What to do with excess cash in a business? This crucial question faces every growing enterprise. The answer isn’t simply “save it”—smart financial management dictates strategic allocation. This guide explores diverse avenues, from lucrative investments and debt reduction to reinvesting in your company’s future and building robust financial reserves. We’ll analyze the pros and cons of each approach, equipping you with the knowledge to make informed decisions that maximize your business’s potential.

We’ll delve into various investment options, including stocks, bonds, and real estate, examining risk, return, and liquidity. We’ll also detail strategies for minimizing debt, optimizing cash flow, and preparing for unforeseen circumstances. Ultimately, this guide aims to empower you to transform excess cash into a catalyst for sustainable growth and long-term success.

Investing Excess Cash

Efficiently managing excess business cash is crucial for growth and stability. Investing this surplus wisely can generate returns, build financial resilience, and fund future expansion. However, the investment strategy must align with the business’s risk tolerance and long-term financial objectives. Understanding the advantages and disadvantages of different investment vehicles is paramount.

Investment Options Comparison

Choosing the right investment vehicle requires careful consideration of risk, potential return, liquidity, and management effort. The following table provides a comparison of several popular options.

| Investment Option | Risk | Return Potential | Liquidity | Management Effort |

|---|---|---|---|---|

| Stocks | High (potential for significant losses) | High (potential for substantial gains) | High (easily bought and sold) | Moderate (requires research and monitoring) |

| Bonds | Moderate (lower risk than stocks, but still subject to interest rate fluctuations) | Moderate (lower returns than stocks, but generally more stable) | Moderate (liquidity varies depending on the bond) | Low (relatively low maintenance) |

| Mutual Funds | Moderate to High (depends on the fund’s investment strategy) | Moderate to High (depends on the fund’s investment strategy) | High (easily bought and sold) | Low (managed by professionals) |

| Real Estate | High (market fluctuations, property management challenges) | High (potential for appreciation and rental income) | Low (can be difficult and time-consuming to sell) | High (requires significant time and effort for property management) |

Diversification Strategy

Diversification is a key risk mitigation strategy. It involves spreading investments across different asset classes to reduce the impact of losses in any single investment. A business’s risk tolerance and financial goals should guide the diversification strategy. For instance, a conservative business might allocate a larger portion to bonds, while a more aggressive business might favor a higher allocation to stocks. A balanced approach might include a mix of stocks, bonds, and mutual funds.

Return on Investment (ROI) Calculation

ROI is a crucial metric for evaluating investment performance. It’s calculated as:

ROI = [(Net Return / Investment Cost) x 100]%

For example, if a business invests $10,000 in stocks and earns a net return of $2,000 after one year, the ROI is:

ROI = [($2,000 / $10,000) x 100%] = 20%

Similarly, for a bond investment of $5,000 that yields $250 in interest, the ROI is:

ROI = [($250 / $5,000) x 100%] = 5%

Hypothetical Investment Portfolio for a Small Business

A small business with $50,000 in excess cash could consider the following diversified portfolio:

* Stocks (25%): $12,500 invested in a diversified portfolio of established companies across different sectors to capture growth potential while acknowledging the higher risk. This could involve investing in index funds or ETFs for broader market exposure.

* Bonds (30%): $15,000 invested in a mix of government and corporate bonds to provide stability and a steady stream of income. This minimizes risk compared to stocks, but offers lower potential returns.

* Mutual Funds (30%): $15,000 invested in a balanced mutual fund that invests in a mix of stocks and bonds, offering diversification within a single investment. This provides professional management and simplifies portfolio diversification.

* Short-Term Savings Account (15%): $7,500 kept in a high-yield savings account to maintain liquidity and provide quick access to funds for unexpected expenses or opportunities. This ensures that the business has readily available cash for unforeseen circumstances.

This allocation provides a balance between growth potential (stocks and mutual funds) and stability (bonds and savings), while maintaining sufficient liquidity. The specific asset allocation should be adjusted based on the business’s risk tolerance and financial goals.

Reducing Debt

Accumulated debt can significantly hinder a business’s growth potential. Excess cash provides an opportunity to proactively address this, freeing up resources and improving overall financial health. Strategically reducing debt can lead to substantial long-term benefits, allowing for reinvestment in core business operations and future expansion.

Identifying and Prioritizing High-Interest Debt

Effectively managing debt requires a clear understanding of your liabilities. Prioritizing high-interest debt for early repayment maximizes your return on investment by minimizing the total interest paid over the life of the loans. This approach ensures you’re tackling the most expensive debts first, freeing up cash flow more quickly.

