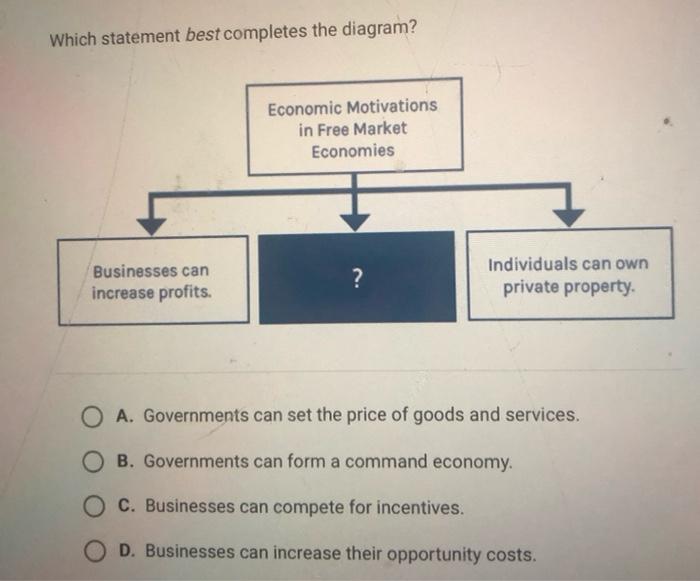

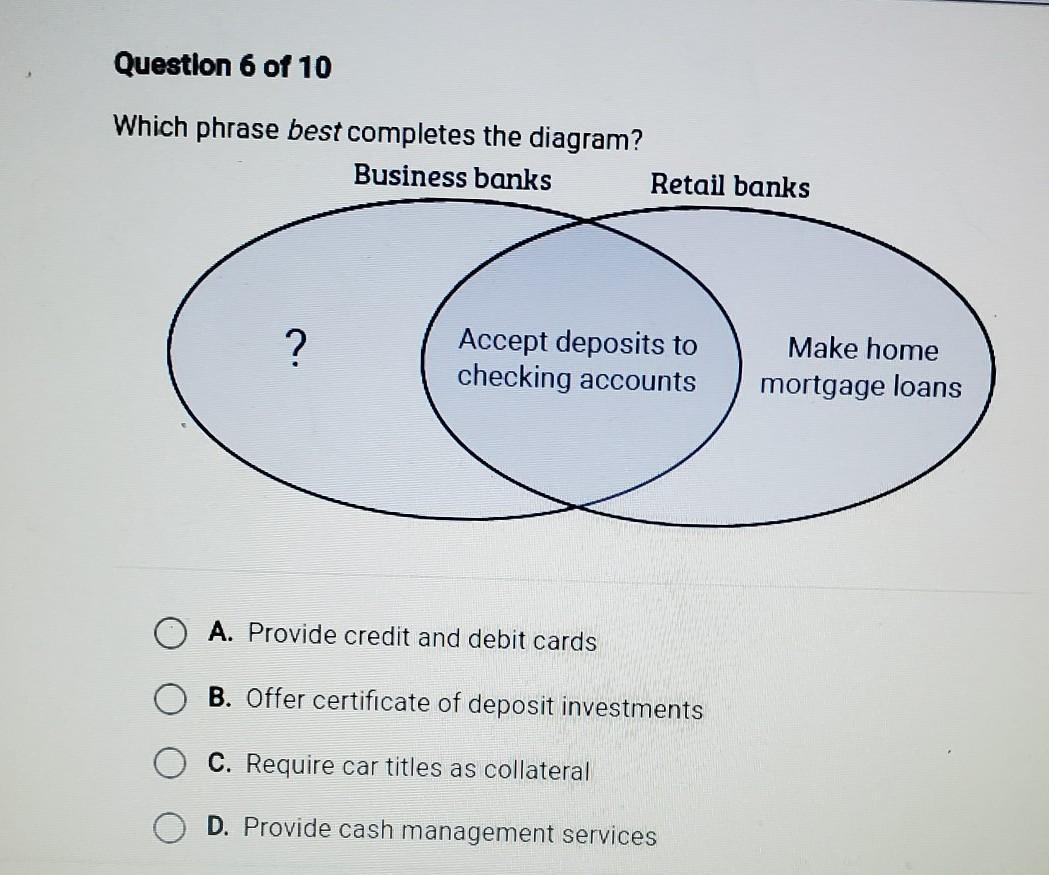

Which phrase best completes the diagram business banks retail banks? This question delves into the core differences between these two crucial segments of the financial industry. Understanding their distinctions—from clientele and service offerings to risk profiles and technological infrastructure—is vital for anyone navigating the complex world of finance. This exploration will illuminate the key characteristics that set business banks apart from their retail counterparts, providing a clear understanding of their unique roles in the economic landscape.

We’ll dissect the services each offers, comparing transaction volumes, account sizes, and the technological underpinnings that drive their operations. A detailed analysis of risk management strategies and regulatory compliance will further highlight the nuanced differences between these two critical banking sectors. By the end, you’ll possess a comprehensive understanding of the distinctions between business and retail banking, empowering you to make informed decisions in this dynamic financial environment.

Defining Business Banks vs. Retail Banks

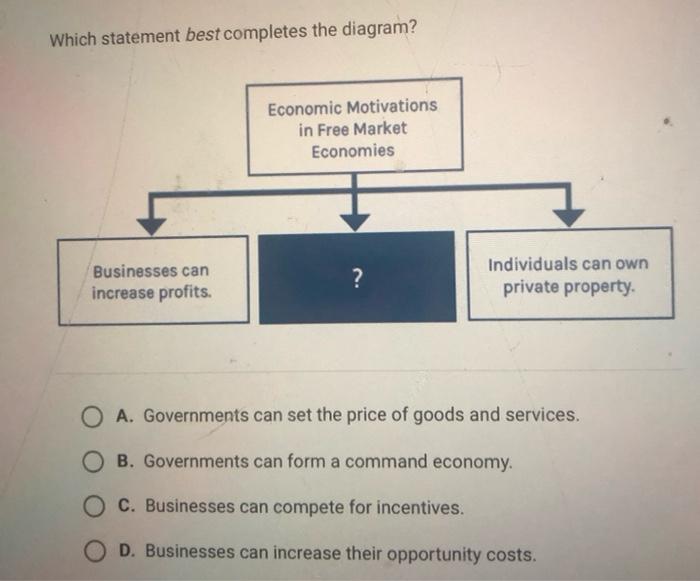

Business and retail banks, while both operating within the financial sector, cater to distinctly different clientele and offer specialized services. Understanding these core differences is crucial for both businesses seeking financing and individuals managing their personal finances. This comparison will highlight the key distinctions between these two vital components of the banking system.

Client Differences

Business banks primarily serve for-profit organizations, from small startups to large multinational corporations. These clients require sophisticated financial products and services tailored to their specific business needs, often involving larger transaction volumes and more complex financial structures. In contrast, retail banks focus on individual customers, offering services such as personal checking accounts, savings accounts, mortgages, and credit cards to meet the everyday financial needs of consumers. The scale of transactions and the complexity of financial needs are significantly smaller for retail clients compared to business clients.

Product Offerings

The product portfolios of business and retail banks reflect their target markets. Business banks offer a wider array of specialized services including commercial loans, lines of credit, merchant services, international trade finance, and treasury management solutions. They often provide sophisticated financial advisory services, including mergers and acquisitions financing and risk management strategies. Retail banks, conversely, focus on products designed for individual consumers, such as personal loans, mortgages, savings accounts, checking accounts, credit cards, and investment products like mutual funds and retirement accounts. While some overlap exists, the complexity and scale of offerings differ substantially.

