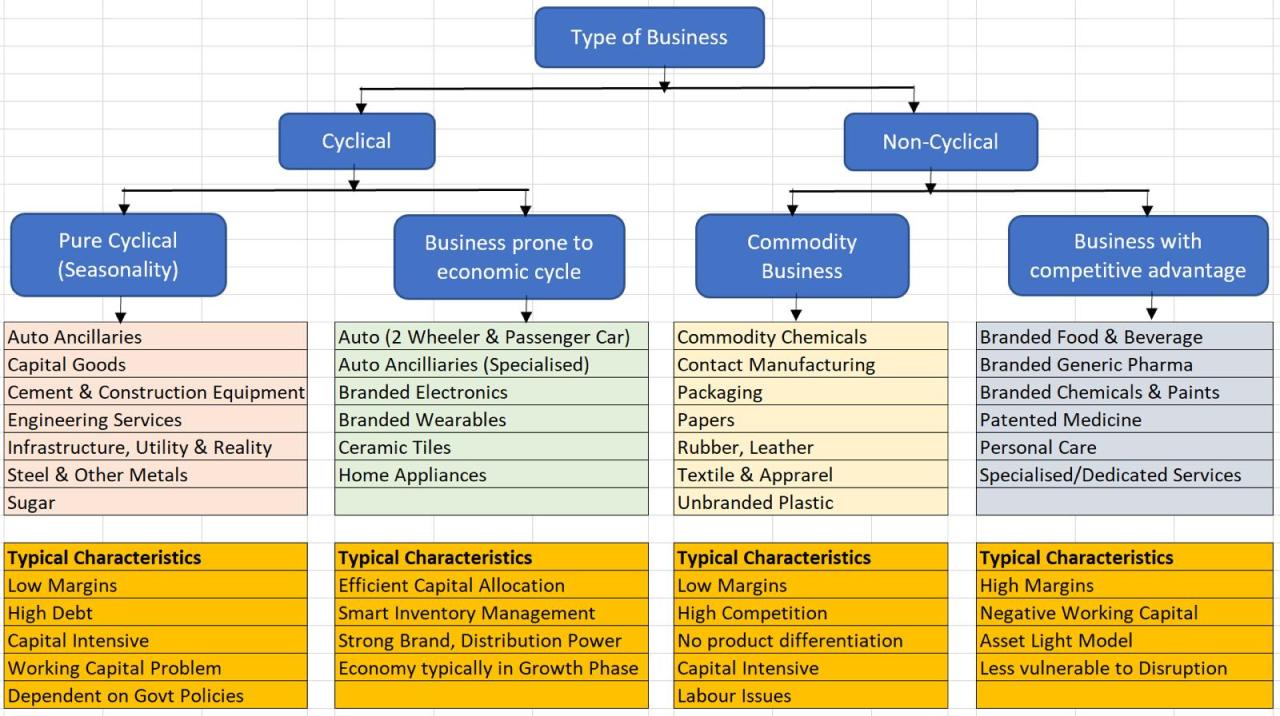

A Hierarchical Diagram of Business Categories

A hierarchical diagram, such as a treemap or a nested set of concentric circles, effectively illustrates the hierarchical relationships between broad categories and their increasingly specific subcategories. For example, the outermost circle might represent the overall business sector (e.g., “Service Industries”), with subsequent circles representing sub-sectors (e.g., “Healthcare,” “Financial Services”), and finally, specific business types (e.g., “Hospitals,” “Investment Banking”). The size of each circle or segment could correspond to the market share or revenue generated by that particular category. This visual quickly conveys the scope and interrelation of various business categories.

A Flowchart for Classifying New Businesses

The process of classifying a new business can be depicted using a flowchart. This visual aid guides users through a series of decisions based on specific characteristics of the business.