- Create a comprehensive debt list: List all outstanding debts, including loan amounts, interest rates, minimum payments, and due dates. This provides a clear overview of your financial obligations.

- Organize by interest rate: Sort your debts from highest to lowest interest rate. This allows for focused repayment efforts on the most expensive debts.

- Consider penalties for early repayment: Some loans may have prepayment penalties. Factor these into your decision-making process to avoid unexpected costs.

- Analyze payment terms: Understand the terms of each loan, including any restrictions on early repayment or potential benefits for doing so.

- Use debt management software: Several software programs can automate the tracking and analysis of your debts, simplifying the prioritization process.

Benefits of Debt Reduction

Reducing debt offers numerous advantages beyond simply lowering monthly payments. It strengthens your business’s financial position, attracting better investment opportunities and increasing overall stability.

Improved credit rating is a key benefit. Lower debt levels demonstrate responsible financial management, leading to improved credit scores and potentially more favorable loan terms in the future. This increased creditworthiness can unlock access to more favorable financing options, supporting future growth initiatives. Simultaneously, reduced debt frees up cash flow, allowing for strategic investments in areas such as research and development, marketing, or expansion into new markets. This increased financial flexibility provides a significant competitive advantage.

Debt Repayment Strategies: Debt Snowball vs. Debt Avalanche

Two common strategies for debt repayment are the debt snowball and debt avalanche methods. Both aim to eliminate debt, but they differ in their approach to prioritization.

| Debt Snowball | Debt Avalanche | |

|---|---|---|

| Prioritization | Smallest debt first, regardless of interest rate | Highest interest rate debt first |

| Pros | Provides psychological motivation through quick wins; builds momentum and confidence. | Minimizes total interest paid; saves money in the long run. |

| Cons | May take longer to pay off total debt; may cost more in interest overall. | Can be demotivating initially as progress may seem slower; requires strong discipline. |

Freeing Up Cash Flow for Growth

By systematically reducing debt, businesses can free up significant cash flow. This freed-up capital can then be reinvested in various growth opportunities. For example, a company might allocate these funds to expand its marketing efforts, leading to increased sales and market share. Alternatively, the funds could be used for research and development, creating innovative products or services that drive future revenue. The reduction in debt servicing costs also contributes to increased profitability, allowing for further investment and expansion. Investing this freed-up cash flow strategically ensures sustainable and profitable growth.

Reinvesting in the Business: What To Do With Excess Cash In A Business

Reinvesting excess cash back into your business can be a powerful strategy for fueling growth and enhancing profitability. This approach allows you to capitalize on opportunities that might otherwise be missed, leading to a stronger competitive position and increased long-term value. Careful consideration of potential projects and a well-defined implementation plan are crucial for maximizing the return on this investment.

Potential Areas for Reinvestment

Identifying suitable reinvestment opportunities requires a thorough assessment of your business’s current strengths and weaknesses, as well as an understanding of market trends and future growth potential. Prioritizing projects with the highest potential return on investment (ROI) is key to maximizing the impact of your excess cash.

- Upgrading Equipment: Investing in newer, more efficient equipment can reduce operational costs, improve productivity, and enhance product quality. For example, a bakery replacing its aging ovens with modern, energy-efficient models could see a significant reduction in energy bills and potentially increase production capacity.

- Expanding Operations: This could involve opening new locations, increasing production capacity at existing facilities, or expanding into new markets. A successful local restaurant chain might reinvest profits into opening a second location in a high-traffic area, increasing its customer base and revenue streams.

- Improving Marketing Efforts: Enhancing your marketing strategy can lead to increased brand awareness, higher customer acquisition, and improved sales. This might include investing in digital marketing campaigns, improving your website, or sponsoring local events. A small software company could invest in a targeted social media campaign to reach a wider audience of potential customers.

- Research and Development (R&D): Investing in R&D can lead to the development of new products or services, enhancing your competitive advantage and opening up new revenue streams. A pharmaceutical company might reinvest profits into research for a new drug, potentially leading to significant future returns.

- Employee Training and Development: Investing in your employees through training and development programs can improve their skills, boost morale, and enhance productivity. A retail store might invest in training programs for its sales staff, leading to improved customer service and increased sales.

Return on Investment (ROI) Analysis

Each reinvestment opportunity should be carefully evaluated based on its potential ROI. This involves projecting both short-term and long-term benefits, considering factors such as increased revenue, reduced costs, and improved efficiency. A thorough cost-benefit analysis is essential to ensure that the investment aligns with your overall business objectives. For example, upgrading equipment might involve a significant upfront cost, but the long-term savings in energy and maintenance could significantly outweigh this initial expense. Similarly, expanding operations may require substantial investment, but the potential for increased revenue and market share could provide a high ROI over time.