Risk Profiles in Lending

Lending to businesses inherently carries a higher risk profile than lending to individual consumers. Businesses are subject to market fluctuations, economic downturns, and competitive pressures that can significantly impact their ability to repay loans. Assessing the creditworthiness of a business requires a more in-depth analysis of financial statements, market conditions, and management expertise. Retail lending, while not without risk, typically involves smaller loan amounts and relies more on credit scores and employment history for risk assessment. Defaults on business loans can result in significantly larger financial losses for the bank compared to defaults on retail loans. For example, the failure of a small business to repay a loan might result in a loss of tens of thousands of dollars, while a consumer loan default might only result in a few thousand dollars in losses.

Regulatory Differences

Business and retail banking operations are subject to different regulatory frameworks. Business banking is often subject to stricter regulations concerning capital adequacy, risk management, and anti-money laundering (AML) compliance, due to the higher risk associated with larger transactions and international dealings. Retail banking, while also regulated, often faces different regulatory scrutiny focusing on consumer protection, such as regulations surrounding interest rates, fees, and disclosure requirements. Compliance with these regulations necessitates different operational procedures and internal controls for each type of banking operation. For instance, Know Your Customer (KYC) regulations are implemented differently for business clients requiring more extensive due diligence than for retail clients.

Services Offered

Business and retail banks, while both offering financial services, cater to vastly different client bases and consequently provide distinct product portfolios. This section details the key service differences, highlighting specialized offerings and common products available to each customer segment. Understanding these distinctions is crucial for businesses and individuals alike in selecting the appropriate financial institution to meet their specific needs.

Comparative Analysis of Services Offered

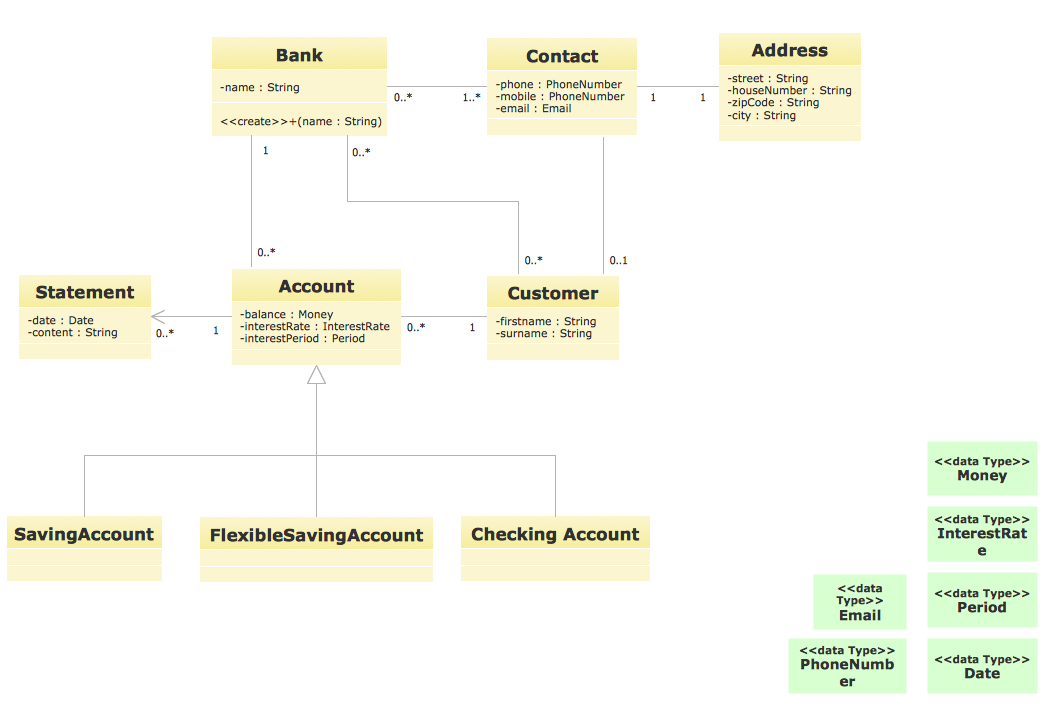

The following table provides a concise comparison of services offered by business and retail banks. Note that the specific services offered can vary depending on the individual bank and its market positioning.