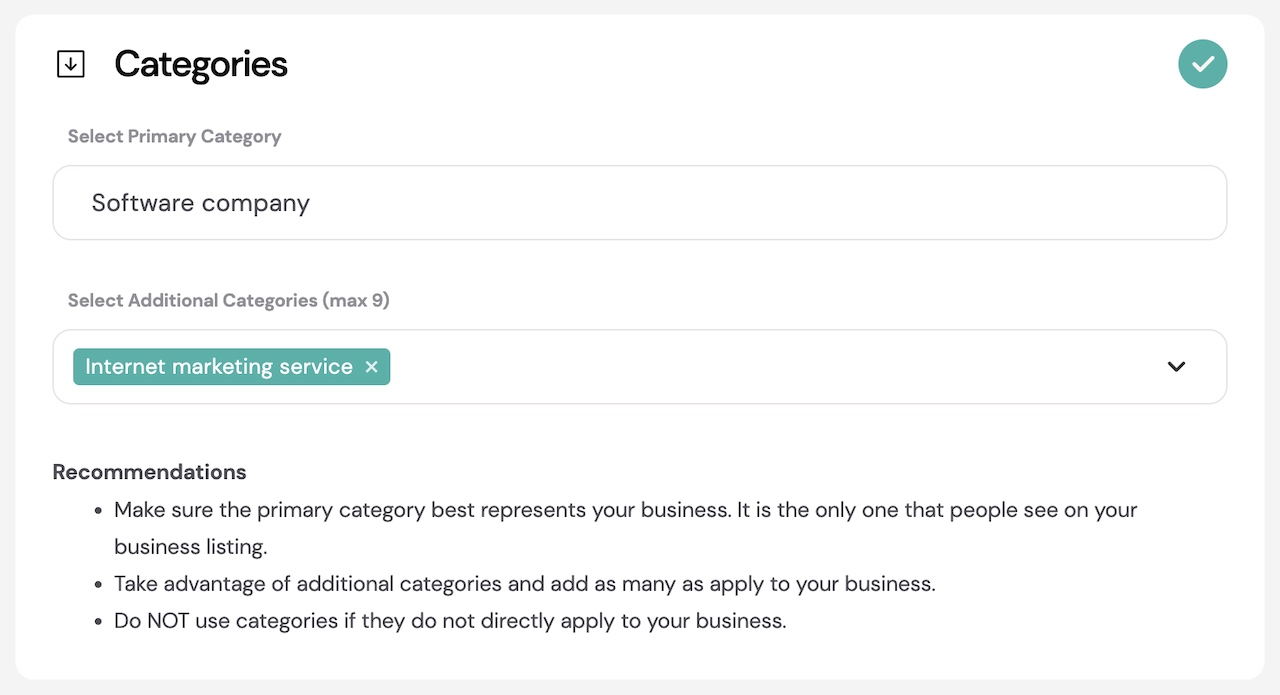

The flowchart would begin with a starting point (“New Business”). Subsequent steps would involve questions about the business’s primary activities (e.g., manufacturing, retail, service), its target market, its legal structure (sole proprietorship, LLC, corporation), and its revenue model. Each answer would lead to a different branch of the flowchart, ultimately leading to a final classification based on established business category definitions (e.g., NAICS or SIC codes). The flowchart would ensure consistent and accurate classification.

Visualizing the Evolution of Business Categories Over Time

A timeline or a series of stacked bar charts can effectively illustrate the emergence, growth, and decline of various business categories over time. For example, a timeline could mark the emergence of e-commerce as a distinct category, its subsequent growth, and the integration of traditional retail into the digital space. Stacked bar charts could show the relative market share of different business categories across different years, highlighting shifts in dominance and the rise and fall of specific industries. This visual demonstrates industry dynamics and long-term trends.

Different Visual Representations and Their Unique Perspectives

Different visual representations highlight different aspects of business categories. For instance:

- Network diagrams can show the interconnectedness of businesses within an ecosystem, illustrating collaborations, competition, and supply chains. For example, a network diagram could illustrate the relationships between a manufacturer, its suppliers, and its distributors.

- Scatter plots can reveal correlations between different business characteristics, such as revenue and employee count, or market capitalization and profitability. This allows for identifying patterns and outliers.

- Geographic maps can illustrate the geographical distribution of businesses within a specific category, revealing regional concentrations or market gaps. For instance, a map could show the density of technology startups in Silicon Valley compared to other regions.