Implementation Plan for Reinvestment

Once a reinvestment strategy has been selected, a detailed implementation plan is crucial. This plan should Artikel specific timelines, budgets, and resource allocation for each project. Clear milestones and performance indicators should be established to track progress and ensure the project stays on track. For example, a plan to upgrade equipment might include a timeline for purchasing, installation, and employee training, along with a detailed budget outlining all associated costs. Regular monitoring and adjustments to the plan may be necessary to address unforeseen challenges or changing market conditions.

Prioritized List of Reinvestment Projects

Prioritizing projects is essential when multiple opportunities exist. This involves ranking projects based on their potential impact on business growth and profitability, considering factors such as ROI, risk, and alignment with overall business strategy. A prioritized list allows for a focused approach, ensuring that resources are allocated to the most impactful projects first. For instance, a company might prioritize projects with the highest ROI and lowest risk, followed by projects that align with its long-term strategic goals. Projects with lower ROI or higher risk might be deferred until resources become available or the risk profile improves.

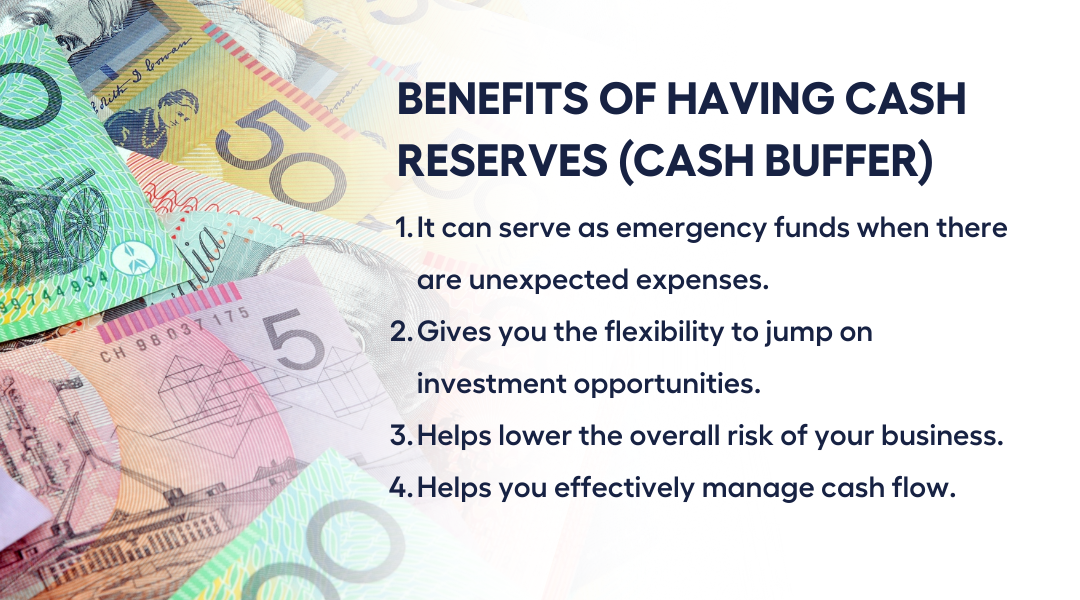

Enhancing Liquidity and Reserves

Maintaining sufficient liquidity is crucial for business survival and growth. A healthy cash reserve acts as a buffer against unexpected financial challenges, allowing businesses to navigate turbulent economic periods and unforeseen operational disruptions without jeopardizing their operations. A strong liquidity position also enhances a company’s creditworthiness, making it easier to secure loans and attract investors.

Sufficient cash reserves are essential for mitigating the impact of unforeseen circumstances. Economic downturns, for example, can significantly reduce revenue streams, while unexpected emergencies like natural disasters or equipment failures can create substantial, immediate expenses. Without adequate reserves, businesses may be forced to take drastic measures, such as laying off employees or ceasing operations, to stay afloat. A robust cash reserve allows businesses to weather these storms and emerge stronger.

Improving Business Liquidity

Optimizing liquidity involves a multifaceted approach. Efficient inventory management is key; holding excessive inventory ties up capital that could be used more productively elsewhere. Implementing just-in-time inventory systems can significantly reduce storage costs and free up cash flow. Negotiating favorable payment terms with suppliers, such as extended credit periods, can also improve liquidity by delaying outgoing payments. Furthermore, businesses can explore options like factoring, where receivables are sold to a third party at a discount to receive immediate cash. These strategies collectively contribute to a healthier cash position.