| Service Type | Business Bank Offering | Retail Bank Offering | Key Differences |

|---|---|---|---|

| Account Services | Commercial checking accounts, money market accounts, sweep accounts, international banking services | Checking accounts, savings accounts, money market accounts, certificates of deposit (CDs) | Business accounts offer features like multiple signatories and enhanced reporting capabilities, catering to complex business needs; retail accounts focus on individual needs and simpler transaction management. |

| Loans | Term loans, lines of credit, commercial real estate loans, equipment financing, syndicated loans, letters of credit | Personal loans, mortgages, auto loans, student loans, credit cards | Business loans are typically larger, with more complex terms and conditions reflecting the risk profile of the business; retail loans are designed for individual needs and typically involve simpler application processes. |

| Investment Services | Investment banking services (underwriting, mergers & acquisitions advisory), treasury management services | Investment accounts (brokerage accounts, mutual funds), retirement planning services | Business banks offer sophisticated investment services tailored to large corporations; retail banks provide more accessible investment options for individuals. |

| Other Services | Foreign exchange services, cash management services, risk management services, trade finance | Debit and credit cards, online banking, bill pay services, financial advice (limited scope) | Business banks provide a broader range of specialized services to manage complex financial operations; retail banks offer convenience-focused services for everyday banking needs. |

Specialized Financial Services for Large Corporations

Business banks provide a suite of sophisticated financial services tailored to the complex needs of large corporations. These services often extend beyond traditional banking, encompassing strategic financial planning and risk mitigation. For instance, syndicated loans, involving multiple lenders to finance large-scale projects, are a hallmark of business banking. Furthermore, treasury management services assist corporations in optimizing their cash flow, managing foreign exchange risk, and executing complex international transactions. Mergers and acquisitions advisory, a crucial service provided by some business banks’ investment banking arms, guides corporations through significant strategic transactions.

Common Financial Products and Services for Individuals

Retail banks offer a range of products and services designed for individual consumers. These services are generally more accessible and easier to understand than those offered by business banks. Common examples include checking and savings accounts for managing daily finances, personal loans for various needs, mortgages for home purchases, and auto loans for vehicle financing. Credit cards provide convenient payment options and often come with rewards programs. Many retail banks also offer basic investment services, such as brokerage accounts and mutual funds, alongside retirement planning services.

Exclusive Services by Bank Type

Syndicated loans are almost exclusively offered by business banks due to the significant capital and expertise required to structure and manage such complex financing arrangements. Conversely, personal loans designed specifically for individual needs with simplified application processes are a hallmark of retail banking. The scale and complexity of transactions involved dictate the type of bank best equipped to handle them.

Transaction Volumes and Account Sizes

Business and retail banks differ significantly in the volume and nature of transactions they process, as well as the size and type of accounts they manage. These differences directly impact their operational structures, risk profiles, and ultimately, profitability. Understanding these distinctions is crucial for comprehending the contrasting business models of these two banking sectors.

Transaction volumes and account sizes are key differentiators between business and retail banking. Retail banks handle a high volume of relatively small transactions, while business banks process fewer, but often significantly larger transactions. This disparity shapes their operational needs and profit margins.

Average Transaction Volumes

Retail banks process a vastly higher number of individual transactions daily compared to business banks. This includes numerous ATM withdrawals, debit card purchases, online transfers, and bill payments, each typically involving relatively small sums of money. Business banks, conversely, handle a smaller overall number of transactions, but these transactions tend to involve larger sums, reflecting the financial activities of businesses, such as payroll processing, bulk payments to suppliers, and large-scale investments. For example, a retail bank might process millions of transactions under $100 daily, while a business bank might process thousands of transactions averaging $10,000 or more.