Risks of Imbalance in Cash Management

Holding too much cash presents the risk of lost opportunity costs. Excess cash could be invested to generate higher returns through various avenues, including stocks, bonds, or other investments. This forgone potential return represents a significant cost. Conversely, insufficient cash reserves leave a business vulnerable to financial distress. Unexpected expenses can quickly deplete available funds, potentially leading to missed opportunities, strained supplier relationships, and ultimately, business failure. The ideal scenario lies in finding the optimal balance.

Ideal Balance Between Liquidity and Investment

Imagine a seesaw. One side represents liquidity – the readily available cash necessary for day-to-day operations and emergency situations. The other side represents investment – the allocation of excess cash into growth opportunities, such as expansion, research and development, or acquisitions. The ideal balance point is where the seesaw is level. There’s enough weight (cash) on the liquidity side to ensure stability and security, but a significant portion is also dedicated to investment, maximizing the potential for future growth. This balance is dynamic and requires ongoing monitoring and adjustment based on the business’s specific circumstances and market conditions. A company experiencing rapid growth might lean more towards investment, while a company facing economic uncertainty may prioritize liquidity.

Strategic Acquisitions or Mergers

Strategic acquisitions and mergers represent a powerful tool for businesses seeking to expand their market share, access new technologies, or enhance their overall competitiveness. However, these endeavors are complex and carry significant risks, requiring careful planning and execution. Successful integration is paramount, and a thorough understanding of the target company is crucial for a positive outcome.

Benefits and Risks of Acquisitions and Mergers, What to do with excess cash in a business

Acquisitions and mergers offer the potential for significant benefits, including increased market share, economies of scale, access to new technologies or intellectual property, and enhanced brand recognition. Economies of scale, for instance, can dramatically reduce operational costs by combining resources and streamlining processes. Acquiring a company with a complementary product line can also broaden a company’s reach and appeal to a wider customer base. However, the risks are substantial. Integration challenges, cultural clashes, and overvaluation of the target company can lead to significant financial losses and operational disruptions. Furthermore, regulatory hurdles and potential antitrust issues must be carefully considered. A poorly planned acquisition can damage the acquiring company’s reputation and erode shareholder value.

Examples of Successful and Unsuccessful Acquisitions and Mergers

The acquisition of Instagram by Facebook (now Meta) in 2012 is often cited as a successful example. Facebook recognized Instagram’s potential for growth and its strong user base, successfully integrating the platform while maintaining its distinct identity. This resulted in a significant expansion of Facebook’s reach and market dominance in the social media sector. In contrast, the merger of AOL and Time Warner in 2000 is widely considered a failure. The vastly different corporate cultures and integration challenges proved insurmountable, resulting in massive losses and ultimately a restructuring of the combined entity. The failure to effectively integrate the two companies’ technologies and business models contributed significantly to this outcome. Another example of a less successful merger is the DaimlerChrysler merger, where cultural differences and strategic misalignment ultimately led to the separation of the two companies.

Checklist for Considering an Acquisition or Merger

Before pursuing an acquisition or merger, a comprehensive checklist should be developed and meticulously followed. This checklist should include:

- Due Diligence: A thorough investigation of the target company’s financial health, legal compliance, operational efficiency, and overall market position. This includes examining financial statements, reviewing contracts, and assessing the target company’s management team and employee base.

- Valuation: A precise valuation of the target company to ensure a fair price is offered. Multiple valuation methods should be employed to mitigate potential biases and ensure accuracy. This includes discounted cash flow analysis, comparable company analysis, and precedent transactions analysis.

- Integration Planning: A detailed plan for integrating the target company’s operations, systems, and personnel into the acquiring company. This should address potential cultural conflicts, technological incompatibilities, and redundancies in workforce or operations.

- Legal and Regulatory Compliance: A comprehensive assessment of legal and regulatory requirements, including antitrust laws and securities regulations. This involves securing necessary approvals and navigating potential legal challenges.

- Financing Strategy: Securing the necessary financing to fund the acquisition, considering various options such as debt financing, equity financing, or a combination thereof. This involves careful consideration of debt levels and potential impact on credit rating.

Comparison of Acquisition Strategies

Friendly acquisitions involve mutual agreement between the acquiring and target companies, facilitating a smoother integration process. Hostile takeovers, on the other hand, are initiated without the target company’s consent, often leading to protracted legal battles and potentially damaging the target company’s reputation and operations. The choice of strategy depends on various factors, including the target company’s willingness to cooperate, the acquiring company’s resources, and the regulatory environment. A friendly acquisition often allows for a more collaborative and less disruptive integration process. In contrast, a hostile takeover can be more costly and time-consuming, with a higher risk of failure.