Typical Account Sizes and Nature

Retail bank accounts are typically characterized by smaller balances. These include checking accounts, savings accounts, and money market accounts, often holding balances in the hundreds or thousands of dollars. Business bank accounts, on the other hand, often manage significantly larger sums, reflecting the financial needs of businesses. These accounts can hold hundreds of thousands, or even millions, of dollars, and may include various business lines of credit, commercial loans, and investment accounts. The nature of the accounts also differs, with retail accounts primarily focused on personal financial management, while business accounts are geared towards facilitating business operations and growth.

Account Size Distribution

Imagine two histograms. The first, representing retail banks, shows a heavily skewed distribution to the left. The majority of accounts cluster around small balances (under $5,000), with a long tail extending to higher balances. A smaller percentage of accounts hold significantly larger sums. The second histogram, representing business banks, displays a more even distribution, although still skewed right. A considerable portion of accounts hold substantial balances (over $100,000), with fewer accounts in the lower balance ranges. A significant portion of accounts will also have associated credit facilities and loans, not represented in the simple balance figures. This visual representation highlights the substantial difference in the typical account size between the two banking sectors.

Impact on Bank Operations and Profitability, Which phrase best completes the diagram business banks retail banks

The differences in transaction volumes and account sizes significantly impact bank operations and profitability. Retail banks, handling a high volume of smaller transactions, require robust infrastructure for processing a large number of relatively low-value transactions efficiently. Their profitability relies on economies of scale and a high volume of transactions generating fees and interest income. Business banks, with fewer but larger transactions, focus on relationship management and personalized services. Their profitability stems from higher interest margins on larger loans and investment products, and fees associated with complex financial services. The operational costs differ significantly, with retail banks emphasizing efficiency in high-volume processing, and business banks emphasizing expertise in managing complex financial needs.

Technological Differences and Infrastructure: Which Phrase Best Completes The Diagram Business Banks Retail Banks

Business and retail banks operate with significantly different technological infrastructures, reflecting their distinct customer bases and operational needs. While both leverage core banking systems, the scale, complexity, and specific technologies employed vary considerably. This divergence impacts customer service, internal operations, and overall security measures.

The technological infrastructure of business and retail banks differs significantly across various aspects, including core banking systems, customer relationship management (CRM) tools, and security protocols. These differences are driven by the unique needs and characteristics of each customer segment.

Core Banking Systems

Business banks often utilize more sophisticated and customizable core banking systems capable of handling complex transactions, large volumes of data, and intricate financial products. These systems may integrate with enterprise resource planning (ERP) software and other specialized financial applications to provide a holistic view of a business client’s financial health. Retail banks, conversely, tend to use more standardized and streamlined core banking systems designed for high transaction volumes but with less emphasis on customized solutions for individual clients. For example, a business bank might use a system that allows for sophisticated treasury management tools, while a retail bank might prioritize a system with robust fraud detection capabilities for a high volume of debit and credit card transactions.

Customer Service Technology

Business banks often prioritize personalized, high-touch customer service, leveraging advanced CRM systems and specialized communication channels. These might include dedicated relationship managers, secure online portals with advanced reporting capabilities, and proactive alerts based on client-specific financial data. Retail banks, with their larger customer base, tend to rely more heavily on self-service technologies such as mobile banking apps, online banking portals, and automated phone systems. While personalized service is still offered, the scale necessitates a greater reliance on automated solutions.

Security Technologies

Given the higher value transactions and sensitive financial information involved, business banks typically invest heavily in robust security measures. This includes advanced fraud detection systems, multi-factor authentication, and encryption protocols. They might also employ dedicated cybersecurity teams to monitor for threats and respond to incidents. Retail banks also prioritize security, but the nature of the threats and the scale of the operation necessitate different approaches. For example, a retail bank might invest heavily in anti-phishing measures and real-time transaction monitoring systems to combat widespread fraud attempts.

Internal Operations Technology

Business banks often use specialized technologies for tasks like loan origination, risk management, and regulatory compliance. These might include advanced analytics platforms for credit scoring and financial modeling, as well as dedicated systems for managing regulatory reporting requirements. Retail banks may use similar technologies, but the scale and complexity are generally lower. For example, a business bank might utilize sophisticated algorithms to assess credit risk for large commercial loans, while a retail bank might rely on more standardized credit scoring models for consumer loans.

Risk Management and Compliance

Business and retail banks, while both operating within the financial sector, differ significantly in their risk profiles and the regulatory landscapes they navigate. These differences necessitate distinct risk management strategies and compliance frameworks. Understanding these disparities is crucial for assessing the stability and resilience of each bank type.

Risk management in banking involves identifying, assessing, mitigating, and monitoring potential threats to a bank’s financial health and operational stability. This process is far more complex for business banks, which often handle larger, more complex transactions and serve clients with higher risk tolerances. Retail banks, conversely, deal with a larger volume of smaller, more standardized transactions, although their overall risk exposure can still be substantial due to sheer scale.

Risk Management Strategies

Business banks typically employ more sophisticated risk management models, incorporating advanced analytics and stress testing to assess the potential impact of macroeconomic events and individual client defaults. They often have dedicated risk management departments with specialized expertise in credit, market, and operational risks. Retail banks also utilize risk management frameworks, but these are often more standardized and rely heavily on automated systems for credit scoring and fraud detection. The focus is frequently on managing volume-related risks, such as fraud and operational failures. For example, a business bank might use complex Monte Carlo simulations to model potential losses from a portfolio of large corporate loans, whereas a retail bank might use a simpler statistical model to assess the probability of default on a large number of mortgages.

Regulatory Compliance Requirements

Regulatory compliance is a cornerstone of banking operations. Business banks, due to their involvement in larger and potentially riskier transactions, face stricter regulatory scrutiny. They are subject to more stringent capital adequacy requirements (Basel III accords, for instance), and more comprehensive reporting obligations. Retail banks also face regulatory oversight, but the intensity and scope are generally less stringent. Compliance requirements vary depending on jurisdiction, but generally involve adherence to anti-money laundering (AML) regulations, consumer protection laws, and data privacy regulations. A significant difference lies in the level of detail required for reporting and the frequency of regulatory audits.

Types of Risks and Mitigation Strategies

Both business and retail banks face a range of risks. Credit risk, the potential for losses from borrowers’ defaults, is a primary concern for both. However, the nature of credit risk differs. Business banks deal with higher-value, less predictable loans to corporations and businesses, while retail banks manage a larger volume of smaller loans to individuals, with more standardized risk assessment methodologies. Operational risk, encompassing internal process failures and external events, is also significant for both. Business banks may face greater losses from operational failures due to the complexity of their operations. Retail banks may face higher operational risks from fraud and cyberattacks due to their vast customer base and digital infrastructure. Mitigation strategies vary accordingly; business banks might invest heavily in advanced fraud detection systems and robust cybersecurity infrastructure, while retail banks might prioritize employee training and robust internal controls.

Impact of Regulatory Changes

Regulatory changes, such as those stemming from increased concerns about financial stability or technological advancements, significantly impact both business and retail banks. New regulations often necessitate substantial investments in technology, compliance infrastructure, and staff training. For example, the introduction of PSD2 (Payment Services Directive 2) in Europe required both types of banks to adapt their systems to accommodate open banking principles, necessitating substantial IT upgrades and changes to internal processes. The impact can be more pronounced for business banks, which may require more significant changes to their operational models and risk management frameworks to comply with stricter regulations.